Ryan Avent did a pretty good job of demolishing Paul Krugman’s recent foray into protectionism. But he didn’t have time to address all the problems, as Krugman has 3 recent posts and one full NYT column. In these posts, Krugman seems to make not one, but two powerful arguments against the very policy he favors. Let’s start with a slightly more recent post where he makes a Keynesian argument that protectionism is OK under certain conditions:

If you think in terms of models, however, you know that the case for free trade is profound, but also conditional: it depends, among other things, on having sufficient policy levers to achieve more or less full employment simultaneously with free trade. Without that, the picture is very different. As Paul Samuelson wrote long ago,

“With employment less than full and Net National Product suboptimal, all the debunked mercantilist arguments turn out to be valid.”

So what I’ve been saying about China comes out of the same model I’ve been using to make sense of our broader economic problem. That doesn’t mean I’m necessarily right about the policy, since we are talking about political economy rather than straight economics. But if you just start yelling “Protectionist!”, you’re demonstrating that you don’t understand what economics is about.

Where does one start? At least Krugman’s argument isn’t quite as simplistic as Samuelson’s. Krugman argues protectionism might be justified if you lack “sufficient policy levers.” Samuelson is making a very different argument—that protectionism is justified any time unemployment is anything less that “full.” That’s probably at least 50% of the time! And not just some of the discredited mercantilist policies, all of them. This includes every single trade idea ever propagated by people like Pat Buchanan, including his argument for tariffs on countries whose people have yellow skin, and free trade with countries full of people with white skin. Yes, they are all suddenly valid—most of the time.

Of course Krugman’s too smart to believe this nonsense, and so is Samuelson. But why quote a Samuelson passage that makes him look like a fool? The guy’s dead, and can’t even defend his reputation.

Krugman says there’s an argument for protection if a country has no macroeconomic policy levers. But elsewhere Krugman insists that the US has not just one, but two levers. Unfortunately (from his perspective) we chose not to use them. We chose not to do the needed $1.3 trillion fiscal stimulus, or raise the inflation target to something higher than 2%. But he’s right, we have sufficient levers, we just chose not to use them. This is a very powerful argument against protectionism, although Krugman doesn’t seem to realize it.

Krugman’s outraged that people are calling him a protectionist for advocating trade barriers against China in order to reduce American unemployment. Perhaps it would help if he talked about more than one country. Over the past 12 months Russia’s trade surplus is about 85% as large as China’s and Russia has 1/10th China’s population. When you go after the favorite target of American protectionists on the grounds it will save America jobs, people are going to regard the argument as protectionist. Especially when the logic of your argument (only if insufficient policy levers are available) actually argues against trade barriers.

In his NYT column, Krugman seems even more populist in an essay entitled “Taking on China”:

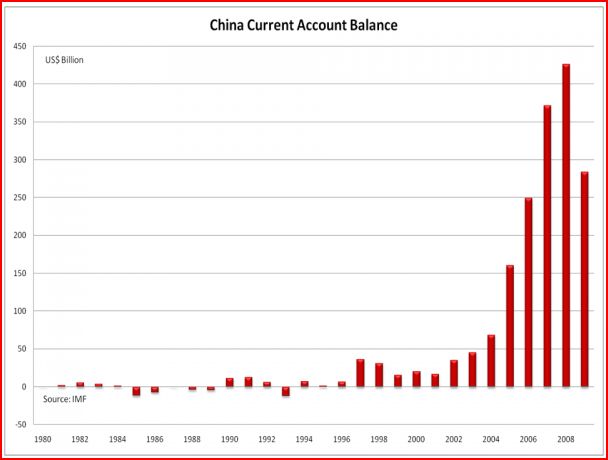

They deny that they are deliberately manipulating their exchange rate; I guess the tooth fairy purchased $2.4 trillion in foreign currency and put it on their pillows while they were sleeping. Anyway, say prominent Chinese figures, it doesn’t matter; the renminbi has nothing to do with China’s trade surplus. Yet this week China’s premier cried woe over the prospect of a stronger currency, declaring, “We cannot imagine how many Chinese factories will go bankrupt, how many Chinese workers will lose their jobs.” Well, either the renminbi’s value matters, or it doesn’t “” they can’t have it both ways.

Yes, you can’t have it both ways. So does Mr. Krugman think that a much stronger yuan would have no effect, and would fail to stem the tide of Chinese exports? Or does he think that it would work, that it would throw millions of desperately poor Chinese workers out of work? He doesn’t say, but doesn’t the logic of his argument point to the latter interpretation?

Some of my more nationalistic readers might say; “So what if Chinese lose their jobs, it’s American jobs that matter.” But Krugman’s a liberal, and liberals are supposed to believe every person’s welfare is equally important, and indeed that the poor are those in most need of assistance. I doubt Krugman would favor abolishing US humanitarian aid on the grounds that it would help US taxpayers. Admittedly the Chinese trade issue is somewhat different from foreign aid. Nevertheless, in all the things I’ve read Krugman write about China, I’ve never gotten the sense he really understands that China is a very poor country, much poorer than Mexico. If you are going to raise the specter of mass unemployment in a country without a safety net, don’t you think it would be appropriate to say one or two things about what that means? About why you favor “taking on China” despite the appalling humanitarian disaster it would cause? But all we get is silence. In the very next paragraph Krugman moves on. He’s done his job, catching the premier in a logical error, there’s no need to consider the impact on the Chinese themselves.

It’s always important to recall that there are real people behind abstract entities. I loved it when someone renamed the “War on Drugs” as “The War on Drug-Using Americans.” I wish people would stop talking about “taking on China” and instead talk about “taking on the Chinese people.” It would make it easier to see what the real issues are.

Krugman concludes the post mentioned above as follows:

All Geithner did here was signal to the Chinese not to worry, U.S. officials will keep making excuses for China’s behavior and doing nothing, regardless of provocation. Remember, this statement comes after China blatantly reneged on earlier promises about the exchange rate. They must take us for fools “” because we (or at least some of us) are.

If I was writing for the NYT, here’s what I would have said:

By reappointing Bernanke and leaving several Fed seats empty for over a year, Obama signaled to the Fed not to worry. US officials and economists keep making excuses for the Fed, despite their blatant disregard of their dual mandate for price stability (defined as 2% inflation) and high employment. They must take us for fools “” because we (or at least some of us) are.

Yes, it’s possible that China could prevent massive unemployment with a major stimulus push. But of course that begs the question of why we don’t do the same.