The face of American poverty

While I was reading a NYT article on the poorest city in America, I came across this interesting tidbit about the second poorest:

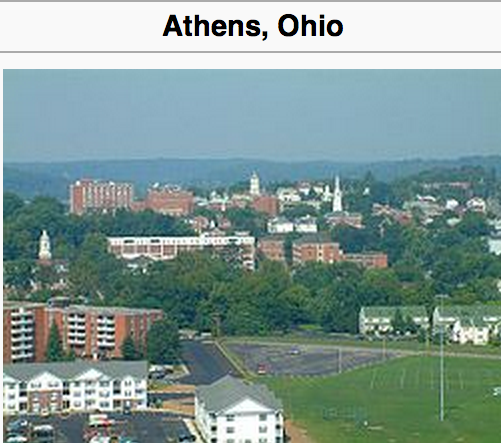

Statistically, no place comes close to Kiryas Joel. In Athens, Ohio, which ranks second in poverty, 56 percent of the residents are classified as poor.

Kiryas Joel is an unusual place. Although it’s the poorest town in America, it didn’t seem very representative of American poverty, or perhaps I should use the scare quotes: “poverty.” But Athens, Ohio, now that sounds like a very normal sort of place.

Brace yourself for a picture of poverty in America:

There you are, a town that is described by Wikipedia as follows:

2010 census

As of the census[2] of 2010, there were 23,832 people, 6,903 households, and 1,842 families residing in the city. The population density was 2,424.4 inhabitants per square mile (936.1 /km2). There were 7,391 housing units at an average density of 751.9 per square mile (290.3 /km2). The racial makeup of the city was 86.4% White, 4.4% African American, 0.2% Native American, 6.1% Asian, 0.6% from other races, and 2.3% from two or more races. Hispanic or Latino of any race were 2.4% of the population.

There were 6,903 households of which 11.8% had children under the age of 18 living with them, 20.5% were married couples living together, 4.2% had a female householder with no husband present, 2.1% had a male householder with no wife present, and 73.3% were non-families. 33.8% of all households were made up of individuals and 5% had someone living alone who was 65 years of age or older. The average household size was 2.28 and the average family size was 2.74.

The median age in the city was 21.6 years. 5.8% of residents were under the age of 18; 67.6% were between the ages of 18 and 24; 14.4% were from 25 to 44; 7.9% were from 45 to 64; and 4.3% were 65 years of age or older. The gender makeup of the city was 50.0% male and 50.0% female.

Did you expect America’s second poorest town to be 92.5% White and Asian? And 4.4% black and 2.4% Latino? How does something like that happen? Take a look at the percentage of the population between 18 and 24. The 2000 census report gives us another clue:

The median income for a household in the city was $17,122, and the median income for a family was $53,391. Males had a median income of $35,849 versus $28,866 for females. The per capita income for the city was $11,061. About 14.8% of families and 51.9% of the population were below the poverty line, including 19.1% of those under age 18 and 7.2% of those age 65 or over.

The typical Athens “family” made 53k in 2000, and the typical Athens “household” made 17k in 2000. Are you beginning to understand why I insist that income inequality data is complete garbage?

I used to talk about how I have spent considerable time in all 5 income quintiles, including 8 years in the bottom quintile. To a significant extent US distribution of income data describes not different classes of people, but the very same people at different stages of their life.

When I would make this claim commenters would insist that college students weren’t counted as poor. That confused me. I was counted as poor, why wouldn’t other college students be counted as poor?

Another response is that I’m engaged in “denial.” I’m not denying anything. I know that there is lots of poverty in urban black neighborhoods, in Indian reservations, along the Tex-Mex border, or even in suburbia. But I don’t know that from the data, I know that because I’ve traveled all over America and seen the poverty. I’ve talked to poor people who have told me how their discretionary income was wiped out by the huge rise in cigarette taxes (supported by liberal politicians.) Roughly $2000/ year for pack-a-day smokers in high tax states, if you include “legal settlement” quasi-taxes.)

So yes, by all means let’s rely on our own two eyes, not the government data. In the 1960s the big problem (that liberals complained about) was that the middle class had it so good and the poor had it so bad. Since that time the living standards of the middle class have improved modestly, while the living standards of the poor have improved much more. At least that’s what I see when I travel around. In many cases poor immigrant hispanics live in those 2 or 3 bedroom ranch houses with one bath, which used to be regarded as middle class in the 1960s. You see many fewer shacks with no indoor plumbing, as compared to the 1960s.

So in my view the country is better off than in the 1960s, and living standards for the poor have risen faster than for the middle class. What about the 1% who are rich? Yes, they’ve done very, very well. Partly through bad public policies that make rent-seeking too easy. Partly because the digital economy is a very low marginal cost, winner-take-all economy. The loot is split between techies and financiers. But if the other 99% of America is richer, and more equal than the 60s in a consumption sense, I’d consider that major progress. What do you think?

PS. This doesn’t mean redistribution is not needed. A healthy subsidy for low-wage workers would be helpful.

PPS. Why did I avoid the poorest town in America? Did I skim over it because it undercut my argument that government-defined “poverty” is not what you think it is? Judge for yourself:

The poorest place in the United States is not a dusty Texas border town, a hollow in Appalachia, a remote Indian reservation or a blighted urban neighborhood. It has no slums or homeless people. No one who lives there is shabbily dressed or has to go hungry. Crime is virtually nonexistent.

And, yet, officially, at least, none of the nation’s 3,700 villages, towns or cities with more than 10,000 people has a higher proportion of its population living in poverty than Kiryas Joel, N.Y., a community of mostly garden apartments and town houses 50 miles northwest of New York City in suburban Orange County.

About 70 percent of the village’s 21,000 residents live in households whose income falls below the federal poverty threshold, according to the Census Bureau. Median family income ($17,929) and per capita income ($4,494) rank lower than any other comparable place in the country. Nearly half of the village’s households reported less than $15,000 in annual income.

About half of the residents receive food stamps, and one-third receive Medicaid benefits and rely on federal vouchers to help pay their housing costs.

Kiryas Joel’s unlikely ranking results largely from religious and cultural factors. Ultra-Orthodox Satmar Hasidic Jews predominate in the village; many of them moved there from Williamsburg, Brooklyn, beginning in the 1970s to accommodate a population that was growing geometrically.

Hasidic Jews with big families, or college students with no kids at all. Take your pick.

HT: Floccina

Update: Kevin Erdmann has a very good post on this topic.

Tags:

8. October 2013 at 09:08

Slow clap.

8. October 2013 at 09:09

Exactly. The retirement age group has an even stronger effect, which I graph here:

http://idiosyncraticwhisk.blogspot.com/2013/09/more-on-lifecycle-effects-on-income.html

If you measured the individual years of my life, you would see a dire landscape of haves and have-nots.

8. October 2013 at 09:51

Scott,

Your complaining about methodological problems of level-measuring. No one cares. Most people have no quantitative sense of inequality in the first place. The big issues are:

-Stagnant real incomes. You and Cowen can go on and on about the consumer surplus of tech advancement, but that’s arguably less than prior eras and certainly no better, yet prior eras showed rising real incomes.

-All the gains are going to the top. Even accounting for a life-cycle analysis, this doesn’t change because only a tiny fraction can expect to spent much of their lives in the annually-calculated 1%. Americans intuit that the more concentrated economic resources are, the more difficult it is to prevent that from corrupting other forms of equality.

Why should people buy in to an system that is yielding worse results for them than prior systems?

But you know all this, your commenters have repeatedly brought up these issues before, and you’ve neither produced an adequate response nor modified your thinking, so I don’t even know why I’m bothering. Please stop writing about income inequality; it’s not exactly your forte.

8. October 2013 at 09:51

I will honestly ask, how does an average Hasidic Jewish family in that town survive on $18k a year? Do income numbers not include all the unpaid, bartered labor between them? I’m honestly curious.

8. October 2013 at 10:02

myb6,

It’s not that I disagree inequality is happening per se, but the “economic system” that generated it is not really lazziez-faire capitalism but a system where special interests build it how they see fit. If income is more concentrated at higher levels to begin with, then it’s easier to mobilize lobbying and increase income further. Income further increases lobbying as well and a positive feedback loop happens.

Special interests are at least a significant part of it. Are there market failures in corporate governance and finance as well? Probably. It’s just hard to see where market failures begin and government distortions end.

Plus I do think technology and globalization has increased inequality without lowering living standards for lower tiers. For example, the reach of sports stars and actors is far bigger, but that’s not a zero-sum game. It just uniquely benefits those who happen to be in the very, very top of whatever they’re doing if technology allows them to replicate their output cheaply.

8. October 2013 at 10:32

Bravo! Unlike myb6 (who ignores your clear arguments and just asserts dogmatically that the present “system” is yielding “worse results” for most people), I think income inequality is one of your (many) fortes, and urge you to go on writing about it as often as you can manage. But is there no solution for the measurement problem you point out? Are you saying income (in)equality simply *can’t* be measured? If we had the right data (and the right instruments) couldn’t the life-cycle factors (etc) be backed out? What would it take? (Or do you think it’s just hopeless at a practical level?)

8. October 2013 at 11:03

A.W.,

Notice the hypocrisy of you not addressing any of the reasoned points in my comment, yet accusing me of dogma.

8. October 2013 at 11:30

Scott…I did not realize you were against Pigovian tax taxes.

8. October 2013 at 11:43

Athens is poor because collage students are poor and Kiryas Joel is poor because Hasidic Jews have big families. They are still poor.

Why do you think that they should not be counted or that they distort the data ?

8. October 2013 at 11:51

“Athens is poor because collage students are poor”.

Yep. If you want to make money, don’t major in art!

8. October 2013 at 12:04

Vivian Darkbloom is right.

My degree is in fine arts, with a focus on painting– earned at the age of 42.

But I did not get my degree to make money. I already had a career.

8. October 2013 at 12:15

my, You said;

“You and Cowen can go on and on about the consumer surplus of tech advancement”

When have I ever done that? Can you find the quotation? Indeed I’ve argued just the opposite, that tech is overrated. I’ve argued that indoor plumping and electricity were far bigger innovations. I wish commenters would stop making up claims about me.

If you think all the gains have gone to the top 1% you are obviously too young to remember what life was like for the poor in the 1960s.

You said;

“Why should people buy in to an system that is yielding worse results for them than prior systems?

But you know all this, your commenters have repeatedly brought up these issues before,”

If you are going to lecture me then you should stop lying about what I believe. I do NOT support our current system. And if you say you aren’t lying, that it’s simply ignorance on your part, then stop claiming that you’ve read my blog enough to know what I think, obviously you have not.

And if you had actually read my blog, you’d know that I don’t believe income would be a meaningful measure of economic inequality, even if measured correctly. So the share of income going to the top 1% is meaningless.

BTW, I am one of the few bloggers who actually does try to respond to my commenters, but I get really annoyed when people claim I have said things that I do not in fact believe.

So tell me, precisely which issue did I not respond to?

CV, You’d want to look at consumption inequality, but that’s really hard to measure.

Bill, I strongly support Pigovian taxes. Perhaps you are referring to cigarettes. There is no Pigovian argument for high cigarette taxes, according to economists who have studied the issue.

http://ideas.repec.org/e/pvi69.html

Bill, So are you saying that I was “poor” in the 1970s when I went to college? Or that I was actually poor? How should the government have addressed that “problem?” Food stamps? Or maybe you are just joking, and it went over my head.

8. October 2013 at 12:17

Bill, I think Vivian is joking. But maybe you are joking too. I’m always the last person to get the joke.

8. October 2013 at 12:24

Scott,

Think Kurt Schwitters.

8. October 2013 at 12:37

Once per year people from all over Ohio destroy Athens during a large Halloween block party. So on top of the transient student population every year there is a major supply shock from cars flipped over, couches burned, etc.

Athens is a great city. I loved going to school there.

Great post, Scott.

8. October 2013 at 12:49

“You’d want to look at consumption inequality, but that’s really hard to measure.” (I assume this was in response to my question.)

Yes, that would have to be the way, but wouldn’t you still need to back out life-cycle components? And in our very pluralistic society, traditional life-cycle stages don’t map very well onto age any more. You could do some approximations. And perhaps index it against survey research (very expensive and the samples would have to be pretty large). Has anyone tried anything remotely like this that you know of?

8. October 2013 at 13:34

Good post. Perhaps a difference between the statistically poor and truly poor can be drawn based on expected lifetime earnings both in dollars and in lifestyle satisfaction? The students are poor but expect to be better off in a few years and enjoy valuable personal freedom. So while they may eat ramen, they do so with their friends on their own time and know that they’ll soon be able to buy steak. On the other hand, a non-student who is poor with a dead-end job, a nagging wife and three delinquent children has little hope…

8. October 2013 at 14:35

I think that even if you could make the case that income equality is a worsening problem, there is nothing that the government could do to make it better. True socialism produces the most unequal outcomes imaginable where a parasitic governing class sucks the wealth out of the rest of the country: Cuba, USSR, North Korea.

Places that have high levels of income equality do so regardless of their economic system and tend to have very high levels of ethnic/cultural homogeneity.

8. October 2013 at 14:47

Clearly, Athens is a bubble economy propped up by the Fed’s crack cocaine monetary policy and Wall Street’s exploitative debt peddling. Those people need to spend within their means, probably about 8k per year per person.

8. October 2013 at 15:32

Scott,

This was one of the posts in my head when writing about consumer surplus: http://www.themoneyillusion.com/?p=23701

There have been others, including at least one that was more biographical. While I’m always open to admitting missing a point or a subtlety, I wasn’t coming from left field; if that isn’t good enough, I’m not interested in an evidence exchange and you can feel free to remain hysterically angry.

I’m aware you think income is meaningless and consumption is all that matters (to which I object- we’ve exchanged comments on this to no resolution). But then you blogged about income inequality! Given that, yeah, no one’s really worried about the Hasidics and college students, it’s relevant for me to bring up what people are *actually* concerned about.

I agree we made progress in the ’60s. The period of concern is Reagan on. But I think you know this, which exasperates me.

Your favored policy (progressive consumption tax, reduce income & capital taxes) would dramatically lower the tax burden on the top. Do you disagree that parallels the policy trend of the neoliberal era? I actually agree with your policy when applied to the vast majority of the popultion, but we need a tax regime that demands more, not less, from those who are benefitting enormously from our shared system.

I’m not lying about anything. I am lecturing you, though.

Matt Waters,

I agree, rent-seeking is rampant and there’s no laissez-faire (beware no-true-communist arguments tho). You’re assuming I’m liberal (understandable given the context); I disagree with liberal thought on most fiscal issues, I just object to people dismissing economic inequality as an urgent risk to our society. I’m not saying that’s what’s happening every single time someone takes issue with the methodology of a metric, but we all know that’s the general pattern, and it gets to me.

I agree on technology, mixed bag on globalization.

8. October 2013 at 16:15

It’s a Yellen! Cigars all around.

But does anyone really expect more than a small change in tilt ?

8. October 2013 at 16:54

http://www.businessinsider.com/janet-yellen-market-reaction-2013-10

October 8, 2013

Here’s What Markets Are Doing After The Janet Yellen News

By Sam Ro

“Minutes ago, the White House announced that President Barack Obama would officially nominate Federal Reserve Vice Chair Janet Yellen for Fed Chair on Wednesday, October 8.

Yellen is considered a dove, which means she is more likely to keep monetary policy loose and easy.

Now that we are almost certain to have Yellen at the Fed’s helm, an uncertainty premium has been removed from the market. And the prospect for easy monetary policy is being seen as bullish for stocks.

Dow futures are up by around 30 points in the wake of the Yellen announcement. And as expected, the U.S. dollar is down slightly and gold is up around $2 per ounce.

Here’s a look at Dow futures via FinViz:…”

8. October 2013 at 17:02

Scott, what do you think is really causing technological stagnation?

What I think, (and this is no way a condemnation of free trade!) is that globalization, combined with easy access to cheaper labor than the first globalization “wave” in the nineteenth century, made businesses reluctant to ramp up R&D spending, because there is little need to! WIth the exception of the internet, everything has been “incremental improvements” We still run on oil, for Christ’s sake!. We don’t have flying cars. Or super batteries. Or quantum computers Or molecular replicators from Star Trek. (Although 3-D printing might come close in the next fifty years )

8. October 2013 at 17:22

Edward:

“Scott, what do you think is really causing technological stagnation?”

His fallacious assumptions about the world compels him to deny that leaving the gold standard in the early 1970s is in any way a cause for stagnant real wages since the early 1970s. So he has to make something up in his mind, such as stagnant technology.

“What I think, (and this is no way a condemnation of free trade!) is that globalization, combined with easy access to cheaper labor than the first globalization “wave” in the nineteenth century, made businesses reluctant to ramp up R&D spending, because there is little need to!”

Does not follow. Cheaper labor means there is more money available to invest in things like R&D. A higher level of R&D spending actually requires lower wage spending, ceteris paribus.

8. October 2013 at 17:25

$100 says Sumner is going to again conflate wealth with riches (real goods with dollars) when he addresses any stock market increase due to Yellen being nominated by Obama for Fed chair.

“See? Inflation is good for us! It raised the stock market!”

8. October 2013 at 17:45

Vivian, Yes, I got the joke. I thought Bill might have missed it.

Thanks Brent.

AW, There are also massive cost of living differences. The average three bedroom condo in NYC is $3.6 million. In most of America a similar size house is $200,000. It makes it look like New Yorkers are consuming much more than people in Kansas, which is misleading.

Randomize, I totally agree, except that I wouldn’t call the students “poor.” That makes no sense to me. For many people those are the best years of their life.

John, I believe the government can do plenty. Weaken some of the more crazy intellectual property rules. Eliminate occupational licensing laws. Have wage subsidies for low wage workers. Get rid of cigarette taxes, or at least cut them sharply. End the war on drugs.

My, You said;

“I’m aware you think income is meaningless and consumption is all that matters (to which I object- we’ve exchanged comments on this to no resolution). But then you blogged about income inequality!”

So if I blog about how meaningless income is, that makes me a hypocrite because I’ve already said income is meaningless, and therefore I should never talk about it? Never provide examples of how meaningless it is? Is that your point.

You said;

“This was one of the posts in my head when writing about consumer surplus: http://www.themoneyillusion.com/?p=23701”

Readers will think you caught me in some sort of mistake. But if you go to the post that you say supports your claim about me, you will not find any evidence to support your claim that I’m one of those “let them eat tech” guys. Indeed it isn’t even one on my arguments, I cite others. When I do my own posts on this I focus on how real incomes have risen for many reasons. That’s a completely different argument. I mention things like bigger homes, more people going to college, longer life expectancy, better restaurants, better cars, indoor plumbing, etc, etc. I usually argue the internet is overrated.

You said;

“I’m not interested in an evidence exchange and you can feel free to remain hysterically angry.”

Sorry, but when you act like a jerk it is your fault, don’t put the blame on me. One Mike Sax is enough. I wish you’d just admit you were wrong, and that I do not hold the views you attributed to me.

You said;

“I agree we made progress in the ’60s. The period of concern is Reagan on. But I think you know this, which exasperates me.”

There’s no need to mention Reagan, as these trends have nothing to do with personalities. Growth slowed more sharply in most other developed countries than in the US. In any case, yes, we are growing more slowly than the 1960s, but we are still growing. Starting in 1980 doesn’t change my argument.

You said;

Your favored policy (progressive consumption tax, reduce income & capital taxes) would dramatically lower the tax burden on the top.”

That’s flat out false. For any income tax, there is an equally progressive consumption tax. The mistake many liberals make is assuming that the person who writes the check to the IRS is the one who actually absorbs the tax. There is only one way a rich person can “pay” a tax, by consuming less. That’s public finance 101. No plausible tax reform in either direction will make Warren Buffett consume more or less. Hence any checks he writes are ultimately being paid by someone else.

I think you need to study consumption taxes before you make any more inaccurate statements about what they can or cannot do. Tax theory is very counterintuitive, nothing looks like what it is. I’ve spent hours here trying to convince people that a VAT is identical to a wage tax, even though they look very different.

You said;

“I actually agree with your policy when applied to the vast majority of the population, but we need a tax regime that demands more, not less, from those who are benefitting enormously from our shared system.”

I agree. But have you seen my post where I propose a compromise system–a progressive consumption tax for the bottom 99%, and the top people still have to fill out IRS income tax forms?

You said;

“I just object to people dismissing economic inequality as an urgent risk to our society.”

And I get pissed when liberals act like American inequality is a pressing issue, when global inequality is 1000 times worse, and famous liberals like Krugman advocate policies that help wealthy America at the expense of the world’s poor, and other liberals don’t call him out on it. Unlike most liberals I know, I actually do favor policies that would help the world’s poor. Most Americans have an absurdly high standard of living; the world has much more pressing problems. But yes, let’s do what we can to make things better here too, with wage subsidies and progressive taxes. But let’s also keep things in proportion. Inequality is not even in the top 5 of problems in America.

Any other questions I haven’t answered?

Mark, Of course it was also widely expected; a few months ago stocks would have soared much higher on the news.

Edward, Maybe we should look at it as the glass half full. This is normal progress. What was really unusual was the supercharged growth of 1900-1970. We won’t see that sort of progress again, at least for a while. Lots of game changing inventions. You can only invent electrical power, internal combustion engines, and modern chemistry once. After that you can keep making innovations, but they are less explosive in their impact.

8. October 2013 at 17:48

I see Geoff thinks America was on the gold standard in 1970. So a gold standard is a regime where a country refuses to sell gold at a fixed price of $35/ounce? And meanwhile the market price of gold is not fixed? Very interesting definition.

8. October 2013 at 18:08

Scott,

That is so friggin’ depressing!

That means America’ best days are behind it! I’m sorry but I dont accept that.

8. October 2013 at 18:38

There is only one cause of technical stagnation: The public sector which is not adopting the tech we have already invented.

Notice: Scott says “healthy subsidy for low-wage workers would be helpful”

And that’s only HALF right. Friedman stepped away from the NIT, for the very reason GI / CYB solves.

As an online open source platform that states adopt, and then fiddle with the levers and buttons on… it is BUILT to absorb every piece of welfare that is given to those able to work.

A lot of times, econos talk about “tech” and “finance” as if they are the same two forces, and they aren’t.

Technology innovation is really just new layers of abstraction, combining multiple more complicated things into something LESS COMPLICATED.

Whatever you want to say about “financial instruments” the exact opposite thing is happening.

Technology doesn’t make people obsolete, it takes a person and every year, even if they learn nothing, makes them more productive, but then takes the “profit” and returns it to the consumer as lower prices.

And technology does this for everyone like a benevolent god.

While the govt, education, and finance for all their machination delivered NO, ZERO, ZIP “income” “wealth” improvement for twenty years…

Technology has made damn sure that every year, everybody in the boat gets to consume more stuff.

SO, what make NIT suddenly an idea that Uncle Milty would embrace?

The new technology that makes it go.

Ladies and gentlemen, Govt. As a Platform, has finally arrived.

And the public sector is going to fight it tooth and nail.

Fortunately, the bond guys, and the pension funds, are going to force them to adopt it. And Silicon Valley is so desperate for real revenue that doesn’t rhyme with “social network” they are coming with long knives as well.

There is no budget crisis in America, and not bc we can print friggin money.

There is no budget crisis in America, bc when we go from 22M public employees to 5M public employees, and every city, state, (and many other nations) are all running on the same platform, the cost of govt. over and above wealth transfer DECREASES every year.

It’s coming.

Only tech matters.

8. October 2013 at 18:55

Obama is picking Yellen. Phew.

http://www.nytimes.com/2013/10/09/business/obama-to-nominate-janet-l-yellen-as-fed-chairwoman.html?_r=0

8. October 2013 at 19:47

Bill Ellis—

We will be lucky to get any changes. Yellin has written papers rhapsodizing about 1 percent inflation. And no Fed Chair wants to be known as the one in power when “inflation got out of the bag” (now defined as anything over 1.8 percent annual).

My hope was that Summers, who has said he is that concerned about inflation, would have been aggressive in seeking growth…I fear Yellin will persist in the current timid approach…all the while being undercut by FOMC sadomonetarists..

8. October 2013 at 21:02

Scott,

“famous liberals like Krugman advocate policies that help wealthy America at the expense of the world’s poor”

I don’t mean to be argumentative but am merely curious. Could you be more specific about the policies.

8. October 2013 at 22:34

Um, the second paragraph of mine above should have said, “Summer, who has said he is LESS concerned about inflation….”

8. October 2013 at 23:00

Seems to me that the inequality-crowd is concerned about the 1%, and your OP was a distraction. You want me to not bring that up because you’ve already stated your opposition to the 1% thesis? Seems to me that reinforces my claim about that thesis being the real point of contention.

Sorry but I have to poke fun of you for the following…

Scott: “Living standards are higher than they seem b/c better cars and longer life, and for support I’m going to quote people talking about mp3s, TVs, on-demand, and the net.”

Myb: “Scott says we underestimate living standards b/c tech.”

Scott: “Myb’s a lying jerk!”

Starting in 1980 does change things- evidence of the improving economic position of most Americans during the ’60s is overwhelmingly persuasive. Not so 1980+. I disagree that Reagan is irrelevant, but fine, replace with “1980+” if it avoids a sidebar.

“There is only one way a rich person can “pay” a tax, by consuming less”- no. Power/control.

Consumption tax w/ income tax on 1%: no, I haven’t seen that post. I read your blog more than any other, but certainly can’t claim every single post. Searched to no avail. I only see proposals excluding capital income, which isn’t like current IRS forms. Not saying you didn’t write such a post, just that I’d appreciate a pointer before I agree to eat crow. But if this is your new ideal policy, why the “inequality doesn’t matter” drumbeat?

I agree that global inequality is a more serious humanitarian issue than domestic inequality. I’m neither liberal nor humanitarian; nationalist probably fits. But my individual motivations are irrelevant.

I’m out of ammo, last shot is yours.

8. October 2013 at 23:10

Justin Wolfers with some bold claims about the new pick:

“If Yellen had been in charge of the Fed over the past few years, millions fewer would be jobless, and we would be less concerned about the danger of deflation… Moreover, while Bernanke has struggled over recent months to communicate with markets, I expect policy statements issued in Yellen’s Brooklyn accent to be clear and direct, as she says precisely what she means.”

http://www.bloomberg.com/news/2013-10-08/janet-yellen-the-right-choice-for-fed-chairman.html

9. October 2013 at 04:18

Scott,

You wrote:

“And I get pissed when liberals act like American inequality is a pressing issue, when global inequality is 1000 times worse, and famous liberals like Krugman advocate policies that help wealthy America at the expense of the world’s poor, and other liberals don’t call him out on it. Unlike most liberals I know, I actually do favor policies that would help the world’s poor. Most Americans have an absurdly high standard of living; the world has much more pressing problems. But yes, let’s do what we can to make things better here too, with wage subsidies and progressive taxes. But let’s also keep things in proportion. Inequality is not even in the top 5 of problems in America.”

Amen

9. October 2013 at 04:24

Saturos:

Well, I hope all that would be true, but is it? What would have Yellin done differently/

Okay, if you say guidance is king, then maybe she would have done a better job. Though she would still have counter-productive FOMC board members making impromptu and destructive comments every couple of days.

But do you think Yellin would have gone to QE harder and heavier and more relentlessly? Cut IOER?

Seems to me Yellin is cut from same cloth as Bernanke. Too timid, cautious.

We need a Volcker of expansionism. Was Volcker meek when he decided to smote (smite?) inflation?

Will Yellin be as bold as Volcker in pursuing growth? In smiting deflationary trends.

I hope so, but I do not predict it.

9. October 2013 at 06:08

What the heck are people talking about when they say technological stagnation? Look at a movie from the late 90s or early 2000s and you will see a dramatic difference in the role of technology in our lives. In the 1990s, most people I knew used pagers. The idea of having a handheld phone where you could browse a much more expansive internet than they had at the time would have made people laugh.

9. October 2013 at 06:17

John,

That’s incremental improvement! Bah!

We don’t have flying cars, super batteries, quantum computers, molecular replicators or FTL space travel.

9. October 2013 at 06:52

‘Look at a movie from the late 90s or early 2000s and you will see a dramatic difference in the role of technology in our lives.’

During the golden age that Krugman is so nostalgic for it’s even funnier. In the Best Picture of 1960, Shirley MacLaine plays an elevator operator, and insurance executives can’t afford to take their girlfriends to a hotel.

9. October 2013 at 07:00

[…] Source […]

9. October 2013 at 08:31

I have a general question for all. I have studied business and finance pretty heavy but am just starting to dive into monetary policy. I too, was brainwashed with all the inaccurate QE bashing just out of ignorance.

Anyways, I wanted to hear more about velocity and how QE and expansionary policy effects this.

Thanks to all!

9. October 2013 at 08:49

Prof. Sumner,

Does this quote from Janet Yellen worry you?

“There are a lot of things holding back the economy. If one were making a list of the top five or ten things holding back the economy, you wouldn’t say money being too tight, and interest rates being too high were on it.”

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/10/09/janet-yellen-in-her-own-words-an-exclusive-interview

Yikes!!

9. October 2013 at 08:57

“The median age in the city was 21.6 years. 5.8% of residents were under the age of 18;”

It took me no longer than once I read that point to realize it was a college town.

9. October 2013 at 09:01

Yikes is right. Further Yikes…

http://blogs.wsj.com/washwire/2013/10/03/white-house-rules-out-plan-b-on-debt-ceiling/

🙁 🙁 🙁

What a despicable, despicable weakling and coward our surrenderer and “congress must do it” in chief is.

Scott, since the President has revealed he has nothing up his sleeve, what is the impact of monetary offset on financial armageddon? Lets say an NGDP contraction of 20%, 10% deflation and 10% real growth, would that force even our weak Fed to act?

9. October 2013 at 09:13

Binyamin Appelbaum: “she has shown only a limited willingness to tolerate higher inflation” http://www.nytimes.com/2013/10/10/business/economy/for-yellen-a-focus-on-reducing-unemployment.html?_r=1&

9. October 2013 at 09:34

In the universe next-door, Summers gets nominated because Yellen is an anthropologist: http://economix.blogs.nytimes.com/2013/10/09/yellens-exclusive-interview-with-yellen/

9. October 2013 at 09:35

Innovating the field with the introduction of finite-dimensional vector spaces, of course.

9. October 2013 at 09:36

Edward,

I don’t think Obama has any choice but to say that publically.

Remember, Congresspeople care more about how they are perceived than about what they actually do. If Obama says “we are considering unconvential policy options”, then the Tea Party gets to have their cake and eat it too. First, they don’t have to support a debt ceiling increase. Second, Obama effectively protects them from the consequences (recession) of their actions. Third, they get to impeach him and use the hearings as an early start on campaigning for the 2014 midterms.

9. October 2013 at 10:02

Michael,

You are underestimating the insanity of the Tea Party, as is Wall Street, as is Obama, as is Scott, Im sorry to say. First, if we have a lehman event next week, the tea party will STILL find a way to blame Obama. Second, isn’t protecting the American people more important even if he protects Repubs along the way?. I know people who are in between jobs right know and they are terrified. Third, who cares about impeachment? The Senate is controlled by the Democrats. There is zero chance of conviction, Fourth Congress approval rating is a ghastly 5% while obamas is 49%, who do you think will come out on top. Fifth, “prioriztion” is a pipe dream, The Treasury lacks the wherewithal to do that , so effectively we’ll default Sixth, The Constitution clearly prohibits default, so the CONGRESS will be violating the Constitution first. Seventh, if what you say is true, and Obama is lying, its unconscionable to wish for a panic on Wall Street. Eight, Jason Furman is NUTS if he thinks their wont be buyers for Treasuries under a cloud of legal uncertainty. They’ll be so relieved that interest rates will go negative. Nine, Revealing you have an empty hand is an awful poker strategy. Ten, The surrendering and weakling tendencies of this president have been well documented in the past. Syria? Going to Congress for authority he already has?

The republicans are banking on that weakness.

Eleventh.

ENOUGH with this SH**!!! The Republicans are the ones who started this, picking this awful strategy

9. October 2013 at 10:10

Twelfth,

The debt ceiling shouldnt be raised, it should be annihilated! Once and for all.

9. October 2013 at 10:50

Morgan, great stuff. But there’s a long road from here…

A story of A and B

A: I need money.

B: But I already gave you $3 trillion this year.

A: Gone. And then some. Overshot by $500 billion actually.

B: Hmmm. Good thing you’ve got that credit card.

A: Yeah, that’s why I need money. The card is tapped out.

B: But…but…splutter…I mean…$17 trillion?

A: Every last simoleon.

B: Oh ah…ok, here’s what we’re gonna do. I’ma up your limit another $500 billion-

A: YES!!!!!!!!!!

B: BUT, we gotta talk.

A: Dude, strings? Really?

9. October 2013 at 10:50

Edward, Just the opposite, we’ll be much richer in the future.

Alan, Support for trade and immigration barriers on poorer countries. He also supports tighter regulations on working conditions, which he correctly argued in the 1990s would hurt the poor.

My, Eat crow:

http://www.themoneyillusion.com/?p=16400

The biggest factor in power isn’t income inequality, the rich have plenty of money to bribe under either a 40% or a 60% top rate. It’s statism that creates power imbalances. I talked to a banker from a big bank in northern Europe, and he said they didn’t even have any lobbying arm, and was shocked at how much American firms lobby. He said there was little point in his country, as the bank was not heavily regulated.

Where you claim to be quoting me, you are actually quoting other people, not me. If you had bothered to quote from a post where I expressed my own views on what’s important, you’d find that I think tech is far down the list.

I don’t know if you understand this, but when a blogger quotes a long passage from someone else, it doesn’t necessarily mean he agrees with 100% of what is said in the passage. It may mean he agrees with the conclusion.

I don’t understand your point about the top 1%, but income data is meaningless anyway, so the top 1% is a meaningless number. Adding together wage and capital income in the same variable is a logical monstrosity.

Unlike you, I’m not a nationalist. I suppose that fact that I care equally about poor people wherever they live is the biggest different between me and you. Everything else is a footnote.

Saturos, Wolfers is extremely bright, but also young. He won’t be making claims like that in 20 years.

Thanks Brian.

John, If you look at a list of the 50 best movies ever made, it is dominated by older movies. There are only 2 from the past 20 years.

stephen, I have a short course on money in the right column of the blog.

Travis, No surprise.

Edward, I did a post on that recently. I’ll do another soon.

Michael, I agree that Obama should say that. The law is debatable, but if the debt ceiling is not raised, then the intent of Congress is 100% clear—no more debt. If they also pass resolutions saying we’ll keep spending on military, Social Security, medicare, medicaid, federal employee wages, etc, then they are basically ordering Obama to default.

Edward, Agreed the debt ceiling is absurd. Why didn’t the Dems raise it to infinity in 2009, when they had the chance?

9. October 2013 at 10:57

Also, Scott, good stuff from Kevin Erdmann. Consistent with the thesis that the 7 fat years, from a “dependency ratio” perspective, were mebbe 1990-2010. The first decade was promising, but, as time goes on, it will become clearer what a horrible decade the 2000s were. Republicans deserve their share of blame, Boomers in general (who benefitted most from the profligacy) get some blame.

For me, though, ultimately, it was 9/11. Afterwards, there was about a 5-year moratorium on anyone, anywhere considering the cost of anything. Unpatriotic, dontchaknow.

9. October 2013 at 11:15

Jon Hilsenrath:

“Key Passages From Fed Minutes Show Officials Torn on Tapering”

http://blogs.wsj.com/economics/2013/10/09/key-passages-from-fed-minutes-show-officials-torn-on-tapering/?mod=WSJBlog

9. October 2013 at 11:42

Regarding that Hilsenrath blog…

If only there was some way to end QE without tightening policy. (Hint)

9. October 2013 at 11:43

This debate prompted me to look at the distribution of wealth in the country vs the distribution of income…

http://en.wikipedia.org/wiki/Distribution_of_wealth

And what would you know…it has been remarkably the same in the US over the years…except for a time during the late 1970s (undoubtedly due to the high inflation and poor stock market performance)…the percent owned by the top 1% was 34.4% in 1965……it what was it in 2007…34.6% …

It seems to me that if distribution of wealth is not changing…then the distribution of income statistics are very misleading as Scott says…either that or the wealthy are consuming alot more of their income than they had previously….

9. October 2013 at 11:51

“We will have to do so in a way that’s novel, that we haven’t tried in the past — by raising interest we pay to banks on their reserves, thus raising short-term interest rates generally.”

Uhm what?

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/10/09/janet-yellen-in-her-own-words-an-exclusive-interview/

9. October 2013 at 11:54

Off topic, but I’m surprised that a very serious economist can write something like this in 2013:

http://www.forbes.com/sites/kotlikoff/2013/09/28/is-hyperinflation-just-around-the-corner/

9. October 2013 at 11:54

To bring this back on topic I find income statistics often ridiculous. If anyone can make a case that the Pine Ridge Indian reservation isn’t the poorest place in America I would like to see them try. Other statistics are more elucidating than the poverty line. Life expectancy at birth hovers around 50; the unemployment rate is between 80% and 90%. Alcoholism is endemic. One town over the border in Nebraska has a population of 12 and 4 liquor stores since alcohol is banned on the reservation (prohibition doesn’t work and lets non-Lakota make the money). 5he only money for healthcare is dorect federql and state subsidies. A large portion of the people have no electricity. There are places where poverty is a major issue but for unique reasons.

9. October 2013 at 12:04

Scott,

Didn’t your parents claim you as a dependent while you were an undergrad? Most college students I’ve met are claimed as part of a household.

9. October 2013 at 12:25

Scott, you’re right.

9. October 2013 at 13:16

Prof. Sumner,

You wrote:

“The biggest factor in power isn’t income inequality, the rich have plenty of money to bribe under either a 40% or a 60% top rate. It’s statism that creates power imbalances. I talked to a banker from a big bank in northern Europe, and he said they didn’t even have any lobbying arm, and was shocked at how much American firms lobby. He said there was little point in his country, as the bank was not heavily regulated.”

Interesting! That might merit a full post…..

9. October 2013 at 13:58

Gallup just reported that the Republicans popularity has sunk to an all time low – just 28 percent approve. The 30+ year experience with big business neo-capitalism is just about over.

Going forward I see much higher taxes on the predator class and higher wages for the battered middle class. The next decades will look a lot more like the 30 years after the war and not at all like the past 30 years of Reaganism.

In other words, Morgan’s world view is about to be shattered.

9. October 2013 at 15:57

Tom wrote: “higher wages for the battered middle class.”

Hahahahahahah, good joke, Tom.

You should become a deadbeat welfare dad. Then Obama will help you. Obama favors crushing the middle class with income/health/carbon taxes.

9. October 2013 at 18:03

Oh Steve,

Please tell me what taxes increased on me – a high school educated electrician making about 55k a year?

9. October 2013 at 18:36

“making about 55k a year?”

Obamacare, subsidizing under 45k.

Of course, debt isn’t a tax until it has to get paid. Surprise! 🙂

Plus, carbon tax, coming soon to an electrician near you.

9. October 2013 at 18:39

Tom, I’d advise cutting your hours 20%. Then you gets subsidized!!! Weeeee!!!

9. October 2013 at 20:20

My employer provides a decent package so I don’t think I’ll need to go on to the exchanges. But if I did, wouldn’t I also get subsidies with a wife and 3 kids?

I am, of course, extremely happy that the country is rejecting the rejecting of Obamacare. I had a little brush with skin cancer a couple of years back and am guessing would be pretty much uninsurable if I ever needed to get insurance from the exchanges.

10. October 2013 at 03:57

Thanks for the acknowledgment Scott.

Here from Tim Taylor:

However, in a paper published in the Fall 2012 issue of the Brookings Papers on Economic Activity, Bruce D. Meyer and James X. Sullivan present some alternative interpretations and more cheerful conclusions in “Winning the War: Poverty from the Great Society to the Great Recession.” They conclude: “Despite repeated claims of a failed war on poverty, our results show that the combination of targeted economic policies and policies that support growth has had a significant impact on poverty. … Noticeable improvements have been made in the last decade; although not as big as the improvements in some earlier decades, they are comparable to or better than the progress made in the 1980s. We may not yet have won the war on poverty, but we are certainly winning.”

IMO the problem that we call poverty in the USA is no longer about a lank of access to goods and services. I am even convinced that it is not about access to schooling or even access to education. Ir is something else.

One personal observation is that the people we call poor in the USA are no longer skinny so they are at least getting enough food.

10. October 2013 at 05:57

Very good post and in spite of some really stupid comments I have to say that your posting on inequality had noticeable impact on my thinking for which I am thankful for you.

Just two points

1) I totally agree with your basic premise that these inequality comparisons are quite misleading. However what do you think about inter-generational income mobility? That means comparing your income when you were 25-44 to the income of your father?

2) I do not think that “consumption equality” is good measure either. For instance compared to some of my friends I am pretty large saver (as percentage of my income) and I am perfectly OK with a modest life. However this is voluntary and I do not think that anybody should use my consumption to show that there is some kind of inequality. And this is also valid for lifetime consumption, as there is a chance that I may die before I may actually spend what I saved. Or that I leave it to my children.

10. October 2013 at 07:31

MikeF, In fairness the distribution of wealth figures are also inaccurate. In my view the distribution of wealth is more equal than the figures show, but also getting less equal to a greater extent than the figures show. Both are due to the exclusion of human capital.

Morgan, That disappoints me.

LK, I did a post on that.

errorr, Exactly.

Benny, No they didn’t, I worked my way through college.

Tom, You do know that the “predator class” didn’t actually pay those taxes, don’t you?

Thanks Floccina.

JV, I don’t know what to make of intergenerational mobility.

2. Yes, I agree that lifetime consumption is better. But even annual consumption is better than income.

28. October 2013 at 15:28

[…] this on the pile of evidence suggesting that our inequality data sucks (at least in part because it’s not changed much since […]

21. January 2014 at 18:51

[…] The second poorest town in America is Athens, Ohio, which is full of middle class college students with low incomes. Are they really poor? That’s a judgment call. But I’d guess that their lifetime incomes are quite respectable. […]