It’s services, i.e., it’s NGDP, i.e., it’s monetary policy

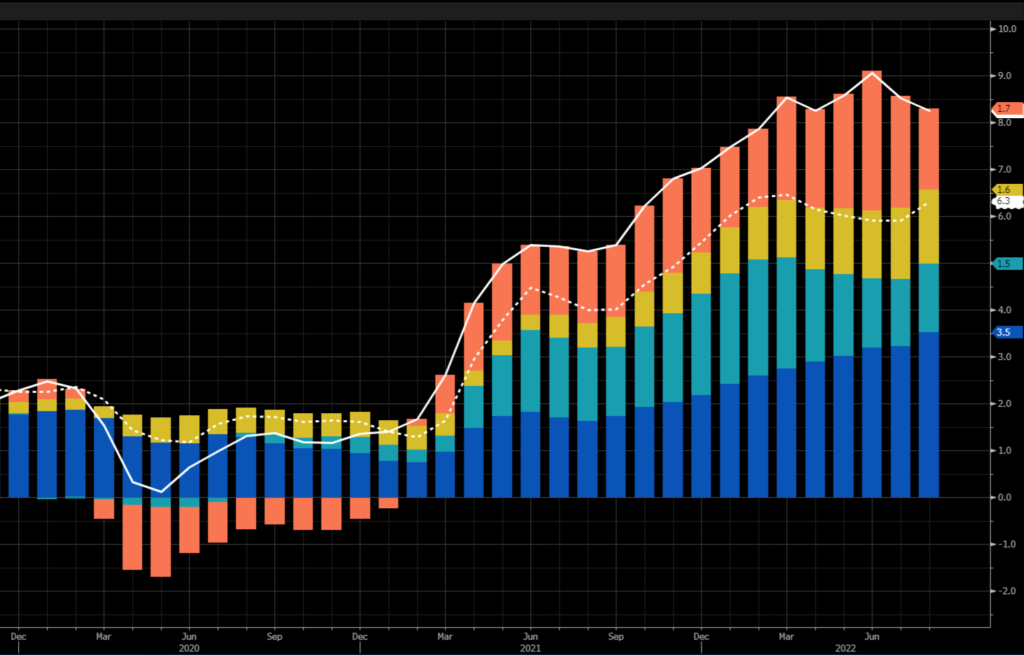

So what’s the problem with inflation? John Authers and David Beckworth directed me to the following graph, which shows that the most recent upswing is in services:

I apologize if the graph’s hard to read, you can look at the original here.

If you decompose the 8.3% annual inflation, 1.7% is energy (orange), 1.6% is food (yellow), 1.5% is other goods (teal) and 3.5% is services (blue.) Be careful interpreting these components; they are not annual inflation rates, they are contributions to inflation. Each component is rising much faster than its contribution to the total. Thus services and other goods are rising at 6.3%, which is the core inflation rate, even though they contribute only 5% to headline inflation. And food and energy prices are rising at double digit rates over the past 12 months, despite contributing just 3.3% to a headline inflation rate of 8.3%.

But I’m more interested in recent trends. Stocks plunged today because core inflation is worse than expected, and that’s mostly services. Why is service inflation getting worse? Because it responds with a lag to increases in nominal GDP. It’s almost always thus way. Much of services inflation is wages and implicit rents. Wages are sticky and rents are even stickier, often on one year contracts. The average “spot” rent on new contracts has already peaked and is heading downward, but the measured average rent will get worse for a while.

There are a few lessons here:

1. During periods when NGDP is rising too fast, ignore so-called experts who try to tell you that inflation is caused by this or that supply problem. It’s the NGDP, stupid.

2. Don’t assume that rising interest rates mean that monetary policy is getting tighter. That may be true in some cases, but until we get a slowing in NGDP growth (which is expected to remain quite high in Q3), we don’t actually have a tight money policy. At most, a bit less loose than earlier in the year.

3. Heavily discount any sort of Phillips Curve analysis of inflation, which focuses on tight labor markets. The problem is NGDP growth.

4. Back in January, I criticized the Fed’s pivot to asymmetric average inflation targeting. With every new data point, it becomes more and more obvious that the abandonment of average inflation targeting was a huge mistake. “Keep It Symmetrical, Stupid.”

We’ll be paying the price for this mistake for years.