Random articles

1. Philippe Lemoine has a good article on how Covid will impact society in the long run:

Conclusion

The pandemic is on its way out, but SARS-CoV-2 is here to stay. Fortunately, as everyone develops immunity to it (whether through vaccination or natural infection), it will soon no longer be a major problem anymore. The virus will continue to circulate, but much less than during the pandemic and, even when people are infected, the infection will typically be mild. In the future, almost everyone will get infected for the first time during their childhood, which is harmless and will protect them against severe illness when they are reinfected.15 The virus will continue to mutate and some of those mutations will favor immune evasion, but while this will allow it to infect people who have already been infected or vaccinated more easily, immunity should continue to protect against severe forms of the disease, thanks in particular to the role played by T-cells. This is likely what happened with other human coronaviruses, which are already endemic and typically cause a cold in the people they infect. To the extent that immune evasion occurs, it will be very gradual and the fact that most people will be infected every few years will update their immunity, ensuring that subsequent reinfections will also be mild. The most vulnerable people, whose immune system doesn’t work very well and could use some help to be ready in case of infection, can get a vaccine booster from time to time. The virus will still kill people, as the flu does, but it will never cause the same amount of disruption again. The hardest part of what lays ahead may be to convince people who have been traumatized by the pandemic that it’s over and that restrictions are no longer necessary.

2. The Economist reports that only 15% of the Bulgarian population has been fully vaccinated, and yet demand for vaccination is so low the country is being forced to export lots of unused doses:

Historically, Bulgarians have had little trust in official advice. Circumventing rules of all sorts is a national pastime. Many people are suspicious of the jabs because they are new; some think the virus does not exist, and that measures against the pandemic are a conspiracy. Only a handful of prominent politicians have had themselves vaccinated on television, or are urging people to get a jab. . . .

Watching Bulgarian television can leave you confused. A few covid-sceptical doctors are regularly invited on talk shows. Some advise people with medical conditions that would place them in priority vaccination groups in most countries against getting jabbed. About 30% of doctors and 60% of nurses are unvaccinated.

Dr Kunchev says this is partly because infectious diseases and immunology are barely covered in medical-school curriculums.

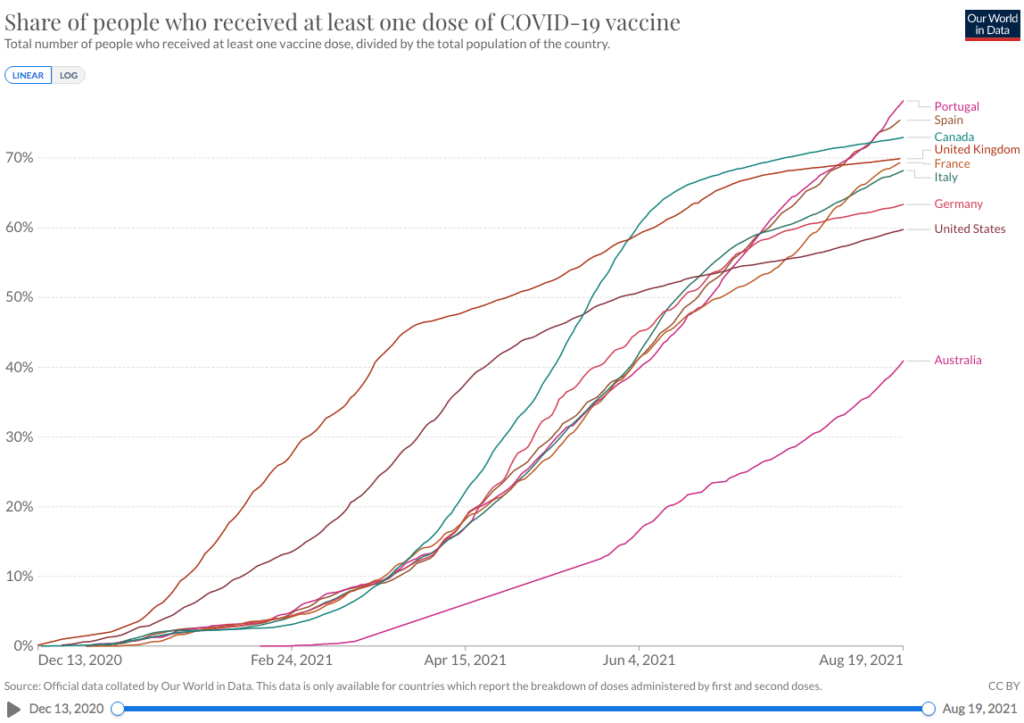

Is this because Bulgaria is poor? Perhaps, but Portugal is also relatively poor, and has the world’s highest vaccination rates, with over 78% having received a first dose:

3. Speaking of The Economist, this is madness:

Only when the world is adequately vaccinated will travel start to feel as it did before the pandemic. That may not be until 2024, by some estimates. Even then, daft rules could stick. America’s ban on travellers with hiv was introduced in the 1980s and abolished only in 2010. Likewise, airlines could be asking for covid-19 papers for years to come. Britain’s transport minister, Grant Shapps, says Britons who venture abroad will need to be fully vaccinated against covid-19 “for evermore”.

Vaccine certification may well make sense in the long run. But bans on visitors from certain countries or caps on international arrivals do not. The risk is that these rules and regulations may outlive their purpose not because governments cannot undo them, but because no politician wants to be the first to try.

4. And The Economist is skeptical of the value of massive fiscal stimulus:

Some economists see insufficient spending as a cause of subdued labour demand. In three-quarters of rich countries the “fiscal impulse”, a measure of the oomph government spending gives the economy, is expected to turn negative this year. Yet it seems unlikely that governments can close the worker deficit simply by spending more. Compare America and the EU. In the spring of 2020 aggregate working hours in both economies tanked. America then passed gargantuan stimulus packages, while European governments chose more modest measures. The recovery in working hours since then has been only marginally better in America—not much extra labour for a lot of extra cash.

5. The same issue documents the sad decline in democracy in numerous Asian countries, including India:

Under Narendra Modi, the prime minister since 2014, the ruling Bharatiya Janata Party (BJP) has eroded many of the checks and balances that underpin true democracy. Elections themselves are largely free and fair. But defamation laws are abused to hound critics. Political opponents are intimidated and even imprisoned. Over 7,000 Indians have been charged with sedition under the BJP, casting a chill on civil society. . . .

The v-Dem Institute at the University of Gothenburg, which produces an annual report on the state of democracy around the world, declared this year that India has gone from “electoral democracy” to “electoral autocracy”, as autocratic as Pakistan and worse than Bangladesh or Nepal.

Still more democratic than China, but the gap is narrowing.

6. A few months ago, some commenters asked me why I thought the US was becoming more puritanical. Here’s an example:

OnlyFans provided a financial lifeline to sex workers during the Covid-19 pandemic. Now those who have built businesses on the platform are wondering whether they’ll see everything evaporate. . . . The company has said the changes were due to pressure from financial services companies, such as banks or payment providers.

This article in Reason provides some context.

7. The war in Afghanistan may soon be over, but the American government’s war on drug-using Americans is endless:

None of the nine wealthy 20-somethings who were rushed to Manhattan emergency rooms by ambulance one night in November 2019 meant to use opioids. They all thought they were using cocaine, until seven of them passed out within minutes of the first bump.

All of them needed hits of naloxone, the overdose reversal drug, on the way to the hospital. Two were so far gone that they needed three.

The partiers were part of five groups who didn’t know each other, but several had the same contact’s number in their phones, suggesting that a tainted batch of coke was indeed floating around Midtown and Lower Manhattan that night. Blood tests indicated that the cocaine was tainted with fentanyl,

That’s what an illegal drug market looks like—lots of accidental overdoses.

8. Trumpistas a month ago: “Biden shouldn’t get credit for the pullout, as he is merely implementing Trump’s policy decision.”

Trumpistas today: “How dare you suggest that this fiasco was Trump’s idea.”

(But don’t underrate Pompeo’s role.)