The GOP decided to stick with their 2016 platform in 2020:

When Republicans read the platform their party is using for the 2020 campaign, they may be surprised to see that it is full of condemnations of the sitting president.

“The survival of the internet as we know it is at risk,” the platform reads. “Its gravest peril originates in the White House, the current occupant of which has launched a campaign, both at home and internationally, to subjugate it to agents of government.”

That’s true; look how they are going after TikTok and WeChat!

The warning about speech online is one of more than three dozen unflattering references to either the “current president,” “current chief executive,” “current administration,” people “currently in control” of policy, or the “current occupant” of the White House that appear in the Republican platform. Adopted at the party’s 2016 convention, it has been carried over through 2024 after the executive committee of the Republican National Committee on Wednesday chose not to adopt a new platform for 2020.

The platform censures the “current” president — who in 2016 was, of course, Barack Obama — and his administration for, among other things, imposing “a social and cultural revolution,” causing a “huge increase in the national debt” and damaging relationships with international partners.

I agree. The current president has run up by far the largest peacetime budget deficits and trashed our relations with foreign countries. (He also increased our trade deficit.)

Seriously, Trump is the platform. Issues no longer matter; it’s a personality cult. If issues mattered, Jeff Sessions would be the GOP nominee in Alabama.

I occasionally get commenters telling me, “but you agree with Trump on the issues; you just don’t like his personality”. So let’s look at the important issues, and count the number where I agree with Trump.

1. The war on drugs

2. Support for authoritarian nationalism

3. Switching to a consumption tax

4. International trade

5. Immigration

6. Cadillac tax on health insurance

7. Residential zoning

8. Occupational licensing

9. School choice

10. Carbon taxes

11. Big budget deficits

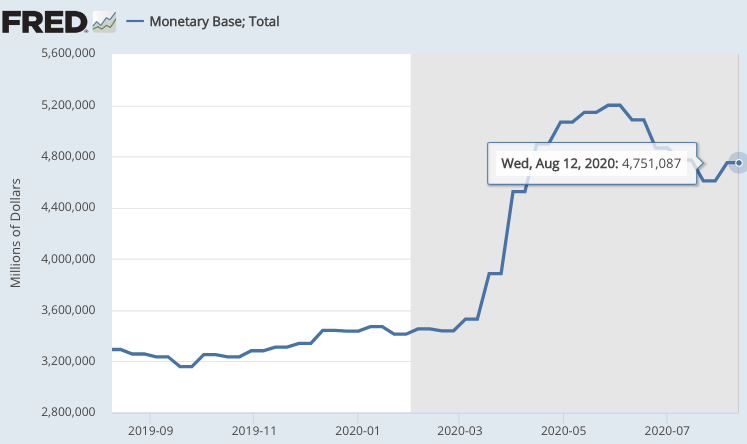

12. Monetary policy

13. Allowing the sale of kidneys

14. Increasing military spending

15. Reforming Social Security and Medicare

16. Abortion rights

17. Sanctions on Iran and Cuba

I agree with the Trump administration on school choice, and I agree with both Trump and Obama on occupational licensing. I disagree with Trump on all the other 15 issues, and in 10 cases (#1, #2, #4, #5, #7, #10, #12, #14, #16, #17) I’m even further from Trump than I am from the Dems. In 4 others (#6, #11, #13 , #15) I’m equally far from both. On consumption taxes I’m closer to Trump. So no, it’s not a question of me agreeing with Trump but not liking his personality. BTW, I also reject the idea that bigotry, dishonesty and corruption are mere “personality quirks”.

Here’s the most important “issue” to me: I want to make the US into a country where people don’t care who is president, a place like Switzerland. The more people care who is president (as in Venezuela) the worse off the country is.

It does make sense for the GOP to stick with the 2016 promises, as Trump has yet to repeal Obamacare, build the wall, reduce the trade deficit, reduce illegal immigration, expel the illegals, rescue the coal industry, bring back manufacturing jobs, and deliver 4% RGDP growth. But maybe this will all happen in the second term.

PS. To be clear, when I say I agree with Trump and Obama on occupational licensing, I mean I agree with their recommendations that states reduce these requirements. I would actually go much further, eliminating all occupational licensing laws. Similarly, I’d completely abolish the public school system.

PPS. I saw this headline this morning:

RNC Naturalization Ceremony Sparks Uproar: ‘This Ceremony Is Not About Worshiping a President

The pre-taped ceremony featured 5 citizenship applicants from disparate backgrounds, with their oaths of citizenship officiated by acting Secretary of Homeland Security Chad Wolf, as Donald Trump watched. Afterward, Wolf effusively praised Trump and the newly inducted citizens were encouraged to do the same.

It appears to be a wholly unprecedented politicization of the naturalization ceremony. No president has ever used such a ceremony as a campaign event, according to the New York Times. And complicating matters further, two weeks ago the Government Accountability Office determined that Wolf is breaking the law by continuing to act as the head of DHS because he was never lawfully appointed.

Of course the ceremony is about worshipping the president! Does the reporter think we are Denmark? We live in a banana republic—it’s long past time for people to get used to that fact.

PPPS. Here’s another example, this time from the left.