Lael Brainard gave a very good speech at the UC Booth School of Business in NYC, which begins by considering what went wrong during the recovery phase of the Great Recession:

Looking back at the international experience, the evidence suggests that forward guidance and balance sheet policies were broadly effective in providing accommodation following the financial crisis. But they were less effective when there were long delays in implementation or apparent inconsistencies among policy tools. It is important to distill key lessons from the past use of these tools in order to make them more effective in the future.

First, in some cases around the world, unconventional tools were implemented only after long delays and debate, which sapped confidence, tightened financial conditions, and weakened recovery. The delays often reflected concerns about the putative costs and risks of these policies, such as stoking high inflation and impairing market functioning. These costs and risks did not materialize or proved manageable, and I expect these tools to be deployed more forcefully and readily in the future.

Second, forward guidance proved to be vital during the crisis, but it took some time to recognize the importance of conditioning forward guidance on specific outcomes or dates and to align the full set of policy tools. In several cases, the targeted outcomes set too low a bar, which in turn diminished market expectations regarding monetary accommodation. In some cases, expectations regarding the timing of liftoff and asset purchase tapering worked at cross-purposes.

In addition, in some cases, it proved difficult to calibrate asset purchase programs smoothly over the course of the recovery. To the extent that the public is uncertain about the conditions that might trigger asset purchases, the scale of purchases, and how long the purchases might be sustained, it could undercut the efficacy of the policy. Furthermore, the cessation of asset purchases and subsequent balance sheet normalization can present challenges in communications and implementation.

Finally, in the fog of war, it was difficult for policymakers to distinguish clearly between temporary headwinds associated with the crisis and emerging structural features of the new normal. In part as a result, it took some time to integrate forward guidance and other unconventional policies seamlessly, and it took even longer to recognize that policy settings were unlikely to return to pre-crisis norms.

This misses the mistakes of 2008, when the Fed wasn’t at the zero bound, particularly the Fed’s excessive focus on inflation (rather than NGDP growth) and its putting too much weight on model forecasts of inflation relative to market forecasts. But otherwise it’s a pretty good summary of mistakes made after 2008.

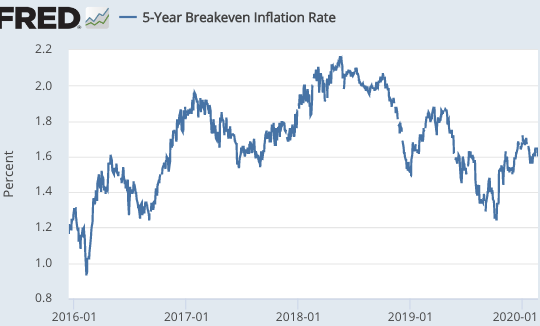

Brainard recommends a much more timely and expansive use of tools in the next recession, including interest rate caps and forward guidance. She also favors “flexible average inflation targeting”. That might sound worse than strict average inflation targeting, but if it’s an implicit nod to the fact that it’s NGDP that really matters, then maybe it would actually be better. In other words, try to get back to the price level trend line when the deviation is caused by demand shocks, but not when caused by supply shocks.

NGDP level targeting would be even better, but that’s off the table right now, so Brainard is right to focus on those improvements that are the most feasible.

Toward the end she suggests that monetary policy might not be enough, and calls on Congress and regulators to do more, using countercyclical fiscal policy and countercyclical macroprudential financial regulations. I think that’s being overly optimistic.

It’s unrealistic to expect Congress to engage is countercyclical fiscal policy; indeed fiscal policy has been highly procyclical in recent years. Basically, the US is now a banana republic, and the Fed needs to understand that fact and behave accordingly. Banking regulation has also been procyclical, becoming more lax as the economy booms. It’s really hard to overcome political pressures that keep pushing policy in a procyclical direction

Instead of relying of fiscal policy, I’d like to see the Fed ask Congress to give it additional tools. Congress should let the Fed declare an emergency when rates fall to the zero bound, and allow the Fed to buy a much wider range of assets during the emergency. If they wish, Congress could add a provision that the Fed must reduce its balance sheet when the emergency is over, and (without a waver from Congress) not allow the Fed to raise rates until “unconventional assets” (like stocks and corporate bonds) were first sold off.

If fiscal policy is to play any role, it should be for Congress to commit to a bailout of the Fed if its QE program leads to such large losses that the Fed’s assets fall to zero. This is something that almost certainly will not happen in the foreseeable future. But this commitment would add credibility to the sort of large-scale QE programs that might be needed in a deep recession.

In the past when I discuss this provision, commenters sometimes want to talk about a fiscal bailout of the Fed as something that might actually happen. That’s not a productive discussion. It’s not going to be needed in the foreseeable future. (The currency stock alone is $1.8 trillion.) The point is to remove any anxiety that Fed officials might have regarding a “whatever it takes” approach to stimulus.

Indeed I don’t think it’s even useful to talk about the Fed buying stocks, as that also seems unlikely to be necessary. What is necessary is to convince that markets that the Fed would buy stocks if needed to hit their average inflation target.