Japan hasn’t yet run out of ink and paper

Here’s Noah Smith at Bloomberg:

Japan’s great monetary policy experiment is drawing to a close, and the results may change the way the world thinks about central banking. The Bank of Japan’s recent quarterly report says, in effect, that the central bank has done all it can do to raise growth and inflation, and that fiscal policy needs to step in and help. The BOJ admitted that monetary policy alone won’t be enough to hit its 2 percent inflation target, now or ever.

This is very troubling for monetarists (as those who think that monetary policy is the key to macroeconomic stabilization are sometimes called). If central banks can’t control the rate of inflation, what hope do they have of affecting the economy?

I was surprised to read that the BOJ’s quarterly report had said that the BOJ had done all it could, particularly since the head of the BOJ frequently says exactly the opposite. So I followed the link to the “quarterly report” and found . . . another Bloomberg article:

Many economists interpreted a BOJ policy shift in September as preparation for a sustained fight to generate inflation. Shirai said the central bank would maintain the status quo on policy unless the yen surges or economic data deteriorate.

And what will it do to policy if the yen “surges”? Let me guess, it will ease policy. So why not ease policy today?

In fact, the BOJ denies that it is out of ammo.

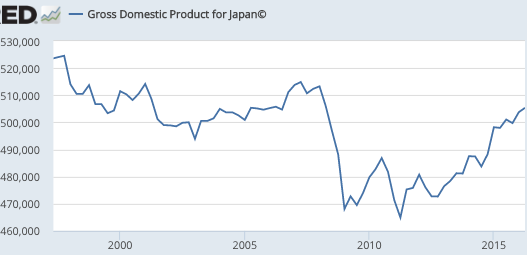

Market monetarists have been more accurate in their Japan forecasts than any other group. I believe that I was the first western blogger to comment on Abenomics, and I consistently predicted that the policy would raise inflation, but not all the way up to 2%. That’s been my view all along, and that’s exactly what’s happened. The actual inflation rate has averaged closer to 1.0%, but even that is a dramatic improvement over the deflation that preceded Abenomics (and this occurred during a period of rapidly falling oil prices, when even US inflation underperformed). I also pointed out early in 2016 that the BOJ was moving to a more contractionary policy, and we now see the effects of that policy switch on Japanese inflation, which has fallen. Even so, the impact of Abenomics on NGDP is clearly positive. It began rising almost immediately after Abenomics was announced in late 2012:

The rest of the article makes the usual mistakes, confusing low interest rates and QE with easy money, whereas they are usually reflective of the fact that the central bank policy is too contractionary. The market monetarist solution now is the same as it always was—NGDPLT—combined with a “whatever it takes approach” to monetary stimulus. If you want a smaller central bank balance sheet, then aim for a higher NGDP growth target. This is not rocket science; we know how to do it, we just need to get real world central banks to try.

The rest of the article makes the usual mistakes, confusing low interest rates and QE with easy money, whereas they are usually reflective of the fact that the central bank policy is too contractionary. The market monetarist solution now is the same as it always was—NGDPLT—combined with a “whatever it takes approach” to monetary stimulus. If you want a smaller central bank balance sheet, then aim for a higher NGDP growth target. This is not rocket science; we know how to do it, we just need to get real world central banks to try.

But don’t let the perfect be the enemy of the good. Abenomics really was much better than what came before, and we can do still better. Instead of abandoning monetary policy, why not improve it?

There’s another thing I don’t understand about all these “monetarism has failed” articles—where are all the “Keynesianism has failed” articles? Didn’t Japan do massive fiscal stimulus, causing it’s debt to balloon to 250% of GDP? Why isn’t fiscal stimulus viewed as a failure? I suppose a Keynesian would say, “well they should have done even more”? OK, but why doesn’t that also apply to monetary stimulus? After all, fiscal stimulus is far more costly. In contrast, there’s no limit to how much money can be printed. And why do we get this:

If Japan is out of the monetary easing game, other countries will doubtless follow. The era of bold monetary policy experimentation that began with the global financial crisis is now drawing to a close. More and more, economic policy makers will look to fiscal initiatives and to deeper structural reforms to boost growth and stop deflation.

Why not say the failure of fiscal stimulus in Japan means that governments are “out of the fiscal game”? In fact, governments can never be out of the monetary policy game, unless they revert to barter. As Nick Rowe likes to point out, there is no such thing as not doing monetary policy. The only question is where are you going with that policy. If you have a policy that delivers low NGDP growth rates and near zero interest rates, then you will end up with a big central bank balance sheet. There’s no way to avoid that except by aiming for a higher NGDP target. Fiscal policy doesn’t create any short cut to success, as the Japanese case already showed. In January 2015, the Swiss tried to “get out of the monetary policy game” so they could shrink their balance sheet, and the balance sheet is now bigger than ever. If you are going in the wrong direction, then switch policy.

If any central bank was going to fulfill the dreams of monetarists, it was Kuroda’s BOJ.

Actually, Australia’s much closer to what monetarists have in mind, unless you consider letting the yen appreciate from 125 to 100/dollar to be a monetarist “dream”.

Here’s another article on the BOJ, from last month:

“We are buying government bonds to achieve the 2% price target,” Kuroda said.

Kuroda said that he doesn’t expect the BOJ to run out of JGBs to purchase.

He said that the BOJ’s easy policy would not lead to hyper-inflation.

PS. Stephen Kirchner sent me to this. Great idea, do massive fiscal stimulus when unemployment is 4.9% and the Fed is raising rates to prevent an overshoot of 2% inflation. Why didn’t I think of that? I often say that talking about politics takes 30 points off a person’s IQ (including me). I have a new one. The zero bound takes 30 years of progress away from macroeconomics. It took macro 30 years to recover from the Great Depression, and it’ll probably take 30 years to recover from the Great Recession. I won’t live that long.

🙁