The Great Recession happened because we ignored Friedman’s ideas

Patrick Sullivan directed me to a Brad DeLong article on the lessons of the Great Recession:

And yet, as recommendable as Wolf’s proposals may be, little has been done to implement them. The reasons why are found in the second book: Hall of Mirrors, by my friend, teacher, and patron,Barry Eichengreen.

Eichengreen traces our tepid response to the crisis to the triumph of monetarist economists, the disciples of Milton Friedman, over their Keynesian and Minskyite peers – at least when it comes to interpretations of the causes and consequences of the Great Depression. When the 2008 financial crisis erupted, policymakers tried to apply Friedman’s proposed solutions to the Great Depression. Unfortunately, this turned out to be the wrong thing to do, as the monetarist interpretation of the Great Depression was, to put it bluntly, wrong in significant respects and radically incomplete.

The resulting policies were enough to prevent the post-2008 recession from developing into a full-blown depression; but that partial success turned out to be a Pyrrhic victory, for it allowed politicians to declare that the crisis had been overcome, and that it was time to embrace austerity and focus on structural reform. The result is today’s stagnant economy, marked by anemic growth that threatens to become the new normal.

I think this is exactly backwards. But first let’s get one issue out of the way; Friedman’s proposed 4% rule for M2 growth might well have failed in 2008. On the other hand, clearly that’s not what DeLong (and Eichengreen?) had in mind. Monetarism in the sense of the k% rule has almost zero influence today. If people are claiming that “monetarist” ideas contributed to the failed policy response in 2008-09, they are clearly thinking of monetary policy more broadly—that the Fed can and should steer the nominal economy, and that we should not rely of fiscal or regulatory solutions to problems that are essentially monetary. So let’s review what happened in 2008:

1. Two days after Lehman failed, the Fed met and decided the US faced a financial problem, not a monetary/AD problem. Thus they decided not to ease monetary policy. A few weeks later the Fed decided to pump enormous quantities of liquidity into the banking system. Under a normal (monetarist) policy regime, that liquidity would have driven short-term rates to zero and increased the broader money supply. But the Fed did not want that to happen. They explicitly tried to avoid easing monetary policy, even as they rescued the banks, by implementing a new device called “interest on reserves.” Paying banks not to move the money out into the economy. This kept rates above zero until mid-December, when the Fed finally threw in the towel and lowered rates to 0.25%, where they remain today.

2. In 1997 Friedman warned the profession that they were confusing low interest rates with easy money. In 2003 Bernanke echoed that warning. In Frederic Mishkin’s final FOMC meeting (in 2008) he made a heartfelt plea to the Fed not to confuse low rates with easy money. Unfortunately, over the next few years the Fed (and most of the rest of the profession) did exactly that, assuming that low rates meant an easy money policy.

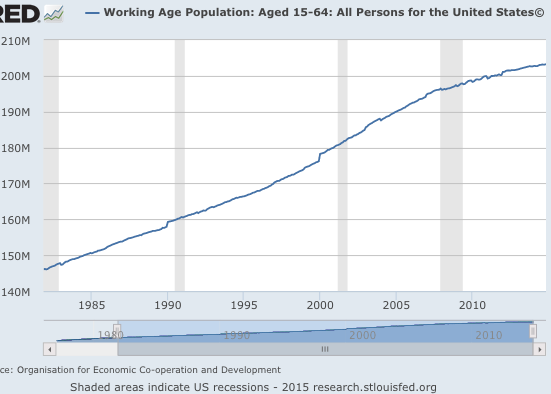

3. By March 2009, the data were coming in much worse than expected, and it was clear that monetary policy had been far too tight in 2008 (when we were not at the zero bound), producing the biggest drop in NGDP since the 1930s. I recall DeLong once expressing dismay that the Fed would acquiesce to such a large drop in NGDP, and do little to repair the damage. They finally did act in March, with the QE1 program, and a weak recovery began. But they needed a much more aggressive program, either more QE, or lower IOR, or more aggressive forward guidance, or the sort of level targeting that Bernanke recommended the Japanese undertake in the early 2000s, or all of the above. But it wasn’t until late 2012, when the Fed saw the approaching fiscal austerity that they moved more aggressively on the QE/forward guidance front. Since the beginning of 2013 the unemployment rate has been falling fast.

I see a profession that wrongly thought the Fed was out of ammo (something Friedman would have never assumed) that wrongly thought low rates meant easy money (something Friedman never would have done), that wrongly thought fiscal stimulus was the answer (something Friedman never would have done), that wrongly thought it was a financial crisis and not a monetary/AD crisis until it was too late (suggesting they put more weight on Bernanke (1983) than Friedman and Schwartz (1963).)

Actually Bernanke was trying to do more, but when the “Fedborg” is hopelessly confused, and when the broader economics profession is hopelessly confused, well then there’s only so much one mild-mannered former college professor can do.

The people most off base in 2008-09 were the conservatives. Friedman’s voice was dearly missed.

PS. I hope DeLong doesn’t get annoyed if I tease him on one point. He calls Martin Wolf a “conservative British journalist” and then spends several paragraphs discussing all sorts of Wolf views on a wide range of issues. The only common thread I found was that Wolf’s policy views seem consistently left-of-center, at least where there is a clear left/right split (the euro seems ambiguous.) So why not say “formerly conservative British journalist?”

(That’s not to say Wolf doesn’t have some good suggestions.)