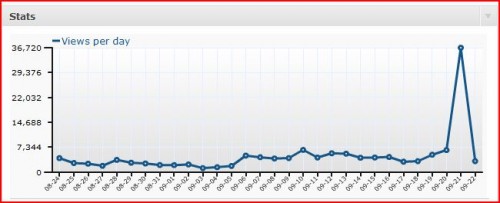

As far as I can recall my record number of comments is about 10,000 in one day. I’m at 15,000 and it’s not even 4:00. And I haven’t done any posts yet (before this one.)

I’m sure I don’t have to tell my long time readers what I think. I’m on record that the Fed’s goal should be much higher long term interest rates (achieved through monetary stimulus.) The econ textbooks rarely even discussed the original operation twist (from the 1960s), except occasionally to note that it probably had no effect. There’s a reason it was tried and then abandoned. So I thought it worse than nothing—something that diverted the Fed’s attention, and made effective moves less likely.

But the markets already had that priced in. What really shocked me was the accompanying statement from the Fed. With the world situation now so precarious, I thought surely they’d have something to say about future possible policies. Something like; “There are significant downside risks and the Fed is prepared to adopt more aggressive techniques if needed.” Perhaps even mention a few more aggressive options like level targeting, at least as a fall back if things keep going downhill. But there was nothing, absolutely nothing in the statement to reassure the markets. It read like the Fed was out of ammunition, even though (elsewhere) Bernanke insists it isn’t. I’m no mind-reader, but if I had to guess it would be that the market reaction was so negative because of what they didn’t say—Operation Twist was already priced in, and understood to be purely symbolic.

This looks more and more like the Hoover Administration. Initially his initiatives were greeted with big stock rallies. But by mid-1932 the stock market reacted to his speeches with big declines. Not because we were “out of ammunition;” the minute FDR got in things turned around. Well that’s not quite right, the stock market did nothing until the April 1933 dollar devaluation, when it began rocketing upward. Symbolism isn’t enough, you need level targeting. Ben Bernanke understood this when he recommended the Japanese show “Rooseveltian resolve.” What happened to that Bernanke?

Lars Christensen sent me a message about the falling euro. Of course it isn’t really the euro that’s falling; it’s the dollar that’s rising. Nothing happened at 2:15 that would affect the value of the euro, but at 2:15 the Fed did adopt a tighter than expected monetary policy, which did appreciate the dollar. The “traitors” got the strong dollar they demanded; now we’ll see how their constituents like this policy. Economics is not a zero sum game. Falling nominal incomes hurts a lot of people, both blue and red.

PS. My definitive statement on NGDP targeting just came out in National Affairs. (In the first version I erroneously said National Interest.) I plan a post in the next few days that organizes my views, as commenters keep asking for a go-to place where they can read my views on the key issues. This article will be one of a number linked to in that post.

PPS. I knew there’d be lots of reaction to my “treason” post. A few comments:

1. Obviously I meant the term somewhat ironically–I assumed readers would understand that Perry has debased the term to near meaninglessness. To the modern GOP, it’s like saying someone has bad breath.

2. Despite point one, I was sincerely outraged by the letter. The GOP leaders have made it clear that they want Obama to fail. Some commenters say I am naive about politics, that it’s hardball. I don’t agree. It’s expected that pols will do special favors for farmers or teachers to get elected. That’s softball. It’s not OK to vote for or against a nuclear weapons treaty on anything but idealistic grounds. I put monetary policy in with the nuclear weapons, not the special interests. It’s not OK to oppose policies because they’ll create millions of jobs and get the incumbent re-elected, unless you’d also oppose them if your own party was in charge. I know that in some less developed parts of our globe politicians are willing to almost destroy their country to maintain power. They play hardball. But scorched earth policies are not acceptable in America.

3. I obviously wouldn’t have brought up the term “treason” if Perry had not already done so. His use was outrageous because with all Bernanke’s faults (and you can see I oppose his policies) it’s absurd to accuse a Republican of doing monetary policies aimed at getting a Democrat re-elected. I don’t question Bernanke’s motives. I wish I could say that about his accuser.

4. BTW, this is nothing like the old gold/silver fights. Those people were principled. The gold side favored the same tight money to help creditors, regardless of which party was in power. The modern GOP only favors tight money when the Dems are in office. They called for easy money when Reagan/Bush were in office.