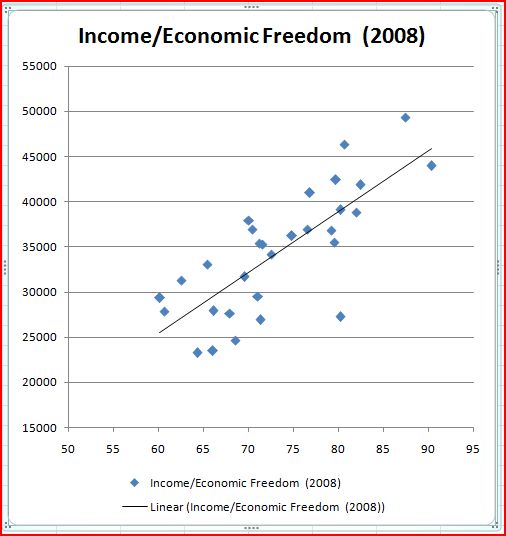

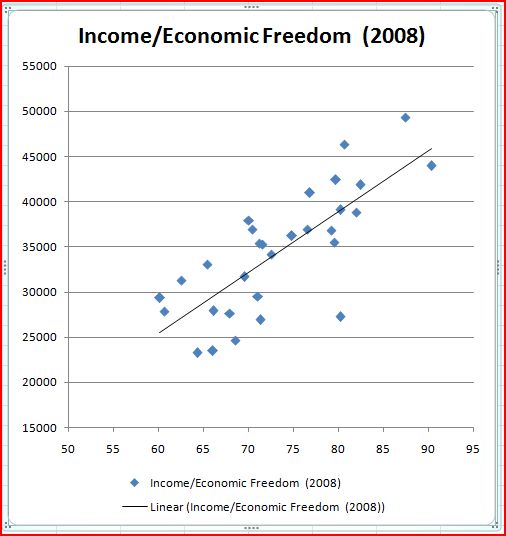

I recently did an EconTalk podcast with Russ Roberts. We discussed economic reforms and growth. In this post I have included a graph that I discussed on the podcast.

The graph shows the relationship between a country’s per capita GDP in 2008 (PPP) and their economic freedom ranking in the Heritage index. I only had time to do developed countries (defined as income above $23,000/year, i.e. Portugal and higher.) But these are more representative in any case, as some developing countries obviously have economic models that will allow them to get much richer in the near future (e.g. China.) In contrast, most developing countries have settled down into a slow rate of growth.

I excluded countries that get a large share of GDP from oil exports, and also excluded Luxembourg because it wouldn’t fit on the graph. Luxembourg has a fairly average Heritage ranking 75.2, but a GDP/person of nearly $79,000. Obviously the Luxembourgers must be cheating somehow. Someone should really go investigate that country. Wikipedia says Kim Il Jung Kim Jung Il has $4 billion dollars stashed away there, which is almost $10,000 for every resident of Luxembourg.

The local students are taught in Luxembourgish for the first three years, then German, and then French in high school. They cannot graduate without being proficient in all three languages. Apparently only half do graduate (or at least only half receive a “certified qualification.”) It almost sounds like a tiny principality full of high school dropouts got together and named their country ‘Luxembourg,’ hoping the rest of the world would think they are rich and want to deposit a lot of money there. I hope they scam Kim out of his $4 billion.

As you can see there is one noticeable outlier; New Zealand. The Kiwis have a fairly low per capita income, despite having done a lot of neoliberal reforms. Why does New Zealand violate the otherwise close relationships between economic freedom and income? I don’t know. Perhaps they have been hamstrung by having a strong comparative advantage in agriculture, only to see other countries undercut them with huge farm subsidies. Or maybe they are just too remote to benefit from multinational investment aimed at the major markets (in contrast to another English-speaking island of 4 million people that also pursued neoliberal reforms.)

I’d appreciate any thoughts on why New Zealand has struggled. (And please, no jokes from my Aussie readers.)

As you can see from the list below, the ranking is basically as follows: Former British colonies, then Nordic countries, then continental Europe, then Mediterranean countries. The Nordic countries are pretty neoliberal, but held back by size of government. The Mediterranean countries are held back by statist policies. For cultural reasons, Holland is usually included in the Nordic group. The chart suggests that going from an economic freedom ranking of 60 (Greece) to 90 (Hong Kong) will raise income by about $20,000 per person. In fact, as of 2008 HK was only about about $14,600 ahead of Greece. Any guesses as to whether that gap is now widening or narrowing?

Note; I excluded Luxembourg and oil-rich Norway from the list. In 2009 Norway’s nominal GDP surpassed Sweden’s despite having barely half the population. I thought the oil wealth distorted Norway’s income too much for it to be useful. If you include Norway on the graph, the trend line flattens slightly, and the predicted change in income if one moves from a ranking of 60 to 90 falls to about $18,500.

As with any graph, correlation does not prove causation. In addition, the term ‘economic freedom’ should not be equated with “conservative” or “small government.” As Statsguy recently pointed out these rankings are heavily influenced by “good government” components, and hence countries with large governments (such as Denmark) often score quite high.

| Country |

EcFree2008 |

Income |

| Australia |

82 |

38784 |

| Austria |

70 |

37912 |

| Belgium |

71.5 |

35238 |

| Canada |

80.2 |

39078 |

| Cyprus |

71.3 |

26919 |

| Czech |

68.5 |

24643 |

| Denmark |

79.2 |

36845 |

| Finland |

74.8 |

36195 |

| France |

65.4 |

33058 |

| Germany |

71.2 |

35374 |

| Greece |

60.1 |

29356 |

| HK |

90.3 |

43957 |

| Iceland |

76.5 |

36902 |

| Ireland |

82.4 |

41850 |

| Israel |

66.1 |

27905 |

| Italy |

62.5 |

31283 |

| Japan |

72.5 |

34129 |

| Korea |

67.9 |

27658 |

| Luxembourg* |

75.2 |

78922 |

| Malta |

66 |

23500 |

| New Zealand |

80.2 |

27260 |

| Holland |

76.8 |

40961 |

| Norway* |

69 |

58714 |

| Portugal |

64.3 |

23254 |

| Singapore |

87.4 |

49321 |

| Slovenia |

60.6 |

27860 |

| Spain |

69.5 |

31674 |

| Sweden |

70.4 |

36961 |

| Switzerland |

79.7 |

42415 |

| Taiwan |

71 |

29500 |

| UK |

79.5 |

35468 |

| USA |

80.6 |

46356 |

In my EconTalk I mentioned a study that examined the relationship between cultural attitudes and the speed of economic reforms. As the following regression shows, there is a strongly positive correlation between civic-minded (or “liberal”) attitudes and economic reform during the period from 1980-2005 (using the fraser index of economic freedom.) I’ll try to link to the paper later today.

Table 3.1 The Relationship Between Cultural Values and Changes in Economic Policy

In this regression the dependent variable was the percentage by which statism fell between 1980 and 2005 in the Fraser Institute Index (with size of government consumption and transfers removed from the index.) There were 28 observations in the regression. The results were as follows:

Indep. Variables Coefficient T-Statistic Adj. R-squared

Constant 79.82 5.48 .375

Values .459 3.53

FraserIndex -9.33 -3.78

I seem to recall that Adam Smith once remarked that while China was richer than Britain, the English were more thriving (which might mean a higher income, or faster growth.) Of course the fast growth eventually made Britain much richer than China.

When I was young the US and Europe were much richer than Asia. Singapore was a “developing country.” But Asia was growing much faster. As this article suggests, the high Asian savings rates are beginning to overturn traditional notions of who’s rich and who’s poor:

The 2010 Global Wealth Report by The Boston Consulting Group says there were 11.2 million millionaire households in the world at the end of 2009, a 14% jump from 2008. That puts the millionaire count about where it was in the good old days before the global financial crisis.

The U.S. had especially strong growth, with the number of millionaire households rising to 4.7 million — still the largest number of millionaire households in the world. That means that roughly 4% of American households are millionaire households. (Singapore had the highest “millionaire density” with 11% of all households being millionaires)

I also found this article, which suggested Hong Kong was second and Switzerland was third. I’d expect the number of millionaires in Singapore to soar over the next few decades, as the current group of older residents (who grew up in a much poorer country) gradually die off.