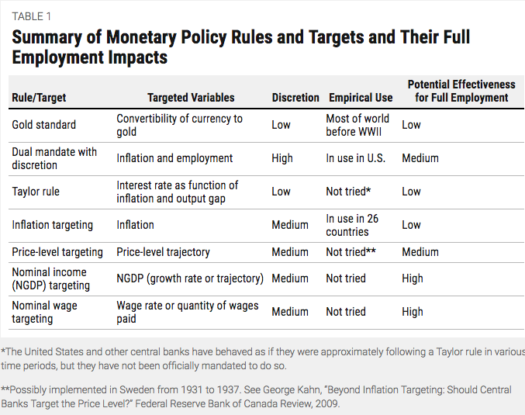

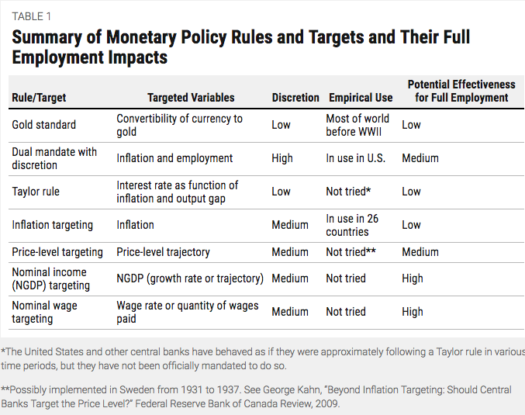

Carola Binder and Alex Rodrigue have a very nice new paper out on monetary policy rules, for the Center on Budget and Policy Priorities. Their paper suggests that either NGDP targeting or total wage targeting is likely to produce the best employment outcomes:

I’d quibble a bit with the rankings, for instance I view the Taylor Rule as much superior to the gold standard, at least at positive interest rates. But I do agree about the advantages of NGDP and wage targeting. They discuss two types of wage targeting:

I’d quibble a bit with the rankings, for instance I view the Taylor Rule as much superior to the gold standard, at least at positive interest rates. But I do agree about the advantages of NGDP and wage targeting. They discuss two types of wage targeting:

Nominal wage targeting can refer to targeting the wage rate (the price of labor) or targeting the quantity of wages paid (total nominal labor compensation, or the average hourly wage times the total number of hours worked). The former can be thought of as a special type of inflation targeting, since wages themselves are a price and wage growth is a type of inflation. Inflation-targeting central banks choose which specific price index to use for their inflation target; nominal wage targeting entails choosing a price index with 100 percent weight on wages. Mankiw and Reis (2003) find that “a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages.”

I tend to favor either targeting total wage payments, or the expected future level of average hourly wages, and they hold exactly the same view:

Nominal wage targeting has never been attempted, and its implementation could entail several challenges. First, there is no single wage rate. Policymakers would need to choose whether to target mean or median wages or some other measure. Second, nominal wages tend to respond to monetary policy with a lag. It may thus be preferable to target either expected future wages or total nominal labor compensation, which reacts more quickly.

In a slump, total wage payments fall faster than average wages per hour (due to wage stickiness). So if you are not using a futures market approach, then aggregate wages may give a clearer signal. However on theoretical grounds average hourly wages are slightly better, and hence to be preferred if the lag problem can be addressed with a futures market for average hourly wages.

Speaking of futures markets, they are skeptical:

Since NGDP responds slowly to monetary policy, Sumner proposes a futures contract approach that would allow monetary policy to respond to expected future NGDP instead of current NGDP.[80] The Fed would set up a futures market in which participants would bet as to whether the future NGDP growth rate would exceed or fall short of the Fed’s target. The Fed would then adjust the monetary base, just as it does today, according to the bets. So, if traders on this NGDP prediction market thought nominal growth would exceed the Fed’s target, the Fed would reduce the base, and vice versa.[81]

This approach is based on the notion that the market is an efficient forecaster, but it could be problematic for a number of reasons. For instance, the futures market could be subject to manipulation by large speculators,[82] or trading volume could be too low. More broadly, the futures-market approach would drastically limit the Fed’s discretion; the Fed would play a passive role. We think it would be more effective for the Fed to commit to pursuing the NGDP target in the medium run, taking into account the Fed’s own forecasts of future NGDP in its policy decisions.

Not surprisingly, this is one area where I do not agree. But before explaining why, let me point out that I would strongly support their (Svenssonian) suggestion of targeting the central bank’s own internal NGDP medium term forecast as a second best policy, as long as it was a part of the level targeting system.

Now for my response:

1. The lack of discretion could be viewed as a feature, not a bug. If you want to preserve some discretion, however, my “guardrails” approach can be employed. Indeed even Bill Woolsey’s index futures convertibility approach allows for discretion, if the central bank sees one big speculator trying to manipulate the market. (Keep in mind that all trades are with the central bank as the counter-party, so they’d know if someone were trying to manipulate the market.) And of course manipulation would be almost impossible under the guardrails approach, where the central bank would promise to go short on 5% NGDP contracts, and long on 3% NGDP contracts. And finally, the same manipulation possibilities apply to a gold standard and/or Bretton Woods regime. But if you search the literature on these regimes, you will discover almost nothing on “market manipulation”, at least when rates actually are fixed and stable. (Selling a currency before devaluation doesn’t count, as no one expects the central bank would default on NGDP futures.) I think it’s a needless worry.

2. Low trading volume is not a problem; indeed the system does not require any trading at all. Here’s an analogy. A gold standard would work fine as long as people were free to convert currency into gold at a fixed price, regardless of whether any such trading actually occurred. It would simply mean that monetary policy is on target. And if you still are concerned about trading, the central bank can always create trading by paying a high enough interest rate on margin accounts.

Even if NGDP futures markets are not to be used to set the policy instrument, there is NO EXCUSE for the failure of central banks to set up NGDP prediction markets, and subsidize trading. This would provide essential high frequency data on NGDP expectations after important monetary policy events, and hence would be invaluable to monetary researchers. Their failure to do so is gross dereliction of duty, which future generations will look back on in disbelief. I would have loved to have such a market in the second half of 2008, exposing all their foolish decisions.

HT: Dilip