Don’t expect the future to be like the past

Garrett MacDonald directed me to a interesting article by Paul Donovan, chief economist at UBS.

Among the many interesting points, this caught my eye:

The ups and downs of the economic cycle may be less violent than they used to be. Recessions are probably less recessionary in the future (see the July Chief Economists comment “Will recessions be less recessionary in the future”).

I often point out that the US business cycle has some very bizarre features:

1. Expansions never last more than 10 years.

2. There are no mini-recessions.

The first is bizarre because recessions seem to occur randomly, not according to any fixed cycle. Expansions do not die of old age. You’d expect some expansions to just randomly drag on for more than 10 years. The second is bizarre because you’d expect that whatever process causes recessions (some sort of shock?) would create far more mini-recessions than sizable recessions. Think about how there are far more small earthquakes than big earthquakes. Instead, the United States NEVER has mini-recessions, defined as an increase in the unemployment rate of more than 0.8% and less than 2.0%. That’s just bizarre. (And even the one 0.8% increase was due to the unusual 1959 nationwide steel strike—normally there is almost no increase in unemployment beyond random noise, unless unemployment soars much higher.)

Before you respond with good reasons why these patterns are not bizarre, I’d like to point out that other countries such as Britain and Australia do have economic expansions that last much more than 10 years, and they do have mini-recessions. So the US really is a very weird place. But for some reason American economists don’t seem to pay much attention to this weirdness.

I’m on record as predicting that this will be the longest expansion in history, the first that extends for more than 10 years. Now I’d like to go on record predicting that we will see some mini-recessions in the next few decades. I don’t see any reason why we haven’t had them; other countries have them, so why can’t we?

Here’s another interesting point:

Economics can generally predict central bank policy. This is hardly surprising. Central banks – at least, the good central banks – are run by economists.

In the past I’ve argued that economists don’t blame central banks for recessions because central banks follow the consensus of economists, and economists don’t want to blame themselves.

Economists should not make forecasts.

In the past, I’ve argued that good economists don’t forecast, they infer market forecasts.

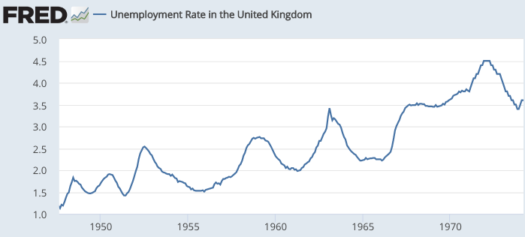

PS. Here are 6 British mini-recessions, in each case with the unemployment rate rising by about 1%.

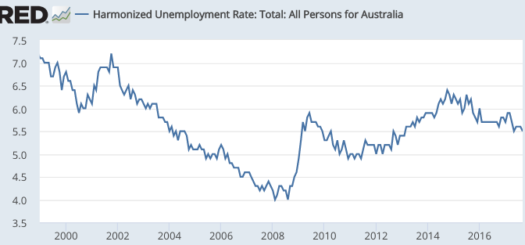

And here are three recent mini-recessions in Australia, in each case with unemployment rising between 1% and 2%:

And here are three recent mini-recessions in Australia, in each case with unemployment rising between 1% and 2%:

Off topic: Did Jesus once say: “Blessed are the beta males: for they shall inherit the earth”? Scanning the recent news headlines, it almost seems like his prediction is coming true, after 2000 years.

Off topic: Did Jesus once say: “Blessed are the beta males: for they shall inherit the earth”? Scanning the recent news headlines, it almost seems like his prediction is coming true, after 2000 years.

PS. Here’s an excellent USA Today editorial on Trump. The press has been way too soft on him.