Economic freedom and GDP per capita

I recently did an EconTalk podcast with Russ Roberts. We discussed economic reforms and growth. In this post I have included a graph that I discussed on the podcast.

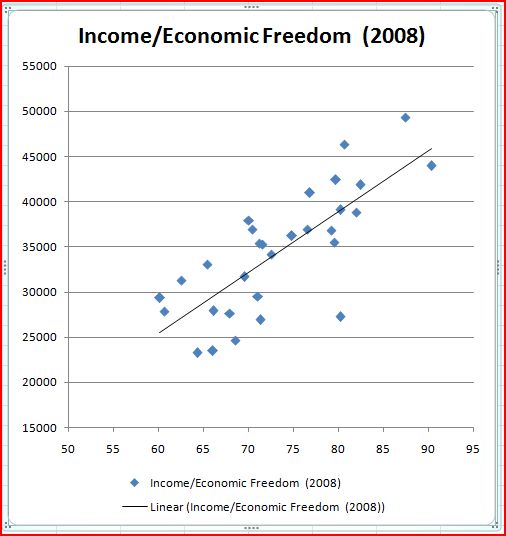

The graph shows the relationship between a country’s per capita GDP in 2008 (PPP) and their economic freedom ranking in the Heritage index. I only had time to do developed countries (defined as income above $23,000/year, i.e. Portugal and higher.) But these are more representative in any case, as some developing countries obviously have economic models that will allow them to get much richer in the near future (e.g. China.) In contrast, most developing countries have settled down into a slow rate of growth.

I excluded countries that get a large share of GDP from oil exports, and also excluded Luxembourg because it wouldn’t fit on the graph. Luxembourg has a fairly average Heritage ranking 75.2, but a GDP/person of nearly $79,000. Obviously the Luxembourgers must be cheating somehow. Someone should really go investigate that country. Wikipedia says Kim Il Jung Kim Jung Il has $4 billion dollars stashed away there, which is almost $10,000 for every resident of Luxembourg.

The local students are taught in Luxembourgish for the first three years, then German, and then French in high school. They cannot graduate without being proficient in all three languages. Apparently only half do graduate (or at least only half receive a “certified qualification.”) It almost sounds like a tiny principality full of high school dropouts got together and named their country ‘Luxembourg,’ hoping the rest of the world would think they are rich and want to deposit a lot of money there. I hope they scam Kim out of his $4 billion.

As you can see there is one noticeable outlier; New Zealand. The Kiwis have a fairly low per capita income, despite having done a lot of neoliberal reforms. Why does New Zealand violate the otherwise close relationships between economic freedom and income? I don’t know. Perhaps they have been hamstrung by having a strong comparative advantage in agriculture, only to see other countries undercut them with huge farm subsidies. Or maybe they are just too remote to benefit from multinational investment aimed at the major markets (in contrast to another English-speaking island of 4 million people that also pursued neoliberal reforms.)

I’d appreciate any thoughts on why New Zealand has struggled. (And please, no jokes from my Aussie readers.)

As you can see from the list below, the ranking is basically as follows: Former British colonies, then Nordic countries, then continental Europe, then Mediterranean countries. The Nordic countries are pretty neoliberal, but held back by size of government. The Mediterranean countries are held back by statist policies. For cultural reasons, Holland is usually included in the Nordic group. The chart suggests that going from an economic freedom ranking of 60 (Greece) to 90 (Hong Kong) will raise income by about $20,000 per person. In fact, as of 2008 HK was only about about $14,600 ahead of Greece. Any guesses as to whether that gap is now widening or narrowing?

Note; I excluded Luxembourg and oil-rich Norway from the list. In 2009 Norway’s nominal GDP surpassed Sweden’s despite having barely half the population. I thought the oil wealth distorted Norway’s income too much for it to be useful. If you include Norway on the graph, the trend line flattens slightly, and the predicted change in income if one moves from a ranking of 60 to 90 falls to about $18,500.

As with any graph, correlation does not prove causation. In addition, the term ‘economic freedom’ should not be equated with “conservative” or “small government.” As Statsguy recently pointed out these rankings are heavily influenced by “good government” components, and hence countries with large governments (such as Denmark) often score quite high.

| Country | EcFree2008 | Income |

| Australia | 82 | 38784 |

| Austria | 70 | 37912 |

| Belgium | 71.5 | 35238 |

| Canada | 80.2 | 39078 |

| Cyprus | 71.3 | 26919 |

| Czech | 68.5 | 24643 |

| Denmark | 79.2 | 36845 |

| Finland | 74.8 | 36195 |

| France | 65.4 | 33058 |

| Germany | 71.2 | 35374 |

| Greece | 60.1 | 29356 |

| HK | 90.3 | 43957 |

| Iceland | 76.5 | 36902 |

| Ireland | 82.4 | 41850 |

| Israel | 66.1 | 27905 |

| Italy | 62.5 | 31283 |

| Japan | 72.5 | 34129 |

| Korea | 67.9 | 27658 |

| Luxembourg* | 75.2 | 78922 |

| Malta | 66 | 23500 |

| New Zealand | 80.2 | 27260 |

| Holland | 76.8 | 40961 |

| Norway* | 69 | 58714 |

| Portugal | 64.3 | 23254 |

| Singapore | 87.4 | 49321 |

| Slovenia | 60.6 | 27860 |

| Spain | 69.5 | 31674 |

| Sweden | 70.4 | 36961 |

| Switzerland | 79.7 | 42415 |

| Taiwan | 71 | 29500 |

| UK | 79.5 | 35468 |

| USA | 80.6 | 46356 |

In my EconTalk I mentioned a study that examined the relationship between cultural attitudes and the speed of economic reforms. As the following regression shows, there is a strongly positive correlation between civic-minded (or “liberal”) attitudes and economic reform during the period from 1980-2005 (using the fraser index of economic freedom.) I’ll try to link to the paper later today.

Table 3.1 The Relationship Between Cultural Values and Changes in Economic Policy

In this regression the dependent variable was the percentage by which statism fell between 1980 and 2005 in the Fraser Institute Index (with size of government consumption and transfers removed from the index.) There were 28 observations in the regression. The results were as follows:

Indep. Variables Coefficient T-Statistic Adj. R-squared

Constant 79.82 5.48 .375

Values .459 3.53

FraserIndex -9.33 -3.78

I seem to recall that Adam Smith once remarked that while China was richer than Britain, the English were more thriving (which might mean a higher income, or faster growth.) Of course the fast growth eventually made Britain much richer than China.

When I was young the US and Europe were much richer than Asia. Singapore was a “developing country.” But Asia was growing much faster. As this article suggests, the high Asian savings rates are beginning to overturn traditional notions of who’s rich and who’s poor:

The 2010 Global Wealth Report by The Boston Consulting Group says there were 11.2 million millionaire households in the world at the end of 2009, a 14% jump from 2008. That puts the millionaire count about where it was in the good old days before the global financial crisis.

The U.S. had especially strong growth, with the number of millionaire households rising to 4.7 million — still the largest number of millionaire households in the world. That means that roughly 4% of American households are millionaire households. (Singapore had the highest “millionaire density” with 11% of all households being millionaires)

I also found this article, which suggested Hong Kong was second and Switzerland was third. I’d expect the number of millionaires in Singapore to soar over the next few decades, as the current group of older residents (who grew up in a much poorer country) gradually die off.

Tags:

21. June 2010 at 05:26

Some ideas on possibilities: I am not happy with any of these though for various reasons, and would like to hear other people’s thoughts:

1. It is a tiny country with its own currency so its currency doesn’t gain value from the size of the country.

2. It is very small and so doesn’t gain quite as much from internal trade as other countries with similar reforms?

3. Its is somewhat isolated in terms of trade, because it is an island, and far away from most countries (other than Australia).

Also, does the PPP take into account NZ’s GST of 12.5%, and they have a very high corporate tax rate (30%).

Also, they have a few things there that struck me as odd. An aquantance of mine who is an NZ postman tells me that mail carriers use bicycles (for the most part) instead of cars.

21. June 2010 at 06:23

I wish I had something more interesting to add, but it’s Kim Jong Il, not Kim Il Jung

21. June 2010 at 06:36

Doc Merlin, Maybe they should adopt the sort of low corporate tax rate adopted by the Irish.

I don’t think the small size is a problem (other small countries are rich) but the isolation might hurt a bit.

21. June 2010 at 07:06

Do you think we should increase wealth redistribution in the US to counter relatively flat wage growth for many Americans over the last few decades?

If you take the loss of US manufacturing jobs for example, contrary to common opinion, most of the losses are due to increased automation. US manufacturing output has risen very consistently over the past 30-40 years, despite these job losses.

Granted, wealth is not dependent on income alone. Many goods and services have become relatively cheaper over the above-mentioned period.

Nonetheless, the increasing income inequality, if you agree this is occurring, may have serious political consequences, if not economic.

BTW, there seems to be a drive among liberals for increasing the support of unions. This would seem to largely miss the point, given the above.

21. June 2010 at 08:15

Looking at TFP numbers or GDP/capita/average working hours might give a clue. Don’t Singaporeans work a lot longer? Maybe New Zealand just has better things to do during non-working hours, so there’s less incentive to work.

21. June 2010 at 09:19

Luxembourg…..it’s really a huge steel plant with some banks attatched. I have no evidence at all but my supposition is that that steel plant has something to do with it.

21. June 2010 at 09:32

Professor Sumner,

I really think you should check out the following criticism of the Heritage Index at the BaseLine Scenario…

http://baselinescenario.com/2010/05/27/heritage-index-good-government-vs-less-government/

It argues that the Heritage Index shows that good government, NOT less government, is what pushes economic growth.

Joe

P.S. Switzerland is definitely the most neoliberal nation amongst the democratic west, moreso than even the USA.

21. June 2010 at 09:35

[…] done, he finds (as do others) that economic freedom is correlated with growth. (See this post and this one at Scott’s blog for […]

21. June 2010 at 09:39

Steve, Thanks, I corrected it.

Mike, I think Singapore’s forced saving plan is the best way to reduce wealth inequality. The lower classes in America don’t save very much, partly because our tax/subsidy system strongly discourages them from saving. So I don’t think we need more redistribution, rather we need smarter policies that address particular areas like health care, pensions and unemployment comp. Self-insurance allows for lower taxes, and this frees up money to provide wage subsidies for low wage workers. I would oppose adding more redistribution on to our flawed system, we need to reform the system first.

I agree on unions, they are primarily a public sector phenomenon today. But liberals act like they protect workers from evil capitalists.

We should also deregulate labor markets, which would reduce the pay of protected fields like medicine and law–although some would see higher wages in those fields. Of course economics is exempt for this recommendation. (Just kidding, economics already lacks any legal barriers to entry. You can legally practice economics with a 4th grade education. I guess they don’t think we can do much harm.)

David, Yes, with very low tax rates the Singaporeans work long hours. I don’t know about NZ–anyone know hours worked per year?

Tim, I’m pretty sure it is the banks and mutual funds that explain most of Luxembourg’s wealth. Steel’s not a very dynamic industry.

21. June 2010 at 10:27

I think it is useful to break things down by region when comparing per capita GDP and to a certain extent other things economic as well.

Estonia and the Czech Republic were perceived, rightly or wrongly, as the most economically libertarian of the east European countries, and hence attracted a disproportionate share of FDI that was destined for that region.

Looking at Southeast Asia and its island countries (such as Australia and NZ), if you were in charge of a multinational looking to make your regional hub for high value added knowledge work or for low value added blue collar assembly work, where would you invest?

For my money, the blue collar stuff would be in the usual suspects, taking a look at China, Viet Nam, India, and maybe a few others as well. For the white collar stuff, it might still be that China and India get a look simply due to possibly low wages for the work being done, but you also have to look at employee turnover and other factors for total labor costs.

More generally, the first thing I’d look at is the corporate income tax rate. The big winners there are Hong Kong and Singapore, and Singapore might knock off some or all off their tax rate if they want your business. New Zealand is on the other end of the spectrum of the regional corporate income tax (they pretty much suck globally while we are on the subject, but regional is what really matters here), and is a country I’d write off pretty quickly given so many attractive alternatives.

As a result, New Zealand doesn’t particularly stand out as a place for multinationals to invest in, and as a result it shouldn’t be too surprising if they get the short end of the FDI stick. Hence lower GDP per capita, all else being equal.

21. June 2010 at 11:29

‘I don’t think the small size is a problem (other small countries are rich) but the isolation might hurt a bit.’

Yah, I don’t think that small size would be a problem either, if they weren’t isolated, but the two together might. Who knows.

Anyway, great interview.

21. June 2010 at 12:35

Scott

This very very short history indicates reasons for NZ not so good economic performance after 1950.

What is amazing is what happened between 1840 and 1950 when NZ went from having a GDPpc that was 29% of Australia´s to 114% in 1950!!! falling to 74% in 2000.

21. June 2010 at 12:36

Forgot the link:

http://eh.net/encyclopedia/article/Singleton.NZ

22. June 2010 at 00:02

Scott,

Are GDP/capita comparisons distorted somewhat by demographic differences? Consider these variations in elderly and presumably non-working populations:

% of pop over 64 (year 2000)

Singapore – 7.2

Japan – 17.2

Italy – 18.1

U.S. – 12.3

Ireland – 11.3

Israel – 9.9

The higher non-working population would by itself account for 10% of the Gdp/person difference between Singapore and Italy.

22. June 2010 at 00:34

Oop! Correcting my math error in the last comment:

The higher non-working population would by itself account for 23% of the GDP/person difference between Singapore and Italy.

If Italy had an elderly non-working population proportional to that of Singapore, Italy’s GDP/person would be $35,631 rather than $31,283. Almost one-fourth of the GDP difference between Italy and Singapore is due to simple demographic variation.

22. June 2010 at 01:16

Scott,

I can’t win the war of economic ideas with you. My only comfort lay in my ignorance.

You’ve taught me more about economics than those intro classes I took. I suspect you’re a very good teaching professor.

22. June 2010 at 03:29

Correlation, not causation, as you say. The more interesting discussion, of course, is about the direction of causality, feedback, and the like. Some argue, of course, that freedom begets wealth, which is a logical proposition. Others argue that freedom is a normal or luxury good for a society, so wealth begets greater demand for freedom (neo-liberal policies) — also a logical proposition. Hence, increasing freedom in China is a consequence of prosperity, not a cause. Some argue both. Any ideas on how to sort out these possibilities?

22. June 2010 at 05:56

Joe, Yes, I did a post on that essay–it was by frequent commenter statsguy. Both good government and small government play a role in economic freedom. Good government is things like property rights, low levels of corruption, etc. Small government is low taxes. Both help.

happyjuggler0, Good point. It seems like the corporate tax rate is more of an issue for small countries (that need multinational investment) like NZ and Ireland.

Thanks Doc Merlin.

Marcus, Thanks for the link. I had forgotten how bad things were back in 1984–so that must be taken into account.

John Dewey, Good point, as I said elsewhere, I am not so impressed by Singapore’s current position, as by its trajectory (which is much more positive than for Italy.) The GDP numbers do overstate living standards.

Thanks Mike.

Richard, My view is that economic freedom creates wealth, which creates political and social freedom. Social freedom in China has expanded greatly, political freedom will arrive within a few decades.

22. June 2010 at 08:15

Scott,

I am curious. What is your take on those who argue (typically Chomsky followers) that Jamaica, El Salvador, Nicaragua and even Haiti have established drastic neoliberal reforms – some even banning unions, strikes, and allowing children to work – yet their economy remains stagnant?

22. June 2010 at 09:47

Scott, I have serious doubts about this Heritage ranking methodology. Heritage, being a right wing neoliberal promoting organization might be expected to come up with “freedom rankings” that tell the story they want to be told.

So let’s look at their rankings. Now, it may be that I don’t know what labor freedom is, but unions are so actively suppressed in Colombia that they are the world leader in execution of union organizers. Unions get crushed there, which means labor freedom, right? Why are they 72% and the US is 94%? Are we to believe there is more labor freedom in the US with teachers unions and the UAW than in Colombia where if you try to form a union you get shot? In France business freedom is 86%. France, where you can’t fire anybody you can’t work more than 35 hours and you must get lots of vacation. Nicaragua, where if you try to initiate a strike they bring in the military, gets a business freedom score of 55.7%. Isn’t this backwards? Are we to believe there’s more restraint on business in Nicaragua than in France? Aren’t the corporations in fact little tyrannies of their own in Nicaragua, whereas in France it is the opposite?

Watch the movie Life and Debt, which is about the imposition of neoliberalism in Jamaica. They make something like a dollar a day. Children working because they’re in total poverty. Labor freedom in Jamaica is 70% while in the US it’s 95%. Then why is it we don’t have child labor? Why is it that we can strike without fear for our lives? You’d think based on these rankings that it is Jamaica that has high minimum wage, but the reality is the hourly minimum wage in America is about what a Jamaican makes in a week working 12 hour days with no bathroom breaks.

Haiti is a neoliberal paradise. Aristide was ousted in a coup because he was not the corporate candidate. He was re-installed under Clinton on condition that he adopt the neoliberal policies of his defeated opponent. It’s a total hell hole. Few things correlate as clearly in my mind as neoliberalism and poverty. The US is highly protectionist and always has been. Same with Japan, England, France. The countries that have free trade imposed are in Latin America. These are the most miserable places in the world.

22. June 2010 at 12:18

Big Poncho and Jon, Part of the problem here is definitions. Some on the left define “neoliberalism” as the set of policies that favor corporations and screw the poor. I define those policies as “statist”. Neoliberal polices are those that make it easy to enter a market (generally not true in poor countries) easy to hire and fire workers (as it is in places like Denmark), easy to trade, property rights (again lacking in many poor countries),low marginal tax rates, etc.

By far the most neoliberal country in Latin America is Chile, which also has less poverty and misery than many other countries in Latin America (although it is far from perfect.)

In the Heritage ranking Denmark is tied with the US despite having a very egalitarian policy of income redistribution through social programs. If the rankings were influenced by right wing bias on the part of Heritage, why would Denmark rank as high as the US, and Canada even higher? Aren’t those countries the sort of economic models that leftists think highly of? Why is Heritage promoting them?

Here’s my suggestion. If you don’t like my definition of neoliberalism, call the variables used in the Heritage ranking “gobbletygoopism” Then I favor countries that pursue gobbletygoop policies, and predict that they will do better than countries that have not pursued those policies.

People see what they want to see in countries. Half of the leftists I talk to say “The Chinese people are suffering horribly under neoliberal policies.” The other half say “Yes, China is doing much better, but not because of neoliberalism. The government has a big role in their economy.” If someone hates capitalism they will attribute everything bad to the market-oriented aspects of an economy, and everything good to the regulatory aspects. I can’t do anything about that. I look at how things are changing (China’s becoming more market oriented and poverty is declining sharply. Or regional comparisons (Zhejiang is the most market-oriented part of China, and the richest.) I think those sorts of comparisons are best.

Heritage gives a detailed explanation as to how they do the ranking, but they are inevitably a bit subjective. The Fraser Institute also does a similar ranking, and reaches modestly different conclusions.

I am not an expert on Jamaica, but have seen articles comparing their very poor economic policies to the much sounder policies followed by Barbados. Barbados has done a much better job at reducing poverty. Perhaps Jamaica should look at what they have done. I’m told it is very hard to do business in Haiti, but don’t know enough to comment any more than that.

In general, I am skeptical that countries can get ahead by following advice from the US or from multinational organizations.

Regarding this comment:

“The US is highly protectionist and always has been. Same with Japan, England, France. The countries that have free trade imposed are in Latin America.”

I doubt you’d find many economists that agree. During the period when Latin America fell far behind the US and Europe, they were far more protectionist than the US and Europe.

Perhaps in Nicaragua you need political connections to become successful in business. That’s not true in the US and France, but is true in many developing countries. It’s the age old insider/outsider distinction.

23. June 2010 at 03:35

[…] че Ñтраните Ñ Ð¿Ð¾-голÑма икономичеÑка Ñвобода Ñа по-богати. И обратно – Ñтраните Ñ Ð¼Ð°Ð»ÐºÐ° икономичеÑка Ñвобода […]

23. June 2010 at 10:15

By neoliberal I mean free capital flows, less regulation, privatization, and limits/elimination of import restrictions. Countries that do these sorts of things I expect to see high “freedom index” from the Heritage foundation. But this is not what we see. The economies most following neoliberal policies (Haiti, El Salvador, Colombia, Nicaragua, Jamaica) have lower rankings despite their strict adherence to US economic demands.

“Aren’t those countries the sort of economic models that leftists think highly of? Why is Heritage promoting them?”

Because they are relatively prosperous. The goal here is to show that neoliberalism is great. So since Canada and Denmark are decent places to live it is necessary to pretend that they are neo liberal even though they aren’t. Neither is the US. Haiti is neoliberal. Jamaica is neoliberal. But they are also miserable. I would suggest that Heritage doesn’t want us to recognize that correlation.

As far as US protectionism, let’s contrast the US and Mexico and Latin America. When Japanese car manufacturers developed certain advances with regards to on time delivery and timing they found they were able to produce better cars than the US for the money. Reagan’s solution was simple. Impose huge tariffs so American companies could learn the Japanese techniques. Their superior products simply would have destroyed our industries. We can’t have that. So we protect.

How does it work for Mexico? Mexican farmers were pretty good, but they weren’t in a position to compete with US agribusiness. They wanted to block our imports for fear that their industry would be destroyed. But under NAFTA that was not permitted. About a million farmers found themselves out of work, conveniently now available for work at the border towns where they were offered jobs assembling flat screen TV’s for export. You can observe the huge proliferation of the shanty homes and suffering at these places. The same was true in Jamaica. US milk started flowing in, as did other food stuffs, destroying Jamaica’s food industry, leaving them destitute and ready to work in the sewing factories making pennies an hour. Note for instance Clinton’s surprising admission of the destructive nature of neoliberalism on Haiti, which underwent similar suffering.

So it would seem that it’s free markets for them but not for us. We’re prosperous. They’re poor. The correlation seems quite strong.

So let’s consider Chile. You say Chile is the most neoliberal “by far.” On the surface it would seem to me that Chile would be neoliberal. Chile had elected a social democrat, so on 9/11/73 the US violently overthrew him and he was killed along with thousands. The US of course does overthrow elected governments in order to impose economic models favored by US businesses. But Chile isn’t the only place this has happened. How about Guatemala? Why aren’t they more neoliberal than Chile? Their brief experience with democracy was crushed in 1952 because of their social democratic leanings. A series of dictators was imposed, turning them into a killing field. But a neoliberal one of course.

Chile’s main export is copper. The largest producer of copper in the world is CODELCO, a nationalized copper producer that provides far more revenue to the state than all of the private copper companies combined, which send their revenue overseas of course. This revenue funds social programs. I can’t see how this can be more neoliberal than Haiti.

23. June 2010 at 13:09

Scott, the Luxembourg GDP per capita is inflated because a relatively large proportion of the workforce do not actually live in the country. They travel over the border from neighbouring states to work in Luxembourg but are counted as resident in their home country.

24. June 2010 at 07:15

Jon, When those on the left want to criticize Chile it is viewed as an evil neoliberal country. When it appears to do well they change their story and it suddenly is no longer the great example of neoliberalism in Latin America.

Trade is only one of the 10 categories in the Heritage index. You cite one example of US protections from long ago, and one single example of a Mexican industry that is not protected. But I am afraid that there is much more to liberalism than one industry, or even trade in general. One reason Mexico’s agriculture is so screwed up is that the farmers don’t own the land they work. Without property rights, agriculture is very inefficient. Those are some of the other factors that go into the free market calculation.

I don’t think many people at Heritage would recommend that we follow the Danish model, so I don’t find your conspiratorial view to be very plausible. Their rating roughly conforms to what I know about varying levels or statism around the world. Denmark’s model is widely known by the label “flexicurity, a combination of social insurance and very free markets, exactly what Heritage found.

Thanks Richard.

27. June 2010 at 05:09

I am curious. What is your take on those who argue (typically Chomsky followers) that Jamaica, El Salvador, Nicaragua and even Haiti have established drastic neoliberal reforms – some even banning unions, strikes, and allowing children to work – yet their economy remains stagnant?

It depends a great deal on basic institutional structures. According to Hernando de Soto’s The Mystery of Capital, it can take up to 19 years to complete the legal processes for land purchase in Haiti. That sort of regulatory quagmire, coupled with massively unstable and confiscatory politics, will keep any country poor. There is a reason Haitians who leave Haiti do much better economically than those who stay.

The same general point applies to other Latin American countries. They operate according to a “social mercantilism” of insiders and outsiders. His grad students famously found it took 289 days and $1,281 (31 times the monthly minimum wage) to legally register a single employee garment business in Lima, Peru. The same process in Miami would take maybe a day. It is not hard to see why Miami (a significantly Hispanic city, after all) would have a lot more economic transactions than Lima.

Why do Latin Americans come to the US? Because the US British-legacy institutional framework works so much better than the Iberian-legacy they grew up under that they can make a lot more income. That sort of difference is simply not covered by free capital flows, less regulation, privatization, and limits/elimination of import restrictions: particularly if the only regulation you are looking at is border regulation (capital flows and trade flows).

Also, the US is such a large economy, the level of protectionism or otherwise does not make much of a difference. But Australia has done far better in comparative performance since we liberalised trade (among other things) precisely because we are a relatively small economy. Prior to adopting a highly protectionist structure in the early part of the C20th, we had a higher per capita income than the US. Once we went protectionist, we lost ground comparatively until we started liberalising. Since we liberalised, we have managed to roughly maintain the same proportion of per capita GDP.

Regarding New Zealand, it suffers from isolation, smallness, an unfortunate economic legacy and unhelpful comparative advantage (farming products).

27. June 2010 at 06:48

‘It depends a great deal on basic institutional structures. According to Hernando de Soto’s The Mystery of Capital, it can take up to 19 years to complete the legal processes for land purchase in Haiti. That sort of regulatory quagmire, coupled with massively unstable and confiscatory politics, will keep any country poor. There is a reason Haitians who leave Haiti do much better economically than those who stay.’

Someone was telling me that for a large project it was up to 6 years in California. I guess that explains why businesses are moving to Houston where it takes days.

27. June 2010 at 06:50

What I said was partially misleading. I included permits, fighting off the inevitable lawsuits, and getting permission for the building(s) in the 6 years for a large project in California. Just purchasing the land can happen in less than day.

27. June 2010 at 07:09

Lorenzo, Very good post. I wish I had that information at my fingertips in my long debate with Chris over at the Amercia’s amazing success post.

Doc Merlin, Yes, we are getting worse in some areas, and I agree that this is one reason why Houston is growing so rapidly.

28. June 2010 at 01:46

Let’s hear it for the power of competitive jurisdictions!

After all, it largely explains why Europe took off and why Japan (where the daimyo could, in terms of economics and commerce, run their provinces pretty well how they liked) was the first non-Western country to follow.

28. June 2010 at 07:12

Lorenzo, Very good point. Earlier I argued that China’s problem was centralization–which was ulimately tied to its non-phonetic language. China has one literary culture because even people who speak differently, write exactly the same way.

9. July 2010 at 04:18

I don’t really have any data to hand, however while NZers are generally entrepreneurial in terms running their own small businesses etc, many of these small businesses don’t grow to become large enterprises. Not sure if this is relevant, but you would think developing small companies into larger ones over time would increase incomes and employment opportunities. Perhaps this is related to the geographical isolation, in which case it will be interesting to observe if government investment in fibre broadband infrastructure will change this picture.

9. July 2010 at 17:33

V, Thanks for that info.

20. August 2011 at 18:28

Guru Masterclass…

TheMoneyIllusion » Economic freedom and GDP per capita…

13. August 2013 at 09:36

[…] matter and providing a stable political environment and relatively free market economy is fairly closely linked to a nation’s economic prosperity. Preventing the Sergey Brin’s of the world from coming to a country where they can fully […]