Krugman suggests that New Keynesianism has disappeared (in the long run all theories are dead)

Here’s Paul Krugman:

Brad DeLong asks why monetarism — broadly defined as the view that monetary policy can and should be used to stabilize economies — has more or less disappeared from the scene, both intellectually and politically.

That’s not just a description of monetarism; it also describes New Keynesianism, as DeLong pointed out in 1999. Is New Keynesian economics actually dead? Here’s an example of New Keynesianism, from the same year that DeLong wrote the article:

What continues to amaze me is this: Japan’s current strategy of massive, unsustainable deficit spending in the hopes that this will somehow generate a self-sustained recovery is currently regarded as the orthodox, sensible thing to do – even though it can be justified only by exotic stories about multiple equilibria, the sort of thing you would imagine only a professor could believe. Meanwhile further steps on monetary policy – the sort of thing you would advocate if you believed in a more conventional, boring model, one in which the problem is simply a question of the savings-investment balance – are rejected as dangerously radical and unbecoming of a dignified economy.

Will somebody please explain this to me?

Yes, I’d say that NK view from 1999 (expressed by Paul Krugman, BTW) is essentially dead. I’m not sure what we have now: new, new Keynesianism, old Keynesianism, or as many Keynesianism as there are Keynesians. (I vote for the latter.) Just as old monetarism is mostly dead, having been replaced by market monetarism.

Krugman also suggests that monetarism is dead because real world governments don’t implement our policies, exactly as we sketch them out. (He forgets that market monetarists invented negative IOR). Which of course means that Krugman’s Keynesianism is also dead, as governments are certainly not doing the sort of fiscal stimulus that he recommends. Indeed the Japanese recently combined fiscal austerity with monetary stimulus, and he seemed to think the Japanese were doing a pretty good job when he met with them recently:

We are all very much wishing, I am a great admirer of the policy moves that have been made by Japan, but they are not good enough, partly because all of the rest of us are in trouble as well.

Yes, he would have preferred they not raise taxes, but the tax increase did not cause a setback to the labor market:

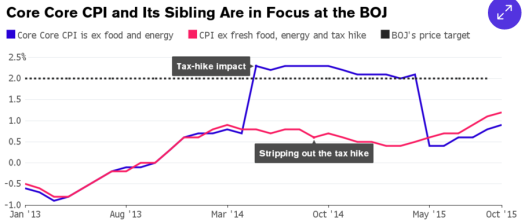

And monetary stimulus did get them out of deflation:

And monetary stimulus did get them out of deflation:

However the BOJ needs to do much more if they don’t want to slip back into deflation.

PS. Ramesh Ponnuru also has a reply to Paul Krugman.

HT: James Elizondo

Tags:

19. April 2016 at 10:46

“Which of course means that Krugman’s Keynesianism is also dead, as governments are certainly not doing the sort of fiscal stimulus that he recommends.”

-Brilliant. How does he suggest Greece do fiscal stimulus, anyway? And didn’t Krugman say there was no evidence tax hikes in a recession are contractionary?

19. April 2016 at 11:46

Dr Krugman has attempted to walk back is earlier views on the effectiveness of monetary policy for Japan in the 90’s. For example:

“Years later, thinking about Japan in the 1990s, I was quite sure that arguments about the ineffectiveness of monetary policy were all wrong — even at zero interest rates, printing money simply had to be effective. But when I tried to model it I ended up finding that this intuition was wrong; that analysis has stood me in very good stead now that we’re all Japan.” The above from: From:http://krugman.blogs.nytimes.com/2016/01/13/mind-altering-economics/

However when I read the Dec 1999 “tried to model it” note (Dr. Krugmans link to it is: http://web.mit.edu/krugman/www/trioshrt.html ) I just don’t see the walk back Dr. Krugman claims. What I see is more claims that the belief in effectiveness of fiscal policy in a liquidity trap is a belief in multiple equilibria and that monetary policy is still effective at the ZLB. Anyone else have this problem?

19. April 2016 at 11:55

Scott

No surprise but I disagree that Keynesianism (new, old whatever) is dead nor does Brad’s links help prove your point. Correct me if I’m wrong but I think what brad and paul are saying is that monetarism has collapsed in the face of reality in intellectual aspects and political.

The political aspects are easier for me to understand. Basically monetarism has no political home. You fit in well with conservatives when it comes to low marginal/capital gains taxes and being adverse to fiscal policy for stimulus purposes. But then you turn around and the same conservatives that you were buddy buddy with are now demonizing the fed for debasing the currency with QE or planting the seeds of hyper-inflation. You obviously dont belong there.

At the same time Keynesianism has found a nice political home with the democrats and thats not going to change anytime soon. The use of IS-LM in government is obvious.

Hey this doesnt mean monetarism is wrong. On the contrary is if one has a deep understanding of the theory he/she will have a big edge in the marketplace.

But as far decisions being made by our political leaders its very much a matchup of Keynes VS. Tea-Party gibberish. Monetarism is absent which is what brad and p.k are saying I think. Hey just keep trying to push your theory to mainstream

19. April 2016 at 12:05

And by mainstream I mean that our political leaders advocate your views.

19. April 2016 at 12:54

Harding, Only on the rich. 🙂

Capt. Parker. You asked:

“However when I read the Dec 1999 “tried to model it” note (Dr. Krugmans link to it is: http://web.mit.edu/krugman/www/trioshrt.html ) I just don’t see the walk back Dr. Krugman claims. What I see is more claims that the belief in effectiveness of fiscal policy in a liquidity trap is a belief in multiple equilibria and that monetary policy is still effective at the ZLB. Anyone else have this problem?”

Yes, me.

James, You said:

“The political aspects are easier for me to understand. Basically monetarism has no political home. You fit in well with conservatives when it comes to low marginal/capital gains taxes and being adverse to fiscal policy for stimulus purposes. But then you turn around and the same conservatives that you were buddy buddy with are now demonizing the fed for debasing the currency with QE or planting the seeds of hyper-inflation. You obviously don’t belong there.”

Politicians know nothing about monetary policy, they just want what gets them reelected, and gets their opponents thrown out of office. So lots of Republicans now want tight money, hoping it gets the Dems thrown out of office. What else is new? What kind of policy did the GOP like under Bush? Gee, I wonder why? What will they like if Paul Ryan is elected in 2020 (as I expect)? Gee, I wonder why?

You said:

“No surprise but I disagree that Keynesianism (new, old whatever) is dead nor does Brad’s links help prove your point.”

You can’t just say that without any evidence. I provided a quote from Krugman, 1999, which is an excellent example of New Keynesian monetary economics. Do you agree? And I claim he doesn’t believe this any longer, nor do most other NKs. Do you agree? In 1999, Brad DeLong said that New Keynesianism was mostly monetarism. Do you agree?

Just saying you disagree with me, without addressing any of my points, doesn’t get you very far.

19. April 2016 at 12:55

James, I would add that GOP politicians did not advocate money supply targeting when monetarism was indisputably in its heyday.

19. April 2016 at 14:01

“Politicians know nothing about monetary policy, they just want what gets them reelected, and gets their opponents thrown out of office. So lots of Republicans now want tight money, hoping it gets the Dems thrown out of office. What else is new? What kind of policy did the GOP like under Bush? Gee, I wonder why? What will they like if Paul Ryan is elected in 2020 (as I expect)? Gee, I wonder why?”

I agree with that politicians know little about monetary policy. But what matters is whom our political leaders are listening to. I think its fair to say that Keynesian economists enjoy a significant political audience via democrats . I would point to the 800b stimulus package to back me up. Who is the political audience for monetarism? Def not Paul Ryan and friends. I think what p.k and brad are saying is that monetarism is politically irrelevant.

I completely disagree with you that republicans want tight money to throw out the dems. They want tight money because they are animatedly against any kind of intervention in the marketplace. Hence the conclusion that monetarism has no political home. The GOP under Bush is not the same tea party-hijacked-GOP we’re dealing with now.

“You can’t just say that without any evidence. I provided a quote from Krugman, 1999, which is an excellent example of New Keynesian monetary economics. Do you agree? And I claim he doesn’t believe this any longer, nor do most other NKs. Do you agree? In 1999, Brad DeLong said that New Keynesianism was mostly monetarism. Do you agree?”

Umm lets see. I largely agree with you that new Keynesians dont share the same viewpoints back in 1999 so it very well might be dead. But I think what P.K and Brad are saying is that monetarism (old, market) is dead/irrelevant and Keynesianism (old, new, or whatever form that it exists today) is very much alive.

They often say that monetarism equals keynesianism which makes sense since you often see p.k and friends pushing for more monetary activism. they just sees practical limitations.

But the main difference between monetarism and keynesianism is that Keynesian is politically relevant while monetarists have no political home. They have a point.

19. April 2016 at 14:29

New Keynesians recognize that monetary policy is not omnipotent, in particular because of constraints on monetary policy such as currency unions or the ZLB.

And because the natural interest rate declined over the last thirty years and is most likely negative today and will most likely remain so for the next decade, we can expect the ZLB to bind much more often.

Monetarism is dead because no one thinks it is a good idea to implémentation Friedman’s roule or target money aggregates. New Keynesian theory on the contrary is the basic model on Modern central banks.

19. April 2016 at 14:45

james elizondo,

“I think its fair to say that Keynesian economists enjoy a significant political audience via democrats . I would point to the 800b stimulus package to back me up. Who is the political audience for monetarism? Def not Paul Ryan and friends. I think what p.k and brad are saying is that monetarism is politically irrelevant.”

Not in the way that you think. Democrats are big Kenynesians when they are talking about increasing deficit spending during a recession; they are often anti-Keynesians, however, on the topic of taxation during recessions. Hence why we see Democratic politicians and even some left-leaning (ostensibly Keynesian) economists calling for tax hikes during recessions. Also, once the recession is over, do Democratic politicians call for spending cuts (i.e., countercyclical fiscal policy?) Generally no.

In short, Democrats actually are not much more Keynesian than the GOP is market monetarist. Democrats are Keynesians when it comes to deficit spending in a recession, not about much else.

I also thing that the equation of Keynesianism with the left both overestimated the economic consistency of Democratic party and also does a disservice to Keynesianism, which isn’t as inherently left-leaning as so many on the right and left contend. Greg Mankiw is right-leaning and is among the most prominent new Keynesian economists in the country, and was an economic adviser to the Bush administration I believe.

19. April 2016 at 15:12

Mark

Dems are anti-keynesian on the topic of taxation during recessions? I kinda see where you’re coming from since Dems probably oppose marginal income tax cuts at all times. But what they want instead is gov spending on infrastructure. Thats very much in line with keynesianism and their belief that spending multiplies are significant.

Do dems call for spending cuts once the recession is “over.” No and neither do keynesian economists. A) spending gets automatically cut like the stimulus package B) even though the recession may be over both groups think its a crappy economy and dems and keynesians want more spending.

Is Keynesianism inherently left? I guess not since keynes economist would want fiscal discipline once the economy is running at its potential while maybe the dems would want to continue to spend. But thats the whole point of a political audience. When disaster strikes dems heed keynesian advice (fiscal stimulus package) and during normal times keyesian economist would use that platform to argue for restraint. Monetarists, sadly, have no political audience.

You sumner bring of the GOP or right-leaning economists from back in the Bush days. Hey I was an republican back then. I voted for McCain! But the republicans we see now do not resemble anything to republicans 10 years ago. It’ll take a while until that changes.

19. April 2016 at 15:49

“Is Keynesianism inherently left? I guess not since keynes economist would want fiscal discipline once the economy is running at its potential while maybe the dems would want to continue to spend. But thats the whole point of a political audience.”

But the fact that Dems only listen to Keynesian when it’s convenient suggests to me that it isn’t Keynesians who have an audience with the Democrats, it’s the Democrats who have an audience with the Keynesians.

I suppose I’m taking the opposite view of Keynes: he though politicians were slaves to political and economic thinkers; I think it’s more the other way around. Politicians make their policies first, then seek intellectual justification from economists later. Even Ted Cruz will use market monetarism if it can justify going after Janet Yellen.

Personally, I think one of the last things I want to see is the GOP returning to its Bush administration days. Much as people complain about how bad the GOP has gotten, frankly, I think the the best Republican politicians of the last half century are around today; e.g. Rand Paul, Justin Amash, etc. The GOP arguably has a more active libertarian wing than at any point in recent history (something I’d consider a good thing), a phenomenon unfortunately overclouded by Trump and whatnot.

19. April 2016 at 15:49

BTW, nothing’s the matter with Western Virginia. Trump wants the struggling old economy back up and moving again. Western Virginia is dominated by the struggling old economy. Therefore, the voters conclude, Trump wants Western Virginia moving again.

BTW, as far as I can tell, Trump has won all the counties that have went GOP in every presidential election since 1864, or whenever they were re-incorporated into the Union (except Walworth County, WI -I’m giving its aberration in 1912 a pass, since the GOP split that year, breaking the GOP lock on the electoral college and allowing a Bryanist sympathizer to take power).

19. April 2016 at 16:30

Call me Keynesian, call me monetarist, call me irresponsible.

Send in the money-dropping helicopters—hold that, send in the B-52s.

19. April 2016 at 17:29

“Just as old monetarism is mostly dead, having been replaced by market monetarism.”

Hahahaha, yeah no.

19. April 2016 at 17:34

Statism is dead intellectually.

19. April 2016 at 18:27

@scott – Who are the current leading NK economists in the U.S. these days?

19. April 2016 at 18:54

@Scott I hate to keep saying this but it’s really simple.

If you want to stimulate the economy, you need to increase the marginal exchange (by the non-financial sector) of financial assets for goods and services. From an AD perspective, it doesn’t really matter whether…

It’s the government spending more (as long as it’s financed by bigger deficits and not tax increases), or

The government funding tax cuts with increased borrowing.

Or… the non-banking sector (including the government) responding to fed asset purchases, higher asset prices, and improving expectations by spending more.

The only reason this is not entirely clear and obvious is because a) politicians (and disingenuous economists like PK) want to obfuscate it for political reasons, and b) economists want to protect their job security by barricading themselves behind DSGE models.

19. April 2016 at 19:05

@dtoh

-Why just financial assets?

19. April 2016 at 19:05

Dtoh

You sound like someone who thinks fiscal policy is reasonable to fight recessions?

19. April 2016 at 20:49

OT but in the ballpark:

From Fortune. Trump says low interest rates good. Cruz says low interest rates hide the cost of federal borrowing and should be raised, which would help cut the deficit.

—

“In fact, if the Fed were to raise interest rates now it could be disastrous, Trump says, because the country would be forced to pay higher interest rates on our debt, and that would be very “scary” for the economy.

“People think the Fed should be raising interest rates,” says Trump. “If rates are 3% or 4% or whatever, you start adding that kind of number to an already reasonably crippled economy in terms of what we produce, that number is a very scary number.”

It’s not certain that raising the fed funds rate would result in higher borrowing costs for the U.S. government—Treasury yields might fall if higher rates cause the economy to tip into recession—but other Republican candidates, like Ted Cruz, have said that low interest rates are hiding the cost of the nation’s debt. And if you were to raise interest rates that would force the government to stop spending, and cut the deficit.”

–30–

Egads, Crus says raising interest rates would force the government to stop spending and cut the deficit?

When Cruz is not promising to make sand glow in the dark in Syria-Iraq (that is, drop nukes)?

Or embracing Trump’s trade and immigration stances?

The Cruz approach: the way to cut the federal deficit is to have the Fed raise rates.

Bernie Sanders is not looking so bad. The old leftie from Brooklyn–maybe he would wreak the least harm on the U.S. and the world.

20. April 2016 at 03:22

@E. Harding – That would work too, but last time I checked banks weren’t in the business of buying real assets.

@james elizondo – No fiscal policy is unreliable, lacks credibility, faces political opposition, and results in poor asset allocation. Monetary policy is easier and more effective. However, either one will work. Again the mechanism is simple…the non-financial sector (including government) just needs to marginally increase its exchange of financial assets for real goods and services.

20. April 2016 at 05:56

dtoh

You say the non-financial sector just needs increase its exchange of financial assets for real goods/services. You say its simple to stimulate the economy. You give you a few examples including more spending by the gov or cutting taxes.

Then you say fiscal policy is unreliable, lacks credibility etc….so which is it?

20. April 2016 at 06:10

@james elizondo

No question. If the government increases spending and funds it by borrowing it will stimulate the economy. IMHO there are better ways to stimulate the economy, i.e. monetary policy, but that’s largely a political question not an economics question.

20. April 2016 at 06:11

‘New Keynesians recognize that monetary policy is not omnipotent….’

So do Monetarists, including the most famous one of all time. Friedman specifically told Walter Heller, in their famous NYU debate (you can look it up), that monetary policy was oversold…as was fiscal policy.

20. April 2016 at 06:14

dtoh

sounds good to me.

20. April 2016 at 06:17

I think some people who are commenting here, ought to read the DeLong piece. Say;

————–quote———–

So what has happened to the ideas and the current of thought that developed out of the original insights of Irving Fisher and his peers?

The short answer is that much of this current of thought is still there, but its insights are there under another name. All five of the planks of the New Keynesian research program listed above had much of their development inside the twentieth-century monetarist tradition, and all are associated with the name of Milton Friedman. It is hard to find prominent Keynesian analysts in the 1950s, 1960s, or early 1970s who gave these five planks as much prominence in their work as Milton Friedman did in his.

…. Thus a look back at the intellectual battle lines between “Keynesians” and “Monetarists” in the 1960s cannot help but be followed by the recognition that perhaps New Keynesian economics is misnamed. We may not all be Keynesians now, but the influence of Monetarism on how we all think about macroeconomics today has been deep, pervasive, and subtle.

———–endquote————-

20. April 2016 at 06:40

Also, Brad returned to this topic in 2003, to defend Friedman from Paul Krugman!

http://www.j-bradford-delong.net/movable_type/2003_archives/001633.html

Particularly interesting were the comments from Jim Glass (Jim, we miss you!). Those were the glory days of Semi-Daily Journal.

20. April 2016 at 09:50

Western Virginia is dominated by the struggling old economy. Therefore, the voters conclude, Trump wants Western Virginia moving again.

There is a distinction between the State of West Virginia, which is provincial, comparatively impecunious, and abnormally invested in extractive industries, and the western portion of Virginia (the Shenandoah Valley and Southwest Virginia), which is economically dynamic and growing demographically as well (but still provincial). I don’t think industry is abnormally prominent in the Valley or points southwest. Most of the Valley &c has seen robust demographic growth in the last four decades, those steeper the farther north you get. West Virginia has about the same population it did in 1937.

20. April 2016 at 19:32

OT, but heard Krugman interview today for Bloomberg’s “Taking Stock”. It was the least impressive interview I have heard Krugman give. He was soft peddling on why Sanders’ suggestion of monetary stimulus was bad, why US debt wasn’t a problem, why free trade wasn’t good (he calls himself “not a rigid free trader”). Through it all, he sounded like someone who knew why these arguments are losers, but tried to get around it by giving qualified answers so he won’t be shredded in the economic circles. The end effect is just someone who’s not at all convincing and sounds like someone who knew he sold his soul. (The closest parallel I could think was Chris Christie’s performance on ABC right after he endorsed Trump.)

About the only thing he said that had conviction was “areas that voted for Trump had higher concentrations of racism”. Ironic he said that the day after New York gave Trump a landslide victory.

20. April 2016 at 22:30

Scott, do you still believe that the BoJ is simply unwilling to hit its target?

21. April 2016 at 04:13

Art, did you read Scott’s post? The state of WV hasn’t voted yet. Buchanan County, VA, which does have about the same population as it did in 1937, has.

21. April 2016 at 06:28

James, You said:

“I completely disagree with you that republicans want tight money to throw out the dems. They want tight money because they are animatedly against any kind of intervention in the marketplace.”

You don’t seem to know much about the GOP. Under past GOP presidents the party favors monetary policies that they think will make the economy perform well. There’s really not much difference between the parties. The last three Fed chairman (before Yellen) were all appointed by one party and reappointed by the other. It’s nothing like the Supreme Court.

As far as the Dems and Keynesianism, recall that Bush also did demand side fiscal stimulus, in 2008.

You said:

“But I think what P.K and Brad are saying is that monetarism (old, market) is dead/irrelevant and Keynesianism (old, new, or whatever form that it exists today) is very much alive.

They often say that monetarism equals keynesianism which makes sense since you often see p.k and friends pushing for more monetary activism. they just sees practical limitations.”

You have a long way to go. No, DeLong did not say that NK was heavily monetarist because of monetary activism, the monetarists oppose monetary activism. It’s not a monetarist idea. So you don’t seem to know much about the ideas you are discussing.

As far as MM being dead, that doesn’t even pass the laugh test. We are rising high and have never been more popular. Negative interest on reserves? A market monetarist idea. We don’t have NGDP targeting yet, but there is a steady flow of academic economists into the NGDP targeting camp. That’s a necessary precondition for success. The combination of fiscal austerity and monetary stimulus in 2013 was a MM idea, and it worked. Abenomics from 2013-15 was MM. Given that MM is composed of just a few obscure economists from small schools, our success and been amazing. Krugman even congratulated us back around 2011 or 2012, for our success.

You said:

“I largely agree with you that new Keynesians don’t share the same viewpoints back in 1999 so it very well might be dead.”

That’s my point! Labels are meaningless, but ideas on both the left and right are constantly changing. MMs are the new version of monetarism, and we are far from dead.

MB, You didn’t address any of my points from the post. Did you read it?

Mark, Good point. Politicians don’t know enough about economics to be monetarists or Keynesians.

James, You said:

“But the republicans we see now do not resemble anything to republicans 10 years ago. It’ll take a while until that changes.”

Wrong, Romney’s views were similar to those of McCain. We don’t know the next nominee, but it looks like he will be to the left of Romney on economics.

Harding, So you are saying that the voters are stupid, and don’t understand they they rely on exports to China?

dtoh, There are as many versions of Keynesianism as there are Keynesians. Every time a Keynesian dies, his form of Keynesianism is dead. I’d say Woodford is the leading NK today.

Ben, Why would I even care what Trump says about monetary policy? He’s a lunatic.

Saturos. In the late 1990s and 2000s, the BOJ target was 0%, and they ended up with -0.3%. That’s close, but slightly below. Either they wanted that, or they foolishly raised rates in 2000 and 2006 expecting more inflation than actually occurred.

Since 2013 the target has been 2%, and actual inflation has averaged close to 2% in recent years. I’ve said they will fall short over the next few years unless they take some fairly dramatic steps. Let’s see what they do next week, that will tell us how sincere they are.

21. April 2016 at 11:39

Scott

I think for the most part your response is right but you are so far off about the GOP. They’re nothing like they were pre-Obama. They’ve been hijacked by the tea-party and it’ll take a long time before you get Milton Friedman Republicans. If this is right it poses a problem for MM as the theory will largley be absent among our political leaders. Key word Political.

21. April 2016 at 11:43

And if it turns out Im right about MM not having a political home feel free to join us democrats. Just go easy on the anti-fiscal stimulus stuff.

21. April 2016 at 13:09

James, Anyone that says monetarism is dead is demonstrating a lack of understand about how progress is made in economics. It’s an evolutionary discipline not a revolutionary one (despite how many apparent “revolutions” there have been: marginal, Keynesian, monetarist…). I’ve been reading Keynes, the Keynesians and Monetarism by Tim Congdon and I’d highly recommend it. In it he explains the Old Keynesian orthodoxy of the time and it does not resemble the mainstream of opinion today. Today no one believes that incomes policies are a useful way of controlling inflation. Virtually everyone agrees that inflation is “always and everywhere a monetary phenomenon”. When interest rates are positive almost all mainstream economists believe monetary policy should be used to smooth out the business cycle. If monetarism was dead then none of the above would be true.

Also the idea that monetarism has no political home may seem true in the US at this moment in time but in the UK monetarist ideas have found sympathetic ears in the Conservative Party since the late 1970s. Even today both David Cameron and George Osborne have used language that sounds undeniably Market Monetarist.

21. April 2016 at 13:41

A.H

“Also the idea that monetarism has no political home may seem true in the US at this moment in time but in the UK monetarist ideas have found sympathetic ears in the Conservative Party since the late 1970s. Even today both David Cameron and George Osborne have used language that sounds undeniably Market Monetarist.”

You just made my point for me, the idea of MM not having a political home. im not familiar with politics in the U.K so I guess ill keep my argument confined to the u.s

21. April 2016 at 14:07

A.H

“Virtually everyone agrees that inflation is “always and everywhere a monetary phenomenon”.

what about grade inflation? is that a monetary phenomenon to?

22. April 2016 at 06:32

James, You said:

“They’ve been hijacked by the tea-party and it’ll take a long time before you get Milton Friedman Republicans.”

There have never been any Milton Friedman Republicans, he was a libertarian. The current GOP is about to nominate a man who likes partial birth abortion, thought Pelosi was a good speaker but is disappointed she did not impeach Bush, likes transgender equality, opposes cuts in welfare spending.

Is that the Tea Party? You are naive if you think parties are about ideology. If you were right, the GOP would nominate Tea Party types, but they have not done that since 1964. Now if Cruz gets the nomination, then I’ll have to reconsider.

You said:

“If this is right it poses a problem for MM as the theory will largley be absent among our political leaders.”

You don’t understand how things work. We are trying to get NGDP targeting. To do that you try to influence your fellow economists; politicians have no say in the matter. Do you think politicians choose the 2% inflation target?

You said:

“And if it turns out Im right about MM not having a political home feel free to join us democrats.”

I’m neither Republican nor Democrat, although I suppose I’d join the Democratic party if you put a gun to my head and made me choose. I’m a libertarian. But that has nothing to do with MM, which is not a political ideology. There are lots of supporters of NGDP targeting that are Democrats, Republicans, Libertarians, etc.

22. April 2016 at 06:48

ok understood but

“The current GOP is about to nominate a man who likes partial birth abortion, thought Pelosi was a good speaker but is disappointed she did not impeach Bush, likes transgender equality, opposes cuts in welfare spending.”

where trump stands on issues depends on his mood. Even if cruz loses the fact that all establishment gop didnt stand a chance in this election (Kasich’s only hope is a contested convention) supports my view that the gop is not what it use to be.