Don’t tell me the facts, I’ve already made up my mind

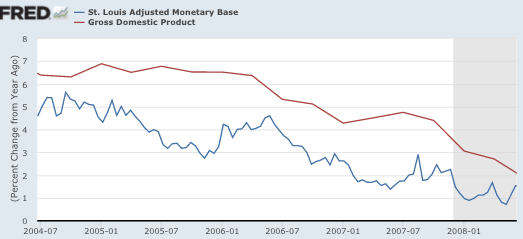

On some days that’s my impression of the economics profession. They’ve made up their minds that the financial crisis (not tight money) caused the recession. When I point to the huge decline in NGDP growth, they insist that’s not monetary policy. They say, “It was a fall in velocity, not tight money.” And yet that’s not true, base velocity was actually rising as the Fed drove the economy into recession. As you can see from the following graph, the Fed gradually squeezed growth in the monetary base, until by early 2008 the year-over-year percentage growth rate of the base had fallen to about 1%. This gradually squeezed year over year NGDP growth, which slowed to 2% by mid-2008 (and much worse later on.)

Just to be clear, I’m not suggesting the monetary base is a good way of thinking about the stance of monetary policy, it’s not. I’m just pointing out that the “concrete steppes” people who insist it’s not the Fed’s fault if V falls, only if the Fed does something concrete with the base, themselves never bother to look for concrete steps. If you tell them that the onset of the recession can easily be accounted for by this concrete action, they’ll still deny the Fed caused the recession. They’ve already made up their minds. Facts simply don’t matter.

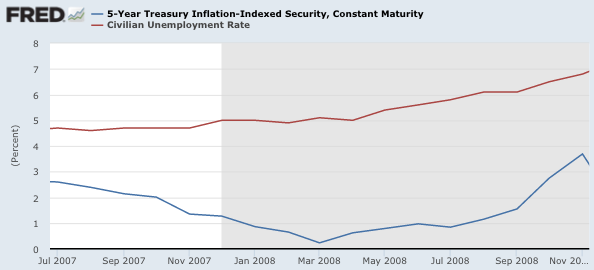

Others will insist that monetary policy is all about interest rates. If you ask “real or nominal” they’ll say real rates. Real rates did fall in the early stages of the recession, as is often the case, but then something really weird happened. Real yields on 5 year TIPS soared between the spring and fall of 2008, as unemployment began to rise sharply. If you point this out, they’ll still deny there was any tight money, because they’ve made up their minds that tight money could not possibly be to blame.

The economics profession considers the Fed to be sort of like the Pope, basically infallible, except for tiny errors induced by data lags. Any shock to AD can’t possible be caused by the Fed, because they fix problems, they don’t cause problems. Here’s James Alexander, posing a question to Tony Yates:

I think Yates’ course might be interesting but would it really help me with my questions.. The blogsphere is alive with debate on them and sometimes academic papers are referred to, but most seem unsatisfactory in one way or another.

Anyway, would they help answer this question: Would you ever create a model that included occasional, but deeply random tightening and loosening of monetary policy by central banks?

To this one he [Yates] answered: “Yes, if you thought central banks faced measurement error in real time, or changes in committee membership that meant changes in the preferences of the median committee voter. Have a look. Large literature on just that.”

I think Yates is expressing the mainstream view. We can draw an AS/AD diagram, and ask our students what would happen to AD if there were an expansionary or contractionary monetary shock. But deep down the profession doesn’t believe those shocks are important. Rather they think there are non-monetary AD shocks, which central banks offset with more or less skill. But surely central banks wouldn’t just create a negative AD shock out of thin air? The ECB wouldn’t just suddenly raise interest rates in July 2008, or April 2011, would they? Bueller, are you paying attention?

This faith in central bankers is what I reject. I see no reason at all to assume that 2007-09 was not a massive negative AD shock, caused by a series of central bank errors of commission and omission. These occur due to a complex mixture of data lag problems (correctly identified by Yates), ignoring market signals, and a deeply flawed model of monetary economics that focuses on growth rates, not levels. All three flaws came together in 2008. First the economy began to slump. That’s the data lag. Then the markets recognized the problem, but the Fed still did not. That’s ignoring market signals (i.e. Sept. 2008). Then when even the Fed realized the problem, they refused to commit to bring NGDP (or even the price level) back up to the previous 5% (or 2%) trend line. Put these three together and you get a massive negative monetary shock and the Great Recession.

PS. I was recently interviewed by the Frankfurter Allgemeine. Here is an excerpt:

The article is gated, and costs 2 euros. (Most of the article discusses Larry Summers, not me.)

Tags:

14. September 2015 at 04:33

Scott, The next day Tony Yates took down James´comments, although he forgot to take down some of his own answers!

14. September 2015 at 04:36

Prof. Sumner, what you are proposing is a paradigm shift, the mainstream think about the change of monetary aggregates as indicative of monetary policy stance, not the change rate of nominal spending, and although they recognize the role of expectations, they seem to believe long and variable lags are much more important than long and variable leads …

14. September 2015 at 04:57

Ah, but some concrete steppes people were looking at the money tightening in late 2007, and found it extraordinarily weird:

http://archive.lewrockwell.com/north/north570.html

http://archive.lewrockwell.com/north/north580.html

14. September 2015 at 05:01

This German journalist is just rephrasing Larry Summers’ first blog post in great detail (and great scepticism) – without really telling the source. That’s basically the whole article.

Being a journalist for a German newspaper in the US is rather easy. You just translate the basic ideas and statements of US blogs and US newspapers and nearly nobody will notice.

You’ve got exactly two sentences: Yes, the FED should wait. And: Yes, there are no signs for inflation and an overheating economy.

They say nothing about monetarism and NGDP targeting at all. That’s just sad, even for German media standards.

I can not imagine too many people buying articles from German newspapers by the way. I guess that’s why most articles are published for free after a short while, here you go:

http://www.faz.net/aktuell/finanzen/anleihen-zinsen/us-notenbank-fed-entscheidet-ueber-leitzinserhoehung-13799968.html?printPagedArticle=true#pageIndex_2

If the link does not work just copy and google for:

“Wie gefährlich ist die Fed”

14. September 2015 at 05:12

Marcus, Interesting.

Jose, You said:

“Prof. Sumner, what you are proposing is a paradigm shift, the mainstream think about the change of monetary aggregates as indicative of monetary policy stance”

I’m not sure that’s true. Most probably look at interest rates. Bernanke says you should look at NGDP growth and inflation to identify the stance of policy, which is basically my view. And he’s mainstream.

E. Harding, A few did see the problem. I recall Tim Congdon was one.

Thanks Christian.

14. September 2015 at 05:34

Great post. BTW, I think there are some economists who will criticize the Fed, but only for not showing enough steel or nerve or being tight enough.

As far as I can tell there is a vocal class of economists for whom monetary policy is never tight enough. When near zero inflation is obtained, then the rhapsodizing about deflation starts.

Central bankers are very vulnerable to this sort of inflation hysteria. Consider that the US Federal Reserve has adopted a numerical ceiling for inflation (as measured) but no floor for unemployment.

14. September 2015 at 05:42

When I point out to people that real yields spiked in 2008, the response is usually, “that’s because TIPS are illiquid, and the liquidity premium spiked because of the financial crisis,” or something like that. Still not blamed on monetary policy.

14. September 2015 at 06:09

Garrett, Yes, I love that sort of logic. First of all TIPS are not illiquid in an absolute sense, only relative to Treasuries. So that still doesn’t explain the spike. Even worse, they don’t seem to understand that “lack of liquidity” is a form of tight money. If money was looser, there’d be more liquidity, and rates would have been lower.

14. September 2015 at 06:40

@Prof. Sumner

O agree with your comment. I drew a very sharp line just to make a point. But this particular line (recognize NGDP change rate as a better “thermometer” for monetary policy stance) seems very hard for a lot of people to cross…

14. September 2015 at 07:01

Scott, Garrett, the explanation I usually hear is that hedge funds and the like needed cash to pay off panicking investors. They were selling what they could quickly sell without taking a massive hit (as would be the case with riskier investments). TIPS are obviously a safe and liquid investment, although as safe and liquid as short treasuries, so they were high on the list.

The Fed obviously should have provided more liquidity at the time.

In today’s WSJ: “In the years since central banks responded to the financial crisis by slashing interest rates, more than a dozen in advanced economies have tried to move rates back up””but not a single one has been able to keep them there.”

14. September 2015 at 07:05

There’s a lot of research to the effect that when presented with facts that contradict deeply held beliefs, people tend to hold those beliefs even more strongly. For example, show an anti-vaxxer or a climate change denier evidence and they’ll usually double down on their beliefs.

14. September 2015 at 07:22

Yes, foosion, and show a climate alarmist that the world has failed to warm for going on 19 year now despite a steady increase in CO2 over that time and he will do the same, i.e., double down on his beliefs. So much so that he will also start jiggering the historical data to help his case, as it turns out, particularly if he can do so from a position of authority.

But, actually, there’s also research out there that shows that when less-deeply-held beliefs are challenged with real data, people are inclined to actually learn, and adjust their opinions on matters to more accurately reflect the data.

In the case of the Fed, I think Scott way overstates the case. Plenty of people over the years, including economists, have been critical of the Fed’s management of their main responsibility, ensuring price stability. I was once able to purchase a pack of gum for a nickel and a penny actually bought a gum ball. Today, pennies are an economic loss to the system, as are nickels and dimes. The quarter is the new penny, all thanks to the Fed’s mismanagement over the decades.

14. September 2015 at 07:26

In terms of what caused the financial crisis, I tend to think about it in a bigger picture: It was caused by Americans over-working themselves into a higher monthly payment but did not notice the US wage premium was disappearing. So CPI was understated during the housing bubble. So if you substituted housing prices for 65% of rents expense, the CPI would have been a lot higher and money was too loose from 2001 – 2006. Then if you did the same thing in 2007 – 2008, the CPI would have been a lot lower and money too tight. (Additionaly in 2009 Deflation would have been a larger. However, if you did the same thing today, the CPI would higher and the Fed would be considering raising rates.)

14. September 2015 at 07:40

Sumner: “And yet that’s not true, base velocity was actually rising as the Fed drove the economy into recession.” – but there’s no such evidence in your blog diagram, which goes to the rate of increase of the monetary base. Cite for rising base velocity please?

14. September 2015 at 07:53

Don’t forget – after the ECB hiked rates in July 2008, Bernanke had to open swap lines and send $600 million to various banks, as demand for dollars spiked over there.

That hike in Europe was not because of inflation (even though that was the official explanation) but because Weidmann was warning about tier one money!

As far as I can tell, with the structure of the euro, the Europeans have recreated a gold standard – because the Great Depression was so much fun the first time around!

14. September 2015 at 08:23

OT – Hussman has a sharp mind but a mediocre stock record. Do as I say, not as I do…and he’s spot on about monetarism below.

http://www.hussmanfunds.com/wmc/wmc150914.htm

September 14, 2015

Consider the following question. The GDP of Bumdibai has been growing at 2% annually. Its central bank has just slashed short term interest rates from 3% to zero. How much do you think GDP growth in Bumdibai will be over the next 2 years? … Based on the actual relationship between central bank policy rates and actual subsequent GDP growth, your answer for GDP growth should have been less than 2.5%. Why? Because as detailed below, the correlation between central bank policy rates and subsequent GDP growth is next to nothing.

14. September 2015 at 08:43

Isn’t it possible that the financial crisis would have caused a severe slump even if the Fed had maintained NGDP growth?

14. September 2015 at 08:48

@M.R. – you’re new here. This is neither the time nor place for such naivete. It’s akin to asking about atheism in the Vatican. Sure maybe a scholar will answer you, but more likely the high priests will bum rush you out the door.

14. September 2015 at 08:51

foosion, Goods points, and thanks for the quotes.

Collin, Yes, the CPI may have been understated during that period, which is why it’s better to focus on NGDP.

Ray, I have base growth rates and NGDP growth rates, I really didn’t think I needed to provide evidence that velocity was rising. But if you insist:

Velocity growth = NGDP growth – base growth

Jean, Good point.

M.R. Possible, but 10 to 1 odds against. The slump was about what you’d expect from the sharp fall in NGDP.

14. September 2015 at 09:07

Sumner: “Velocity growth = NGDP growth – base growth” and also: “base velocity was actually rising as the Fed drove the economy into recession. As you can see from the following graph, the Fed gradually squeezed growth in the monetary base, until by early 2008 the year-over-year percentage growth rate of the base had fallen to about 1%. This gradually squeezed year over year NGDP growth, which slowed to 2% by mid-2008”

…but wait, the math does not work!? How can velocity be increasing, if both NGDP growth and base growth are decreasing? The math does not work!

And people call me a moron…

14. September 2015 at 09:46

@foosion. OT, but you might want to be a little more charitable to catastrophic AGW skeptics and not lump them all in with the anti-vaxxers. Some of us have become skeptics precisely because we looked at the data and changed our minds… and would be willing to change them back in the face of new data.

14. September 2015 at 10:44

“The slump was about what you’d expect from the sharp fall in NGDP.”

What’s the basis for this?

As a subscriber to the mainstream view that the financial crisis caused the Great Recession, why should I think that NGDPLT would have rendered the financial crisis unimportant from a macro standpoint?

14. September 2015 at 10:45

I learned above that liquidity is yet another factor which determines tight money. I confess that I don’t know liquidity in what market or how that is quantitatively measured.

Call me a peasant. These discussions have so many factors and interpretations that I doubt there is any predictive value. It is misleading to look at the past, pick out likely factors, and declare that a theory is correct.

=== ===

http://www.johndcook.com/blog/2011/06/21/how-to-fit-an-elephant/

Renowned mathematician John von Neumann: “With four parameters I can fit an elephant, and with five I can make him wiggle his trunk.”

By this he meant that one should not be impressed when a complex model fits a data set well. With enough parameters, you can fit any data set.

It turns out you can literally fit an elephant with four parameters if you allow the parameters to be complex numbers.

=== ===

14. September 2015 at 10:46

To put it differently, if I said “the slump was about what you’d expect from the financial crisis,” what would you say to that?

14. September 2015 at 11:27

Ray, You said:

“And people call me a moron…”

Yes . . .

M.R. Assume there were no financial crisis, and NGDP still declined 3% from mid-2008 to mid-2009. What sort of recession would you have expected? Take the difference between that recession and the actual recession, and that’s the impact of the financial crisis.

Andrew, That’s why I say focus on NGDP growth ,and ignore all the other indicators of easy and tight money.

K.I.S.S.

14. September 2015 at 11:40

Velocity of the St. Louis measure of the US monetary base-

https://research.stlouisfed.org/fred2/graph/?g=1PMb

14. September 2015 at 12:06

If the Fed tanked the economy, NGDP and RGDP would fall. It doesn’t follow that, if NGDP and RGDP fell, the Fed tanked the economy. A pandemic would do the trick, or California falling into the ocean.

14. September 2015 at 12:11

Scott, I love your title:

“Don’t tell me the facts, I’ve already made up my mind”

Unfortunately we live in a society that doesn’t value belief revision and instead gives tax advantages to institutions promoting and glorifying fake confidence in pretend knowledge. Confidence any outsider can tell is fake because these “expert” institutions disagree with one another.

In contrast, when I see physicists (for example) disagree over fringe, cutting edge or speculative ideas (like the multiverse) I don’t see a lot of confidence expressed in them.

Perhaps a good first baby-step sign of improvement in the field of macro is a precipitous drop in confidence in all conflicting hypotheses, and negative consequences for those found to be muddying the waters by promoting unreliable ways to know things. Eventually a few bad ideas may actually be identified and squashed for good.

14. September 2015 at 12:19

“Don’t tell me the facts, I’ve already made up my mind”

is the attitude I’ve seen epidemiologists refer to as “pre-contemplative.”

14. September 2015 at 12:24

@M.R:

> A pandemic would do the trick, or California falling into the ocean.

I disagree. In the event of a zombie apocalypse, I think a properly-measured CPI would show a great deal of price inflation in consumer goods as demand would increase while supply was curtailed on account of the apocalypse.

Remember that a typical falling-NGDP recession is characterized by stores being full of goods that they can’t sell for want of customers. This is a monetary phenomenon; supply-side recessions are characterized by empty shelves.

A financial crisis is a monetary crisis by definition, since people don’t eat stocks.

14. September 2015 at 12:49

Majromax, interesting perspective, you think a pandemic would be associated with constant or accelerating NGDP growth. That would have to be quite an inflation, and a cruel thing for the central bank to preside over.

14. September 2015 at 17:58

@W.Peden – thank you! St. Louis Fed graph is excellent to show velocity. Expand it to include a longer time scale and you’ll notice how comical Sumner’s insistence that such a tiny bump has any significance (then again, Sumner thinks the tiniest Fed pronouncements have huge ‘expectations’ effects, a butterfly wings flapping into a hurricane). Clearly there’s no cause-and-effect between velocity and anything looking forward.

And modern research rejects Sumner’s conclusions, see here: “Modern research on the QTM such as that of Ahmed (2003) which adopted a block causality test showed that there was a unidirectional causality from output and prices to money. That is, interest rate and money as a block do not cause output and prices, but output and price cause interest rate and money.” And: “Miyao (1996) used quarterly data for the period 1959 to 1993 to investigate the long – run relationship between money, price level, output, and interest rates in the United States and found that there was mixed evidence of a long – run relationship prior to 1990 and little or no evidence of a long – run cointegration relationship for the entire sample.”

So who to believe? Respected Granger-causation econometrics researchers like Ahmed (2003), Miyao (1996), or some crackpot advocate of butterfly wings flapping into typhoons who insults his loyal blog readers and never supplies a hard model (or even a decent historical analogy) for his secular theology rantings and ravings? Sadly, the prior sentence was not strawman rhetoric, but literally true.

Don’t expect Sumner to reply to the substance of this post. He’s already made up his mind.

14. September 2015 at 18:08

@myself – to give the reader a sense of how easy it is to manipulate the data when you deal with ‘expectations’, see the below abstract. You can find anything you want, as Andrew_M_Garland suggests above.

‘Source of underestimation of monetary policy effect: Re-examination of the policy effectiveness in Japan’s 1990s’ – Masahiko Shibamoto – ABSTRACT – This paper re-examines the empirical evidence on the potency of Japanese monetary policy in the 1990s by comparing the estimated impacts of various proxies of monetary policy shocks on the macro economy. My empirical results demonstrate that the surprise target changes as a proxy of monetary policy shocks had impacts on real output and financial variables over the period 1990-2001. I also show that the estimated effects of identified monetary policy shocks depend on whether the shocks are anticipated or not; The monetary policy effects on the economy are underestimated when the empirical models fail to control for the market expectation for monetary policy stance. JEL Classification: E52; E58.

14. September 2015 at 21:49

@myself

If you know everything already, why keep turning up here? Get your own blog and see who turns up.

15. September 2015 at 04:25

Ray Lopez,

I think the first thing you should do before you make up some mind is learn some basic maths.

15. September 2015 at 04:25

* your mind.

15. September 2015 at 06:50

@W. Peden – why don’t you teach me what you mean by basic maths? Was Sumner’s post clear on velocity? If so, please deduce it, without resorting to the St. Louis Fed graphic. Your move…

15. September 2015 at 11:48

I got my penny pencil out today, and ended up, I think, making the argument that biases we have regarding capital income vs. wage income have a large impact on monetary policy. Taken to its logical conclusion, I think my argument is that recoveries from financial contractions tend to rougher because we insist on it.

I think our lack of consciousness regarding this point is at play in the stubbornness you describe in your post.

http://idiosyncraticwhisk.blogspot.com/2015/09/housing-tax-policy-series-part-61-stong.html

15. September 2015 at 14:11

Simple-

(i) The rate-of-change of stock A is a lower number at time T2 than at T1.

(ii) The rate-of-change of stock B is a lower number at T2 than at T1.

(iii) A/B is rising.

These are consistent. I have a fever and I can barely type intelligible sentences, and I understand this.

15. September 2015 at 14:11

* Smaller number. As I said, barely intellgible, but still mathematically OK.

15. September 2015 at 16:17

MR, No, natural disasters are supply shocks, they don’t cause NGDP to fall. The Black Death didn’t kill money, hence it was very inflationary.

Ray, You said:

“substance of this post”

Substance?

15. September 2015 at 16:29

Kevin, Excellent post.

15. September 2015 at 18:59

@W. Peden – your example, abstract, made no sense and did not follow anything Sumner said. It’s OK though, you’re delirious from fever.

@Kevin Erdmann – you’re bat shiite crazy. Nothing in your California drought post relates to the thesis–already outlined in Rogoff et al’s book “This Time Is Different”, that ‘recoveries from financial contractions tend to rougher’ (statistically true, as Rogoff et al point out), nor, the metaphysical, ‘because we insist on it’.

15. September 2015 at 20:17

Thanks, Scott.

16. September 2015 at 02:16

Scott Sumner: “base velocity was actually rising as the Fed drove the economy into recession.”

Ray Lopez: “How can velocity be increasing, if both NGDP growth and base growth are decreasing? The math does not work!”

What I gave you was a schema, not an example. (Another good thing to learn before you start making up your mind about these sorts of things.) If you’d wanted an example, you could have used the charts provided in the post and comments. A mature person would just say they’d spoken too soon, which I’m sure you’ll say; it’s hardly the end of the world or worth fighting over.

16. September 2015 at 05:15

My take is still this.

Deficits got too small relative to GDP and the trade deficit, driving the private sector into debt to support a growing economy. That private debt was centered around real estate. Toward 2008 deficit was 1% of GDP and trade deficit around 6%. Then the fed was increasing rates, which tightened all the existing private debt, and stopped new debt. So you had tight monetary policy and a tight fiscal position, thus a massive recession.

16. September 2015 at 05:47

Ray, maybe I can help. But I’must having to dust off my cobwebs! MV=PQ or just = NGDP. When Scott talks about velocity growth, one way to see this is to take logs of both sides of MV=NGDP. This gives log(M) + log (V) = log (NGDP). Now solve for log (V). Differentiating both sides of the resulting equation with respect to time gives growth rates. As long as base growth is less than NGDP growth (less positive or “more” negative) then V is increasing.

16. September 2015 at 06:21

Thanks gofx

16. September 2015 at 19:57

Matt, the trade deficit is funded by our highly profitable foreign assets.

17. September 2015 at 10:16

Kevin – not sure what you mean? It does not seem to be “financed” by anything. Foreigners simply are demanding to save in our currency. I am simply looking at this through a sector balance view (Wynne Godley).

Here is a resources to better understand where my post comes from:

http://www.epicoalition.org/docs/99-4.htm

18. September 2015 at 01:11

Matt.

If you have not seen this, you may find it ‘interesting’?

“Importantly for our disaggregated quantity equation, credit creation can be disaggregated, as we can obtain and analyse information about who obtains loans and what use they are put to. Sectoral loan data provide us with information about the direction of purchasing power – something deposit aggregates cannot tell us. By institutional analysis and the use of such disaggregated credit data it can be determined, at least approximately, what share of purchasing power is primarily spent on ‘real’ transactions that are part of GDP and which part is primarily used for financial transactions. Further, transactions contributing to GDP can be divided into ‘productive’ ones that have a lower risk, as they generate income streams to service them (they can thus be referred to as sustainable or productive), and those that do not increase productivity or the stock of goods and services. Data availability is dependent on central bank publication of such data. The identification of transactions that are part of GDP and those that are not is more straight-forward, simply following the NIA rules.”

http://eprints.soton.ac.uk/339271/1/Werner_IRFA_QTC_2012.pdf

18. September 2015 at 05:28

Postkey thanks – excellent paper.

3. October 2015 at 01:25

[…] heir to Milton Friedman in this realm. Sumner sees the business cycle as the dance of the dollar. He argues (convincingly in my opinion) that tight money caused the Great Recession and that a more expansive […]