A poll of central bankers

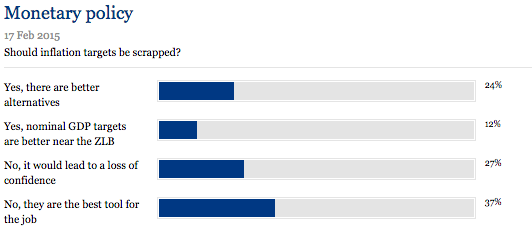

Ignacio Morales of the Costa Rica Central Bank sent me the following, which is from a poll of central bankers readers of Central Banking.com:

I will be traveling over the next few days, so blogging will be intermittent.

I will be traveling over the next few days, so blogging will be intermittent.

Tags:

21. April 2015 at 06:21

Er, is that really a poll of central bankers? When I click through the link, I see an option to vote on an identical poll at the right hand side. When I voted, I didn’t see any errors or invitations to prove I’m a central banker (which I’m not).

21. April 2015 at 06:55

Leon: I hope the public is not as ossified as central bankers.

21. April 2015 at 08:20

Numbers are also in flux

21. April 2015 at 09:37

There is a problem in definition because the question does not distinguish between inflation as a stated target and inflation as a target the monetary authority actually pursued. We need to analyse the factors that have contributed to monetary authorities pursuing de facto inflation ceiling targets to determine if some other kind of target would be better. NDGP targeting seems plausibly better, but since inflation targeting has not been tried we cannot know.

21. April 2015 at 09:39

Fortunately, monetary policy is not based on popular vote.

21. April 2015 at 12:13

If the poll is correct, I think this is a good thing. It shouldn’t be difficult to convince younger economists of the advantages of NGDP Targeting as opposed to Inflation Targeting, on technical grounds. Most people I talk to these days agree with the technical advantages, but cast doubt on the difficulties of explaining to the public at large the central idea. Inflation is something they “feel” directly, it means prices going up or down. NGDP is not so intuitive to the public. People that are serious about moving to NGDP targeting should hire PR experts, as opposed to engage in eternal technical discussions …

21. April 2015 at 18:57

Robazzi: Excellent points and your last sentence is supreme.

22. April 2015 at 06:47

In free banking even the bankers do not need to understand the overall monetary system, they only need to understand their own business.

In a central bank system, the central bankers need to know how the system works and even if they do the politicians and voters can mess the system up. And it looks like the central bankers do not really know how the whole system works.

Keep fight though Scott.

22. April 2015 at 09:52

Might be on to something, Ken;

http://www.voxeu.org/article/debt-supercycle-not-secular-stagnation

‘… there has been far too much focus on orthodox policy responses and not enough on heterodox responses that might have been better suited to a crisis greatly amplified by financial market breakdown. ….central banks were too rigid with their inflation target regimes. Had they been more aggressive in getting out in front of the Crisis by pushing for temporarily elevated rates [of inflation], the problem of the zero lower bound might have been avoided.’

Or really gone rogue, and targeted something other than inflation?

22. April 2015 at 09:55

More from Rogoff;

‘What of Solow’s famous 1987 remark that “You can see the computer age everywhere but in the statistics”? Perhaps, but one has to wonder to what extent the statistics accurately capture the welfare gains embodied in new goods during a period of such rapid technological advancement. Examples abound. In advanced countries, the possibilities for entertainment have expanded exponentially, with consumers having at their fingertips a treasure-trove of music, films and TV that would have been unimaginable 25 years ago. Quality-of-health improvements through the low-cost use of statins, ibuprofen and other miracle drugs are widespread. It is easy to be cynical about social media, but the fact is that humans enormously value connectively, even if GDP statistics really cannot measure the consumer surplus from these inventions. Skype and other telephony advances allow a grandmother to speak with a grandchild face to face in a distant city or country. Disruptive technologies such as Uber point the way towards vastly more efficient uses of the existing capital stock. Yes, there are negative trends such as environmental degradation that detract from welfare, but overall it is quite likely that measured GDP growth understates actual growth, especially when measured over long periods. It is quite possible that future economic historians, using perhaps more sophisticated measurement techniques, will evaluate ours as an era of strong growth in middle-class consumption, in contradiction to the often polemic discussion one sees in public debate on the issue.’

Gee, I wonder who he has in mind.

22. April 2015 at 14:02

@Floccina: What is the Unit of Account in free banking? Is its value stable? Just because free banking bankers do not (“need to”) understand the overall monetary system, doesn’t mean that the monetary system functions well.

It seems similar to saying: you can have an economy without a common currency; just use barter! Yes, such an economy is possible, in theory, but it’s much less efficient and leads to much lower economic growth rates (and thus lower future wealth).

Free banking, without an analysis of the stability of the value of the Unit of Account, isn’t a very useful proposal.

23. April 2015 at 00:45

Since money is super-neutral or neutral even short term, there’s not much harm in any of these rules (including NGDPLT) so long as moderation is used…it just does not matter. My beef with Sumner’s proposal is that in his lust to steer the economy (foolishly thinking he can) there will be a burst of hyperinflation.

23. April 2015 at 06:04

Role of immigration in population growth:

http://www.washingtonexaminer.com/census-record-51-million-immigrants-in-8-years-will-account-for-82-of-u.s.-growth/article/2563463

23. April 2015 at 07:50

@Ray: I like how you’ve managed to make a bad argument, that doesn’t just have a single weak link, but where essentially each and every step is wrong by itself. A remarkable achievement.

23. April 2015 at 16:07

Did I just enter the insult school for mentally challenged children?

23. April 2015 at 17:28

Patrick, That’s a good quote from Rogoff.

Everyone, I had my first visit to a Fed since I started blogging. St. Louis–the only Fed that got it right in the 1960s and 1970s. Met lots of interesting people.

23. April 2015 at 17:40

Scott did you get to meet Steve Williamson?

23. April 2015 at 17:42

ChargerCarl, No, but I spent an hour chatting with Jim Bullard.

23. April 2015 at 17:43

Also David Andolfatto and David Wheelock.

23. April 2015 at 19:32

“I spent an hour chatting with Jim Bullard.”

I wish I had been a fly on the wall for that one! I hope that what happens in St. Louis doesn’t stay in St. Louis. 🙂

24. April 2015 at 04:43

Scott Sumner: Um, did you broach the topic of the piece by Yi Wen, “Evaluating Unconventional Monetary Policies—Why Aren’t They More Effective?”

Wen says QE could have been four times larger with only some effect.

“Thus, based on our model the Federal Reserve’Ìs total asset purchases must be more than quadrupled and remain active for several more years if the Fed intends to eliminate the 10% output gap caused by the financial crisis.”

Wen also says,

“Our model provides an alternative explanation for the low inflation level. The Federal Reserve’s LSAP alone can depress inflation near the liquidity trap: Once the real interest rate of financial assets is low enough, QE induces flight to liquidity because portfolio investors opt to switch from interest-bearing assets to money. Hence, the aggregate price level must fall to accommodate the increased demand for real money balances for any given target level of long-run money growth…”

24. April 2015 at 06:06

“I spent an hour chatting with Jim Bullard.”

Please do tell.

24. April 2015 at 08:51

Negative interest rates, the lower bound and the changing demand for currency, especially high-denomination notes, in Europe…

http://jpkoning.blogspot.ca/2015/04/plumbing-depths-of-effective-lower-bound.html

24. April 2015 at 09:07

Bullard probably is so full of himself, believing that the people who hang on his every word count for anything. He’s about as important as an obscure Congo chief in an unmapped part of Africa in the 13th century. Money is superneutral, and the only consequence of QE is that the Fed is loading up on debt that has to be paid off if this continues with either default or hyperinflation. By that time the Pied Piper will have long left town.

24. April 2015 at 09:47

From the book by Brendon Brown “Bubbles”(2008), in response to Don Geddis: Some US researchers (see Posen, 2006) have argued that there is not a strong correlation between periods of abnormal ease in monetary policy and the emergence of asset market bubbles. Under the subtitle of “getting the excess liquidity creates bubbles myth out of the way”, Posen contends that only a third of instances of monetary ease resulted in asset price booms (15 OECD economies studied for a 30-year period from 1970-2000). He also contends that a substantial share of the bubbles identified had no period of exceptional monetary ease preceding them. In short: money is neutral always and everywhere. Sumner would of course argue something metaphysical like “never reason from a price change”, saying that “tight” is “loose”, but this is simply changing the data to fit your priors.

24. April 2015 at 10:24

So I see the NGDP growth futures trade is falling below 4%. Will the Fed loosen to keep NGDP growth over 4% this year?

Looks like we might find out sooner than we thought whether they’ve learned anything from 2008-9 and the ongoing debacle in Europe.

I wonder what Bernanke thinks.

24. April 2015 at 15:20

Ray Lopez:

“Money is superneutral … if this continues … hyperinflation”

So you must think hyperinflation doesn’t matter, since money is super neutral?

24. April 2015 at 16:22

Off topic, I’m curious about a reaction to this piece:

http://www.wsj.com/articles/global-glut-challenges-policy-makers-1429867807

They’re talking about falling commodity prices in a world of plentiful labor and cheap energy, bemoaning that the resulting deflation might keep interest rates “unnaturally low” for even longer, and trying to figure out who to blame for the “mess”. And here’s what they come up with:

> Producers have their own share of the blame. In a lower commodity price

> environment, producers typically are reluctant to cut production in an

> effort to maintain their market shares.

Can you believe it? Those crazy producers are just producing too much, and then they’re too selfish to cut production. If they’d just cut back production already, then prices could start to rise, and then the Fed could raise interest rates, and then all of us wealthy WJS readers could finally earn interest for doing zero work like god intended.

Am I the only one who just wants to cry at this sort of “analysis”? If the problem is slack demand, the answer is more AD, not less AS. The way you get more AD is through more expansionary monetary policy. If the interest rate channel is out of gas, how about the inflation expectations channel?

Grr.

-Ken

Kenneth Duda

Menlo Park, CA

24. April 2015 at 16:32

Jose Romeu Robazzi: I would be interested in hiring/supporting a PR effort around better monetary policy. Please let me know if you have any leads.

-Ken

Kenneth Duda

Menlo Park, CA

kjd@duda.org

24. April 2015 at 16:36

Kenneth,

Agreed. I do agree with Scott that there is an AS problem that some sensible policy proposals could alleviate, but I also think that there is an obvious lack of AD. Regard gin AS: For existing capacity variable costs seem incredibly low with low inputs, low transportation costs, lots of cheap labor and automation. Scott’s proposals would alleviate some of the barriers to creating new capacity something that would shift AS to the right but also create many more new jobs and capital expenditures. Those would increase AD some. But the big driver would be an expansive monetary policy that drives NGDP higher than 3.5-4%. Americans need to fix their balance sheets, and an expansive monetary policy will hasten that and return us to “normal” much quicker than the WSJ’s weird policy of limiting production.

24. April 2015 at 16:45

Thanks Anthony, I obviously agree with you, but I must admit I feel like your message did not reflect the full horror of what the WSJ seems to be suggesting. When you talk about “an AS problem that some sensible policy proposals could alleviate”, you are talking about expanding AS. I’m all for expanding AS. The WSJ wants to *deliberately hurt AS*. They’re just nuts.

What makes this so hard for people to understand? We’re talking about people who write about the macro-economy for one of the world’s leading business/finance newspapers, and they apparently think up is down, black is white, and freedom is slavery. Who was it who said, “why oh why can’t we have a better press corps?” I can’t quite place it….

sigh

-Ken

24. April 2015 at 16:55

Ken—excellent commentary. BTW, I spent a professional lifetime in financial journalism and I have worked a few years in public relations. I will send you a resume.

24. April 2015 at 17:49

Thanks Ken, that piece only shows that there is a critical shortage of competent editors at the WSJ. Another example is this one from Serena Ng;

http://www.wsj.com/articles/high-costs-put-cracks-in-glass-recycling-programs-1429695003

Writing about the changing market for recycled glass, she confidently asserts that, ‘The reason has little to do with supply and demand.’

Then she goes on to pile anecdote upon anecdote that demonstrate that supply and demand has EVERYTHING to do with it.

24. April 2015 at 18:11

LOL Patrick, the line after is the best:

> The reason has little to do with supply and demand. Americans generally

> want to recycle their beer bottles and jelly jars, and manufacturers

> like working with recycled glass because it requires less energy than

> starting from scratch.

Well, look at that. Americans like to recycle — there’s the “supply”. And manufacturers want the glass — there’s the “demand”. What could possibly go wrong?

Silly articles like this one are more entertaining than depressing (to me) because the policy implications aren’t so devastatingly wrong. It’s the articles that say, “gee, the economy is a bit of a mess, but really, all we have to do is jab this sharp pointy stick in our eye,” that upset me.

-Ken

24. April 2015 at 18:36

@Britonomist: “Ray Lopez:”Money is superneutral … if this continues … hyperinflation” – So you must think hyperinflation doesn’t matter, since money is super neutral?”

No, I’ve said that hyperinflation is the exception that proves the rule. Just like in rocket science you have regimes of different types of flow: laminar (smooth) flow has different equations than turbulent flow, and the change in regimes is abrupt. But, btw, how much does hyperinflation ‘cost’ to an economy? That much vaunted “shoe leather cost”? (Google this). Turns out, not as much as I thought, as I mentioned to Robazzi re Brazil: The inflation tax went as high as 8% of GDP in 1961-63 but generally was about 4%/yr during this 40 yr period of 1947-1986. And when inflation accelerated towards the end of this period, the cost actually went down as people adjusted by withdrawing money early and using checks rather than cash for transactions. Source: new Calomiris book on banking. In short, even in hyperinflation money is kind of neutral (-4%/yr GDP is of course severe, since 20 years of this will halve your GDP if the GDP is not growing, but not catastrophic by itself).

PS–Duda throwing his money around trying in this thread to brainwash others with Sumner’s NGDPLT propaganda. Something about fools and parting money comes to mind. Billionaire Pete Peterson has done something similar with his money funding the Peterson Institute for around $12M a year (small change for him), but the difference is Peterson is trying to reduce the size of the federal deficit, a noble goal.

24. April 2015 at 18:43

Ray: “No, I’ve said that hyperinflation is the exception that proves the rule.”

Oh how convenient, because this clearly doesn’t signal someone as a hack who chooses what is economic reality to fit their agenda/narrative.

24. April 2015 at 18:45

@myself – just in case somebody argues that Brazil did not have checking accounts (which many countries did not, and I was surprised to learn they did), here is Calomiris on Brazil hyperinflation remedies: “Inflation dodges [in Brazil] took a variety of forms, including treasury bills, interest-paying deposit accounts at financieras (finance companies), treasury bonds imperfectly indexed to inflation, and repurchase agreements between commercial banks and their depositors. Repurchase agreements (repos) allowed depositors to transfer deposits into treasury bills at the end of each day to avoid having their deposits counted for purposes of the reserve requirement at the central bank.” As you can see, the Brazilians were way ahead of even the Weimer Germans. So then how does the USA get rid of crippling debt, if hyperinflation is too slow? Default, which is just as popular if not more so.

24. April 2015 at 18:48

@Britonomist – I am not going to argue here with a simpleton. You probably don’t know much about science or math. You can email me at raylopez 88 at gmail dot com if you want to troll more…

24. April 2015 at 19:44

Ray ‘money is super-neutral even in the short term except when it causes hyperinflation’ Lopez, rowing backward as if trying out for an Olympic team, wrote…

“No, I’ve said that hyperinflation is the exception that proves the rule. Just like in rocket science you have regimes of different types of flow: laminar (smooth) flow has different equations than turbulent flow…”

Just like! ROTFLMAO! Dude, you don’t appreciate the kindness the EconLog people showed you.

Do yourself the same good deed. Ban yourself!

24. April 2015 at 23:40

@Jim Glass–can’t stand the truth? Question for the group: how is Sumner’s NGDPLT any different than chartalism? It’s just a matter of degrees not of kind. Google this and “MMT”.

25. April 2015 at 03:36

Not being able to stand the truth is a prerequisite to supporting any socialist plan, (anti) market monetarism included.

You have to not be able to stand the truth of economic calculation in a division of labor.

You have to not be able to view other humans as independent ends in themselves, but rather as like cells in a “higher” organism the understanding.

You have to not be able, nay I will go as far as saying you have to loathe, respecting individual liberty. Related to this, you have to not be able to tolerate not getting what you want from other people’s persons and property on account of them wanting something different for themselves.

Do you know what pragmatism really is? It is not being able to stand up for individual freedom out of fear and contempt of innocent people because they merely look like other humans who have committed violent crimes.

It is “I condemn all of you to monetary slavery because I am unable to distinguish any of you from that other bipedal homosapian they called Hitler”.

25. April 2015 at 03:40

@Ken:

If building a PR campaign for better monetary policy includes a need for an information technology back end, I’d be willing to donate services and IT logistics as I am able. Seeing and personally experiencing the devastation that seemingly arbitrary and capricious monetary policy choices cause, it’s my civic duty to contribute in any way that I can to put a stop to the financial and intellectual abuse of ordinary people.

I am currently working for a Fortune 500 global firm in IT engineering for production directory and naming services, and cloud/virtual server engineering for the corp. development network. I am petty rough around the edges in a political sense, but I wouldn’t expect to contribute to content, only to participate in engineering the means to deliver it.

25. April 2015 at 05:13

Ken,

In the short run, at least, the profession appears hopeless. You can’t get published these days without a math-heavy DSGE model, and those models far fall short of adequately incorporating the many functions of money.

In the real world, money is both the unit of account and the medium of exchange. In the former role, it’s existence enables the price system to coordinate the actions of millions of people and direct resources to their most valued use. Screwing up thousands of relative prices by randomly supplying too much or too little money can’t happen in a DSGE model because there aren’t thousands of relative prices in those models. At most there are two or three. In fact, in the typical DSGE model, there is no reason for money to exist in the first place.

Some modern macro models do try to capture the medium of exchange function through cash in advance constraints, but these also fall very short of the mark. In the real world, there are dozens of close substitutes for “money”, and again we find that the math rapidly becomes intractable once you start expanding the model to include much heterogeneity.

There is also the old aggregation problem. In grad school 30 years ago I learned that only under very unrealistic assumptions was it true that the sum of a large number of differing demand curves would behave much like the individual curves did. This for a single market. Aggregating across markets is even worse. Production functions can be worse still. So there is really no reason to think that models with representative consumers and representative producers are going to tell us much about how the real economy behaves.

But none of this seems to matter to the gatekeepers of the profession. They are not about to admit that their heavy duty math tells us less about what good policy is than Nick Rowe’s simple stories or Milton Friedman’s historical studies do.

Maybe you could try to get a politician or two aboard. The Democrats are probably not your best bet here, as good monetary policy obviates the perceived need for bigger government. Most of the Republicans are still fighting the last war (on inflation) but you may find one or two who can be persuaded to join the 21’st century. Marco Rubio may be a possibility, as Rand Paul followers include a lot of Major Freedom types who would oppose any monetary policy at all, and most of the others are trying to appeal to low-information anti-immigrant voters.

On second thought, maybe the Republicans are hopeless too. Damn.

Perhaps blogs like this are it. That and setting up NGDP futures trading to expose the FOMC members to NGDP expectations that differ from their own.

25. April 2015 at 06:34

@Jeff, @Cole

Yes, bloggers are it. But couldn’t Rand Paul be persuaded ?

What strikes me most is that NGDP as an indicator of what is going on with AD is a thought process, and not a specific policy recommendation. A lot of people don’t seem to get it. One can be a tight money sponsor, say, misesian, and still can use MM as proposed by Sumner, you just have to set NGDP growth rate to zero, and get Inflation = – RGDP growth.

One can be like me and defend that relative prices matter, they are sticky both ways (not just downward) and set NGDP target = RGDP potential, and still use MM as proposed by Sumner. Couldn’t Rand Paul like this option ? I think if he understood the idea he could be persuaded. I think he could be persuaded by Sumner’s 4.5% NGDP target.

Finally, those who believe more inflation is good (like PK), set NGDP target = RGDP potential + 5%, and still use Sumner’s proposal. For the people in this last group, I advise you that Brazil did set inflation target to 4.5%, and now we are with 8.2% inflation and zero real growth. But hey, PK wants to be able to “manage AD” more effectively just by being farther away from the zero lower bound. As if macro policies should be designed by their “ease of use”, as opposed to achieve real effects, let’s say, have relative prices move move around with the minimum possible distortion …

25. April 2015 at 18:42

@Robazzi – good points, indeed if prices are sticky they are sticky both ways, which actually undercuts Sumner’s arguments. Why retard growth with Sumner’s proposal, if prices are sticky upwards? (But I personally don’t think they are that sticky, nor that money is anything but neutral). As for your point that Sumner’s NGDPLT is ‘all things to everybody’ that’s also a feature that makes it so hard to adopt. If it incorporates Taylor’s Rule as well as ruinous hyperinflation, why not just adopt Taylor’s Rule, and not take the chance of runaway inflation? But in fact Sumner, despite his protestations and Chicago school upbringing, is a closet hyperinflationist. That’s why he’s pushing this untested and unclear framework.

25. April 2015 at 18:44

Ben, I did not mention that article, but I doubt he fully accepts that result.

Ray, I agree that easy money doesn’t cause bubbles.

Ken, That doesn’t look very promising, but I’ll take a look when I get home.

Everyone, I went to an NGDP targeting conference today, perhaps the first one ever offered?

26. April 2015 at 03:46

Scott,

That’s great news. Where was it?

26. April 2015 at 07:19

“Freedom granted only when it is known beforehand that its effects will be beneficial is not freedom. If we knew how freedom would be used, the case for it would largely disappear…. Our faith in freedom does not rest on the foreseeable results in particular circumstances but on the belief that it will, on balance, release more forces for the good than for the bad…. It is because we do not know how individuals will use their freedom that it is so important.” – Hayek

26. April 2015 at 08:48

Sumner wrote:

“Ray, I agree that easy money doesn’t cause bubbles.”

And I agree that you do not define easy money from a foundation of free markets, but rather from the flawed anticapitalist “This is not easy money because my socialist rule decrees it thus.”

I.e. Pragmatism.

27. April 2015 at 04:16

On Bubbles,

i have seen so many comments about “bubbles”, trying to figure it out using only prices. Readers of this blog and others have learned that the level of a price (interest rate) does not tell you anything about the monetary police stance. Moving to “bubbles”, valuations are hardly an indicator of “bubbles”. I have read many times that people cannot identify a bubble from prices, and the phenomenon of rapidly declining prices is associated with the idea of a “bubble” only after the fact, when it bursts. Now, the process which I think should be associated with a bubble is the amount of term mismatch in financing structures. It does not have anything to do with the debt level as well, but how it is financed. The investment banks went down in 2008 because they were highly levered, yes, but mostly because they were poorly financed, holding long term assets and financing it with one day repos. That caused the liquidation process after recongnized as a bubble bursting. I disagree with Sumner, I think bubbles exist, and yes, easy money is a condition that is necessary on the time frame before the burst, because easy money is one of the conditions that make term mismatch possible. But easy money alone does not “cause” a bubble. It just raises the probability one may occur.

27. April 2015 at 08:10

@Robazzi on bubbles – but if money is superneutral (since the Fed follows the market nearly always), and animal spirits is what drives bubbles (as Nobelian Schiller believes) then what Sumner thinks about where in the AS-AD curve we are is irrelevant. Something to think about.

27. April 2015 at 10:22

“Producers have their own share of the blame. In a lower commodity price environment, producers typically are reluctant to cut production in an effort to maintain their market shares.”

Haha, apparently OPEC is now the ideal production model.

But resentment from other producers is natural, Rockefeller was hated for what Standard Oil did to oil prices even though he generally lowered costs to consumers.

27. April 2015 at 12:37

W. Peden, West Virginia University.

27. April 2015 at 14:09

@Ray

I don’t think money is neutral or superneutral. Using an engineering term, I think the economy has a lot of hystereses, one cannot, in my view, revert to something that existed before after the money supply was adjusted, just because the price level adjusted. In that regard I am very much an Austrian, I think capital structures are heterogeneous and idiossyncratic. Having said that, I still think stabilizing NGDP is the best nominal anchor in order to not distort relative prices, and therefore, create conditions for a healthy capital formation. To me, the best option is to set NGDP = potential RGDP.