Where would an aggregate nominal labor comp target fail?

In the US, labor compensation is about 52% of nominal gross domestic income (or NGDP.) Another 26% is capital income, 15% is depreciation and 7% is indirect business taxes such as sales and excise taxes. (Income taxes are of course a part of labor compensation, and corporate income taxes are a part of capital income.)

I don’t recall ever seeing an economist propose targeting aggregate nominal labor compensation (NLC), and I’m not exactly sure why. The purpose of this post is to figure out where that sort of policy target is likely to fail. Because no one is proposing NLC targeting, it’s presumably a bad idea. I am especially interested in how it compares to inflation targeting, NGDP targeting, etc. By the way, don’t be fooled by the fact that NLC is only 52% of NGDP. Depreciation is extremely inertial, and hence of little interest in business cycle analysis. Sales taxes tend to follow the economy. The two key components are labor and capital income, and NLC is 2/3rds of that aggregate.

Let’s start with one stylized fact that almost everyone accepts. Nominal hourly compensation looks very sticky. That doesn’t mean it is sticky, just that it tends to be much less volatile than NGDP. My NLC targeting proposal is based on the assumption that hourly wages would not become more volatile if NLC was targeted (indeed I’d expect wages to become less volatile.)

If hourly comp remained fairly stable, and the Fed targeted NLC, then total hours worked would also become relatively stable. However RGDP might still be somewhat volatile, if productivity was unstable. And even if RGDP was stabilized, inflation might become more unstable.

So I can think of three arguments against stabilizing NLC:

1. The Lucas Critique—as soon as you start targeting NLC, negotiated wages would become very unstable.

2. When hours work stabilize, there would still be output instability due to productivity shocks.

3. Inflation might become more unstable.

Are there other potential problems?

FWIW, here’s my intuition on the three possible problems:

1. I can’t imagine why stabilizing NLC would make hourly wages more unstable. It might, I just don’t see the mechanism. I’d expect the opposite.

2. I view instability in hours worked (i.e. unemployment) as THE business cycle problem. It’s the sine qua non of old Keynesian economics. I see no reason to assume that variations in output for any other reason are suboptimal. In other words, the RBC model is probably the appropriate way to think about output variations not caused by involuntary unemployment.

3. If inflation is the proper way to measure the welfare cost of nominal instability (and I doubt it is) then surely core inflation is more useful that headline inflation. I can’t imagine any welfare costs flowing from fluctuations in flexible food and energy prices. And isn’t core inflation closely linked to wage inflation? Which leads back to point one.

In other words, I have a hard time imagining where a NLC target would fail. Hours would become more stable, and core inflation would remain well behaved. There’s probably enough wage flexibility in the long run to accommodate gradual changes in the labor force associated with declining birthrates, etc. I actually find it easier to visualize a NGDP target failing than a NLC target failing, especially for small un-diversified economies. For the US, I’d expect a NLC and NGDP target to produce very similar results. If one were highly effective, the other would be too.

Then why even bring up the NLC target? Because it’s easier to visualize the “musical chairs model” using NLC shocks than NGDP shocks. It simplifies things, as you no longer have to model the impact of changes in NGDP on NLC. You model the growth rate of the total revenue used to compensate labor (monetary policy), assume nominal hourly wages are sticky, and you end up explaining employment. What could be simpler?

PS. Back in 2013 Miles Kimball and Matt Rognlie had a very good discussion of the relative plausibility of sticky-wage and sticky price-based models. Both make excellent points, but Matt’s defense of the sticky-wage assumption is as good as I’ve ever seen. I’d like to think that if I were 30 years younger and 30 IQ points higher I would have made similar arguments.

PPS. Between mid-2008 and mid-2009, NGDP (actually NGDI) fell by 2.9%, NCL fall by 3.8%, capital income fell 2.4%, business taxes fell by 2.3% and depreciation fell by 0.2%.

PPPS. One area where NGDP targeting might be better than NLC targeting is financial market stability. NGDP is the total income available to repay nominal debts. As noted earlier, however, the two are highly correlated.

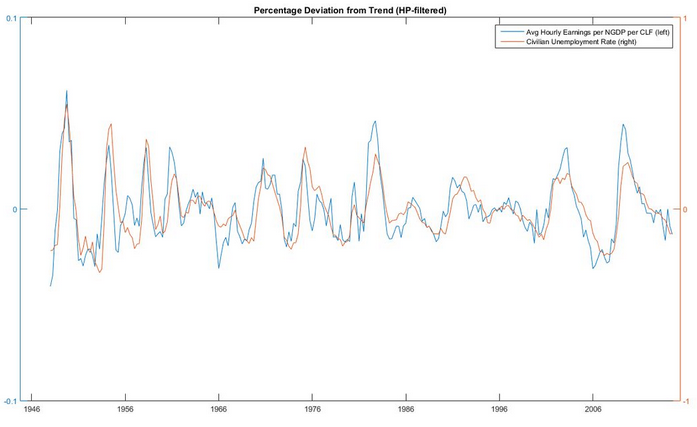

Update: Commenter Rob sent me a graph with unemployment compared to W/(NGDP/Labor Force). He smoothed it using the Hodrick-Prescott filter.

Tags:

3. February 2015 at 19:46

One of the few balanced posts by Sumner. In it, Sumner acknowledges his ignorance, acknowledges the brilliant Dr. Miles Kimball’s argument that there are relatively no sticky wages/prices, and cries out for help from his readers. I better stop now since I’m liable to perturb Sumner, which is NOT what I want.

As for the last point, here are my thoughts (for what they are worth, I’m not an economist, thank goodness);

1) Wages jump too much to be of any use for stable monetary targeting, see http://research.stlouisfed.org/fred2/series/LABSHPUSA156NRUG (Share of Labor Compensation in GDP at Current National Prices for US)

2) from #1, and the BLS site online, it seems NLC targeting is not counter-cyclical. Note the share of labor component does not change during recessions, and from the BLS site, the index is: yr 2007: 104.4, yr 2008: 108.2, ’09: 110, ’10: 111.6 — note no drop in ’08-’09. Likewise for the recession of the early 90s. If you believe monetary policy should be counter-cyclical, this is bad (personally, I think money is neutral, but just pointing it out to you Keynesians/monetarists)

3) If Total Factor Productivity increases, as it has since 1973 (see Kimball’s site) we’ll need fewer people and more machines. Why target your money supply based on a declining statistic?

I’m sure I can think of some more criticisms, but let me stop here.

3. February 2015 at 21:00

@Ray Lopez: “If TFP increases…we’ll need fewer people and more machines.” More machines, yes … but not fewer people. You’re just repeating the Luddite fallacy. What you actually get is full employment, and greater wealth.

3. February 2015 at 21:09

Re the updated chart by Rob, unless I’m reading it wrong, it’s still not countercyclical, but procyclical. Look at the spikes in the 50s, early 1970s, the 70s, the early 80s, the early 90s the early 00s, and the Great Recession of 2008–if you expanded during these period, you’d have: massive inflation in the 50s, 60s, and 70s, as money supply is inflated even more, arguably an OK response in the early 90s recession, which was mild, but, an even bigger bubble post 2001 recession (look at the steep drop, which would have required printing massive money in this NLC model), which would arguably cause an even greater financial crisis in 2008. Anyway, with present monetary stimulus, as shown by the chart post-2008, we had a decent recovery, so what’s the point?

3. February 2015 at 21:15

Capital income, GDP, and labor income move, more or less, together. But, capital income is much more volatile and usually slightly leads labor income. So, to stabilize capital income, it seems like you would be gaining a lot more stability compared to the status quo, and the signal would be more timely. Also, I would expect that to lead to lower equity risk premiums, which would raise compensation as a portion of GDP and increase growth rates.

So, if you’re going to be specific, target capital, not labor. Everyone wins.

http://research.stlouisfed.org/fred2/graph/?g=Zuu

3. February 2015 at 21:16

@Don_G – I’m aware of this Luddite fallacy, thanks. But maybe this time may be different, with robots replacing the extra worker. A solution to this problem is perhaps a very small guaranteed national income.

3. February 2015 at 22:35

This idea may lead to a Communist coup.

It makes the economy a zero sum game between rich and poor. Each salary rise for a rich executive takes money from many poor job seekers.

3. February 2015 at 23:36

@Jonathan – “Each salary rise for a rich executive takes money from many poor job seekers.”

If this were true under NLC targeting wouldn’t it be true under inflation targeting as well?

It probably is true in both cases but I wouldn’t call it zero sum. And the only problem that I see with NLC is that there will be a lot of propaganda posters using this zero sum falacy.

If you combine NLC targeting with guaranteed income you get a good system to handle the transition to robots taking over all our jobs.

4. February 2015 at 02:27

In my salary, there is a fixed component and a variable component. I’m presuming that when a policy is targeting wages, it’s targeting the fixed component alone and not the fixed+variable component, or am I wrong here?

4. February 2015 at 02:27

If you target NLC as growing at (say) 5% per year, then every union contract will contain a 5% (or more) annual increase, particularly in the public sector. This will be impossible for the government to refuse, as they will have stated that their policy is for labour compensation to grow at 5% per year. Therefore this will make labour market rigidities, and the “game of musical chairs,” much worse.

4. February 2015 at 03:29

Therefore this will make labour market rigidities, and the “game of musical chairs,” much worse.

I take it that when you’re cold, you start designing a rocket that will take you closer to the Sun.

4. February 2015 at 05:18

Scott,

Isn’t the labor anchor already implicit in the NGDP target? I believe that a focus on time aggregate utilization would clarify the relationship between labor and capital which needs to be better understood. However,targeting capital is not enough, because income reflects changes in both productivity and output, whether they be positive or negative.

4. February 2015 at 05:20

Well, all well and good.

I sometimes wonder if we expect the public to follow along, how much can a central bank and federal government complicate matters?

As I have said before, I wonder if 95% of Americans could identify Janet Yellen in a NYC mug line-up. The Fed delivers wimpy-sounding forward guidance, while loose-cannon FOMC members go into sweat-drenched hysterics about inflation, or lie about economic growth in the 1970s. No wonder forward guidance does not work.

Seems to me a central bank needs a simple, clear message, delivered in English and not forward-guidance speak.

Such as, “The Federal Reserve Board is committed to four straight quarters of nominal GDP above 6%, and will continue stimulus on all fronts, by any means necessary, until that goal is obtained. After that goal has been obtained, the situation will be reassessed.”

KISS.

The Fed needs to let people it is going to pour it on until the job is done. And as Krugman says, what is the damage if the Fed overshoots? Too many people employed? Inflation at 2.1%? Let us not fool ourselves into too-fancy and exact approaches. Leave that the Fed staffers.

I am not sure NLC passes the KISS test.

Salem–

I agree somewhat with you, but are you aware that now 6% of the private workforce is unionized? It is one of many structural impediment vastly changed since the 1970s, making the current economy much less inflation-prone than 30 years ago, even as FOMC become peevishly fixated on microscopic rates of inflation.

4. February 2015 at 05:52

Interesting thought exercise.

But why depreciation as a metric? Generally, national accounts are prepared on a cash, not accrual, basis. (This may not be a strength, by the way.) Using that standard, we’d probably want to use capex (a cash outlay) rather than depreciation (an accrual-based estimate).

However, if you want to talk about depreciation, why not go whole hog and suggest the preparation of national balance sheet accounts? Any non-Keynesian would want those.

4. February 2015 at 05:56

Another thought:

All economics curricula should include an intro accounting course. It’s incredibly important to understand the essentials, I think.

In addition, I would include a semester on demographics. This will be very important from here on out.

4. February 2015 at 07:02

Ray, I’ve never seen you put so much nonsense into one post:

“brilliant Dr. Miles Kimball’s argument that there are relatively no sticky wages/prices”

Miles would get a kick out of that.

You said:

“it seems NLC targeting is not counter-cyclical. Note the share of labor component does not change during recessions”

That actually helps my argument.

You said:

“If Total Factor Productivity increases, as it has since 1973 (see Kimball’s site) we’ll need fewer people and more machines. Why target your money supply based on a declining statistic?”

Yeah, because most people don’t “need” more stuff.

Kevin, Not always, labor income fell more sharply in this recession. But I think you miss my point, the goal (I’d argue) is not to stabilize output growth, it’s to stabilize employment growth.

Jonathan, Only in nominal terms, not in real terms.

Prakesh, The proposal is to target AGGREGATE labor compensation, not compensation per person.

Salem, That’s a good argument, but I doubt it. First because hours worked will change over time. Second, since inflation targeting doesn’t make all workers ask for 2% raises. But it is a valid argument, and is perhaps the biggest potential drawback of my proposal.

In that case we would not observe highly volatile employment, but perhaps long periods where it was slightly too high or too low.

Becky, You asked:

“Isn’t the labor anchor already implicit in the NGDP target?”

Yes, but this makes the link much clearer, and tighter.

Ben, The KISS test is a good point. I’m still going to be advocating NGDPLT

Steven, I don’t follow your point. My proposal ignored depreciation.

4. February 2015 at 07:50

I would expect that NLC can be tracked relatively easily on a month-to-month basis (payroll statistics, government payroll and income tax receipts, etc…). This would be an advantage over GDP/GNI whose data is only available quarterly.

The FOMC would get better data at a higher frequency about its target if it chose NLC rather than NGDP.

An NLC prediction market would be provided better data at a higher frequency than an NGDP prediction market.

4. February 2015 at 08:02

@Sumner – why do you still read me? I wonder about you sometimes. Kimball indeed debated Rognlie and took the position there are no sticky wages, relatively speaking. The fact that two eminent researchers even debated this topic shows it is not settled. Kimball: “My biggest objection to nominal wage rigidity is that observed wages are not allocative. It is hard to believe I would just give up on more labor input because the wage is high as opposed to asking my existing workers to work harder for the same pay…”. (indeed)

As for your NGDPLT, it’s pro-cyclical now? Wow, Houdini strikes again. You are a bottomless pit, there’s no limit to your theory. It’s the theory of everything…and therefore nothing.

As for the topic of this post, if labor tracks total NGDP, why complicate things by tracking just labor? I see two reasons: one, your monstrous ego demands you wish to be ‘original’ in your contribution to theory, since Mint et al already anticipated NGDPLT. Second, you correctly intuit that NGDPLT will be extremely volatile (my earlier point exactly), so you wish something less volatile. I agree it’s embarrassing if the central bank has to expand and contract in the same week because the NGDP futures market changes sign. But, in conclusion, I have to say the more I read you the more I am impressed, really. You are a true academic, showing great flexibility of mind, changing ideas and coming up with new ones nearly every other post. That means, for a conservative Fed and society that abhors change (rightly), that your proposals are hardly likely to be taken seriously, unless we happen to fall into another recession, as has happened in Japan over the last 25 years. So your best hope is to pray for a series of disasters. Blog on!

@Benjamin Cole – KISS is this: money neutrality is real, no sticky wages, even less sticky prices, fiscal policy is impotent, and a return to the Gold Standard would not only not be a disaster, but would allow a resetting of the economy to beneficial levels. What you propose is Weimer hyperinflation. They tried that in Zimbabwe; didn’t work.

@S Kopits –indeed we need to audit the Fed Govt, and audit the Fed. I support Rand Paul on this last issue.

4. February 2015 at 08:06

Even as short term Keynes, targeting L comp seems WAY too hard and unemployment is a heck of a lot easier to implement.

1) For all the Piketty labor getting screwed emotions, I wonder if capital is getting more productive in the economy. From our office, new IT rollouts are a lot cheaper and quicker than 15 years ago. So we spending less and getting more on IT capital.

2) One aspect of The Great Recession is the increase in part time working. There are lot reasons for this, but I think retail workers are not competing on wages but flexibility in hours. So a companies are controlling labor through hours and limits L comp ability.

3) How benefits are weighed is almost impossible and controversial.

4. February 2015 at 08:47

Tyler Cowen linked to this:

“As Parents Get More Choice, S.F. Schools Resegregate”

http://sfpublicpress.org/news/2015-02/as-parents-get-more-choice-sf-schools-resegregate

4. February 2015 at 10:55

If you are going to target an economic variable shouldn’t you target whatever is most sticky?

It a world of perfect information, it doesn’t matter what you do to the money supply, all prices instantly adjust and output is unchanged. Since information is not perfect, some prices do not adjust, this created pockets of inefficiency, and unemployment.

So, target the variable that is most seriously failing to adjust in a timely manner.

4. February 2015 at 11:00

Prof. Sumner,

Do you agree with this new Nick Rowe post?

http://worthwhile.typepad.com/worthwhile_canadian_initi/2015/02/what-is-the-right-sort-of-risky-asset-for-central-banks-to-own.html

Specifically, is it especially bad that central banks buy government bonds? Aside from lottery tickets, what would be the ideal asset to purchase? A weighted average basket of foreign currencies, perhaps?

4. February 2015 at 11:31

If you’re looking at new targets regardless of how difficult they might be to get implemented, I’m surprised you’re not proposing Aggregate Labor Compensation Per Capita? It seems like you usually follow up NGDPLT with a caveat that you’d prefer NGDPLT per capita.

Which implies an answer to the question you asked: It would fail if major population shifts occurred (say emigration in the EU, or Japan’s current falling population growth.)

4. February 2015 at 12:18

If the capital and labor shares of aggregate income remain constant, then targeting aggregate wage compensation is the same thing as targeting aggregate income, which is the same as NGDP conceptually.

Good.

What about disequilibrium. Excess supply of money, spending on output rises, prices of output rises, profits rise, and only once this leads to an increase in hours worked does aggregate labor compensation rise and the monetary disequilibrium impacts something the monetary authority cares about.

Do the high output prices and profits cause any mischief?

Same thing in reverse. Excess demand for money, spending on output falls, sales and maybe output falls. But only when employers start telling workers to stay home or cutting shifts, does aggregate labor conmpensation fall.

Let’s say the capital-labor share shifts. More capital income relative to labor income. This would result in higher prices and higher nominal GDP. All of the shift will be in higher nominal capital income. Real wages are reduced, as is needed to maintain full employment despite the shift in shares.

Let’s say capital income falls relative to labor income. This leads to deflation and lower nominal GDP. Nominal Capital income falls. All of the change occurs in nominal capital income. Real wages rise as is needed to maintain full employment.

4. February 2015 at 13:29

LK, That’s a very good point.

Ray, No, it’s not true that Miles Kimball doesn’t believe in sticky wages or prices, just the opposite.

And no, I am not claiming that NGDPLT is procyclical, just the opposite.

You said:

“Second, you correctly intuit that NGDPLT will be extremely volatile”

No, I never said any such thing.

A monkey at a typewriter . . .

Collin, You said:

“Even as short term Keynes, targeting L comp seems WAY too hard and unemployment is a heck of a lot easier to implement.”

I don’t know what this means.

Doug, I agree.

Travis, I don’t see why the Fed should worry if the value of their T-bonds fluctuates. A loss to them is a gain to the Treasury. And if they ever got into trouble they’d be bailed out.

Cy, Good point, but in this post I just wanted to focus on one issue. And it’s not clear which population figure is best—total or working age?

Bill, Then why did labor income fall more sharply than capital income between mid 2008 and mid-2009?

4. February 2015 at 13:51

I read a blog post recently, showing that, in a two-product economy, one product price being sticky, the other flexible, it was not optimal to steer monetary policy in function of the sticky price product only. I feel that the same applies to NLC vs NGDP targeting. Unfortunately, I do not remember who had written that post.

Beside, I think the Lucas critique is defendable in case of NLC targeting.

4. February 2015 at 13:55

BTW Scott, you should write something about the monetary situation in Greece today, Grexit, and monetary policy in Greece after Grexit. I think there are plenty of interesting things to tell. Ever seen a tighter monetary situation in your lifetime?

4. February 2015 at 15:11

Sumner and Ray, you are talking past each other.

The quote Ray posted is from a larger debate that can be read here:

http://blog.supplysideliberal.com/post/53902444407/sticky-prices-vs-sticky-wages-a-debate-between

An excerpt from Kimball’s arguments:

“I have no problem with wage rigidity when there is an actual union setting wages in the picture. But if the firm is a unilateral wage setter, and has a lot of influence over pace of work as well as wages, how can there be effective wage stickiness?

In other words, I don’t think it needs to be spelled out what is really going on inside the firm/worker relationship before we too readily agree that there are sticky wages. Unfortunately, most of the models there are either too rudimentary or too complex and focused on other issues to be of the help we would want in figuring out how effectively rigid wages are. I am just raising the skeptical point that if there is an allocative inefficiency from having the wrong amount of labor input, wouldn’t firms and workers together figure out some way around that? They have a long-term relationship in a way that few customer-supplier relationships can match.

A more simple prediction is that wages should look stickier the more conflict there is in the firm/worker relationship. Where firms and workers get along famously, there should be very little allocative inefficiency and therefore no allocative wage stickiness. Where firms and workers are at loggerheads, there could be a lot of effective wage stickiness.

One other point: one way in which nominal wage rigidity fails is that firms make workers contribute more for medical insurance. If you can cut benefits across the board in that way, and then have raises for some, you have loosened the downward nominal rigidity.

Finally, don’t forget my point that the observation that technology improvements are contractionary can only work if there is substantial price stickiness. You can’t get that from wage stickiness alone. So that means price stickiness is a major factor in the economy””though there might also be wage stickiness.

My bottom line has been that if for tractability you have to choose between only price stickiness in a model and only wage stickiness, you are closer to reality with price stickiness. But if you can manage both and can deal with the micro issues of long-term labor relationships and variable effort, then it could be reasonable to have some wage stickiness too.”

It seems to me that Kimball is saying that in a free market, wage stickiness would be all but absent. He remains skeptical of it even in our real world hampered market.

I think both of you are saying something that is not exactly what Kimball believes, but Ray is less inaccurate on this one.

4. February 2015 at 15:31

@ Doug M:

“So, target the variable that is most seriously failing to adjust in a timely manner.” But (a) it must be a systemically important variable, and (b) you need to know not just that it is sticky, but what its value *ought to be*. You can assume that NGDP and NLC are systemically important and that they should be growing at the trend rate, but that will not be true for many other variables. Suppose, for example, that the stickiest price turned out to be *the wage rate for manicurists*.

4. February 2015 at 16:36

I think that an NLC is a good surrogate for the prices of non-traded goods which is what a PL target ought to be targeting. The advantage over IT is that in practice central banks cannot seem to commit to being “irresponsible” enough to actually manage an IT which requires overshooting after undershooting.

4. February 2015 at 16:41

Radical ideologue extremist Utopian thought:

Maybe…just maybe…socialism, in all of its forms, causes long term impoverishment (or permanent economic depression).

Maybe the human race has gone through a less severe depression for the last 300 years or so, but is still in depression because of socialism remaining in protection and security, which of course is an ozymoron, and because of a shift to socialist money worldwide.

Maybe the fears that an absence of socialism in protection and security will “allow warlords to take over and kidnap your children and turn them into slaves” are of the same fears that an absence of socialism in the production of goods and services as in the former USSR will “allow capitalists to take over and kidnap your children and turn them into slaves”

Maybe our strengths, hopes, and drives allow us to adapt to the permanent economic depression and view it as pretty much the best we could do, and that the unnecessary pain experienced by millions of people around the world are viewed as “that’s just life”.

Maybe it is foolish to advocate for what one believes is second best “given that conditions are fundamentally unalterable”, just as it would be foolish to advocate today something close to what was “second best” 2000 years ago under a despotic Roman Emperor named Diocletian.

Maybe the whole notion of promoting second best is indistinguishable from a positive advocacy to promote X and stamp out Y by force.

Maybe Sumner does not want to be known as the NGDP guy, so as to avoid having his name tarred and feathered in the annals of anachronistic kooky socialist money ideologies, we are now seeing more than just passing mentions of the relative superiority of nominal wage targeting. Excuse me, sorry, I mean maybe it is OK to flip from one kooky idea to another all the while tiptoeing and purposefully ignoring free market solutions along with honest critiques of it. You know, pragmatism.

Rorty said, the truth is what you can get away with. Get away from who or what? Shhhh…we shall not name those who are needed in Rorty’s philosophy for it to even have a modicum of non-laughability: those who reject Rorty’s philosophy and set the intellectual standard for his followers to attempt to decieve and outmaneuver in the name of “getting away with it”. So that…what again? So that the Rortyists can achieve the grand goal of being regarded as prestigious in the eyes of those they deceived and outmaneuvered. Bwahaha, it’s a friggin gong show.

4. February 2015 at 16:59

“not exactly what Kimball believes”

I find it interesting Kimball approaches it predominately as a conflict/relationship issue and neglects to analyze it from the perspective in which it should be analyzed, which is an issue of time. Wages are are generally reset on an annual basis. Therefore over time you are creating a stairstep function and not a smooth continuous function. Smooth = non-sticky, ratchet-stairstep = sticky. Why and how sticky is another issue, but simply as a function of how wages change, it would seem foolish to say they are floating and smooth.

4. February 2015 at 17:20

Derives:

It is not a coincidence that inflation is calculated, reported, and adapted around on an annual basis.

4. February 2015 at 19:52

@MF, Derivs: nice reading of Kimball, indeed he is saying sticky wages/prices don’t exist much, and don’t matter much. After all, it is the dream of every product monopolist or price maker to have sticky prices, but it’s rarely achieved in practice. Derivs point about stair-step vs smooth is also good: sure, there might be some sticky wages after a demand shock like Sept. 2008, but now, eight years later? Hardly. The wages have adjusted, even if wages are only set once a year.

PS-reading Calomiris book “Fragile by Design” and it’s excellent, full of statistics that argue the US bank sector is corrupt (politically biased), and arguably should be regulated like a utility and even more so, akin to Canada. That’s what happens IMO when you have FDIC insurance (moral hazard and guaranteed profit, historically, encourages rent seeking and excessive risk taking (hence regulation; which would not be necessary with a pure gold standard and no bank insurance). Sample quote: “The 19 countries that had two banking crises are also far from a random draw. The list includes Chad, the Central African Republic, Cameroon, Kenya, Nigeria, the Philippines, Thailand, Turkey, Bolivia, Ecuador, Brazil, Mexico, Colombia, Costa Rica, Chile, Uruguay, Spain, Sweden, and … the United States. “

4. February 2015 at 20:38

I convinced myself a long time ago that labor’s share of income is an ideal target. It is still be vulnerable to volatility in real output, but who cares? If half the world’s oil suddenly disappeared, and the price of oil shoots up, why not collectively tighten our belts and adapt to our means?

I had assumed this blog focused on NGDP simply because its an easier target to communicate.

4. February 2015 at 22:05

I know! Why can’t the Fed target NGDP, and then maybe the White House can make it a law that employers must hire X workers and pay them Y dollars per hour?

Wages and employment would be nice and “stable”, because stability is not to be questioned or treated as anything other than morally ideal because something something instability is bad something something.

The Fed can hire every unemployed person to build pyramids and statues of eminent economists whose brilliant plans are the blueprint to utopia.

4. February 2015 at 23:26

@MF – “maybe the White House can make it a law that employers must hire X workers and pay them Y dollars per hour? ” – they did this already, it’s called ‘minimum wage’! And, due to Baumol’s Cost Disease, not to mention fiat money issuance by government at a constant rate, it’s caused people to aspire to be no more than hamburger flippers rather than Nobel Prize winning scientists. Sumner’s NGDPLT is another step in this direction. Seriously…

http://en.wikipedia.org/wiki/Baumol%27s_cost_disease

5. February 2015 at 03:05

“It is not a coincidence that inflation is calculated, reported, and adapted around on an annual basis.”

Mjr.Freedum,

You are making an error in construct between measurement frequency and actual occurrence. I assume, knowingly and self-servingly.

5. February 2015 at 04:31

Derive:

I understand the difference, which is why I specifically used measurement predicates and not occurrence predicates.

“What has been inflation the last 10 years? What’s that? 2% per year? I hope my wage rate has increased 2% per year. Do I get 2% yearly raises?”

5. February 2015 at 05:08

Major Freedom:

I think your laconic, terse commentary results in some shortcuts in your thinking.

Flesh it out a little more. The pixels are basically free, no need to save on pen, ink and paper.

5. February 2015 at 05:22

“I understand the difference, which is why I specifically used measurement predicates and not occurrence predicates.”

Yes, I know. This is the problem.

You are suggesting that because a^2 + b^2 = c^2 the fact path a+b is not identical to the path of c is irrelevant.

5. February 2015 at 06:03

I didn’t bring up depreciation, Scott. You did.

You write: As a percent of NGDP “15% is depreciation” and “depreciation is extremely inertial, and hence of little interest in business cycle analysis.”

GDP is a real measure and NGDP is a current monetary equivalent thereof. Depreciation is not a real thing. It is not a source of funds or a use of funds. There is no part of GDP spent on ‘depreciation’ The part spent on such activities is capital expenditures, and they are the current period offset to some theoretical amount of depreciation.

You cannot calculate depreciation without having a stock of assets to depreciate. This stock includes physical assets, and in a service economy, amortization related to intellectual capital and the health of the population. To the best of my knowledge we have no estimates of either of these. If you adjusted DD&A to account for these, RGP growth might be half or less of the posted numbers.

In any event, while DD&A might be relatively stable, its current period counterpart, capital expenditures, is not. And of course, capital expenditures are critical in understanding the business cycle.

5. February 2015 at 06:21

“indeed we need to audit the Fed Govt, and audit the Fed. I support Rand Paul on this last issue.”

I agree, but that’s the least of it, Ray.

How do we measure the physical health of the country? If I believe Scott’s thesis, this is a critical issue, with demographics slowly turning against us. This is not an easy task, nor is it without significant arguable or subjective components. Creating a reliable measure would take a decade or more.

Then consider depletion. Have US oil resources risen or been depleted in the last decade? Not easy to answer.

And consider the environment. Improving the environment is the reverse of depletion. How do we measure it? Is carbon dioxide deteriorating the environment or not? If so, by how much? This will be highly political, to be sure.

And what about the stock of human capital? Do we measure it by degrees earned? Years of experience? Percent of college graduates to population? Literacy? Again, this is not an easy task and not without political and ideological overtones.

None of this is easy, and even a reasonable balance sheet would take a decade or more and thousands of man-years to develop. The methodology would likely remain in flux for a generation. Nevertheless, this is no reason not to undertake the process.

Economics, a generation ago, seemed to be about big things, a willingness to undertake major projects to improve the condition of mankind. It seems so small-ball by comparison today. Who is willing to put in a decade of hard work to advance our understanding of the formation and decay of human capital, to create metrics and reporting systems, and to champion these through the thickets of the political process? I don’t see the vision, the imagination, the dedication, or the faith in the importance of numbers today.

5. February 2015 at 06:32

Numawan: “I read a blog post recently, showing that, in a two-product economy, one product price being sticky, the other flexible, it was not optimal to steer monetary policy in function of the sticky price product only”

You might be talking about this one.

http://www.thebigquestions.com/2012/06/21/thursday-solution/

5. February 2015 at 07:27

Economists today seem to be wholly taken up in the nominal economy, in the accounting, in the financial numbers — so much so that the real economy and the real standard of living seem not be considered.

We’re so wealthy we assume we don’t have to make hard choices, and so careless about who is running the printing presses that we let the bankers write trillions to themselves in the financial crisis to cover their gambling losses.

5. February 2015 at 07:56

Why target unemployment versus comp L? One for all the holes in unemployment measurements, it is a general statistic to show the strength of the labor market. We measured it for years, we know the holes, it does also measure the work choices as well. Comp L is new, tough to measure, and if the L comp decreases we don’t know if that is the health of the labor market or people changing their work decisions.

Overall, you are right the labor participate has permanently dropped during The Great Recession. We identifying reasons for this but people today view work differently than 30 or 50 years ago. (ie families don’t value a part time retail work for teenagers as much as when I was a teenage in the 1980s.) There are other choices in the labor market being made with older workers retiring earlier and the increase of part time work.

5. February 2015 at 08:33

Numawan, I did something on Greece a week ago (Econlog?) Maybe I’ll do another.

Joel, You said:

“I had assumed this blog focused on NGDP simply because its an easier target to communicate.”

I proposed a wage target back in 1995. But yes, the ease of communicating an NGDP target is one factor that led me in that direction.

Steven, I don’t follow your point. What does depreciation have to do with NLC?

5. February 2015 at 08:35

Collin, Unemployment is a real variable, and the Fed can’t target real variables.

5. February 2015 at 11:48

http://research.stlouisfed.org/fred2/series/CPROFIT

That looks like a pretty sharp decrease to me. Are you measuring after the recovery in profit?

There was a 30% drop in corporate profit when the crash occurred.

Labor compensation only fell 3%.

Interest income?

http://research.stlouisfed.org/fred2/series/B069RC1

By the way, we aren’t targeting aggregate labor compensation.

I think there is a story about the snail paced recovery where profits have recovered to record levels, while employment has lagged and wage growth has slowed only so very gradually.

What does that tell us about whether labor hours are especially sensitive to monetary disequilibrium?

By the way, I think aggregate labor compensation (maybe per capita) is likely better than nominal GDP.

I know getting rid of indirect business taxes would be a plus.

But I am just thinking through possible problems.

6. February 2015 at 08:51

Bill, Labor comp fell 3.8% between mid-2008 and mid-2009, which is more than NGDP fell. It’s also more than investment income, although I don’t know about corporate profits. Corporate profits are very volatile, quarter to quarter. There might be a lot of write-offs in one particular quarter.

You said:

“By the way, I think aggregate labor compensation (maybe per capita) is likely better than nominal GDP.”

i agree.