Low interest rates are deflationary (holding the base constant)

I was teaching the money multiplier the other day, and showing how lower interest rates tend to reduce the multiplier, and hence M1. A student asked for clarification—they’d been told that lower interest rates were expansionary. I knew how I was going to answer the question, but I sort of wondered how other (less heterodox) money and banking professors would respond to the question. (Let me know in the comments.) In any case here’s my answer. First let’s see why low rates are contractionary:

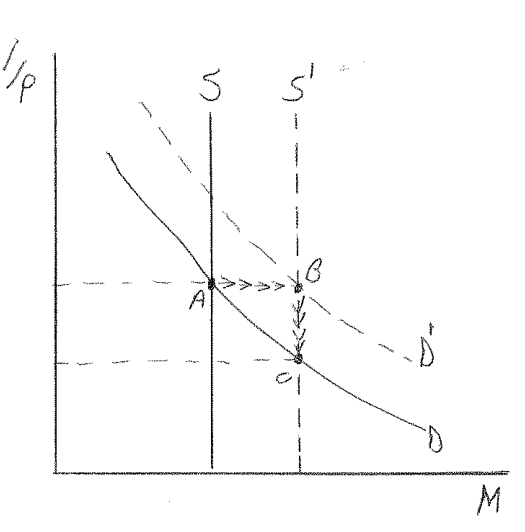

A fall in interest rates will increase the demand for base money (here I assume no IOR, or at least a fixed IOR.) As money demand increases the value (or purchasing power) of a dollar bill increases. Here I use the standard 1/price level as the value of money, although I actually prefer 1/NGDP.

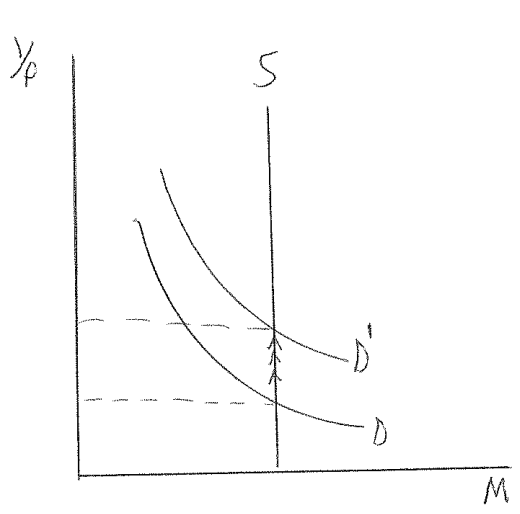

So that’s the answer. But of course that’s not a sufficient answer for a student; you also need to explain to students why they had the false belief that low interest rates are expansionary. So I draw another graph, this time showing the case where lower interest rates are caused by a fall rise in the monetary base.

In this case the supply curve moves first. In the very short run we assume prices are sticky, so the interest rate must fall to equilibrate Ms and Md. In the long run expectations of higher future NGDP cause an increase in current AD. When all wages and prices have fully adjusted to the increased money supply, interest rates return to their original level, and the demand for money shifts back. The value of money falls to point C, which means prices have risen. So the myth that low interest rates are expansionary comes from the fact that in some cases low interest rates are caused by an increase in the base. In that case the base is the expansionary impulse, and the accompanying fall in interest rates actually delays the inflationary impact of the higher money supply (point b).

What would be an example of the first case? That’s easy. Between August 2007 and May 2008 there was no change in the monetary base, and yet interest rates fell sharply. Not surprisingly NGDP growth slowed and we tipped into recession.

Nick Rowe has a new post that argues the money supply is fully exogenous, even when the central bank is targeting interest rates. I’m not sure I fully understand the post, but I’ll attempt to translate his argument into Ms/Md graphs, and then see if he corrects me.

Most students are used to a Ms/Md graph with interest rates on the vertical axis, not 1/P. Suppose there was an increase in the demand for credit, Md shifted to the right on the interest rate graph, and the Fed had to raise the quantity of money (“money supply”) enough to keep interest rates from rising. That’s what most people think of as “endogenous money.” Here’s Nick:

P and Y will (eventually) adjust until the quantity of money demanded equals the quantity of money created by the supply (function) for money and the demand for loans. The supply (function) of money, and the demand for loans, together determine the quantity of money created, and that quantity created (eventually) determines the quantity of money demanded.

I believe Nick is saying that if the central bank increases the quantity of money to accommodate the loan demand (and hence keep interest rates from rising) that will boost AD, which will raise P and Y. If you use my graph above, he seems to be saying that just because Md shifts right on an interest rate graph, doesn’t mean it shifts right on a Ms/Md graph with 1/P (or 1/NGDP) on the vertical axis. Instead on that graph only the Ms line shifts right, causing you to slide down to the right on the stable Md curve (point C on my graph.) That’s what he means by more quantity of money demanded.

In other words, interest rate targeting creates a money supply function that causes quantity of money changes that are exogenous on a “1/P” graph, and hence the normal monetarist assumptions about money still hold. I think that’s a good way to think about the whole “endogenous money” issue (which has spawned more nonsense than almost another other topic in economics.)

PS. I’m never too sure what the MMTers are trying to say, but in comments to my blog they seem to claim that if for some weird reason the Fed were to do an exogenous increase in M, interest rates would fall, we’d go to point b, and just stay there.

Tags:

20. March 2014 at 19:15

I believe that’s what I get in this model as well:

http://informationtransfereconomics.blogspot.com/2014/03/the-effects-that-move-interest-rates.html

A drop in interest rates can’t be in equilibrium at the current level of base money, so the price level must fall. I realize my diagram, at the bottom of the linked post and also here:

http://twitter.com/infotranecon/status/446430331936071680

basically has your 1/P vs M graph, but as P vs M.

20. March 2014 at 19:48

“I believe Nick is saying that if the central bank increases the quantity of money to accommodate the loan demand (and hence keep interest rates from rising) that will boost AD,”

I really wish when we make statements like this, we’d ALSO say something like

“Yes, by accommodating the loan demand, we are allowing some players in the economy to have a musical chair that they wouldn’t be able to afford, and they and their old way of doing business will get to live on, which is a bad thing, but we want people to have jobs”

IF we said it this way, it would REMIND everyone how important is to fix the structural BS like Minimum Wage.

We are WILLING to do this to keep everyone working, but this is not the optimal way to run the economy.

20. March 2014 at 20:13

All fall in interest rates “does” absolutely nothing to demand for money holding.

A fall in interest rates is constituted by, among other things, a reduction in the difference between money costs of production and money spent on output of production.

Now it is certainly possible for money expenditures on output of production to fall in the short run. Combined with the fact that money costs of production will then fall with a time lag, due to the fact that costs are a reflection of past money spending on factors and is thus temporally more slow to change relative to current spending conditions. This is what drives profitability down, and hence interest rates down.

The causation is the other way. Interest rates don’t cause demand for money holding changes. Interest rates are an effect of a three part decision making process:

1. Money spent on output of production;

2. Money invested in factors of production; and

3. Money held as cash.

This three part decision making process is what determines the difference between money invested and money spent, and thus profits, and thus interest rates. It is not the case that interest rates “cause” a particular demand for money holding, or vice versa.

MM theory on the other hand assumes, like the Keynesians, and most contrivedly, that an individual first decides how much to consume or not, calling this “not-consumption” saving, and then decides how much to invest and how much to “leak” into hoards.

As Dennis Robertson put it with the Keynesians, MM theory is incapable of “visualizing more than two margins at once.”

20. March 2014 at 22:12

Mr. Sumner: “So the myth that low interest rates are expansionary comes from the fact that in some cases low interest rates are caused by an increase in the base”.

So, in some cases low interest rates are associated with increases in the monetary base, and in other cases with decreases in the base. Not very illuminating.

It seems that I have a simple mind. First, I get lost in narratives based on graphs, temporarilly sticky prices, then a change to equilibrium prices. There are just too many variables, interrelations, and possibly unmentioned factors for me to understand and reapply the story to a new situation.

And, again lost when market interest rates are described as causing something else. I understand market interest rates as arising from an interplay between the value of using real resources now rather than later, and the ability of money to aquire those resources. Restated, market interest rates arise from other factors, a discovered result rather than an independent cause, with feedback effects.

For example, caviar is expensive. I could say that high caviar prices decrease the amount sold, and also that high prices prompt more catching of fish to supply more caviar and thus to sell more later. We get that sometimes higher prices increase sales, with possible price declines later. And, sometimes higher prices decrease sales to match an involuntary decrease in supply. I can’t say from first principles just what higher prices will lead to, outside of a peaceful, hard to change equillibrium which hardly exists.

I don’t understand how to apply your interest rates vs contraction story regarding Federal Reserve actions. It seems that they can lower interest rates on T-Bills by buying them. That is an expansionary action which results in lower interest rates. So, even reversing cause and effect, how can I say that lower interest rates cause contraction, when in this case they “cause” (are associated with) monetary expansion?

An explanation is only as good as its ability to predict. I see only after-the-fact “explanation”.

20. March 2014 at 22:37

Sorry to ask a dumb question, but in your second graph you talk about a fall in interest rates caused by a fall in the monetary base. But your graph shows S moving to S’ outwards and everything else seems to imply an increase in the monetary base. Is that a typo?

Sorry, a confused fan …

20. March 2014 at 23:40

Scott says “A fall in interest rates will increase the demand for base money…”. Yes, but how are interest rate cuts implemented? By the Fed printing money and buying government debt. I.e. the increased supply of base money precedes any increased demand (and by several months or getting on to a year from some of the evidence I’ve seen).

This isn’t my area of expertise, but what have I missed?

21. March 2014 at 00:05

SSumner

Is your theory towards economics changing over time? Are you open to the possibility of being wrong about any aspect of your economic theories?

21. March 2014 at 03:59

Scott Sumner wrote:

“What would be an example of the first case? That’s easy. Between August 2007 and May 2008 there was no change in the monetary base, and yet interest rates fell sharply. Not surprisingly NGDP growth slowed and we tipped into recession.”

Is that really an example of the first case? I am probably misunderstanding something, but calling 2007-2008 an example of contractionary low rates seems very “concrete steppes”-ish. Doesn’t the expected future path of policy play a role in whether current policy is expansionary or contractionary? Or are you already accounting for that in your model?

21. March 2014 at 04:31

Andrew, Prediction? My model predicts that when interest rates fall during a period where the base is stable, then the economy will usually slow.

UKGB, Not dumb at all. Thanks–I fixed it.

Ralph, You missed the whole point. I was describing a fall in rates not caused by an easy money policy.

Danny. I’m not sure what “theory toward economics” means. Do you mean my economic theories? In any case, yes, I am open to being wrong about everything, not just in economics.

Michael, Expected future policy should play a role in the determination of interest rates. If expected future policy in 2007-08 had been more expansionary, then rates would have fallen by a smaller amount, or not at all. So it is accounted for.

21. March 2014 at 06:15

Sounds like the student meant the price of credit/loan/financial liability, while this explanation is based on the price of debit/deposit/financial asset.

The (hidden) assumptions of no output gap and a closed economy etc. are also needed.

21. March 2014 at 06:21

As your student, I would ask where one on the graph is located. This would establish the scale.

This would allow me to check the demand curve with three points: p is infinite, M is infinite, and p = M.

The shape of the curve looks correct.

Now is “p” the interest rate or is “p” relative prices of products. I think you intend that the curve is unchanged either way.

If p is interest rates, the demand for money is infinite at zero interest rate. If p is prices-of-products, the demand for money is infinite at zero price-of-product. Because this second possibility is ridiculous, p must not be prices-of-products.

This student is a little confused.

21. March 2014 at 07:32

Scott,

I’d really like to understand you better. So I’m going to pester you with questions.

I do not understand this paragraph.

“A fall in interest rates will increase the demand for base money (here I assume no IOR, or at least a fixed IOR.) As money demand increases the value (or purchasing power) of a dollar bill increases. Here I use the standard 1/price level as the value of money, although I actually prefer 1/NGDP.”

1. What do you mean by “a fall in interest rates?” Which rates? What caused the fall? Does this matter?

2. How does increased demand for base money manifest itself? Is this people borrowing from banks? Is it people selling stuff to the Fed in exchange for base money?

3. Why would the supply of base money be fixed in this example? If the lower interest rates are in response to Fed policy, why would the Fed refuse to meet the additional demand for base money? Wouldn’t this undermine its own policy? Or does your example assume that rates are somehow falling in contradiction to Fed policy?

4. If demand for money rises and supply stays fixed, how are rates falling?

21. March 2014 at 07:54

So in your model it is the fixed supply that is causing deflation. It would cause a subsequent rise in interest rates. Not the low interest rates.

21. March 2014 at 08:02

Since there are some students professing to be confused by Scott’s explanation, I’ll again recommend David Friedman’s explanation here;

http://www.daviddfriedman.com/Academic/Price_Theory/PThy_1st_Edn_Ch22/PThy_1st_Edn_Chap_22.html

The key to understanding ‘the price of money’, is to realize that it is NOT an interest rate. That price is whatever goods and services you give up to get money. For most people, the price of money is their labor.

Interest rates are the price of borrowing money, and that price often moves in the opposite direction of the price of buying money, for the reasons Scott is showing in his graphs.

21. March 2014 at 08:09

Scott:

Off topic, but I only manage to read your stuff periodically so I’m tossing in this question here:

What do you think the effect would be if the Fed, tomorrow, announced a 3% inflation target?

What if they said they would maintain that target until labor share of income (measured by wages or total compensation, whatever) showed two quarters of “strong” growth? (Some designated percentage, perhaps.)

If you’ve answered or addressed this elsewhere, links much appreciated. Thx.

21. March 2014 at 08:54

Scott,

Off Topic.

Simon Wren-Lewis is determined to blame the UK’s negative AS shock on fiscal consolidation:

http://mainlymacro.blogspot.com/2014/03/see-no-evil.html

“There are two possible verdicts that history will bestow. The first, and more optimistic, is that the OBR is wrong. There will be a long and vigorous recovery such that over the next decade the economy does recover the ground it has lost. The question economic historians will then ask is why the recession lasted so long, and George Osborne’s austerity will be up there as a major explanation. He will be remembered as the Chancellor who helped create the longest recession the UK has ever had. The second possibility is that the OBR is right, and this productivity has been lost forever. In that case historians will search in vain for his analysis of the problem, and mark him down as the Chancellor who presided over a disaster and pretended it was not happening.”

I can think of a third verdict, one based on common sense.

Regardless of the future course of the British economy, people will look back on this period and realize that negative aggregate supply (AS) shocks have almost nothing to do with fiscal policy stance.

Here is the productivity (RGDP per hour worked) change in percent according to the Conference Board and the change in cyclically adjusted primary balance (CAPB) as a percent of potential GDP according to the IMF Fiscal Monitor from 2007 to 2013 for 31 OECD members (there are no CAPB estimates for Estonia and Luxembourg):

Country-Prod-CAPB

1.Korea 22.4 (-0.8)

2.Poland 17.8 (-2.3)

3.Ireland 12.2 7.0

4.Spain 11.4 (-3.5)

5.Slovak Republic 10.4 1.3

6.United States 7.3 (-0.9)

7.Portugal 6.0 2.0

8.Australia 5.3 (-3.4)

9.Israel 5.3 (-5.5)

10.Slovenia 5.2 3.4

11.Japan 4.7 (-6.2)

12.Austria 4.2 0.6

13.Iceland 4.2 (-2.2)

14.New Zealand 3.9 (-3.4)

15.Sweden 3.3 (-3.5)

16.Czech Republic 3.2 2.0

17.Canada 2.7 (-3.6)

18.Denmark 2.0 (-2.8)

19.Germany 1.8 0.6

20.Mexico 1.8 (-2.7)

21.Hungary 1.7 2.5

22.France 1.3 0.6

23.Switzerland 0.2 (-0.6)

24.Norway (-0.5) (-1.1)

25.Turkey (-0.7) (-2.2)

26.Belgium (-0.8) (-1.8)

27.Italy (-1.3) 2.7

28.Finland (-1.7) (-2.4)

29.Netherlands (-1.8) 0.9

30.United Kingdom (-3.1) 1.1

31.Greece (-6.5) 9.8

Not only is there no correlation at all between fiscal policy stance and productivity (the adjusted R-squared value is 0.7%), the UK’s increase in CAPB between 2007 and 2013 was only slightly above the OECD average of (-0.5%) of potential GDP.

Evidently when the only economic tool you have is a fiscal stimulus hammer, every single economic problem looks like a nail.

21. March 2014 at 09:10

Mark A. Sadowski,

Barro was being unfair when he said that New Keynesians regarded a macroeconomic model’s implying a role for fiscal policy as a means of assessing that model, but sometimes it’s hard to resist his suggestion.

21. March 2014 at 09:11

Scott, when you quote Nick above:

“P and Y will (eventually) adjust until the quantity of money demanded equals the quantity of money created by the supply (function) for money and the demand for loans. The supply (function) of money, and the demand for loans, together determine the quantity of money created, and that quantity created (eventually) determines the quantity of money demanded.”

Don’t forget the bit about “and the demand for loans.”

That goes back to Nick’s comments in his previous article (and the 2nd page) with “Dustin”: by “demand for loans” he means “the supply curve for loans as determined by BORROWERS!”

I asked him specifically about that, and he responded and made it abundantly clear.

http://worthwhile.typepad.com/worthwhile_canadian_initi/2014/03/the-sense-in-which-the-stock-of-money-is-supply-determined.html?cid=6a00d83451688169e201a73d91fdeb970d#comment-6a00d83451688169e201a73d91fdeb970d

http://worthwhile.typepad.com/worthwhile_canadian_initi/2014/03/the-sense-in-which-the-stock-of-money-is-supply-determined.html?cid=6a00d83451688169e201a3fcd7204c970b#comment-6a00d83451688169e201a3fcd7204c970b

“Tom: “Who determines the demand for loans?” My “model” isn’t specified fully enough to say, other than “the people who want to borrow”.”

There’s more there in that thread with Nick… where he emphasizes several times, that it’s both, together, in conjunction that determine it… I was prompted to ask by another thread I was having with Mark Sadowski:

http://www.themoneyillusion.com/?p=26355#comment-323881

That thread continues on to the end of the post, but contains all the links to Nick’s statements I refer to above.

21. March 2014 at 09:19

… BTW, when you think about it “demand for loans” makes no sense from the borrowers, which is why Nick first stated that the more sensible way “supply of loans from borrowers.” Substitute “bond” for “loans” and “bond issuers” for “borrowers” to see why.

Here’s Nick’s convo w/ Dustin where he examplains that:

“”- First Dustin “”-

Quick clarification – you said: “it is the supply curve of the thing that the bank is buying that interacts with the bank’s supply curve of money”

Is that a typo, or are we really talking about 2 supply curves? I’ve never considered this type of thing.

“”- Now Nick “”-

Dustin: that was not a typo. See my new post, for an example of what I mean. (In that new post, the central bank is buying non-monetary IOUs in exchange for money, which means that people are supplying non-monetary IOUs to the central bank, and their supply of non-monetary IOUs, in normal language, is their demand for loans. So it is the central bank’s supply of money, plus the demand for loans [i.e. supply of loans provided determined by borrowers], that determines the stock of money. If the bank were buying apples, it would be the supply of apples [loans], plus the supply of money, that determine the stock of money.)

I added the bit in [square brackets].

Nick Rowe | March 16, 2014 at 03:48 PM

(links don’t work onto the second page of comments)

21. March 2014 at 09:20

Scott,

Also off topic.

A general comment on the UK productivity situation…

Referring to Figure 3.5 from this IFS study:

http://www.ifs.org.uk/docs/34598THZZ12.pdf

If you bring it up to date (2013Q3) taking the gross value added data from “GDP(O) low level aggregates at constant and current prices” which can be found here:

http://www.ons.gov.uk/ons/about-ons/business-transparency/freedom-of-information/what-can-i-request/published-ad-hoc-data/econ/december-2013/index.html

And hours worked data from “Productivity jobs and hours (whole economy), market sector workers and hours – 2013 Q3″³ which can be found by searching for it here:

http://www.ons.gov.uk/ons/datasets-and-tables/index.html

And taking care to exclude the real estate sector (SIC 2007 Section I) because output of this sector includes the imputed rent of owner-occupiers, which requires no labour input (the IFS did the same) what you’ll find is the following.

Labour productivity fell 5.6% from 2008Q1 to 2013Q3 using ONS data. Of the 15 sectors considered by the IFS, labor productivity has fallen in 12 which accounted for 84.7% of non-real estate gross value added in 2008Q1. The only sectors where productivity increased are: 1) administrative and support service activities, 2) arts, entertainment, recreation and other services, and 3) information and communication.

Within the 12 sectors in which labour productivity declined, labour productivity declined by 7.9%. The decline weighted by the size of the 12 sectors relative to the whole economy in 2008Q1 yields a value of 6.6 points. Doing the same thing for financial and insurance activities, and mining and quarrying, yields a value of 2.2 points and 1.4 points respectively. Thus within the portion of the economy experiencing declining productivity, finance and insurance contributed about a third of the decline by weight, and mining and quarrying about a fifth, with nearly half of the decline caused by the ten other declining sectors.

In short, declining productivity is a very widespread problem in the UK involving 80% of the sectors contributing 85% of output.

21. March 2014 at 09:41

Also, Mark and I have a thread in that same post about the money multiplier in the form that Mark prefers:

(1+c)/(r+c)

http://www.themoneyillusion.com/?p=26355#comment-323668

In which I propose a simply hypothetical of no cash, and reserve requirements at 0%, which reduces the money multiplier to 1/r where r is ONLY (excess reserves)/deposits.

http://www.themoneyillusion.com/?p=26355#comment-323692

Tom:

“another way to say that is that lenders (who buy loans from borrowers) chose r so as to maximize their profits.”

Mark:

“Exactly.”

Tom:

“But isn’t the set of available r for them to chose determined by both the CB and the borrowers (the loan sellers) who control the supply curve for loans?”

Mark:

“Well, it’s kind of a simultaneous system with multiple markets each with a set of supply and demand curves and multiple agents each maximizing their utility.”

Mark finishes up with this, which I find difficult to digest as a stand along statement, in light of what he just wrote:

“But in a very real sense the CB is running the whole show even if they can’t force the other agents to act in a certain way.”

But that may be because it requires a lot more explaining.

21. March 2014 at 09:46

In short, I think Nick’s post and Mark’s comments about “r” are related. As Nick says:

Quantity of money created (by money he means broad money) is a function of two things:

1. The supply (function) of money

2. the demand for loans (and as Nick says, this is determined by borrowers, and is more accurately referred to as “the supply function of loans as determined by borrowers).

Similarly, I’m wondering if it wouldn’t be more accurate to describe “r” not as solely the “lenders’ choice” (as Miskin does in his textbook, according to Mark), but rather as a function of these same two things that Nick has identified.

21. March 2014 at 09:51

Barry Ritholtz just wrote this:

http://www.bloombergview.com/articles/2014-03-21/understanding-why-you-think-qe-didn-t-work

He discusses whether or not QE has helped and concludes “The honest and accurate answer: We just don’t know”

Very disappointing in light of what’s happened in Japan and Europe and the strong market reactions in the U.S…….

21. March 2014 at 09:53

– There’s no such thing as a “Money Multiplier”. It’s credit that gets multiplied. Because money can be lent out over and over again.

– You got it backwards. Interest rates going lower are THE sign the “multiplier” is slowing down. People simply don’t want to lend anymore and that leads to short term rates going lower.

21. March 2014 at 09:56

Scott, also I took your Case 7 from your “HPE Explained,” made explicit a few other conditions (one commercial bank and reserve requirements = 0%), and showed how your answer and Nick’s answer differed.

With some coaching from Nick, I drew the same “rectangular hyperbola” charts that you draw, and show graphically how your answer differs from Nick’s:

http://banking-discussion.blogspot.com/2014/03/toms-epsilon-example.html

Nick took a quick look and said the chart looks “roughly correct.”

21. March 2014 at 09:59

Addition: then people buy T-bills in stead of lending it out to other debtors.

21. March 2014 at 10:01

…and I even made an animation showing Scott’s answer and Nick’s answer diverging:

http://banking-discussion.blogspot.com/p/epsilon-animation.html

😀

21. March 2014 at 10:09

Mark, your name’s in that post too, just so you know:

http://banking-discussion.blogspot.com/2014/03/toms-epsilon-example.html

21. March 2014 at 10:19

Scott you write:

“Nick Rowe has a new post that argues the money supply is fully exogenous, even when the central bank is targeting interest rates.”

But here’s a quote from Nick Rowe that he made in response to a note I made to myself. First here’s Nick:

“Tom: thanks, but that’s not quite right. Under inflation targeting the quantity of money is endogenous in both the short run and the long run. It’s the nominal rate of interest that is exogenous in the very short run (6 weeks or less, for the Bank of Canada anyway), but endogenous in the long run.”

and also this:

“David Glasner is explicitly using “endogenous” in a different sense than normal. I agree with David there, once we take that into account.

I disagree with David Beckworth on this bit: ” These policy changes in target interest rates mean exogenous changes in the monetary base.” (Unless he too is using “endogenous” in a different sense that normal.)

I don’t disagree with anything Scott actually says there, but he maybe implies something about the long run I might disagree with.”

The thread starts at the first comment here:

http://tinyurl.com/p8ooj7h

21. March 2014 at 10:21

Plus Mark Sadowski says this:

“So, in short, there is no such thing as “exogenous money” theory. (Where’s the Wikipedia page?)”

Which sounds reasonable to me.

http://www.themoneyillusion.com/?p=26355#comment-323404

21. March 2014 at 10:38

BTW, if someone wants to explain to me the “different sense” in which Nick thinks Glasner (and perhaps Beckworth) is using “endogenous” I’d love to know!

21. March 2014 at 10:52

“Stocks Slump As Bullard Doubles Down On Yellen’s “Six Month” Freudian Slip”

http://www.zerohedge.com/news/2014-03-21/bullard-doubles-down-yellens-six-month-fedian-slip

21. March 2014 at 10:58

Kat, No, it makes no difference which interest rate you focus on, they tend to be highly correlated.

And it has nothing to do with whether you are a closed economy, or at full employment.

Roger, The Md curve is a hyperbola, and P is the price level. But it also works with 1/NGDP on the vertical axis.

John, 1. The interest rates is any short term market interest rate. It works for any of them, as long as they are free market rates. It doesn’t matter why rates fall, as long as it’s not caused by monetary policy.

2. It manifests itself via a fall in AD.

3. The Fed held the base fixed from August 2007 to May 2008. Ask them why they did so. Stupidity?

4. You are confusing the demand for money as a function of i, with the demand for money as a function of P. Interest rates fall for reasons having nothing to do with monetary policy (the 1/P) graph. At lower interest rates people obviously want to hold more base money, as the opportunity cost has fallen. Nothing controversial at all about that part of my post.

Brett, Depends how you define “cause.” There are lots of possible definitions. My assumption was quite clear, spelled out in the post title. A very plausible definition.

Steve, The effect would be utter chaos, because it would be unexpected. It would have an expansionary impact on NGDP, and to a lesser extent RGDP. I don’t think it’s a good idea, although you could argue it’s better than current policy.

Mark, Great comment.

Tom, How does Nick’s comment relate to this post?

On your other comment, even if 100% of the base is ERs, the central bank can still target nominal aggregates by adjusting the supply of ERs.

Lenders choose r, but obviously the r they choose may be affected by things done in the non-bank sector.

Willy, The multiplier is M/MB. If there is no money multiplier then there is either no M, or no MB.

Tom, I doubt Nick and I differ on the HPE, you probably misunderstood one of us.

21. March 2014 at 11:08

Tim Duy:

http://economistsview.typepad.com/timduy/2014/03/kocherlakotas-dissent.html

“If the most dovish member of the FOMC can tolerate no more than a 25bp upside miss on inflation, what does it say about the other FOMC members? Regardless of whether this is Kocherlakota’s max or the best he thinks he can get, it tells you that 2% is really a ceiling, not a target…….Bottom Line: Kocherlakota’s dissent paints the rest of the FOMC as surprisingly hawkish.”

21. March 2014 at 11:14

Mark Sadowski, you are amazing! I spent half a day trying to update that data and I got about as far as your first paragraph. How did you weight, by hours share or by nominal GVA share of NGDP?

21. March 2014 at 11:38

Britmouse,

Thanks! Actually, if I recall correctly (I did this around New Year’s Eve for an argument I was having with Steve “oil explains everything” Kopits at Econbrowser), I weighted by real GVA share of non-real-estate real GVA.

21. March 2014 at 11:48

@Scott: “The effect would be utter chaos”

IOW, immediate big shifts in (relative) financial-asset prices?

I’m more curious what the one- to four-year effects might be.

21. March 2014 at 12:15

Scott, thanks for your responses.

“Tom, How does Nick’s comment relate to this post?”

Not sure which one you mean… I provided several there. Some were taken directly from Nick’s post you linked to in your post here. In the other he was basically saying this I think: the CB chooses an “exogenous” variable to target: MB, overnight interest rates, inflation rate, etc., and the other variables become endogenous. That seems to be in contradiction to your statement above:

“Nick Rowe has a new post that argues the money supply is fully exogenous, even when the central bank is targeting interest rates. ”

Regarding this:

“Lenders choose r, but obviously the r they choose may be affected by things done in the non-bank sector.”

Great, that’s what I thought. Isn’t that equivalent to saying that lender’s choose how many loans agreements to buy from the loan agreement suppliers (i.e. the borrowers), but their choice is determined in part by the supply curve for loan agreements which is in turn determined (in part) by the borrowers? I.e. r is a function of both lenders and borrowers?

Thanks.

21. March 2014 at 13:17

Scott,

in that post Nick reduces the supply of money to a central bank function only – eliminating commercial banks – and removes the risk factor in lending by making it impossible for borrowers to default. This of course means the money supply is exogenous and the only constraint on lending is the need to control inflation. It’s lovely, but it isn’t what we have. You just can’t write commercial banks and commercial risk out of the equation like that. We don’t have an IMF Chicago Plan revisited banking system (yet).

Regarding your own model here: I would venture to suggest that it is the fixed supply of base money that is deflationary, not low interest rates. It’s effectively a gold standard – or the Euro, if you prefer.

It is only possible to maintain low interest rates if the money supply can flex with demand. If it is fixed, increased demand for money would tend to push the interest rate up.

21. March 2014 at 13:22

Frances, keep in mind this quote in the post which Nick put in bold face:

“The supply (function) of money, and the demand for loans, together determine the quantity of money created, and that quantity created (eventually) determines the quantity of money demanded”

In other words: quantity of (broad sense) money supplied is a function of TWO things:

1. “The supply (function) of money” (determined by the CB in this case)

2. “demand for loans” = supply (function) of loans determined by borrowers.

I specifically asked Nick who determines the “demand for loans” and he said “borrowers.” So is “exogenous” really a good description here?

21. March 2014 at 13:26

Frances, Scott I think is saying something similar when he responds to my comment above about the (1+c)/(r+c) form of the money multiplier when he writes:

“Lenders choose r, but obviously the r they choose may be affected by things done in the non-bank sector.”

21. March 2014 at 13:29

… here’s what it comes down to for me: the commercial banks, like the central bank, can “force” money (including broad sense money like bank deposits, which Scott calls “credit”) into existence, however commercial banks have to do this with an eye towards profits and solvency, whereas the central bank doesn’t. So the “force” word used on commercial banks in this context is a little misleading.

21. March 2014 at 13:44

Tom,

I specifically read the constraints that Nick put upon his model. He eliminated commercial banks, and he eliminated the risk-return profile. Under these PARTICULAR circumstances money is exogenous and borrowers entirely determine the demand for loans. But that is not how the financial system works in reality. Borrowers may want loans, but banks don’t have to lend to them. The risk function DOES matter – it can’t be simply imagined out of existence.

Mind you, if all you have is a central bank, then you have a nationalized banking system with all lending implicitly backed by the state – in which case lending risk is actually sovereign risk and we are in a completely different world.

21. March 2014 at 13:47

sorry, that should be EXPLICITLY backed by the state, not implicitly.

21. March 2014 at 13:56

Frances, yes, I know those are the constraints Nick put upon his simplified model. But like you say, borrowers entirely determine the demand for loans and that “in conjunction” with the CB determined supply curve for money determines the quantity of money determined (M):

M = function_of(borrowers, lenders)

The “lenders” in this case being the CB. But unless we have

M = function_of(lenders)

How can we say that money here is “exogenous?”

It seems to me that ONLY the interest rates, that Nick says are being targeted by the CB, are the ONLY thing that’s exogenous in his example.

21. March 2014 at 14:02

… Nick never claims that he’s demonstrated that the quantity of money supplied (broad sense money) is “exogenous” in his simplified example: Only Scott claimed that.

21. March 2014 at 14:06

Nick says this in his final sentence (bold faced):

“The supply of money determines the quantity demanded, and not vice versa.”

And in this example, I agree with that. However, he certainly didn’t say that the “supply of money” exclusively determines quantity demanded, in fact he points out that it does NOT exclusively determine that in the rest of the post.

He’s making a big distinction between “demand for loans” and “demand for money,”

21. March 2014 at 14:12

… and like I point out above (and Nick points out elsewhere), “borrowers’ demand for loans” is a poor way to put it. That’s like saying “bond issuers’ demand for bonds” when bonds is all they have and they’re looking to trade them for money! It’s much better (IMO) to refer to this concept as “borrower’s supply of loans.”

21. March 2014 at 14:21

Nope. The US monetary base in 2007 was at ~ $900 billion. But total US debt in 2007 was at ~ $ 57 tillion. Money multiplier ? No, debt multiplier.

21. March 2014 at 14:23

Even Nick’s title to this post:

“The sense in which the stock of money is “supply-determined””

means to me:

Supply of money (function), which is lender determined and…

Supply of loans (function), which is borrower determined.

He makes that abundantly clear. Nowhere does he use the word “exogenous” EXCEPT when referring to interest rates:

“exogenously fixed rate of interest”

21. March 2014 at 14:23

In that regard this blog has a very appropriate name: “Money Illusion”.

21. March 2014 at 14:30

Steve, Stocks would probably soar, long term bond prices would plunge.

Tom, On your second point, yes it’s both the supply and demand for loans that determines Q.

Perhaps I misunderstood Nick, but he seemed to be arguing the supply of money is exogenous. In any case, if you substitute “supply-determined” for exogenous nothing in my post would change.

Frances, You missed the point. I am not so much assuming the supply of base money is fixed, I am saying that given the supply of base money, lower rates are deflationary and higher interest rates are inflationary. If the supply of base money rises at 2% per year, then it’s still true that a fall in interest rates will result in slower inflation and NGDP growth than a rise in interest rates. Larry Summers did a whole paper that made the same argument, it’s nothing controversial, but a widely misunderstood concept. The point is that the common view that low interest rates are expansionary ignores the fact that this is only true when the low interest rates are caused by monetary policy (never reason from a price change.)

I understand that Nick made some restrictive assumptions that I didn’t, but I nonetheless think I captured his main argument. He’ll probably tell me if I didn’t.

21. March 2014 at 14:38

Scott,

“Perhaps I misunderstood Nick, but he seemed to be arguing the supply of money is exogenous. In any case, if you substitute “supply-determined” for exogenous nothing in my post would change.”

I’m going to go out on a limb and say you did misunderstand him. He’s VERY explicit that the “fixed rate of interest” is exogenously determined. He doesn’t say anything like that about the quantity of broad money.

And that’s not at all inconsistent with the quantity of broad money being “supply determined.” However, both the lenders (the CB in this example) and the borrowers determine two different supply curves, both of which “together” and “in conjunction” determine the quantity of broad money, and thus the quantity of broad money demanded.

So yes, you could (and should!) replace “exogenous” with “supply-determined,” but be mindful there are two different supply (function) curves he’s talking about… one of which he unfortunately refers to with “normal” language as a “demand for loans.”

21. March 2014 at 14:45

… again, Nick’s quote from the comments of the previous post, referring to this post:

“it is the supply curve of the thing that the bank is buying that interacts with the bank’s supply curve of money” — Nick Rowe

Commentator Dustin is confused: “Is that a typo, or are we really talking about 2 supply curves?”

Nick: “Dustin: that was not a typo. See my new post…”

That next post is the one you link to here.

21. March 2014 at 15:12

Tom, that’s a useful way of thinking about the problem I was trying to point out. The supply of loans is not entirely determined by borrowers: banks have to be willing to buy the loans that borrowers offer. What Nick did was change the way in which loans are priced. He eliminated the risk function which banks use to price loans (if they won’t lend at all the price is infinite, of course…), and replaced it with a fixed (“exogenous”) interest rate. Maybe I’m being dim, but would someone please explain how this is helpful?

21. March 2014 at 15:16

Tom, At this point the best solution would be to see if Nick thinks my simple example correctly illustrated his “supply-determined” argument.

I have no interest in the supply of loans or deposits or microwave ovens, my focus is on monetary economics.

21. March 2014 at 15:18

Frances you bring up some undeniable points about risk, etc. As for what Nick was trying to accomplish…I’m not sure, but I think I learned something after studying it. So educating me was one thing. 😀

21. March 2014 at 15:19

Scott,

“I have no interest in the supply of loans or deposits or microwave ovens, my focus is on monetary economics.”

I never thought you did, which is why I was a little surprised that you cared about this at all! 😀

21. March 2014 at 15:20

… also I already did ask Nick. Waiting for a reply.

21. March 2014 at 15:29

Scott, although if you notice in Nick’s hypothetical the CB has taken over the role of the commercial banks (I told him that all right minded folks like to consider such a scenario on occasion… …if you don’t get my joke, that’s the same hypothetical I pestered you and Sadowski with a week or so back).

So in essence the CB’s deposits (in Nick’s example) are MOA: they are direct liabilities of the CB. But the CB has NOT chosen to “exogenously” determine their quantity: instead it’s decided to target (and thus exogenously determine) a fixed interest rate.

So, in this example, those deposits are “money” in that they are MOA (and in fact, although Sadowski doesn’t like this terminology, you indicated to me than in such circumstances (CB takes over banks) you’re OK saying those deposits are “base money” too). But who cares about that terminology here… the important thing is they’re MOA…. and thus part of “monetary economics” in this case. 😀

21. March 2014 at 15:42

Scott,

Sorry if I misunderstood, but you did say “holding the base constant”.

I’m not convinced, though. A fall in interest rates will increase demand for loans, which would increase demand for bank reserves, but (in these days of electronic settlement) not necessarily physical currency, which is the only “base” money that actually circulates in the economy. So far so good. But the additional loans themselves increase broad money through the multiplier effect. Even if base money has not increased, there is actually more, not less, money in circulation in the economy. So the value of a dollar has NOT increased – it has fallen, at least in the short-term.

I guess I’m objecting to your definition of M. Though I could believe that low interest rates might depress economic activity generally, because the returns on investment would be so poor – which I think is Larry Summers’ argument.

21. March 2014 at 15:50

Frances, what do you think Scott’s definition for M is? Normally in Scott’s usage:

money = MOA = base money = reserves (including currency in bank vaults) + currency in circulation (not bank vaults) = MB (as defined in the Wikipedia “Money Supply” article).

Checkable bank deposits are definitely NOT money (they’re “credit”) even though they may be an MOE.

This is not the same in Nick Rowe’s world. Nick is OK letting a mere MOE (like checkable deposits) be called “money.”

21. March 2014 at 16:06

To Frances, Tom and whomever else is interested,

In my opinion, the following is the reason for Nick’s post.

There was at least one commenter in Nick’s preceding post who made the claim that the stock of money is determined entirely by the demand for money when the central bank targets an interest rate. Nick argued that the stock of money is still generally determined by both the supply of, and demand for, money under such conditions.

In order to demonstrate that targeting an interest rate does not automatically mean that the quantity of money is determined solely by the demand for money, Nick explicitly constructed an example where the central bank targets an interest rate and the stock of money is determined by the supply of money, and not the demand for money.

Anyway, that’s my take.

21. March 2014 at 16:09

Mark, thanks. I didn’t see the comment that you refer to.

21. March 2014 at 16:28

Neither did I. Thanks Mark, that explains quite a bit.

21. March 2014 at 16:38

Tom,

Yes, that’s exactly what I thought Scott’s definition of M was. I think it is too narrow for a modern monetary system in which the majority of money in circulation in the economy is what he calls “credit”. The distinction is entirely artificial. Money is fungible.

21. March 2014 at 16:41

Frances, that may be the case, but it’s not use trying to convince Scott. When in Rome do as the Romans. 😀

21. March 2014 at 16:52

You’re probably right. 🙁

21. March 2014 at 16:57

Scott,

This is very useful.

“The point is that the common view that low interest rates are expansionary ignores the fact that this is only true when the low interest rates are caused by monetary policy (never reason from a price change.)”

I’m tempted to agree with you but I cannot. What if low rates are not caused by “monetary policy” but simply a expansion of lending by private banks competing with each other to make loans? Would this credit expansion be contractionary?

Or do you think it is impossible for lending to expand bank lending outside of an expansionary monetary policy?

On a slightly different note, how do you know people want to hold money instead of spend it now that the opportunity to invest it is less attractive?

Let’s say that as a result of the low rates, people decide to invest less because the rewards are diminished. I guess you’d say that demand for money has increased because the opportunity costs of holding money have have fallen. That’s misleading, however, because the opportunity costs of purchasing consumption goods has also fallen.

So the low rate could produce deflation (people competing for higher balances, raising demand and price for dollars) or inflation (people competing for stuff, raising demand and price for stuff).

21. March 2014 at 17:13

Frances, you need to know Scott defines money = MOA = monetary base.

I believe he would say demand deposits don’t influence the price level.

My guess is that you would define money = MOA = MOE = currency plus demand deposits. Currency and demand deposits influence the price level.

Take a gold standard with a fixed conversion rate to currency. I am pretty sure Scott would say there is a dual MOA now because of the fixed conversion rate.

See:

http://www.themoneyillusion.com/?p=20207

Now replace gold with demand deposits, which are fixed at 1 to 1 convertible to currency. We have a “demand deposit standard” now (dual MOA).

21. March 2014 at 17:14

John Carney, what is the MOA in the USA?

Is the MOA monetary base?

Or, does the MOA = currency plus demand deposits?

21. March 2014 at 17:21

Test

21. March 2014 at 17:22

“I knew how I was going to answer the question, but I sort of wondered how other (less heterodox) money and banking professors would respond to the question. (Let me know in the comments.)”

I save $1,000 in currency. Someone else starts a bank and sells me $1,000 in new bank stock. Assume a 10% reserve requirement and a 10% capital requirement for everything (unrealistic).

The bank creates $10,000 in new demand deposits and buys $10,000 of new loans from some entity that wants to borrow. The bank keeps the $1,000 in currency for the reserve requirement.

Assets: $10,000 in loans plus $1,000 in currency

Liabilities: $10,000 in demand deposits

Equity: $1,000

MOA went up by $10,000 in demand deposits because of fixed 1 to 1 convertibility to currency.

The borrower spends the $10,000 in demand deposits, while $1,000 in currency is “saved” at the bank, Overall, MOA circulating went up by $9,000.

21. March 2014 at 17:33

“Medium of account” was coined by Jürg Niehans in “The Theory of Money” in 1978 (although, as Niehans notes, Wicksell seems to have inferred the concept as early as 1906):

http://www.amazon.com/The-Theory-Money-J%C3%BCrg-Niehans/dp/0801823722

Whereas unit of account refers to the word used to quote prices, make contracts, and keep accounts (e.g. dollar, euro, yen, pound etc.), Jurg Niehans defined “medium of account” as the commodity that defines the unit of account. For example, going from a silver to a gold standard changes the medium of account, with the unit of account remaining the same.

In a purely fiat system, as the US has had since 1971, currency is the medium of account. Moreover, since the central bank can issue currency at will, there is no constraint on the creation of reserve balances. That is why both currency and reserve balances are the medium of account.

Commercial bank deposits however, are not the medium of account. Banks are contractually required to redeem their deposits at par value, but deposits in insolvent or illiquid banks have been known to trade at a discount. This cannot happen to the medium of account, as its price is fixed, and the central bank is by definition the lender of last resort.

21. March 2014 at 17:34

“I believe Nick is saying that if the central bank increases the quantity of money to accommodate the loan demand (and hence keep interest rates from rising) that will boost AD, which will raise P and Y.”

I believe you need to have demand deposits in your model there with the idea that the reserve requirement is not 100%.

“The supply (function) of money, and the demand for loans, together determine the quantity of money created, and that quantity created (eventually) determines the quantity of money demanded.”

I am pretty sure banks will be needed in this model.

21. March 2014 at 17:35

“Commercial bank deposits however, are not the medium of account. Banks are contractually required to redeem their deposits at par value, but deposits in insolvent or illiquid banks have been known to trade at a discount. This cannot happen to the medium of account, as its price is fixed, and the central bank is by definition the lender of last resort.”

What about FDIC insurance?

21. March 2014 at 17:44

http://books.google.com/books?id=XE3Hp2MYyksC&pg=PA254&dq=%22Indirect+redeemability+separates+the+medium+of+exchange+from+the+unit+of+account+and+introduces+the+concept+of+a+medium+of+redemption.%22&hl=en&sa=X&ei=ZeksU43aD82c0gHIzYC4Bg&ved=0CC0Q6AEwAA#v=onepage&q=%22Indirect%20redeemability%20separates%20the%20medium%20of%20exchange%20from%20the%20unit%20of%20account%20and%20introduces%20the%20concept%20of%20a%20medium%20of%20redemption.%22&f=false

“Indirect redeemability separates the medium of exchange from the unit of account and introduces the concept of a medium of redemption. A medium of exchange is an asset that is widely accepted in trade and to settle financial obligations. Currency notes or transferable bank deposits are typical examples. A medium of account is the commodity defining the unit of account. A unit of account is a specific amount of the medium of account. For example, for the gold standard the medium of account is gold, while the unit of account might be one ounce or one pound of gold of specific purity. A unit of account is the unit in which the medium of exchange and other assets are denominated and in which other values and prices are expressed. Along with the medium of exchange and the medium (or media) of account, there is also a separate medium (or media) of redemption. Just because government fiat money (currency and commercial bank deposits with the central bank) currently serves all three of these purposes in most countries, it must not be concluded that it has always been or must always be so”

Warren Coats,

In Search of a Monetary Anchor: Commodity Standards Revisited

Page 254

From:

Frameworks for Monetary Stability: Policy Issues and Country Experiences (IMF, 1994)

Edited by Tomás J. T. Baliño and Carlo Cottarelli

21. March 2014 at 17:49

Mark, do you own a copy of Jürg Niehans’ “The Theory of Money?”

21. March 2014 at 17:52

Tom Brown,

I do not. Somebody needs to buy me a copy.

21. March 2014 at 17:54

Fed Up,

I do know how Scott defines money. And I think he is wrong. It seems utterly illogical to me that physical currency apparently influences the price level but demand deposits do not. So yes, I think demand deposits DO influence the price level, and I would regard MOA as currency + demand deposits (i.e. M1 not M0).

My answer to his question would be the same as yours. Assuming an undamaged banking sector (a big assumption these days!) MOA circulating rises when interest rates fall, due to increased lending. Therefore, low interest rates are expansionary, at least in money supply terms. There may however be other effects of low interest rates that are deflationary. I’ve mentioned poor returns on investment, for starters.

21. March 2014 at 17:56

“Somebody needs to buy me a copy.” Have you tried asking Santa? 😀

JP Koning needs a copy too. Perhaps you two could go in halvsies with your Vincent Cate proceeds. Hell I’d even chip in for that. My Vincent Cate proceeds are still burning a hole in my pocket. Lol.

21. March 2014 at 18:00

BTW, have you seen this?

http://en.wikipedia.org/wiki/Vince_Cate

21. March 2014 at 18:00

“A medium of exchange is an asset that is widely accepted in trade and to settle financial obligations. Currency notes or transferable bank deposits are typical examples.”

Agree. Scott take note of that one.

“A medium of account is the commodity defining the unit of account. A unit of account is a specific amount of the medium of account. For example, for the gold standard the medium of account is gold, while the unit of account might be one ounce or one pound of gold of specific purity.”

Agree. I also agree with Scott above about a dual MOA by fixing.

Now let’s say currency is MOA and MOE. Now fix demand deposits and currency as 1 to 1 convertible. Why aren’t demand deposits MOA and MOE? Think about it this way. Assume a 0% reserve requirement. Everyone turns in their currency for demand deposits. The commercial banks turn in the currency and what I call central bank reserves for treasuries. It is an all demand deposit economy.

“Just because government fiat money (currency and commercial bank deposits with the central bank) currently serves all three of these purposes in most countries, it must not be concluded that it has always been or must always be so”

What are commercial bank deposits with the central bank? Is that the electronic “money” of the central bank?

21. March 2014 at 18:01

Mark,

What Fed Up says. FDIC-insured deposit accounts cannot trade at a discount. They are contingent liabilities of the federal government. It’s quite wrong to exclude them from the definition of the MOA.

21. March 2014 at 18:09

Frances said: “I do know how Scott defines money. And I think he is wrong. It seems utterly illogical to me that physical currency apparently influences the price level but demand deposits do not. So yes, I think demand deposits DO influence the price level, and I would regard MOA as currency + demand deposits (i.e. M1 not M0).

My answer to his question would be the same as yours. Assuming an undamaged banking sector (a big assumption these days!) MOA circulating rises when interest rates fall, due to increased lending.”

I totally agree!

Now assume an undamaged banking sector. The fed lowers the fed funds rate, and other rates go down. What happens to demand deposits if people stop borrowing?

I say most loans are set up to pay back both principal and interest. Paying back principal lowers the number of demand deposits. Assuming MOA = currency plus demand deposits. MOA goes down causing a possible shortage.

21. March 2014 at 18:11

Tom Brown,

Yes, I noticed that Vincent Cates has his own Wikipedia page. It just shows you that irrational fear of hyperinflation is probably positively correlated with being important enought to have a Wikipedia entry. But then I should be careful of biting the hand that might very well end up buying me a copy of “The Theory of Money”. 🙂

21. March 2014 at 18:17

http://www.fdic.gov/deposit/deposits/penny/

The more you know about FDIC insurance, the safer your money.

Since 1934, the FDIC has been protecting the money depositors put in banks. And in all that time, no one has ever lost a penny of insured deposits.

But like any type of insurance, you must understand how it works and stay within the coverage limits in order to be fully protected. There are many facts about FDIC insurance that every depositor should know. We call them the Depositor’s Bill of Rights. They’re listed on the back of this brochure. For more information, visit

“EDIE”

I understand there are limits. I understand someone could be “illiquid” if an insured bank becomes insolvent and it takes some time for their demand deposits to be available.

21. March 2014 at 18:27

Patrick R. Sullivan: Thanks for the link. That helped.

Scott Sumner: Thanks for the clarification. Now I can see that if the money supply approaches infinity, value of what ever I desire to exchange for money also approaches infinity. For example, lots of money for very little work.

21. March 2014 at 18:32

Fed Up and Frances,

FDIC only insures “small” accounts, and, far more importantly, FDIC is a United States government corporation operating as an independent agency. Consequently the FDIC receives no congressional appropriations and is funded entirely by premiums that banks and thrift institutions pay for deposit insurance coverage.

True, since the start of FDIC insurance in 1934, no depositor has ever lost any insured funds as a result of a failure, and, to my knowledge, the FDIC has never had to be directly recapitalized by the U.S. Treasury. But each remains a possibility, and with today’s House of Representatives I could easily see Congress refusing to fund the FDIC if it were needed, just as they have repeatedly played games of chicken over the debt ceiling.

And in the final analysis, being backed by the “full faith and credit” of the U.S. Treasury is still not the equivalent of being backed by the Federal Reserve.

21. March 2014 at 18:43

Mark, what I was most impressed with by Vincent’s Wikipedia page is that it does make one mention of “fiat” or “hyperinflation” which is a good indication that he didn’t write it himself. 😀

21. March 2014 at 18:44

shoot, should be “…does NOT make one mention…”

21. March 2014 at 18:50

Everyone, NOTHING IN THIS POST HINGES ON MY WEIRD DEFINITION OF MONEY.

Tom, You said:

“Scott,

“I have no interest in the supply of loans or deposits or microwave ovens, my focus is on monetary economics.”

I never thought you did, which is why I was a little surprised that you cared about this at all!”

I still think you misunderstand what this post is about. It’s not about loans or deposits, it’s about the base. So you shouldn’t be “surprised” about the post.

Frances, In economics we constantly make “ceteris paribus” claims when looking at causal relationships. For instance, I might say “ceteris paribus an increase in the demand for apples will increase the price of apples.” That does NOT mean I think my claim about the causal effects of a change in the demand for apples has no explanatory power in a world where supply is ALSO changing.

Regarding my definition of money, that is completely irrelevant. The monetary base is clearly a medium of account. If you are going to claim lower interest rates reduce the demand for base money you are going to have to tell a coherent story of how this occurs. Both theory and data strongly support my claim.

Lower interest rates will also tend to reduce the money multiplier, so your claim that the broader aggregates would increase is simply not true. In assuming that lower interest rates would be associated with a larger quantity of loans you were reasoning from a price change.

You said;

“which I think is Larry Summers’ argument.”

Nope, Larry Summers (1986?) paper on the Gibson paradox makes exactly the same argument that I do. I encourage everyone to take a look at it.

You said:

“Yes, that’s exactly what I thought Scott’s definition of M was. I think it is too narrow for a modern monetary system in which the majority of money in circulation in the economy is what he calls “credit”. The distinction is entirely artificial. Money is fungible.”

No, nothing in my argument hinges on the definition of money. If you don’t like my definition, then call the monetary base “ZXQZPPYTQ.” And hold the supply of ZXQZPPYTQ constant when interest rates fall. Same argument applies.

John, Lower interest rates will tend to lower the money multiplier, and hence the broader aggregates. Nominal bank loans will fall. But in the example you cite it’s very possible that real bank loans increase.

We can’t say anything about C and I unless we know why rates changed. But both theory and empirical evidence overwhelming point to the demand for money being downward sloping as a function of the nominal interest rate. I don’t know of any economist who disagrees.

Frances, You said:

“I do know how Scott defines money. And I think he is wrong. It seems utterly illogical to me that physical currency apparently influences the price level but demand deposits do not.”

I never said DDs don’t influence the price level. But if they do influence prices during a period where the base is constant, then it must be though a change in the demand for base money. That’s pretty much a tautology.

21. March 2014 at 19:07

Scott, I was thrown off by you talking about M1 at first, which does include deposits and does not have as a subset the monetary base (because it excludes reserves).

Mostly I was questioning your use of “exogenous” though… not that I’m an expert, just because it seems to conflict with how I understand Nick Rowe uses it.

21. March 2014 at 19:10

http://www.nber.org/papers/w1680.pdf

Gibson’s Paradox and the Gold Standard

Robert B. Barsky and Lawrence H. Summers

February 1990

Abstract:

“This paper provides a new explanation for Gibson’s Paradox — the observation that the price level and the nominal interest rate were positively correlated over long periods of economic history. We explain this phenomenon interms of the fundamental workings of a gold standard. Under a gold standard, the price level is the reciprocal of the real price of gold. Because gold is adurable asset, its relative price is systematically affected by fluctuations inthe real productivity of capital, which also determine real interest rates. Our resolution of the Gibson Paradox seems more satisfactory than previous hypotheses. It explains why the paradox applied to real as well as nominal rates of return, its coincidence with the gold standard period, and the co-movement of interest rates, prices, and the stock of monetary gold during the gold standard period. Empirical evidence using contemporary data on gold prices and real interest rates supports our theory.”

21. March 2014 at 19:33

“A student asked for clarification””they’d been told that lower interest rates were expansionary.”

Ask if the student meant lower interest rates and create more debt (thru the banking system), which is expansionary.

“Regarding my definition of money, that is completely irrelevant. The monetary base is clearly a medium of account.”

No, it is completely relevant. No, it is not clear the monetary base is MOA.

Take a gold standard with a fixed conversion rate to currency. I am pretty sure Scott would say there is a dual MOA now because of the fixed conversion rate.

See:

http://www.themoneyillusion.com/?p=20207

Now replace gold with demand deposits, which are fixed at 1 to 1 convertible to currency. We have a “demand deposit standard” now (dual MOA). Dual MOE also.

“John, Lower interest rates will tend to lower the money multiplier, and hence the broader aggregates. Nominal bank loans will fall.”

That could go either way. Nominal bank loans do not have to fall, but they could. I hope John Carney looks at that one.

“I never said DDs don’t influence the price level. But if they do influence prices during a period where the base is constant, then it must be though a change in the demand for base money. That’s pretty much a tautology.”

Let’s say there is zero demand for monetary base, and monetary base is zero. It is all demand deposits. Now lower interest rates and have more demand deposits created from more bank loans with a 0% reserve requirement. Spend the demand deposits.

Demand for monetary base can stay at 0, and monetary base is zero. It is all demand deposits.

21. March 2014 at 19:35

… also by your reference to the money multiplier, which describes how broad money relates to the base.

Not to say your post isn’t interesting, because it is. But I’m having a hard time lining it up w/ Nick’s:

For example you write:

“I believe Nick is saying that if the central bank increases the quantity of money to accommodate the loan demand (and hence keep interest rates from rising) that will boost AD, which will raise P and Y.”

But Nick writes:

“By cutting the rate of interest, the central bank increases the quantity of loans from the central bank, which creates more money. Eventually P and/or Y will increase and the quantity of money demanded will increase in proportion to the quantity created.”

So you’re talking about “keeping interest rates from rising” and he’s talking about “cutting the rate of interest to increase the quantity of loans.”

Maybe he means “cutting the rate of interest in the short term” by raising the quantity of base money. It’s not totally clear to me. But again, in his example, ALL money is effectively MOA since it’s all a direct liability of the CB.

I still think he means controlling the rate of interest directly, because he mentions twice that’s the “exogenous” variable: the “fixed rate of interest.”

21. March 2014 at 21:11

Scott, you write:

“Instead on that graph only the Ms line shifts right, causing you to slide down to the right on the stable Md curve (point C on my graph.)”

But in Nick’s example with

“Md=L(P,Y)=PY”

He explicitly states

“Cutting the rate of interest would not work. But we know it will work, provided the quantity of loans demanded depends on the rate of interest. By cutting the rate of interest, the central bank increases the quantity of loans from the central bank, which creates more money. Eventually P and/or Y will increase and the quantity of money demanded will increase in proportion to the quantity created.”

So he’s not necessarily talking about a “stable Md curve,” since Y could increase, which shifts you to a different Md curve, not a stable one. Although he allows for the possibility of a stable one if ONLY P increases. I think he’s implying it will probably be some combination of increased P and increased Y that gets you there.

Also it’s supper clear that he’s not keeping interest rates fixed, he’s decreasing them to “create more money.” And again all money in this example is MOA since there’s only one bank: the CB.

That’s my read anyway. So by what Nick is saying you could end up at your point D, but also at your point B or anywhere in between (since that line segment represents different combinations of P and/or Y eventually increasing.

21. March 2014 at 21:16

So has Nick produced a feasible line segment of solutions with Scott Sumner at one extreme (point C: i.e. only P increases, Y stays fixed) and MMT at the other extreme (point B: i.e. only Y increase, P stays fixed)? 😀

21. March 2014 at 22:10

Scott, I drew a diagram of what I think Nick was talking about here (in his example where Md = P*Y):

http://banking-discussion.blogspot.com/2014/03/nick-rowes-example-from-sense-in-which.html

22. March 2014 at 05:09

Thanks Mark,

Fed up, Even if we accept your claim that DDs are “a” medium of account it in no way refutes my claim that the MB is “a” medium of account.

Tom, I think you are wrong about the MMTers. If we used 1/NGDP instead of 1/P, then Nick and I clearly agree we end up at point C. But the MMTers that comment over here imply you end up at point B.

As for the rest, we’ll see what Nick says.

22. March 2014 at 05:58

Mark,

FDIC insured deposits are backed by ‘the full faith and credit of the United States Government’, not the US Treasury. The Fed is an ‘independent agency of the US Government’.

22. March 2014 at 06:10

Scott, I may very well be wrong about the MMTers… I was just trying to match what you said about them with how I interpreted Nick’s plot. I have no idea!

22. March 2014 at 06:14

… In fact if you notice I wisely put at “?” at the end of that MMTer statement, so that was a question, not a statement. Well, I have your answer then anyway. “No.” 😀

22. March 2014 at 06:19

Philipe,

Actually part of my point is that the FDIC is *not* backed by the U.S. Treasury, nor by any other U.S. government entity. Nobody denies that the FDIC, the Treasury and the Federal Reserve are all part of the U.S. government (except for some oddball Austrians).

Treasuries and other government establishments can and do go insolvent or illiquid all of the time. Only an institution whose liabilities are the very medium of account that they are valued in (i.e. a central bank) can do neither.

22. March 2014 at 06:20

BTW, I’d be OK w/ your “exogenous” if (in my diagram above) the “supply of loans” curve plotted against interest rates were fixed: so that interest rates and loan supply were always perfectly correlated: then choosing a stock of money and choosing an interest rate would always be exactly the same thing. But I suspect that in general if you exogenously choose a fixed rate of interest, as Nick specified, then the supply of loans curve will in general bounce around a bit, since it’s determined partly by borrowers, and this will cause the stock of money to fluctuate.

But maybe you’re right: in terms of this example Nick perhaps was implying a perfect correlation. I still don’t think so, but we’ll find out I guess.

22. March 2014 at 06:26

I’m going to disagree a bit with Mark and with Frances/Fed up.

Frances/Fed up: Not all dollars circulate at par. The best example of this is that “Visa dollars” often trade at a discount to Fed dollars (or conversely, Fed dollars trade at a premium to “Visa dollars”).

Mark: Fed currency is the medium-of-account in a lot of places, but often “Visa dollars” are adopted by merchants as their medium-of- account. That’s why stores offer cash discounts. Of course merchants would rather use Fed dollars as the medium-of-account and put a surcharge on credit cards, but laws and tradition conspire against this.

I went over this all here, if you folks are interested.

I think Scott is right when he differentiates between “a” medium of account and “the” medium of account. Merchants have adopted a number of different “media” of account. What sorts and brands they have adopted is an empirical question. The lever that gives the Fed power over the Visa price level (and any other price level that is determined by private dollar-branded media-of-account) is that Fed dollars are the universal medium-of-redemption (after costs incurred for redemption).

So in the everlasting battle of MOA vs MOE, we shouldn’t forget the MOR. Even if the asset you issue is highly illiquid (a bad medium-of-exchange), and merchants do not use it as a medium-of-account, you can still influence the price level as long as all those institutions that issue popular media-of-account use your asset as redemption media.

22. March 2014 at 06:46

Scott,

Ah. I was referring to Summers’ more recent work. I hadn’t read his Gibson’s paradox paper. I have now.

The paper specifically says Gibson’s paradox is a gold standard phenomenon which does not hold in fiat money regimes. See for example p.3:

“The Gibson correlation evaporates in recent decades when a fiat money standard prevailed.”

Given that the whole point of the paper is to solve Gibson’s paradox by reference to the behaviour of the gold price in a classical gold standard, how do Summers’ conclusions apply to our fiat money system? I wouldn’t like to think you regard a fiat money regime as simply a paper version of a gold standard. Even Summers says they are very different.

Regarding definitions: renaming the monetary base as “ZXQZPPYTQ” doesn’t change its definition. A rose by any other name, and all that.

I did not say the monetary base was not a medium of account. I said it was not a SUFFICIENT medium of account.

22. March 2014 at 07:00

Hi JP,

I don’t entirely agree, I’m afraid. Visa dollars are simply another form of bank-created money, since Visa itself does not create credit (see its statement here: http://www.visa.co.uk/about-us/): the credit money associated with Visa transactions is created by the bank that issued the card. Like all other forms of bank-created money, they are exchangeable at par with Fed dollars and are recorded at par on the issuing bank’s balance sheet. However, Visa charges a fee per transaction for use of its payments technology. This can make it appear as if “Visa dollars” trade at a discount to Fed dollars. But they don’t.

The situation with something like Paypal is slightly different. Paypal creates its own credits which can be exchanged for bank-created or Fed dollars at a slight discount to par. Paypal probably regards this as a transaction fee, but I think it is more correct to regard it as an exchange difference between two parallel currencies. Bitcoin is a much more obvious version of the same thing.

The distinction between a transaction fee and an exchange difference between two currencies is a fine one, though.

22. March 2014 at 07:08

Mark,

“Actually part of my point is that the FDIC is *not* backed by the U.S. Treasury, nor by any other U.S. government entity.”

How can that be true if it is explicitly the case that the FDIC is backed by ‘the full faith and credit of the United States Government’?

“(A) Each insured depository institution shall display at each place of business maintained by that institution a sign or signs relating to the insurance of the deposits of the institution, in accordance with regulations to be prescribed by the Corporation…

(B) Each sign required under subparagraph (A) shall include a statement that insured deposits are backed by the full faith and credit of the United States Government”.

http://www.law.cornell.edu/uscode/text/12/1828

http://en.wikipedia.org/wiki/Federal_Deposit_Insurance_Corporation

22. March 2014 at 07:11

JP Koning,

I read your post on Visa as MOA a few days ago and I remain agnostic. I’m curious what your response is to Frances’ point (Cullen Roche made a similar one to Tom.)

And, as you yourself point out, US merchants are no longer prohibited by Visa/Mastercard network rules from passing on surchange fees to consumers, so this situation may not persist in the US.

Actually, what troubled me most about your post was the idea of a purely digital MOA. (Tom Brown will very likely find this amusing.) So I started reading about the monetary policy implications of digital currency:

http://mpra.ub.uni-muenchen.de/37392/1/MPRA_paper_37392.pdf

But until the Federal Reserve issues FedCard (“don’t leave home without it…unless you want to be arrested for vagrancy”):