The musical chairs model, updated

It’s been about 6 months since we’ve looked at the sticky wage model, so let’s see how it’s doing:

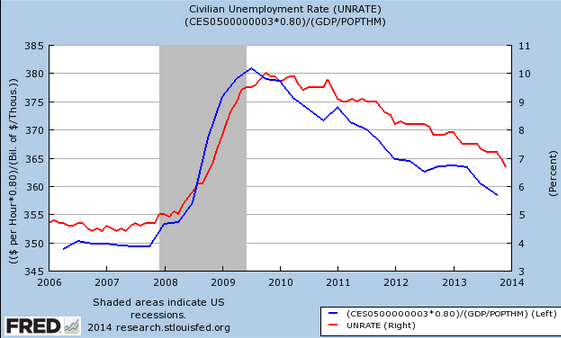

The fit seems better than ever. To my eyes it looks like “real wages” [(nominal average hourly earnings)/(NGDP/pop)] lead unemployment by about a month or two. That’s partly an artifact of a flaw in the St. Louis Fred graphing program. The (W/(GDP/pop)) data for Q4 is put in the October 2013 slot, whereas it should be November 2013. If you shifted the wage series one month to the right the correlation would look even closer.

The fit seems better than ever. To my eyes it looks like “real wages” [(nominal average hourly earnings)/(NGDP/pop)] lead unemployment by about a month or two. That’s partly an artifact of a flaw in the St. Louis Fred graphing program. The (W/(GDP/pop)) data for Q4 is put in the October 2013 slot, whereas it should be November 2013. If you shifted the wage series one month to the right the correlation would look even closer.

The musical chairs model does a great job of explaining both the onset of the recession, its intensity, and the slow pace of recovery. When the blue line gets down to about 350 the recession will be over and the red line (unemployment) will be in the 5% to 5.5% range.

More M*V plus sticky wages = recovery. It’s that simple, and always has been.

PS. Yichuan Wang has an excellent post over at Quartz explaining why it would be foolish for the Fed to try to pop bubbles.

Tags:

4. February 2014 at 18:32

Central bank inflation misleads investors and causes booms, and hence busts with or without further inflation. It’s that simple, and always has been.

Artificially stablizing M*V won’t solve the problem. Markets will become used to it, just like they got used to price level targeting. Capital and labor misallocation would continually get worse as before, and a zero/negative real growth economy would not be unexpected.

There would have to be an inflation greater than what NGDPLT promises, to postpone the corrections to the future. Perhaps NGDPAGDRT, for nominal gross domestic product accelerating growth rate targeting, would then become what NGDPLT is now on this blog.

Central banking is not a long term solution. To continue using central banks to solve the problems they themselves cause, and by that I mean problems caused by inflation, not the “problematic” corrections that occur with insufficient inflation afterwards, will invariably result in a collapse of the currency.

Promising, and following through with, a fixed M*V would require more money inflation as compared to promising and following through with a fixed price level. This is because the deflationary pressures inherent in corrections subsequent to prior inflation are more easily manifested with price level targeting than with M*V targeting. Evidence for this is the MM hysteria over the inadequacy of price level targeting.

MM theory treats corrections as a problem, but that is because it is a short term theory. Economists think in the long term.

4. February 2014 at 18:56

You have probably answered this before, but why measure real wages the way you do. A per hour seems more appropriate such as real compensation per hour.

In addition, why multiply by 0.8?

4. February 2014 at 19:12

Matt, I multiplied by 0.8 because I don’t know how to adjust the scale of the graph.

This is a sort of real compensation, but divided by per capita NGDP rather than prices. It’s because W/NGDP is what matters for business cycles, not W/P.

4. February 2014 at 19:29

Do you know if this pattern shows in the data of other countries and in other business cycles? Eg. Japan, Germany/Eurozone and UK from 1960 to today? Would be cool if it was repeated.

I had a look at the US data from 1950-2013 and it appeared to repeat, but it was less apparent than over 2006-2013 because of the long term decrease in W/NGDP over the period, as the economy became more capital intensive.

4. February 2014 at 21:21

Excellent blogging. The Fed should have been, and still needs to be, more more aggressive in fomenting growth.

Bubbles?

Here is an odd one: Why do right-wingers and inflation-hysterics insist that private-sector investors and capital allocation—usually thought of as a strength of free markets—goes bananas when interest rates are “low”?

Then there is John Cochrane’s sentiment that in a low-interest rate environment, corporate managers will over-allocate funds to plant and equipment.

Thus, free enterprise is an inherently unstable platform easily upended by feeble-minded money managers and buffoon corporate chieftains, in this gloomy vision held by the tight-money cultists.

You want to wreck free markets, capitalism and the USA? Just bring on low interest rates.

I got news for the inflation-obsessed: We may see very low interest rates for 20 years. See Japan.

If free market capital and resource allocation goes bananas when rates are low…we have a worlds of hurt in front of us.

5. February 2014 at 00:53

The recession is over at the end of the grey bar.

The recession is over when Real GDP BEGINS to expand.

the recession is over when unemployment BEGINS to fall.

Does life still suck for a whole lot of people, even though the recession is over? sure.

5. February 2014 at 03:11

Couldn’t the results here be partly the consequence of the composition of the labor force? Who is getting these new jobs? Low earners or high earners? The Employment Cost Index accounts for labor force composition. Does the data underlying this graph (nominal average hourly earnings) do the same?

5. February 2014 at 03:40

Scott,

Thanks for the clarification, but now I have another question.

Your measure essentially shows labor’s share of income rising. But there has been a lot of discussion lately about labor’s share of income decreasing using a BLS measure.

Do you know if the two sets of results are consistent or inconsistent?

5. February 2014 at 06:38

The correlation is great, but how much is driven by corr(dRGDP, U)? The huge jump in the blue line is pretty obviously caused by the drop in real GDP – there wasn’t enough inflation or wage change that quickly to get movement like that.

Can you add a line for 1/RGDP as a placebo? Is your measure a significantly better predictor of dU?

5. February 2014 at 06:57

Matt G, I’d guess there would be some correlation, but less so than in the US. Their labor markets are more prone to non-monetary shocks.

Ben, Good observation.

Doug, Picky picky.

Vivian, This doesn’t account for labor force composition. But I think this approach is best for explaining business cycles.

Matt R, My graph tells us nothing about labor’s share of income, it looks at hourly wages.

5. February 2014 at 07:05

“Vivian, This doesn’t account for labor force composition. But I think this approach is best for explaining business cycles.”

Why? If you adjust for labor force composition, the graph would look much different. My sense is that in the last recession (perhaps in most recessions but particularly the last one) more jobs with relatively low wages got eliminated and in the recovery the opposite occurs. Doesn’t this affect the slope of your curve in both directions such that not everything that’s going on is accounted for by “sticky wages” per se?

5. February 2014 at 07:47

Vivian, I agree that not everything is accounted by sticky wages. But I think the model I have in mind is better described by a measure of wages that does not include composition effects. However I agree that if you did so the graph would look somewhat different.

5. February 2014 at 07:50

Salim, I did a study with Steve Silver on real wages in the 1930s, and we found that autonomous nominal wage shocks were also associated with changes in output. So its not just driven by NGDP.

5. February 2014 at 09:17

REMINDER: Any monetary argument based on sticky wages tacitly agrees that conservative fiscal efforts to unstick wages are CORRECT.

That is all.

5. February 2014 at 09:27

Benjamin Cole:

You wrote:

“Here is an odd one: Why do right-wingers and inflation-hysterics insist that private-sector investors and capital allocation””usually thought of as a strength of free markets””goes bananas when interest rates are “low”?”

There are two main reasons, explained many times before from the sources, but I guess you’d rather be informed via blog posts:

1. The main reason is that there is no reliable way of parsing from prevailing interest rate changes how much is due to market forces, and how much is due to the Fed’s activity. As a result, regular, rational profit seeking activity leads, quite naturally, to re-allocating capital and labor into production lines that are not in line with market forces, both cross sectionally (due to the fact that inflation leads to more income for wealth destroyers and thus less to wealth genwrators.

2. Even if investors believed interest rates have been changed due to monetary policy, profits can still be made by pretending that the interest rate changes are fully market driven. The urge and desire to profit in the short run often takes precedence over long run expectations of interest rate change reversals. The idea here is that if an investor believes he can take part in the boom for the short run, and get out before the music stops, then there is an incentive for even Austrian economists to game the market and make short term profits and get out before other investors decide to get out first.

Actually, there is a third reason, which is tied to the first two. Let’s suppose that investors developed hard hearts, and refused to invest in longer projects despite the Fed holding rates down at near zero. Suppose investors kept hoarding more and more money, all of them not falling for it, like you say they should be able to do. What would happen then? The economy would of course fail to boom, or fail to recover. Prices and spending and employment would not rise thw way the Fed wants. So the Fed would double down and keep inflating more and more until they can convince an initial group of investors to get their feet wet and make some short term profits while every other investor does what you believe they should be able to do, and stay dry. When you have a central bank with unlimited power to create money, it is likely that there will be some investors who will risk going in to make a quick profit. But once that occurs, if you’re a stingy investor brainwashed by the Austrians, then you will lose market share to the short run risk takers. You might even incur losses. So in the real world, the Fed makes it almost impossible for investors to do what you claim they should all be able to do.

Hope that helps!

5. February 2014 at 09:41

Sorry Benjamin, missed a part:

“both cross sectionally (due to the fact that inflation leads to more income for wealth destroyers and thus less to wealth generators), and inter-temporally (which is what interest rates regulate).

The key point is that interest rates mean something. They regulate the flow of investment according to when consumers want to consume.

5. February 2014 at 10:03

MF you said:

Let’s suppose that investors developed hard hearts, and refused to invest in longer projects despite the Fed holding rates down at near zero. Suppose investors kept hoarding more and more money, all of them not falling for it, like you say they should be able to do. What would happen then? The economy would of course fail to boom, or fail to recover. Prices and spending and employment would not rise thw way the Fed wants. So the Fed would double down and keep inflating more and more until they can convince an initial group of investors to get their feet wet and make some short term profits while every other investor does what you believe they should be able to do, and stay dry. When you have a central bank with unlimited power to create money, it is likely that there will be some investors who will risk going in to make a quick profit. But once that occurs, if you’re a stingy investor brainwashed by the Austrians, then you will lose market share to the short run risk takers. You might even incur losses. So in the real world, the Fed makes it almost impossible for investors to do what you claim they should all be able to do.

Yes MF thanks for this. You actually described what monetary policy is supposed to do. When there is a lack of aggregate demand in the economy then the monetary authorities can step in and remedy the situation. I don’t see a problem with that.

Hopefully you have noticed that in the past two years monetary policy in the US has brought the US economy back to life without the nasty side-effects Austrians were predicting. I know I should wait longer for the side-effects; well in the long run money is neutral so it doesn’t really matter I guess. Monetary policy can only hope to make a painful situation less painful and in this way perhaps make the long run less painful as well so in this respect it has been a success it seems and it remains to be seen if you have any point or not.

5. February 2014 at 12:07

Morgan says:

“REMINDER: Any monetary argument based on sticky wages tacitly agrees that conservative fiscal efforts to unstick wages are CORRECT.

That is all.”

What would be the market clearing wage rate for the 600 positions at Walmart that 23,000!!! people applied for?

The conservative plan for America? Work for Bangladeshi wages!

5. February 2014 at 12:24

Tom M:

Better Bangladeshi wages than no wages.

Oh woops, I forgot, just steal from the wealthy like a nice humane benevolent philanthropist.

Or maybe to show you a lesson, the borders should be open to Bangladeshis coming to America with wages free to fall, so that you can see just how many people would gladly take whatever the low wage would clear the Walmart labor market.

I expect your full financial support helping the US workers who are priced out of the Walmart labor market.

5. February 2014 at 12:52

MF,

Your third reason sounds like a “Tragedy of the Commons”-type scenario. I guess it makes sense that if you increase the amount of property titles without increasing actual property, that you will set in motion a scramble to turn those property-less titles into actual real property before you get stuck with worthless pieces of paper.

5. February 2014 at 13:03

Tom M says:

“What would be the market clearing wage rate for the 600 positions at Walmart that 23,000!!! people applied for?

The conservative plan for America? Work for Bangladeshi wages!”

Precisely. If your labor isn’t worth more than an unskilled Bangladeshi, why should you be paid more? Paying more to an unskilled American versus an unskilled Bangladeshi effectively entrenches global poverty.

If you’re more concerned with the American for tribal/welfare reasons then subsidize his earnings, as in Morgan’s GI/CYB plan. To be fair though, under Morgan’s plan Walmart workers wouldn’t be eligible for the subsidy, but workers at competing small retailers would be.

5. February 2014 at 13:21

MF/Geoff,

Please proceed. Have the plutocrats you so willingly shill for announce to the country your plan for open borders/Bangladeshi wages. In fact, the sooner the better. Can you get your policies implemented by the 100th anniversary of the October revolution? Because that would be fantastic timing. As went the Romanovs so will go the Koch’s and their shills.

Of course it doesn’t have to be that way. There is absolutely no reason this country can’t replicate the extraordinary prosperity we had during the post-WWII years. Unfortunately, history has a way of repeating itself and you didn’t do yourselves any favors by making common cause with the NRA. Bangladeshi wages and AR-15’s are not a good combination for you guys.

5. February 2014 at 13:24

conservative fiscal efforts to unstick wages are CORRECT

When’s the last time that sort of thing (aka “internal devaluation”) was successful in practice ? Last time I checked, the answer was NEVER.

You accuse left-wingers of wishful thinking (I do not consider myself a left-winger), but how are you any different ?

5. February 2014 at 13:25

Cthorm,

LOL. So you believe in the fairy tale that wages are set by a “free market”? Please tell me what the going rate for a skilled optometrist would be?

5. February 2014 at 13:31

Tom M

Lemme guess – wages are set by “the plutocrats”, right ?

The stupid is strong in you, young padawan.

5. February 2014 at 13:48

Daniel,

An awful lot of wages are absolutely set by plutocrats. I guess you missed this news story:

http://pando.com/2014/01/23/the-techtopus-how-silicon-valleys-most-celebrated-ceos-conspired-to-drive-down-100000-tech-engineers-wages/

5. February 2014 at 14:53

Scott:

Surely someone else has pointed out to you by now that your definition of real wages begs the question, right? Let’s expand this a bit:

1. (nominal average hourly earnings) = (total nominal earnings) / (total hours worked)

2. (total hours worked) = (hours worked per person) * pop

3. (total nominal earnings) ~= NGDP

4. ergo (nominal average hourly earnings)/(NGDP/pop) = {NGDP / [(hours worked per person) * pop]} / (NGDP / pop)

Which simplifies to 1 / (hours worked per person). Of course that’s correlated with the unemployment rate! It also tells us nothing about money or prices or wages.

5. February 2014 at 16:32

Major Freedom:

Interest rates are only a part of any investment decision. If you want to open up a bar you consider 100s of variables…and even with rates low, could lose your money easily…And remember, in free markets savers sometimes are entitled to losses…btw do you know that Jim Glassman wrote Dow 36000 book in 1999 and corporates were at 7.5 percent?

5. February 2014 at 16:46

I like how conservatives on this blog advocate for people working for less than the cost of a day’s meal. Fun fact conservatards, we tried that already and it lead to labor unions.

5. February 2014 at 17:52

Alex, I think you missed the point. I argue that wages are sticky and hence monetary shocks drive employment fluctuations. Not all economists believe that.

6. February 2014 at 00:19

Scott, I know that. My point is that your graph is meaningless. You are observing a correlation between (1 / hours worked) and the unemployment rate.

6. February 2014 at 04:03

Benjamin Cole:

Interest rates being only one factor does not refute nor challenge the notion of interest rates regulating the temporality of investment.

If a central bank lowers rates, which they can do and have done, then investment temporality is affected.

6. February 2014 at 04:09

Benny:

You are fallaciously holding prices constant when you consider a fall in wage rates. Wage rates are a business cost as well. Falling wage rates puts downward pressure on prices, the same way rising wage rates puts upwd pressure on prices.

And the reason labor union legislation was formed was that existing, politically connected unions did not want to compete in the open market for wages against other, non-unionized workers who were willing to accept a lower wage rate than the unionized workers. By threats of state violence, employers were coerced into “fair bargaining”, which means they are not allowed to deal with non-unionized potential workers.

6. February 2014 at 05:23

So the only reason we have recessions is unions ?

Austro-sadists stupidity knows no bounds.

6. February 2014 at 06:58

Daniel,

That isn’t the argument being made. You are unable to read the English language.

6. February 2014 at 06:59

And once again, sadism is taking pleasure in hurting people. You advocate for the state to hurt innocent people, which means you are a sadist.

6. February 2014 at 07:14

What a laughable account of history by the clueless Austrian brigade. For a somewhat lighthearted account of the real violence taking place before the rise of progressivism watch the following video:

http://www.youtube.com/watch?v=jIfu2A0ezq0&feature=kp

6. February 2014 at 07:23

Tom M.,

The fact you consider songs on YouTube as counter-evidence, tells me who is clueless about history.

The rise of progressivism was an increase in violence, not a decrease. Progressivism calls for the state to point more of its guns at innocent people, steal even more, coerce even more. Eugenics for example was a progressive brainchild. That’s actual history, but I understand that it conflicts with your mickey mouse understanding of pseudo-Marxist ideology.

6. February 2014 at 08:29

MF/Geoff,

You open borders/Bangladeshi wage advocates aren’t too bright are you? YouTube is merely the MEDIUM which is used to show historical illustrations of the way people lived. Not much different then the TV show “Happy Days” chronicled the extraordinary prosperity of the the post WWII period.

Do you have any evidence that violence increased with progressiveness? Or does the mafia type gangsterism rampant in the 20’s not count as violence in your book because it is done by private actors and not the state?

6. February 2014 at 08:34

Here’s an oldie but goodie:

http://ftalphaville.ft.com/2009/06/10/56858/the-need-for-greater-realism-in-monetary-policy/

“Don the libertarian Democrat Jun 10 20:46

I never get irony. Sorry. However, the policy of a Central Bank leaning against the wind should be called “P—ing Against The Wind. In the same way that a Central Bank is a Lender Of Last Resort, it’s a Leaner Of Last Resort. The Central Bank will always lag a bubble because it has to slow the entire economy to act against the bubble. It will not do that until the bubble is about the size of one’s face and about to burst. **** this idea out before someone begins to take it seriously.”

6. February 2014 at 10:12

Alex Godofsky,

Good catch.

Real wages = (nominal wages)/ GDP deflator.

NGDP / pop is per capita GDP.

and per capita GDP has little to do with the deflator.

6. February 2014 at 10:18

Tom M, what do you have against the Bangladeshi that you want to keep them in poverty. Protecting the wages of the employed comes at the expense of those poor Bangladeshi.

6. February 2014 at 16:36

I think it would be fair to say Tom M is a nationalist AND a socialist. Funny combination, that national socialism.

Also, he thinks “Happy Days” is a documentary …

6. February 2014 at 17:50

Tom M.:

“You open borders/Bangladeshi wage advocates aren’t too bright are you?”

Brighter than you apparently.

“YouTube is merely the MEDIUM which is used to show historical illustrations of the way people lived.”

Songs are not evidence. I have evidence. You can look it up yourself. Google “progressive era + eugenics”.

“Not much different then the TV show “Happy Days” chronicled the extraordinary prosperity of the the post WWII period.”

So, so far you have youtube songs, and television shows. Outstanding scholarly work there.

“Do you have any evidence that violence increased with progressiveness?”

Dude, progressivism IS violence. It is a theory that holds governments can use force against innocent people to “progress” their standard of living. What else do you call it when the government orders you to do anything other than not violating the property rights of others, and if you don’t obey, they will throw you into a cage?

“Or does the mafia type gangsterism rampant in the 20″²s not count as violence in your book because it is done by private actors and not the state?”

The government is a mafia writ large.

6. February 2014 at 17:51

Tom M.:

http://www.princeton.edu/~tleonard/papers/retrospectives.pdf

6. February 2014 at 20:29

Alex, I agree that the graph by itself doesn’t prove anything. But I think it nicely shows why NGDP matters so much in a world of sticky wages. Not everyone agrees that wages are sticky. RBC proponents don’t think they are sticky. But if you buy sticky wages, it shows nicely how NGDP is important for the cycle. If you deflated W by P the results would not be impressive, which is one reason I oppose inflation targeting.

6. February 2014 at 22:35

MF/Geoff,

I can’t believe you are seriously denying that books, magazines, plays, television shows, etc. are instructive for providing a glimpse into the societies in which they took place. Deny it all you want but reading Charles Dickens or Geoffrey Chaucer or watching Downton Abbey will give you real insight into the lives of the people living in these eras.

Imagine pitching an idea for a movie like “Wall St.” in the 60’s or “Happy Days” in the Bush/Obama era. You’d be laughed out of the studio executive’s office. Geez, it’s like I’m debating a two year old.

7. February 2014 at 06:15

[…] Scott Sumner writes, […]