Money and output (The musical chairs model)

I’ve recently done a number of posts explaining how monetary policy impacts prices in the long run. The basic approach might be called the “hot potato model.” People have a certain demand for non-interest bearing money. When the Fed increases the supply of base money, people try to get rid of excess cash balances. Individually they can do so, but collectively they cannot. The paradox is resolved by the fact that when people try to get rid of excess cash balances, prices rise until the public wants to hold those extra cash balances.

Unfortunately, in the real world wages and prices are slow to adjust, and as a result the short run is far more complicated than the long one. In the next post I’ll look at the short run impact of money on asset prices. In this post I’ll look at the short run impact on real output. Here it will be useful to switch from a focus on the price level:

P = Ms/(Md/P)

to a focus on nominal GDP:

P*Y = Ms/k

Where k is the fraction of gross income that the public chooses to hold as base money (k=1/V.) We continue to assume no interest on reserves. For any given k, more money means higher NGDP. And a one-time change in M probably doesn’t impact k in the long run.

Because hourly wages are sticky in nominal terms, a drop in NGDP caused by tight money will lead to a fall in output and hours worked:

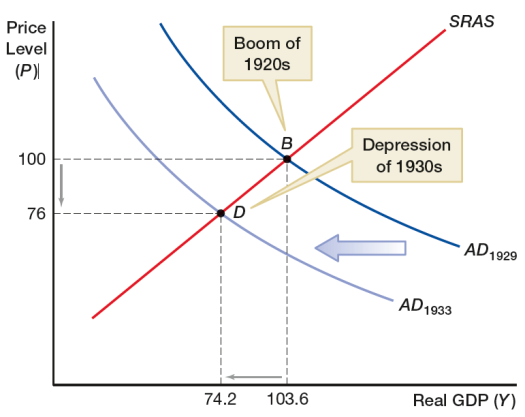

The aggregate demand curve should probably be called “nominal expenditure,” as I like to assume it represents a given NGDP (and hence is shaped like a rectangular hyperbola.)

Tight money leads to lower NGDP, which reduces output and employment. This graph also provides one explanation for why money is non-neutral in the short run; a change in M leads to a change in output, not just prices. In the next post we’ll see that M also affects k (i.e. velocity) in the short run. The P/Y split is determined by the slope of the SRAS curve, which reflects the degree of short run wage/price stickiness.

In the long run wages and prices adjust, and hours worked/output return to the natural rate. Of course like any macro model, it simplifies certain aspects of reality. For instance, during a depression investment may be postponed and workers may lose touch with the labor market, and hence there may be a permanent loss of output. However I’d argue that the permanent effects are relatively small, as we saw in the strong bounce back after the Great Depression.

Another non-neutrality can occur if workers have “money illusion,” which means they confuse nominal and real wage changes. For this reason, the bell-shaped distribution of wage rate changes has a discontinuity at zero percent—workers are irrationally reluctant to accept nominal wage cuts. Thus very low trend rates of NGDP growth, per person, may lead to a higher natural rate of unemployment.

[Each time I make this point a few commenters try to argue that aversion to nominal wage cuts is not irrational, because of factors like nominal debt obligations. Unfortunately this argument doesn’t work unless all of one’s expenditures are repayment of nominal debts, which is obviously not true.]

Putting aside these special factors, most US business cycles are a pretty simple phenomenon. Because of excessively tight money, NGDP growth slows relative to what was expected when labor contracts were signed. Because hourly nominal wage growth is very slow to adjust, a sharp slowdown in NGDP growth raises the ratio of W/NGDP, which leads to fewer hours worked and less output. It may take many years for the labor market to fully adjust. (Note: if NGDP had started growing again at 5% in mid-2009, we’d be mostly out of the recession by now. The recovery was slowed by further unexpected (negative) NGDP growth shocks after 2009.)

Think of recessions in terms of the game of musical chairs. When the music stops several chairs are removed, and a few participants in the game end up sitting on the floor. Slow NGDP growth combined with sticky wages is like taking away a few chairs; several unemployed workers end up “sitting on the floor” (i.e. unemployed), as there is not enough aggregate nominal income to support full employment at the existing nominal hourly wage level.

Other variables such as interest rates also move around over the business cycle, but don’t really play a causal role in unemployment. It’s all about NGDP and hourly wage growth.

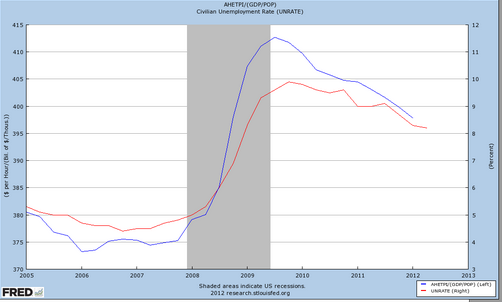

PS. Mark Sadowski sent me this graph showing the correlation between W/[NGDP/(pop)] and the unemployment rate:

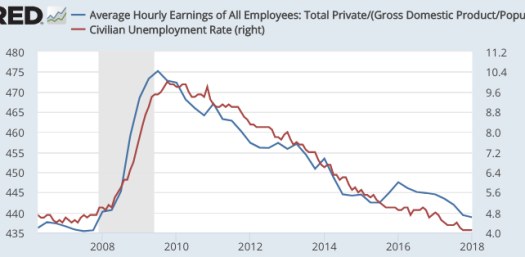

Here is an update for 2018:

The final post in this short intro to money course will focus on money and asset prices. Then I hope to develop an online version of the intro to money course.

Tags:

6. April 2013 at 07:33

Scott, if it were up to you,

which in your important would be better, given two and only two politically feasible choices: price level targeting or ngdp growth RATE targeting?

6. April 2013 at 07:37

So Close!

Except you are worrying about the wrong people. The marginal ZMP workers, that’s a bad thing but we can do a great plan like GI and Job Auction:

http://www.morganwarstler.com/post/44789487956/guaranteed-income-auction-the-unemployed

So those people are taken care of.

What matters most is that musical chairs is GREAT GAME for the people who matter very much, the investors.

When the music stops, they get dragged into the public square, and their assets are sold off for pennies on the dollar, and the fester they are forced through liquidation the better off the entire system is.

The problem we have now is that everyone has come to believe the Fed will not allow the stock market to decline EVER.

It’d be nice if there was more favorable NGDPLT conversation around the positive values of individual investors losing, and less around savers as a group losing.

Also:

you on Kudlow > you in New Yorker

Altho it is nice to see you be the main source, that’s the way it oughta be.

6. April 2013 at 08:22

“When the Fed increases the supply of base money, people try to get rid of excess cash balances. Individually they can do so, but collectively they cannot.”

But if the fed has just added $100 to the monetary base, people can collectively reduce their holdings of checking account dollars, credit card dollars, walmart gift card dollars, etc. It’s also possible that the new $100 only displaces barter transactions. In these cases, even the most rabid quantity theorist would have to agree that there need be no effect on prices.

6. April 2013 at 08:26

Edward, I was just asked that! If targeting-the-forecast, then probably NGDP growth rate targeting is best. If backward-looking targeting is used then PL targeting might work better. But I doubt that would always be true. Right now PL targeting would help in the eurozone but not Britain. So on balance I think NGDP growth rate targeting is the safer bet.

Morgan, Thanks for the comments–glad you liked Kudlow. But I’ll never be able to please you entirely because I believe ALL THE PEOPLE MATTER.

6. April 2013 at 08:50

Mike, Whenever the supply of something rises its value will fall, unless offset by changes in other assets that are perfect substitutes. But there are no perfect substitutes for cash, and most substitutes aren’t even particularly close. That’s why unexpected OMOs have such a big effect on markets–they lead to changes in the value of base money.

It’s true that the public COULD fully offset the effect of an OMP by holding more of their M1 in the form of DDs and less in the form of cash, but why would they WANT TO?

6. April 2013 at 09:25

“I’ve recently done a number of posts explaining how monetary policy impacts prices in the long run. The basic approach might be called the “hot potato model.” People have a certain demand for non-interest bearing money. When the Fed increases the supply of base money, people try to get rid of excess cash balances. Individually they can do so, but collectively they cannot. The paradox is resolved by the fact that when people try to get rid of excess cash balances, prices rise until the public wants to hold those extra cash balances.”

This paradox solution is substituting one mistake for another.

The solution here attributes a “desire” on the part of an abstract concept that doesn’t think or act (e.g. “the public”), which leads to the false conclusion that there can arise a point at which “the public” wants to finally “hold” the additional money. But there was *always* desires to hold all of the money that existed throughout! Before and after the inflation, every dollar was claimed as owned *by someone*, to hold as cash.

The “public” demand for cash balances *is* the sum total of all bank balances, i.e. the money supply. If one person has more cash than they desire, after which they sell it, this requires *someone else* to have an equal and opposite desire, namely, they desire more cash than they currently have. That part Dr. Sumner got right.

But what he missed is that this is the case before, during and after inflation! There is no point at which people will finally “hold” the additional money, as if there was no holding before. That’s a confused way of looking at the issue. There was “holding” of money, all of it, the entire time!

The reason prices rise after inflation of the money supply is not due to any transition between “the public” wanting to “rid itself” of money, and some final equalibrium at which “the public” wants to “hold” money. At all times up to that point, the sum total desires to hold money was exactly equal to the money supply itself. If there was a one time inflation, then yes, prices would rise, but then after that they would start to fall as production outpaces the money growth (zero) during that time, and will continue to fall if inflation is zero.

The reason prices rise after inflation of the money supply is due to individuals attaching a lower marginal utility to dollars relative to goods exchanges against dollars *at the time*. There is not a “public” desire to “get rid of money”. Every dollar “rid” of ownership, is rid of by individuals, and every dollar “acquired” of ownership, is acquired by individuals. “Rid” is not a plausible concept to describe an entire population of individuals, which in reality consists of individuals *not* wanting to rid money, but to acquire more money.

The “public” desire for cash, meaning the sum total of all individual *desires* of money, is actually always greater than the existing supply of money, save for events such as when EVERYONE rejects any and all cash in an extreme hyperinflation. If money didn’t have this property of scarcity, it couldn’t serve as money.

Similarly, the sum total of all individual *desires* of real goods is always greater than the existing supply of goods.

——————

I often see “inflationists” point to various statistics and conclude “the public wants more cash, therefore I’m right that the CB should inflate by $X!” This is a confused way of looking at money. Yes, individuals want more cash. But that doesn’t mean you know how much they want in a context of choosing between more production of real goods, or more money.

The logic of this position would imply the CB should inflate, and inflate, and keep inflating, until *just below* that which would result in a flight into real values (hyperinflation). After all, anything less is not fully satisfying all individual desires for more cash. There would be people wanting more cash, but the CB isn’t making enough cash available.

Would such massive inflation finally give people all the money they could ever want or need? No, it wouldn’t of course, because exchange ratios to goods will rise as well, which means once prices rise, the sum total of individual desires for money would once again become greater than the existing supply.

So there is a trade off. More cash has to be weighed against more goods. Since resources are scarce, how do we know how much to expand both, for this population, for this time frame? How do we know if more money should have been more goods, or more goods should have been more money?

1. Arbitrary CB rules that are almost always going to result in too much or too little money relative to real goods?, or

2. Using the market process to find out how much money people actually want relative to goods, the way we do that for potatoes and computers and virtually everything else, such that close to the right amount of money relative to goods can be had?

Dr. Jekyll and Mr. Hyde have a problem, but I don’t.

6. April 2013 at 09:25

Sorry about the bolding format. I thought I closed it

6. April 2013 at 09:57

@Geoff: Its seems like you also forgot to close your production of words. After the first few paragraphs, your words just kept coming. I assume you also left off a “close typing” tag.

6. April 2013 at 10:08

@Geoff: BTW, as a more serious response: you’re confused, because you’ve made (at least) two mistakes: (1) you think that “individuals want more cash”, but that’s not actually true. Individuals want more wealth, but not necessarily more currency. Sumner’s “hot potato” is all about giving individuals more currency than they want to hold (at current prices).

Secondly, (2) you seem to think that there is a “right” amount of money, which ought to come about through (free) supply and demand. But this flies in the face of our observation of the long-run neutrality of money, namely that the public can be satisfied with essentially any quantity of money. This is all about the short-run effects of transitions from one quantity to another. But it’s not as though the CB has to somehow poorly “guess” about the “right” quantity of money. You seem all concerned about pressures from the CB guessing wrong, compared to how much money there “should” be. But there is no magic quantity of money which is the “correct” absolute amount. Prices and wages will adjust (in the long run) to any specific quantity. So there’s no need to be concerned about what exact quantity you wind up with. We can, instead, focus all our attention on the short-run effects of transitions between different quantities of money, with no concern at all for the total absolute amount of money (since the total amount has no consequences of macro significance).

6. April 2013 at 10:08

Don Geddis:

Still feeling down I see. Chin up bro!

6. April 2013 at 10:31

Geoff,

We are fortunate enough to know what cash balance the public wants a priori.

6. April 2013 at 10:36

Don Geddis:

“(1) you think that “individuals want more cash”, but that’s not actually true. Individuals want more wealth, but not necessarily more currency.”

This is demonstrably false by the simple fact that individuals give up goods and services, to acquire cash.

Yes, individuals want more wealth. Yes, one could argue that individuals want money because they want more wealth. But wanting more money because it is a means to wanting more wealth, doesn’t refute the fact that individuals want more money.

All trades are at the time and at the place. If an individual trades their labor or goods for someone else’s money, that is an example of an individual wanting to hold cash.

At any rate, in your course of trying to refute my argument, you have (inadvertantly) thrown your own theory under the bus. If individuals don’t want more cash, then your calls for central bank inflation are calls for what people don’t want.

“Sumner’s “hot potato” is all about giving individuals more currency than they want to hold (at current prices).”

But individuals who don’t want to hold money, requires other individuals to want to hold the money. You are ignoring the individuals who accept money, and you’re only focusing on the individuals who accept goods. Trades are two way.

If you accept that someone who accepts more goods, wants more goods, then you have to accept that someone who accepts more money, wants more money!

“you seem to think that there is a “right” amount of money, which ought to come about through (free) supply and demand. But this flies in the face of our observation of the long-run neutrality of money, namely that the public can be satisfied with essentially any quantity of money.”

No, by the market process revealing the right quantity of money, that argument is to be understood as referring to today, tomorrow, next year, and any other time.

At any rate, I don’t regard money as neutral, not in the short run and not in the long run. I regard history as a subsequent series of events where events today are influenced by events in the past. We have the current capital we have today, because capitalism started when it did, rather than earlier or later. Every decision people have made in the past, has resulted in a series of outcomes which are then the starting points of which new decisions are constrained to the available alternatives going foward.

Money has short term effects, and a series of short run effects that can be understood as the long run, are contingent upon all the previous short term effects put together.

It is not wrong to argue that even the Trojan War has had a non-zero effect on the course of history forever into the future, and not just by what we can learn via history books, but also by what physical reality looks like right now. For suppose that the Trojan War did not take place, and someone who otherwise would have been killed, developed a new philosophy that subsequent generations read, which then affected their actions, and thus what human civilization consists of, and so on. You or I may very well not exist, or we may exist but with completely different lifestyles because the material world has been made differently by people alive prior to us.

Money cannot possibly be regarded as neutral, for any time “term”, without contradicting both money and historical contingency.

“This is all about the short-run effects of transitions from one quantity to another. But it’s not as though the CB has to somehow poorly “guess” about the “right” quantity of money.”

Do you honestly believe that putting some silly equation on a piece of paper, based on what people have known and chosen in the past, turns that equation into something other than an equation that outputs an incorrect quantity of money that individuals actually want in the present, or in the future?

“You seem all concerned about pressures from the CB guessing wrong, compared to how much money there “should” be. But there is no magic quantity of money which is the “correct” absolute amount.

Then there is no need for CB.

“Prices and wages will adjust (in the long run) to any specific quantity. So there’s no need to be concerned about what exact quantity you wind up with. We can, instead, focus all our attention on the short-run effects of transitions between different quantities of money, with no concern at all for the total absolute amount of money (since the total amount has no consequences of macro significance).”

You’re setting up a false choice. The free market isn’t constrained to the long run only. It is also, and even more so, relevant to the short run.

You’re wrong on both issues. Not only is money not neutral, but a free market in money isn’t only long term constrained. People can produce money in the short run, in response to short run supply and demand changes. You do realize that free market money can exist in part in “inventory”, right?

6. April 2013 at 10:42

Ben J:

“We are fortunate enough to know what cash balance the public wants a priori.”

This is an empirical question, not an a priori one, because it depends on what people’s knowledge and preferences happen to be content wise, not the fact that they have knowledge and preferences form wise.

It is a priori true that only unhampered revealed preferences (free market) can serve as the a posteriori empirical means by which a random individual can know how many goods others want versus how much money others want. We see this information in prices, which of course do not exist for the means of producing fiat money, because the means of producing fiat money are monopolized by the state.

6. April 2013 at 10:57

The graph.

http://research.stlouisfed.org/fredgraph.png?g=hg6

The page for drawing the graph.

http://research.stlouisfed.org/fred2/graph/?g=hg6

6. April 2013 at 11:14

Ron M:

http://research.stlouisfed.org/fredgraph.png?g=hgb

Add 50-60 years to 1945-1950.

6. April 2013 at 11:21

Dear Commenters,

Could someone please help me out and explain how to create hyperlinks and make text bold within this comment section?

Thanks!

6. April 2013 at 11:26

Scott,

“Slow NGDP growth combined with sticky wages is like taking away a few chairs; several unemployed workers end up “sitting on the floor” (i.e. unemployed), as there is not enough aggregate nominal income to support full employment at the existing nominal hourly wage level.”

Two questions: 1) if nominal hourly wages did fall, wouldn’t aggregate nominal income fall too? 2) granted, firms will hire more workers at lower wages provided demand remains constant; but why would demand remain [roughly] constant?

6. April 2013 at 11:36

Scott do you just not like the part of capitalism where people lose money?

You aren’t a give everybody a trophy guy right?

6. April 2013 at 11:50

Scott – Does Japan’s recent experience with monetary stimulus flattening the Japan yield curve suggest the term structure is also an unreliable indicator of monetary policy? I thought the slope of the curve would move with breakeven inflation spreads there (as it has here). It’s been a good recession barometer here but the Japan experience suggests it may not be at the ZLB.

6. April 2013 at 11:55

TravisV:

To make a hyperlink:

http://www.w3schools.com/tags/att_a_href.asp

To make comments in bold:

http://www.w3schools.com/tags/tag_b.asp

Browse the rest of the site for other tags. Warning: Not all of them work on this blog.

6. April 2013 at 12:56

Ron, Thanks, I’ll update.

Greg, It’s not obvious why a change in wage rates would impact NGDP, which is determined by the central bank. FDR used that theory when he tried raising wages in the 1930s, and it didn’t work.

Morgan, When they hit those big depositors in Cyprus I was almost going to do a post entitled “I love the smell of uninsured depositors taking a hit in the morning.” (Don’t know if you are old enough to remember Apocalypse Now.)

Tommy, Yes, the term structure is very unreliable when rates are near zero.

6. April 2013 at 13:15

There are some equivalent graphs here:

http://thefaintofheart.wordpress.com/2013/01/28/another-take-on-the-game-of-musical-chairs-view-of-business-cycle/

6. April 2013 at 13:44

Scott:

At the margin, there will always be people who regard a checking account dollar as a perfect substitute for a paper dollar. The next group thinks a checking account dollar is 99% as good as paper, the next group 98%, etc. So when the fed pays $100 paper for a $100 bond, maybe 98 checking account dollars will reflux to their issuers, and that $100 OMP only increases M1 by $2.

But we should start by asking why the fed would want to inject that $100 in the first place, and why the public would want to hand over $100 of their bonds for it. If the public’s cash holdings are already overly large, the fed would find that they have to pay $101 in paper for that $100 bond, and the fed would decline to buy. Likewise the public, already flooded with paper dollars, will only hand over their $100 bond if the fed overpays and gives them $101 for it. If the fed only offers $100, then the public will decline the offer and the $100 will not be issued in the first place.

If the public is short of cash, it’s another story. The fed will find the public eager to soak up the new $100. But if that’s the case, the new $100 would be more likely to act on real output of goods, rather than increasing prices.

6. April 2013 at 14:47

“If the public’s cash holdings are already overly large, the fed would find that they have to pay $101 in paper for that $100 bond, and the fed would decline to buy.”

That’s the current situation, substituting ‘reserves’ and ‘banks’ for ‘paper’/’public’, and the Fed is still buying! Some crazy people say the Fed should buy even more.

(The Fed is paying 0.25% on reserves while t-bills yield less).

With seignorage negative, the Fed is able to arbitrarily increase the base money supply without creating a “hot potato effect”. This would be true even without paying interest on reserves, since the IOR is so close to 0%.

6. April 2013 at 15:07

Prof. Sumner,

When you describe “musical chairs” why don’t you tell a simple story like this:

“Wages are sticky. Specifically, employers are extremely reluctant to cut nominal wages.

Imagine that your economy suffers a large demand shock or supply shock. If that happens, then the average real wage has to go down.

In an environment of decelerating spending growth, employers reduce the average real wage by firing lots of people. We get mass unemployment. The productive potential of the economy is reduced.

But in an environment of consistent nominal spending growth, employers don’t fire lots of people. Instead, they raise the wages of most workers while keeping the wages of some workers flat. This way, the average real wage goes down but mass unemployment is avoided.”

David Glasner seems to believe something like this story: http://uneasymoney.com/2011/10/25/crocodile-tears-for-the-working-class

6. April 2013 at 15:35

Scott,

How would you respond to proponents of endogenous money who make the following argument. They would say that your hot potato story applies to a world of only outside money with no commercial banks and fractional reserve banking. But the moment it is introduced, it no longer applies. Since you agree that there is no structural deposit/money multiplier, proponents of endogenous money would argue that the direct link between outside money and people’s money demand is broken and there is no necessary connection between changes in the base and AD. Since banks don’t have to DO anything with the base, the connection is broken.

In other words, according to what economic model of the monetary economy, which accounts for commercial banks, can the CB have control over the Price Level and NGDP if there is no structural deposit/money multiplier. I don’t agree with them based on the empirical evidence, but I have still never quite heard the theory of commercial banks and fractional reserve banking which would still account for exogenous money.

Here are some intelligently written posts against exogenous money. Perhaps, at some point you might respond to them. I always learn a lot from your posts.

http://unlearningeconomics.wordpress.com/2012/09/22/endogenous-versus-exogenous-money-one-more-time/

http://unlearningeconomics.wordpress.com/2012/09/27/exogenous-and-endogenous-money-room-for-reconciliation/

http://socialdemocracy21stcentury.blogspot.com/2010/07/quantity-theory-of-money-critique.html

Best regards!

6. April 2013 at 16:22

Scott,

Here is how I think the short term trigger/transmission mechanism works.

OMP is an exchange of (non-money) financial assets for money.

When the Fed engages in OMP, there is an ultimate counter-party to the trade. (Ignore the primary dealers and other intermediaries).

The ultimate counter-party enters into the exchange voluntary.

Why? Because the counter-party wants to hold more cash? No.

The reason is because the counter-party has been induced to exchange financial assets for real goods and services. To effect this exchange the counter-party needs to sell the financial assets and acquire money to make the purchase of real goods and services. I.e. they need to exchange financial assets for money.

The reason the counter-party has been to induced to effect this exchange of financial assets into real goods and services is twofold and both a result of OMP.

1) OMP has raised the real price of financial assets relative to real goods and services so there is a marginal increase in the exchange of real goods and services (unless you reject the fundamental economic principle of indifference curves).

2) OMP have raised expectations of NGDP which also cause a marginal increase in the exchange of financial assets for real goods and service.

(When I talk about exchanging financial assets, I’m not just talking about selling assets already held, but also increased borrowing against credit lines, equity issuance, increased credit card purchases, taking out a new home loan, etc., etc.)

6. April 2013 at 16:23

@Geoff: I see you’re making up for your lack of content, via volume of words. You should consider putting some effort into attempting to be more concise. It’s not worth engaging someone with your style.

On the other hand: I did see Troy, with Brad Pitt. Wasn’t Achilles supposed to be gay? It confused me when they kept having scenes of him sleeping with girls.

6. April 2013 at 17:29

Scott:

For your next post, I think it would be extremely helpful to address/clarify the following in your stylized story (I know you have discussed these points before, but a clear reiteration might quell some recent arguments in the comments):

1. A definition of “the public” (and/or how money moves from primary dealers to the general public).

2. Why does the public try and get rid of it’s excess cash holdings at the ZLB when bonds and cash are considered to be perfect (or near perfect) substitutes?

3. The possibility that with a negative economic shock, the public may hold cash because it believes there are no other assets with satisfactory risk-adjusted returns

6. April 2013 at 20:22

Scott,

You said;

” When they hit those big depositors in Cyprus I was almost going to do a post entitled “I love the smell of uninsured depositors taking a hit in the morning.” (Don’t know if you are old enough to remember Apocalypse Now.)”

Funny you should mention that. At this very moment I’m sitting on the beach in Danang where Lt. Col. Kilgore spoke those lines.

7. April 2013 at 06:22

Don Geddis: Greek conceptions of sex were more fluid. Also, Achilles was young, healthy, and people were regularly trying to kill him. Tends to lead to randiness and the Greeks were not big on limiting options. That Patroclus and he were a couple was widely assumed (e.g. in Plato) but not definitively stated in the Illiad and would not have been assumed to preclude bonking female captives, for example.

7. April 2013 at 06:53

Thanks Marcus, nice graphs.

Mike, I’m puzzled by several of your points. What does “short of cash” mean?

One definition is monetary disequilibrium produced by sticky prices and a tendency for the overall price level to decline slowly in response to sudden money supply decreases and/or money demand increases. Is that your definition? If so, do you agree that an economy with flexible prices can never be short of cash? If it was, why wouldn’t the price level adjust until the money supply equalled money demand? Normally we think of shortages as being caused by price controls–where are they?

I also don’t understand the “at the margin” comment. At the margin there are a few people who view oranges and tangerines as perfect substitute. But even so, an increase in the supply of oranges changes the value of oranges.

And so what if the Fed had to slightly overpay to buy some T-bonds? (certainly no where near 1%, BTW) They’ll still make huge profits over time from seignorage as long as they pay zero interest on base money and earn positive interest on T-bonds.

TravisV, I agree on supply shocks, but why must real wages go down if there is a big demand shock?

Ilya, I disagree with just about everything in the first link, but it would take forever to explain why. The bottom line is that those people confuse a short run targeting technique (interest rate targeting) with a long run policy (inflation targeting or money supply targeting or NGDP targeting, or the Taylor rule.) It is true that the money supply is endogenous during the period where rates are being targeted (assuming rates are above zero), but that fact has no importance. Nevertheless they think it does, and built a grand theoretical edifice on a simple misconception–that misconception being the view that the central bank doesn’t control the supply of money.

dtoh, It seems to me that you are trying to explain two very different phenomena under a single explanatory umbrella. One phenomenon is the tendency of more money to lead to higher NGDP. The explanation is centered on the money market itself. People have a stable preferred “k” ratio in the long run, so more M means more NGDP. Then an entirely different explanation is needed to explain why more NGDP leads to more RGDP. Your explanation implicitly incorporates sticky prices (I use sticky wages) but you try to get at both issues with that single assumption. You say people will spend more (OK) and thus buy more “stuff”. But why doesn’t the extra spending just lead to higher prices? If you look closely all you’ve really explained with your financial channel is that more M leads to more NGDP. But we already knew that from the hot potato effect! Not saying you are wrong, but . . . well read my newest post then we’ll continue the conversation.

Justin. Anyone not part of the Fed, including the Treasury, is part of the public in my model.

Points 2 and 3 relate to money demand. You are right that other assets are near perfect substitutes when nominal rates are zero, and hence large QE often has little effect on prices. But monetary policy is still very powerful, due to the expectations channel.

I doubt whether the public ever views short term T-bills as being particularly risky, but if your scenario did come to pass it would increase the demand for base money, and hence be deflationary.

dtoh, I envy you.

7. April 2013 at 07:55

Scott:

“Short of cash”, while incoherent on quantity theory principles, has a clear meaning on backing theory principles. For example, if the market interest rate is 5%, while the fed lends at 4%, then people will want to borrow huge amounts from the fed. The fed will normally respond by rationing loans, lending only $1 to people who wanted to borrow $100. That’s a cash shortage, and they can result from many causes. For example, the fed might have issued $100 in paper, backed by 100 oz worth of stuff, and might simply refuse to issue any more (e.g., the Greenback period). A quantity theorist might think that the unsatisfied money demand would act to drive prices up until the money shortage disappeared, but on backing theory principles the dollar can only be worth 1 oz, since that is the value of the assets backing it. At this point, quantity theorists would say that the value of the dollar was ‘sticky’, while a backing theorist would say that the real reason that prices won’t change is that the backing per dollar hasn’t changed.

If growers produced 100 more tangerines, then the price of oranges will fall and other growers might produce 98 fewer oranges. Same with money.

Nowadays, with the fed earning <1% on its bonds, while issuing dollar bills that cost $.02 each to print and last 2 years in circulation, we might have to re-evaluate our views of the fed's profits

The best historical examples of cash shortages come from the American colonial period. In 1685, Quebec had virtually no coins, and was suffering a recession. The intendant started paying the government's bills with IOU's written on playing cards, each promising to be redeemed for 1 silver livre when the next supply ship arrived from France. The recession ended almost immediately. The same thing happened when Massachusetts issued paper shillings in 1690, and by 1710 the story had bee repeated in every colony. See Curtis Nettels, The Money Supply of the American Colonies Before 1720, which I have in a pdf if you're interedted.

7. April 2013 at 08:02

Prof. Sumner,

I wrote:

“Wages are sticky. Specifically, employers are extremely reluctant to cut nominal wages.

Imagine that your economy suffers a large demand shock or supply shock. If that happens, then the average real wage has to go down.”

And you wrote:

“TravisV, I agree on supply shocks, but why must real wages go down if there is a big demand shock?”

If there’s a huge demand shock, real GDP falls. Which means the average real wage has to fall, right?

In such a situation, you’d like to see the price level accelerate, so that employers don’t cut the average real wage by firing lots of people. Right?

7. April 2013 at 08:46

[…] Money and output (the musical chairs […]

7. April 2013 at 14:30

Scott-

“But monetary policy is still very powerful, due to the expectations channel.”

I think this is a point with which many non-monetarists have a problem. It comes down to a game-theoretic issue, in my opinion. If demand for money is so high so that increasing the supply doesn’t have much impact on prices, and everyone knows that everyone else’s demand is high, expectations are then that increasing the money supply won’t be inflationary. The “expectational hot potato effect” (as I understand it) is significantly muted.

I believe your responses to this include:

a) if the Fed buys Treasuries, it is funding government spending, not just the investment portfolios of primary dealers.

b) The Fed could buy other assets, say corporate bonds. Or pay off my credit card bill this month 🙂

“[B]ut if your scenario did come to pass [perception that there aren’t satisfactory risk-adjusted investments] it would increase the demand for base money, and hence be deflationary”

I think this is the argument of current liquidity trap proponents. It appears to hold some weight, as firms are holding quite a bit of cash relative to fixed investment. On the other hand, the S&P 500 is near all-time highs…

7. April 2013 at 15:46

Don Geddis:

“@Geoff: I see you’re making up for your lack of content, via volume of words. You should consider putting some effort into attempting to be more concise. It’s not worth engaging someone with your style.”

Translation: I don’t like it when you easily refute my incorrect claims, so I’ll pretend it didn’t happen.

7. April 2013 at 16:41

Scott,

You said, “If you look closely all you’ve really explained with your financial channel is that more M leads to more NGDP. But we already knew that from the hot potato effect! Not saying you are wrong, but . . . well read my newest post then we’ll continue the conversation”

Yes I agree. I’m saying that more M leads to more NGDP. We are both in complete agreement on that. (In these comments, I’m not saying anything about how more NGDP breaks down into real growth versus an increase in the price level although I do have some thoughts on that subject.)

The distinction I’m making is that the triggering/transmission mechanism by which M leads to more NGDP is not the HPE, but rather through a) higher financial assets prices, and b) changed expectations regarding NGDP growth.

This is an important distinction because I don’t think the HPE reflects real behaviour (Bill Gates doesn’t buy a Ferrari because he has more cash) and because it’s much easier for people to understand and accept. (95% of the arguments against MM are a result of a failure to understand the transmission mechanism).

The HPE suggests that the market is somehow forced to hold the money issued by the FED in OMP and then are somehow forced to spend the money. This is not what’s happening. The ultimate counter-party to OMP is voluntarily entering into an exchange of financial assets for money because they have been induced to do so for the reasons cited above (higher financial asset prices and/or expectations) and the money is required for the purchase of real goods and services. (People hold the amount of money they need for transactions). They don’t voluntarily convert other financial assets into money unless they plan to spend it.

Again, I think this distinction is extremely important. From a modeling perspective it produces identical results as the HPE model, but because it more accurately represents actual market behavior, it also allows you to easily rebut 95% of the arguments that are made against MM.

7. April 2013 at 18:06

dtoh, assume the economy is in equilibrium and the overnight money rate is 5%. Now suppose the central bank issues ‘excess’ 0% base money. This can only be absorbed if the bank rate falls to 0%, but there’s no reason why the equilibrium rate of interest should fall to 0% just because the central bank issued more money. It’s still at 5%. So the only way you reach a new equilibrium with the ‘excess’ base money is if the central bank targets a higher price level. At the higher price level, people are willing to hold more 0% base money when the money rate is at 5%.

What if instead of issuing 0% base money, the central bank issues 5% base money? In that case, a large increase in base money is consistent with stable prices. If people really don’t want the base money, then the overnight interest rate may fall from 5% to, say, 4.9%, and the central bank will start to lose money.

7. April 2013 at 18:35

Max,

Sorry I don’t understand what you mean by “0% base money” or “5% base money.”

7. April 2013 at 20:19

“When the Fed increases the supply of base money, people try to get rid of excess cash balances. Individually they can do so, but collectively they cannot.”

They could simply store the currency (safe, mattress, etc.). They could take the currency to say a JP Morgan bank in exchange for demand deposits. They could pay down debt. They could buy a financial asset and the seller could pay down debt.

7. April 2013 at 20:33

From: http://www.themoneyillusion.com/?p=20489

“Max, I don’t agree, it’s much more costly to hold $2 trillion in cash than $2 trillion in reserves. With negative IOR, market rates on bank deposits would go negative.”

Why much more costly?

“Max, I don’t agree, it’s much more costly to hold $2 trillion in cash than $2 trillion in reserves. With negative IOR, market rates on bank deposits would go negative.

In any case, the purpose of negative IOR is not to create inflation, it’s to reduce the size of the central bank balance sheet.”

$800 billion in currency, $2.2 trillion in central bank reserves, $6.2 trillion in demand deposits. Now make IOR = negative 3%. Let’s assume vault cash gets negative 3% also (I’m not conceding that point, just assuming). Let’s also assume checking accounts, savings accounts, and CD’s all go negative too. What happens?

7. April 2013 at 20:40

“[Each time I make this point a few commenters try to argue that aversion to nominal wage cuts is not irrational, because of factors like nominal debt obligations. Unfortunately this argument doesn’t work unless all of one’s expenditures are repayment of nominal debts, which is obviously not true.]”

I don’t think that is correct. Couldn’t interest and principal payments somewhere between 40% to 60% of monthly wage income start to “impede” monthly budgets?

7. April 2013 at 20:48

” (Note: if NGDP had started growing again at 5% in mid-2009, we’d be mostly out of the recession by now.”

“It’s all about NGDP and hourly wage growth.”

Let’s assume price inflation of +4%, real GDP of +1%, and productivity growth of +1.5%. How will hourly wage growth recover?

7. April 2013 at 20:56

“When the Fed increases the supply of base money, people try to get rid of excess cash balances. Individually they can do so, but collectively they cannot.”

They could simply store the currency (safe, mattress, etc.). They could take the currency to say a JP Morgan bank in exchange for demand deposits. They could pay down debt. They could buy a financial asset and the seller could pay down debt.

So this is why I think Scott needs to refine his model because the HPE does not reflect reality. The Fed does not force anyone to hold cash. It’s not like magically people are holding extra cash as a result of OMP. What happens is that the Fed exchanges cash for financial assets and at the end of the line (not the primary dealers or other intermediaries), there is an ultimate counter-party who voluntarily enters into this exchange of financials securities for cash because they have been induced to exchange the financial assets for real goods and services and the cash is needed to effect this exchange and the incremental expenditure on real goods and services.

The reason the ultimate counter-party has voluntarily entered into this exchange of financial assets for real goods and services is because of either a) an increase in the real price of financial assets relative to real goods and services, and/or b) an increased expectation of higher NGDP.

8. April 2013 at 05:54

Mike, I’m afraid I can’t follow your comments. I am not interested in production of oranges and tangerines, I want to know if producing more tangerines causes its price to fall. What do you think?

I also don’t understand your claim that quantity theorists believe a shortage of money would make prices rise. Wouldn’t they claim it would make prices fall?

I agree that seignorage can fall to low levels, perhaps even zero, when interest rates become very low. But I think that’s consistent with what I said, which referred to the case of “normal” interest rates, which produce lots of seignorage for the government.

And I agree that when you have two types of money, plus a fixed exchange rate between the two, you can have a shortage of one type. I recall the coin shortage of 1964.

Travis, No, real wages do not have to fall just because RGDP falls. An alternative would be lower hours worked in aggregate.

Or you could just reduce wages and prices enough to keep real wages constant, and then money should be neutral. I.e. suppose M, AD, P, W and NGDP all fell by 10%, no change in real wages.

Justin, You said;

“The “expectational hot potato effect” (as I understand it) is significantly muted.”

No, as we’ve seen in Japan recently the expectational effects are massively important. BTW, the NK put far more emphasis on the expectations channel than the old monetarists. So it’s not simply a “monetarist” idea, indeed it’s more new Keynesian.

I have many other posts showing that the liquidity trap argument fails on all sorts of grounds. There’s not a shred of empirical evidence in support of the idea. No fiat money central bank ever tried to inflate and failed. And no, I don’t think the central bank should buy unconventional assets, there’s no need to.

dtoh, You said;

“This is an important distinction because I don’t think the HPE reflects real behaviour (Bill Gates doesn’t buy a Ferrari because he has more cash)”

I agree, more cash raises NGDP, not real GDP. If RGDP rises it’s due to sticky wages, not more cash.

You said;

“The HPE suggests that the market is somehow forced to hold the money issued by the FED in OMP and then are somehow forced to spend the money.”

No, the HPE says people are forced to hold the money, then prices and NGDP adjust until they WANT to hold the money.

You said;

“The ultimate counter-party to OMP is voluntarily entering into an exchange of financial assets for money because they have been induced to do so for the reasons cited above (higher financial asset prices and/or expectations) and the money is required for the purchase of real goods and services.”

I’d say the money is required for nominal transactions, and nominal hoarding to evade taxes, not the purchase of real goods.

Fed Up, I think you missed the point. The question is not what can people do, it’s what do they want to do.

8. April 2013 at 06:56

I agree, more cash raises NGDP, not real GDP. If RGDP rises it’s due to sticky wages, not more cash.

I disagree here. I think its that higher NGDP absorbs more cash…. not the other way around.

No, the HPE says people are forced to hold the money, then prices and NGDP adjust until they WANT to hold the money.

How are the forced to hold it? No one has to exchange securities for cash with the Fed. It’s not like the Fed liquidates your bond portfolia at Fidelity and delivers cash to your doorstep. Nor will financial intermediaries enter into a trade with the Fed unless they believe there is an ultimate counter-party who will voluntarily take the other side of the trade.

People take the trade because increased prices of financial assets and expectations of higher NGDP have made them want to spend more on real goods and services and they need the cash to do so.

I’d say the money is required for nominal transactions, and nominal hoarding to evade taxes, not the purchase of real goods.

I don’t know what you mean by nominal transactions. Why would OMP cause someone who has heretofore been holding Treasuries to change their tax evading behaviour and now exchange those Treasuries for cash. That doesn’t make sense.

8. April 2013 at 07:28

dtoh, “Sorry I don’t understand what you mean by “0% base money” or “5% base money.””

The interest on reserves, or on currency, whichever is higher.

8. April 2013 at 08:57

Scott:

Yes, producing more tangerines will make the price of tangerines fall. If there is a close substitute (oranges) then tangerine prices will fall by less. As to money: checking account dollars are a close substitute for paper dollars, so when quantity theorists talk about a 10% increase in paper dollars causing the value of the dollar to fall 10%, they forget that the 10% rise in paper dollars can cause 9% of checking account dollars to reflux to their issuers, so that even on quantity theory principles, the value of the dollar only falls by 1%, not 10%.

Nothing like a typo to mess things up. I meant to say that the QT implies that a shortage of money will make the value of money rise.

9. April 2013 at 10:10

“Fed Up, I think you missed the point. The question is not what can people do, it’s what do they want to do.”

A bond is a savings vehicle. If the fed buys a bond from a bank and the bank buys a bond from say Apple or Warren Buffett, Apple or Warren Buffett may still want to save. They can buy the same or a different financial asset (savings vehicle), save in the medium of exchange (MOE and I consider MOA), or save in some thing MOE/MOA like. Buying the bond does not mean they will quit saving. Both may not want to consume or invest (NIPA definition).

9. April 2013 at 10:17

“Tight money leads to lower NGDP, which reduces output and employment. This graph also provides one explanation for why money is non-neutral in the short run; a change in M leads to a change in output, not just prices. In the next post we’ll see that M also affects k (i.e. velocity) in the short run. The P/Y split is determined by the slope of the SRAS curve, which reflects the degree of short run wage/price stickiness.

In the long run wages and prices adjust, and hours worked/output return to the natural rate.”

It sounds like you are saying MOE/MOA is neutral in the long run. If so, I disagree.

9. April 2013 at 10:21

dtoh said: “there is an ultimate counter-party who voluntarily enters into this exchange of financials securities for cash because they have been induced to exchange the financial assets for real goods and services and the cash is needed to effect this exchange and the incremental expenditure on real goods and services.”

The counter party could be selling for MOE/MOA because they have a gain or believe the financial asset has gotten overvalued. Just because the counter party sold does not mean it wants to quit saving. It does not have to buy real goods/services with the MOE/MOA from selling the financial asset.

9. April 2013 at 14:07

I said: “”Max, I don’t agree, it’s much more costly to hold $2 trillion in cash than $2 trillion in reserves. With negative IOR, market rates on bank deposits would go negative.

In any case, the purpose of negative IOR is not to create inflation, it’s to reduce the size of the central bank balance sheet.”

$800 billion in currency, $2.2 trillion in central bank reserves, $6.2 trillion in demand deposits. Now make IOR = negative 3%. Let’s assume vault cash gets negative 3% also (I’m not conceding that point, just assuming). Let’s also assume checking accounts, savings accounts, and CD’s all go negative too. What happens?”

Looks like I need to answer this myself. There will be a bank run. Currency goes to $7.0 trillion. The central bank balance sheet will expand, not be reduced.

9. April 2013 at 14:14

Mike Sproul said: “Nowadays, with the fed earning <1% on its bonds, while issuing dollar bills that cost $.02 each to print and last 2 years in circulation, we might have to re-evaluate our views of the fed's profits"

Could you tell me where to find this on the internet? Thanks!

ssumner said: "And so what if the Fed had to slightly overpay to buy some T-bonds? (certainly no where near 1%, BTW) They’ll still make huge profits over time from seignorage as long as they pay zero interest on base money and earn positive interest on T-bonds."

What if they have to pay IOR to raise the fed funds rate?

9. April 2013 at 14:49

FedUp, “Looks like I need to answer this myself. There will be a bank run. Currency goes to $7.0 trillion. The central bank balance sheet will expand, not be reduced.”

No, the balance sheet would be the same size, just with $3 trillion currency and $0 reserves.

The mere existence of currency is not inflationary, much less highly inflationary. It’s only inflationary if it would require (much) lower interest rates to balance supply and demand. Not the case if interest rates are fixed at 0%.

And it makes no difference whether people like you and me want to hold more currency. If we don’t, then it will be held by arbitragers.

9. April 2013 at 16:42

“No, the balance sheet would be the same size, just with $3 trillion currency and $0 reserves.”

Why wouldn’t all the demand deposits be exchanged for currency?

9. April 2013 at 18:04

FedUp, IOR=-3% doesn’t mean that bank deposits would yield -3%. Deposit yields would be about the same as now. Even if some banks set a negative deposit yield (or stopped offering deposits), that wouldn’t trigger a total shift into currency.

The important thing isn’t the IOR rate, it’s the Fed Funds rate. There’s no point in a negative IOR because it doesn’t result in a negative FF.

9. April 2013 at 19:17

Max, I agree with JKH here:

http://monetaryrealism.com/loans-create-deposits-in-context/

Use + then type “seen sumner”

Negative 3% IOR AND negative 3% on vault cash will cause the fed funds rate to go negative near 3%. That should make checking accounts, savings accounts, and most, if not all, CD’s to go negative. I think people will redeem their demand deposits if that happens. I would.

9. April 2013 at 19:19

That should be Use Ctrl + F then type “seen sumner”. Something here didn’t like the carats.

9. April 2013 at 19:37

ssumner said: “And so what if the Fed had to slightly overpay to buy some T-bonds? (certainly no where near 1%, BTW) They’ll still make huge profits over time from seignorage as long as they pay zero interest on base money and earn positive interest on T-bonds.”

It looks like the “money” here is about interest rates, specifically the interest rate spread. Welcome to the “hedge fund” model.

9. April 2013 at 19:45

Fed Up:

Here’s a good source of info on costs of issuing money:

http://www.federalreserve.gov/faqs/currency_12771.htm

9. April 2013 at 21:11

“Negative 3% IOR AND negative 3% on vault cash will cause the fed funds rate to go negative near 3%. That should make checking accounts, savings accounts, and most, if not all, CD’s to go negative. I think people will redeem their demand deposits if that happens. I would.”

As soon as the reserves are drained, the Fed Funds rate goes back to 0%. Note that this doesn’t even require the quantity of deposits to decrease, or for ordinary people to take any action. The currency could be withdrawn exclusively from newly created deposits (created by loans).

9. April 2013 at 21:11

Mike Sproul, thanks!

Got any links for what the fed is earning on the bonds it owns?

9. April 2013 at 21:29

“As soon as the reserves are drained, the Fed Funds rate goes back to 0%.”

I’ll have to check with the accouting people, but at first glance I’m going to say the fed funds rate would stay at negative 3%. The fed has a monopoly over the fed funds rate.

9. April 2013 at 21:30

Make that accounting people.

9. April 2013 at 21:48

The Fed Funds rate can’t stay at -3% if the Fed is offering a risk-free 0% return (currency). Simple arbitrage.

If the Fed stopped converting reserves into currency, then it could set the Fed Funds rate at any level since a 0% return investment would not exist.

10. April 2013 at 20:02

I haven’t gotten this far with this exercise, but I’ll try. $800 billion in currency outside of the banking system, $2.2 trillion in central bank reserves, $6.2 trillion in demand deposits. Assume negative 3% on both central bank reserves and vault cash and a 0% reserve requirement. The fed funds rate goes to near negative 3% and checking accounts, savings accounts, and CD’s go negative too. People cash in their demand deposits for currency.

DETOUR for Max’s case. I assume you mean there will be $3.0 trillion of currency, $0 in central bank reserves, and $4.0 trillion in demand deposits. Next, the fed funds rate goes to near zero (I’m not conceding this point but assuming it). It is now above the fed’s target. It will purchase treasuries with central bank reserves to create excess reserves. The fed funds rate should start falling back to near negative 3%. Let’s assume $500 billion in treasuries were purchased. $500 billion more of demand deposits are converted to currency. Repeat until there is $7.0 trillion in currency, $0 in central bank reserves, and $0 in demand deposits. Now the fed purchases just enough treasuries to create excess reserves. They get a negative 3%. The bank converts it to vault cash. The vault cash gets a negative 3%. There is nowhere for the vault cash to go (there are $0 in demand deposits). Fed funds rate starts falling. The fed repurchases at around negative 3%.

10. April 2013 at 20:48

“DETOUR for Max’s case. I assume you mean there will be $3.0 trillion of currency, $0 in central bank reserves, and $4.0 trillion in demand deposits.”

No, I don’t think the quantity of deposits would decrease.

I said this already, but converting reserves into currency doesn’t require that existing depositors take any action.

It only requires that someone see a profit opportunity in borrowing at -3% and investing risk-free at 0%. The currency is withdrawn from NEW deposits, not existing ones.

11. April 2013 at 19:52

Max, I was assuming no new borrowing. If there is no new borrowing, does my example hold?

Next, doesn’t borrowing involve a markup over the fed funds. rate? If so, let’s assume it is 3%. Now borrow at 0%. Currency is 0%. No spread.

It seems to me the fed can keep the fed funds rate at negative 3%. Will there be consequences to that? Probably. Will there be consequences the fed does not want? Probably.

11. April 2013 at 19:56

EDIT: “funds.” TO: “funds”

EDIT: “It seems to me the fed can keep the fed funds rate at negative 3%.” TO: “It seems to me the fed can keep the fed funds rate at negative 3% if the negative 3% can be applied to vault cash, a big if.”

12. April 2013 at 06:22

“Max, I was assuming no new borrowing. If there is no new borrowing, does my example hold?”

Yes, but why assume that?

“Next, doesn’t borrowing involve a markup over the fed funds. rate? If so, let’s assume it is 3%. Now borrow at 0%. Currency is 0%. No spread.”

The loan markup depends on risk. Investing in currency is riskless. So one way or another, the markup will be close to zero. Maybe special purpose firms will be formed that do nothing but own currency. It would be a simple matter for lawyers.

13. April 2013 at 13:33

$800 billion in currency outside of the banking system, $2.2 trillion in central bank reserves, $6.2 trillion in demand deposits. Assume negative 3% on both central bank reserves and vault cash and a 0% reserve requirement. The fed funds rate goes to near negative 3% and checking accounts, savings accounts, and CD’s go negative too. People cash in their demand deposits for currency.

Now there is $7.0 trillion in currency, $0 trillion in central bank reserves, $0 trillion in demand deposits. Let’s also assume treasuries go negative in yield.

Now add new borrowing from a bank. Assume you can borrow from the bank at negative 1% and want to make “money” from the negative 1% to 0% spread between your loan and currency. Now let’s think about how this would work. You would get a demand deposit(s) that yield negative 3%, and the bank gets a loan that yields negative 1%. You need to exchange your demand deposit for currency. Nobody wants to exchange 0% currency for a demand deposit that yields negative 3%. You go to the bank and want to exchange the demand deposit for currency. The bank has to check with the fed. The fed will probably say no. If the fed says yes, then the fed gets an asset (treasury or your loan) that yields some negative % and has a liability(ies) that yield 0%. The fed has a yield spread problem.

13. April 2013 at 14:27

FedUp, yes, absolutely if the Fed refuses to convert reserves (not deposits – the Fed never converts deposits) into currency, then it can set a negative rate.

Note that once the central bank stops converting reserves into currency, currency ceases to be base money. It’s still money of a sort, usable as a medium of exchange, but it’s not base money. Its market value is higher than its face value – a $1 bill would be worth more than $1.

And yes, the Fed can drive its yield spread negative if it overproduces money. In fact, that’s the current situation – the Fed Funds rate is lower than interest on reserves. (The solution is simple: the Fed should sell some assets). The zero bound isn’t technically a hard limit at 0.0%, if the central bank is permitted and willing to intentionally lose money. It’s a soft limit slightly below 0%.

14. April 2013 at 04:39

FedUp, looking at

http://moneyfactory.gov/uscurrency/annualproductionfigures.html

the government prints 35 million notes per day. If they were all $100 bills, that would be $3.5 billion per day – 628 days to print $2.2 trillion!

So there would be a massive currency shortage at the official exchange rate and the Fed would have to ration it, and of course lose money on the yield spread. Which would not make them look like smart bankers who know what they’re doing.

It’s possible to *temporarily* drive Fed Funds negative in this way, but the fact that it’s time limited weakens the effect.

It doesn’t make sense to set a negative IOR unless the plan is to permanently eliminate the zero bound.

15. April 2013 at 20:19

I like the example where there are no central bank reserves and no demand deposits. Then, someone wants a loan and does not want to hold the demand deposit (wants currency). It is about what asset the fed wants in exchange for the currency.

“And yes, the Fed can drive its yield spread negative if it overproduces money. In fact, that’s the current situation – the Fed Funds rate is lower than interest on reserves.”

It seems to me the yield spread for the fed is like this. Currency yields 0% and central bank reserves yield .25%. Those are the fed’s liabilities. Mostly, there are treasuries and mortgage backed securities yielding 1% or more in total. Those are the fed’s assets. The difference is the fed’s spread. I’m not sure what the fed’s assets are yielding.

22. April 2013 at 09:12

[…] zero. Thus if the central bank can control ONI, it can also influence E in the short run. The musical chairs model. The rest of the economy can be modeled using new classical […]

13. June 2013 at 10:27

[…] like 2008-09, NGDP growth fell 9% below trend, while nominal wage growth was little changed. W/NGDP soared. Using my musical chairs model, we’d expect about 9% fewer hours […]

29. December 2014 at 09:17

[…] This picture is perfect because Scott Sumner even refers to the relationship between wages, nominal GDP and unemployment as the “Musical Chairs Model”. […]

9. April 2015 at 15:39

[…] Sumner describes his theory of demand-side recessions as a “musical chairs model”. Recessions happen when there is a large and unexpected drop in nominal GDP (or more accurately […]

28. November 2015 at 22:55

[…] Sumner, “Money and output (The musical chairs model)”(TheMoneyIllusion, April 6, […]

24. August 2016 at 07:30

[…] outlines a simple “musical chairs” model of unemployment. He describes that model here and here. Essentially the idea is that the total number of jobs in the economy can be […]