Ryan Avent on the Fed’s timidity

I’ve done many posts making the following two arguments:

1. Interest rates will remain low for the foreseeable future. The “new normal” during the 21st century will be unusually low real interest rates on Treasury securities, and short term nominal rates are likely to hit zero in future recessions.

2. The Fed tends to follow the conventional wisdom—at any given time Fed policy is roughly what a consensus of respected macroeconomists favors.

I’ve argued the Fed needs to adopt a new policy regime going forward—interest rate targeting won’t work at low rates. One option is a higher inflation target, although I’d prefer NGDPLT.

Bill Woolsey sent me a Ryan Avent post that suggests the Fed has all but admitted that interest rates will be lower going forward, and that in retrospect a slightly higher inflation target (or some other option) might have been better, but it’s up to the academic profession to come up with the new regime. Here’s Ryan:

At today’s post-meeting press conference, I attempted to ask Ben Bernanke whether the FOMC was concerned about the lack of a cushion between the fed funds rate and the ZLB and whether the FOMC had considered adjusting policy to address the issue””by raising the long-run inflation target, for instance. His answer, essentially, was that the Fed had only just announced its 2% inflation target and had no plans to change it. And he reckoned that weighing the costs and benefits of ZLB events with an eye toward computing the optimal inflation target was a matter for academic debate. Some research suggests that at low inflation rates an economy will hit the ZLB more often than was previously assumed, he noted, which might make the cost-benefit trade-off of a higher target more attractive.

Fair enough; monetary economists have and will continue to debate these points. But the issue is not merely academic. Most of the other questions at the press conference concerned the problem of continued high unemployment and the Fed’s assessment of the risks of unconventional policy. We are living the consequences of the ZLB and the Fed’s best estimates have America right back in the same hole when the next recession hits. If the Fed is simply waiting for academia to sort things out, that’s really disconcerting. Alternatively, if the Fed is actually pretty comfortable using unconventional policy and not particularly worried about rolling it out again during the next downturn then one has to ask why it isn’t doing much more now to address unemployment.

The answer doesn’t have to be a higher inflation target. It can be a commitment to treat the current target more symmetrically (that is, to err above as often as it errs below). Or it could be a switch to an NGDP level target. But right now, the Fed’s answer seems to be: get used to nasty recessions and insufficient monetary responses, suckers. At least until academics tell us its safe to try something new.

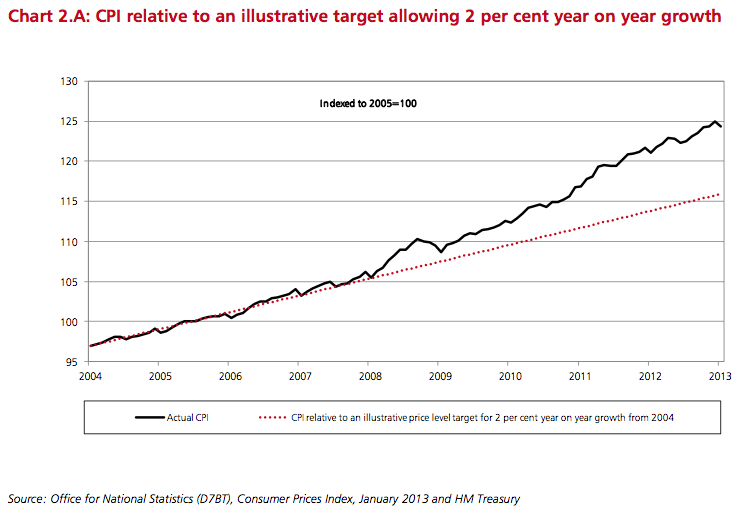

PS. I’ll have limited time for blogging over the next month or so. Several people sent me the Bank of England’s critique of NGDP targeting. Market monetarists have already addressed all the objections they raised. But the one that made me smile was the fear that the public might not understand a policy of keeping the total aggregate income of the British people growing at 4% per year as well as they “understand” inflation targeting. Then the report presented this graph showing British inflation zooming far above target since 2008. We also know that the BoE is looking for excuses to be even more expansionary. That’s fine, I also think policy should be easier in the UK. But looking at that graph does anyone seriously believe the British public understands what the BoE is up to? On the other hand if they looked at a graph of NGDP (which has slowed sharply), wouldn’t that make it easier to explain to the public why they want to ease?

Update: It was a Treasury report, not the BoE.

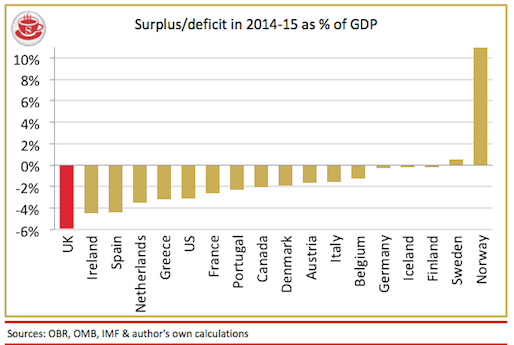

PPS. Another Ryan Avent post presents this graph:

Do Keynesians really believe Britain’s problems are due to fiscal austerity?

Tags:

21. March 2013 at 05:22

“Interest rates will remain low for the foreseeable future. The “new normal” during the 21st century will be unusually low real interest rates on Treasury securities, and short term nominal rates are likely to hit zero in future recessions.”—Scott Sumner.

Right, right, right.

If one looks at sovereign debt yields for the last 30 years, this seems even more likely. And if one looks at Japan.

The Fed seems unaware of this, although anyone with an Internet connection can see it.

But I wonder even if academia moves to NGDP targeting, will the Fed? There has been 30 years of ossification at the Fed, of encrusting and glorifying the stern will to fight inflation, despite the depredations of soft-headed weaklings who want to print money. They genuflect not to growth, but to sub-2 percent inflation.

So now, some Ivory Tower pointy heads say “print more money, we are hurting too much. Waaa-waa-waaa.” Will the Fed listen?

The Fed is independent. They may not listen to the academics. Richard Fisher?

That Fed independence is looking like a bad idea now. They can follow their divine purpose, and ignore the results.

It is Theomonetarism at the Fed.

21. March 2013 at 05:30

Scott, I was sick and I asked my doctor to bump up the dosage of the medicine he’d prescribed, because I wasn’t getting better. He said, “Well, there are risks of increasing the dosage beyond the level we’re already doing. There are researchers out there conducting experiments, but we don’t have the results yet. It might end up making you even sicker, so I’d recommend we wait.”

Can you believe that guy? What a quack! Everybody knows you should just try anything until the patient gets better.

21. March 2013 at 05:44

Bob, that’s what the doctor tells you, but what he tells the other doctors is: Bob doesn’t know this, but the experiment whose result we’re awaiting is him.

21. March 2013 at 06:57

If the economy really takes off, will tax revenues grow quickly enough to offset increased debt payments required by higher interest rates on treasuries?

Empirical question, but what’s the point at which a high debt load, increasing entitlements, and a narrower tax base would trap the government into preferring a zero interest rate, stagnant economy over an increasing interest rate growing economy?

21. March 2013 at 07:04

I still can’t figure out if I should buy bonds because the Fed is going to continue pursuing the wrong policies, or something more growth-oriented because they’re going to pursue better policies 🙂

MikeDC — I’ve been wondering that too. If the fiscal expansionists continue to get their way, eventually the short-term debt will be so large that the higher interest rates associated with faster growth would bankrupt the government. It looks like this is probably going to happen within 20 years unless the Tea Party takes over the fiscal picture or Fed policy creates growth sooner.

21. March 2013 at 07:08

MikeDC – That would depend on whether the interest rates lead or follow the recovering economy.

21. March 2013 at 07:08

But the one that made me smile was the fear that the public might not understand a policy of keeping the total aggregate income of the British people growing at 4% per year as well as they “understand” inflation targeting.

Also: ARRRGH!! Why do we even have “independent” central banks if they’re just going to worry about public opinion all the time? Especially when their worrying implicitly assumes people don’t want growth?

Sorry, that’s really bothering me a lot lately.

21. March 2013 at 07:11

TallDave – Sounds like you’re trading on an uncertainty either way. If it’s interest rate movements you’re concerned about, why not dividend stocks, or perhaps bank loans?

21. March 2013 at 07:14

[…] Scott Sumner has a post on […]

21. March 2013 at 07:19

We need “guts”!

http://thefaintofheart.wordpress.com/2013/03/20/i-say-a-little-prayer/

21. March 2013 at 07:44

Tyler — ha, that’s why I bought high-dividend REIT indexes and took out a mortgage.

Generally I’ve been buying long-term bonds to arbitrage my mortgage, I come out maybe 12K a year ahead (the tax-adjusted difference is maybe 3% a year). But our investments are larger than the mortgage, and I’m not sure I want the exposure.

Lately I’ve been thinking global equities may be a good long-term play — I’m betting more people will take Acemoglu seriously and incentives will start aligning, plus it’s a nice hedge against the doomsday US money-printing scenario.

21. March 2013 at 07:46

Scott, what is your reaction to claims by Bernanke himself that the Fed cannot fully offset the fiscal contraction underway? Is he being dishonest?

21. March 2013 at 08:32

Judging whether a country is doing fiscal austerity by looking at their deficit/GDP seems a bit like judging whether monetary policy is loose or tight by looking at interest rates. It could be that austerity would lead to an economic collapse, which would make the deficit bigger.

21. March 2013 at 09:58

It could be that austerity would lead to an economic collapse, which would make the deficit bigger.

It should be pretty obvious the fiscal multiplier can’t be so large that it actually shrinks deficits. If that were the case, no government would ever have a fiscal crisis and we’d all be living at >$100K PPP GDP per capita under regimes that spent upwards of 90% of GDP.

21. March 2013 at 10:17

Bob Murphy,

If the patient is going to die anyway, Dr. House thows every treatment he can think of, putting his patient through unbearable agony, before stumbling upon the cure at minute 50.

21. March 2013 at 11:27

TallDave,

Not to be a nitpicker, but I’m sure you realize that capturing the spread between your mortgage and the bonds is not arbitrage. I take your point though, and it sounds like a reasonable strategy.

As long as you know what your long term goals are, and make your investments in light of those, global equities are just fine. Most of the the time the problems I help my clients address are not the quality of their ideas, but the lack of methodology and a way to measure progress towards finite goals.

21. March 2013 at 11:41

Scott – the remit review is from the Treasury not the BoE itself. It looks like the Treasury are pushing for Carney to do something like the “Bernanke-Evans” rule. But basically they have not really changed the remit in a meaningful way, so UK macro policy now all hinges on what Carney can persuade the MPC to endorse. I’ve no idea how that will work out.

My post on this: https://uneconomical.wordpress.com/2013/03/21/monetary-policy-regime-change-remit-fudged-and-mpc-nudged/

21. March 2013 at 11:47

Not to be a nitpicker, but I’m sure you realize that capturing the spread between your mortgage and the bonds is not arbitrage.

I may not have been clear, it’s actually tax arbitrage (well, that and the gov’t intervention on behalf of mortgages). There may be some risk differential in there too, I hope not too much.

Here’s an NBER paper on it.

http://www.nber.org/digest/apr07/w12502.html

21. March 2013 at 11:50

Please see the graphs here of historical NGDP in Germany:

http://macromarketmusings.blogspot.com/2013/02/note-to-charles-goodhart-europe-is.html

Could someone please explain how Germany has been able to achieve such a robust rate of NGDP growth while the rest of Europe and the U.S. have been so sluggish? Shouldn’t NGDP growth in Germany be slow as well? Hard for me to understand……

21. March 2013 at 11:51

[…] See full story on themoneyillusion.com […]

21. March 2013 at 11:55

That’s an interesting chart Tyler. It sort of implies Germany is gobbling up all the money supply increase.

Maybe because of the capital flows out of the PIIGS?

21. March 2013 at 11:56

*TravisV, not Tyler. Sorry!

21. March 2013 at 12:41

Actually, it is a critique by the UK’s Her Majesty’s Treasury (HMT), our Finance Ministry, not the Bank of England. I take comfort that they are thinking about the issue. It will make for a good debate when Mark Carney arrives and starts explaining a thing or two about monetary policy.

There are far too many old guard inflation targetters around, still fighting the current war with the tools of the last war, while haphazardly adopting some new tools. It’s classic. It will never win the war, but the debate is clearly getting to some high places. NGDP LT is being thought about, the genie is out of the bottle. It is up to British supporters to fight the battle over here.

21. March 2013 at 13:19

Good point, TallDave, thanks. Not sure if that totally explains it but still a good guess.

Given the ECB’s policy, there is a limited amount of NGDP to go around. So Germany has taken a lot of NGDP away from other Eurozone countries.

Anyone else have any ideas?

21. March 2013 at 13:24

What’s interesting about the paper is that they have felt NGDP LT to have enough of a head of steam to make it worth “refuting”. As far as I know there is very little public clamour for it, but it must be an important enough of an issue in the corridors of power for someone at the HMT to write about it. The main critique they use as a source is written by the once eminent monetarist Prof Charles Goodhart published not in academic journal but by Morgan Stanley. It’s sad he’s so obsessed with his IT legacy that he’s lost sight of the point of it. Stable inflation is not an end in itself.

Another irony of the paper is that NGDP LT, otherwise known as “wages” is said to be not easily understandable. As Sumner shows in the one chart above IT is not very straightforward. To help clear up exactly the way the target operates in our atmosphere of hugely volatile core and headline RPI the Treasury have tried to elucidate it thus:

2.17 The remit for the MPC set at Budget 2013 has been updated to clarify the trade-offs that are involved in setting monetary policy to meet a forward-looking inflation target. For clarity, the target “applies at all times”, as distinct from a requirement to be met at all times, because the latter could be mis-interpreted as strict inflation targeting with zero weight on the secondary objective, contradicting the flexibility to respond efficiently to shocks and disturbances that move inflation away from target. The MPC’s forward-looking policy decisions must be consistent with ensuring price stability in the medium term. The appropriate policy horizon is subject to the operational independence of the MPC.

What a joke!

21. March 2013 at 14:29

Ben, Eventually ideas matter.

Bob, The analogy is doubly wrong. The right analogy is steering a ship. Why do a plan that you expect to fail? Steer toward the target.

And monetary stimulus has not yet been tried, so the analogy fails that way as well.

I actually agree with you in one respect. Bernanke’s making a mistake to do “gestures” and then wait and hope for success. Succeed in 5 minutes, or don’t bother at all.

MikeDC. The budget is extremely procyclical. Growth reduces deficits.

Randy, I don’t think he’d say they “can’t,” he’s not that stupid. He’s always said the Fed can do more, that the Fed is never out of ammo.

I trust what Bernanke said when he was free to speak his mind, as when he said monetary policy since 2008 has been the tightest since Herbert Hoover was president. Well, he didn’t really say that, but he certainly implied it back in 2003 when he said to look at NGDP growth and inflation.

Blackadder, In the Keynesian model there is no “Laffer curve effect” Fiscal austerity should not make the deficit bigger. If it does, then the Keynesian model is wrong. But in that case why should we believe Keynesians when they ridicule the Laffer Curve?

Britmouse and James, Thanks, I’ll correct that.

James, I’ve also been thinking about the “genie out of the bottle” metaphor. Central banks will never agian be able to ignore a collapse in NGDP.

21. March 2013 at 14:49

Perhaps the really worrying genie out of the bottle is that if central bankers stop believing in inflation targeting (i.e. we get ever more “flexible” inflation targeting) then we might see an inflationary resurgence sometime in the future. A historical parallel is with the UK in the late 1980s, when monetary targeting had become too pragmatic to be worthy of the name, and a “look at everything” approach gave the cover to a resurgence of inflation back into double digits.

As I like to say now: NGDP targeting is not only good as means of solving the current growth problem, but also the next inflationary risk. What’s needed is a nominal target for all seasons.

21. March 2013 at 14:50

@Bob Murphy,

You wrote:

Why on Earth do you think the Fed is acting in a risky, reckless manner? Why would increasing demand expectations be “risky”?

Do you seriously think that decreasing demand expectations would be prudent and responsible? What a ridiculous notion.

21. March 2013 at 15:01

Holy Smokes Check This Out!!! Larry Kudlow embraces Market Monetarism!

http://www.businessinsider.com/larry-kudlow-says-bernanke-may-have-gotten-it-right-2013-3

Bernanke might have been right all along, says Kudlow!

21. March 2013 at 15:08

By the way, Pethokoukis is holding an event tomorrow at AEI featuring Ryan Avent, David Beckworth, and Scott Sumner on revamping the Fed and the idea of market monetarism. You’ll be able to watch it live online at noon, and hopefully get a glimpse of new monetary ideas on the right that aren’t all about hard money.

http://www.aei.org/events/2013/03/22/mend-it-dont-end-it-revamping-the-fed-for-the-21st-century

21. March 2013 at 15:34

Holy Smokes! A pundit talking head is bending with a wind he feels!

21. March 2013 at 15:54

Kudlow is not a man I like in the least.I am stunned.

21. March 2013 at 16:02

Supply side problems in the UK

——————————

Britain faces gas supply crisis as storage runs dry

(Reuters) – Britain is grappling with a potential gas supply crisis as a late blast of winter depletes stored reserves, coal power plants close and pending maintenance in Norway threatens to further squeeze supply.

The country risks running out of stored gas by April 8 based on the fall in its reserves seen since the cold hit at the beginning of March, Reuters calculations show.

Gas storage sites have been depleted by 90 percent, with the equivalent of less than two days’ consumption remaining, data from Gas Infrastructure Europe shows.

If the cold persists, as is forecast, the UK may need to cut gas supplies to some big industrial customers, as it did in 2010 at a time of severe gas shortages.

http://uk.reuters.com/article/2013/03/21/uk-britain-gas-supply-crisis-idUKBRE92K0T120130321

21. March 2013 at 16:08

Geoff,

Exactly! Exactly! Prof. Sumner’s ideas are so persuasive that the wind is at his back. Kudlow is a very influential guy and his opinion reflects those of many elites.

http://bit.ly/10pn7o8

This blog is changing the world!

21. March 2013 at 16:21

Dr. Sumner:

“And monetary stimulus has not yet been tried, so the analogy fails that way as well.”

I think I just broke my keyboard after spitting my coffee all over it.

21. March 2013 at 16:22

I said “a” wind, Travis, not “the” wind.

21. March 2013 at 16:22

“The right analogy is steering a ship. Why do a plan that you expect to fail? Steer toward the target.”

Read the story of American Airlines flight 587… Apply too much rudder and the rudder might break.

More on rudders… The movement of the compass lags the movement ship. And, since the ship has momentum, the ship continues to turn after the rudder has been moved back to neutral. So, you must straighten out your course well before the compass shows you to be on the correct heading.

So, what is the lag between fed action, and economic response? (12-18 months) And what is the lag between economic response and confirmation in the data? (2-5 months)

21. March 2013 at 16:25

Dr. Sumner:

“And monetary stimulus has not yet been tried, so the analogy fails that way as well.”

Thanks. Now my coffee has been spitted all over my keyboard.

“The right analogy is steering a ship. Why do a plan that you expect to fail? Steer toward the target.”

Except they are steering towards the target. You just don’t agree with the target they’re pointing towards.

Every central planning “target” will have disagreements that are unable to be reconciled rationally, since they are enforced politically.

21. March 2013 at 16:32

Tall Dave, Travis V

Of course all of the money creation is going to Germany. Money flows where there is the greatest return for risk, and the risks of going into Greece or Italy or Spain is too high. Printing more money, won’t stabilise the basket case economies.

More printed money in the US won’t make Detroit rich. It might make New York a little richer, though.

21. March 2013 at 17:50

“Could someone please explain how Germany has been able to achieve such a robust rate of NGDP growth while the rest of Europe and the U.S. have been so sluggish? Shouldn’t NGDP growth in Germany be slow as well? Hard for me to understand……”

Germany is the “safe haven” of the Euro zone (mostly because it’s the largest country – too big to fail!), so a financial crisis benefits Germany relative to other Euro zone countries. Germany can basically issue unlimited amounts of risk-free euro debt; other euro zone countries can’t.

21. March 2013 at 18:26

Larry Kudlow’s always been a serious guy who will change his mind with enough evidence, I’m not a big fan but he was someone for whom I’ve had some respect.

His conversion doesn’t surprise me — anyone who saw some version of Scott’s post showing the recent coupling of monetary supply and stock markets has to conclude NGDPLT = growth. The markets don’t speak much more clearly than that.

I did not realize “(Janet Yellen, the likely next Fed chair has all-but endorsed [NGDPLT])” — is this a common view on both counts?

21. March 2013 at 18:42

The chart illustrating your comment about UK austerity fails because it is % GDP and Keynesians can (and do) argue that GDP responds more than proportionally to a fall in spending. However, I think you are right; it s just that you should use a chart like this:

http://www.ukpublicspending.co.uk/spending_chart_1900_2011UKb_12c1li011mcn_F0t

21. March 2013 at 19:15

Doug M,

You wrote:

“what is the lag between fed action, and economic response? (12-18 months) And what is the lag between economic response and confirmation in the data? (2-5 months)”

Not true. Geoff said something similar a couple months ago.

The stock market is very efficient and forward-looking. Responses to Fed surprises happen immediately. There are no “long and variable lags.” Google what Prof. Sumner has said about “long and variable lags.”

21. March 2013 at 19:23

“Germany is the “safe haven” of the Euro zone (mostly because it’s the largest country – too big to fail!)”

Good point. Richard Fisher and Elizabeth Warren should get to work calculating the “too big to fail subsidy” being paid to Germany by the small European countries, using the credit spread differential times the debt outstanding. Then they should inform the Germans and French of the need to break up so that no country has more than 10% of the Eurozone economy.

21. March 2013 at 20:12

MSM Headline Of The Week:

“Fed to Maintain Stimulus Efforts Despite Job Growth” (NYT). Reminds me of “Prisons Full Despite Fall In Crime Rate”.

21. March 2013 at 20:30

You argue that monetary policy in the UK should be more expansionary despite it’s elevated inflation (meaning above 2%). This has been the case since 2008 and it doesn’t look as if that was going to change anytime soon. So, would you argue for more expansionary monetary policy irrespective of the current and anticipated future inflation rate as long as e.g. unemployment is high? Wouldn’t we end in a situation similar as in the 70s, with ever-rising inflation and high unemployment? Monetary policy is not the appropriate tool to solve structural problems.

21. March 2013 at 22:46

TravisV,

The stock and bond markets react instantly. But the markets are not the economy. Until someone increases his ouput, GDP has not changed.

The Fed creates money, banks lend against the created money, someone begins a new project with that borrowed money, people get hired to work that project… there are lags.

22. March 2013 at 04:15

Doug M

What about the ‘instant’ reversal of industrial production in 1933, increasing more than 50% in the first 4 months? In 2009 it took less than 3 months for NGDP to reverse after QE1.

22. March 2013 at 05:26

TallDave,

That NBER paper is interesting. FWIW, I’m paying down my mortgage in addition to saving in tax-deferred accounts mostly because I don’t trust the government not to take a bite out of that savings, probably through reducing other transfers, so it’s hard for me to compare the returns, and because the math is really hard, especially when the AMT comes into the equation.

22. March 2013 at 05:40

Ah, means-testing for SS and Medi? Quite likely I think.

I ignore AMT for the most part because the effect is small (limited to 20% of the interest paid).

I guess I worry more about inflation spiking if the Fed is forced to monetize the US debt at some point. That could get ugly fast, and I’d like something to be inflated away to my benefit 🙂

22. March 2013 at 07:44

TallDave,

“I may not have been clear, it’s actually tax arbitrage (well, that and the gov’t intervention on behalf of mortgages). There may be some risk differential in there too, I hope not too much.”

You’re hedging your interest rate risk and making some money off the mortgage interest tax deducation, but arbitrage is by definition a trade that happens simultaneously where you capture a known spread between two equivalent assets in such a fashion that profit is riskless. Your mortgage and the bonds are not equivalent securities, so it’s not tax arbitrage.

Hedging out specific risks can be a smart strategy, but it’s not the same thing as arbitrage. In your long bonds & mortgage scenario, you still have other risks. You’ve got credit risk on the bonds still, and if interest rates go up, you could be forced to hold the bonds to maturity, which is a form of liquidity risk. There is also legislative risk, as the trade is on-going rather than a one time event. And so forth.

These are not necessarily bad things, just so long as you know what you’re getting into.

22. March 2013 at 08:43

“Ah, means-testing for SS and Medi? Quite likely I think.”

The best ‘arbitrage’ for this is to spend all of your own money now, and all of someone else’s money later.

22. March 2013 at 09:08

Tyler,

Did you read the NBER paper? They suggested buying MBS, which are mortgages.

In any case your definition of arbitrage is too limited — the assets don’t have to be equivalent, there just has to be some gain that would exist if the assets were equivalent. The fact that some gain/loss is due to risk spread doesn’t erase the gains from arbitrage.

You’re never forced to hold bonds, they can always be sold at whatever the market price is. The mortgage is of course a different story, and I could run into trouble if I wanted to pay off my (more valuable to me) mortgage with (devalued to me) bonds, since I can’t sell (reassign) the mortgage.

You are correct that hedging and arbitrage are different things, in this case I am doing both.

Steve — haha, no kidding. But I have aspirations of higher consumption than that strategy would allow 🙂

22. March 2013 at 09:21

BTW, on the mirror of the bond credit risk, it’s worth noting something that a lot of people forget — there is also some risk in paying your mortgage. This is something I ran into with the seller of our house — he owed about 50% more than the sale price, so the sale was a short sale.

He probably could have decided pay off the house years ago, he was a commercial real estate lawyer and while he lived in this house he built and moved into the largest house in the whole development (it’s lakefront and has 9.5 bathrooms and a triple deck to give you some idea), but if he had done that he’d have lost the difference between the loans and the sale price that the banks ended up eating.

Of course quite a few people ended up in short sales, and I suspect many of them rued early payments.

22. March 2013 at 13:33

Interesting new article where Stiglitz praises Abe and Japan. He still says a few things that are quite wrong, however.

http://blogs.wsj.com/japanrealtime/2013/03/22/nobel-laureate-stiglitz-gives-abenomics-thumbs-up

22. March 2013 at 14:24

I think that both the Keynesians and MM types are being a little disingenuous although perhaps more so on the Krugman side. If I take the Sumner critique at face value the Keynesian argument for stimulus/anti-austerity becomes a political argument. The MM has convinced me that the FED could make the fiscal fight meaningless. The problem is that they don’t!!!

The Krugmans et.al. are making a POLITICAL argument couched in an economic one. If fiscal policy changed then the increase in debt would allow the FED to continue its policy without obvious change and allow for expansion while giving it political cover. If a stimulus of some type is passed (Payroll Tax Cut) then to maintain a similar level of NGDP growth would require some small amount of change in policy as T-bill supplies increase. Now the Hawks can be resisted and the FED does nothing extra.

Now while the FED can always raise the price level, I don’t believe they have the political will or political capital to pull this off.

I think the Keynesians must acknowledge that there is no limit to FED intervention (start buying everything!!!) except what is allowable politically. The MM must admit that the political constraints of the current FED could mean that some kind of stimulus could be a way to avoid recalcitrance among the idiot board members.

22. March 2013 at 14:30

Fran,

Scott is arguing that an NGDP target of ~5% so at worst you could have 5% inflation (unless something is really really wrong, like the Luftwaffe starts bombing London again). If the BOE grows NGDP at a 5% rate and there is no growth then that would require some serious structural reforms as that means there are some structural issues preventing unemployment from falling because workers are getting cheaper and nobody is hiring. All that seems highly unlikely.

22. March 2013 at 18:52

@James in London

I had missed your “genie out of the bottle”. So I gave the title to my post quite independently. As I argue, the point is to keep the “genie well within the bottle”!

http://thefaintofheart.wordpress.com/2013/03/22/genie-in-a-bottle/

22. March 2013 at 19:15

Hi Scott,

Totally off-topic : Scott, I’m doing Eric Landers course ” Intro to biology” on EDX and it is really really amazingly well done. Dr. Lander is a great teacher , but it’s more than that, they have the whole program structured so functionally, so well organized and it’s totally free open to anyone anywhere in the world. It is an incredible gift to autodidacts everywhere.

Scott, they have nothing in Econ…….you’ve been talking about a book, why not an EDX course?

MONEY with Scott Sumner. Part econ history, part monetary theory, some analysis of current events. Can’t you see it?

It would be great exposure for Bentley and with your ever increasing bloggosphereic street cred you would actually have the clout to make it happen.

OK….have a good weekend

22. March 2013 at 21:45

Dear Commenters,

Where is the best list of influential people who support NGDP targeting?

23. March 2013 at 02:51

I admit I was surprised that HMT did not at least call for a consultation on NGDP targeting. I always thought that the UK government was looking for a way to relax the inflation target constraint as it became binding, but more recently, I also thought that the government would welcome a splurge of NGDP to boost tax revenue and reduce their embarrassment of missing their fiscal targets too. Certainly, with the well-connected and influential journalists at the FT apparently onside, the signs were pointing in that direction. I can only imagine that the politicians found that ordinary people are becoming increasingly aware of the effect that inflation is having on their savings, and concluded that being seen to be playing that trick would be a vote loser. Better leave any such fiddles to the BoE. Note, however, that Carney has not been invited to consider NGDP targeting, which I guess means that the high water mark of support for NGDP targeting in the UK has passed for the foreseeable future.

While I am delighted that the danger of NGDP targeting in the UK seems to have receded, it seems to me that the inconclusive questioning of the BoE remit in the UK Budget is bad for the clarity and credibility of UK monetary policy, not least because it leaves the remit, not just the operation within it, in the hands of the personalities at the BoE. George Osborne must be confident that he has installed enough servants on the MPC to ensure its support.

23. March 2013 at 06:57

W. Peden, Good point.

TravisV, Thanks, I did a post.

Doug, That’s why I say “target the forecast,” which takes lags into account.

Not worried about the printing press “breaking.”

Robert, You need to look at spending as a share of GDP.

Max, That’s not the issue. Italy is much more “too big to fail” than Finland and Austria.

Chris, Touche.

Fran, You said;

“So, would you argue for more expansionary monetary policy irrespective of the current and anticipated future inflation rate as long as e.g. unemployment is high?”

No, I believe the BoE should ignore inflation and unemployment, and target NGDP. No repeat of the 1970s as long at NGDP is kept growing 4% to 5% per year in Britain. The 1970s saw double digit NGDP growth.

Errorr, But the Fed has been offsetting recent fiscal actions. For instance the easing of late 2012 was partly motivated by the looming tax increases of 2013—that’s fiscal offset.

Paul, Thanks, I hope to do something online.

Rebeleconomist—I agree that the recent policy statement is a move from rules toward discretion.

25. March 2013 at 07:43

Hi Scott, I was suprised to hear him say “can’t”. I finally found the transcript and will reproduce it for you below:

CHAIRMAN BERNANKE. Well, our analysis is fairly comparable to analysis that Congressional Budget Office has presented to the Congress. And they estimate that putting together all the fiscal measures, including the fiscal cliff deal, the sequester, and other cuts, that federal fiscal restraint in 2013 is cutting something like one and a half percentage points off of growth, which, of course, is very significant. So that is an issue for us. We–you know, we take as given what the fiscal authorities are doing. The economy is weaker. Job creation is slower than it would be otherwise. And so, that is one of the reasons that our policy has been as aggressive as it is. That being said, as I’ve said many times, monetary policy cannot offset a fiscal restraint of that magnitude. And so the final outcome will be worst or–in terms of jobs than would have been the case with less fiscal restraint. I want to emphasize that I do believe that long-term fiscal stability is extremely important. And I urge Congress, the administration as I always do when I go to testify to do whatever is necessary to put us on a sustainable fiscal path going forward. But in doing so, I think it’s a good idea to pay attention to the impact in the near term on what is still not a completely satisfactory recovery.

http://www.federalreserve.gov/mediacenter/files/FOMCpresconf20130320.pdf

He could be talking about the policital “can” versus the theorhetical “can”. Or maybe I a missing a piece of the nuance.

Just wanted to share that quote with you; it stuck out to me when I was listening last week.

26. March 2013 at 06:11

Randy, I’m almost certain he means the political “can’t”. How about Zimbabwe style monetary policy?

29. March 2013 at 08:16

[…] At this point it’s virtually impossible for the fed to end its quantitative easing program anytime soon. As economics professor Scott Sumner puts it: […]