Liquidity trap? Don’t be a sap!

Here’s Martin Wolf:

The traditional view at the BoJ has been that monetary policy cannot raise inflation. This shows a surprising lack of imagination. In principle, the BoJ can use its fiat money to buy everything in the world, at any price it wanted. This would certainly lower the purchasing power of the yen.

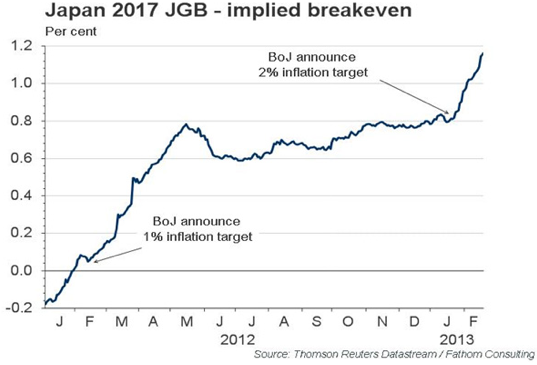

And here’s the Japanese breakeven:

And here’s a longer term breakeven:

FWIW, The most (only?) important difference between Paul Krugman and me on monetary policy has been whether a BOJ promise to inflate would be credible. Now take another look at the first graph.

And here’s Peter Pan (You Can Fly) in Japanese:

http://www.youtube.com/watch?v=K_hveXw3xZU

Tags:

6. March 2013 at 07:08

I posted this story yesterday.

6. March 2013 at 07:27

http://www.nytimes.com/2013/01/14/opinion/krugman-japan-steps-out.html

“Enter Mr. Abe, who has been pressuring the Bank of Japan into seeking higher inflation “” in effect, helping to inflate away part of the government’s debt “” and has also just announced a large new program of fiscal stimulus. How have the market gods responded?

The answer is, it’s all good. Market measures of expected inflation, which were negative not long ago “” the market was expecting deflation to continue “” have now moved well into positive territory. But government borrowing costs have hardly changed at all; given the prospect of moderate inflation, this means that Japan’s fiscal outlook has actually improved sharply. True, the foreign-exchange value of the yen has fallen considerably “” but that’s actually very good news, and Japanese exporters are cheering.

In short, Mr. Abe has thumbed his nose at orthodoxy, with excellent results.”

Could you clarify that Krugman point? Am I missing something here, or is that Krugman saying that promises to inflate have pushed up inflation expectations? I thought the only difference was that Krugman thinks coordinated promises of fiscal and monetary stimulus were necessary and you think that only monetary stimulus is necessary.

6. March 2013 at 07:36

I think you are declaring victory a bit early to be honest. While it’s true that the BOJ definitely created a market reaction, I am not sure they could have without the noise from the politicians. So even in this case, it’s not a pure experiment. It doesn’t clarify if the central bank could have acted without support from fiscal policy. It could be you need both and in this case the central bank acted last.

Market forecast is the best forecast we can get, but it doesn’t mean it is accurate, it just means we cannot do better. It will take a long time before we can really judge.

Your chart is a bit short as well… B/E inflation was 1% in 2006 as well… It didn’t really happen…

6. March 2013 at 08:18

Interesting that the stock market got Abe’s pre-election, mid-November announcement of his intention, but the bond market did not. Any ideas why?

6. March 2013 at 08:49

Thanks Niklas, Good post.

Aidan, I don’t think anyone who has been closely following this rally thinks it’s fiscal stimulus driving up inflation expectations. The market have been responding to calls for a more expansionary monetary policy. The small fiscal stimulus was announced to appease one faction of the Abe coalition. Fiscal stimulus was tried and failed in Japan–it’s mostly a non-issue.

Carraro, You said;

“I think you are declaring victory a bit early to be honest. While it’s true that the BOJ definitely created a market reaction, I am not sure they could have without the noise from the politicians. So even in this case, it’s not a pure experiment. It doesn’t clarify if the central bank could have acted without support from fiscal policy. It could be you need both and in this case the central bank acted last.”

How can it be too early? It doesn’t matter whether inflation actually rises, only whether the market believes it will And they obviously do believe that.

It is a pure experiment. As for government support, that’s a completely irrelevant point. Everything central banks do should be done with government support. We live in a democracy. I’ve always favored central banks obeying the law, and shooting for whatever target the government set. That’s a given. In the past the BOJ violated their mandate by allowing persistent deflation. Thus the government was forced to enact (ineffective) fiscal stimulus to try to boost AD. The BOJ has never been held back by a lack of government support for ending deflation.

W le B, I’m not sure why.

6. March 2013 at 09:28

It doesn’t matter whether inflation actually rises, only whether the market believes it will

This is something I constantly have to explain to people on the right. Asset purchases aren’t a policy per se, they’re solely to create credibility. If the markets expect 5% NGDP growth, then they’ll behave in a way different than they’re behaving now.

The reason the Fed has to work so hard right is precisely the gap between stated policy and actual expectations — they’re trying to push the policy against expectations, and the gap can eat up massive amounts of intervention.

6. March 2013 at 09:32

That’s kind of a dodge. Where did Krugman say that a promise to inflate wouldn’t be credible? Isn’t that the whole point of his “credibly promise to be irresponsible” idea that he’s been promoting since 1998? Do you think Niklas was incorrect in grouping Krugman’s position with Lars Christensen’s?

6. March 2013 at 09:49

[…] See full story on themoneyillusion.com […]

6. March 2013 at 09:56

I’m sympathetic with acarraro’s point about caution. Japanese inflation remained weak according to the data that came out in late February, in spite of the increase in your measure of inflation expectations, which began last year. The change in policy may have led to a change in expectations, but for those expectations to be justified the economy actually has to produce inflation.

Also, I wanted to check on those numbers, so I pulled up the Japanese sovereign and inflation-indexed curves on Bloomberg. The first graph close enough to what I got, but I couldn’t find a comparable 10 year inflation-indexed note in Japan over the relevant period, which makes me not want to trust that second graph.

Also, the BoJ inflation-indexed curves are a rather weird shape, beginning slightly negative (-0.4% at 2 years, which is equivalent to a breakeven closer to 0.4%), becoming most negative a few years out and then becoming less negative over the longer-term. This suggests that the Japanese market believes it will take some time for the inflation to actually come about.

6. March 2013 at 10:07

W le B, it’s possible that Japan’s bond market isn’t as efficient as their stock market. I’ve read before that Japanese pension funds are ‘forced’ to invest in JGBs by the Ministry of Finance. I’m not sure that this is something that’s easily verified but it would explain why so many of Japan’s Bonds are financed domestically. Households may not have much choice.

6. March 2013 at 11:30

Aidan is right… the Japan graph is a confirmation of both Sumner and Krugman/Eggertson. I don’t think that Scott has properly formulated how he deserves to be dehomogenized from Krugman. Until then, rather than reading both I’ll skimp on time and read Sumner Mon/W/F and Krugman T/T… two birds with one stone.

6. March 2013 at 12:12

Where did Krugman say that a promise to inflate wouldn’t be credible?

His comments to that effect have been linked here so often it’s getting tiresome.

6. March 2013 at 12:35

“His comments to that effect have been linked here so often it’s getting tiresome.”

But he’s also said multiple times that a higher inflation target would be effective.

I guess its just confusion on his part.

6. March 2013 at 13:01

[…] Source […]

6. March 2013 at 13:19

This was Krugman’s long discussion of the issue in the New York Times Magazine in April:

“Earth to Ben Bernanke”

http://www.nytimes.com/2012/04/29/magazine/chairman-bernanke-should-listen-to-professor-bernanke.html

6. March 2013 at 13:30

Markets are volatile, they go up and down, they over-react. While I agree you cannot out-forecast them on average, it doesn’t mean that at any point in time they are a perfect forecast. All that chart says is that most market participants believe in some more inflation.

In 2006 they believed in 1% inflation over the following 10 years. You can argue that the BOJ changed and that it didn’t deliver (and I share that belief in part). Market should have seen that if it was really a perfect forecast at all times.

The previous target was 1%. So we from below the previous target to 20 bp above. Why is it not much closer to 2% if the central bank is so credible/powerful?

I agree that this is evidence of an effect. Conclusive evidence? I still think not…

6. March 2013 at 13:42

Krugman clearly believes that the Fed can technically increase inflation (for that matter, so does Bernanke), but he has argued that institutional/political constraints, and the “credibility” bogie, result in a self-fulfilling handicap. Sometimes Krugman assumes that his readers are familiar with this argument, so it can look like he believes that all Fed pathways terminate at the ZLB.

6. March 2013 at 13:52

To give him credit, Krugman’s not wrong that monetary policy is too tight, and pieces like the one on Bernanke are helpful. Krugman’s problem is that after the 1990s he became ideologically married to welfare state expansion irrespective of the economic merits. So his arguments tend to be along the lines of “monetary stimulus wouldn’t hurt, but since it isn’t very effective we really need fiscal stimulus.”

See, for instance: http://krugman.blogs.nytimes.com/2013/02/07/spending-cuts-and-monetary-policy/

http://krugman.blogs.nytimes.com/2012/06/26/deleveraging-monetary-policy-and-fiscal-policy-a-further-note/

There are dozens of similar pieces, these are just the first two that popped up on Google.

6. March 2013 at 15:09

Interesting argument TallDave. I have wondered why Krugman consistently neglects to mention his conditionals when promoting fiscal vs. monetary action. One would think that he would be frustrated by misunderstood arguments. But your hypothesis is a reasonable explanation.

6. March 2013 at 18:04

@TallDave

The short version of that story simply is that he always want goverment spending more. I has nothing to do with recession or montary policy. If montary policy would be on track, and/or there would be no recession he would argue for the same things just instead of calling them a fiscal stimulus they would be something like ‘investment in public goods’ or something.

6. March 2013 at 18:47

Krugman at least acknowledges that in the long-run we could have problems with ballooning growth in healthcare costs……

6. March 2013 at 19:48

Yep, Krugman is wrong, and rationality dictates he should become a market monetarist right now.

6. March 2013 at 19:53

Other ramifications: http://www.bloomberg.com/news/2013-03-06/harry-winston-japan-jewelry-prices-set-to-rise-amid-weaker-yen.html

6. March 2013 at 20:16

Is the “we can do nothing” crowd just bondholders?

How can the BoJ or the Fed not cause inflation, if that is that they set out to do?

Then we have the other side of the coin–the Fed cannot start inflation, but it can cause hyper-inflation. In fact any minute now.

I assume the “hyper-inflation is pending” are just hyper-hysteric gold nuts with their gold hoards.

Is it only Market Monetarists who believe the Fed can actually bring about reasonable growth and inflation, in the current context?

LIke Eleanor Roosevelt said, “Better to light a single candle….and make sure it is a very big and long candle, as this night is going to be a long one.”

6. March 2013 at 20:18

@nickik,

The interesting thing about Krugman is that in the 1990s he was actually quite skeptical of government spending. I suspect his evolution began when married Robin Wells in 1994 — he himself has stated that she actually originates many of his points, especially the more partisan ones.

6. March 2013 at 20:43

Saturos,

I actually sympathize with Krugman some. If the Fed actually committed to raising its core inflation target to 4% or committed to NGDPLT, then I’d be cool with government spending cuts.

But the Fed isn’t doing any of those things. So no, I don’t think we should have any big government spending cuts.

7. March 2013 at 06:05

Aidan, I had a debate with him (in our blogs) on this issue. I said the BOJ could inflate, he said they’d tried but failed. I claimed they don’t have to promise to be irresponsible. He says they do, and because central banks are conservative, they often can’t make that promose.

John, You said;

“I’m sympathetic with acarraro’s point about caution. Japanese inflation remained weak according to the data that came out in late February, in spite of the increase in your measure of inflation expectations, which began last year. The change in policy may have led to a change in expectations, but for those expectations to be justified the economy actually has to produce inflation.”

I certainly agree that the BOJ may not carry through with inflation. But that’s not the issue being discussed in this post. The debate here is whether the BOJ can impact inflation expectations. It can.

I agree that the inflation is likely to take a while to develop, if it happens at all.

Al, I agree that Krugman’s comments are confusing to many people. He draws subtle distinctions–one must pay close attention to the specifics of each comment.

Saturos, Just as the opera’s not over till the fat lady signs, the inflation’s not here until wages (or NGDP) start rising.

7. March 2013 at 08:48

OK, everybody’s got to admit the title on The Economist’s graph, “When doves fly” is pretty clever.

7. March 2013 at 09:16

[…] Scott Sumner highlights this chart from The Economist, crediting the respective central banks with rising […]