A hundred million millionaires?

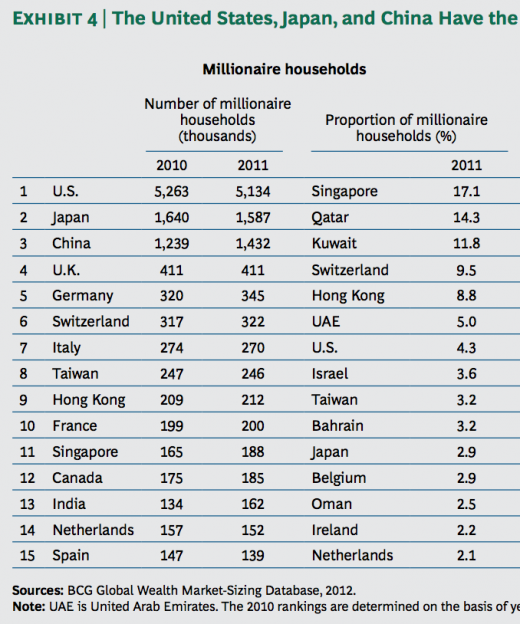

In the past I’ve often touted Singapore’s high saving model. Last year I noted that 15% of Singaporeans were millionaires in 2010, and I predicted that the number would rise sharply over the next few decades. The numbers for 2011 are in and the share of millionaires is up to 17.1%, nearly twice as high as the next “real country.” (Although I suppose one could argue that Singapore, Hong Kong and Switzerland are also not real countries, as they attract the rich from elsewhere. That would make the US number one among the bigger economies. But the number of millionaires in the US declined 2011.)

I would argue that this table actually understates Singapore’s success:

1. These numbers exclude housing wealth (which seems reasonable) but also excludes investor-owned businesses and luxury goods. So the actual number is somewhat higher–probably around 20%, even without housing wealth and luxury goods.

2. Many older Singaporeans grew up in a period where Singapore was much poorer. Thus if the current steady-state is maintained, the number of Singaporean millionaires should rise to 25% to 30% of the population, even without further rapid growth. The younger generation will eventually include many more millionaires.

3. This number ignores life-cycle effects, as do almost 100% of discussions of income inequality. These are huge. The number of very young millionaires will generally be much lower that the percentage of millionaires who are 50 or 60 years old, at least in the steady state (This is obviously less true of fast-changing countries like China.) So if Singapore ends up with a steady state of 25% to 30% millionaires, that steady state will imply that roughly half of all Singaporeans will be millionaires at some time during their lives.

This will make the Singaporean electorate much more “conservative” i.e. anxious to have government policies that preserve wealth. It will also allow Singapore to get away with a smaller set of social welfare programs, and lower tax rates. A virtuous circle of growth creating good economic policies, which will create even more growth.

Could the US do something similar? Should it try to create a country where 100 million people will become millionaires at some time in their lives? And another 100 million will at some point become $500,000 aires, or $600,000 aires, or $800,000 aires?

I’d say the answer is yes, but I would caution that it would be much more difficult to do. In addition to all the practical problems that will be listed in the comment section, I’d add that I expect rates of return on safe investments to remain very low going forward, even if the US government doesn’t force Americans into a Singapore-style high saving model. And of course if it does, then real interest rates will plunge even lower.

But I also think there is something to be said for going this way, even if it did depress real interest rates further. (I won’t insult your intelligence by explaining why Keynes’s fear that saving leads to depression is nonsense.) The advantages to conservatives are obvious–a more sensible electorate that is self-reliant, not dependent on government programs. But there are also huge advantages to liberals. This massive pool of saving would need useful outlets. There’s only so many more car factories or office buildings or shopping centers that could plausible be built. At some point the money would flood over (perhaps through public–private partnerships) into infrastructure, medical research, new energy alternatives, education, environmental cleanup and lots of other forms of “investment” that liberals favor.

What’s not to like?

Tags:

15. December 2012 at 11:31

“What’s not to like?”

The liberal answer: inequality

15. December 2012 at 12:10

Yeah, trickle down. Reagan was right. 🙂

15. December 2012 at 12:43

Is there any significant difference between Singapore’s “forced saving” model, and relatively low-paying social security as provided for e.g. in the UK? It seems to be largely a wash.

Also, having interest rates fall too low relative to the growth rate of the economy is not quite efficient. When this happens, the government can improve things by going into debt today and paying it off later, when the debt service is going to be a smaller share of the economy. This has the benefit of providing more safe assets when the private sector has a need for them.

15. December 2012 at 13:24

Where is Luxembourg? They have are ususally at the top of the list in percapita GDP, but not percapita millionaires? Curious.

15. December 2012 at 14:08

Why is Keynes’s fear that saving leads to a depression nonsense? Just to take the extreme; is his argument that it slows the velocity of money which causes the economy to shrink, thus increasing unemployment and a vicious deflationary/ high unemployment cycle would ensue?

15. December 2012 at 14:20

You forgot to mention the fact that Singapore has a universal healthcare system.

15. December 2012 at 14:47

Wouldn’t more savings in the US mainly reduce the current account deficit? That’s what it does in Singapore.

15. December 2012 at 16:40

High savings economies work only with massive current account surpluses (Singapore, Nordics, Germany, Switzerland, Japan [was]).

Plaza Accord anyone ?

15. December 2012 at 19:44

young lady, move West—all the way to Singapore.

15. December 2012 at 19:50

ahem .. if we’re measuring how well a nation is doing, a better measure would be how little poverty there is, or how low the incarceration rate is.

15. December 2012 at 21:05

Doug M

15. December 2012 at 13:24

” Where is Luxembourg? They have are ususally at the top of the list in percapita GDP, but not percapita millionaires? Curious. ”

Luxembourg GDP per capita is a statistical anomaly. A large part of their workforce don’t actually live in Luxembourg, they travel over the border from neighbouring countries. They contribute to GDP but are not counted in the population. To a lesser extent the same thing happens with Switzerland GDP per capita.

16. December 2012 at 06:28

Of course, assuming a constant 4% NGDPLT, we will all be millionaires one day…

16. December 2012 at 07:34

anon, I’d prefer to be forced to save, rather than be forced to pay taxes.

mijj, Even better would be to look at how many people want to move to that country.

16. December 2012 at 07:51

But isn’t the high saving the key here? Is America anywhere near achieving such a rational political economy? There is something dramatically different about the way that Singapore’s political system works at bottom. I tend to believe in path-dependence for these kinds of things, there are reasons why countries evolve in the directions they do. I expect Sweden, Norway, Switzerland to keep getting better and better, for instance. Whereas it’s doubtful America will have eg. real school choice in the next 50 years.

16. December 2012 at 08:45

There’s only so many more car factories or office buildings or shopping centers that could plausible be built. At some point the money would flood over (perhaps through public-private partnerships) into infrastructure, medical research, new energy alternatives, education, environmental cleanup and lots of other forms of “investment” that liberals favor…..

All I can say is “what universe” do you live in??

Give me one iota of proof this would work.. or how.. or when..on a useable scale..

AND as mentioned.. give “Medicare for all” and most of the problems disappear.. Business is no longer “burdened” by it.. At the same time just eliminate FICA as well.. THAT would surely stimulate the economy..

16. December 2012 at 09:28

According to Acemoglu, et al, we’re the pioneers who take the arrows (and everyone prospers for it);

http://www.voxeu.org/article/cuddly-or-cut-throat-capitalism-choosing-models-globalised-world

‘…the main implication of our theoretical framework is that we cannot all be like the Nordics! Indeed it is not an equilibrium choice for the cut-throat leader, the US, to become cuddly. As a matter of fact, given the institutional choices of other countries, if the cut-throat leader were to switch to such cuddly capitalism, this would reduce the growth rate of the entire world economy, discouraging the adoption of the more egalitarian reward structure. In contrast, followers are still happy to choose an institutional system associated to a more egalitarian reward structure. Indeed, this choice, though making them poorer, does not permanently reduce their growth rates, thanks to the positive technological externalities created by the cut-throat technology leader. This line of reasoning suggests therefore that in an interconnected world, it may be precisely the more cut-throat American society, with its extant inequalities, that makes possible the existence of more cuddly Nordic societies.’

It’s win-win!

16. December 2012 at 14:48

Yeesh, did the professor just Greg Ransom his readers with the dismissal of the “Paradox of Thrift”? There seems to be no value to such a statement except to appeal to the more intellectual servile parts of mind.

17. December 2012 at 07:47

Saturos, I’ve lived long enough to see things I never would have imagined (low inflation, welfare reform, deregulation of transportation, etc.) So never say never.

BTW, Lots of commenters seem to think this post has sonething to do with business cycles. It doesn’t.

17. December 2012 at 09:39

I doubt the number of rich Singaporeans will rise to the levels predicted in this article. In fact, there is some ambiguity – do they refer to citizens, or just anybody who lives in Singapore?

If they’re referring to citizens, any cursory look at alternative media will indicate a growing anger at increasing income inequality. Wages for many locals have remained stagnant for the past decade, including wages and salaries for many professional workers – we call them PMET here.

Also, projections in the future take into account a rapidly aging population, with its attendant increase in healthcare costs, which will probably consume huge chunks of wealth.

Finally, much of Singapore’s wealth/forced savings is locked up in CPF, and the lack of transparency is leading a lot of people to wonder if their money in CPF is as secure as the state keeps saying it is. For example, the 2008 financial crisis brought to light many failed investments (disastrous returns) as the state’s investments in many US financial institutions failed to yield returns when they collapsed.

A frank discussion of your article here:

http://www.tremeritus.com/2012/12/16/25-to-30-of-sporeans-to-become-millionaires/

17. December 2012 at 10:57

This massive pool of saving would need useful outlets. There’s only so many more car factories or office buildings or shopping centers that could plausible be built. At some point the money would flood over (perhaps through public-private partnerships) into infrastructure, medical research, new energy alternatives, education, environmental cleanup and lots of other forms of “investment” that liberals favor.

i.e. a series of catastrophic asset bubbles.

It can work in Singapore as they are a very tiny country. It can’t work in US as global capital markets wouldn’t be able to absorb capital on such a vast scale.

17. December 2012 at 14:41

If they keep printing money we will all be millionaires!

17. December 2012 at 17:37

Singaporean here – the data probably has a very generous interpretation of “Singapore”, as a commenter above has pointed out. You are assuming that there is a direct correlation between % of millionaire households and the high savings rates for Singapore citizen/permanent resident households (who pay into the Central Provident Fund). However, the government has always sought to attract wealthy non-Singaporeans, whose wealth probably do not come about via the same mechanisms (think people like Jim Rogers).

17. December 2012 at 20:37

Writing from Singapore also.

Don’t worry, it is a real country – it has a real army, air force and navy, and it controls its borders. But I doubt you can extrapolate it as a model. Renaissance Venice could only be Venice because it had unique advantages.

Singapore has its own worries, just different ones, primarily adverse demographics.

18. December 2012 at 00:55

[…] Millionäre in Singapur (themoneyillusion.com, Scott Sumner, englisch) 17,1 Prozent der Bevölkerung von Singapur sind […]

18. December 2012 at 08:36

It has become increasingly fashionable to extol the virtues of the Singapore model. Foreigners come to our country, zipping through our excellent airport, straight to downtown where all the glitzy new buildings and “Integrated Resorts” (casinos) are, and think they know all about Singapore.

What you don’t see is what Singaporeans, who live in the real Singapore rather than the expensive playground that our government has built to attract the rich, actually see on a daily basis.

Sights like these, where 70+ year old women go around collecting cardboard for 13 Singapore cents per kilogram (4.8 US cents per pound)

youtube.com/watch?v=T463nFtg3tg

Even the most hardened US libertarian would object to the Singapore model, if she really comes to understand it.

21. August 2013 at 23:14

One advantage of the blimp is that it can move freely

in the skies, there is no restriction to its movement

even in no fly zones. If you are looking for links of a certain size, especially for

an advertiser that does have many links, this really does save time.

Many working fishermen up and down Florida’s East coast, and really across the state and nation, continue to suffer economic hardships.

25. August 2013 at 18:10

[…] has also been linking to Scott Sumner’s writings about Singeaporean inequality. To Sumner, Singapore is great because Singapore is rich. That […]

26. August 2013 at 00:08

[…] of Singaporeans are millionaires. Holy […]

14. April 2016 at 23:59

According to the inaugural Wealth Report: Europe 2014, published by Julius Baer Group, 22.7 percent of Luxembourg (50,612) households owned a net worth of more than 1 million euros.