Another interpretation of the Mankiw policy simulation.

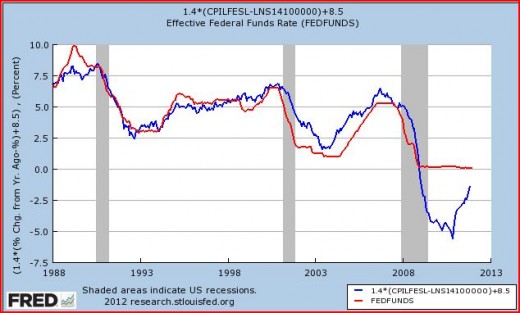

Back in the 1990s Greg Mankiw did a Taylor Rule-type simulation for the US economy. His estimated formula was:

fed funds target = 8.5 + 1.4(core inflation – unemployment)

Here’s what the graph now looks (courtesy of Eddy Elfenbein):

Paul Krugman recently re-estimated the equation using more recent data, and shows the optimal fed funds rate even further below the target.

He criticizes Mankiw’s comment that this suggests we are almost out of the liquidity trap. Marcus Nunes and some other market monetarists also seem upset by Mankiw’s post.

I actually have mixed feelings. I agree with those who say that raising rates in the near future would probably be a mistake. For quite some time I’ve agreed with Krugman that it’s likely we’ll exit too soon. That happened in the US in the 1930s, in Japan in 2000 and 2006, and in Europe just this past spring. Countries always seem to exit prematurely from the zero rate bound. Why should the current Fed be different?

On the other hand, it’s not clear to me that the model will soon call for rate increases. I could see unemployment being around 8% late in the year, and core inflation around 1.5%. If so, the formula would still call for negative 0.6% fed funds rates. (Ryan Avent makes a similar point.)

More importantly, this formula seems to show Fed policy was too tight ever since late 2008, which was precisely the market monetarist argument. I think this puts some separation between Mankiw and John Taylor. These two figures are regarded as future policy heavyweights in a Romney administration (although I don’t expect the GOP to take power until 2017.) If Bernanke is replaced in 2014, I could see either Mankiw or Taylor being offered the job. I’d prefer Mankiw, if my interpretation is correct (that he thinks money’s been too tight since 2008.) It’s possible he doesn’t feel that way, as the formula doesn’t account for QE2 and other unconventional policy techniques. But I have to think that if policy was on target in 2008 and 2009, we ought to have moved fairly briskly toward a situation where the fed funds rate needs to be positive. Obviously the progress has been agonizingly slow.

I probably should keep my mouth shut, as this blog is increasingly seen as offering a “liberal” take on monetary policy, despite the fact that my views haven’t changed since the 1970s, when NGDP growth was near 11% and I was a fierce inflation hawk. So if I endorse Mankiw that might make him less popular with some in the GOP (although I doubt many political operatives have even heard of this blog.) Of course if I were really cynical I’d wonder whether GOP hawkishness would still be in style once Romney took office and needed a booming economy to assure re-election in 2016. Let’s not forget the very conservative WSJ bashing the Fed for tight money in 1984, when inflation was 4%, or 2.8% higher than the average rate since September 2008.

But fortunately I’m not a cynical guy.

Tags:

13. January 2012 at 07:21

i disagree with both. The past is the past, estimating this tells us no more than what the Fed did in the past, how much weight (on average over this sample period) they put on output and inflation. period. The coefficients are sensitive to the time period, choice of inflation metric, i could go on and on – there are as many versions of this as there are economists (at banks, in consulting, in academia x3 because as we know all economists have 3 hands)

ultimately, policy is endogenous and the taylor rule weights on inflation/unemployment are different under NGDP targeting (and probably dynamic, depending on your view of the phillips curve). So all this equation tells us is that if the Fed follows past policy it will (maybe, depending on specification) raise rates. Its a policy prediction, nothing more, based on the past. It does not say if the fed should raise rates! It does not say IF the Fed should be doing more QE to get us back to potential. All this equation says is that the Fed did not do so in the past, which we already know!!!!!

As for who should replace Bernanke, my vote is for an obsure economist from Bentley.

13. January 2012 at 07:25

… and this is also completely useless if the Fed adopts an inflation target by the way. again, policy is endogenous. personally i think both mankiw and krugman get a D- for not appreciating this.

13. January 2012 at 07:26

As we’re doing hypotheticals, Scott, who would you like to see appointed if Bernanke were gone if you could choose your best choice and why?

As you think but are not sure that Mankiw thinks monetary policy has been too tight I’m presuming you’d rather someone for who there is no doubt on that score.

Speaking for myself I certainly wouldn’t choose either of them as my first choice but maybe Mankiw with a gun to my head. Taylor for me is the reason the Fed remains so preoccupied with inflation to the present day.

The main reason I like the idea of NGDP targeting is I presume it would be considerably different than the Taylor Rule. However reading Morgan makes me wonder… LOL

Still in my mind at least there is something pretty paradoxical about Mankiw as a Republican Keynesian-New or otherwise.

13. January 2012 at 08:04

ROFL.

“I probably should keep my mouth shut, as this blog is increasingly seen as offering a “liberal” take on monetary policy,”

That’s because you intentionally bury the lede.

You don’t want it to be the lede, but it is.

Under Scott Sumner’s 4% level target of NGDP, we will have less inflation then we have had previously, and we will fire lots of public employees.

Then less interesting: we will also reduce unemployment.

13. January 2012 at 08:05

Intrade puts the chance of an Obama victory at 51%, having swung between 68% and 46% over the last 8 months or so. I don’t know that I’d be willing to put money down on either side of this bet.

“But fortunately I’m not a cynical guy.”

Certainly, the fact that Mankiw backed down from an aggressive stance supporting additional monetary (and even fiscal) action from 2008-2009 wouldn’t change your opinion, right?

I don’t blame Mankiw – blogging is dangerous for anyone who hopes to go into politics. All things considered, he’s been more straight-shooting than I would have expected.

Taylor, btw, is a complete hack. You should be very much against Taylor at the helm of anything…

http://uneasymoney.com/2011/12/03/john-taylors-obsession-with-rules/

13. January 2012 at 08:08

Also (sorry, separate post because a second link)

http://mobile.bloomberg.com/news/2011-11-02/goldman-idea-could-let-inflation-out-of-the-bottle-amity-shlaes

“Taylor’s Reform

Taylor says he would like to see reform happen in this order: 1) Congress enacts a single mandate for price stability; 2) Congress enacts reporting requirements for the Fed on what its strategy or policy rule is; and 3) the Fed picks a strategy relating to money and interest rates and tells the public what that strategy is.

Friedman, in turn, noted in “Capitalism and Freedom” that any goal or target set should be one that Fed authorities have the “clear and direct power to achieve by their own actions.” That is, not something big and ephemeral such as a higher GDP growth rate. Friedman recommended a “legislated rule instructing the monetary authority to achieve a specified rate of growth in the stock of money.”

One distinction here is mandate. In both the Taylor and Friedman plans, the Fed’s mandate narrows to money alone. In both of them, there is less discretion, not more, for the Fed.

Managing Expectations

To be bold in the way the NGDP fans would like is to risk destroying the very legacy that Romer praises — that of Volcker. In his day, Volcker did such a convincing job reducing the expectations of inflation that mortgage interest rates came down and continued to drop long after he left office.

To signal that you don’t care very much if inflation accelerates, which the NGDP target plan does, invites citizens to change their expectations about inflation. That, in turn, will raise interest rates far above any currently contemplated.

It’s surely important to have rules and targets, but not more discretion masquerading as a rule called the NGDP target. Here’s hoping this particular abbreviation remains locked away in the economists’ closet.”

I think you’d have a better chance getting Krugman on your side than John Taylor – he’s basically kicked sand in your face. And he seems (like the author) to be of the opinion that an NGDP target is “not something Milton Friedman would approve”. I don’t think there’s any single non-policy figure who has had as much influence in putting a bullet through the head of NGDP targeting than Taylor.

We hates him. Yesss, we do.

13. January 2012 at 08:37

dwb, I agree with everything except your replacement for Bernanke.

I think Krugman would agree that this procedure doesn’t tell us when to raise rates.

Mike Sax, Robert Hetzel.

There are lots of Republican new Keynesians. New Keynesianism is not a “liberal” ideology.

Morgan, Did I say 4%.

Statsguy, I can’t figure out why Taylor started favoring an inflation target, that’s what got us into this mess.

13. January 2012 at 09:02

“Countries always seem to exit prematurely from the zero rate bound.”

Certainly true as a generalisation, but probably not in the case of the UK, where bank rate wasn’t raised until 1948 (excluding a brief psychologically-orientated rise at the outbreak of war in 1939).

However, because the UK’s monetary policy arrangements in that period, bank rate was arguably of relatively little importance. Still, monetary policy wasn’t tightened in 1948 (when the incompatibility of controlling nominal expenditure and controlling nominal interest rates won out over government policy) and this was arguably too late, since NGDP hit 9.8% in 1948, though it was also true that loose monetary policies helped avoid a post-war slump at a time when the government was tightening fiscal policy dramatically near zero-bound. Monetary policy always wins!

13. January 2012 at 09:54

I really hate the Taylor rule. Why use LTM Core inflation? Why not use TIPS breakevens? Is it a belief in cost-push inflation or “anchoring”? I bet if you used TIPS breakevens the policy became too tight in mid 08 rather than late 08.

As for politics, you can’t win. Either you choose politics and forgo intellectual integrity or you choose intellect and forgo politics. My liberal friends accuse me of being a heartless conservative and my conservative friends accuse me of being a commie liberal.

13. January 2012 at 10:14

I am cynical and I think that is exactly what will happen. If Romney wins the GOP will stop talking hard currency and inflation and talk job creation. There will be a dog and pony show jobs bill but the real lifting will be done by the Fed. I can see this as clear as day. Am I too cynical?

13. January 2012 at 10:48

At 3-4% level NGDP, Amity Shlaes doesn’t write her article.

At 3-4%, there is no risk that consumer expectations change.

3-4% level targeted = KING DOLLAR.

Winning over the Shlaes of the world is the way no one calls you too liberal.

—-

Just start your mid-November, “Morgan was right” blog post right now Scott, then once a month you can open it up and add even more words of regret and dismay at the error of your ways.

Benny,

ROFL. That’s not cynical, that is reality.

Naive is you pretending money and monetary policy are some kind of tool for Democracy.

Benny, listen up, if the GOP spending all the money puts the Democrat President in a position to cut like Bill Clinton or else get trounced like Obama, if the Fed naturally prefers to see only certain kinds of Fiscal Spending (tax cuts), if the Fed can neutralize crazy weird artificial Dem spending with monetary policy… that is proof you are pretending the rules of the game are different than they are.

No one ever said the Fed wasn’t going to be independent – which means not in favor of Democrats.

No one ever said the GOP wouldn’t become profligate tax cutters and big pharma / military industrial complex supporters, JUST SO, the Dem can’t pay off their voters with more free shit.

There are ways for Dems to win (or lose less) under the real rules of the game, but pretending the over-riding game play is Democracy – ain’t it.

13. January 2012 at 11:23

Scott, forget about Mankiw…I share Marcus’ view – he is just a New Keynesian. My candidate is the professor from Bentley University…You sir!

13. January 2012 at 13:56

More top-knotch blogging by Scott Sumner. Excellent.

13. January 2012 at 15:21

Scott, concerning the weak recovery in the UK economy David Eagle has a much better explanation than PSST.

Even if you accept that the Bank of England is targeting NGDP you should acknowledge that BoE is targeting the GROWTH of NGDP rather than the level. As David Eagle shows targeting NGDP growth is nearly as bad as inflation targeting.

With growth targeting monetary policy is tightened much earlier than with LEVEL targeting and this obviously is reflected in expectations.

David’s research that the speed of recoveries in the US economy to a very large degree can be explained by whether the Fed has targeted growth or the level of price or NGDP.

I am pretty certain that the UK economy if the BoE read David’s research and acknowledged the problem with NGDP growth targeting and instead implemented a NGDP LEVEL target.

13. January 2012 at 15:22

Oops wrong post…

13. January 2012 at 15:33

[…] Mankiw discussed it here which drew a response from Paul Kurgman. Ryan Avent, Matthew Yglesias and Scott Sumner also added […]

13. January 2012 at 18:08

You can do it the Oz way: stabilise nominal income while pretending you are doing inflation targeting, because your inflation target is an average over the business cycle.

13. January 2012 at 20:17

W. Peden, Good point.

Steve, I agree about the Taylor Rule.

Benny, When it comes to politics it’s pretty hard to be too cynical.

Shlaes is a historian, not an economist, much less a macroeconomist.

Lars, Thanks, but no thanks.

Lorenzo, I agree about oz.

13. January 2012 at 21:13

“Benny, When it comes to politics it’s pretty hard to be too cynical.”

This sounds like an Ambrose Bierce quote.

14. January 2012 at 07:10

Thanks Benny.