Even if I’m wrong, I’m right

You might wonder how I can sleep at night knowing my policy proposal, if enacted, might simply lead to higher inflation, without creating any jobs at all. My answer is very simple. Even if I knew that dismal outcome would occur, I’d still favor monetary stimulus. I believe steady growth in NGDP is optimal, even if fluctuations in NGDP don’t affect employment. But let me explain my reasoning using the more familiar inflation targeting criteria.

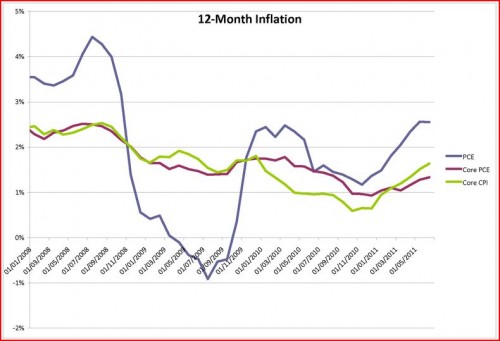

As you know, the Fed has a dual mandate, stable prices and high employment. They’ve generally assumed that stable prices mean roughly 2% core inflation, for complicated reasons. And core inflation has been around 2% during recent decades. If you favor inflation targeting, you’d like it to stay at that level, as inflation instability can cause problems for the economy. So how’s the Fed doing? Here’s a graph I found at Stephen Gordon’s web site:

So both measures of core inflation have run below 2% since the end of 2008. I also tried to estimate inflation expectations from the TIPS market, which isn’t easy. I found a TIPS yielding negative 1.05%, due January 2014. Regular T-notes due at that time yield about 0.25%. So 1.3% seems a ballpark estimate of inflation over the next 2 and 1/2 years.

This, or course, would be what you’d expect if the Fed’s dual mandate were stable prices and high unemployment, not high employment. If the Fed didn’t care a bit about the suffering of the unemployed, and was a strict inflation targeter, we’d have 2% inflation. Instead we are in the middle of five years of sub-2% inflation. Why is that? One theory is the Fed is sadistic. It’s willing to miss its inflation target on the low side if it can inflict suffering on the unemployed. I admit it’s acting as if this were true, but we all know it’s not true. Another theory is that the Fed is helping the bankers. But as we saw in recent weeks, slower NGDP growth hurts the banks too. My theory is that this big, highly sophisticated institution employing many of the brightest monetary economists on the planet, made a big boo boo. Needless to say I’m the only one who believes this theory.

But whatever your views, the Fed is in a position where if it does more monetary stimulus in an attempt to speed the recovery, and totally fails to create a single new job, the policy will still be smashing success. It will still move core inflation closer to its 2% target.

And that, my friends, is why I can sleep comfortably at night. I am proposing a policy that literally cannot fail.

When there are $100 bills on the sidewalk, they should be picked up. And when printing $100 bills (for 5 cents) and injecting them into the economy might create lots of jobs, and will not increase the national debt, and might reduce the budget deficit, and will definitely move us closer to the Fed’s definition of price stability, why would we not want to print those $100 bills? Are we a bunch of masochists?

Tags:

17. August 2011 at 17:53

Increasing inflation (compared to expectations) is a transfer from creditors to debtors. This country has way more debtors than creditors, given concentrations of wealth, therefore the change helps a lot of people.

>>Are we a bunch of masochists?>>

We also have a solid contingent of sadists who think tight money is to their benefit. The later group has much more political power than most people.

17. August 2011 at 18:10

foosion

I very much agree. The deflationists are sadists. Larry Kudlow and now Rick Perry really do squirm at the pure pleasure of the thought of cutting spending on and smashing the lives of the poor. They really do. Just watch Richard Shelby when he talks. Or read George Will – if you can stand it.

Personally that is what I think a lot of all this really is. Pure sadism.

You know what they say:

Why do Republicans like recessions (depressions)?

Because recessions lower the price of maids. waitresses, and whores.

17. August 2011 at 18:23

Or Rick Santelli from CNBC

The other night he (blushingly) said that he really likes the idea of debt deflation as a kind of “involuntary enema”. He really did say literally that. The purest kind of sexual sadism.

For the deflationists – well they already own quite enough currency themselves – so their highest marginal unit of pleasure does not come from getting another dollar for themselves, but rather from thinking about the begging the poor must now do to get any dollars at all.

I really do think that John Taylor thinks like that. What other explanation could there be for his completely ignoring his own work?

To some extent I am of course being rhetorical here. But I certainly did hear Santelli say what I said he said. And I am very sure of my reading of Kudlow’s smirk and smile when he speaks of he joys of king dollar and deflation.

17. August 2011 at 18:24

JimP, the maids and waitresses can earn more than they do now, and we can spend less on their services.

Read up:

http://biggovernment.com/mwarstler/2011/01/04/guaranteed-income-the-christian-solution-to-our-economy/

17. August 2011 at 18:26

“I’m the only one who believes this theory”

No theory. Patently accurate.

17. August 2011 at 18:30

Another theory is that the Fed is helping the bankers. But as we saw in recent weeks, slower NGDP growth hurts the banks too. My theory is that this big, highly sophisticated institution employing many of the brightest monetary economists on the planet, made a big boo boo.

Three years of continual, hardened, bound and determined boo boo can go unexplained but a couple weeks full of legitimately bad news outside Fed control is enough to safely dismiss the fairly obvious explanation?

Yes, slower NGDP growth would hurt, but the monetary policy solution would require ending the banks’ free lunch. Which would also hurt.

17. August 2011 at 18:38

Didn’t you hear, though, the Fed has switched from targeting core inflation to targeting the spread on 5-year TIPS? Because they think core inflation is biased on the low side, given the secular rise in food & energy prices since 2004, due to peak oil. So, they are targeting medium-term headline CPI expectations now, aiming to keep them slightly below 2%.

Not making this up 😉

17. August 2011 at 18:46

I think it is worth pointing out that under inflation targeting, the FED would likely be targeting 2% TOTAL inflation. Core is generally used as a guide to achieving that target because it filters out the noise.

This doesn’t refute the point of your post, though. Its not like headline inflation is through the roof, and there is even a case to allow for a higher inflation target at this time.

17. August 2011 at 18:59

I’m thinking the helicopters are down for maintenance 😉

MMTers would say the Fed isn’t increasing inflation because they are unable to do so. Moving money from one box at the the Fed to another box at the Fed is not going to increase the money supply. Perhaps this is an explanation you should consider.

17. August 2011 at 19:08

If I understand money at all, then if the Fed usually targets a 2% inflation rate, any rate below that is equivalent to deflation, as it represents a lower money supply than anticipated. I guess things are worse than I thought.

What I don’t understand is why we expect central banking to do any better than central planning. It’s one thing I’ve never understood about Milton Friedman. Why all the fuss about competitive markets, but not competitive production of currency? Isn’t currency just another good people are trading for? Maybe I’m too Hayekian in my thinking.

17. August 2011 at 19:13

This man wants to stabilize the stock market.

http://www.frbsf.org/economics/conferences/1106/Farmer.pdf

17. August 2011 at 19:15

Perhaps this is politics rather than economics at the Fed.

Perhaps the Fed’s implicit goal is to sustain high unemployment as long as the wrong political party is in power.

Perhaps Rick Perry will be in favor of monetary stimulus by the Fed after he’s been sworn in.

I think this explanation is more feasible than downright sadism.

I am just kidding with the speculation above as I truly believe that even the ‘inflation hawks’ are really trying to do what they think is best for aggregate welfare. On the other hand, when I read some of the comments on this blog (particularly those by one commenter), my crazy theory suddenly starts appearing somewhat plausible.

17. August 2011 at 19:20

Where I belong I’m right, where I belong

17. August 2011 at 19:25

“If I understand money at all, then if the Fed usually targets a 2% inflation rate, any rate below that is equivalent to deflation…”

So if I have a target of increasing my income 2% per year, and it only increases 1%, then it has actually gone down?!

17. August 2011 at 19:35

Scott wrote:

“When there are $100 bills on the sidewalk, they should be picked up. And when printing $100 bills (for 5 cents) and injecting them into the economy might create lots of jobs, and will not increase the national debt, and might reduce the budget deficit, and will definitely move us closer to the Fed’s definition of price stability, why would we not want to print those $100 bills? Are we a bunch of masochists?”

No doubt. And I think Romer (via Krugman) agrees:

“But World War II has something to tell us here, too. Because nearly 10 million men of prime working age were drafted into the military, there was a huge skills gap between the jobs that needed to be done on the home front and the remaining work force. Yet businesses and workers found a way to get the job done. Factories simplified production methods and housewives learned to rivet.

Here the lesson is that demand is crucial “” and that jobs don’t go unfilled for long. If jobs were widely available today, unemployed workers would quickly find a way to acquire needed skills or move to where the jobs were located.”

http://krugman.blogs.nytimes.com/2011/08/15/oh-what-a-lovely-war/

Weird how demand stimulates supply, huh?

I don’t have time to acknowledge every intelligent reply these days because:

1) My county is harrasing me about the condition of my house’s gutters. They seem to be under the mistaken perception that my house alone is the primary reason for the decline in real estate values in the entire state. (I’ve tried argueing with them based on my expertise in macroeconomics but they’re not buying it.)

2) I’ve been offered the opportunity to teach math at the UD this fall in addition to teaching economics at Rowan. Thus I’m doubling up on adjunct fees. (Moreover, evidently, I need the money as my county expects me to fix up my house, because I’m the one who’s primarily responsible for the state’s falling real estate values.)

3) My dissertation adviser is getting very anxious as to whether I will ever finishing my PhD. He thinks my thesis is incredibly important. (I wonder why?)

17. August 2011 at 19:44

Excellent blogging—top drawer.

On top of everything else, even if all we got was inflation, that would help develerage the economy, and especially real estate owners, thus helping banks.

BTW, most small business can only get loans based on collateral. But your employees, equipment and even yourself are usually worth nothing. Your property is collateral.

Okay, so property appreciates, then small businesses can get loans. If it deflates, you cannot get loans. Factoring has just about died.

I won’t even get into the national debt, but delevering through inflation is not the worst thing that would ever happen.

Or, conversely, we could say the most important thing was that drug-lords, who keep large amounts of cash, lose no purchasing power on their hoards. You know, why should inflation get in the way of financing that next hit? You think running an narco-drug empire is easy?

(Eureka!–I discovered who is behind all the blabber about not debasing the currency—drug-lords who have hired PR firms!).

17. August 2011 at 20:02

At least no politician was called evil in this post.

17. August 2011 at 23:55

OK, for the sake of the debate, I will take up the baton for the anti-inflationists (by the way I am only partly in their camp, you sing a seductive song). Here is the argument anyway;

Scott, we can both agree hyper-inflation is really, really, really bad. It destroys countries and starts wars. The belief in fiat money is like the belief in banks, it works as long as everyone believes it works. When that belief is lost, all is lost. In every case the inflation was caused by printing money. None of those countries started printing money because they wanted to cause hyperinflation, they all started a little bit at a time, to deal with a small local difficulty and I am sure they all promised themselves that as soon as the problem was over they would stop. But they didn’t. We have many examples of this.

OTOH deflation is only bad. We have only one example of deflation in a fiat currency regime, Japan, and honestly, Japan is not really that bad. In many ways, the reduction in prices was needed. Unemployment was actually lower than in the US for most of the deflationary period.

So, shouldn’t we err on the side of deflation and avoid printing money for now? I know you think we are miles away from stoking inflation, but even the charts above show we are actually above target for PCE inflation and only slightly below on core. Why take the risk and set such a bad precedent for such a small deviation? I mean the US is not actually officially even in recession, never mind depression. What’s the emergency?

Add to this that you might be wrong (yes even economists can be wrong) for reasons you don’t know yet (plans never survive contact with the enemy, and unintended consequences are rife). Isn’t the properly conservative approach to take things slow and only use conventional methods until we really know we have a problem?

18. August 2011 at 00:07

Scott,

.

The US has had episodes where the employee/consumer status was a very unhappy one. I remember in my first job in the US, in the early 1980s (high misery index time) my research economist telling a joke he ascribed to Milton Friedman: “How to get rid of poverty? Tax the poor. Because whatever you tax, disappears. Since the US hardly taxes the rich (but that is not unique to the US, fortunately) poverty will disappear if you give it some time, and with it the unemployed.

No doubt, by emphasizing the inflation component -even where inflation feigns to be subsiding- of the Fed mandate as a short term priority and the employment one as a very long term one (and in the long term there is no unemployment unless you are a Keynesian or worse), people like the Fed dissenters are heroes. They sacrifice popularity among economists to do the right thing for the economy -as they see it. Did not the Philips curve say that the best way to curb inflation is to maintain a healthy level of unemployment? Or am I a bit simplistic here?

18. August 2011 at 00:18

“My theory is that this big, highly sophisticated institution employing many of the brightest monetary economists on the planet, made a big boo boo.”

The only reason for doubt I can point to is that after all this time has gone by, and straight out admission on more than one occasion by Bernanke himself that they made a boo boo, one would think they’d be falling all over themselves to fix it given the severity of the consequences. “Instead [of fixing the boo boo, however,] we are in the middle of five years of sub-2% inflation. ”

After more than a century of research in macroeconomics is available on line from sometime blogger professors, at the library, in book stores, and on Amazon.com, is there really any excuse for continuing down this path when a large portion of the answers have been said to lie mostly in reasoning that comes in basic macroeconomics textbooks? And what about the stubborn persistence of IOR when there’s plenty of scholarship available that says it’s a pretty dumb idea? These are rhetorical questions, of course; I don’t expect anyone to try to defend the indefensible. If these people are “the brightest monetary economists on the planet,” maybe it’s not such a mystery why there’s so much global economic chaos and contagion.

18. August 2011 at 00:24

You might be interested in the fact that the swiss central bank is trying negative rates.

The market is trying to decide if they will manage, but they are offering funding through FX swaps at the equivalent of -1.45% all in a bid to weaken the currency (or stop appreciating). They might impose negative rates on o/n deposits soon (maybe later today). 2y swaps are -13 bp, 2y govies -9bp. So actually US short rates are quite attractive.

It’s a brave new world…

18. August 2011 at 01:07

Actually not so new. I just read on a bank research piece that they imposed 2% a quarter tax on non-domestic deposits for a long time in the ’70 (again to avoid appreciation since everybody else had inflation I think).

Maybe there is no zero bound…

18. August 2011 at 02:08

Richard Fisher disagrees:

“Fed’s Fisher: Businesses Need Regulatory Clarity, Not More Monetary Stimulus”

http://blogs.wsj.com/economics/2011/08/17/feds-fisher-businesses-need-regulatory-clarity-not-more-monetary-stimulus/

18. August 2011 at 02:56

I support a GDP target too, but not because the Fed has been a tad behind on its inflation target.

Inflation is a bad thing, but if productivity grows slowly than trend, higher inflation is the least bad option. (And if productivity grows more than trend, disinflation or deflation is the least bad option.)

In other words, using monetary policy to offset the effects of productivity shocks on the price level causes more harm than good.

If inflation (or expected inflation) was more than 2%, then that would be unfortunate, but the least bad outcome, assuming GDP was on either on or returning to the target growth path.

Now, if GDP was rising above its target growth path, and inflation was rising, then that would be very bad. More or less as bad as GDP being below its target (well, what we wish were its target) and inflation falling.

18. August 2011 at 03:11

Scott,

Here are the SAAR’s for nominal Final Sales to Private Domestic Purchasers during the recovery:

3Q09: 4.0

4Q09: 2.1

1Q10: 4.0

2Q10: 5.4

3Q10: 3.5

4Q10: 6.0

1Q11: 5.6

2Q11: 4.0

So if we strip out the noisy components of inventories and trade, as well as govt, which I hope you’d agree monetary policy can’t do anything about, we’re running at pretty darn close to a 5% rate at what I’d call “core GDP.” (I think this accoutns for something like 83% of the total, btw).

Of course, in the last two quarters, the deflator has risen quite sharply, so we’re getting more price increase and less real increase. But there’s hardly anything concerning about the trajectory of nominal demand here.

So why would need more easing?

18. August 2011 at 03:56

@Steve – the lack of regulatory clarity argument makes no sense.

Any sensible business faced with demand for its product or service that it can profitably sell will produce more. If regulations change to make its production unprofitable, it will cut back.

A possible exception is if additional production would require extensive investment in capital equipment, but that’s not today’s situation.

18. August 2011 at 04:08

Growth path, not growth rate.

GDP is 14% below the trend of the Great Moderation.

If it grows at 5% forever, it will never catch back up.

The growth path

By the way, monetary policy can impact trade and government spending. It impacts state and local spending much like it impacts private spending. I suppose it could impact Federal spending in the same way too, but I suspect that by reducing the interest in fiscal stimulus, it would have the opposite effect.

18. August 2011 at 04:47

Given the amount of excess reserves, would the Fed need to stop paying interest on reserves in order to deliver monetary stimulus?

18. August 2011 at 04:51

Interest on reserves is currently 0.25%. That’s about the same rate as 2.5 year treasuries.

18. August 2011 at 04:54

The problem here, speaking as your somewhat average voter, is how is one supposed to know who is right? I just listened to Art Laffer on CNBC and his views are the exact opposite of yours – he says it’s math, not religion, yet the numbers as he sees them say one thing and you think they say something else – how is a nonspecialist like myself supposed to figure out who is right? People like yourself need to find a way to make your points in the simplest way possible cause it’s starting to look come Nov 2012 we’re all just gonna flip a coin in the air and hope for the best. You obviously don’t like Perry – but I’m guessing Ryan you would also hate since he’s from the Laffer camp?

18. August 2011 at 05:14

AC,

They can always use QE to flood banks with cash above their new demand-for-cash, but this is a problematic approach for the Fed’s balance sheet (it’s an unnecessary expansion of their asset holdings) and it runs the risk of overstating the required size of QE for future generations.

Were I appointed King of the Fed tomorrow, my first action would be to stop paying IOR and see what happens, then start thinking about whether expansionary/contractionary OMOs were necessary.

18. August 2011 at 05:19

Bill Woolsey,

“(And if productivity grows more than trend, disinflation or deflation is the least bad option.)”

What convinces you we’ll have the political will for this.

Has this crisis terrified us enough to piss on future booms?

18. August 2011 at 05:26

Scott,

Some more TIPS data:

5YR TIPS yields -0.85%, 5YR T yields 0.85: Implied inflation of ~1.7%

10YR TIPS yields 0.02%, 10YR T yields 2.06%: Implied inflation of ~2%

30YR TIPS yields 1.02%, 30YR T yields 3.44%: Implied inflation of 2.4%

Still can be interpreted that we are “below target” now, and “above target” 5 yrs from now, but it’s not as extreme as you suggest.

18. August 2011 at 05:44

IOeRs should be replaced with higher reserve requirements. Once again, contrary to Milton Friedman, legal reserves are not a tax under fractional reserve banking.

And if consumers are given the opportunity to refinance their homes under policies that encourage lower mortgage rates, then they should also have the option of refinaning their usurious credit card interest rates. The repeal of usury rates under Volcker was contrary to proper public policy.

18. August 2011 at 06:20

TIPS / inflation expectations data

There are two problems:

1) For 5 years and shorter, there’s a circularity problem. The 1.7% inflation expectation really embeds a high probability that the Fed does more and a low probability that the Fed adopts an attitude of indifference.

2) For 30 year TIPS, the 2.4% expectation reflects a concern about regime change. Inflation targeting probably won’t be popular in academic circles any longer. Academic theories always change once a new generation of economists takes over. The alternatives run the gamut from hard money, to NGDP targeting, to employment targeting, to outright debt monetization.

18. August 2011 at 07:54

foosion and JimP, I guess I’m naive compared to you.

Flow5, Now there are two of us.

MikeDC, If tighter money hurts the banks, slightly easier money probably helps. That’s how bank stocks reacted to QE2, isn’t it?

Doug, If only they’d targeted 5 year spreads in Sept. 16, 2008, maybe we wouldn’t be in this mess.

Mik, My understanding is that they target overall inflation forecasts (now 1.3%), and use core inflation when looking backward, and trying to predict future trends. Both indicators are below 2%.

Greg, I considered it and quickly discarded it for reasons that Nick Rowe ably identifies in another recent thread.

But even if true, it wouldn’t explain the Fed’s passivity–they believe they can raise inflation, they simply aren’t taking the actions that they believe might effectively raise inflation. Why not?

Jameson, Suppose the pilot and co-pilot both die of heart attacks. The stewardess is now piloting the plane. Would you refuse to give her advice because “stewardess’s shouldn’t pilot planes?”

JimP. I recall he had that idea in 2008. It’s not the best way, but it’s also not the worst.

Primed Primate, I think I know which crazy commenter you are referring to.

Mark, Forget the gutters, finish that dissertation.

Ben, Good point, I forget about the fact that it would ease the debt crisis too.

Disgrunt, As far as I recall, I’ve never once personally insulted someone (in my blog) who didn’t personally insult someone else.

Chris, You said;

“Scott, we can both agree hyper-inflation is really, really, really bad. It destroys countries and starts wars.”

No we can’t. The German hyperinflation did significant damage to the economy and didn’t start any wars. The subsequent deflation destroyed the German economy and directly led to WWII. Deflation is far worse than severe inflation. And mild deflation is far worse than the sort of mild inflation that is the worst case scenario for the US. There’s no way the Fed ever allows 10 year TIPS spreads to rise above 5%.

You said;

“What’s the emergency?”

9.1% unemployment is the emergency.

Rien, You don’t get it. The doves are emphasizing inflation, not the hawks. The doves are the ones trying to produce price stability as defined by the Fed, the hawks are moving inflation away from the Fed’s definition of price stability. They are ignoring the inflation target.

BTW, the American tax system is more progressive than European tax systems.

Bonnie, You obviously have the stronger argument, but I have trouble believing these guys are sadists.

A Carraro, That’s different, as it applies to bank deposits, if I’m not mistaken. It doesn’t overcome the zero bound.

Steve, We need both.

Bill, I agree, but I decided to do this post from the Fed’s perspective. Showing they weren’t even doing the right thing from their own perspective.

Throwback, First of all, I favor a NGDP growth target, not final sales. Second, I favor level targeting. NGDP fell 9% below trend between mid-2008 and mid-2009. Since then it’s fallen another 2% further below trend. That’s no way to “recover.”

AC, It doesn’t have to, but that’s one way to do it. Setting an explicit NGDP or price level target path is another.

foosion, Yup, we’ve inverted the yield curve out to 2.5 years. What does that imply about growth?

Carl, I don’t hate Laffer or Ryan–I agree with them on many issues–just not monetary policy. Ironically Laffer was influential in the formation of my futures approach to monetary policy.

Master of None. Yes but policy today should address inflation today and in the near future. Policy 5 years from now should address inflation 5 to 10 years from now.

flow5, Usury laws are horrible, they lead to black markets.

Steve, I agree, that’s one reason I cited the 2.5 year inflation forecast.

18. August 2011 at 10:02

“Jameson, Suppose the pilot and co-pilot both die of heart attacks. The stewardess is now piloting the plane. Would you refuse to give her advice because “stewardess’s shouldn’t pilot planes?””

Thanks for the response. I don’t mind a pragmatic approach at all, I’m just interested in knowing what the more ideal system is. It seems like they should always go together, as in, “Well, ideally we should do X, but since that’s a little out of reach, let’s do Y…”

18. August 2011 at 15:30

Scott

I thought before you went on break you said you were going to come up with a “greatest hits” list or something so that newbies could link to your most important (blog) writings without having to wade through all of them. Is that still a possibility? I think you’re probably getting more traffic than ever and it would help.

18. August 2011 at 16:42

Jameson, I did do a post explaining how and why the market should determine interest rates and the money supply, not the Fed. But I don’t keep repeating it each time.

Brian, Yes, but I just haven’t had time. The blog is now so large it’s hard to find things. I’ll try to do so at some point.

19. August 2011 at 14:00

> slower NGDP growth hurts the banks too

Yes, but it doesn’t hurt the *bankers,* and it probably doesn’t hurt the banks in the long run, assuming it’s accompanied by low inflation.

Inflation reduces the buying power of creditors, and increases the buying power of debtors. (The ability to buy real things that have human value.)

Creditors hate inflation for its effect on financial assets more than they love growth for its effect on real assets.

Foosion gets it totally right in #1:

> This country has way more debtors than creditors, given concentrations of wealth

And the creditors have the power.

Suppose we change the terminology? Creditors are “hoarders” and debtors are brave risk-takers.

19. August 2011 at 17:23

Steve, Let’s not change the terminology, as it’s only misleading. The rich and powerful of this country would greatly benefit from monetary stimulus–they would become much wealthier–it’s as simple as that. The unemployed would also benefit.

22. August 2011 at 13:34

[…] here’s Scott in a post titled, “Even if I’m wrong, I’m right,” showing that we dare not try to paint him into a reductio ad absurdum, because he’s already […]

23. August 2011 at 02:11

So your advice to this stew–ahem–flight attendant is? Keep the wings level and just keep cruising? Not Set her down as best you can and walk away?

10. September 2011 at 08:12

Tom, As long as she insists on flying the plane, I’ll keep telling her how.

I’m also telling her how to set the plane down (in other posts.)

23. May 2013 at 06:22

[…] made similar observations over the years, but even more forcefully. The Fed has undershot its inflation target over the […]