Anatomy of a confused market (why real time data is essential)

Cameron sent me this valuable data, which I will use to analyze the market reaction to Tuesday’s Fed announcement:

The S&P :

http://www.google.com/finance?q=INDEXSP%3A.INX&hl=enZoom in on 5 day or 1 day and you’ll get even better than 15-30 minute intervals.

I can’t find yields yet, but here are prices:

2 Year Treasury Prices

http://www.google.com/finance?q=INDEXNYSE%3AAXTWO&hl=en

5 Year Treasury Prices

http://www.google.com/finance?q=INDEXNYSE%3AAXFIV&hl=en

10 Year Treasury Prices

http://www.google.com/finance?q=INDEXNYSE%3AAXTEN&hl=en

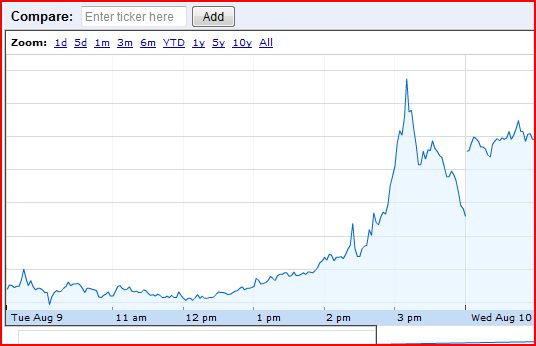

Here’s the graph for the S&P 500:

If you click on Cameron’s link, a bouncing ball will announce the exact time. As I see it, stocks were 1135 at 2:15, fell to a low of 1104 at 2:42, and rose to a peak of 1172 at closing. Then the next day they opened down around 1140. Here’s how Andy Harless described the stock market reaction to the Fed announcement:

At the close on Tuesday (by the time it finished parsing the Fed’s statement), the stock market and the forex market was up quite dramatically, with the Fed’s statement as the only reasonable explanation. Meanwhile, at the time the stock market closed (as well as before and after) yields on Treasury securities were considerably lower than they had been at the beginning of the day. Surely these observations are not consistent with the interpretation of falling interest rates as the result of a contractionary shock.

That’s a highly persuasive argument, but I’m going to argue the opposite. Let’s look at the price of two year notes:

The price seems to have been about 1049.5 at 2:15, rose to a peak of 1051.8 at 2:42 (note the time!!), fell to 1051.1 at 4:00, and opened back up at 1051.6 the next morning. That’s the exact opposite of the path of the S&P500. But since bond yields and prices move in the opposite direction, stock prices and interest rates were positively correlated after the Fed announcement. Here’s my interpretation:

1. In the first half hour the markets digested the report, and were quite disappointed. They did note the Fed commitment to hold rates down, and that contributed to the reduction in two year bond yields. But they had hoped for something better–such as QE3, or at least a strong signal that QE3 was on the way. This disappointment caused stocks to fall sharply. If QE3 had occurred, then it’s possible that the economy might have recovered enough to allow fed funds increases before mid-2013. Now that the Fed had virtually guaranteed no increases until then, two year yields fell from slightly above 0.25%, to slightly below 0.25%. No big deal for the economy. But a missed opportunity in the eyes of the market.

2. I could stop here, and say the EMH predicts that any market response occurs very quickly. But let’s be honest—the subsequent powerful rally in stocks was probably linked to the announcement. Some sort of “second thoughts” hit the market. I’m not exactly sure what those were, but I’ve seen two possibilities discussed. John McDermott suggested that there was wording similar to the Fed statement that preceded QE2. Others pointed to the three dissents, suggesting that Bernanke is preparing to move ahead more boldly, and is willing to tolerate a higher number of dissents. Just to be clear, I’m not claiming to know what caused stocks to rally in the last hour. And I am fully accepting Harless’s conjecture that the late rally was due to second thoughts about the announcement. All I am claiming here is that the rally was not due to the Fed’s decision to hold rates down for two years–they clearly knew that at 2:42, when both stocks and T-note yields bottomed out. Whatever these “second thoughts” were, they almost certainly were not about interest rates, as interest rates actually rose as the stock market rose after 2:42.

3. On Tuesday evening there was another flood of commentary, including the eagerly awaited “Epic Fail” post on this blog, which turned Wall Street in a more pessimistic direction. This caused stocks to open sharply lower, and interest rates to fall as well. So whichever way the market moved, stocks and bond yields were moving in the same direction. Andy is right that stocks ended Tuesday higher and bonds yields ended lower. But there is no evidence that stocks ended higher because bond yields ended lower. Instead, the late rally in stocks seems to have been due to investors finding other glimmers of hope in the Fed statement. During the period when the 2 year low interest rate policy was being absorbed and fully processed by the 2 year T-note market, stocks actually fell sharply.

4. Now let’s look at the graph for 10 year bonds:

Here we see a broadly similar pattern, with one anomaly–which might represent market inefficiency. The price of 10 year bonds didn’t peak until 3:10. This means 10 year yields hit bottom at 3:10, 28 minutes after both the S&P500 and 2 year yields bottomed out. Perhaps traders in the 10 year market were different from those in other markets, and were slower to catch on to the “second thoughts” of traders in the stock market. Note that even at 3:10 stocks hadn’t risen very much off their lows, and were still well below 2:15pm levels. However I hesitate to call that “inefficiency,” as even today we don’t know if those second thoughts were correct.

The Fed has picked such a bizarre and convoluted strategy that it is difficult for markets to predict which way the economy will go. Under interest rate pegging, NGDP can either fall or rise at an accelerating rate, depending on tiny differences in initial conditions. (Think about those saddle-point graphs you studied in math.) Fortunately, they only committed to this idiotic policy for two years, and hence it’s unlikely we’ll see explosive moves in either direction. But it would have been much simpler if the Fed has just TOLD US WHERE IT WANTS TO GO.

Of course my use of bold letters just shows that I don’t understand all the subtle games a political institution like the Fed must play. Ryan Avent (who wrote the following) and Tyler Cowen have a better understanding of what goes on in Washington, and here’s what they think:

Which is it? Market movements are at least as suggestive of a weak statement as a bold one. I had the opportunity to speak to Tyler Cowen today, and he made a few interesting points by way of judgment. Those looking for a positive, pro-inflation sign in the statement could point to the three dissenters, he noted; clearly enough changed in the report to drive the more hawkish members (whatever the merits of their view) to find the shift objectionable. However, he noted that its ambiguity was suggestive of a Fed facing intense pressure from two sides, and wishing to put itself in a position to avoid blame for failure but take credit for success.

I also think the ambiguity is problematic. It doesn’t much matter if Fed insiders all understand the sly-yet-bold nature of the Fed’s action if the tens of millions of price-setters in the economy don’t get it. If financial markets are acting schizophrenic, it may well be because the Fed has them guessing at two removes. Markets aren’t just weighing what the Fed said; they’re weighing how economic actors will weigh what the Fed said.

Now, maybe that’s a savvy way to try to help without angering pressure groups, but it strikes me as far less likely to prove effective than a more straightforward statement. Look again at what the Fed said:

“The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.”

Now you tell me: what inflation rate does the Fed want? What rate is it prepared to tolerate? Maybe””hopefully””the Fed’s action was actually an aggressive move to counter economic weakness. The fact that we’re all still able to debate the matter leaves me sceptical that it was.

Me too. But let me emphasize again that all I do is infer market forecasts. As of today markets are still quite pessimistic about NGDP growth. Whether the markets are correct is a different question.

Update: I noticed this Marcus Nunes post after I posted mine. He looks at longer time periods.

Tags:

11. August 2011 at 17:53

Everyone whines about how the fed doesn’t properly gauge the market’s sentiment when it keeps lobbing softie monetary solutions. But nobody really knows what enough is, right?

Maybe the optimal strategy is for Bernanke to use the market reaction to:

1. build internal political capital and

2. calibrate what solution might actually work.

Going into round 1 he doesn’t have the influence to nuke disinflation Krugman/Sumner-style, and doesn’t have the knowledge to pick a good second-best option with any precision.

11. August 2011 at 18:19

all i can offer from years of Fed watching is the Fed has to move in steps. There is a kind of political and bureaucratic inertia that makes leaders extremely circumspect about the precedent they set.

The fact that there were 3 dissenters against basically acknowledging the obvious, and that 3 dissents itself was a !huge! break from the prior consensus-driven process, speaks volumes.

I think that the ambiguity is because the Fed itself does not know what the next move is. Occam’s razor says so: if they knew they would telegraph it. They always do, by floating trial ballons in the market to gauge the reaction, talking to primary dealers, and the like. By the time the size of QE2 was announced everyone had a number in mind. My experience is that the fed both gauges market reaction and provides soft feedback so that the market is not overly surprised.

Negative interest on reserves? more QE? print money and buy more real estate directly? I think it’s all on the table and since policy lag is 9 -12 months, Bernanke-san could afford to wait until Jackson Hole on the 26th to collect the Feds thoughts together.

And again, going back to the circumspect way they treat new initiatives, if the next move is something other than QE 3, which I think is a fair bet, one statement is not going to do it. For example, if the next move is negative interest on reserves, a 20-30% chance IMO, they will talk to dealers, make sure internal systems and computers can handle it (yes some dumbass IT person may have programmed the system so that all interest rates are positive numbers), do some test runs, study the Swedish experience… blah blah blah, and this in turn will allow the primary dealers to form expectations about what is coming.

so that by the time august 26th rolls around I think it will be very clear what the next move is. the minor change in language was just a stalling exercise.

in sum, new initiatives cannot be implemented with the flip of a switch. Given the rapid way the data deteriorated,IMO they were ill prepared to yank something from their bag of tricks. I think the ambiguity was because they really don’t know and just wanted to buy a couple weeks until a little more data come in and they can study alternatives.

11. August 2011 at 18:34

i said sweden, meant switzerland. doh!

11. August 2011 at 18:56

DW, That’s why we need an NGDP futures market.

dwb, Good observations. Sweden had negative rates on reserves (sort of) and Switzerland had negative rates on foreign bank deposits. The Fed would certainly try zero, before moving into negative territory.

11. August 2011 at 18:57

Looking at Marcus Nunes’ chart, what jumps out at me is that the bond yield and the S&P 500 almost always move in the same direction, with August 9 as the one dramatic exception. A pure empiricist would be inclined to ask, “Did something unusual happen on August 9?” And indeed something did.

My interpretation of what happened on August 9 is that the initial reaction of stock traders was negative because they’re not sufficiently familiar with the Fed to appreciate the import of the statement. When the professional Fed watchers (and particularly those with experience at the Fed) got a chance to interpret the statement, they told the traders to buy.

I think, also, if you look at TIPS yields, you will find that breakeven inflation rates rose significantly in the hours after the announcement. I don’t know whether they rose immediately after the announcement, but they were certainly higher Wednesday morning than they had been on Tuesday morning. (If someone knows how to get the intra-day TIPS data, that would be helpful.) In the Fed’s H-15 data, I see the 5-year TIPS BEI widening out 21 basis points between Monday and Wednesday. I don’t see any other news that would account for this change, and I don’t see any plausible explanation that doesn’t involve interpreting the Fed’s statement about “exceptionally low levels” as an indication of more stimulative policy than what had been expected.

11. August 2011 at 19:22

Andy, But I just don’t see how your hypothesis fits the data. Let’s say you are 100% correct, and they only figured out that the Fed was going to cut rates late in the day. They why did market rates rise in the last hour, as that realization set in? I’m having trouble with this hypothesis, perhaps I’m missing something.

I do think the Fed action explains why rates fell more than typical, given the stock reaction that day. The Fed did do something, it promised to hold rates down. I just don’t think the markets saw that as very expansionary. Rather I think markets later thought about the other aspects of the statement and found glimmers of hope. But not the interest rate move.

I agree with your comments on breakeven inflation, indeed I agree that the net effect of the entire statement was perceived as expansionary by 4 pm. I just don’t think the interest rate part of the statement was what did the trick.

11. August 2011 at 20:19

I think the part about interest rates was the meat of the statement. I find it hard to believe that the net import of the statement was in the opposite direction from what was implied by the part about interest rates.

There are two ways to interpret the statement about interest rates. First, you can take it literally, “The economy is going to suck for the next two years (maybe even worse than you thought), so we’ll have to keep interest rates low.” That interpretation is consistent with the stock and bond markets’ initial reaction but not with the stock market’s subsequent change of heart. The other interpretation is, “You already knew the economy was going to suck for the next two years, but maybe you thought we were crazy enough to raise interest rates anyway. Well, we’re not.” That interpretation is consistent with the eventual reactions of both the stock and bond markets.

Yields rose slightly in the last hour, but I think that’s consistent with moving from the first to the second interpretation. If you think, “Oh, wait, it’s not that the Fed is worried that the economy is worse than we thought before the announcement, it’s that the Fed is promising not to foolishly raise interest rates,” then you’ll think that the economic outlook is stronger, and there is a slightly higher chance that even the less conservative Fed will end up raising interest rates. But if markets had skipped the first interpretation and proceeded directly to the second, then their reaction to the announcement would be consistent with Justin Wolfers’ story.

I will note, though, that the small changes in yields at the end of the day are also consistent with the markets’ receiving some minor new information or having some minor change in sentiment or order flow that has nothing to do with the Fed. I don’t think one should read too much into every wiggle. The approximate story is that yields went down on the announcement and then stayed roughly flat, whereas stock prices went down at first and then came back strongly.

11. August 2011 at 21:17

I still think it is a small mystery, and I don’t think parsing the minute-by-minute co-movements helps remove the scales from the obvious oddity: From 2:15 to 4:00pm on Tuesday, stock prices went up substantially while bond yields declined substantially. The stock part doesn’t need any explaining to me, and I kinda hate resorting to Andy’s explanation of the equity market radio delay. I like to think of it as the natural result of the multiple equilibria hell you find yourself in when the Fedphonics dictionary goes illegible like it has. When the Fed tries to communicate its reaction function without the benefit of the market knowing its own pre-existing expectations (like through a Fed Funds Futures market) or what the new language means (without some handy Taylor rule to translate), it runs a high chance of bouncing around like a roulette ball until it happens to bounce so far on one direction that the movement itself becomes important fundamental information, generating a temporary anchor and helping create an ad hoc interpretation of whether the Fed was really trying to be looser or tighter than the market expected. Plus, any positive market move in light of a shaky downside CB reaction function can be seen as ipso facto good news. Then the next morning you get an exogenous demand shock (SocGen rumors) and the fragility of a stupidly murky CB reaction function again rears its ugly head.

But bond prices failing to rally appreciably with the late Tuesday stock surge seems strange to me, liquidity effect be damned. I would have expected it to look more like today, but it didn’t. The small end-of-day correlation that you point out in the post seems, well…small.

11. August 2011 at 21:53

Naïveté knows no bounds on this comment trail. You need more equities futures markets professionals to comment on how little buying of index futures can move market, especially if rumored to be semi-official. The whole theme of this blog remains based on trickery, “money illusion”, fraud even. Just how low would you go, Scott, to get business confidence/animal spirits/NGDP growt expectations going? Ethics never seemed Keynes’ strong point, what about you?

11. August 2011 at 22:02

I think you are all reading too much into the entrails. When you have volatile movements in the equity market, then the bond market becomes the tail of the dog. Investors get out of equities, they have to go into something…usually the bond market…prices go up….yields go down. A lot is going on in the equity markets…reaction to the fed, contrarians, digestion of the S&P downgrade, program trades, etc. There are technical differences in the market which make it difficult to draw conclusions as well.

11. August 2011 at 22:12

Here’s the 5yr BE with 15min running.

DATE OPEN HIGH LOW CLOSE

08/09 16:45 1.7824 1.7856 1.7771 1.7794

08/09 16:30 1.7690 1.7832 1.7661 1.7816

08/09 16:15 1.7618 1.7738 1.7601 1.7722

08/09 16:00 1.7697 1.7753 1.7570 1.7611

08/09 15:45 1.7579 1.7729 1.7464 1.7697

08/09 15:30 1.7552 1.7626 1.7513 1.7571

08/09 15:15 1.7497 1.7700 1.7462 1.7560

08/09 15:15 1.7497 1.7700 1.7462 1.7560

08/09 15:00 1.7457 1.7590 1.7263 1.7497

08/09 14:45 1.7394 1.7517 1.7334 1.7457

08/09 14:30 1.7647 1.7661 1.7204 1.7394

08/09 14:15 1.8133 1.8236 1.7553 1.7655

08/09 14:00 1.8137 1.8218 1.8059 1.8133

08/09 13:45 1.8125 1.8150 1.8065 1.8145

08/09 13:30 1.8077 1.8142 1.8042 1.8117

08/09 13:15 1.8127 1.8184 1.8042 1.8077

08/09 13:00 1.8115 1.8135 1.8061 1.8111

11. August 2011 at 22:14

I love these types of posts as I am fully convinced that every large market moves matters and is not just a “conspiracy” or “manipulation” like popular opinion and the two posts above me suggest.

However, I was wondering if you that the effectiveness of ECB bond purchases in bringing down Italian and Spanish government play any role in the rallies? I think the ECB has sufficiently kicked the can down the road enough to give markets a little bit of confidence. Also, lots of commitment to big bond purchases by BOJ as well. I know that the purchases themselves do little, but I think the markets were at least a little relieved to see that both of the clumsy institutions would act at a certain level of market distress.

12. August 2011 at 04:05

Scott, I think you failed to noticed that at 3:00 PM or so, Goldman publicly issued the following statement:

http://www.zerohedge.com/news/goldmans-take-fed-returns-moentary-easing

Many traders, who had shorted immediately after reading no QE3, got caught unawares, and reversed their trades. You can hate zero hedge, but there’s a reason people read it. The instability in the markets suggest that it’s not a stable voting mechanism (like EMH predicts), but the outcome of a very unstable game theoretic equillibrium.

12. August 2011 at 05:19

FYI, CNBC had their Fed survey this morning and for what it’s worth, there was support for more QE. Even better though, NGDP targeting got a mention among write-in options around the 3 minute mark.

http://video.cnbc.com/gallery/?video=3000039005

12. August 2011 at 05:59

Andy, My next post provides further comment on this issue. I don’t deny that you might be right, but I have trouble seeing why markets would initially react to the implied forecast about the economy, and then decide that doesn’t matter. Markets respond to Fed statements all the time. Surely by now they’ve decided whether the implied fed view of the health of the economy matters, or doesn’t matter. When the statement is clear, (as when the Fed cuts rates by a half point, when a quarter point cut was expected) the initial reaction is almost never “perverse,” at least as far as I can recall.

As far as interest rates being the “meat” of the statement, that may be so. But it’s also true that the Fed’s longer run strategy has a far bigger impact on current AD, than a decision which lowers the two year bond yield by 9 basis points.

dlr, Yes, I see your point. You also need to ask whether there are other policies that are more expansionary, and also lower bond yields. The obvious choice is QE3. After all, QE2 initially lowered bond yields. If the growing optimism later in the day reflected hints of QE3 in the message, it seems possible that rates could end up lower and stocks could end up higher. But that’s really just a guess on my part.

James, Very low.

Dtoh, In net terms people don’t “get in or out” of equities–money flows through markets. Each purchase is a sale. There is no “money” to go “into” bonds. In addition, the correlation between stocks and interest rates depends on the nature of the shock hitting the system, there is nothing automatic about it at all. Sometimes they move together, sometimes in the opposite direction.

Mark, Thanks, So inflation expectations initially fell on the bearish interpretation, then rose on the bullish interpretation.

Liberal Roman, You are certainly right about the lack of market manipulation–these markets are way too big. You also may be right about the foreign purchases of bonds, I haven’t followed that issue closely enough.

Statsguy, I’m willing to buy your explanation, but contrary to what you say it’s fully consistent with the EMH. Monetary statements are very complex–too much for the average trader. It’s no surprise that people would look to experts like GS for guidance. I’m sure many other experts were making similar statements. After the Challenger exploded traders looked to rocket experts for advice, and the stock of the company that made what turned out to be the faulty part fell quickly, long before the hearings on the crash.

Must be nice to be GS. It’s good to be the king! 🙂

Mike, Thanks, I’ll take a look.

12. August 2011 at 07:17

“I could stop here, and say the EMH predicts that any market response occurs very quickly. But let’s be honest””the subsequent powerful rally in stocks was probably linked to the announcement. Some sort of “second thoughts” hit the market.”

I’m having understand your style of analysis. You say you adopt the EMH approach, but in invoking “second thoughts” (which logically allows for third, fourth, fifth, and 56th thoughts), you are consciously or unconsciously sliding out of EMH style reasoning. Actually, you’re adopting the financial industry’s style of reasoning about markets which includes fuzziness, delays, imperfections, hastiness, foolishness etc. That is quite pragmatic of you.

I can add one other data series to your collection of real time data. The 10 year TIPS spread fell consistently from 2.33 or so to 2.27 from the 2:15PM announcement till 4:00PM.

12. August 2011 at 07:50

Scott,

Strictly speaking yes, but by that line of reasoning stock prices would never move because there is always a buyer and a seller (no change in “net terms”) for any equity. As investors try to move from equities to bonds, it pushes equity prices down and bond prices up (yields down). The price relationship between equities and bonds does depend on the nature of the shock, but when you have a big movement, the market response is pretty Pavlovian.

12. August 2011 at 08:42

[…] Sumner has two recent posts on this issue. In this piece, Scott shows that first (i) equity prices and treasury yields both plummeted immediately […]

12. August 2011 at 11:38

Scott, Sorry I have not been following this thread and am just jumping in from out of left field, so pardon me if this has already been mentioned, but as you pointed out to me in an email, one also needs to take into account the uncertainty or riskiness of estimates of expected inflation. I think that it is quite plausible that the FOMC statement confused everybody and increased the perceived risk of TIPS, causing the BE TIPS spread to rise even though the mean expected inflation rate may not have risen or even fallen. It’s a jungle out there.

12. August 2011 at 11:52

[…] Sumner is trying to figure out the answer to that question in an interesting thread on his blog. I just posted this comment. Scott, Sorry I have not been following this thread and […]

12. August 2011 at 12:18

Scott. Get real, very real. If the “market” response matters as much as you and your fans think then it will be “targeted” too, or at least try to be fixed.

People wil see through it eventually, one minute, one hour, one day, one week, or the two years it’s taken for the sovereign bailout of the banks to finally hurt the sovereign rating, as S&P eventually saw.

12. August 2011 at 12:43

Are you on a retainer from GS? I guess I missed the ironic realpolitik in your answer. Or was it just a Freudian slip? Amounts to the same thing.

12. August 2011 at 12:56

Putting the same question another way. Big banks and merchant/investment banks have always throughout history worked hand in glove with the state, why would it be any different today?

Or another way, is “money illusion” an ethical policy to advocate?

12. August 2011 at 15:00

[…] Source […]

12. August 2011 at 18:40

JP, I’ve always been a pragmatist on the EMH. Clear information is absorbed instantly–very complex information takes a bit of time to digest.

Someone else had 5 year TIPS spreads, which showed them falling then rising.

dtoh, I’m saying your flat out wrong. You are using incorrect logic–money doesn’t move from one market to another. It’s an cognitive illusion–which causes people to misunderstand the nature of markets. Some shocks make stocks and bond both more valuable, (say lower taxes on both) and some make one more valuable and one less valuable. Moving money around has nothing to do with it.

David, You may be right–I actually didn’t discuss TIPS in the post. I haven’t studied the data closely.

James, You said;

“Are you on a retainer from GS?”

If only!

13. August 2011 at 04:55

Scott,

To be more specific, I don’t think I referred to moving money from one market to another. I think what I referred to was investors moving from one market to another market. More specifically, I think (and correct me if I am wrong) what happens is that you have a certain price equilibrium established in the equity market where there are an equal number of buyers and sellers at a specific price point. When you get a shock, then you have a change in both the willingness to sell and buy at that specific price which causes a price change until a new equilibrium is established. Typically for shocks related to changed in expectations in general macroeconomic conditions, there is a Pavlovian expectation that there will be an inverse impact on supply and demand in the bond market. A lot of investor demand or supply for bonds and equities is met in the short run by dealers taking short term positions where they either borrow or finance the securities in the repo market. So short term anyway, I think there is some shift of credit which facilitate the movement of investors from one market to the other. But the bigger point, I was trying to make is that I don’t think the bond traders (and investors) are so much making judgements about the impact of fed action on bond yields as reacting to the general expectation that movement in the equity market is going to impact the bond market.

13. August 2011 at 09:57

OK. I’ll take your word that you are not on a retainer from GS, but how low would you go to NGDP expectations rising? Would ethics come into the decision?

14. August 2011 at 08:00

dtoh, I see no evidence of a Pavlovian affect of the stock market on the bond market–nor is such an effect consistent with the EMH.

James, I’m a utilitarian, so if the benefit exceeds the cost, I do it. That’s my “ethics.”