Due to the positive reaction to my previous post, I’ll do something even more self indulgent–keep a running tab of my trip. I write this from a secure undisclosed Red Roof Inn in Utica.

July 20: After packing I got gas, and was told my sticker had expired months ago Got to get out of Massachusetts before they catch me. Two blocks from home I enter the Mass Pike (I-90) in the evening “rush” hour. Not a good start. Over my entire life I’ve lived in a string of locations along I-90–which means I should have moved to the beautiful Pacific Northwest.

Just as I entered the Hudson River valley, a corny Thomas Cole sunset appeared in front of me, with musical accompaniment from a Joy Division CD. Surreal. Stopped at a NY wayside at 9:30 and got a stale cheeseburger for dinner. The AC was so cold it was painful. Picked up one of those coupon magazine and tried to book a motel an hour down the road. The call lasted forever–why does modern life have to be so complicated–do you have a room or not?

And that’s it. Hopefully something more exciting will happen later on the trip. Perhaps my wife will gamble away our 401k plan in Vegas. (She’s not with me now, but we’ll meet up in the midwest.) Maybe I’ll find a picture or two to post.

July 21. Before describing today’s trip I have one request. I am working on a principles textbook and need some cartoons with economic themes. I am trying to find one that I recall with a king who is relieved to hear the kingdom is merely run out of gold, not paper and green ink. If you know any good econ-oriented cartoons (any field within econ), please leave a link in the comment section.

Right next to my hotel in Utica I found an actual original McDonald’s:

After my Egg McMuffin I took off in my new (used) Maxima. First stop Buffalo, which has one of Frank Llyod Wright’s greatest houses, the Martin house designed in 1903:

So far they’ve spent over $40 million on the restoration, and it shows. The interior is amazing. The neighborhood is full of nice old homes.

Then on to the Knox-Albright art museum, which I found disappointing–not at all my taste in art.

Downtown is pretty quiet–much easier to park than in Boston. But it’s full of nice buildings like this art deco gem:

With a lovely art nouveau mural in the lobby:

Then late at night I arrive at my surprisingly expensive “Super 8” motel, and had endless trouble getting my room key to work. Remember when hotels had actual keys, which generally worked? Then a quick KFC dinner, which is pretty horrible stuff, but surprisingly tasty. I believe it’s the number one fast food in China. The checkout guy described all the deer he had hit with his car, in gory detail. I was tired and just wanted to get back to my hotel, but I’m too polite, and just waited him out.

I forgot to mention an interesting incident when the packers loaded our furniture on Thursday. They spoke a romance language I could not place (which I usually assume means Portuguese), but had an eastern European accent. It turns out they were Moldovan–I suppose they were speaking Romanian. In any case I talked to a big burly guy named Vitalia afterwards and he asked what I did. I said economic research and he asked what area. I said monetary policy, and then explained that that related to the Federal Reserve (many Americans have no idea what monetary policy is.) He smiled and said he knew what it was, and then asked me if I was the guy with a blog on the subject. It turns out he reads my blog, and even described some of the amusing items in the in the comment section. Lessons? It’s a small world, prob. values of 0.05 are meaningless, and never assume a big muscular worker is not highly educated.

July 22: I was blown away by the quality of Detroit’s highway system. It’s far better than what Chicago has, and serves a much smaller population. You want infrastructure, Detroit has plenty. And very few cars on either the downtown streets or the expressways. I also saw lots of new apartment construction along Woodward Ave., which I drove from downtown out to Wayne State, where Detroit’s fine art museum is located. Speaking of art museums, Toledo has probably the most underrated collection in all of America. It’s a comprehensive collection, but I only had time to look at the paintings (I’m told they have an impressive glass collection, in another wing. Toledo is glass city.)

I’m normally pleased when a small city museum has a couple of gems, but Toledo has dozens, with strength in both old masters and impressionism/post-impressionism. To my eye Rubens can seem a bit overdone, but when he’s on his game no one produces more beautiful paintings:

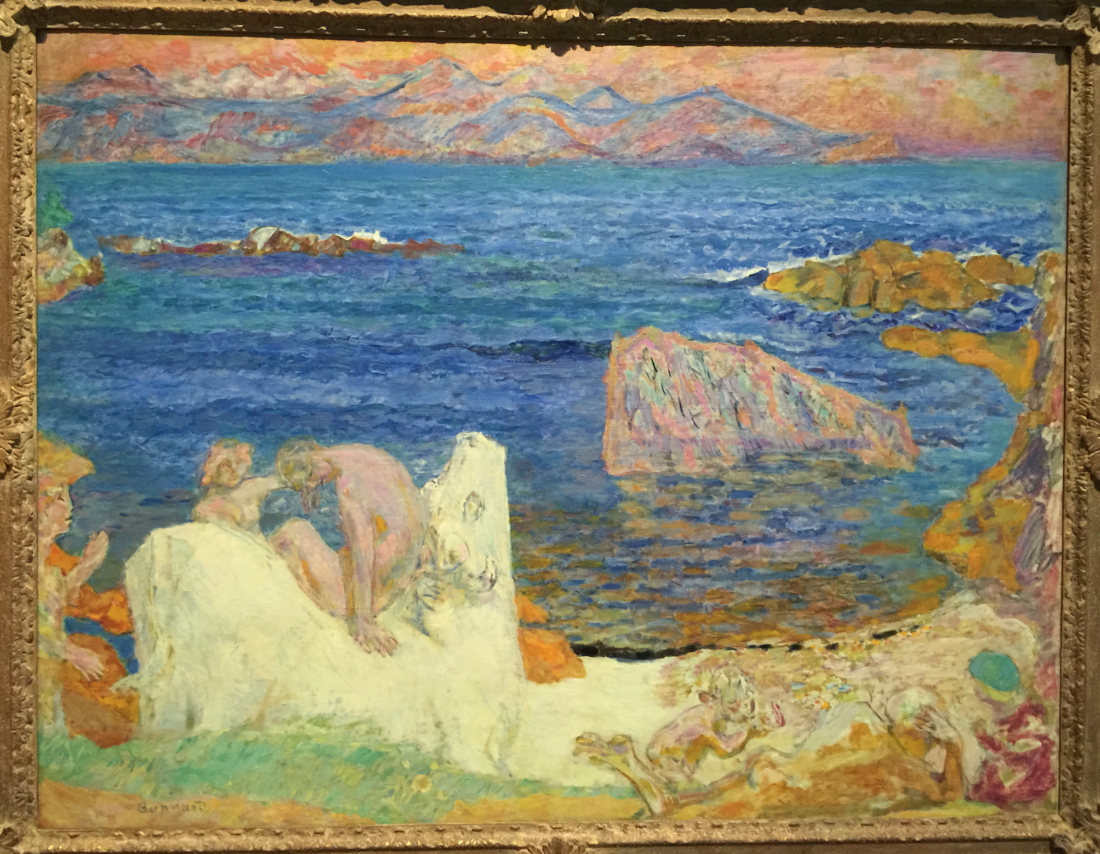

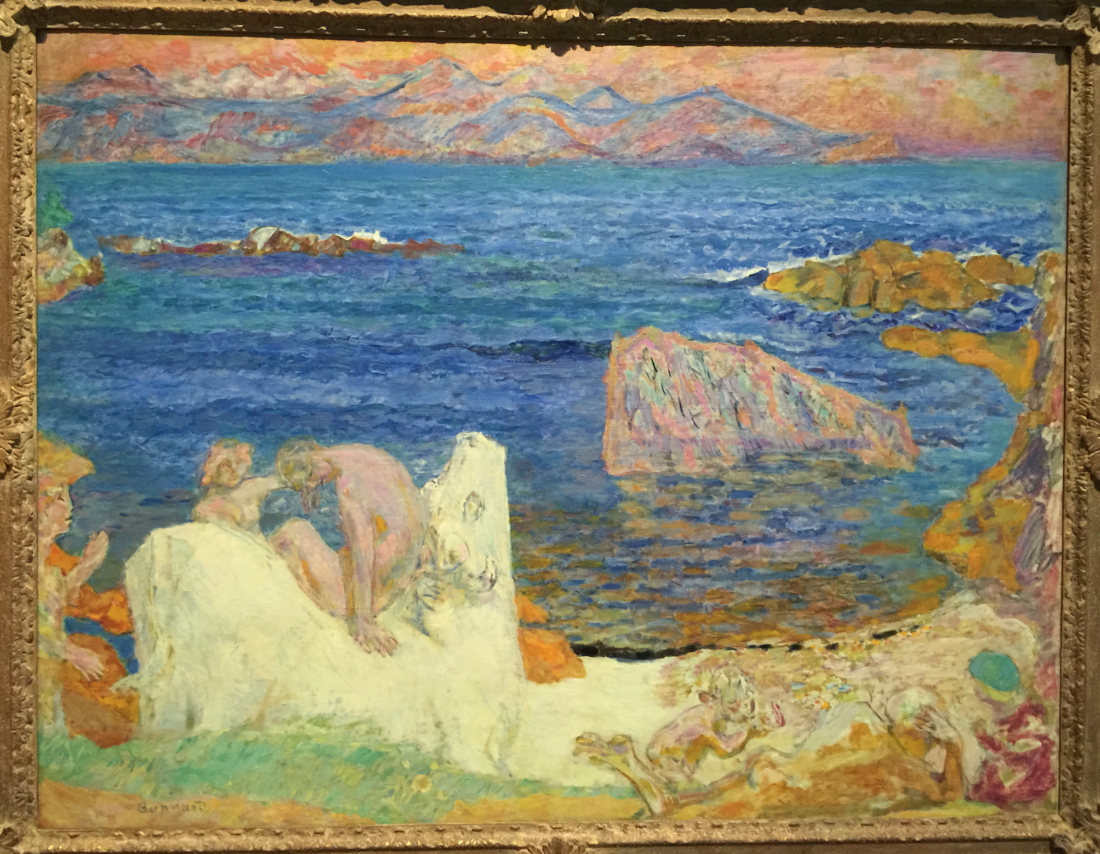

And here is a dazzling Bonnard (much more impressive in real life):

And here is a dazzling Bonnard (much more impressive in real life):

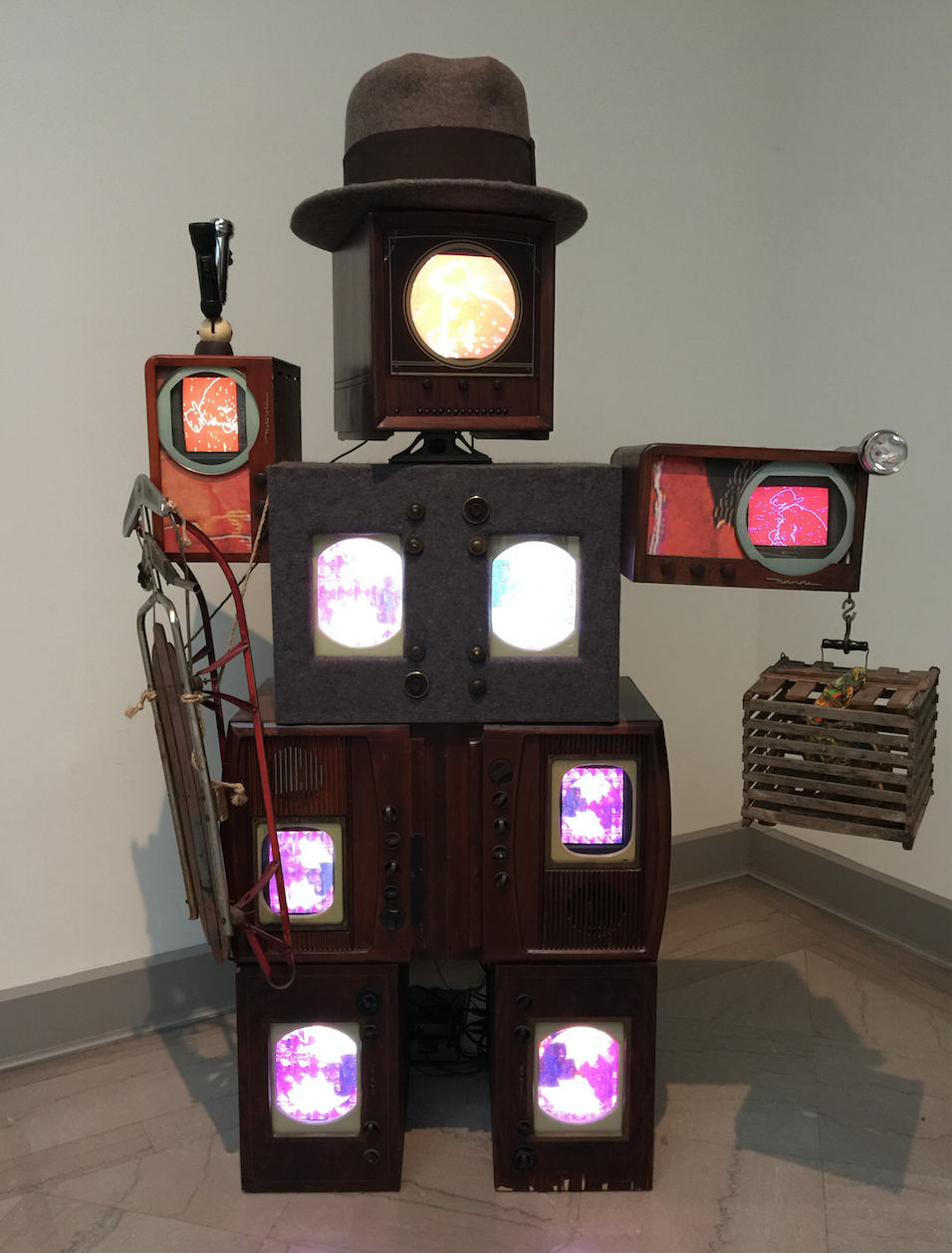

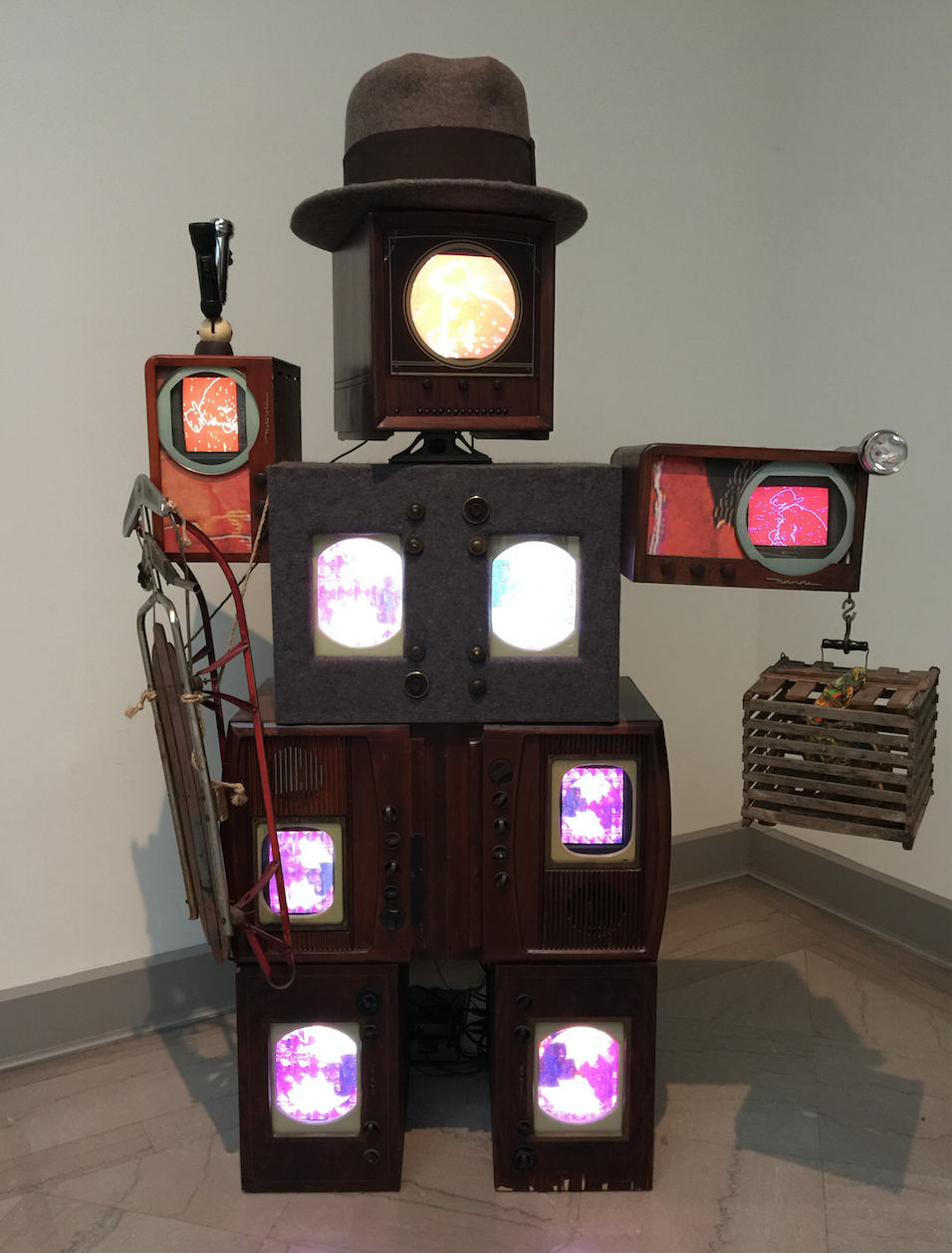

Also some cute modern art:

Also some cute modern art:

July 23: Left Ann Arbor and drove to a house on Lake Michigan, owned by a commenter to this blog. Once I reached Battle Creek it became an exercise in nostalgia. As a child we drove once or twice a year from Madison to Lansing, to see family. That was our one vacation of the year. The trip was originally 12 hours, but fell to 6 after the interstates were built. I used to be glued to the window, and now I started seeing a few familiar milestones—Kalamazoo, Paw Paw, and other oddly named towns. (My grandmother was born in Hell, Michigan.) But there were a few new additions, signs for “Sun Spa” and “Oriental Health Massage–open until 1am”. After lunch my 3 hour trip from Benton Harbor to Rockford became 5.5 hours, as traffic in northern Indiana came to a standstill. Out of frustration I decided to take local roads, the old highway 20. It passed though downtown Gary as a thunderstorm was approaching. To say Gary has seen better days would be an understatement–it seemed like a third world country. I should have taken some pics, but didn’t know if the local residents would appreciate a visit by an aficionado of “ruin porn”. I’m a long way from Mission Viejo.

July 24: I returned to my hometown yesterday. In an earlier post, I explained why Madison, Wisconsin has convinced me that progressives are wrong about race in America.

In another post, I discussed my brother Mark’s amazing collection of old stuff. He was featured on “American Pickers” (the second part of the episode entitled “Catch 32”.) My best friend is an equally serious collector, except that he collects much larger objects. Whenever I return to Madison I can count on seeing something new, and this time I was not disappointed. Roger has purchased the original train station in Madison, as well as a big long train:

I’ve known Roger since I was 5. When we were 14 we’d go to the rail yards in downtown Madison in the middle of the night, to collect unused flares. The material was then packed into long aluminum tubes to make fireworks. (Today we’d be investigated for suspicion of terrorism.) We were roommates in college, and he started buying and selling bikes out of our apartment. He gradually built that up into a bike retailing business with many stores, by working harder than anyone I’ve ever met. The old Madison train station is now one of those stores.

I’ve known Roger since I was 5. When we were 14 we’d go to the rail yards in downtown Madison in the middle of the night, to collect unused flares. The material was then packed into long aluminum tubes to make fireworks. (Today we’d be investigated for suspicion of terrorism.) We were roommates in college, and he started buying and selling bikes out of our apartment. He gradually built that up into a bike retailing business with many stores, by working harder than anyone I’ve ever met. The old Madison train station is now one of those stores.

My brother, Roger, and I share a strong interest in the past, and a fascination with old objects, buildings, photos, posters, etc. Roger’s much more interested in the project of restoring an old building than in any money he’ll make from the venture.

I’m drawn to people who have a strong sense of nostalgia.

BTW, Roger chartered a boat trip for us yesterday, which provided a nice view of the Frank Lloyd Wright convention center and the capital. Otis Redding died in December 1967, when the plane he was on crashed into this lake:

July 25: Still in Madison. Here are some pics from my brother’s “house”, which is more like a museum. It’s a 5000 sq. foot Ford dealership from 1918, and the inside feels like you are back in time, with old store fronts hiding bedrooms:

July 25: Still in Madison. Here are some pics from my brother’s “house”, which is more like a museum. It’s a 5000 sq. foot Ford dealership from 1918, and the inside feels like you are back in time, with old store fronts hiding bedrooms:

Here is a giant clock face from an old bank in Illinois:

And here is “naked Santa”:

And here is “naked Santa”:

This is just the tip of the iceberg.

July 26: Last day in Madison, not much to report. Visited my favorite modern housing development (Middleton Hills), which consists of nothing but prairie-style or craftsman style homes:

I was very happy to see that the Wisconsin state capitol building in Madison still has no security at the entrance. You can just walk right in. Perhaps there is still a sliver of hope for America.

I was very happy to see that the Wisconsin state capitol building in Madison still has no security at the entrance. You can just walk right in. Perhaps there is still a sliver of hope for America.

July 27: Long drive from Rockford to Bartlesville, OK. Drove through some of the best farmland in the world in north central Illinois. My two favorite America hotels are in Oklahoma. Tomorrow we have lunch at the 21 Museum Hotel in OKC, while last night we stayed at the wonderful Price Tower Inn in Bartlesville. It’s well off the beaten track, but worth it:

July 28: Driving through Oklahoma reminded me of a trip I took in 1976 (with three others), driving from Madison to Yucatan over Christmas break. The first “day” was Madison to San Antonio almost non-stop. By the time we got to Oklahoma is was the middle of the night and there was a freezing rain outside. The next day the driver of the Oklahoma segment told us he kept trying to keep his eyes open as he zoomed 80 mph over frozen bridges at 4am. Of course we all laughed it off. Now I’d be angry about something like that. What makes 20 year olds so much braver than 60 year olds, despite having far more to lose (in terms of foregone years of life.)

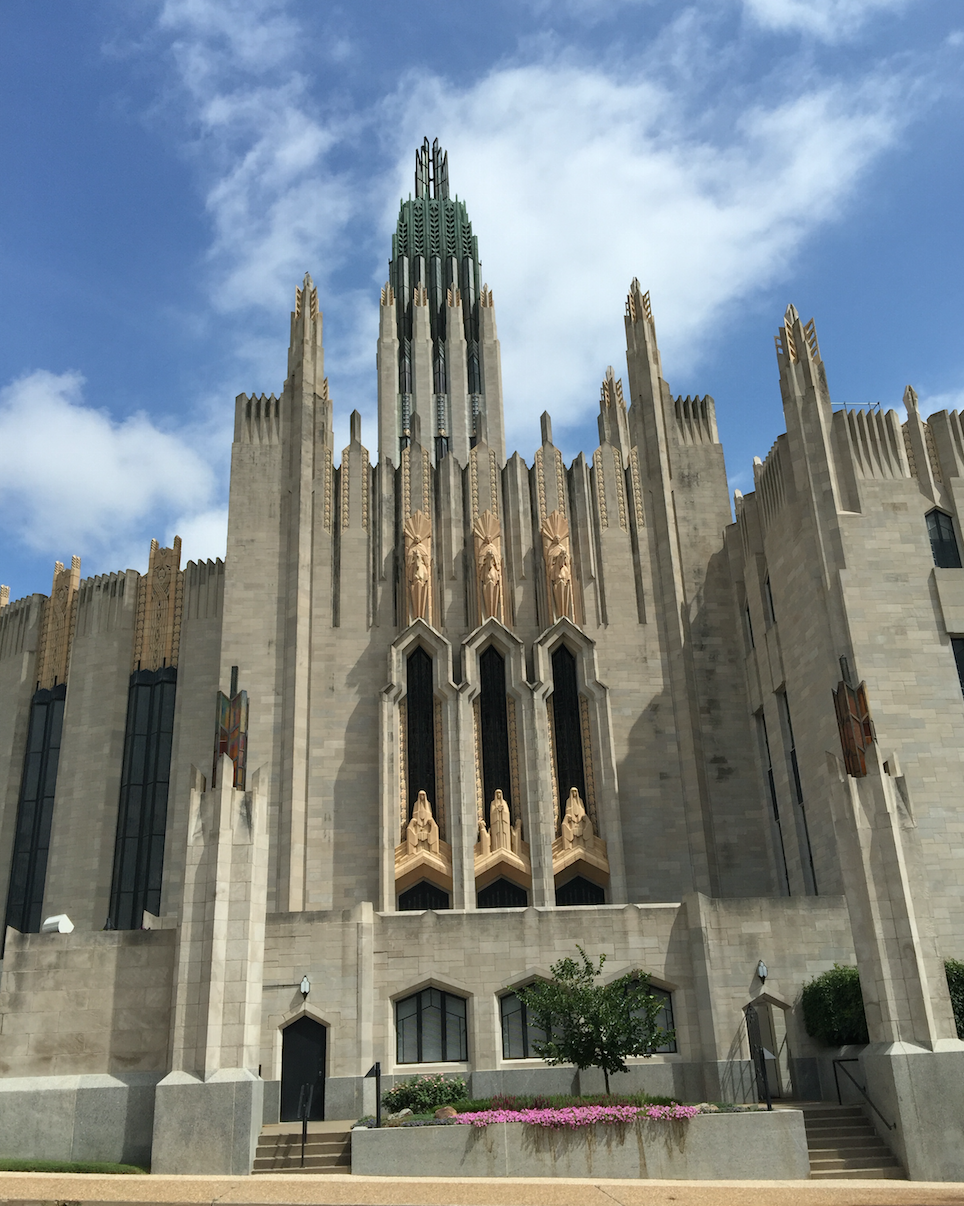

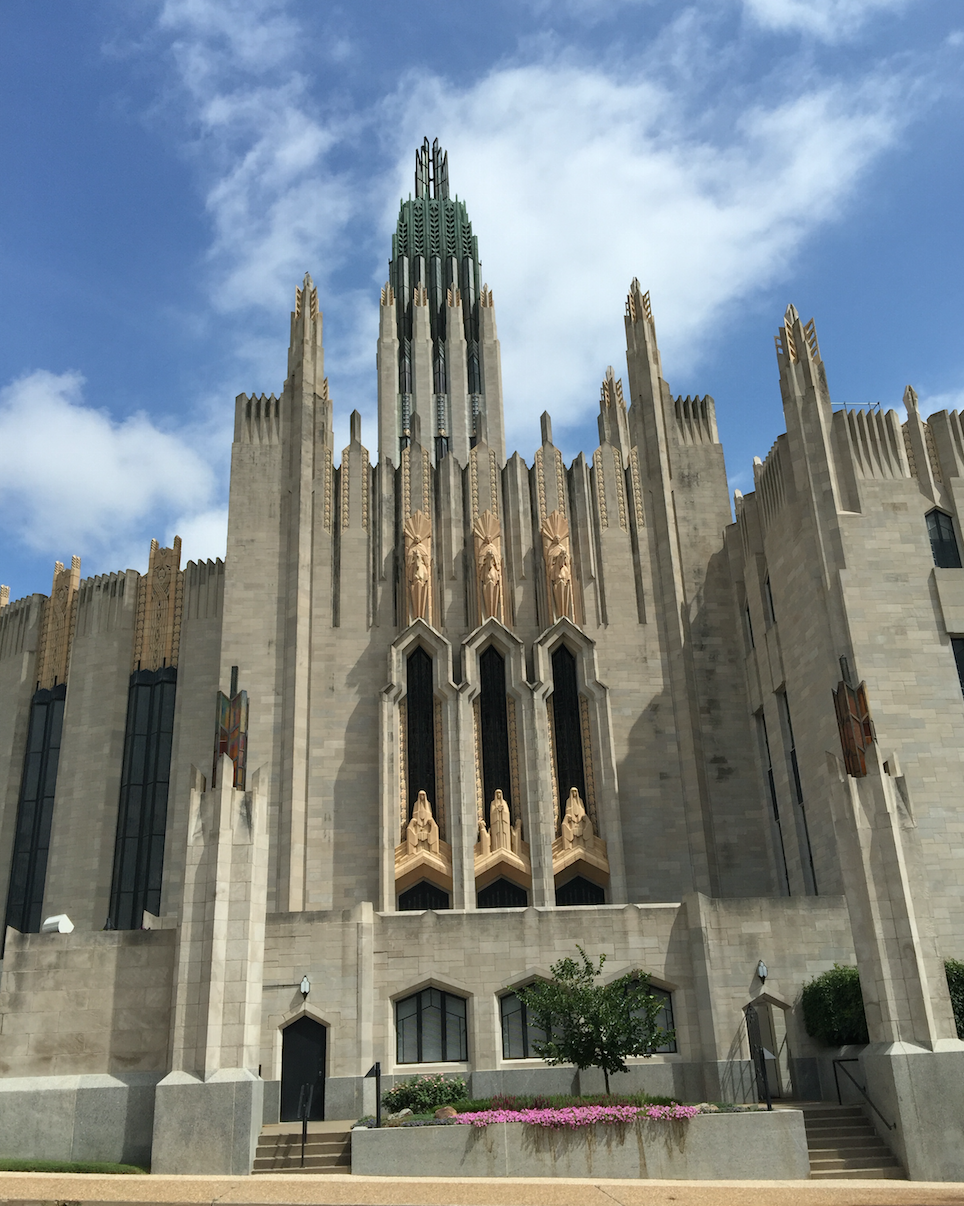

We saw some nice art deco buildings in Tulsa:

Had lunch with Steve Winkler at the Museum Hotel in OKC. The lobby is full of art—perhaps this one is a comment on the modern GOP:

Had lunch with Steve Winkler at the Museum Hotel in OKC. The lobby is full of art—perhaps this one is a comment on the modern GOP:

North Texas is full of windmills—there seems to be thousands of them. I enjoy driving the old Rte 66:

North Texas is full of windmills—there seems to be thousands of them. I enjoy driving the old Rte 66:

July 29: I expected Arizona and New Mexico to be wide open highways and sunny skies. Instead it was rainy with lots of traffic jams on I-40. Truckers like to drive side by side at 60 mph on a 75 speed limit highway. What’s up with that? Albuquerque is a mess—no wonder New Mexico is the only state in that part of the country that does not have fast population growth. However I saw some wonderful old 50s signs and motels along the way.

July 29: I expected Arizona and New Mexico to be wide open highways and sunny skies. Instead it was rainy with lots of traffic jams on I-40. Truckers like to drive side by side at 60 mph on a 75 speed limit highway. What’s up with that? Albuquerque is a mess—no wonder New Mexico is the only state in that part of the country that does not have fast population growth. However I saw some wonderful old 50s signs and motels along the way.

July 30: Just arrived in Orange County. Exhausted. California traffic was bad, as expected, except the last 20 miles which were like my own private highway. Wait, it was a toll road, which is sort of like a private highway. Had dinner at a nice Japanese place on a lake, within walking distance of our house. It’s 78 degrees and dry, with a cool breeze off the lake. Paradise:

And had some yummy shrimp wrapped in pork:

And had some yummy shrimp wrapped in pork:

No internet connection for the next few days, so blogging will be slow.

No internet connection for the next few days, so blogging will be slow.