It’s all demand side

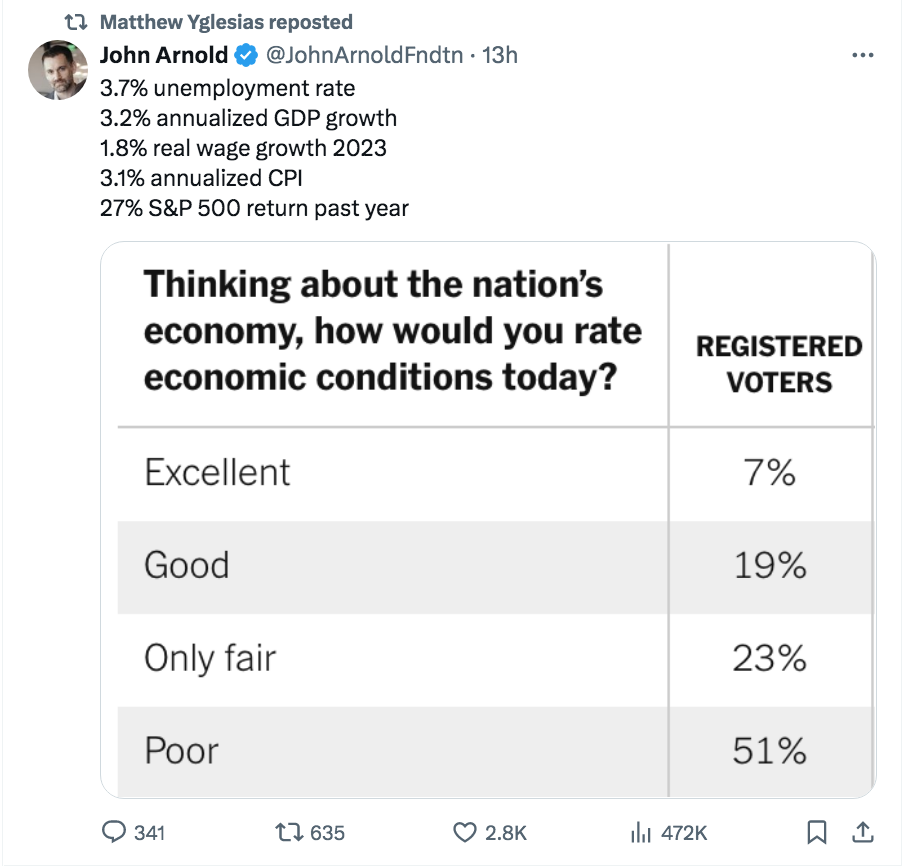

Here’s The Economist:

The economists who had warned that excessive stimulus and overheating demand, rather than production snarls, would make inflation a more serious problem seemed prescient. In the shorthand of the day, it looked as if “Team Persistent” had defeated “Team Transitory”.

Fast-forward to the present, and something strange has happened. The Fed, along with most other major central banks, has acted as if Team Persistent was right. It jacked up short-term interest rates from a floor of 0% to more than 5% in the space of 14 months. Sure enough, inflation has slowed sharply. But here is the odd thing: the opposite side of the debate is now celebrating. “We in Team Transitory can rightly claim victory,” declared Joseph Stiglitz, a Nobel prizewinner, in a recent essay.

It’s hard to believe that some prominent economists believe our recent inflation has been due to supply side factors. In fact, the inflation experienced over the past 4 years has been all demand side. The total amount of supply-side inflation has been zero, none, nada.

Over the past 4 years, the PCE price index is up 16.7%. Under FAIT it should have risen by 8.2% (i.e., 2%/year). Thus we’ve had roughly 8.5% excess inflation (a bit less due to compounding.)

Aggregate demand (NGDP) is up by 27.6%. Under FAIT targeting (which is similar to NGDPLT) it should have been up by about 17% (i.e., 4%/year). So we’ve had a bit less than 10.6% extra demand growth. That explains all of the extra inflation.

Supply shocks do explain inflation over shorter periods of time. But people who point to supply shocks tend to forget that they are transitory. For every negative supply shock like 2022, there’s a positive supply shock like 2023. Over any extend period of time the supply shocks cancel out, leaving virtually all excess inflation due to demand shocks.

It’s always been this way. The PCE price index rose at a 6.1% annual rate between 1965 and 1981. NGDP rose by 9.6% annual rate. That means the “Great Inflation” was 100% due to excessive growth in demand—supply shocks had nothing to do with it. Our textbooks are wrong. (Of course supply shocks do explain some of the inflation in individual years such as 1974 and 1980, but they do not contribute at all to the longer run trend in inflation during 1965-81.

As a first approximation, all supply side inflation is transitory, and all demand side inflation is permanent. Those who predicted transitory inflation (including for a brief period me) were completely wrong. In 2021, I naively believed the Fed was serious about FAIT.)

Some people seem to believe that transitory means something like the following inflation path:

2% 2% 4% 4% 4% 2% 2% 2% 2%

In fact, it would mean something like:

2% 2% 4% 4% 4% 0% 0% 0% 2%

If it’s truly transitory, then inflation should average 2% in the long run.