Trump’s mandate

There is no issue that Trump emphasized more than having Mexico pay for a new border wall. The suggestion always got huge applause from his crowds. Now there are disturbing signs that America’s Congress is about to ignore the will of the voters, and spend $38 billion on a boondoggle that no one seriously expects to work. So sad!!

Voters need to contact their representatives, whether Democrat or Republican and insist that not a dime of taxpayer money be spent on the wall. Trump repeatedly insisted that Mexico would pay, and the voters gave him a mandate to fulfill that promise.

Some people seem to think Trump favors having US tax money spent on the wall. Wrong!

Now is the time to rally around Trump and loudly insist that no US funds are spent on the wall.

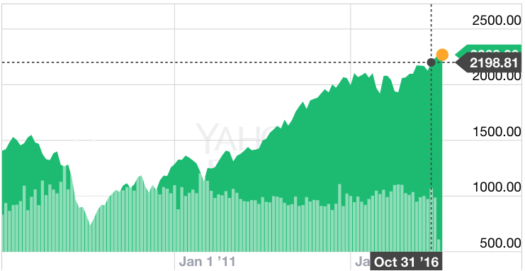

PS. Here is the stock market recovery after the March 2009 lows:

Trump fans think Obama had nothing to do with the massive rise in the S&P from the lows of roughly 700, but Trump definitely caused the small (roughly 6%) rise since the November election (black dot to yellow dot.)

Here is what I believe:

1. They may well be right.

2. They have not presented any persuasive evidence that they are correct.

In other words, you Trumpistas may be right, but don’t expect any non-Trumpistas to believe it. Just take a look at the graph, and you can see how absurd the claim seems.

Now you might reply that this is a superficial criticism, and that sophisticated analysis shows that Trump helped the stock market but Obama did not. But Trump is all about superficial, and completely rejects sophisticated analysis, of any sort. This is the guy who picked Peter Navarro to advise him on trade.

PPS. Even if you ignore all the accusations of conflict of interest for Trump and his cabinet picks, it’s been far and away the worse interregnum I’ve ever seen. Yes, FDR’s transition from Hoover probably did much more damage, but this has been an almost non-stop set of face palm moments. Telling us that CIA reports of Soviet anti-Hillary actions were ridiculous, and then later implicitly admitting they were correct. (And now he calls the latest allegations of Russian dirt on him as “Fake News”. Okaaaay.) The two China fiasco. The suggestion that we need more nukes. The pro-Putin posture. The increasingly clear evidence that Trump has absolutely no plan to fix Obamacare, or anything else on the domestic front. The picks of economic advisors from the 1% of economists who do not understand Ricardian trade theory, and foreign policy advisors from the kookiest fringes of the GOP. The new ambassador to Israel. The embarrassing tweets. Steve Bannon. Jeff Sessions.

We now know that the General Election Trump was the real Trump; he’s not a serious man who was pretending to be a demagogue. This is who he is; it’s not an act. He’s in way over his head. I expect that the Congressional debate of Obamacare will be an absolute horror show, and Trump will provide no leadership. It’s going to be fun watching the faces of Republicans when they find out what the new health care regime will look like. I can hardly wait.

Fortunately Presidents don’t have much say on the domestic front, so the country will probably be fine (unless his trade policy is even worse than I fear). Let’s hope his foreign policy screw-ups are not too serious.

PPPS. Trump repeatedly promised to release his tax returns. Where are they? (Perhaps Putin has them—if so, he knows how to gain maximum leverage from them.)