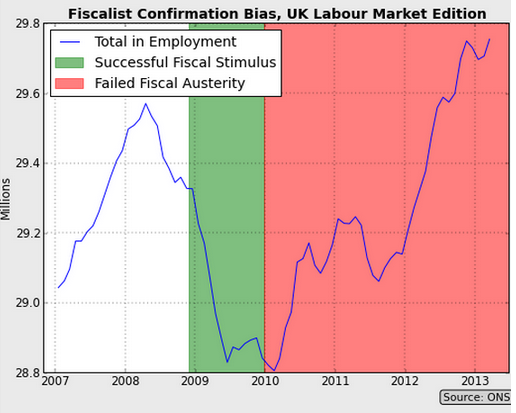

Worth 1000 words

From Britmouse:

(I’m getting senile—this link turns out to be 2 years old. But still worth revisiting.)

(I’m getting senile—this link turns out to be 2 years old. But still worth revisiting.)

But here’s a new paper by Andrew Johnston and Alexandre Mas, sent to me by John Thacker. Here’s the abstract:

In this paper we examine how an unanticipated cut in potential unemployment insurance (UI) duration, which reduced maximum duration in Missouri by 16 weeks, affected the search behavior of UI recipients and the aggregate labor market. Using a regression discontinuity design (RDD), we estimate that a one-month reduction in maximum duration is associated with 15 fewer days of UI receipt and 8.6 fewer days of nonemployment. We use the RDD estimates to simulate the change in the time path of the unemployment rate assuming there are no market-level externalities. The simulated response closely approximates the estimated change in the unemployment rate following the benefit cut, suggesting that even in a period of high unemployment, the labor market was able to absorb this influx of workers without crowding out other jobseekers.

Shorter version: Krugman’s wrong again.

Tags:

12. June 2015 at 08:20

Here’s another paper suggesting a surprisingly high employment effect from cutting UI duration, even during high unemployment.

12. June 2015 at 09:31

Remember, folks, the r-squared between the Federal deficit and the unemployment rate in the United States is .65. I think a similar phenomenon may be going on here.

12. June 2015 at 09:58

So the counterfactual was zero employment growth?

If not, what is the counterfactual?

What model was used to produce the counterfactual?

Do you know that the acceleration on a cannonball throughout its flight is down, even if it goes up in the beginning? Looking At the graph, the curvature is much tighter on the stimulus side than the austerity side … Imagine gravity pointing up, then the force of gravity decreases when austerity kicks in.

Result: narrow half-parabola attached to a wide half-parabola. Almost exactly what is shown!

12. June 2015 at 10:07

@Jason

-I don’t think this is a serious test of anything. It’s just Sumner poking fun at naive supporters of fiscal stimulus (that is, most supporters of fiscal stimulus) and knee-jerk Cameron critics.

12. June 2015 at 10:09

BTW, we do have a test of no/negligible fiscal stimulus during a recession: the U.S. recession of 1981-2.

12. June 2015 at 10:48

“Employment falls during recessions shocker”

12. June 2015 at 11:31

John, Thanks, I added a link.

Jason, I’m not expert on physics, but would you agree with the following:

Britmouse’s evidence is no more or less simplistic that the data that austerity foes like Paul Krugman point to in opposition to austerity.

12. June 2015 at 13:54

The even more “naked truth” about austerity:

https://thefaintofheart.wordpress.com/2015/06/12/is-iceland-krugmans-inadvertent-case-for-the-monetary-policy-offset-of-fiscal-policy/

12. June 2015 at 15:55

I love the conclusion: Krugman wrong again.

You have to keep poking that bear.

12. June 2015 at 19:06

Good post by Sumner, who concedes this ‘evidence’ is no better or worse than what Krugman’s camp points out to buttress their case. But I offer another explanation: it’s traditional, post-Keynes, for governments to be ‘counter-cyclical’. They did this until 2010, when voters rebelled at the thought of even higher deficits. Then, post-2010, the economy recovered on its own. The graphs support this thesis. In fact, you can find such coincidences in random stock market data: sine waves, logarithmic curves, ‘tops’, ‘double tops’, ‘support’ at a certain price, etc.

In short, as Taleb would say, all of you are simply being ‘fooled by randomness’. If I write a book on ‘charts and how to predict stocks’, would you buy it, believe it? No. But certain people would buy and believe it, namely the stock market chartists. I posit you MMs are no different, in that way, from the astrology believers and stock-market chartists.

12. June 2015 at 20:36

Hi Scott,

I think I would actually say it is more simplistic in two ways: 1) the idea that if something is heading downward there can’t be some kind of upward ‘force’ on it goes back to Aristotle, and 2) there is no allowance of a counterfactual from the evidence as presented.

I don’t mean this to be insulting, but these two points are at their heart the viewpoint of a baby: if you don’t see it, it isn’t there … falling with unseen upward force/no counterfactual reality.

E. Harding,

I agree it’s not intended as rigorous analysis, but even the basic premise is not obvious to me:

https://twitter.com/infotranecon/status/609571487968727041

12. June 2015 at 21:38

For the anti-austerians to be wrong, they have to actually define what austerity is.

Otherwise they’ll keep shifting, as with the UK.

13. June 2015 at 00:21

In Ben Bernanke’s recent blog post about monetary policy and inequality [http://www.brookings.edu/blogs/ben-bernanke/posts/2015/06/01-monetary-policy-and-inequality], he made a comment in passing about monetary offset: “if fiscal policymakers took more of the responsibility for promoting economic recovery and job creation, monetary policy could be less aggressive.”

So, there you have it. If fiscal policymakers had used more fiscal stimulus (to promote “economic recovery and job creation”), the Fed would have used less monetary stimulus (monetary policy would have been “less aggressive”). Because there wasn’t more fiscal stimulus, the Fed used more monetary stimulus. The Fed offsets fiscal policy.

13. June 2015 at 03:01

I haven’t looked at any of the relevant data, but the fact that this graph uses absolute numbers in employment instead of a more typical measure like the unemployment rate inclines me to be suspicious that it’s misrepresenting the overall story.

Not saying one measure is necessarily better, but one *is* standard, and if you’re using a non standard measure without a clear reason it’s possible that it’s to make your argument look better.

13. June 2015 at 05:50

Thanks Marcus, I did a post.

Jason, You didn’t answer my question–how’s that different from the anti-austerian arguments, which are equally simplistic?

BC, Good find.

Nathan, I doubt that affects it very much, elsewhere I’ve seen similar patterns using employment ratios.

13. June 2015 at 15:38

reduced maximum duration in Missouri by 16 weeks, affected the search behavior of UI recipients and the aggregate labor market. Using a regression discontinuity design (RDD), we estimate that a one-month reduction in maximum duration is associated with 15 fewer days of UI receipt and 8.6 fewer days of nonemployment.

So if this is true could this explain Card and Kruger’s results on minimum wage. That is if people can find jobs if they want, could a higher minimum wage be sufficient to cause such worker to seek employment with a little more zeal? Would that be a good thing?

13. June 2015 at 23:16

77 economists could be wrong.

http://www.theguardian.com/business/2015/jun/12/academics-attack-george-osborne-budget-surplus-proposal

14. June 2015 at 08:06

Floccina, There’d be more supply of workers, but less demand.

James, Even 350 can be wrong. 🙂

14. June 2015 at 08:46

James, I don’t even understand the argument for how that would “shift debt” to the private sector.

14. June 2015 at 09:19

Osborne’s plans are said to “have no basis in economics”. If governments run a surplus “households, consumers and business may have to borrow more overall”.

It seems to be some sort of an accounting identity, but is very confused. Is it a closed economy? What about gross assets? What is the mechanism? Governments lend to the private sector? Would this be so bad, anyway?

In any case, running public sector surpluses in the good times to ensure that in the bad times public sector deficits can be run up seems pretty straightforward.

14. June 2015 at 11:10

Actually, the letter wasn’t meant to make much sense.

“…these letters should never be read for the details of the text, but instead for their overall message.”

mainlymacro, “signing-letters”, 13th June 2015

And Wren-Lewis even admits the main point is, well, pointless. From the comments section:

“To be honest, its just an identity with no behavioural content at all. I think it can be useful because it reminds people about how macroeconomic sectors interact – running public sector surpluses has consequences. The normal way to make the same point is to trace through the macro consequences of how a surplus is achieved, but sometimes thinking about these balances can get you where you want to go quickly or more intuitively.”

Just a pretty naked bit of politicking by a bunch of Labour-supporting academic economists. Does wonders for their reputations as scientists.

14. June 2015 at 14:26

An insight into the mindscape of central bankers?

BC wrote…

More significantly to me, Bernanke implies more fiscal stimulus and less monetary response would have been a good thing, the preferable course.

Lets see. The problems with fiscal stimulus are: delayed by the political process, distorted inefficiently by the political process, permanently adding to the national debt which must be tax-serviced forever (deadweight cost of taxes), the resulting higher national debt reduces room to respond to unexpected future troubles (things mentioned even in Krugman’s textbook).

While the corresponding problems with monetary stimulus are … ???

But given those tradeoffs, the head of the Fed prefers more fiscal stimulus so the Fed can keep monetary policy “less aggressive”.

Is anyone surprised that with this mindset reigning across the institution, for years on end it simply can’t get up to achieving its own stated 2% inflation target (even as Bernanke actually claims credit for “keeping near” it)?

It seems an actual achieved 2% is “too aggressive” for its culture to be, well, comfortable with.

Opportunistic disinflation rules! Even amid a Great Recession.

15. June 2015 at 07:59

James, Good, I don’t have to spend much time figuring that out.

Jim, Good point.