Will Japan also lead the way on phony recessions?

In recent decades, Japan has been a pathbreaker for the rest of the world. It led the way on slowing population growth (and then falling population), secular stagnation, and zero interest rates. Will Japan’s frequent “phony recessions” also begin to occur in the US? I suspect the answer is yes.

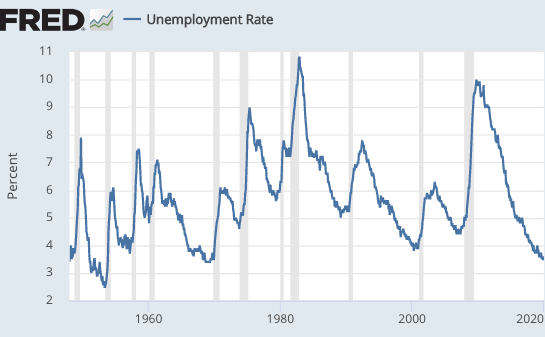

As you can see from this graph, the US hasn’t had any phony recessions. Each time there is an official recession, unemployment rises by at least 2%:

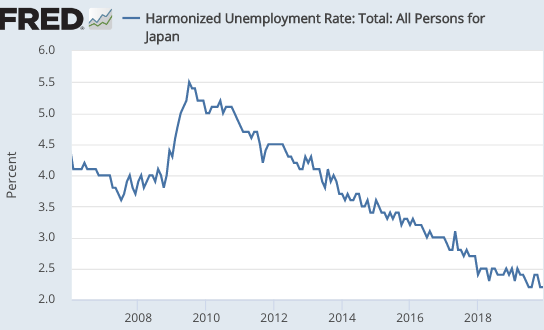

In contrast, Japan has lots of phony recessions. After a big actual recession in 2008-09, Japan has had three phony recessions (maybe 4, if they are in one now), defined as brief periods of falling RGDP and a booming labor market:

I’m not certain that the US will begin having phony recessions. But given that we’ve adopted so many other recent Japanese trends, I think it’s fairly likely that it will happen in the US before too long.

It’s certainly something to keep an eye out for.

PS. If the Fed wants a V-shaped recovery from Covid-19, consider level targeting. That’s what it’s for.

Tags:

27. February 2020 at 18:17

Didn’t the US have a phony recession after WWII?

27. February 2020 at 18:20

Interesting post, but keep in mind, Japan has not accepted tens of millions of unauthorized laborers into its domestic labor pool, in addition to legal immigrants, as has the US.

MIT says there are perhaps 22 million illegal immigrants in the US. They are not criminals, but rather people desperately seeking employment.

There are about 130.6 million full-time employed workers in the US. So 22 million illegal workers is a considerable number.

Japan may be proving that the doom-and-gloom orthodox macroeconomists have predicted would accompany national population declines was off-base. Maybe 180-degrees off-target.

Japan is enjoying record-low unemployment, and rising labor participation rates. There are about 157 job openings in Japan for every job hunter. Wages are slowly rising.

Yes, inflation is big problem—it is too low! Likely, Japan will wander back into deflation in Q1 2020.

I wonder if there is any aspect of the Japanese economy that lines up with the predictions of orthodox Western macroeconomists.

Japan seems to have more social and political stability than any other large nation on Earth. I think economic conditions in Japan play a large role in this.

In the most recent US recession, unemployment exploded, like it always does. The chart above shows a nearly vertical line for rising unemployment in 2008-9. That was 12 years ago. Has so much changed in 12 years? Maybe, but I think not.

https://mitsloan.mit.edu/ideas-made-to-matter/study-undocumented-immigrant-population-roughly-double-current-estimate

PS, see this FRED chart below, it is utterly fascinating. While Japan living standards have been maintained and have risen over the decades, they are actually working many less hours than in earlier decades. From 2,175 hours in 1961 per worker, to 1,738 hours in 2017.

The Japan model works, and probably better than the US model, for its citizens. Does that mean the Japan model can be adopted by the US? I don’t know.

https://fred.stlouisfed.org/series/AVHWPEJPA065NRUG

PPS Yes the Fed should engage in level NGDP targeting (NGDPLT). They lack the tools to ensure such a result. Somehow the Fed needs to engage in helicopter drops, and pronto. But they cannot.

27. February 2020 at 19:40

It’s frustrating watching the Fed not do anything. It allows the crazy bears to have their moment and be right for the wrong reasons.

28. February 2020 at 00:58

Ben

The UK has an unemployment rate not much higher than Japans but has high immigration. So I don’t think Japan’s low unemployment ratio is due to labor shortages.

28. February 2020 at 02:57

Trump has been widely ridiculed for saying the coronavirus is good for America (Trump is assuming the virus won’t come to America and will only negatively impact our competitors). But maybe Trump is sort of right. Reliance on rising asset prices for prosperity won’t work, at least not in the long run (prices that go up will eventually come down – it’s a law of nature). But the Fed is loathe to adopt policies that are intended to burst asset bubbles. So along comes the coronavirus to check rising asset prices, freeing the Fed to adopt expansionary policies. It’s a win, win. Well, not a win for the poor saps who get the virus, but a win for the Fed, for it will set the Fed free to, for example, implement level targeting without having to worry about asset bubbles. I suspect that’s what Trump had in mind when he said the coronavirus is good for America.

28. February 2020 at 06:59

Matthais, Actually, you might be right. The unemployment series at Fred starts after that event.

Rayward, You said:

“I suspect that’s what Trump had in mind”

LOL, You have quite a sense of humor.

28. February 2020 at 07:37

I think we can all agree now is the time to raise rates so the Fed can have more ammo later. /s

Fed funds futures now give >50% chance of 50 basis points of cuts on/before the next meeting. They’ll cut with no market reaction (because this already priced in) and this will of course be viewed as evidence the fed is no longer effective.

28. February 2020 at 08:58

I recommend reading the CDC’s Weekly Influenza Surveillance Report “Fluview”. Then use a little imagination and imagine we followed Flu like we do Covid 19. We would all hide inside our house

28. February 2020 at 10:19

Cameron, Yes, and check out my newest Econlog post. 🙂

28. February 2020 at 12:51

What causes phony recessions in Japan? Is this some sort of dig on the Sahm rule?

28. February 2020 at 12:58

DF, A very low rate of trend RGDP growth.

28. February 2020 at 15:02

Michael Rulle,

There seem to be a few differences right now, such as: limited historical knowledge, no herd immunity, no proven antivirals, no vaccinations, suspected higher mortality.

If you look at it from this side, you can understand a little better why the concerns and the measures are different. I’m not saying that I understand all the measures, but at least you understand them a bit better. The logic seems to be: rather exaggerate at first and do too much than too little. This seems to be a standard human approach, which might even have proven its worth in the past.

But indeed, I also assume that corona will soon be a normal part of our lives, just like influenza now.

1. March 2020 at 19:45

Scott, what do you suggest is the correct reaction to phony recessions, easing or no reaction? They seem inflationary for reasons entirely unrelated to monetary policy (or any monetary effect due to endogenous changes in money supply), such as productivity declines and therefore I see no benefit in adding easing and therefore magnifying that inflationary effect. However one of your defenses of NGDP targeting appears to be that it would cause easing in such situations. Can you please clarify if this is indeed your view?