11 Responses to “Why raise rates when we’re not yet at full employment?”

Leave a Reply

A slightly off-center perspective on monetary problems.

Back in the late 2010s, I’d often get this question from commenters.

Here’s why:

Tags:

This entry was posted on June 28th, 2022

and is filed under Uncategorized.

You can follow any responses to this entry through the RSS 2.0 feed.

You can leave a response or Trackback from your own site.

11 Responses to “Why raise rates when we’re not yet at full employment?”

Leave a Reply

28. June 2022 at 14:41

I’d like to see this chart with a starting point of 1983 instead of 2012.

28. June 2022 at 15:38

rwperu, Why? How about one going back to 1883?

28. June 2022 at 20:19

I just plotted it starting with 1983 and of course there is no qualitative difference: the spike starting Q2 2020 is still in stark contrast to everything prior.

28. June 2022 at 21:47

Will, Thanks for doing that. But honestly, it wasn’t worth wasting your time on.

29. June 2022 at 07:35

Raise rates? That’s the fundamental problem with economics. The Gurley-Shaw thesis (Non-bank financial intermediaries are to be treated in exactly the same way as commercial banks).

The welfare of the DFIs is dependent upon the welfare of the NBFIs. Lending by the banks is inflationary, whereas lending by the nonbanks is noninflationary (as the Golden Age in Capitalism clearly demonstrates). The NBFIs are the DFI’s customers.

Thus, Powell’s radical reform of U.S. central banking will result in even slower economic growth than the introduction of remunerating IBDDs. The economic engine, the savings->investment process, is being run in reverse. Banks are not financial intermediaries.

29. June 2022 at 12:48

Some market prices have taken a negative turn. How do we know if they’ve done enough? What’s your best read?

29. June 2022 at 14:31

Milljas, I lean toward the view that they need to do a bit more. But their current policy regime is making it much harder to get an accurate read on the economy. So I’m not certain.

My best guess is that they’ll have to try again at a later date, much as Volcker took a second stab at the problem in mid-1981, after failing in early 1980.

29. June 2022 at 15:08

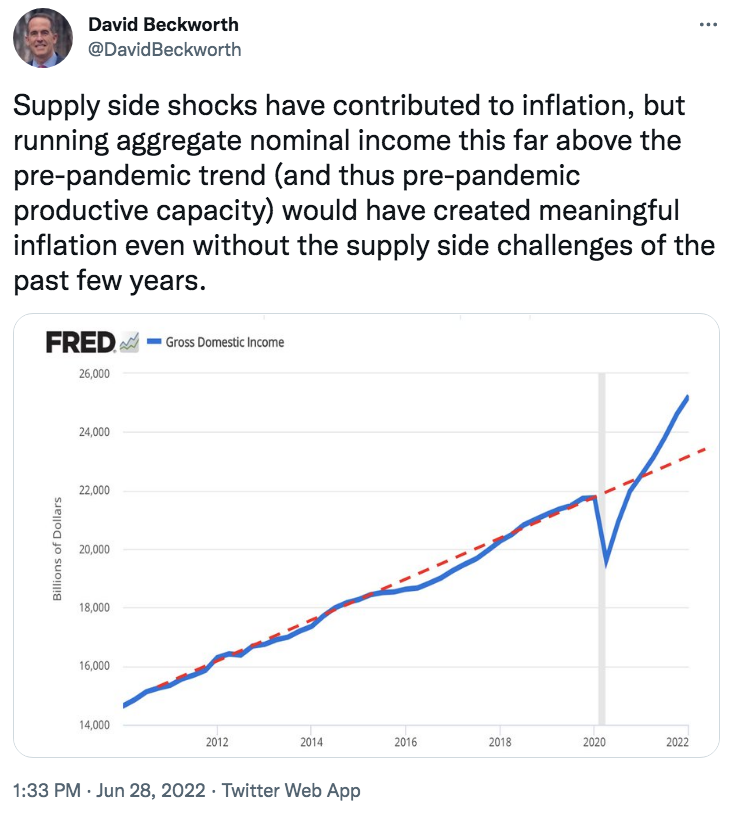

But then, why should we have raised rates more in the late 2010s? Based on that chart, it doesn’t look like we were above trend then.

29. June 2022 at 16:32

yep

29. June 2022 at 19:19

Trying, Who said we should have raised rates more in the late 2010s? I said the rate increases were appropriate.

30. June 2022 at 14:12

Oh okay gotcha. Based on the title of the post and first line, I thought maybe you were pushing for more back then.