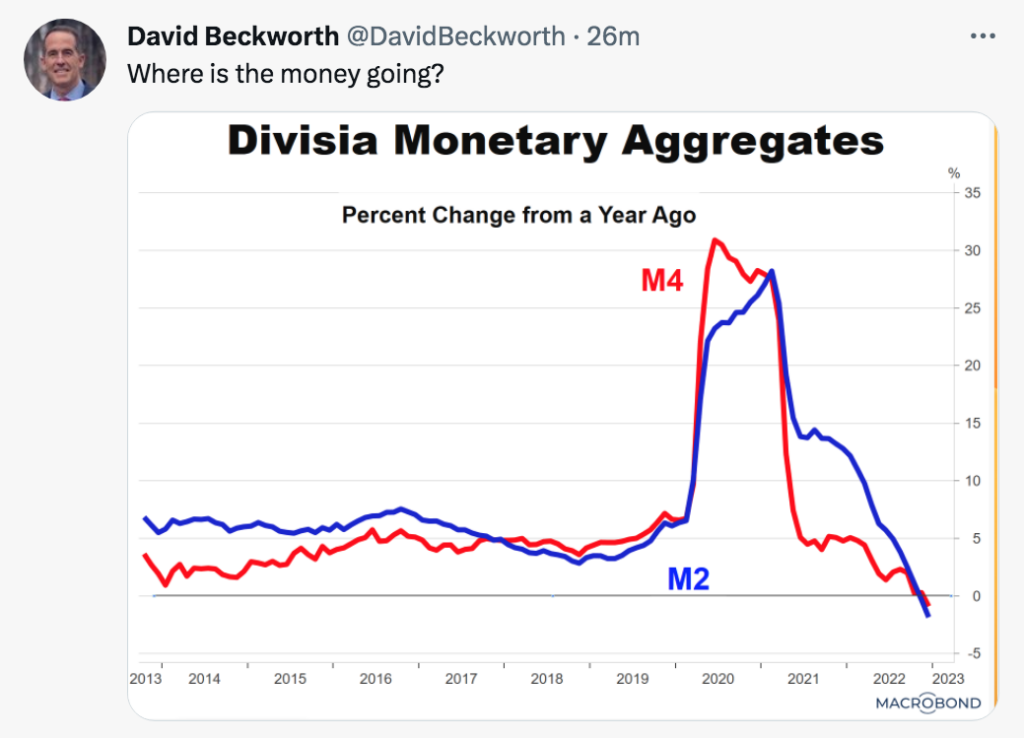

Where is the money going?

This David Beckworth tweet asks an interesting question:

If inflation had stayed stable at 2%, this question would have a simple answer. In that case, changes in the money supply growth rate would reflect changes in real money demand. In other words, the Fed would have been accommodating shifts in money demand with equal changes in the money supply growth rate.

It would also be easy to provide a simple explanation if inflation were perfectly correlated with the money supply growth. In that case, changes in money growth would reflect exogenous changes in monetary policy, which destabilized the price level.

In this case, the truth is somewhere in between. Inflation rose sharply in 2021 and has fallen off a bit in recent months, but the change in inflation is much smaller than the change in money growth. This means that most of the change in money growth reflects the Fed accommodating a shift in the real demand for money, and a smaller portion reflects an exogenous monetary policy that caused inflation to rise sharply and then fall back somewhat.

Here I’d like to focus on the shift in real money demand, which explains most of the pattern we observe in the graph. Why did the public wish to hold larger real cash balances in 2020 and 2021, and why has the real demand for cash balances fallen off somewhat in recent months?

The answer seems clear. Nominal interest rates plunged from 2.5% to zero during the Covid crisis of March 2020, and nominal interest rates rose sharply during 2022. The fall in nominal interest rates sharply increased the demand for real cash balances (although other factors such as stimulus checks might have also played a role.)

With the recent rise in nominal interest rates, investors are moving from relatively lower yielding bank accounts to higher yielding alternatives.

I don’t pay much attention to the monetary aggregates, as I believe the Fed mostly accommodates shifts in money demand. One counterargument is that those who do focus on the monetary aggregates saw the inflation problem before the rest of us.

I would respond as follows. If the Fed had adopted an appropriate monetary policy during 2020 and 2021, the money supply still would have risen extremely rapidly, albeit a bit less rapidly than it actually did. And in 2022 the money supply growth rate might well have fallen more quickly. If that had occurred, those who focus on the money supply growth rate would have warned about an inflation crisis that (by assumption) never occurred.

There are certainly occasions when the money supply gives an accurate read on the stance of monetary policy, or at least the direction of a policy shift. Nonetheless, I find other indicators to be more useful, on average. (But not the Phillips Curve!!)

PS. Keep in mind that while the 30% M4 growth rate did accurately signal an upsurge in inflation, it did not give us any useful information on how high inflation would get.

Tags:

6. February 2023 at 14:41

A substantial amount of deposits flowed to Money Market Funds, who then invested in reverse repo in NY Fed. While RRP is technically an alternative to deposit (with reserves), RRP is a de facto deposit at the NY Fed.

Monetary aggregates with MMFs have been reduced through

– QT, obviously.

– Less loans made by banks due to less loan demand. The ex nihilo deposit model can create controversy, but it’s safe to say higher rates mean less deposits backed by private assets.

Velocity did not stay constant partly due to more cash reserves post pandemic. But I also think money tends to move towards those predisposed to savings. Once rates had some parity with inflation, savers weren’t quick to spend. Unless the spending was for fixed investment, but rates make less fixed investment make sense.

6. February 2023 at 20:17

That all may be true, but just from the path of interest rates you can pretty much explain the unusual growth rates of the monetary aggregates. There’s no mystery to be solved here.

6. February 2023 at 23:13

I think the “inflation crisis that never occurred” in the 2010s can be explained pretty simply by the fact that the messaging the Fed was sending out was not in fact getting the point across that they thought they were communicating. They thought that by announcing the 2% inflation target, and making a big deal about widely publicizing it, they would thereby buoy inflation expectations. But in reality it did the opposite, because most of the public heard it as a ceiling on inflation, rather than a floor, and most of the public definitely did not know the difference between PCE inflation vs CPI inflation vs “asset infiation”, and in any case the number the Fed was giving out was so low that people took it to be, in essence, a de minimis quantity (an impression supported by Bernanke’s oft-repeated quote that they chose they inflation rate to be low enough such that no one would ever really have to think about it, or some similarly verbiage). So this contributed to money growth greatly exceeding the inflation rate for many years.

By contrast, in 2020, memes like “one third of all dollars in existence were created in the past six months” circulated very widely and a lot of people very quickly began to understand that what the Fed had in mind by “2% inflation” was quite different than what they had understood. It’s not clear this was unintended, since it seems like the Fed’s plan was essentially designed to diminish confidence in the dollar as a store of value and they succeeded. But I predict that as a result they will have to work off not only the money growth from 2020-2021 but also a good chunk of the money growth from the 2010s if they want to get back to “normal”.

7. February 2023 at 01:39

This statement:

“There are certainly occasions when the money supply gives an accurate read on the stance of monetary policy, or at least the direction of a policy shift. Nonetheless, I find other indicators to be more useful, on average.

Confirms the pseudoscience status of monetary economics. When you use words like “on average”, “certain occasions”, “or at least the direction of” you are not practicing science.

That’s not certainty. That’s sometimes it’s this, and sometimes it’s that, and other times it’s this and that. It’s good thing NASA engineers don’t have to worry about “sometimes” and “certain occassions” and “on average” when discussing fuel consumption and velocity or the astronauts may never have been able to return home.

7. February 2023 at 02:34

Princess Bajrakitiyabha is now in a Coma after taking Pfizer jab.

Folks, these globalists are a threat to the reputation and sovereignty of the United States. We are now on the road to facing serious backlash, on a global scale, that will completely isolate the country economically and diplomatically.

The babyboomers and their perpetual war machine, along with their love of biofascisim, and thug-style culture is so disgusting that countries would rather align with Putin and the CCP than us.

The baby boomers and their radicals must be voted out of office immediately.

We need to investigate every pharmaceutical company for crimes against humanity; I mean these people are morons to a degree that threatens our very existence. And if these low IQ babyboomers continue to make decisions for us, then we can be sure that future generations will be living inside bunkers, eating canned foods, hoping they can one day return to the surface because of these Neolithic Neanderthals, born out of some misconception of self during the counterculture (idiot 60’s), and who now pervade every moment of our lives.

I hope Sumner rots in hell. And I pray that the devil personally injects him with poison, over and over and over again, because that’s what hell is: repetition.

7. February 2023 at 06:23

“…although other factors such as stimulus checks might have also played a role.”

Did they not definitely play a role?

When I think about actual individuals in the real world, there is definitely a lag between a windfall deposit landing in their bank account and them spending or investing the money. Lags are variable between individuals.

And on a personal note, I hope Sumner enjoys a long and happy life.

7. February 2023 at 06:27

“the change in inflation is much smaller than the change in money growth”

Does this mean that rather abrupt changes in the money supply can be used to ‘tweak’ the inflation rate? Would that be a better approach than playing with interest rates as a means to control the inflation rate?

7. February 2023 at 08:39

Jeff, Yes, communication played a big role. The more dovish communication in 2020 was an implication of the FAIT policy.

Todd, Yes, but money demand would have risen by far less if the fiscal stimulus has occurred during a period of 5% interest rates, rather than a period of near zero rates.

Chris, I don’t favor targeting the broader aggregates, but I do believe that the monetary base is a better policy instrument than the interest rate.

7. February 2023 at 12:00

re: “investors are moving from relatively lower yielding bank accounts to higher yielding alternatives”

That’s obviously wrong. Consumers have been engaged in dis-saving in 2022 (decrease in money demand).

Barnett’s obviously wrong too. The distributed lag effect of monetary flows, the volume and velocity of money, is not 1 year.

7. February 2023 at 16:34

How does the explanation that money growth is all rate driven jive with growth being many times larger than the last ZLB episode? Does the credit theory of money not explain the growth as explained by the FRB and others?

https://www.federalreserve.gov/econres/notes/feds-notes/understanding-bank-deposit-growth-during-the-covid-19-pandemic-20220603.html

https://economic-research.bnpparibas.com/pdf/en-US/Inside-money-creation-United-States-6/25/2021,43264

7. February 2023 at 17:06

HB, Good point. Of course it’s partly the big difference in inflation/NGDP growth. But yes, I imagine that the sudden spike was partly driven by the huge stimulus payments. Longer term, the near zero rates makes people willing to continue holding wealth in the form of low interest bank deposits

7. February 2023 at 19:24

I don’t think the behavior of the money supply can be explained by nominal rates, for two reasons. First, the growth rate of M2 and M4 started to fall in March 2021, much before short-term interest rates started to rise in late 2021. Second, if the money supply was mainly determined by interest rates, then you would expect the level (not the growth rate) of the money supply to fall back to where it was in early 2020 as interest rates return to their pre-pandemic level. Clearly this has not happened.

7. February 2023 at 19:29

If the growth in M2 were mostly due to inflation/NDGP growth, what explains the very significant growth in M2 as a percentage of NDGP? I am very interested in your thoughts on the credit / endogenous money theory that ascribes money growth to credit growth by commercial and central banks. It seems too coincidental that deposits grew by about the same amount as QE plus loan growth. Isn’t it not possible that fiscal stimulus and excess savings explains the run up in deposits since that is just a transfer of funds between the government, households and businesses and not net creation? Also, the reduction in deposits since the start of QT can’t be explained by moving savings into higher yielding assets since the seller or issuer spends those funds, which land back into the banking system. Do read the BNP Paribas article linked above. Thanks in advance for your thoughts. I am fascinated by this and surprised it gets so little attention outside central bank circles. For example:

https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy

7. February 2023 at 19:34

Philippe, I don’t quite agree. Suppose the move to zero rates causes a one time 30% rise in desired real cash balances. Normally, that would occur gradually, but suppose the stimulus money speeded up the process. Once the desired real cash balances are reached, the growth rate should fall back close to zero.

You are correct that when interest rates rise, money demand should fall back, according to my theory. Normally, however, cash balances adjust gradually, and I expect the ratio of M2 (or M4) to NGDP to gradually fall back to normal.

I do agree with you and other commenters that my interest rate explanation is somewhat too simple. (Stimulus money affected the dynamics.) But I still think it’s a big part of what’s going on here.

Also, NGDP is now much bigger, so we won’t lose all of the previous surge in nominal money demand.

7. February 2023 at 19:48

HB, I don’t have time to give a complete answer here, but you need to be really careful with “endogenous money” theories. The endogeneity of money is not a fact about the world, rather it’s an analytical tool for evaluating the monetary system. Any variable can be viewed as endogenous or exogenous, depending on how you want to look at a problem. Thus if the Fed targets interest rates, money and exchange rates are endogenous. If the Fed targets money, then interest rates and exchange rates are endogenous. If the Fed targets exchange rates, then interest rates and money are endogenous.

But it’s even more complicated. The Fed might target interest rates, but adjust that target every 6 weeks with the goal of a certain increase in inflation. Then money is still endogenous within the six week period. But from another perspective the adjustments in interest rates every six weeks cause changes in M that cause changes in inflation. From that perspective, the Fed is using M almost like an exogenous policy tool to control inflation, at least over longer periods.

I don’t know if the preceding makes sense, but be very careful of claims about “endogenous money”, “the money multiplier” “lending out reserves” and other concepts. They are very dependent on what the policymakers are actually doing. Whether money has a “multiplier effect” depends on whether the base injection is merely accommodating increased demand for cash balances, or flooding into an economy that doesn’t wish to hold larger cash balances. One is endogenous, the other is exogenous.

8. February 2023 at 04:07

Thanks. I agree, money is not truly endogenous as the Fed can influence credit growth via interest rates and capital and other regulations. What about the overall idea that the money growth during COVID is primarily a function of QE and bank credit growth (with other affects from RRP and the TGA at times)? This seems to be the view from central bank economists that is not consistent with mainstream models and I have been scouring the internet for a valid criticism of it, but have so far not found it.

8. February 2023 at 04:08

Wow, Edward is burning

Sounds like he “had 20 years of schooling and they put him on the day shift”——

8. February 2023 at 06:30

Isn’t “real money demand” the same thing Alfred Marshall was talking about? His “cash balances approach”?

No money stock figure acting alone is adequate as a guide post for monetary policy. But since Ed Fry discontinued the G.6 release, there’s been no valid velocity figure.

M2 is mud pie and divisia aggregates confuses money and liquid assets.

Obviously, all money is endogenous. The source of time deposits is demand deposits.

see: Toward a More Meaningful Statistical Concept of the Money Supply

https://www.jstor.org/stable/2976184

The Journal of Finance

Vol. 9, No. 1 (Mar., 1954), pp. 41-48 (8 pages)

8. February 2023 at 07:37

https://marcusnunes.substack.com/p/both-inflationistas-and-recessionistas/comments?utm_source=substack%2Csubstack&publication_id=274427&post_id=100723598&utm_medium=email%2Cemail&isFreemail=true&comments=true

Barnett chimes in.

If you look at the G.6 release you’ll know monies impact on prices:

https://fraser.stlouisfed.org/files/docs/releases/g6comm/g6_19961023.pdf

Those who contend that financial innovation has changed money demand are wrong. Nothing’s changed in > 100 years.

8. February 2023 at 18:59

Yes, I agree that M2 will continue to fall until it the M2/GDP ratio returns to something close to its pre-pandemic level and that this “real” quantity of money is affected by interest rates.

What I find unintuitive is the idea that changes in the money supply have been driven by movements in interest rates. The rise and later fall of M2 seems to be in large part caused by changes in the monetary base. But the expansion and later contraction of the base is not a response to movements in interest rates. It’s true that these two variables have moved in broadly opposite direction since the pandemic, but this is just a consequence of the fact that the Fed has used both of its instruments to change the stance of monetary policy – increasing the base when it is lowering rates and vice-versa. There is no causal link between the two. To me, this is most evident when we consider the significant slowdown in the growth of the monetary base (and of M2) that occurred in the first half of 2021 while short-term interest rates were near zero and unmoving.

9. February 2023 at 15:38

HB, I don’t think very many economists pay attention to money growth anymore.

Michael Rulle, Always like a good Dylan quote.

11. February 2023 at 10:44

re: “Where’s the money going?”

Vt is an “independent” exogenous force acting on prices.

“Quantity leads and velocity follows”.

Cit. Dying of Money -By Jens O. Parsson

The rate-of-change in money flows, DDs, peaked in Feb. Obviously, Vt peaked in June and hasn’t yet declined.