What is easy money? (Watch me try to open DeLong’s eyes)

Some people think easy money is low nominal interest rates. (DeLong)

Some people think easy money is low real interest rates. (DeLong)

Some people think easy money is an inflationary monetary policy; rising commodity prices. (Laffer)

Some people think easy money is a rising non-interest bearing monetary base. (DeLong)

Some people think easy money is a rising interest-bearing monetary base. (DeLong)

Some people think easy money is a rising M2. (Milton Friedman)

Some people think easy money is a depreciation of the currency in the forex market. (Mundell)

Some people think easy money is a rising NGDP growth rate. (Sumner)

What do we make of all this? Brad DeLong seems to think I’m a little bit nuts. But I think the rest of the profession is overlooking something basic. Any definition of easy money is arbitrary, unless it is relative to the policy objective. Let’s start with the fact that these indicators often give off different readings. For instance, in 1929-33 the nominal interest rate and MB indicators said money was easy, M2 and inflation said it was tight, and the real interest rate is ambiguous, because it was hard to measure back then. So I don’t really see what good it does DeLong to cite lots of indicators of easy money, when those indicators are themselves often contradictory:

Well, I would say that not just “modern Keynesians” but a lot of people believed that monetary policy was expansionary in 2008.

They believed so not just because (safe) nominal (and real) interest rates were falling, but because the money supply was expanding. Indeed, since 2007 the Federal Reserve has tripled the monetary base:

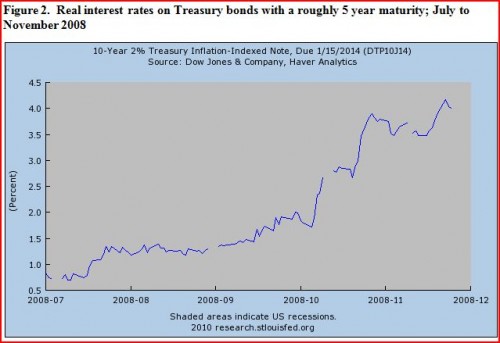

Let’s take these one at a time. Here are real interest rates in the last half of 2008, when the economy fell off a cliff.

As you can see, DeLong isn’t just wrong about real rates, he’s about as wrong as a person can be. And these aren’t estimated real rates; they are actual real rates, ex ante, from the TIPS market. Any bank thinking of making a loan knew for a fact that it could earn 4% on risk free government bonds in late 2008, bonds that are far more liquid than bank loans. How’s that for an increase in the opportunity cost of funds used in loans! (Yes, the high real rates only lasted briefly, but that because rates almost always fall when an economy collapses.)

I don’t want to pick on DeLong, because I’ve found that virtually every economist I talk to makes the same error. They all play lip service to the importance of real rates, but obviously only bother to follow nominal rates. So I can’t take very seriously their protestations that they don’t have a flawed monetary policy indicator.

Second, I’ve also noticed that most economists are much more respectful of Friedman’s argument that money was tight in the early 1930s, than my argument that money was tight in 2008. Why is that? Not because in 1932 the base or nominal interest rates were giving different signals than today (they showed easy money in the early 1930s), but rather because M2 was falling in the early 1930s, but not in 2008. Of course most of these economists also rejected the usefulness of M2 after the early 1980s, so it’s not clear why that variable is suddenly important to them. Neither M2 nor NGDP are directly controlled by the Fed. In both cases (it is alleged) the Fed has a hard time increasing them during a “liquidity trap.” So why the lack of respect for NGDP as a policy indicator? There isn’t any logical reason; I’m inclined to think most economists just go with their gut. “Easy money; I know it when I see it.” Actually they don’t; they confuse easy money with easy credit, an entirely unrelated phenomenon.

Lars Svensson showed that under a fiat money regime the Fed should target the forecast, set the monetary base and/or short term rates at a level expected to produce on-target nominal growth in whichever aggregate is being targeting. It makes no sense to talk about the ease or tightness of monetary policy in some absolute sense, as the many indicators listed above often give arbitrary and conflicting indications. All that matters is whether monetary policy is easy or tight relative to the goals of policymakers.

Since the 1980s I’ve advocated a policy aimed at steady growth in NGDP expectations. Brad DeLong has recently made similar recommendations. That’s great. And if that’s the goal, then easy money is a policy expected to exceed the NGDP growth target, and tight money is a policy expected to fall short. And by that criterion, money was extremely tight in late 2008.

One more point. Just how far out of the mainstream am I? Frederic Mishkin has the number one selling money textbook in America, and is a respected NK economist. So what does he think? (pp.609-10):

1. It is dangerous always to associate the easing or the tightening of monetary policy with a fall or a rise in short-term nominal interest rates.

2. Other asset prices besides those on short-term debt instruments contain important information about the stance of monetary policy because they are important elements in various monetary policy transmission mechanisms.

3. Monetary policy can be highly effective in reviving a weak economy even if short term rates are already near zero.

Hmmm. Isn’t that Sumnerian economics? What did those “other asset prices” show in 2008:

1. Housing prices fell throughout 2008.

2. Then when NGDP fell in the second half:

a. Commercial RE prices plunged

b. The dollar soared against the euro

c. Commodity prices fell in half

d. TIPS spreads plunged into negative territory

e. Real interest rates soared much higher

f. Equity prices collapsed

I wonder how Mishkin would characterize those “other asset prices?” What were those markets telling us about the stance of monetary policy? And who’s the one teaching textbook economics, me or Brad DeLong? Whose eyes are closed?

HT: Dilip

Tags:

9. October 2011 at 10:10

It seems like the confusion is between easy and easier. Person A might be fatter than B, while still not being fat. Expanding the base makes monetary policy easier compared to not expanding it. But it might still not be easy money.

And then we have the word contractionary. Does that mean easy or easier?

9. October 2011 at 10:18

“Any definition of easy money is arbitrary, unless it is relative to the policy objective.”

I don’t think this is entirely true. You can define easy money relative to the policy instrument. Not to say that this is a good way to define it, but it’s not an arbitrary way. If the federal funds rate (being the policy instrument) is lower than it has been for, say, most of the past decade, it doesn’t seem arbitrary to me to define that as easy money. And particularly, when your talking about changes (or lack thereof) in policy at a given point in time, there is a case for defining policy in terms of the instrument, because otherwise you end up saying that there was a change in policy even when the central bank did not actually make any changes in the settings of its policy instrument. I think that’s more or less what Brad is saying. But see the comments to his post, in which I point out the problems with using that criterion and he acknowledges my point. (Also, I guess you and I independently noticed the thing about real interest rates rising in the fall of 2008.)

9. October 2011 at 10:23

Correction: “when you’re talking” not “when your talking”

I’m a grammar Nazi caught by my own Gestapo.

9. October 2011 at 10:35

I said:

“I guess you and I independently noticed the thing about real interest rates rising in the fall of 2008.”

…although Brad hasn’t approved my last comment yet, so you scooped me on that one 🙂

I will, note, though, as I did in the pending comment on Brad’s blog, that much of the fall in TIPS prices was not an increase in real interest rates in the abstract but an increase in the liquidity premium. It’s hard to tell exactly what was really happening to inflation expectations at the time. My guess is that the real interest rate on T-bills was rising but not by enough to account plausibly for the subsequent behavior of NGDP.

9. October 2011 at 10:43

DeLong seems to think you’re saying the large expansion of the money supply was contractionary, so monetary policy was contractionary. I believe you’re saying policy encompasses much more than just the money supply, in particular what the Fed is implying about the future path of its actions and inactions. Fair?

9. October 2011 at 10:52

EASY: A bank issues $100 for a bond worth $99

TIGHT: $100 issued for a bond worth $101

NEUTRAL: $100 issued for a bond worth $100

9. October 2011 at 11:01

“Any definition of easy money is arbitrary, unless it is relative to the policy objective.”

I like this sentence. Is our defense budget “large”? At 6 percent of GDP? Well, yes, if we face no serious military threats. No, if Japan and Germany are arming to the teeth and invading neighbors. Then 6 percent would be “small.” It is relative to the reality, not the models or rules.

I think Sumner is right on this. Money is not “easy” if nominal GDP is creeping along well under trend. And if you are unemployed or a small business guy or tied to real estate, money is not easy at all. It needs to be way easier. I prefer the expression that “monetary policy has to be far more aggressive or bullish.” (In the American political lexicon, words like “easy” and “soft” and “doves” are associated with weakness. Try to use words that suggest strength and boldness).

I have to say, this is when economists look their worst to outsiders. Deciding that money is “too easy” when there is 9 percent unemployment, nominal GDP is way below trend and real estate has collapsed—this is when economists look like some guys overly absorbed by their models and rules, and who disdain to look out the window.

Crickey-Almighty, money is not easy now. We have a very feeble, dithering monetary policy now.

9. October 2011 at 11:02

I’ve been following the models discussion and that of interest rates, and something keeps coming back to me, that is, the ease in repaying loans that existed at a time when interest rates were particularly high, the late seventies. The fact that rates were high didn’t seem to stop anyone, when one’s income could easily buy a house or launch a business.

In other words, people were borrowing because they 1) expected to be able to readily repay, and 2) They expected business profit well beyond the cost of the loan. This is why I don’t understand the idea of low interest as incentive to borrow, to me, low interest just looks like an economic climate in which one cannot necessarily repay what one borrows. Is this accurately reflected in the models? There is an important exception to what I have observed, mortgage refinance in which the incentive to borrow is in fact because of the interest rate.

9. October 2011 at 11:05

The Fed’s revealed preference is to keep interest rates constant. Loose policy is when they are forced to lower it. Tight policy is when they are forced to raise it.

In the old days, what forced the Fed to act would be gold flows and the need to maintain convertibility. (OK, the fact that they can accumulate gold reserves is a bit of a problem with my story. Well, maybe not. Let’s keep rates constant like we want, and just accumulate gold. So what if it creates a Great Depression.)

Today, of course, the constraint is inflation expecations. In particular, if they leave rates unchanged in the face of rising inflation expecations, we head towards hyperinflation. And the same thing goes for deflationary expectations.

Milton Friedman and the old monetarists were central bank critics.

What is Scott Sumner and the market monetarists? The same.

For both, they attack the central banks key goal. Forget short term interest rates. For the old monetarists, it was do open market operations to keep M2 on a steady growth path. Short term interest rates will just rise or fall however much it takes. Yikes!

For Market Monetarists, it is the same. Open market operations to keep nominal GDP expecations on the target _growth path_. (Scott, not NGDP growth, the target level of NGDP, which changes each quarter.) And short term interest rates have to change however much is needed. Yikes!

Of course, Market Monetarists are in just as much trouble with old monetarists, because “base money?” “M2?”… they just have to be and whatever level is needed.

Still, who cares about the old Monetarists. It is the central banks whose preferences count.

9. October 2011 at 11:07

[…] IS/LM debate continues. Scott Sumner and Brad DeLong now debate how to define “easy money”. Here is my take on how to identify easy […]

9. October 2011 at 11:09

P.S.

Tight money is when the quantity of base money is less than the demand to hold it. Loose money is when the quantity of base money is greater than the demand to hold it.

We can do interest rates too. Tight money is when the interest rate is above the natural interest rate. Loose money is when the interest rate is below the natural interest rate.

Unfortunately, the demand for base money and the natural interest rate can’t be observed. However, it retrospect, we can look at what happens to the growth _path_ of spending on output. And we can say whether there was tight or loose money in the past.

9. October 2011 at 11:33

Scott, I am beginning to think that it is not really meaningful to talk about easy and tight money. Obviously, if the money supply growth faster than money demand then it will increase inflation and NGDP, but as you say we have to see that in relation to the policy objective.

However, what if there is no policy objective or the policy objective is insane? Most of us would argue that Zimbabwian monetary policy has been too loose, but RBZ (that is the central banks of Zimbabwe) did not have an inflation target, or a NGDP target.

Furthermore, lets say that the Federal Reserve said it would freeze NGDP at the present level. Would monetary policy then be neutral now?

9. October 2011 at 11:37

Bill, spot on!

9. October 2011 at 11:44

What do we make of all this? Brad DeLong seems to think I’m a little bit nuts.

I don’t think you’re crazy, Scott. But I think you are in the grip of an a priori theory. You are convinced that there is something called “money” that can be either easy or tight. You are convinced that when money is easy certain observable economic effects occur; and that when money is tight, certain opposite economic effects occur. Since we are actually seeing effects of the latter kind, you have reasoned backward to conclude that money must be tight.

The problem is that your theory seems impervious to empirical confirmation or disconfirmation, and now borders on a kind of triviality. You apparently will not accept any of the usual measurable quantities that most people have called “money” as the thing that plays the role of money in your own theory. Instead money is a pure unobservable theoretical variable, that is posited to take a range of values along a linear scale of tightness to easiness. In effect, money plays no non-trivial theoretical role.

If the NGDP growth rate is the policy target you think the government should adopt, then it you add nothing at all to that prescription when you claim that there is also an unobservable quantity whose so-called tightness or easiness is by definition equal to the NGDP growth rate. Does your theory make a substantive and testable empirical claim or doesn’t it?

I think Sumner is right on this. Money is not “easy” if nominal GDP is creeping along well under trend.

Or maybe money is easy, but its posited causal connection with NGDP growth doesn’t exist?

9. October 2011 at 12:09

Kervick:

You continue to assume that analysis in terms of the quantity of money must assume constant velocity. Sumner, supposedly, is defining the quantity of money in some changeable fashion so that a constant velocity results in a changeable nominal GDP.

But Market Monetarism is based upon the quantity of money and the demand to hold it. There is no assumption that the demand to hold any particular measure of money is proportional to nominal expenditure on output. It can change.

Does the theory of supply and demand require that we can predict next year’s equilibrium price and quantity of apples?

9. October 2011 at 12:22

[…] and Sumner “duel it out”. First Sumner: Some people think easy money is low nominal interest rates. […]

9. October 2011 at 12:27

Dan Kervick–

If money is “easy” and we are creeping well below nominal GDP trend for three years, have 9 percent unemployment, and real estate busted, then money supply is not easy. We need to be much more aggressive or bullish.

We need larger QE, and sustained, with an announced nominal GDP target, and no more IOR.

In other words, the Fed puts out a picture of Ben Bernanke with his hand on the lever of a printing press. The caption: “Think I can’t cause nominal GDP to rise? Go ahead, make my day.”

If the Fed has an aggressive and bold leader who vows to raise nominal GDP by any means necessary, are you going to bet against him? Or buy real estate right now? (At 10 percent down on $100k building, if the value of the property goes up by 25 percent, you just earned 150 percent on your money, before costs and taxes).

I am telling you, if the Fed committed to aggressive nominal GDP growth, and followed through with three or four months of steady QE purchases—and it looked like they were not going to back down soon—then real estate would soon boom. And real estate is the lagging sector of the GDP, and would bring up all other numbers.

BTW, small business guys can usually only borrow against assets—and your employees and equipment are usually worth nothing. It is the real estate you borrow against. When you can.

Or, we can stay with the dithering, feeble, no-nothing Bank of Japan approach, and watch equities and real estate fall in value by 80 percent in the next 20 years. As they did in Japan.

No one who talks about stable prices and the need to fight inflation ever wants to talk about Japan. For good reason.

Come on Kervick, get on board. Market monetarism is the best hope from here.

9. October 2011 at 13:26

Scott,

To summarize your post.

1. “Asset prices …. are important elements in various monetary policy transmission mechanisms.”

2. “I… advocate a policy aimed at steady growth in NGDP expectations.”

3. “The Fed should target the forecast, set the monetary base and/or short term rates at a level expected to produce on-target nominal growth in whichever aggregate is being targeting”

So if I am not mistaken….a) the Fed can”t set rates any lower and a dramatic expansion in the base has not increased NDGP.

So why not tell the financial institutions to buy more assets (through an equity reserve ratio policy tool). This will definitely push asset prices up.

If this is not a good approach, what is your prescription. (I don’t think eliminating IOR gets you to the NGDP target you want, and there is opposition to additional QE). So tell us what does the FED do to achieve the NDGP target.

9. October 2011 at 13:31

Benjamin Cole is right, but the way to do it is not through elimination of IOR (though this would help) and additional QE (which is politically difficult and of only indirect efficacy) but rather by specifically forcing the banks to acquire additional specific assets through the introduction of an equity reserve ratio policy.

9. October 2011 at 13:53

Some people think easy money is CPI declining during the 4th Q 2008 from 218.852 to 211.327 — deflation at a 13% annual rate.

9. October 2011 at 15:15

The simplest and most coherent definition of easy money seems to be increases in the monetary base since that’s what the central bank can control. If additions to the monetary base don’t multiply out as expected, it’s not the fault of money, it’s a lack of demand for loans pulling money and greater spending into existence.

Ben Cole,

Another real estate boom already? We haven’t even recovered from the last one yet. It reminds me of when Krugman called for a real estate bubble to replace the dot com bubble back around 2002.

9. October 2011 at 15:50

John,

In other words it seems that the control of velocity is as much up to the public, as the banks.

9. October 2011 at 16:13

But Market Monetarism is based upon the quantity of money and the demand to hold it. There is no assumption that the demand to hold any particular measure of money is proportional to nominal expenditure on output. It can change.

Bill Woolsey, I’m not sure where I am confusing the quantity of money with its velocity.

But it is incumbent on the people who defend a theory that purports to find a correlation between changes in the quantity of money, on the one hand, and changes in any economic other economic phenomenon – such as NGDP – on the other hand, to offer evidence for their theory. The evidence, I would think, must consist in measurements of the latter kind of changes considered together with measurements in changes in the quantity of money, and demonstrations of a correlation between them.

If a critic says that your theory seems iffy because NGDP changes don’t appear to correspond to a change in M2, for example, it is appropriate for the monetarist to reply that byy “money” they don’t mean M2. And maybe they can reply that don’t mean MB, or M3 or anything else that has been put forward in the past as a definition of money. But at some point you have to say what you do mean by money, and what you mean by “easing” it or “tightening” it, so that we can study the observable phenomena to see whether the theory is true or false.

If in the end the expression “easy money” is just a synonym “rising NGDP” and “tight money” is just a synonym for “falling NGDP”, then any theory of a correlation between the quantity of money and NGDP is tautologous. And it is unclear whether you are really left with any kind of monetarism at all.

The real question I have is about policy options. The hypothesis that NGDP changes are correlated with changes in money is presumably behind the belief that the central bank is the key to economic policy-making, and that targeted changes in NGDP can be determined by some combination of central bank policies. But if the alleged monetarist aspect of this view collapses into a tautology according to which the money supply change is simply redefined as the NGDP change, then it’s no longer clear what role the central bank has in determining it.

I think DeLong makes this point in one of his comments in the blog post thread that Soctt links to.

9. October 2011 at 16:21

John-

Reflation of real estate values would do wonders all across America.

As Scott Sumner has pointed out, the real estate boom or “bubble” only popped due to bad monetary policy. It might have cooled off, or had a minor correction if the Fed had not tightened too much.

Once real estate collapsed it took down all those loans with it. Remember, commercial real estate collapsed almost identically to residential, strongly suggesting it was not institutions or regulations (Fannie, Freddie, CAR etc) but a tight money supply that crushed the real estate sector’s prosperity.

I am baffled by people who say prosperity is bad, booms are bad. There is a defeatism about the land, with naysayers talking about the need to restrict booms and inflation, even though we are in a deep recession.

Japan has shown what happens if any little signal about inflation causes you to tighten up. You get 20 years of perma-deflation-recession.

A real estate boom? Sure, I’ll take a boom. I’ll take lots of booms. Booms are a sign of a prosperous risk-taking culture and economy.

Boom-times baby, bring ’em on.

Or do you prefer the Japan model?

9. October 2011 at 16:35

We need to be much more aggressive or bullish.

I agree Benjamin Cole. I think the US government should act directly to hire people; and to create massive income flows away from surplus savings toward those people most likely to spend it on consumption, hiring or capital goods. And if monetary expansion is to be part of the solution, it should be an accompaniment to a fiscal program to inject money directly into the real economy, rather than simply making more liquidity available to financial institutions.

My problem with all of the monetarists is their frustrating conservatism. On the plus side, the market monetarists are very aggressive about what they think the central bank can and should do and the impacts they hope that will have on the financial sphere. But whenever it comes to the more obvious need – direct and aggressive government activism in the real economy to break the logjam of stagnation – they throw their big, conservative “thou shalt not” wet blanket over all the options, and clutch at the free-to-choose idols of Friedman’s religion. They continue to tie shackles around the democratically elected branches of government, but have no compunctions about the scope they are willing to allow to the largely unaccountable central bank. They even think the central bank is and should be the chief economic policy-making institution in the United States, an outlook I think is both empirically wrong and morally misguided.

Help liberate government activism from these ideological shackles. Let my people go! 🙂

9. October 2011 at 17:23

Peter, That’s right.

Andy. You said;

“I don’t think this is entirely true. You can define easy money relative to the policy instrument. Not to say that this is a good way to define it, but it’s not an arbitrary way. If the federal funds rate (being the policy instrument) is lower than it has been for, say, most of the past decade, it doesn’t seem arbitrary to me to define that as easy money.”

I hate to disagree, especially after the excellent job you did defending me over at DeLong’s blog. But I can’t agree here. I don’t think it makes any sense to say money was tight during the German hyperinflation, because interest rates were much above their normal level. And if we accepted your argument, that would be the implication, wouldn’t it?

Here’s why I don’t like the “doing nothing” argument. Brad cited the base as an indicator. But there’s no way that if the drug cartels hoarded an extra $100 billion in currency, and the Fed “did nothing,” that DeLong would regard that as a passive monetary policy. He’d say the Fed tightened when rates rose.

Yes, I’ve been harping on the rise in real rates for several years now. Indeed I’ve had many battles on this issue, which is why I put the stuff about opportunity cost into my post–I already anticipated your observation about the liquidity premium on T-bills. People need to focus on the real interest rates on TIPS, not T-bills, because TIPS are much more like other assets in the economy, and hence the real yield on TIPS is far more representative of what’s happening in credit markets. To be sure, I don’t believe real rates are a reliable policy indicator, but for those who do, real rates were certainly rising sharply for risk free assets that banks could own if they didn’t lend money out.

Robert, Yes, and indeed I don’t think even DeLong really believes the money supply is the right way to decide whether money is tight. Suppose it went up because drug dealers were hoarding more cash?

Mike Sproul, So Fed policy is always neutral?

Ben, I agree.

Becky, The 1970s is a very good example, you’re right.

Bill, I assume your first paragraph is describing the Fed’s views, not yours.

On your second comment, I’d note that easing monetary policy can actually cause interest rates to rise, for maturities as short as 3 months.

Lars, Fair point. Perhaps I should have said that most economists didn’t realize Fed policy in 2008 was too tight to hit the Fed’s implicit policy objectives.

Dan, You said;

“The problem is that your theory seems impervious to empirical confirmation or disconfirmation”

That’s not even close to being true. I have frequently discussed what the Fed should do. If they do those things and fail, then I am wrong.

I define money in terms of expected NGDP growth, not actual. I favor targeting an NGDP futures contract at a 5% growth rate. If they do that, I will be satisfied that policy is neutral. If actual NGDP comes in low, I wouldn’t make up any excuses.

I’d add that this blog has made a lot of predictions since starting out in early 2009. There’s a reason it has become more popular–I’m seen as having been right about some key issues.

dtoh, You said;

“So if I am not mistaken….a) the Fed can”t set rates any lower and a dramatic expansion in the base has not increased NDGP.”

People keep talking like the Fed has tried to inflate and failed. They aren’t trying! They did IOR for a reason, the reason was to prevent the base injections from being expansionary. If the Fed tries and fails, then we can look at alternatives, but your entire argument is based on a mistaken premise, that the Fed wants to expand but is out of ammo. Bernanke says they have ammo, but just don’t want to use any more right now.

The Fed’s strongest tool is setting a significantly higher NGDP target, and announcing level targeting. In that case no QE will be needed.

Jim Glass. Wow, I forget it fell that fast.

John, You said;

“The simplest and most coherent definition of easy money seems to be increases in the monetary base since that’s what the central bank can control.”

So if drug dealers increase their demand for cash by $100 billion, and in response the Fed increases the base by $5 billion, and interest rates soar from 5% to 14%, you are going to call that “easy money.” Fine, but there’ll be 299,999,999 Americans who disagree with you.

9. October 2011 at 18:09

Almost on topic: here’s an example of why distinguishing real and nominal interest rates is important (as well as distinguishing correlation from causation and distinguishing credit from money)-

http://books.google.com/books?id=qh1KLhjMqIoC&pg=PA155&dq=overfunding+money+supply&hl=en&ei=VoLvTc-HKYSr8QOcvsz9Dg&sa=X&oi=book_result&ct=result&resnum=3&ved=0CDEQ6AEwAjgK#v=onepage&q=overfunding%20money%20supply&f=false

– it’s amazing that monetary theorists haven’t realised that reducing the monetary base has no effect & high interest rates cause inflation!

9. October 2011 at 18:10

Scott:

“So Fed policy is always neutral?”

Close to it. If the fed overpays for bonds by some fraction of a percent, that’s easy, while underpaying is tight. Lending a bit below market rate is also easy, while lending above the market rate is tight. The same is true of private banks or, for that matter, for anyone who issues anything used as money (gift certificates, etc.)

Easy money results in assets rising less than money issuance, and is therefore inflationary. Tight money results in assets rising relative to money issuance, and is deflationary.

9. October 2011 at 18:29

They did IOR for a reason, the reason was to prevent the base injections from being expansionary.

I know that’s the usual explanation, and is based on a standard model of fractional-reserve banking which sees banks as lending from their reserves. But if the theories of the endogenous expansion of the money supply are correct, then there might be a very different motivation for IOR.

Banks make loans and frequently create additional deposits as a result. They might then find, based on the volume of their activity, that they will soon come up short against their reserve requirements. They have several weeks of first calculation and then compliance within which to acquire the additional reserves they need, subject to possible penalties if they fail. They get the additional reserves by borrowing them from other banks, or from the Fed directly, at the rates of interest the Fed has targeted for these transactions. Thus their willingness to make new loans when they are up against their reserve requirements has something to do with the size of the difference between what they can expect to earn from the loans and the subsequent cost of shoring up their reserves.

Most banks would, as I understand it, prefer to have no reserves at all, and regard these reserves as a burdensome cost. IOR effectively reduces the cost of building up and holding reserves, by refunding part of the cost of acquiring them in the first place.

If the sketch I just drew is correct, then wouldn’t paying interest on reserves actually motivate additional lending, by making it less costly for banks to build up the reserves they need to meet the additional reserve requirements on their new lending?

9. October 2011 at 19:21

Dan Kervick,

“I know that’s the usual explanation, and is based on a standard model of fractional-reserve banking which sees banks as lending from their reserves.”

Perhaps. A better model is simply one of supply & demand: paying interest on base money changes its attractiveness relative to other financial assets.

As for the analytical sketch you provide, aren’t you assuming that banks are currently reserve-constrained? Also, I think that we really need to bring in banks’ holdings of broader securities before we can properly describe the effects of IOR in detail; a simple loan-base model, as usual, is incomplete.

9. October 2011 at 19:48

“…paying interest on base money changes its attractiveness relative to other financial assets.”

We have some empirical experience with which to gauge the elasticity of ER’s to relative changes in the IOR.

The April extension of the FDIC levy to deposits that fund ER’s reduced the effective IOR by 40%. The impact on the ER/RR mix was quite small. Instead, the effective IOR drop caused the yields on close substitutes — s.t. repo’s and T-bills — to fall, in some cases below zero.

Also, since June, bank lending spreads have dropped by more than 75bps from the peak. This dramatic increase in the “attractiveness” of ER’s relative to “other financial assets” has, nonetheless, had little impact on the ER/RR mix.

Given the two examples, it seems hard to argue that credit is sensitive to even large changes in the relative return to ER’s.

9. October 2011 at 20:43

Jim Glass-

Superb point.

All Market Monetarists: Please note the point Jim Glass has made. If anybody rants and chants about inflation, we should bring this fact to bear.

9. October 2011 at 21:27

Becky,

I understand velocity as the result of individual choices about how many dollars they want to hold. If people want to increase their cash balances, velocity slows and vice versa. The important point is that all economic effects trace back to individuals.

Ben Cole,

Booms involve severe misallocations of resources that leave society poorer. They aren’t sustainable. That’s the whole point; there’s a difference between sustainable growth and a boom based on rapidly rising prices in a specific area. Keynesians and Monetarists think it’s possible to keep a sort of permanent semi-boom going but history keeps disputing that sentiment.

Scott,

Wouldn’t drug dealers increasing their demand for cash, assuming they don’t put it in savings accounts, mean that they have to increase their cash holdings at the expense of other players in the system, including Federal Reserve member banks and people with accounts in such banks? In which case, drug dealers withdraw funds and the monetary base would contract right? I think it’s worthwhile to point out again that there is really no such thing as tight, easy, or just right money. Any quantity of money above a certain amount can serve the function of money and the only correct rates of interest are determined by market outcomes instead of central banks.

9. October 2011 at 21:38

W. Penen: As for the analytical sketch you provide, aren’t you assuming that banks are currently reserve-constrained?

Not constrained, W. I’m assuming that they can always get the reserves of the price is right, and they aren’t constrained by the volume of reserves they already possess. But I’m assuming that the price of acquiring the reserves can influence the attractiveness of different kinds of loan terms in their dealings with borrowers.

9. October 2011 at 21:39

Scott,

Your scenario is interesting. It took a minute for me to understand what you were getting at. I think what you’re saying is that the extra $100 billion held by the drug dealers would not have any influence on the monetary base but would mean that there was less cash for banks to lend, hence other monetary aggregates would fall due to the fractional reserve nature of the banking system. Is that right?

In that case, I think you could still argue that money didn’t significantly tighten unless the drug dealers decided to burn their money, in which case the monetary base would fall. If they decided to withdraw cash from the banking system, they did it for a reason. At some point they will use it to consume or invest, therefore it’s conceivable that total spending wouldn’t fall that much and you wouldn’t see the symptoms of tight money such as disinflation, deflation, rising real or nominal interest rates, etc. In fact, in our present situation, drug dealers removing money from the bank for their personal use might actually lead to more total spending considering the way banks are sitting on their reserves.

9. October 2011 at 21:51

Dan Kervick,

Government hiring programs have always and will always fail as solutions to a depression. The liberals on CNBC always talk about infrastructure projects and get boners over how it’s gonna build or nation and end the unemployment problem. But if you really think about it, how many of the unemployed people that you know have ability or inclination to work on construction projects. People have to grasp that there isn’t a homogenous stock of workers and resources that are underutilized right now. As a result of that, it’s impossible for government projects to specifically target the unemployed workers and resources.

Second, government spending tends to be wasteful. Since government doesn’t depend on voluntary contributions for funding it’s projects, it has no way of determining whether those projects are wasteful. Without the profit and loss test, government cannot engage in economic calculation and is likely to squander scare resources which could have been utilized in a more efficient way.

Third, government spending projects are also wasteful because they usually involve a great deal of corruption. Read some accounts of the New Deal. It’s a fact that Roosevelt channeled money into contested districts and states while leaving places that had voted solidly one way or another without money. For a more recent example of government spending, corruption, and waste, look at Solyndra.

On a side note about Solyndra: the government’s green energy/jobs program is destroying our country’s energy future. The market needs to decide on profitable new sources of energy, the government is wasting money and promoting industries that have no chance of succeeding (ethanol and solar). That sucks money away from companies working on things that might actually have a chance and puts them at a huge competitive disadvantage.

9. October 2011 at 21:58

“Not constrained, W. I’m assuming that they can always get the reserves of the price is right, and they aren’t constrained by the volume of reserves they already possess. But I’m assuming that the price of acquiring the reserves can influence the attractiveness of different kinds of loan terms in their dealings with borrowers.”

But banks currentely have a huge quantity of reserves relative to their outstanding loans. I think that US M0 is now bigger than even some broad measures of the money supply. Given their huge balances at the Fed, why would banks worry about acquiring new base money?

9. October 2011 at 23:01

[…] Source […]

9. October 2011 at 23:07

[…] – The many interpretations of easy money. […]

10. October 2011 at 00:21

Jim Glass-

Superb point. All Market Monetarists: Please note the point Jim Glass has made.

Aw, thanks. I’ll add the related fact that QE1 stopped and turned around that deflation on the proverbial dime.

That’s for the benefit of any who think it didn’t do anything significant, and/or that money policy is ineffective at the zero bound.

The problem is: then the Fed stopped.

10. October 2011 at 01:26

The TIPS bond is not an opportunity cost benchmark for banks. To my knowledge this market is restricted and banks can’t hold arbitrary volumes of TIPS.

P*Y = M*V

Money is tight if the product on the right hand side of the equation is shrinking and exerting downward pressure on P. In this moment money becomes more valuable even by not being employed and a vicious circle sets in in which the pressure becomes ever greater. The wealth of the money holders increases by not circulating their stock, in turn forcing P and Y down and even more increasing the purchasing power of the remaining money. All of this is governed by real interest rates and the price level of investable assets and goods.

Compare the price of gold to real interest rates and you can witness it during depressionary eras.

10. October 2011 at 04:10

John,

My view is that our economy is driven from the bottom up by ordinary consumers who have a steady, regular and secure income, and thus the confidence and need to spend most of it. They represent the desire and willingness to buy new products, and that gives existing businesses the rational incentive to invest in the provision of new products, and also gives entrepreneurs the rational incentive to create new businesses. The fact that these income-receiving consumers happen to be providing work in exchange for their incomes streams is very important, but is secondary to their role as consumers.

If income flows and wealth stocks become too concentrated in small sectors of the population over some period of time, the result is to drain purchasing power from consumers and steer it toward savers. An overly high proportion of national wealth becomes a buffer surplus that is saved in low-risk, low-return savings vehicles, since it is not needed either for consumption, and is not desired for the very few higher-risk, higher-return investment opportunities that are available. As a result, output stagnates or falls, and unemployment rises, creating further downward pressure on output. Many of those who still have jobs lose their income security due to the harshly competitive conditions in the employment market, which creates further downward pressure on consumption and excessively high savings rates.

If 100,000 existing companies and entrepreneurial startups were to decide at more-or-less the same time to take a leap of faith, and invest in the hiring of millions of workers and the production of new products, their action might stimulate a virtuous circle by giving more income and security to all those workers, who could then afford to buy the new products, leading to renewed investment, etc. But they can’t and won’t do that. They are in a prisoners’ dilemma; their stagnation is self-perpetuating.

The public sector – with its massive resources, national scope and organized government – has unique power to break through the logjam by committing to a sustained program of new spending of its own, and also also executing compulsory transfers of wealth and re-directions away from surplus savings back toward consumption and demand. The public sector can massively hire unemployed workers to do various jobs, and also boost demand for consumption through outright transfers.

I believe we need to stop looking at employment and income conditions as merely an effect of stagnating output, but as the chief sustaining cause for stagnating output once a recession is underway. Rather than aim only at a slow, long run improvement in hiring as a consequence of other economic effects, we should start with the hiring. Government should commit to a full employment target, through a permanent program of government work. Most of the work done can be in the improvement of public goods and public property, which is therefore work that wouldn’t be done otherwise without the government role. So we will get the benefits of whatever additional output this employment provides. But the workers also receive incomes which increases aggregate demand and stimulates production in the private economy.

The program can be administered in such a way as to employ metrics of private sector demand for employment to release workers into the private workforce during booms, and absorb workers into the government workforce during downturns. This would do much to stabilize our economy, and prevent a lot of needless human misery and unnecessary periods of reduced output.

10. October 2011 at 05:05

“An overly high proportion of national wealth becomes a buffer surplus that is saved in low-risk, low-return savings vehicles, since it is not needed either for consumption, and is not desired for the very few higher-risk, higher-return investment opportunities that are available. As a result, output stagnates or falls, and unemployment rises, creating further downward pressure on output.”

I’ve seen this theory before, but I don’t buy it. As the proportion of savings invested in “safe” assets increases, the yield of such assets will fall and the premium accruing to risky assets will increase. So investors should readjust their portfolios towards risky assets. Nevertheless, something akin to what you describe did briefly occur in 2008, as credit markets became dysfunctional for a time. And even then, the resulting fall in aggregate spending and NGDP was wholly preventable. If expectations of aggregate spending had been kept on target, business opportunities should have been abundant. Moreover, government spending tends to displace private investment and employment, so it is less effective at boosting the economy even when it succeeds in increasing AD. Unless you think we have too little government in general, tax cuts on investment and payrolls are better for fiscal policy.

10. October 2011 at 06:42

To all:

I am just an every day average joe who has developed the odd hobby of reading economics blogs. I landed on this one perhaps 6 months ago. I have been very fortunate over the years to have invested well thru my 401k and the housing boom to put my self in a situation where i may retire early, but who knows what the next ten years holds, ( I am 45, own my home, and a rental, 401k holdings that should come close to replacing all my current income at the time I retire) have been a fan of Jim Rogers for years as an investment guide.

When I see references on this and other blogs that the public does not understand what it takes to keep an economy going and that it is not politically feasible to QE forever I agree. I think that I get that the difference between me and the government is that I cannot get an unending credit line that that the US dollar provides. And I think I basically understand that this BlOG is advocating using this power to maintain a level of output (NGDP Targeting) to keep our economy expanding at a steady rate, or at least as close as feasibly possible. I have no college education, barely finished high school, landed in a quality manufacturing job but to my credit am an avid reader. And in my discussions with my friends it is clear that I am light years ahead of there understanding of this stuff.

So if I am anywhere near right in my simplistic view of this, then you are right. The average joe on the street will come unglued if we keep spending dollars like they are growing on trees. Someone is going to have to figure out how to do this and make it look not so obvious. And maybe a new tool like a futures contract or something of that nature is the way to go, change the discussion from borrowing against our kids future to investing in it! This combined with some government sanity (seemingly incompatible words) may just save us from ourselves. My 2 cents worth. Go easy on me if I am so far off as to be laughable!!!

10. October 2011 at 06:44

As the proportion of savings invested in “safe” assets increases, the yield of such assets will fall and the premium accruing to risky assets will increase.

Can’t we get into a deflationary spiral in which even a negative real return on the relatively safe assets is reckoned as superior to the average expected returns on riskier assets? If the economy is stuck in reverse or neutral, the continuing flight to safety can cause a continuing lack of investment in production and consumption, and a continuing, self-reinforcing preference for the safe assets.

Even if real opportunities for higher returns begin to pick up gradually, with little trickles eventually becoming streams. But why limit ourselves to these slow-paced and gradual market adjustments? Why not just deliberately shift resources from savings to investment and consumption. The argument against this always seems to come down to the idea that that large-scale government fiscal decisions are bound to be bungling next to those of the locally acting invisible hand, no matter how crippled, palsied or mutilated that invisible hand is. But it seems to me that this is a very implausible reservation when the needs and dysfunctions are so obvious.

10. October 2011 at 07:01

Dan Kervick

You said;”The fact that these income-receiving consumers happen to be providing work in exchange for their incomes streams is very important, but is secondary to their role as consumers.” This is very bad economics for the simple reason that there would be nothing to consume if people didn’t work to produce things first. What makes mass consumption possible is a large supply of consumer goods. The process that generates the necessary increases in output is SAVINGS followed by capital investment which increases the productivity of labor. This increased productivity leads to a larger stock of consumer goods equaling more purchasing power for the worker and higher real wages. It is only savings that makes improvements in economic conditions possible.

To address your second argument, if businesses fail because wealth becomes too concentrated, isn’t that a failure on the part of entrepreneurs? Businessmen are supposed to be able to notice, predict, and cater to trends like that. For instance, more companies could produce boats and luxury car. Also, a greater pool of savings can enable longer term investments in things like research and development. It is the duty of entrepreneurs to anticipate and meet the consumption demands of the public. This is possible at nearly any type of income distribution or preference for saving (other nations save far more than us and/or have similar income inequalities but have no problem with unemployment).

The underconsumption idea is an old, zombie fallacy. Its reasoning crumbles once you examine it. It has no ability to explain the string of entreprenurial errors seen during a bust and the policy prescriptions that come with that worldview tend to be horrendous. Herbert Hoover was the most famous proponent of the idea and his plan to prop up wages following the stock market crash, with the aim of boosting purchasing power, created massive unemployment and a collapse in output.

10. October 2011 at 08:41

W. Peden, That’s depressing.

Mike, Suppose the Fed is buying assets at market prices, and keeps buying until we get hyperinflation. What then?

Dan, It might motivate additional lending (although I doubt it–as it force interest rates higher.) But even if it did, the quantity of lending has nothing to do with monetary policy. Monetary policy is about changes in the supply and demand for the medium of account, and IOR increases the demand–which is contractionary.

The Fed instituted IOR in early October 2008, then raised the rate twice. On all three days the stock market crashed, by an average of about 5% per day.

David Pearson, What would happen if the Fed raised IOR to 5% tomorrow? How about if they reduced it to negative 3%?

John, You said;

“Wouldn’t drug dealers increasing their demand for cash, assuming they don’t put it in savings accounts, mean that they have to increase their cash holdings at the expense of other players in the system, including Federal Reserve member banks and people with accounts in such banks? In which case, drug dealers withdraw funds and the monetary base would contract right?”

Wrong, it has no impact on the base. The money comes from other base holders.

Finster, You said;

“The TIPS bond is not an opportunity cost benchmark for banks. To my knowledge this market is restricted and banks can’t hold arbitrary volumes of TIPS.”

What is the legal limit on bank holdings of TIPS and can you provide a source? Thanks.

I agree with your comment on M*V.

10. October 2011 at 08:51

Scott,

You say, “Your entire argument is based on a mistaken premise, that the Fed wants to expand but is out of ammo.”

I don’t think the Fed is out of ammo, but I do think the Fed may be worried about using their last two bullets because a) they’re not certain the bullets will work and b) they’re worried about running out of ammo.

You assume that simply announcing an NDGP target will work through market expectations. You may be right but it is by no means certain since it requires the market to believe that the Fed can and will take steps needed to reach the target. With the dithering to date and the introduction of an entirely new policy, I don’t think you can assume Fed credibility is a given.

This discussion needs a more thorough analysis of possible Fed motivations, but I’ll leave that for another comment.

10. October 2011 at 09:40

Scott:

“Mike, Suppose the Fed is buying assets at market prices, and keeps buying until we get hyperinflation. What then?”

The simple answer is that it wouldn’t happen, but let’s work through it anyway.

First, let’s say the central bank buys gold, and assume that the central bank is so small that its purchases do not affect the relative price of gold. In that case it’s clear that the new dollars are backed by newly-purchased gold, so the value of the dollar is unchanged.

If the central bank were big enough to affect the price of gold, then it seems likely that the bank would realize this, and start buying land or something instead of gold. In that case, the dollar is unchanged again.

But you are probably thinking of a case where the central bank just keeps buying bonds, presumably without overwhelming the bond market. Here again, new money is matched by newly-purchased assets, so the value of the dollar is unaffected. But you might not be considering the Law of Reflux: If a mint stamps out too many silver coins, then people will melt the excess coins. They will reflux to bullion. If the central bank buys too many bonds, people will return their dollars to the central bank in exchange for bonds. The new money refluxes to bonds.

10. October 2011 at 09:57

Scott,

A -3% IOR might induce credit demand. However, it is not clear the 2006 IOR enabling legislation authorizes the Fed to charge interest on bank reserve balances. Further, such a legislative proposal from the Fed would be dead on arrival in this Congress.

If you know for a fact the 2006 legislation clearly authorizes a negative IOR, it would make for a useful post.

10. October 2011 at 10:01

BTW, here’s the relevant paragraph from the 2006 “Financial Services Regulatory Relief Act”:

SEC. 201. AUTHORIZATION FOR THE FEDERAL RESERVE TO PAY INTEREST ON RESERVES.

(a) In General- Section 19(b) of the Federal Reserve Act (12 U.S.C. 461(b)) is amended by adding at the end the following:

(12) EARNINGS ON BALANCES-

(A) IN GENERAL- Balances maintained at a Federal Reserve bank by or on behalf of a depository institution may receive earnings to be paid by the Federal Reserve bank at least once each calendar quarter, at a rate or rates not to exceed the general level of short-term interest rates.

10. October 2011 at 10:26

Dan,

You are mistaken in assuming that aggregate private investment ins binary. It’s not. It’s incremental… both at the aggregate level and usually at the firm level. If asset prices go up this means the cost of capital is going down. As the cost of capital goes down, incremental investment goes up. Even if overall output is stagnant or declining, there are many individual economic players who will still invest.

John,

Re Solyndra. I agree the government should not be in the business of picking winners, but what actually got Solyndra was not a bad pick, but rather Chinese competition.

10. October 2011 at 11:01

Dtoh,

A company that fails despite a half billion dollar grant and special low interest credit lines seems like a bad pick. The government should have accounted for Chinese competition before investing.

I should also point out how idiotic it is to have two countries heavily subsidizing green energy projects. People really need to have the concept of opportunity cost drilled into their minds. Economists aren’t being very helpful with that I might add.

10. October 2011 at 17:11

dtoh, OK, we’ll revisit the issue later.

Mike, You misunderstood me. I’m assuming they buy gold, but don’t make the new currency redeemable into gold. It’s fiat currency. In that case you get lots of inflation.

David, There are many responses I could give.

1. They are obviously already breaking the law, as it doesn’t allow them to pay interest at rates above market levels, and they clearly are. So why should the law slow them down as far as negative IOR? Negative IOR doesn’t exceed the short term rate, but 0.25% sure does!

2. They didn’t have the right to do positive IOR until they asked Congress for authority–and they got it right away.

3. The FDIC could raise the premium of ERs to a much higher rate. Then IOR could be set at zero. That would make the IOR effectively negative.

4. All this is a moot point, as it assumes the Fed wants to inflate. But it doesn’t. If it wanted to inflate it would say so.

10. October 2011 at 18:04

Scott,

My theories on what is going on.

At the Fed, there is combination of political motivation and some uncertainty as to whether the tools at hand can get you the right mix of inflation and real growth.

Looking at the politics. 9% unemployment probably gets you a Republican landslide in 2012. If you were on the Fed and thought this might translate into a permanent elimination of taxes on capital, would you take that trade (12 more months of high unemployment versus a chance for the permanent elimination of tax on capital). If it was me, I’d sure think about it.

Looking at the uncertainty, assume just announcing a target doesn’t work, you actually have to drop IOR and/or buy assets. The Fed will definitely take a lot of political heat for more major asset purchases. Then on top of that, assume you get another major external shock. Then you’re really out of ammo.

Now look at this from the Delong/ Krugman perspective. If monetary policy really does work, what are the chances in the current political environment of more government programs and or more progressive taxes… Zero!! If I’m DeKrugman, I can’t buy into a monetary only solution without my worldview exploding. For Japan, monetary expansion was fine, but for the U.S., it means no fiscal stimulus and the end to the entire liberal agenda. Which is going to win, logic or your worldview. So far it ain’t logic.

10. October 2011 at 21:13

Scott,

Those scenarios seem quite farfetched under a GOP-controlled House of Representatives. For all intents and purposes, discussion of a negative IOR seems purely academic. It would be useful to note that fact to your readers.

11. October 2011 at 03:08

why isn’t this a matter of words? for instance i could hold a screwdriver tight for 70 years and never drop it but when you yank it out of my hands and then claim that i wasn’t holding it tight, that’s not a fair use of language. you could say i wasn’t holding it tight enough.

11. October 2011 at 03:58

Very interesting points, Scott, thanks for sharing. I’d never thought about easy money as something having so many contexts.

I’m always skeptical, but your arguments get more convincing every time I come here.

If we get a GOP gov’t 2012, maybe you can sell them on a combination of fiscal austerity and true easy money.

11. October 2011 at 05:17

“If we get a GOP gov’t 2012, maybe you can sell them on a combination of fiscal austerity and true easy money.”

They are already sold.

And Scott knows it.

The question is WHEN between now and After November 2012 (AN12), Scott will accept that HIS OWN PERSONAL BEST strategy is to focus on “selling” it to them.

Friedman kept his conservative small government bona fides front and center…

sometimes Scott soft sells that bit to win liberal approval.

Conservatives need to publicly repudiate liberalism, they need their economists to do the same.

11. October 2011 at 05:20

dtoh,

Welcome to my argument! It is great to have a convert.

11. October 2011 at 05:25

Pearson,

You show very little grasp of what the GOP is about.

Negative IOR is an necessary Red Herring. The GOP would easily buy no IOR, they’d support it, likely demand it.

The real issue is once Obamacare is rolled back and public employees are deeply weakened, the GOP will KNOW it is imperative we have easy money, said another way, they’ll KNOW it is Morning In America and we should all be hopeful and confident, and that means easy money.

11. October 2011 at 09:12

Scott:

“Mike, You misunderstood me. I’m assuming they buy gold, but don’t make the new currency redeemable into gold. It’s fiat currency. In that case you get lots of inflation.”

If the central bank dumped that gold in the ocean then I’d agree. But if the central bank keeps the gold, then either the central bank intends to never pay out that gold again no matter what (equivalent to dumping it in the ocean) or it plans to someday use that gold to buy back the dollars it issued. This would presumably happen 100 years from now, when people trade only with computer blips and no longer need the central bank’s dollars. In that case, assuming each dollar will be redeemed for 1 gram of gold in 100 years, that would make each dollar worth 1/(1+R)^100 grams today. Unless of course the cost of printing and handling those dollars was C grams/year, in which case each dollar would be worth 1/(1+R-C)^100 grams today. In the plausible case where C=R, that would make each dollar worth 1 gram from now until the 100-year redemption.

Those dollars are not fiat money. They are backed by the central bank’s assets.

11. October 2011 at 18:15

dtoh, I’m just not that cynical.

David, I don’t agree for the 4 reasons I gave above. The Fed’s already breaking the law, so I very much doubt that’s a practical barrier. And if necessary they could do higher FDIC premiums.

q, We all agree what a tight grip is, but none of us agree as to what tight money is.

Tall Dave, I won’t need to sell them on easy money, you can be sure of that!

And don’t expect anything different brom Bush II–the GOP likes big government.

Mike, There is no reason to assume the money will be redeemed for any specified quantity of gold in the future. Prices might be 1000 times higher than today. And the gold might be sold off, or just given to the Treasury as a gift.

11. October 2011 at 18:48

Scott:

You had asked what would happen if the fed bought huge amounts of assets, and my answer is that it depends what the fed does with those assets. IF the fed uses those assets to buy back its dollars, now or in the future, then the dollars will hold their value. But IF the fed dumps the assets in the ocean or gives them away or refuses to ever use them to buy back its dollars then the dollar would lose value. I’m just exploring alternatives, which is reason enough to assume future redemption in gold.

But back to the original subject of this post: I think a completely satisfactory definition of ‘easy money’ is that the fed pays $100 for $99 of assets. This mis-pricing would cause assets to flood into the fed as new money floods out. But since the fed’s assets would not be keeping up with its issuance of money, the fed would be UNABLE, not just unwilling, to buy back the money it issued. Hence inflation.

13. October 2011 at 05:42

Mike, I think a much more plausible explanation is that they pay $100 for $100 in assets, with no intention of redeeming the money for anything close to its original value.

Central banks have no reason to pay less than fair market value when doing OMOs, but they can still inflate like crazy.

13. October 2011 at 12:01

Scott:

But central banks do redeem their money all the time. They just redeem their money for bonds, rather than gold. If the central bank sees the value of their money drop by 1%, they start using their bonds (or other assets) to buy back their money. So in any given year the money doesn’t lose more than a few percent of its value.

So if the central bank bought bonds like crazy and doubled the money supply, and if the money held its value, then they wouldn’t bother using their bonds to buy back money, even though they could. If there was inflation, the central bank would use its bonds to buy back its money.

Of course, if the central bank had dumped those bonds in the ocean as soon as they were bought, then they would have no bonds with which to buy back that money.

Assets matter.

15. October 2011 at 09:53

Mike, I don’t follow your argument. The dollar has lost 3.8% of it’s value in the past year, and I don’t see the Fed redeeming dollars for bonds. In the 1970s inflation was higher.

18. October 2011 at 09:06

Scott:

The Fed hasn’t soaked up any dollars because they are more worried about unemployment right now. If inflation became the bigger worry the fed would (or could) soak up dollars. Keep in mind that with a growing economy you need a growing money supply, so redemptions of money are naturally less common that issuance of money.

29. October 2011 at 06:03

Mike, If the Fed had no bonds, and the government was worried about inflation, then the government could simply give the Fed bonds, and they could sell them to soak up cash. The balance sheet seems completely uninteresting to me.

29. October 2011 at 06:42

Scott:

That’s because the government stands behind the Fed, so ultimately it’s the government’s balance sheet that matters. If the fed were not supported at all by the government (because it was completely independent, or because the government was broke) then the fed’s balance sheet would be the only thing that mattered. If the fed had no assets of any kind, then it would be unable to buy back its dollars and the dollars would be worthless. On the other hand, if the fed had plenty of assets with which to buy back its dollars at par, then the dollars would hold their value, even if then fed had suspended convertibility. As long as people know the assets are there, they don’t always need to be able to redeem their dollars for them.

30. October 2011 at 08:09

Mike, Sure, if the government was broke people might expect inflation, and it might become sulf-fulling a la Sargent Wallace. But for developed countries nowhere near broke what matters is money supply growth. Balance sheets had nothing to tell us about why inflation picked up in the late 1960s (when are debt was quite low, and fell in the early 1980s when our fiscal situation deteriotated dramatically. The Fed calls the shots and Congress tags along.

1. November 2011 at 09:44

Scott:

Finance professors say that they have an equally hard time explaining stock prices by looking at the balance sheets of the firms, so it’s not surprising that the balance sheet approach to money doesn’t fit the data very well. On the other hand, money supply growth doesn’t have a great record of fitting the data either. The cases where the balance sheet approach seems to work best is when firms and governments are broke. Bankrupt firms have worthless stock, and bankrupt governments have worthless money.

Somewhere out there is a government that went broke without simultaneously printing huge amounts of money. The balance sheet approach would predict inflation, while the quantity theory wouldn’t. That would be a good test of the competing theories.

4. November 2011 at 18:36

Mike, it might be a good test, but only if it wasn’t a government expected to collapse, bringing the currency down with it–like Czarist Russia or Confederate States of America.

14. November 2011 at 14:32

Scott:

Here is some thoughts from an undergrad so take it with a grain of salt, but it seems that the debate has been confused by use of different terms.

DeLong talks in terms of expansionary and contractionary policy and Scott, you talks in terms of tight and easy money. It seems to me that these terms are two distinct concepts. The terms expansionary and contradictory are referring to the changes variables such as M2 or interest rates (real or nominal) over time. The terms tight and easy money refer to monetary policy relative to the current/future state of the economy (or the market for money). For example, policy can be expansionary from time A to time B but if the demand for money is also increasing from time A to time B or monetary policy is not expansionary enough then money is still tight at time B.

So I don’t think DeLong actually thinks money was easy for the state of economy in 2008-2009 but just that variables such as interest rates and M2 had changed. When he criticizes your statement that “The IS-LM model led economic historians to argue money was easy in 1929-30, because rates fell sharply. It led modern Keynesians to assume that money was easy in 2008, because rates fell sharply…” by saying “a lot of people believed that monetary policy was expansionary in 2008” I think he just misunderstands that you a defining monetary policy relative to current state of the economy and that there is a distinction between the terms loose money and expansionary policy or tight money and contractionary policy. You’re talking about something completely different than he is. I think making this distinction could allow you both to reconcile your positions.

14. November 2011 at 14:37

He also says “in order to avoid confusing readers who try to wrap their minds around the idea that a large monetary expansion is contractionary–is that monetary policy was expansionary but the expansion was not large enough to cope with the macroeconomic problem.” But I don’t think you’ve ever said monetary policy was contractionary just that money was tight. Using the term tight money implies exactly what he said you need to do.

15. November 2011 at 12:42

LeeN, To me those terms mean the same thing, but I think it’s DeLong that hasn’t really thought through this issue. Suppose the base rose 3%, but drug dealers hoared lots of cash so that interest rates soared (real and nominal) from 2% to 7%. Does DeLong really want to call that “expansionary” policy?

26. September 2012 at 00:47

Scott said: “Dan, It might motivate additional lending (although I doubt it-as it force interest rates higher.) But even if it did, the quantity of lending has nothing to do with monetary policy. Monetary policy is about changes in the supply and demand for the medium of account, and IOR increases the demand-which is contractionary.”

Dan is correct in his view that the interest paid on the reserves actually *decreases* the cost of lending for banks, not that it *increases* the cost (interest rate), as Scott thinks.

This is really easy to see: When a bank makes a loan, it creates a deposit, for which it has to keep a (fractional) reserve. Now the bank receives interest on the reserve (as before), and in addition receives interest on the loan.

If the CB does not pay interest on the reserve, the bank still has to hold the reserve, but does not receive interest on it. So it actually gets less money, only the interest on the loan.

This is true for both the cases where the bank already holds the required reserve, as well as where it has to acquire new reserves for the deposit created in extending the loan.

So there is no tradeoff! The IOR does *not* increase the cost to the bank in extending a loan!

In addition, I am really surprised by the statement from Scott that “lending has nothing to do with monetary policy”. Why not, exactly? Obviously lending affects the amount of “money” that is created, and in turn this affects the required monetary base. How can you think about monetary policy without thinking about lending?

26. September 2012 at 03:02

Shining Raven, banks don’t have to hold more reserves as a fraction of the loans they have made than the required ratio. If they didn’t have an incentive to hold any reserves in excess of this amount, they would spend them, increasing money (transactions) velocity, and ultimately also final velocity.

4. December 2014 at 11:00

[…] 1921. (The further reduction to 4% to which Barkley refers did not occur until June 1922.) But, as Scott Sumner has been tirelessly observing for some years now, even under an interest-rate targeting regime, a low policy rate doesn't […]

17. February 2015 at 10:36

[…] 1921. (The further reduction to 4% to which Barkley refers did not occur until June 1922.) But, as Scott Sumner has been tirelessly observing for some years now, even under an interest-rate targeting regime, a low policy rate doesn’t […]

14. November 2015 at 04:36

[…] 1921. (The further reduction to 4% to which Barkley refers did not occur until June 1922.) But, as Scott Sumner has been tirelessly observing for some years now, even under an interest-rate targeting regime, a low policy rate doesn't […]