What do you say now?

Back in 2016, I pushed back against the conventional wisdom that Americans were opposed to trade and that this explained the rise of Trump. Even then the polls didn’t show that. Of course I was viewed as naive—the zeitgeist was all about the China shock, deindustrialization in the Rust Belt, the rise of populism, etc. Didn’t I know that neoliberalism was passé, it had failed us? OK, so how do things look today?

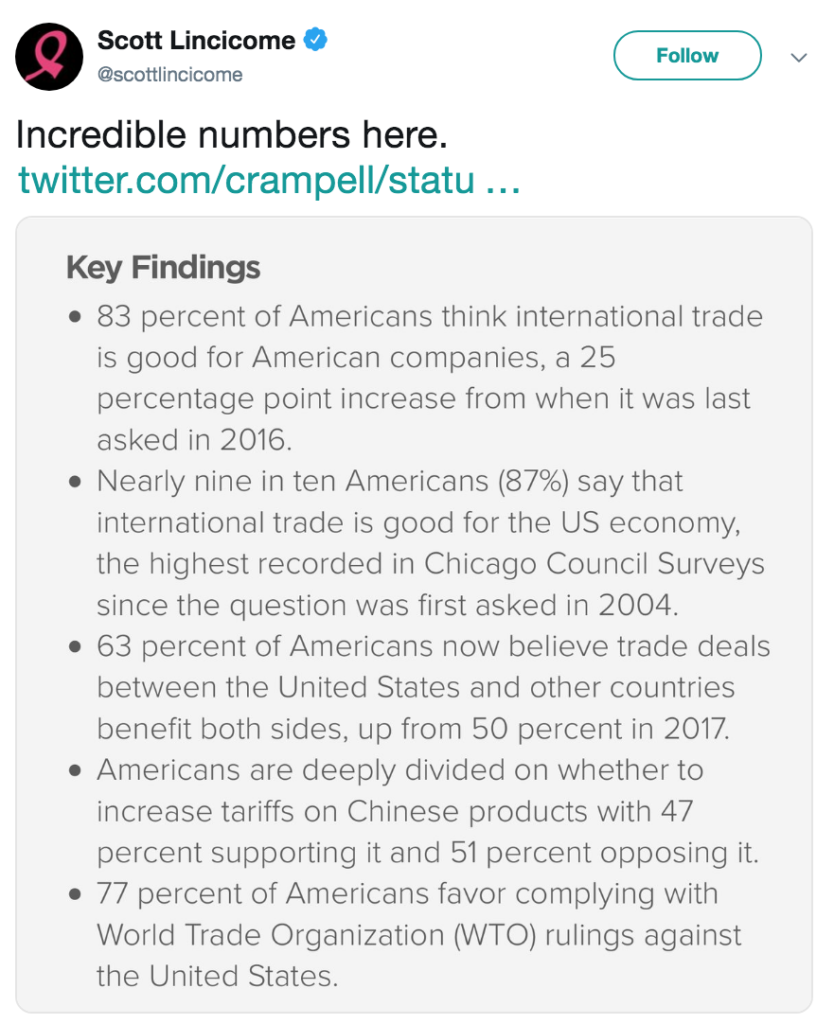

So do you guys still believe that Trump’s views on trade (“trade wars are good, and easy to win”) represents the wave of the future? Am I just an old foggy who doesn’t understand how bad globalization has been for average people?

BTW, Tyler Cowen linked to a new study of the China trade shock:

The estimates imply that trade with China increased U.S. consumer surplus by about $400,000 per displaced job, and that product categories catering to low-income consumers experienced larger price declines. [emphasis added]

I bolded the low income part, because if trade is good for efficiency then equity is the only issue at stake here.

PS. I notice that the current zeitgeist is all about “progressive” ideas like wealth taxes and fiscal stimulus. Unlike certain publications, I don’t swing with the political winds. Taxes on capital income always have been evil, and always will be. All taxes are consumption taxes. The only difference is that some consumption taxes tax future consumption at higher rates than current consumption. Those bad consumption taxes are called “income taxes”, “capital gains taxes”, “wealth taxes”, etc. Instead we should tax higher levels of consumption at higher rates. That’s a truly progressive agenda.

Stick to your principles when the rest of the world is losing its head. In the long run, they’ll come back to you. Stable NGDP growth, free markets, free speech, free trade, progressive consumption taxes, externality taxes. Those principles aren’t going to change.

HT: Noah Smith, David Beckworth

Tags:

11. October 2019 at 09:39

“Trade as a threat” tracks the unemployment rate very closely. So to the degree any president improves the domestic economy they will improve views on trade. The real test will be next recession.

See second chart here:

https://news.gallup.com/poll/228317/positive-attitudes-toward-foreign-trade-stay-high.aspx

11. October 2019 at 09:54

“Taxes on capital income always have been evil, and always will be. All taxes are consumption taxes.”

You forget, all taxes are also public goods. Try having an economy without a tax-funded military, a tax-funded judiciary, a tax-funded education system, a tax-funded police force, tax-funded roads, etc.

You only think capital gains taxes are evil because they are a tax on economists and economists’ most prolific patrons.

11. October 2019 at 10:25

Sumner, do you think anyone cares about low-income MexAms?

11. October 2019 at 10:59

Would the consumption taxes apply to donations to political candidates and charities?

11. October 2019 at 11:20

I remember in my high school history class when we were talking about colonialism, and the concept of center-periphery came up. In essence, you have the colonizer(Britain) and the colonized(India). In each country you have the center(capitalist/ruling class) and the periphery(working/labor class). The benefits from trade between the two countries were allocated in the following order, from first to last:

1. Center – colonizing country

2.Center – colonized country

3. periphery – colonizing country

4. periphery – colonized country

This same simple dichotomy still exists between the U.S. and its trading partners, it just isn’t an obvious colonization anymore(its still implicitly backed by military strength). Instead, the U.S. uses its economic power to colonize other countries(e.g. globalism).

The uproar around trade is that while the “center” in both countries has been profiting enormously since the 1990’s, the “periphery” of the U.S. has been ceding too large a share to the “periphery” of the economically colonized country(e.g. Mexico).

Its still in the interest of the U.S. “center” to convince the “periphery” that trade is in their interest, but the argument had begun harder to make. Labor rich countries were taking a larger cut, and it seemed unfair to the “periphery” of the U.S. Along comes Trump, who says, in the zero-sum game sort of way, that he will make sure it doesn’t look like the other country’s “periphery” is stealing from our share. Suddenly, trade seems like a good idea again.

11. October 2019 at 11:22

Effem, Not sure what you think that graph shows. Why did attitudes become anti-trade in (booming) 2006?

Bob, You said:

“You only think capital gains taxes are evil because they are a tax on economists”

One of the more bizarre comments I’ve ever read. Don’t economists consume goods?

Harding, Yes.

Bill, I’d prefer we treat health, education, political spending, etc. as consumption. But there are arguments that part of education spending is investment.

11. October 2019 at 11:24

Derrick, Not sure what you are trying to say. What exactly did Trump do?

11. October 2019 at 11:31

Scott-

Trump is a part of the economic center. It is in his best interest to convince his base that trade=good. His base, in my example, is the U.S. “periphery”, and the group of people hit hardest by the inequities of globalization.. So, Trump has a problem. He needs to convince his base that they aren’t actually being screwed over by international trade, while at the same time make China stop stealing IP for example. His base couldn’t care one-whit whether Fortune 500 companies lose billions of dollars of profit overseas. If they were going to profit by that system they would’ve already.

Instead, if he can appeal to their sense of American supremacy over all things, and play off their hatred of democrats and globalism, he may just be able to pull it off. This is of course nonsense, as the trade war victories will in little to no way improve the lives of his base.

11. October 2019 at 13:24

Is this part of your ongoing series?

public opinion polls don’t matter

There’s no such thing as public opinion, example #421

Be skeptical of surveys of public opinion, example #441

The many problems with public opinion

There is no such thing as public opinion, example #734

I assume yes. Otherwise, one must assume that you are an incoherent hypocrite, who evaluates polls depending on how they fit into his political ideology.

11. October 2019 at 14:21

I don’t know how I’d answer the question about whether to increase tariffs on China. China tariffs are good if our demand is for them to end their atrocities, but bad if we’re demanding an end to the trade deficit.

11. October 2019 at 16:02

Derrick, I don’t think most Trump voters have been hurt by trade. Farmers voted for Trump. So did my neighbors in Mission Viejo. Both groups are greatly helped by trade. Only a small share of Trump voters were hurt by trade.

Christian, I’m not the one making the claim about public opinion, I’m responding to the claims made by others. So where’s their evidence? They are the one’s who rely on polls, so I’m throwing it back in their faces.

Oscar, I’d say human rights tariffs are far less bad than trade deficit tariffs.

11. October 2019 at 18:53

Scott,

A few comments,

1) Did Galileo or Columbus consult public opinion polls.

2) Trade is incredibly beneficial

3) If you don’t have completely free trade (i.e. trade is governed by trade deals,) then the terms of the trade deal can be a zero sum game and you should negotiate like hell to get the best terms possible.

4) Some trade partners will cheat on the terms of a trade deal. It’s foolish to allow this.

5) If the terms of trade are suddenly changed by political action, the impact on small segments of the population can be highly disruptive. IMHO not recognizing this is both unfair and foolish as it results in a political backlash.

6) Peace and liberty can be more important than the incremental benefits in utility gained from trade.

11. October 2019 at 20:49

Well, Sumner, it would be best if you explain who.

12. October 2019 at 05:24

Hi Scott,

Thanks for the post.

Can you point to any literature that fleshes this idea out more?

> Instead we should tax higher levels of consumption at higher rates.

In your opinion, why aren’t any of the democratic candidates advocating for progressive consumption taxes?

12. October 2019 at 06:19

Scott,

87% of respondents think international trade is good, yet almost half favor higher tariffs on China. Isn’t this just another example of how little can really be cleaned from such polls?

This indicates that, at best, many Americans may favor a trade war with China while generally favoring free trade.

I suspect that Warren can beat Trump, as current polls indicate, and she will have a more coherent trade policy, but still considerably suboptimal.

It seems to always be popular to find a country to demonize, look down upon, and crusade against.

People like Warren could get a lot of traction by demanding countries like China and Mexico pay “fair wages” with more environmentally friendly policies than most developing countries can afford.

In this sense, I think people like Warren can be even more dangerous to free trade than Trump. Trump discredits himself with most people with his obvious stupidity and instability, and I don’t think he can make a permanent impact on US trade. I’m not sure that’s true of Warren.

I want to be clear, that if I vote for Warren, it will be because I’m in Florida and it’ll be to get rid of Trump. I think she’s full of really naive, bad ideas.

12. October 2019 at 06:21

“gleaned”, not cleaned.

12. October 2019 at 11:16

dtoh, As far as Galileo, even if the public were 100% wrong about trade, it has no bearing on this post, which is about public opinion.

On trade, unilateral free trade is far superior to “trade deals”.

Automation is far more disruptive than trade, BTW, and almost no one is calling for an end to technological progress. Almost all the job loss in coal and steel is automation, as is most of the job loss in autos. And the job loss from automation is not “gradual”; it’s sudden as old plants shut down and new and more modern one’s open. In coal and autos it’s even regional, as production shifts to different parts of the US.

Harding, People who are not racist jerks like you and other white supremacists.

Frank, This post has a bit more on the intuition:

https://www.themoneyillusion.com/income-a-meaningless-misleading-and-pernicious-concept/

You could also check out a public finance textbook.

Mike, I’m also skeptical of polls. I’m asking my opponents for evidence that they understand “public opinion”. So far not a single commenter here has presented a shred of evidence supporting the claim that the American public no longer supports globalization. Maybe they don’t, but where’s the evidence?

12. October 2019 at 18:28

> You forget, all taxes are also public goods. Try having an economy without a tax-funded military, a tax-funded judiciary, a tax-funded education system, a tax-funded police force, tax-funded roads, etc.

Most of those have been tried as privately funded and run organisations. Can work pretty well. See David Friedman’s scholarship for example.

Of course, organising eg the judiciary privately doesn’t magically make it free. If you want highly competent people to become judges and lawyers, you still have to pay them. But it’s easier in a private system to cut costs. (There’s still lots of private legal systems around. These dsys they usually integrate with the public ones or work on the margins.)

Scott, where would land value taxes fall? I’d conceptualise them as a one-time partial appropriation of land (check how much the capitalised rent = market value of the land falls after the land value taxes are announced), and not so much as a continuous tax.

Somewhat similar, in Singapore the government leases out land for 99 years at a time. You could think of a slightly different system where they’d lease to the highest bidder eg every ten years. That would be very similar to a land value tax system in economic consequences, but not a tax in the traditional sense. Land is then just an asset the government owns and derives revenue from.

13. October 2019 at 02:39

Well, I don’t know if anybody is still reading, but I tried to read the China trade paper linked to by Tyler Cowan.

https://cepr.org/active/publications/discussion_papers/dp.php?dpno=13902

It is behind a paywall, so who knows what it says.

The abstract:

“This paper finds that U.S. consumer prices fell substantially due to increased trade with China. With comprehensive price micro-data and two complementary identication strategies, we estimate that a 1pp increase in import penetration from China causes a 1.91% decline in consumer prices. This price response is driven by declining markups for domestically-produced goods, and is one order of magnitude larger than in standard trade models that abstract from strategic price-setting. The estimates imply that trade with China increased U.S. consumer surplus by about $400,000 per displaced job, and that product categories catering to low-income consumers experienced larger price declines.”

–30–

Well, okay a 1 pp increase in China import penetration into the US drives down consumer prices by 1.91% (is that believable?) but mostly due to US manufacturers and retailers cutting prices on domestically produced goods. I guess this means lower profits than otherwise for US companies.

The $400,000 figure is not really explained, and we do not know if that is the “consumer surplus” over a five-, 10- or 15-year period for every “displaced job.”

That is, did the US lose one job every year for 10 years to get a $400,000 consumer surplus over that time period?

That is a horse of a different color, no?

Perhaps the US gave up one job for 10 years, that paid a cumulative $380,000 to get to a $400,000 “consumer surplus” for that “displaced job.”

Of course, no one knows as the paper is behind a paywall.

But why let huge and fundamental gaps get in the way of a good storyline….

13. October 2019 at 11:27

Ben, You asked:

“That is a horse of a different color, no?”

No, same color.

13. October 2019 at 13:25

“Stable NGDP growth, free markets, free speech, free trade, progressive consumption taxes, externality taxes.” Gets my vote.

13. October 2019 at 16:03

Scott Sumner: unless you have penetrated the pay wall to that study, I don’t know how you can tell what horse the color is?

Is the $400,000 consumer surplus an amount obtained cumulatively over a 10- or 15-year period?

Meaning that the US had one less job for that same period?