Thomas Raffinot on interest rate free monetary policy

I’ve always felt that the fundamental problem with conventional monetary policy is an excessive use of interest rates, as both an instrument and indicator of monetary policy. The Mercatus Center has just published a new working paper by Thomas Raffinot entitled:

Interest-Rates-Free Monetary Policy Rule

which is music to my ears. Here is the basic idea:

This paper’s objective is to elaborate a monetary policy rule assessing the stance of monetary policy without any reference to any interest rate. This rule should thus be able to measure the stance of monetary policy in conventional and unconventional environments without any distinction. To that end, this study develops a new monetary indicator based on the forward-looking generalization of the Taylor rule introduced by Koenig (2012).

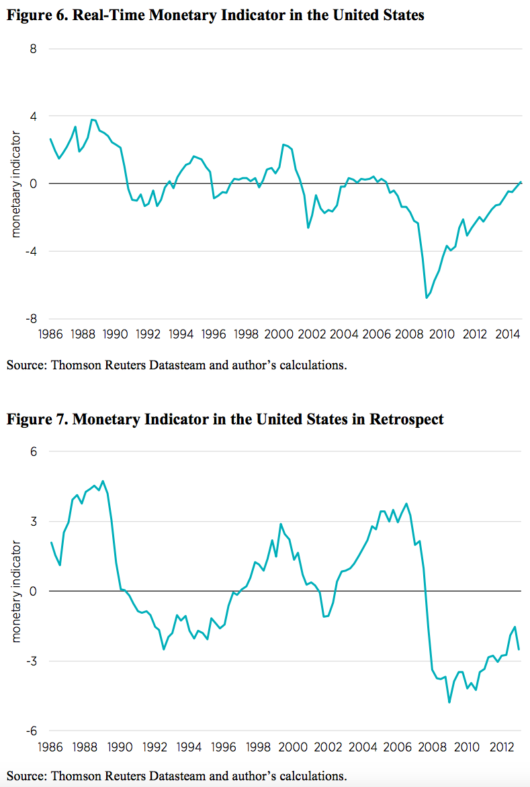

Raffinot uses surveys of professional forecasters to derive his estimates of inflation and growth expectations. Ideally we like to go one step further, and use market expectations. He also constructs estimates of the stance of monetary policy “in retrospect”, that is, looking at how the actual inflation and growth played out over the next few years. Interestingly, this is often quite different from the estimates using real time data.

Here are his estimates for the stance of monetary policy in the US, both using real time forecasts and actual ex post data:

A figure above zero represents an excessively expansionary monetary policy stance, and vice versa. You can see that money became way too tight in 2008, using either approach.

A figure above zero represents an excessively expansionary monetary policy stance, and vice versa. You can see that money became way too tight in 2008, using either approach.

I should note that the Lars Christensen newsletter that I discussed in my previous post provides these sorts of graphs from many key economies. Of course his formula is not exactly the same.

Tags:

28. May 2017 at 08:13

I think his real-time estimate dowes a better job!

http://ngdp-advisers.com/2017/05/25/yes-interest-rates-banned-monetary-policy-discussions/

28. May 2017 at 13:04

Two cheers (maybe 2-1/4) for saying interest rates shouldn’t be the guide for monetary policy. I’d have given him a full three cheer salute if he’d explained why.

I.e., interest rates are NOT the price of money, so why would they be a good guide.

28. May 2017 at 17:31

By a number of measures, monetary policy in general has been getting tighter ever since 1980. The Richmond Fed put out a study to this effect recently.

And, of course, we have seen declining rates of real growth and inflation since the 1980s.

The question is, in the current environment, should not the Fed be much more expansionary?

29. May 2017 at 07:24

Marcus, Interesting. Of course that’s the only one available to policymakers.

31. May 2017 at 15:43

This policy rule is equivalent to the Taylor rule except it assumes the real interest rate is equal to the equilibrium real interest rate.

It’s just a bit of algebra after that:

i = π + r* + a(π – π*) + b(y – y*)

assume r = r*

0 = a(π – π*) + b(y – y*)

0 ≈ a((P-P_T)/T – (T/T)π*) + b(y – y*)

0 ≈ (a/T)(P-P_T – T π*) + b(y – y*)

0 ≈ (P-P_T – T π*) + α(y – y*)

where α = b/(a/T)

Of course if you assume r = r* always, then you’re just assuming interest rates don’t matter because they’re always at the equilibrium rate. You could similarly construct a ‘GDP-free Taylor rule’ by assuming y = y* or an ‘inflation-free Taylor rule’ by assuming π = π*.

1. June 2017 at 04:00

I think Bernanke (and by extension Raffinot, who is quoting him) is right when he says this:

“As emphasized by Friedman . . . nominal interest rates are not good indicators of the stance of policy. . . . The real short-term interest rate . . . is also imperfect. . . . Ultimately, it appears, one can check to see if an economy has a stable monetary background only by looking at macroeconomic indicators such as nominal GDP growth and inflation.”

However, I’m not sure how useful “[seeing] if an economy has a stable monetary background” by construction an index that’s basically a Taylor Rule minus the real interest rate part is. It’s pretty obvious if you look at GDP and inflation over the last few years that the recovery hasn’t been as fast or as large as anyone expected in 2007, and I guess this indicator gives us a number for exactly how bad or good the economy is relative to the central bank’s goals at a given point in time.

But I think everyone (except maybe gold bugs, John Cochrane, John Taylor, and a few others) would have been happy if the Fed had provided more stimulus throughout 2008 and in the 9 years since then. This indicator has the major flaw that it doesn’t give any quantitative estimate of what needs to be done. At least the Taylor Rule says how much lower the interest rate should have been. This indicator doesn’t tell the Fed how many more trillions of dollars of quantitative easing it needed to do to get inflation up to 2%.

It’s not like monetary aggregates that the Fed has close control over even have direct relationships with output and inflation anyway — the monetary base has grown by 354% since December of 2007 while inflation has been consistently below target and NGDP falling precipitously below its pre-recession trend. Heck, the Bank of Japan has been increasing Japan’s monetary base by about 80 trillion yen a year for about 4 years while CPI has remained flat (ignoring the VAT hike).

Ideally “interest rate free monetary policy” would tell central bankers how much extra stimulus is needed in units of something, rather than just being some index that says monetary policy was roughly “-3” in 2012. And this is before you consider that monetary base growth is a terrible predictor of actual data, let alone consider the obvious issues with monetary policy at the zero lower bound.

Comparing the monetary base to Bennett McCallum’s rule would probably make a lot more sense in terms of assessing the stance of monetary policy, but even then I doubt, for instance, increasing the monetary base to $5 trillion instead of $4 trillion would have had much effect if any on output and inflation.

1. June 2017 at 08:22

May 18, 2017 Deutsche Bank Sued for Running An “International Criminal Organization”

Having been accused, and found guilty, of rigging and manipulating virtually every possible asset class, perhaps it was inevitable that Deutsche Bank, currently on trial in Milan for helping Banca Monte dei Paschi conceal losses (as first reported last October in “Deutsche Bank Charged By Italy For Market Manipulation, Creating False Accounts”) is now facing accusations that it was actually running an international criminal organization at the time.

https://youtu.be/2pCSu9ZdkoM

1. June 2017 at 11:07

Jason, Which policy rule?

John, In my view we need to use market NGDP expectations as an indicator of monetary policy.