The recession we should have had

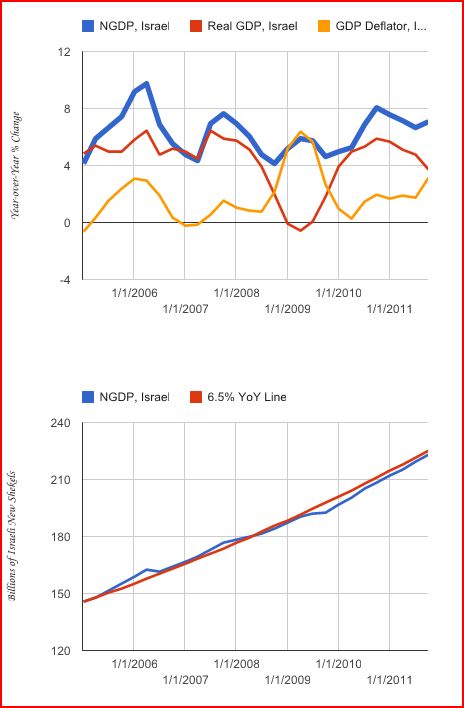

People often ask me what would have happened if the US had done 5% NGDP targeting, level targeting, in 2008. I suggested we would have had stagflation. A very mild and short recession, with above normal inflation. Maybe 6% or 6.5% unemployment. Evan Soltas has a new post where he argues that the Bank of Israel has been doing NGDPLT in recent years, with a 6.5% trend rate of NGDP growth:

People often ask me what would have happened if the US had done 5% NGDP targeting, level targeting, in 2008. I suggested we would have had stagflation. A very mild and short recession, with above normal inflation. Maybe 6% or 6.5% unemployment. Evan Soltas has a new post where he argues that the Bank of Israel has been doing NGDPLT in recent years, with a 6.5% trend rate of NGDP growth:

You might wonder whether this was just good luck; is there any smoking gun? Evan makes two good arguments that it’s not coincidence:

What gives the Bank of Israel’s NGDP level target away, to me, is the temporary increase in inflation in 2008 and 2009, which cancels out the slowdown in real growth such that NGDP growth is constant through the recession, and the tendency of monetary policy to correct for past errors to maintain a 6.5 percent year-over-year growth path; see the swing between 2006 and 2007. As real growth has slowed since the first quarter of 2011, inflation has been allowed to rise.

Think about it. How often have you heard people say; “Of course inflation slowed during the recession, that’s natural.” No, it’s unnatural. For any given MV, a lower Y implies a higher P. Lower inflation during recessions is a sign of procyclical monetary policy, i.e. policy failure. You’d like lower inflation during booms and vice versa. Indeed it’s the Fed’s mandate to produce countercyclical inflation, although for some strange reason they don’t seem to understand their mandate.

Evan’s second piece of evidence is that the Bank of Israel is headed by Stanley Fischer. Here’s Fischer on NGDP targeting:

“In the short run, monetary policy affects both output and inflation, and monetary policy is conducted in the short run–albeit with long-run targets and consequences in mind. Nominal- income-targeting provides an automatic answer to the question of how to combine real income and inflation targets, namely, they should be traded off one-for-one…Because a supply shock leads to higher prices and lower output, monetary policy would tend to tighten less in response to an adverse supply shock under nominal-income-targeting than it would under inflation-targeting. Thus nominal-income-targeting tends to implya better automatic response of monetary policy to supply shocks…I judge that inflation-targeting is preferable to nominal-income-targeting, provided the target is adjusted for supply shocks.” (“Central Bank Independence Revisited,” AER, 1995)

To say Evan Soltas is on a role roll is an understatement. I bet Matt Yglesias gobbles this up.

HT: David Levey

Tags:

4. June 2012 at 16:49

“I judge that inflation-targeting is preferable to nominal-income-targeting, provided the target is adjusted for supply shocks.”

“Inflation-targeting…adjusted for supply shocks”

Otherwise known as NGDP targeting…

4. June 2012 at 16:56

FYI- Evan Soltas is on a *roll 🙂

4. June 2012 at 17:21

Integral, Yes, it’s pretty close.

Neal, Dear God, what’s happened to my spelling.

4. June 2012 at 18:45

Look, I know you don’t want to hear about fiscal stimulus, but I think part of the reason the sort of counter-cyclical monetary policy you advocate is encountering resistance is the same reason proposals for counter-cyclical fiscal policy encounters resistance. It is counter-intuitive.

People fall for the money illusion. They only notice price inflation and don’t notice if wages also rise. When times are hard, people feel pinched and dread rising prices more than they do when conditions are generally prosperous. I think that’s why every tiny uptick in inflation is causing such a panic, even though we have endured higher inflation rates in good times and no one complained. People feel pinched, see prices going up, and panic.

I’d say the remedy is teaching much more economics in school to encourage basic economic literacy, but most macro theories are too controversial to be taught as fact.

4. June 2012 at 18:59

“People often ask me what would have happened if the US had done 5% NGDP targeting, level targeting, in 2008. I suggested we would have had stagflation. A very mild and short recession, with above normal inflation. Maybe 6% or 6.5% unemployment.”

Sort of like the 1975 recession-without all the stimulus it could have been a worlwide depression according to Minsky. The trouble is that most policy makers today came of age during the 70s and still seem to thitnk that it was the ulitmate nightmare scenario rather than the 30s

4. June 2012 at 19:22

Gobble, gobble Matty!

Perhaps Evan would like to tackle what would happen in Israel under a 4.5% NGDPLT target.

Oh Evan!!!!!

4. June 2012 at 20:14

Scott,

I haven’t looked in detail, but I’m not sure the same pattern holds for Australian inflation. The RBA pursues the “average over the cycle,” as you have noted on this blog before, so I would expect to see the same pattern.

In 2007 the RBA was caught napping and core was climbing well above target. Rates went in to 7% plus territory. I remember the relevant quote being that the “inflation genie is out of the bottle”. Late 2008, that all changed, and inflation fell well back into the range.

Would you expect the data to show higher inflation for the one quarter of contraction Australia had? Should I start looking for a smoking gun in Glenn Steven’s writing? Or does the fact that real GDP movement over the cycle in Australia wasn’t that bad mean that ‘apparent’ nominal GDP targeting appeared as an emergent phenomenon of the “over the cycle” inflation targeting?

I guess I’m worried that the RBA has stumbled into success in keeping NGDP growth stable, and that if any pressure is placed on the bank over the next few months it might not be so successful.

Every RBA employee I quiz about the procedure they have for communication at the ZLB fobs me off.

Sautoros, do you have any idea?

4. June 2012 at 21:27

Canadian newspaper editorial urges NGDP target, Bernanke resignation! It looks like Nick Rowe may know the authors…

http://www.theglobeandmail.com/report-on-business/economy/economy-lab/bernanke-must-go-further-faster-or-resign/article4229140/

“The economic data out of the United States is eerily reminiscent of Japan in the 1990s, with 10-year U.S. bond yields being at their lowest level in two centuries, negative stock returns for the year, falling oil prices and stagnant job growth.”

“The Federal Reserve needs to announce an explicit goal such as expected nominal GDP growth or Cleveland Fed inflation expectations and commit to continually adjusting the money supply to maintain that level. If Mr. Bernanke is unable or unwilling do so, he needs to resign.”

4. June 2012 at 22:09

Great post professor. I just have one question.

If consumer expect a recession then they will not spend as much money today as they otherwise would. Thus if spending has decreased, then our aggregate demand must decrease. An aggregate demand decrease means the AD curve will shift to the left resulting in a lower equilibrium point in the AS/AD model. Meaning that both price level and output will fall. This would leads me to believe that unless a recession is caused because of a shortfall in AS then it would be deflationary?

PS. please go easy on me! I have become an avid reader and an advocate of Sumnerian Economics ever since graduation.

4. June 2012 at 22:51

Looks like large amounts of RGDP were still lost in Israel because the rest of the world’s poor central banking. A massive real shock they have no control over.

5. June 2012 at 01:04

This ongoing support from Ryan Avent is so, so heartwarming.

http://www.economist.com/blogs/freeexchange/2012/06/business-cycles

When you start thinking about NGDP targeting you can’t think about anything else.

I must say that this concept start to become like a religion to me. An universal rule that can saved the world. 🙂

That’s why there something wrong with it, it can be so perfect, nothing is. But I don’t know what is wrong with it.

🙂 🙂 🙂

I hope that this adulatory comment will make your day professor.

But seriously you should crunch all this material that you created during these 3 years of writing the blog, gather all the charts and numbers, systematize this stuff and

PUBLISH a book. I suggest a title:

End this depression. NOW! By NGDP Targeting obviously.

🙂 😉

(Additionally you could earn some money, that would be a reward for all this hard, unpaid job on the blog.)

5. June 2012 at 02:04

Wadolowski, Scott’s already doing a book on the Great Depression. The book on the crisis you’re looking for is this: http://www.amazon.com/The-Great-Recession-Failure-Macroeconomic/dp/1107011884/ref=la_B001JSATKI_1_1?ie=UTF8&qid=1338890641&sr=1-1

5. June 2012 at 02:33

@Saturos

Thank you for the reference. Yes, I started to look for and prof. Sumner endorsed it here as well:

http://www.themoneyillusion.com/?p=13765

So there must be something in it. 😉

When I suggested writing a book about NGDP Targeting by prof. Sumner I thought rather about something that would be a mixture of this:

http://press.princeton.edu/titles/6380.html

and this:

http://www.amazon.com/End-This-Depression-Paul-Krugman/dp/0393088774

A book that explains all the aspects of NGDP Targeting (a crunch from the blog, filled with examples, charts and numbers, criticizing all this austrian/conservative not supported by fact ideology, prejudice and biases. But a book that is directed to the future, telling what to do, not deliberating, reconsidering the past (like Krugman’s book).

So simply an abstract from TheMoneyIllusion blog. 🙂

5. June 2012 at 02:55

Off topic – Glasner’s really been roasting Taylor lately: http://uneasymoney.com/2012/06/03/omg-john-taylor-really-misunderstands-hayek/

5. June 2012 at 03:09

David Beckworth edited a book:

Boom and Bust Banking: Leaning with the Wind

Sumner has a chapter, as does Rowe, Beckworth and Hendrickson. Other aurthors include Espinoza, Hummell, and Selgin. (and me too.)

I hope it is forthcoming soon.

5. June 2012 at 03:20

Mike Sax,

A major difference would be that, during the the 1975 recession, NGDP growth was nearly 10%. It’s the classic supply-side recession: aggregate demand growth was strong and yet still there was a recession. In the UK, NGDP growth was 26.4% in 1975 and the GDP deflator growth rate was 27%.

If you have a supply-side recession and NGDP growth is well about the natural rate of output, then you get rapid inflation. A short 5% inflation is a very different situation than a permanent <20% increase in the price level.

5. June 2012 at 03:53

Interesting, but not yet persuasive.

Since Israel has a much higher average rate of inflation than the USA or Germany you’d have expected an international decline in inflation to have less of an impact on them anyway because they’d be less likely to hit the lower bound. A country with a more similar history of inflation using NGDP targeting would make a more persuasive example.

5. June 2012 at 04:04

From Twitter:

LaGarde is trying to get the ECB to ease:

http://www.reuters.com/article/2012/06/05/us-imf-ecb-idUSBRE85409420120605

And it’s not looking good for Obama:

http://www.theatlantic.com/health/archive/2012/06/poll-only-36-percent-of-americans-support-the-affordable-care-act/258038/

5. June 2012 at 04:29

Lower inflation during recessions is a sign of procyclical monetary policy, i.e. policy failure.

Yes! I do not know why pop econ is so counter to this. If we are producing less due to investment mistakes or supply shocks or whatever, prices in general should go up as supply goes down. The fact is that sometimes inflation is good and sometimes deflation is good.

One proof that inflation is sometimes good is that farm and petroleum economies are doing good (North Dakota has very low unemployment). Employment is high in food and petroleum producing areas, and as for real wealth production is up and rising.

Let me address another thing to my fellow conservatives. You think that debt is bad and that people and corporations should pay down their debt but you fret about the rise in base money. Well since money is created be debt wont we need much more base money if everyone gets wiser and uses less debt?

Now a big problem is that monetary policy is controlled by voters and though relatively lower home prices are good and needed but to home owners, who are mostly voters lower home prices are a negative and so they want lower food and gasoline prices and higher home prices.

5. June 2012 at 04:43

what would have happened if the US had done 5% NGDP targeting, level targeting, in 2008.

I think it more important to specify what would have happened since the dot.com bubble pop:

2000 – 2006.

On the fiscal policy issue, there must always be included that most small gov’t supporters see most fiscal policy as the gov’t wasting money on its crony capitalist friends.

Plus, most fiscal policy supporters are also critics of Bush tax cuts — which was clear fiscal policy that also happened to work in creating a deficit which, over time, was getting lower (due also to the bubble).

5. June 2012 at 04:53

Professor Sumner,

Could you possibly add a section to your FAQ where you listcentral banks that have approximately targeted NGDP, such as Israel? Maybe with brief descriptions/analysis/key features/distinctions from your ideal monetary regime. As a semi-regular reader of your blog, I would find that immensely helpful.

5. June 2012 at 05:23

Eassayiest-Lawyer, That’s a good point, and is precisely why NGDP would be way more politically popular than inflation targeting. As I point out in my National Affairs article (recommended, BTW), when Bernanke tried to raise inflation in late 2010, when the inflation rate had fallen to 0.6%, there was huge controversy, even though that was exactly what inflation targeting called for. In contrast, if Bernanke had announced he was trying to raise the incomes of Americans it would have been much less controversial. Americans would have much rather had Israel’s small recession than our huge one.

Mike Sax, Not really, much milder than 1975 and much lower inflation.

Ben, With Australia you need to focus on the “level” part of NGDPLT, not the NGDP growth rate. The RBA did a poor job of maintaining NGDP growth in 2009, but the economy had overheating a bit in 2008, so the level in 2009 was still decent. Then they had a nice recovery, to again stay close to the trend line. Bottom line, more volatility than you’d like, but kept close to that 7% trend line coming out of 2002.

Steve, Great, I’ll do a post.

Rodrigo, You said:

“If consumer expect a recession then they will not spend as much money today as they otherwise would. Thus if spending has decreased, then our aggregate demand must decrease. An aggregate demand decrease means the AD curve will shift to the left resulting in a lower equilibrium point in the AS/AD model.”

PS. please go easy on me! I have become an avid reader and an advocate of Sumnerian Economics ever since graduation.”

A former student. Don’t worry, I’ll go easy on you because you are polite–it’s the arrogant jerks . . .

This is a common mistake. AD refers to all spending, not just consumption, and NGDP targeting means controlling AD (to rise at a steady 5%.) So by assumption there are no AD shocks. Instead, when people consume less, interest rates fall (as they save more), and investment rises, or maybe G or NX rises. Leaving NGDP unchanged. All recessions are then supply-side, as you correctly inferred.

Thanks Wadolowski, I hope to do a book–trying to free up time. Comment answering may have to suffer.

Thanks for the link Saturos,

Bill, Yes, when is the book coming out?

OneEyedMan, Two issues. Can you target NGDP? And if you do so does it make recession milder? This answers the conservative critique that recessions would be just as bad under NGDP. No they wouldn’t.

Floccina, The problem is that people’s instincts go the opposite way.

Mikey, I may at some point, although Israel is the only example I’ve come across that seems obvious. Australia less so.

5. June 2012 at 05:43

You mean investment spending rises. Keynesianism is so horrendous, even you can get sucked in. If you’re using National Income Accounting, distinguish between the composition of spending flows (the components of “quantity demanded” in the AS/AD model), the composition of nominal output (not the same thing as spending flows, which may change their composition as the price level rises to “clear the market” – i.e. not quantity demanded but actual equilibrium quantity sold) and the composition of real output.

But I don’t blame you – I bet even at Harvard when they teach Macro 101 they say C + I + G + NX = Y without clarifying the exact nature of these variables. Indeed that was part of the original confusion of Keynesianism into which Milton Friedman and others had to wade in and clarify matters.

On another note, I actually prefer your Adam Smith Institute piece to the National Affairs article. I even prefer your Cato piece. I wonder which bit it was exactly that convinced Christina Romer…

5. June 2012 at 05:56

“Canadian newspaper editorial urges NGDP target, Bernanke resignation! It looks like Nick Rowe may know the authors…”

Nick Rowe and I (the author of the op-ed) are both with WCI.

5. June 2012 at 07:22

It would be interested to see those 1995 Fischer quotes in context. Does anyone know if the paper is available online for those who don’t want to pay $10 for the PDF? I wouldn’t accuse Soltas of cherry-picking without more evidence, but it does seem that Fischer was discussing a different situation to today (namely a supply shock) and that overall he still comes down in favor of inflation targeting.

5. June 2012 at 07:36

Essayist-Lawyer:

“People fall for the money illusion. They only notice price inflation and don’t notice if wages also rise.”

That is so true. I remember a coworker insisting to me that the government should go on the gold standard with this question – “What if inflation is 3% a year and you don’t get a raise for 20 years?” I asked why the price of my labor wouldn’t be affected by the inflation, and he just said “What if? It could happen.”

This was a fairly smart guy too. That’s the thing that strikes me – how many otherwise smart people start talking nonsense when it comes to money.

5. June 2012 at 08:03

Steve, Mike Moffatt and Nick Rowe are on the same blog (link in the sidebar).

5. June 2012 at 10:29

Saturos, Interesting that you like those better—I thought my NA piece was best. I thought it had the best analysis of the politics of the situation.

I meant nominal investment spending, because I was talking about NGDP. If I’m talking about RGDP, I’d mean real investment spending. But I should have been more precise.

Mike, Yes, I should have mentioned that.

o. nate, I’m sure he didn’t cherry pick, because if he was trying to deceive he would have left off the last sentence, which made it clear Fischer prefers flexible inflation targeting to NGDP targeting. But is a sense NGDP is just a very flexible form of flexible inflation targeting.

Negation, Then tell him with zero inflation he’d get a 3% nominal pay cut every year for 20 years, at least if he wanted to keep his job!

6. June 2012 at 00:17

I took a class at the University of Pennsylvania on central banking policy that was taught by the Deputy Governor of the Bank of Israel at the time, Zvi Eckstein, and I spoke to him about his views on NGDP targeting. I’m afraid to say that his view was that NGDP targeting remained “an academic exercise at best, with no practical implementation possible”. NGDP targeting didn’t even get a mention in our class.

Prof. Eckstein WAS however a HUGE advocate for the Taylor rule; he spent at least 4 weeks on the topic. He also seemed to indicate that the Bank of Israel used the Taylor rule to guide their policy at the time of crisis. He also spent a lot of time going over inflation expectations from 2007-2010 and how that would affect the Bank’s policy via the Taylor rule, implying inflation targeting – which sort of follows Fischer’s comment that inflation targeting is prefered to nominal-income targeting.

Prof. Eckstein however was also equally convinced that there was very little the Central Bank could do at the zero bound, so not quite a home run.

6. June 2012 at 06:44

I bet Matt Yglesias gobbles this up.

Yep.

6. June 2012 at 06:50

Sanchit, Surely he thought they could devalue?

7. June 2012 at 10:40

People often ask me what would have happened if the US had done 5% NGDP targeting, level targeting, in 2008. I suggested we would have had stagflation. A very mild and short recession,

What about whether inflation will be normal or above/sub normal? Why didn’t you address that?

See what I did there?

12. June 2012 at 09:05

How often have you heard people say; “Of course inflation slowed during the recession, that’s natural.” No, it’s unnatural. For any given MV, a lower Y implies a higher P.

Couldn’t people hoard M or reduce V?

12. June 2012 at 10:40

RPLong:

Couldn’t people hoard M or reduce V?

Indeed they could, and it would be entirely NATURAL for them to do so, contrary to Sumner’s belief that it is “natural” if people acted like automatons and always spent with a constant growth rate, such that we can assume a “given” MV.

It is unnatural to assume a constant MV.

13. June 2012 at 08:13

RPLong, Yes V could fall, but I was holding MV constant when discussing the impact of lower inflation. If V fell the Fed should offset it with higher M.

And pay no attention to MF, he’s wrong nearly 100% of the time–including this time.

25. June 2012 at 09:51

This stuff is really beyond the pale. So, the BoI is undertaking a policy that relies for its effectivity mostly on expectations… IN SECRET? That’s pretty impressive. A bit like running a successful presidential campaign in secret — an amazing achievement; mind-bending, if you will. (Yeah, I know you’ll claim that manipulation of reserves actually affects inflation, but no one in the markets believes that any more — BIS and PIMCO are two recent anti-converts; academics and desperate central bankers may keep pushing this line to hold their wobbly models together, but that means little).

“How often have you heard people say; “Of course inflation slowed during the recession, that’s natural.” No, it’s unnatural. For any given MV, a lower Y implies a higher P. Lower inflation during recessions is a sign of procyclical monetary policy, i.e. policy failure.”

This is just weird. We assume that velocity slows sharply as a recession takes hold and people’s propensity to save increases. The data shows this pretty clearly. Liquidity preference etc.

The Fed also cannot ‘offset’ V by increasing M. Unless it starts buying goods and services directly. The assumptions this is based on are crude, mechanical and do not fall in line with empirical evidence. (They also ignore interest income, but I won’t go into that).

Seriously, none of this stuff stands up to empirical scrutiny. And just saying “NO! These people are wrong” in the comments section — as if you have some innate authority over what is right and what is wrong — doesn’t help your case.

25. June 2012 at 10:58

Phil, You said;

“This stuff is really beyond the pale. So, the BoI is undertaking a policy that relies for its effectivity mostly on expectations… IN SECRET?”

The Fed did a reasonably good job of targeting NGDP between 1985 and 2007, and yet no one claims they were explicitly targeting NGDP. How is the Israel case any different?

Who made that claim? Evan didn’t. I certainly didn’t.

You said;

“Seriously, none of this stuff stands up to empirical scrutiny. And just saying “NO! These people are wrong” in the comments section “” as if you have some innate authority over what is right and what is wrong “” doesn’t help your case.”

This is just silly, I get 1000s of comments and treat them respectfully unless they come from Major Freedom, who’s a complete fool that doesn’t understand even the most basic economic concepts, and comes over here with an insulting tone of voice, and fills up huge portions of the comment section with long treatises that are mostly gibberish. And I still don’t ban him. Name one blogger who is more tolerant than I am.

13. October 2012 at 10:02

[…] 2008) by arguing that the CB must announce a policy rule for it to work, but simultaneously hold up Israel and Australia – where the CB has done no such thing – as examples of NGDP targeting […]

1. January 2015 at 03:04

[…] I am aware that had the Fed been implementing NGDPLT in 2008 the crisis would have been much less severe, perhaps not even a recession! The above is for […]