The problem with old-style monetarism

This should be a time of celebration for monetarists. While many conventional economists and market monetarists did not express much concern about inflation (until recently), more traditional monetarists like Bob Hetzel and Tim Congdon correctly warned that excessive money growth would trigger high inflation. And yet I don’t expect them to get much credit and I don’t expect a revival of monetarism. To see why, let’s look at the data:

Here I’d like to compare annual growth rates from 2019:Q4 to 2021:Q4:

Nominal GDP: +5.16%

PCE inflation: +3.33%

Real GDP: +1.56%

(They don’t quite add up because I used the PCE inflation index that the Fed targets, not the GDP deflator)

M2: +18.8% (December 2019 to December 2021)

Given the dramatic fall in immigration during Covid, the 1.56% RGDP growth is basically right on trend (per capita.) But the relatively normal growth in RGDP actually reflects two rather dramatic shocks, which roughly offset each other:

1. Excessive growth in aggregate demand. Nominal growth should have been no higher than 4%/year, and instead averaged over 5%. That pushed output above normal.

2. Supply chain problems related to early retirements and the switch from services to goods. That reduced output relative to trend.

These two factors roughly offset, leaving (per capita) output close to trend. The extra 1.16% in NGDP growth mostly led to higher than target inflation.

In some respects the situation is even worse than these figures suggest. NGDP growth was at an annual rate of 14.3% in 2021:Q4, confirming that monetary policy in the second half of 2021 was far too expansionary, as many traditional monetarists claimed. I expect the overheating problem to get even worse in 2022, as NGDP growth is likely to continue running at a rate that is well above 4%. Monetary policy is still too easy.

So why won’t monetarism make a big comeback? The problem here is that while monetarism was correct in a directional sense, the actual rise in inflation and NGDP was dramatically different from the growth in the monetary aggregates. (I used M2, but other aggregates also grew rapidly.) This reflects the fact that velocity slowed dramatically in 2020-21. M2 rose by over 41% over two years, while NGDP rose by barely over 10%. Thus it is still true that monetary aggregates are not a reliable guide to monetary policy. To judge whether money is too easy or too tight you need to look at expectations of NGDP growth.

Recent inflation figures look even worse. For instance, the PCE index is up 5.73% from November 2020 to November 2021. But that still means that someone who predicted 2% inflation this year was more accurate than someone who predicted 10% inflation. Is that how you think about forecast accuracy? Be honest.

I would call 2021 a marginal success for traditional monetarism. It supports the argument that the monetary aggregates provide some useful information that is not captured in conventional macro models. And while it’s still early, I am pretty confident that 2022 will provide another marginal success for traditional monetarism. We are in for another year of high inflation. So don’t take this post as a criticism of monetarism—its reputation should be higher today than a year ago.

Nonetheless, I don’t see enough evidence to support the claim that the monetary aggregates can play a decisive role in policy formation—velocity is too unstable. Markets saw what happened this time, and I’d expect the next time we get a surge in the monetary aggregates you’ll see that data better incorporated into market forecasts. Markets will decide how much weight to put on the aggregates.

Market forecasts are still the best guide to policy. Recall that market forecasts were far more useful than the monetary aggregates during the Great Recession.

PS. Hypermind predicted 8.1% NGDP growth, whereas the actual figure was 11.7%, which represents a spectacular failure of the Hypermind market. (Hypermind forecasters implicitly expected Q4 NGDP growth of roughly zero, instead it was 14.3%.) I suspect that there is a flaw in the way Hypermind reports its forecast, but I need to investigate further before I reach any conclusion. For the moment, I put more weight on TIPS spreads.

PPS. It’s not clear why the economy overheated in late 2021, but I suspect one reason is that the Fed abandoned its FAIT regime. There doesn’t seem to be any commitment to push inflation below 2%, as required by FAIT. Someone needs to ask Powell why that is.

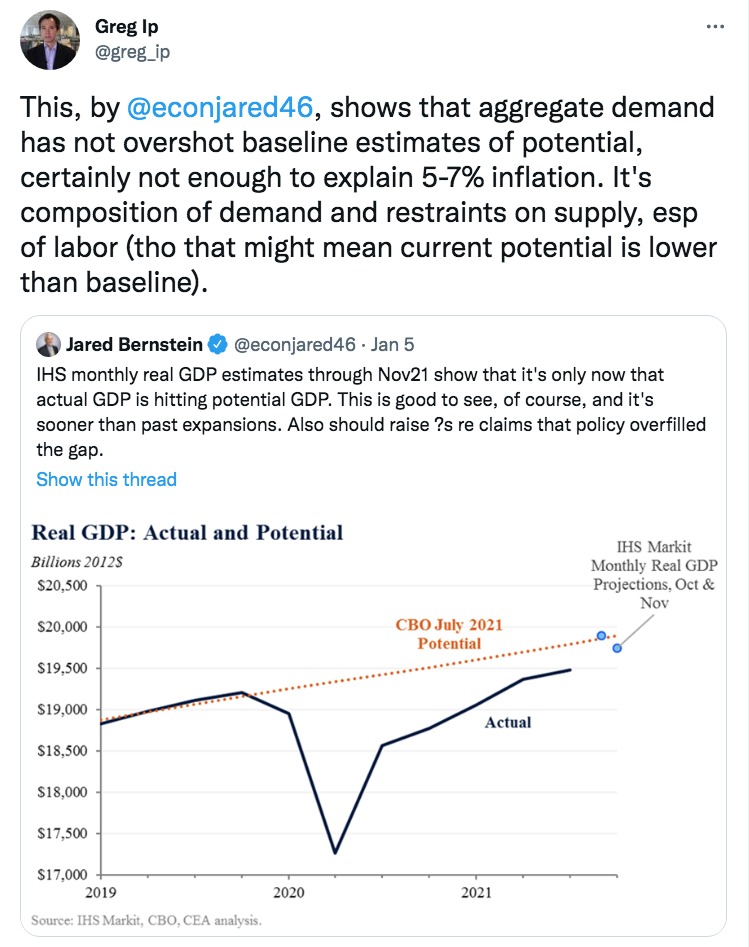

PPPS. Greg Ip makes the common mistake of assuming that RGDP is a measure of aggregate demand. It isn’t. Nominal GDP measures aggregate demand. (Consider RGDP and NGDP in Zimbabwe.) This leads him to wrongly conclude that the high inflation wasn’t caused by excess demand. Supply problems certainly played a role, but so did excess demand.

Tags:

27. January 2022 at 18:18

I’m curious; if the rate immigration is so low, then why is the whitehouse secretly flying illegals into the country in the middle of the night?

https://www.youtube.com/watch?v=ZBeoXGtOCcY

The reason is because immigration is not at an all time low. It’s at an all time high! The rate of immigration exceeds America’s ability to integrate, and it will continue to put downward pressure on wages – not to mention, increase social strife.

But of course, that is the goal isn’t it Scott. You, like other radicals, want to break the United States both fiscally & socially, and then replace it with a dystopian CCP style of governance.

27. January 2022 at 19:26

Don’t worry.

The commies won’t win.

We have musk

https://twitter.com/elonmusk/status/1486772334635536395?cxt=HHwWlsCivfTjiaIpAAAA

They have fat and old losers who are ugly as sin (i.e., schwab and 90% of american communists sitting behind their desks at Uni).

Never in human history have ugly people won. Human nature won’t let it happen. Evil is ugly, and evil loses. Round and round we go.

27. January 2022 at 22:11

I don’t think your central claim in this post is controversial, to the point where I think the only people who would think it wasn’t would be old-style monetarists themselves. But I wanted to raise two points.

The first is the idea that excessive growth in nominal demand pushes output above normal. I guess that’s related to your recent EconLog post about Bryan Caplan and prices and shortages – for given nominal demand, higher prices imply lower real output. I guess I’m so used to thinking in terms of your sticky wages/musical chairs model, I find it hard to think in terms of a sticky price model. But I suppose the idea is similar? With sticky wages, the ‘real wage’ (in W/NGDP) paid by businesses is lower, which increases labour demand and employment; with sticky prices, businesses respond as though increased nominal demand is an increase in real demand (NGDP/P) for their products (ie by producing more)? Is that right?

Second, on FAIT, one wonders whether the motivating force for adopting it was to signal to the market that – finally – the Fed is serious about allowing *some* make-up policy so the 2% target won’t be a cap, rather than constraining the Fed too much. Every time a central bank unilaterally adopts ‘flexibility’ it seems to be to give itself more discretion to take the easier (less politically-difficult) course. The RBA has behaved similarly since (before) 2016, when it modified its target to allow it to take account of ‘financial stability’ and to achieve its 2-3% inflation target “over time” rather than “over the cycle”.

Separately, you’ve said something like the Fed does what the median elite macroeconomist thinks it should. I can’t paste a tweet in this comment, but if you go David Aldolfatto’s account for 26 January, he has a thread that argues that even if inflation remains high during 2022, so long as it decelerates over the course of the year as supply chain issues resolve, that implies “a higher P-level, not an elevated inflation rate” and so, “…why the calls for aggressive monetary tightening?”

27. January 2022 at 22:21

One of the problems with the Hypermind market is idiots like me making bad bets. I think I picked 7.5% for 2021 YoY NGDP because I thought herding would be rational. My only excuse is that I didn’t enter a bet until late fall—just before the big spike in PCI came out.

My 2022 bet is also going to be wrong, although I just bumped it from 4.5% YoY to 6.5%–which puts me outside of the current mean. Even if I had to pay money to make these bets I’m still reluctant to consider NGDP at the end of this year as higher than 8%—which my reptilian brain is screaming it will be.

I’ve been running my mouth on this blog saying we’re going to have a repeat of the 90’s in terms of composition of NGDP, but I’ve spent so many years in a low interest rate and low inflation world that it’s hard for me to adjust my thinking.

28. January 2022 at 01:09

The Hypermind forecast was more like 7.8%. It only bumped up over 8% after the release yesterday, when a number of forecasters adjusted their final forecasts to fit the data.

I did okay, 23/458, but was far too conservative. I also need to remember to adjust my forecast more often!

One problem with it is that a lot of the forecasters clearly misread the question (I don’t know how). Just look at the comments, there are people saying in January that they were predicting 2%! Maybe people thought it was real GDP?

28. January 2022 at 02:36

Hi

I took part in the hypermind competition (rank 7), and I was studying my competitors and the pool for the past year or so. As Tacitus points out – its clear if you review submissions that many forecasters either misunderstood/hadn’t read the question or had no rational basis for their forecasts (and from other submissions/comments it was obvious I’m not the only person who believed this). Implicitly from reading comments etc I think many thought they were forecasting the QoQ annualised RGDP (i.e. the number that normally gets reported in the financial news) for 4Q. I’m not sure what kind of averaging is used to create the composite crowd forecast from the individual forecasts, but there probably needs to be some careful thought into this given the presence of a meaningful number of clearly mistaken forecasts.

This of course shouldn’t be taken as a criticism of the wording of the question, I don’t think it could have been any clearer – its just obvious to me that some people didn’t read it properly or even at all.

I wonder if you can extract some meaningful information from the competition by looking at the time series of forecasts from the top performers etc. As Tacitus points out, the window to forecast wasn’t closed the day of the announcement, so several participants “pinned” their last forecast after they had the data.

28. January 2022 at 03:29

Scott,

You might not believe in long and variable lags, but old style monetarists do. So looking at NGDP and M2 over two years is not going to provide much evidence for or against their view.

Here is an example of an old (crusty and brittle, in fact) monetarist forecast from 2020:

“At some point in the next two or three years the annual growth rate of US nominal GDP will accelerate towards double digit figures. A similar trend, though not as dramatic, will be followed in other advanced economies.”

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3851979

Congdon has also been talking about the risk of double-digit inflation in the US. The test of that will be in 2022 and 2023, with the classic 2-3 year lag from the big M3 surge of Spring 2020.

I am much more sympathetic with market monetarism than old monetarism (Divisia aggregates can be useful for forecasting and have a causal role in inflation, but I wouldn’t make them the basis of a policy rule) but we need to make sure that we are disagreeing with what old monetarism, at its best, actually says.

28. January 2022 at 06:23

Scott, I think I have finally formulated a China policy we can agree on… it can solve Ukraine peacefully as well.

I’ve run it past lots of NatSec and GOP names and Chinese nationals in US. This is like Uber 4 Welfare. Tech can elegantly solve a previously hard problem.

(drumroll) DEFECT TO STAY

1. US should publish a database of all CCP family members in West

2. Randomly select 1K and force them to DEFECT (renounce CCP) or return to China. 80% will DEFECT.

3) Defect to Stay policy immediately show CCP and Putin that their internal main incentive for mafia state (make $ and GTFO away from Xi/Putin) is controlled by an open door to US/West for their loyalists- AND WE KNOW IT, and now the whole world does too.

4) Defect to Stay is LIBERTARIAN in many ways. Some VERY deep and weird (more later). But is a very peaceful answer to land war.

It starts with this fact: Mafia states feast on their own talent. This creates the perverse incentive of amassing money even via corrupt means to LEAVE.

USSR had the capacity to lock in talent – until they didn’t. Defection is a contract between US and the defector.

Xi will immediately have to either LOCK IN TALENT like USSR, or quietly accede to US policy demands. Don’t invade Taiwan. Putin, don’t invade Ukraine, or the Oligarchs must sell at western assets in a fire sale and move back to Russia.

There is a 3rd option!

Perhaps Morgan is wrong, and 80% of CCP will not choose DEFECT.

Perhaps they will all move back to China where GDP is 1/6th US.

This is anti-Realist policy. The US is allowing mafia states to exist, it allows them to keep the perverse incentive to corruption of talent to make $ and GTFO, but it requires NOW the tacit admittance of defection of talent (renouncing what they left when it arrives here).

So can we finally agree on US-China policy?

28. January 2022 at 06:36

Although I understand that velocity is mathematically part of the monetarist model, it’s basically a fudge factor that makes monetarism pretty much unfalsifiable. M and NGDP up equally? Victory, velocity must be stable! M and NGDP moving in opposite directions? Victory, velocity must be varying! Velocity is *measured* as NGDP/M; we don’t independently measure velocity in a way that would even allow testing the theory. You’d think we would have learned about over-interpreting accounting formulas.

Market monetarism cites the disconnect between M and NGDP as evidence for the inadequacy of monetarism. Market monetarism doesn’t address the velocity monetarism-savior because it isn’t convenient to. Faced with monetarism’s failures to accurately gauge the stance of monetary policy without observing velocity, market monetarism throws in the towel and assumes the market will accurately gauge it. There are attractive reasons to believe markets, but it seems less a model of the economy and more a call to believe the wisdom of the crowd.

This state of affairs is extremely frustrating to me as someone who sees market monetarism as currently the best guide to policy but would like fundamental reasons to endorse it.

28. January 2022 at 07:55

Is it possible the Fed is including past years in the Average Inflation it is targeting? I seem to recall mention of that possibility around the time of Powell’s August 2020 speech, but I can’t find that mention now.

Inflation averaged 1.95% compounded from 2011 to 2021:

PCE index excluding Food and Energy (PCEPILFE):

12/2011 98.992

12/2021: 120.047

Average 1.95%

I’m not saying the Fed SHOULD target backwards; I’m asking whether you think the Fed IS including past years in the Average Inflation Target.

Thanks!

28. January 2022 at 08:06

On Hypermind, I was at around 10.5%.

I don’t have a good sense of how this Hypermind forecast is generated. For instance, is it a simple average of all guesses? Well, then people who haven’t updated their forecasts are given the same weight as someone who updated their guess recently. So if I understand it correctly, the average is just aggregating views, but does not take into account how strongly a person feels. In markets, we like to use money to express how strongly someone feels. This suggests moving more towards a prediction market approach. For instance, suppose the bid/ask if 8/8.5 and I think it should be 10.5. I should be able to keep buying contracts until the bid/ask is something like 10.25/10.75. When the GDP number comes out, then I would get paid off on the level of GDP growth less the price of my contracts (or something like that).

28. January 2022 at 09:14

The “one-legged” (or old) monetarist looks at the Quantity Theory equation in growth form: M+V=P+y, where M is the growth in money supply, V the growth in velocity, P inflation and y the growth of real output, and assumes V is stable (a leg that doesn´t move). Further, in the medium to long run, real output growth is determined by real factors, so that, rewriting the equation as M-y=P they conclude that higher M growth will result in higher inflation P (that´s the meme of “too much money chasing too few goods”)

Now, if you allow the V leg to move, the inference changes.

https://marcusnunes.substack.com/p/how-the-inflation-story-changes-when

28. January 2022 at 10:06

Rajat, If I understand your first point about wages, then that is correct.

On the second point, I have the sort of personality that finds it extremely annoying when a institution like the Fed announces a new policy regime, and then almost immediately ignores its commitment. And my annoyance doesn’t go away even if someone convinces me that the digression from the policy regime is justified. If it’s justified, then why adopt the policy regime in the first place? What not adopt Bernanke’s TPLT, which doesn’t force one to offset temporarily high inflation that occurred at the zero bound?

BTW, I’d say policy is too expansionary even if FAIT is the wrong policy and NGDPLT is the right policy. NGDP growth is also way too strong. I see no justification for this sort of policy.

Tacticus, I looked at it in the weeks before the announcement and it was 8.1%. At least as reported in the right column of this blog.

Thanks OG.

William, Good points, but of course it doesn’t change my view that the aggregates are not a good guide to the stance of policy.

Morgan, I’ve long advocated admitting 100,000,000 Chinese to the US.

Daniel, I don’t think monetarism is unfalsifiable. It makes definite predictions.

Todd, Some Fed officials suggested the clock started around the end of 2019, which was also my view. Why go back earlier?

28. January 2022 at 10:32

Perhaps the problem with Hypermind is that the official NGDP values are cooked. Imports are reported late. Inventory growth is artificially high. With the Biden war on energy, I expect 20% inflation during his first 3 years in office.

28. January 2022 at 13:05

@Don:

And I expect Mila Kunis to drop by my place later. I think we’re both going to be disappointed.

Is the war on energy anything like the war on Christmas or the war on white people?

28. January 2022 at 15:03

Don, Oh come on, do you seriously believe Biden has any significant impact on the global price of energy?

(Where do these commenters come from?)

29. January 2022 at 08:16

RE: “Thus it is still true that monetary aggregates are not a reliable guide to monetary policy.”

“The Fed’s favorite inflation indicator – Core PCE Deflator – surged more than expected to +4.9% YoY, its highest since April 1983…”

This fits my modeling.

The cash-drain factor, the ratio of currency to demand deposit accounts, has increased from .667 in January 2000 to 2.301 in December 2021. Ergo, more currency is being used to support higher prices.

The 4th qtr. 2021 increase in R-gDp of 6.9% can only be explained by the surge in currency during the 4th qtr. (by the cashing of time deposits).

29. January 2022 at 08:32

RE: “To judge whether money is too easy or too tight you need to look at expectations of NGDP growth.”

The composition of money has changed. And the velocity of money has changed. But you can’t look at N-gDp growth with just one rate of change in the monetary aggregates.

29. January 2022 at 10:41

In “Tight Money, Easy Money, and the New Economics”, August 1967, pg. 135-137, by Leland J. Pritchard, Ph.D. Economics Chicago, 1933, M.S. Statistics, Syracuse, Dr. Pritchard elaborates.

He dissects the “credit school” and the “money school” and says: “With immaterial exceptions it may be said that as time deposit grow the primary money supply shrinks pari passu-unless offset by an expansion of bank credit.”…”Although increases in currency are always at the expense of demand deposits, either directly, or indirectly through the liquidation of time deposits, it cannot be said, as of time deposits, that increases in the public’s holdings of currency reflect prior commercial bank credit creation. It is more appropriate to say that expansions of currency are accompanied by concurrent expansions of Reserve bank credit”

“Unless Reserve authorities are desirous of following an easier or more restrictive monetary policy, any loss of bank reserves due to currency withdrawals from the banking system will be offset by an approximately equal volume of open market purchase of Governments for the portfolios of the Reserve banks”.

September 2020’s NSA M2 was reported as 14253.1. The figure was not exceeded until September 2021 @ 14,377.3. M2 has then exploded in the 4th qtr. until December 2021 @ 14,737.7. M2 grew by 516.6 in the 4th qtr. DDs have grown by 353.4, and currency by 30.7. Thus, the overall money stock grew by 900.7.

Currency was previously, prior to Covid-19, a fraction of DDs @ .907 in FEB 2020. Now currency is a multiple of DDs @ 2.291. I.e., the cashing of time deposits has greatly increased our “means-of-payment” money supply.

29. January 2022 at 11:16

Okay, this is very strange; my entire Hypermind crowd forecast has now changed from yesterday to today. Not just the end result, but the historical forecast too. Yesterday, it was showing 7.9 on 26/1; now it clearly went above 8 in December. I had noticed before that what I saw in Hypermind was not the same as what is displayed to the right of this blog, but I thought the right of the blog notice was off, not my Hypermind. Any ideas?

29. January 2022 at 12:19

Re: the Bernstein/CBO plot, why do so many plots in economics look like the person is just drawing a line through a few points and projecting into the future. Is the “CBO July 2021 potential” line based on some complex fundamental model, or is it essentially just glorified linear extrapolation?

I tried looking into this a bit. Despite a lot of huffing and puffing about how these models are very complicated, I wasn’t convinced that the latter isn’t a more honest description of what is going on. E.g., according to https://www.frbsf.org/economic-research/publications/economic-letter/2017/november/problems-predicting-potential-output/:

“the CBO assumes that the growth rate of potential output does not fluctuate dramatically from quarter to quarter or year to year. Instead, it focuses on medium- and longer-term movements in supply-side factors and generates estimates of potential output that are relatively smooth.”

That sounds a lot like linear (or nearly-linear) extrapolation, no?

Even the more complex “top-down” model he cites seems underwhelming:

“At the other extreme, some approaches to measuring potential output assume that the factors affecting potential output are constantly in flux and may be subject to frequent and large changes….A statistical method called the Kalman filter is used to distinguish between shifts in output due to movements in potential output and those stemming from other sources.”

So, lots of hoopla, but in the end, a Kalman filter. Still sounds like there are large gaps in understanding that are papered over by just smoothing the data.

29. January 2022 at 13:42

What problem?

Monetary flows, volume times transaction’s velocity, proxy for inflation:

RE: “excessive money growth would trigger high inflation”

02/1/2020 ,,,,, 0.03 bottom

03/1/2020 ,,,,, 0.21

04/1/2020 ,,,,, 0.40

05/1/2020 ,,,,, 0.46

06/1/2020 ,,,,, 0.50

07/1/2020 ,,,,, 0.53

08/1/2020 ,,,,, 0.56

09/1/2020 ,,,,, 0.61

10/1/2020 ,,,,, 0.68

11/1/2020 ,,,,, 0.79

12/1/2020 ,,,,, 1.26

01/1/2021 ,,,,, 1.31

02/1/2021 ,,,,, 1.41

03/1/2021 ,,,,, 1.51

04/1/2021 ,,,,, 1.60

05/1/2021 ,,,,, 1.65

06/1/2021 ,,,,, 1.79

07/1/2021 ,,,,, 1.91

08/1/2021 ,,,,, 1.94

09/1/2021 ,,,,, 1.88

10/1/2021 ,,,,, 1.97

11/1/2021 ,,,,, 1.86

12/1/2021 ,,,,, 2.08

01/1/2022 ,,,,, 2.15 top

02/1/2022 ,,,,, 1.71

03/1/2022 ,,,,, 1.44

04/1/2022 ,,,,, 1.40

05/1/2022 ,,,,, 1.35 bottom

29. January 2022 at 15:34

The poor Hypermind performance is likely due to the design of the Prescience site where the forecasts are made causing people not to update their forecasts often. At least three problems:

1. The interface makes it inconvenient (time consuming) to create a distribution that matches what you want.

2. Prescience has less visibility and is harder to access than the markets site, so active Hypermind users don’t access it as often as they might otherwise want (given that the rewards are much higher for Prescience questions).

3. The NGDP questions on Prescience aren’t prediction markets.

On the main markets site questions are play-money prediction markets (with small rewards), so you can signal that you know better than the crowd by making bigger trades. On Prescience, you can’t do this. This reduces the better predictors’ incentive to participate often.

Prescience lets you extract a full distribution (harder to do from the prices of multiple-choice markets) but what use is that if the predictions have low quality?

29. January 2022 at 18:20

Tacticus, I’m trying to get an answer from them.

Jeff, I agree. Today I did a Econlog post where I expressed skepticism about the usefulness of “potential” estimates.

Artifex, Good points. One problem is that prediction markets are usually focused on binary (yes/no) questions, not point estimates of variables such as NGDP. So perhaps the market’s design was not optimal.