The job market is very weak and very tight

Last year, I began talking about labor shortages. Lots of commenters suggested that it was just employers gripping because they didn’t want to raise wages. They pointed to the fact that total employment remained far below pre-pandemic levels.

Employment is still far below pre-pandemic levels, but it’s now pretty clear that I was right. There really is a labor shortage. The labor market is “weak” in the sense that total employment is low, and “tight in the sense that it’s hard to find workers and wages are rising fast. Unemployment is only 3.9%.

The latest employment report is a disappointment, but the job market is actually somewhat stronger than this number would suggest. Consider the following:

While the payroll survey shows gains of only about 450,000 over the past two months, the (less accurate) household survey shows gains of over 1.7 million. That’s a phenomenal number, as household employment has gone from a deficit of 4.6 million to a deficit of 2.9 million in just two months.

But why pay any attention to the less accurate household survey? Because even though it is less accurate, it provides some information, at the margin. Thus it picks up gains in self-employment, which might matter during a period where people like working at home to avoid Covid.

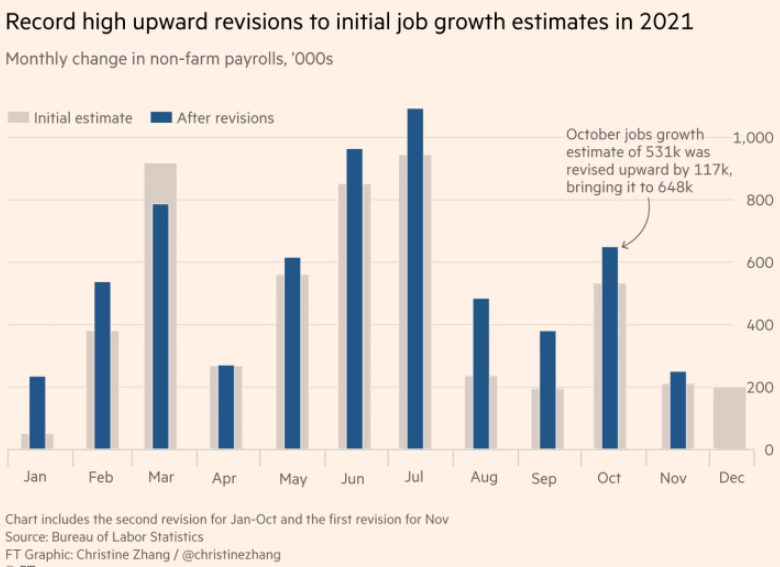

It’s also worth noting that the payroll figures will likely be adjusted upward. How do I know this? Because the payroll numbers were revised upward in each of the past 8 months. The odds of that happening randomly are 1 in 256. Let’s revisit my prediction in two months to see if I’m right:

Wage growth again came in higher than expected, and the unemployment rate fell by more than expected. Inflation is way above target, and NGDP is growing at a rate than is not consistent with the Fed’s inflation target. Even worse, NGDP growth in 2022 is likely to be excessive. TIPS spreads are excessive at both 5 and 10 year time frames. We need tighter money. Under FAIT, the Fed should be shooting for below 2% inflation.

There’s a lot of confusion about full employment. We are at “full employment” (as defined by economists) given the headwinds of Covid. And yet it’s equally possible that by July the full employment level will be three million higher than today. But that would not mean that we are not at full employment today. Full employment is not a fixed number, it moves around due to “real” factors, such as Covid.

Tags:

7. January 2022 at 10:36

Inflation is the Ill-defined economic bogeyman. There is no such thing as the “wage-price spiral”; the “price-wage spiral”; or the “cost-push spiral”; in the sense that increases in wages, prices, or costs are causes of inflation.

Unless effective demands (money times transactions’ velocity) are adequate to prevent a cutback in sales, or a diversion of purchasing power to the price raisers, any administered increase in prices will result in less sales, smaller outputs, less employment, lower payrolls and less demand for products—in other words, depression and deflation in due course.

7. January 2022 at 10:46

Would employment be higher or lower if inflation had been 2 percentage points lower in 2021? My guess is that inflation is lowering real wages, driving up demand for employees.

7. January 2022 at 10:47

Solid analysis.

It’s amazing to me (given our demonstrated inability to forecast such things), how many economists want to forecast lower inflation and/or higher labor force participation to give the Fed extra perceived breathing room.

7. January 2022 at 10:59

Those numbers don’t include the millions of Americans who have stopped looking for work, convinced a judge to give them disability because they couldn’t find work, are working in the dark market, etc, etc. Bankruptcies continue to increase, as are govt outlays on social benefits, and most student loans are either in deferrment or forebearance. 85% of small businesses in the United States are zombie companies, propped up by loans they can never repay. 70% of Americans have less than 1000 dollars in savings. Companies who can hire cheaper freelance workers abroad, using online platforms, are doing so in larger numbers. And the manucaturing sector, the backbone of American ingenuity and innovation, is now dead. If that wasn’t bad enough, most bank loans will not be repaid. And yeah, you can keep printing – but only for so long.

Those are not signs of a robust economy.

And terms like “full employment” are meaningless when you aribitrarly change the definition to “fit one’s needs”.

7. January 2022 at 11:04

Lizard, Employment would be lower in that case.

Rinat, You said:

“Those numbers don’t include the millions of Americans who have stopped looking for work,”

Whoa, I never thought of that. Thanks!

7. January 2022 at 13:35

An observation about our obsession over the Fed and monetary policy…

I feel as though we’ve lost site of how the economic system works. We all want more jobs, higher real wages, more wealth, etc. The answer in the medium/long-run is always productivity. And yet I hear so little about it. It’s as though we’ve given up on finding real solutions in hopes that the Fed has some magic wand, when in fact their tools are very limited. It should be the opposite – we should be obsessing over how to get more productive (especially in the areas we need it most like housing) and monetary policy should be a side show.

7. January 2022 at 14:51

Scott, my latest blog post is about the early to mid 2000s fall in U.S manufacturing employment and increase in trade deficit.

I try and answer the question: why did the “China Shock”, shock America so badly?

Many people would say that the high savings rates in China and other Asian economies were the cause of the higher U.S trade deficit. The puzzle though is the way excess savings are meant to translate into a trade deficit is via a higher exchange rate; however the dollar fell right throughout the period (2002 to mid 2005) in which the trade deficit increased.

Most of the post is about how to resolve that paradox.

Here is the link:https://strangetidings.substack.com/p/the-america-shock

7. January 2022 at 15:15

Nathan, The China shocked helped the US economy. Trade is good.

8. January 2022 at 02:36

Effem, inflation is pretty easy to forecast reasonably well. Just look at the TIPS spread and be done with it?

8. January 2022 at 04:38

M2 wasn’t in vogue during Paul Volcker’s reign. Why is it now the most widely cited?

8. January 2022 at 04:40

“If a strong union is able to force wage rates up, this will not have inflationary effects. In fact, quite the opposite will happen unless the increase in wage rates is accompanied by increased productivity.”

— Congressional Record, March 14, 1966

8. January 2022 at 21:11

One thing that occurred to me re: TIPS spreads; some of this year’s inflation has to be already priced in. For example if inflation is at 6% over the last year, even if the market were forecasting 2% inflation from today forward it would still have that 6% in the bank for the first year. That would lead to a 2.8% five year or a 2.4% ten year.

I realize the main thing this shows is I don’t really understand how these bonds work, but I can’t imagine the Treasury is issuing 5 year TIPS every day. Some of the data has to be derived from the secondary market.

9. January 2022 at 07:41

“In fact, the slope of the line declines with inflation, indicating that periods of higher inflation (especially higher than 6 percent) were also periods of lower real wage growth”

https://www.stlouisfed.org/on-the-economy/2015/november/relationship-between-wage-growth-inflation

9. January 2022 at 10:03

rwperu, I seem to recall there is a one or two month lag in adjusting TIPS for changes in the CPI

10. January 2022 at 05:56

Contrary to the accountants at the Board of Governors of the Federal Reserve System (in contradiction to the presupposed GAAP), the sale of securities by the FRB-NY’s trading desk decreases both the assets and liabilities of the Reserve Bank. It is not just an exchange in liabilities. The O/N RRPs destroy the volume of the broad money stock. PG. 305 in my 1963 Money and Banking book. PG 366, 382, & 398 in my 1958 Money and Banking book.

10. January 2022 at 06:00

Given the falling Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Employed Persons (PRS85006092), the deflationary impact of rising wage rates will be exacerbated.

11. January 2022 at 07:26

yep the Great Moderation taught us “full employment” is a very fluid equilibrium

11. January 2022 at 12:49

Powell speaks today and 5 year inflation expectations rise 10bp! It’s very hard to understand why he wants to make a dovish pivot here.

24. January 2022 at 12:01

Remember the 2% PCE target from 2012? Well, for the first time since then, the 7-year average PCE increase has just reached 2.0%.