The Fed hasn’t done much monetary stimulus this year

It doesn’t much matter how you measure monetary stimulus, the Fed hasn’t done much of it during 2020:

1. They cut rates by 150 basis points. That’s very little compared other recessions. Some would argue they could not cut rates further. I disagree, but even so that just means they haven’t done much stimulus because they cannot do much stimulus.

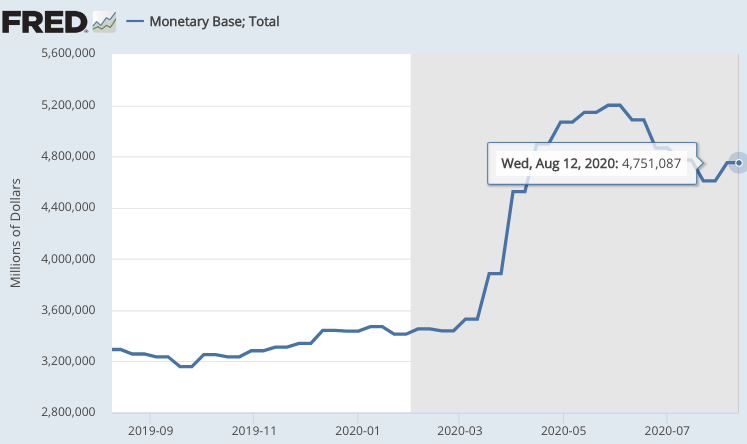

2. The monetary base is about $4.75 trillion. That’s up less that 20% from the summer of 2014. NGDP grew by more than 20% between mid-2014 and 2020:Q1. Thus in relative terms the base is not particularly large.

3. The monetary base is up about $1.3 trillion from February. That’s the same increase as from September 2008 to February 2010 (i.e. QE1) and it’s smaller than the increase during QE3. And of course NGDP was far smaller back in 2008. You can certainly argue that $1.3 trillion is “a lot”, but in relative terms the Fed’s basically done less than during two of the three QE programs during the Great Recession.

4. Using the Bernanke criteria, monetary policy has been contractionary (due to disinflation and falling NGDP.)

You can certainly argue the Fed’s done lots of “other stuff”, such a bail out the bond market and facilitate the provision of credit. But “other stuff” is not monetary policy. If you look strictly at monetary policy as usually defined (interest rates and the money supply) the Fed has not done all that much.

Fiscal stimulus actually has been unprecedented (for peacetime), even as a share of GDP. Far more expansionary than anything the supposedly “socialist” Obama could have imagined in 2009, and all done with a GOP president and senate.

So why does almost everyone assume that monetary policy has been highly expansionary? Because they don’t actually pay attention to what the Fed does. Deep down they don’t think the monetary base matters, and hence they assume based on media accounts that the Fed must have injected vast quantities of base money into the economy. As an analogy, no one paid attention when growth in the monetary base came to a screeching halt during August 2007 to May 2008, because people don’t care about the base. But then these same people will tell you that QE is evidence of easy money. Sigh . . .

Back during the Great Recession, the Fed bought most of the budget deficit. (I hate to use the term ‘monetized’ because with IOR the Fed no longer actually monetizes debt, except for the portion bought with currency.) This time around, the Fed is only buying up a modest portion of this years $3.7 trillion budget deficit, much less than half. Unless I’m mistaken, that’s not the impression people have, because it’s not the impression the media is providing.

So why doesn’t the Fed do much more? Maybe because they think we are in a good place, with adequate AD given the fact that people are reluctant to shop. But then why do Fed officials keep asking for fiscal stimulus? Why not do more monetary stimulus?

The Fed never really answered that question during the early 2010s, and they are again refusing to answer the question. The first time around it was exasperating. Today it’s even more exasperating. Will the press ever demand that the Fed ANSWER THE QUESTION?

PS. And why has the Fed been reducing the base in recent months?

Tags:

25. August 2020 at 18:26

Your language of the base is different than the language everyone else uses: the balance sheet. People still assume that a large balance sheet means loose money. They don’t distinguish how a large balance sheet may be necessary for appropriate funding of the financial system (George Selgin and Zoltan P from Credit Susie talk a lot about this) but is not necessarily a sign that policy is loose. In short the vast majority of people have not read Friedman’s address, listened to you or Bill Barnett or the many others that comment on this. Your message is out there but it needs to be amplified and the economics profession only seems to listen to certain people. You need to channel Milton.

Perhaps you could do a big post on some of the above with some charts. There are lots of charts floating around at brokers showing large increases in some monetary aggregates. I don’t pay attention to them to get into it, but there’s a view among many that inflation is about to take off.

25. August 2020 at 18:31

Excellent blogging. I have pondering similar weighty thoughts.

And not only the Fed.

The Peoples’s Bank of China also states it is pursuing a “normal” monetary policy, and not anything dramatic. The PBOC has lowered interest rates a little bit, and says it does not engage in QE.

From Reuters:

“Sun Guofeng, head of the monetary policy department at the People’s Bank of China, told a press conference the central bank would not change its monetary policy direction or its flexible approach to policy.

Liquidity would also stay reasonably ample, which would allow China’s economy to return to its potential growth, he said.

“To cope with all sorts of uncertainties, the monetary policy requires greater certainty,” said Sun, adding that China has not adopted zero or negative interest rates and other non-traditional policies such as quantitative easing. That means the PBOC does not need to deal with the complications associated with exiting such measures.”

https://www.reuters.com/article/us-china-economy-pboc/china-determined-to-keep-normal-monetary-policy-cenbank-official-idUSKBN25L0CU

—30—

To state the obvious, the US and China are the globe’s two biggest economies. The central banks have eased credit conditions, and national government have gone to fiscal stimulus in both countries.

I am not sure what to look for in China, but FRED charts of Sino money supply seem to show nothing unusual, that is no large supply increase.

In fact the M3 money supply growth rate in China is long-term shrinking.

https://fred.stlouisfed.org/series/CHNMABMM301GYSAM

The China economy is doing rather well, at least relatively.

What does any of this mean? I don’t know.

25. August 2020 at 19:10

Milljas, You said:

“I don’t pay attention to them to get into it, but there’s a view among many that inflation is about to take off.”

OK, maybe. But are these people all shorting T-bonds and buying TIPS?

25. August 2020 at 23:18

As milljas says, nobody thinks like Sumner does. I would say that Sumner refusing to let the Fed take credit for stemming the fall in the US bond and stock markets in March was the biggest surprise for me, a sometime reader of this blog for well over five years. It’s shocking. But it also shows that monetarism is bankrupt. If Sumner cannot agree with Selgin, and cannot agree that the Fed is responsible for stemming the fall in the US economy, it must mean monetarism is metaphysics. Unobservable “natural rates” and unknown “transmission mechanisms”. Not that fiscal policy is much better, with unknown, unquantifiable “multipliers”. That leaves only one candidate as the plausible variable for economic change: Shiller’s animal spirits. What the Fed does is simply bail out some parties at a cost to taxpayers, but it does not fundamentally change the economy. Money is short term neutral (though long term, for unit of account purposes, it seems to expand when an economy expands, archeologists have found with mining of gold).

25. August 2020 at 23:58

“Deep down they don’t think the monetary base matters, . . . ”

I wonder why?

“However the M0 to unemployment correlation has the wrong sign, and is even stronger than the wrong correlation for the 1930s at +0.51 (see Figure 4). The biggest boost to Base Money in recorded history did little to avert the collapse into the Great Recession, and repeated boosts are doing very little to end it.”

https://www.debtdeflation.com/blogs/2011/12/10/debunking-macroeconomics/

26. August 2020 at 01:30

“Money is short term neutral . . . ”

“China initially had a soviet-style

40:48 economy but in 1978 a new leader came to

40:53 power in China Deng Xiaoping and he

40:56 analyzed the situation and he concluded

40:58 that the Soviet system is doomed to

41:01 failure and that’s of course dangerous

41:04 he concluded for you know for the

41:08 country and it’s better to abandon this

41:10 system and instead he looked at other

41:14 countries that had a more successful

41:16 monetary system such as Japan and

41:19 Germany and the US and he concluded well

41:23 we need to decentralize banking and so

41:26 when he came to power 1978 what what was

41:28 the key one of the key things he

41:30 introduced was he found it thousands of

41:34 banks thousands of new banks local banks

41:36 small banks regional banks specialized

41:40 banks all across China and the rest is

41:43 history that’s how you get high economic

41:44 growth “

https://www.youtube.com/watch?time_continue=1&v=OdYmdKUiQNw&feature=emb_logo

26. August 2020 at 03:12

“It doesn’t much matter how you measure monetary stimulus, the Fed hasn’t done much of it during 2020:. . . ”

But?

“Professor Richard A. Werner

@ProfessorWerner

·

Aug 21

As I warned, significantly high inflation is coming. It’s a policy.”

https://twitter.com/ProfessorWerner/status/1296834083050393606?s=20

26. August 2020 at 03:48

But couldn’t you also view bailing out the bond market and facilitating the provision of credit as monetary policy? The bond market needed bailing out and the provision of credit needed to be facilitated because of an increased demand for money…

So although it’s not expansionary monetary policy, not doing so would equate with a tightening of monetary policy.

Could you also argue that increased unemployment benefits, which ensure that people still have money to pay their bills and debts, also is a form of monetary policy (in a way) because it prevents a rise in money demand?

26. August 2020 at 04:24

From Bloomberg this morning:

Fed Seen Holding Rates at Zero for Five-Years Plus in New Policy

• Fed expected to tolerate faster inflation, lower unemployment

• Powell to speak Thursday on long-awaited Fed framework review

[…]

But staying the Fed’s hand will be a change in how it reacts to developments in the economy as a result of the framework review.

When it raised interest rates in December 2015, core inflation was clocked at 1.5% — it’s since been revised lower — while unemployment stood at 5%.

Economists said it’s hard to see the Fed increasing rates under similar conditions now.

The Fed first pronounced a 2% target for inflation in 2012, and officials took that to mean they would always shoot for 2%, no matter how much or for how long they missed. Bygones, they said, would be bygones. The trouble was that inflation has consistently run below their objective since then.

Under the new regime, the Fed is expected to seek an inflation rate that roughly averages 2% over time. So a modest rise in inflation above target would be welcomed, not feared, after an extended period where it undershot.

The Fed is also expected to codify a change in its approach toward achieving full employment. In the past, officials shied away from pushing joblessness below what was considered its long-run natural rate out of concern that would lead to too rapid inflation.

Now, the emphasis is on the benefits of a strong labor market for the economy and society. “They’re not going to act to cool off the labor market unless it’s generating unwanted inflation,” said Nomura Chief U.S. Economist Lewis Alexander. “That’s essentially walking away from the concept that there is a natural rate that it is irresponsible to push beyond.”

26. August 2020 at 04:35

“But are these people all shorting T-bonds and buying TIPS?”

They don’t even need to do that. Institutional investors can go long zero-coupon inflation swaps. So any of them can go long the swap and agree to pay less than 2% annualized and receive inflation for any tenor.

26. August 2020 at 06:06

Maybe they think they’re pushing on a string because velocity just keeps plummeting:

https://fred.stlouisfed.org/series/M2V

26. August 2020 at 06:42

The 5-year TIPS breakeven series is useful for comparing the two recessions:

https://fred.stlouisfed.org/graph/?g=uM9Y

Much steeper relative collapse, and then a 12 month recovery to what would become the new median value for the series, no return to the precollapse range.This time we have a less horrible plunge, and then within 3.5 months we’re back to the lower end of the pre-recession range. Still recovering 6 months after the shock.

If you look at copper prices you see a similar thing (though that’s more of a global indicator). Markets seem to expect something like “normal” NGDP growth after we work through this Wuhan virus situation.

26. August 2020 at 07:05

“Doing monetary stimulus” and “achieving expansionary monetary policy” are not exactly one and the same.

It seems (chart in OP) the Fed has in fact been doing a LOT of monetary stimulus in 2020 (PS: indeed, what’s up with the recent reduction?!), but not necessarily to the achievement of an expansionary stance (though certainly relatively expansionary compared to what policy would be if they had not done the insufficient level of stimulus they have done).

https://fred.stlouisfed.org/graph/fredgraph.png?g=uMdo

26. August 2020 at 07:13

This Bloomberg article seems to capture the mainstream consensus view:

https://www.bloombergquint.com/gadfly/fed-s-powell-to-frame-monetary-policy-rethink-at-jackson-hole

“Another idea is to change forward guidance to tell investors that overshoots of future inflation will be tolerated or even deliberately engineered. This might take various forms — such as a commitment to maintain 2% inflation on average over a span of years, so that undershoots would require overshoots. Or the Fed could switch to a target for the level of future prices rather than the rate of inflation. This would have a similar effect, again requiring periods of higher-than-target catch-up inflation. The implicit promise in both cases is that interest rates would stay low for longer than the current approach dictates.”

26. August 2020 at 07:14

Actually this is probably the better part to quote:

“One way to overcome this difficulty, long recommended by many economists, would be for the Fed to express its goals in terms of nominal gross domestic product — that is, in terms of growth in demand. In effect, this would collapse the Fed’s dual mandate to one guiding metric combining changes in both prices and output. If demand grows more slowly than its target (of say 5% a year) the Fed would provide stimulus, regardless of whether the shortfall was due to lower output or lower inflation. This would make the promise of keeping interest rates low for longer more credible. Tolerating higher inflation, occasionally and within limits, would be baked into the formula.

The Fed might see an outright switch to targeting NGDP as too radical, but could take a useful step in this direction by making the measure more prominent in its analysis and public presentation. Other smaller changes would help as well. For instance, the Fed could refrain from issuing information that begs to be misunderstood — starting with its so-called dot plot of projected interest rates, which reliably causes more confusion than clarity.”

26. August 2020 at 07:52

The press will likely never ask the Fed that because the average reporter, even financial reporters, don’t understand monetary policy. Like most people, they fall into simple heuristics when it comes to this kind of thing.

I remember a wealthy and successful businessman screaming at me in 2012 that I was an idiot for not being concerned about inflation. According to him, Obama’s un-Godly (a term used literally, not rhetorically) spending habits and money printing was going to make the 1979-1981 inflation look like child’s play, and we should all buy gold and farm land. I bet him $1,000,000 that inflation would not average more than 5% 2012-2017, with the proviso that I would pay him in gold weight based on its 2014 price. Hee looked like he wanted to choke me on the spot. Really wish he had taken that bet. If he was so right, I had given him great odds! Coward.

People with opinions like his, and the gold bugs today, seem to trust headlines more than statistics. People saw all the attention-grabbing articles about how the Fed was going to lend money to all and sundry and never really checked how much they lent or how they financed it or any of the details. I like those programmes, it reminds me of the magic power we used to attribute to the Governor of the Bank of England, whose eyebrows were said to be the most powerful tool in the City of London.

That said, the lack of actual monetary policy is both concerning and frustrating. The base is down almost 10% since May! Why?

26. August 2020 at 07:58

tpeach, Those variable do affect velocity. But M*V has been very weak this year, so even including those sorts of “indirect” policy moves doesn’t really change the picture.

This post is aimed at the widespread misapprehension that the traditional policy tools (base money and interest rates) have been highly expansionary. That’s not really true.

Garrett, Thanks for that info on CPI swaps.

Carl, So push harder! Seriously, they should change the target to a level target and they buy up whatever it takes to hit the target. It’s not complicated.

Justin, Yes, I suspect the economy will be surprisingly strong after the vaccine is rolled out.

Daniel, I’d put it this way. Almost everyone now agrees that QE1 was too weak. But relative to the size of the economy, this is even less than QE1.

26. August 2020 at 08:07

I know you have said the Fed has been falling short and has been relatively tight. That is their seeming permanent bias. Also, you did mention once that the “lifers” in the Fed have a lot of power—and I implied from that they will push back on change. However, I do recall that you did think the Fed at least was doing better back in the Spring —-meaning less tight than ususal—-so my impression had been that while “not good enough” you thought they were “better than they had been”.

For what its worth, I have always thought—not that I recall you saying it—that MM takes velocity into account as part of determining the supply and demand for money. Having said that FRED has velocity of M1 down 70% –straight down—-since 2008—-so if anything I assume that makes money more tight.

But Base is up 4 fold since 2008—and velocity is down as an offset(?)—could be observers have not noticed velocity.

Yet, other issues I often associate with tight money—–markets down—-are clearly not happening. I am in over my skis on this—but just making comments.

I do think this economy —-even as it is down seriously—-cannot be compared with normal recessions. I analogize it to a bimodal distribution. Restaurants, Tourism, and other businesses which require high human contact are doing terrible. But other businesses are doing better than normal. 2008, like most recessions, everyone does worse.This is not the case today.

The fed is always prone to being tight–I think that is a given. But perhaps they believe Covid will gradually slip slide away—and is already doing so—-and maybe they are forcasting current policy will naturally beome less tight.

As usual–just thinking out loud.

26. August 2020 at 08:32

Once again, reparations are a no brainer during this reboot. Give descendants of slaves up to $50k along with a pre-approved $150k mortgage and then get non hip cities to compete for them with incentives like no property taxes for a year just like they compete for Amazon or Tesla. Win win win all the way around because those dollars are simply demand which end up in the pockets of productive Americans and homeowners in non hip cities get a little home value increase and American companies can cut salaries as people work from home in lower cost of living cities and travel industry benefits as people have more time and money to travel.

26. August 2020 at 08:34

Tacticus, You said:

I remember a wealthy and successful businessman screaming at me in 2012 that I was an idiot for not being concerned about inflation. According to him, Obama’s un-Godly (a term used literally, not rhetorically) spending habits . . .

LOL, I bet this guy loves Trump despite the 3.7 trillion deficit.

Michael, You said:

“I do think this economy —-even as it is down seriously—-cannot be compared with normal recessions.”

I agree. We’ll know for sure after the vaccine is out.

26. August 2020 at 13:06

@Gene F:

I’m Jewish. I’m a descendant of slaves in Egypt. Can I get some money?

I have a friend who’s Haitian. He’s a descendant of slaves in Haiti. Can he?

26. August 2020 at 13:26

The federal government and state governments had slave laws and then after slavery we had 100 years of de jure segregation and laws that perpetuated white supremacy. And the white baby boomers had red carpet rolled out for them with things like super cheap college, and then super cheap homes, and good jobs with pensions, and draft deferments…while Blacks fought for civil rights and won and so they got to fight in Vietnam! Btw, Germany has given Israel billions to make up for what it did during the Nazi years.

But here is the thing—the reparations for slavery are merely pretext to get dollars to people that will definitely spend those dollars—the true beneficiaries are actually the productive members of society that will end up with those dollars in their pockets!! Reparations = demand…and Americans that sell goods and services will benefit from more demand. So the key is finding a reason to give people money and focusing on people that will definitely spend that money and then getting those people the money without others throwing a tantrum because of “fairness”. We could easily have 4% GDP growth if we give descendants of American slaves reparations…it’s a no brainer right now.

26. August 2020 at 14:13

re: “no one paid attention when growth in the monetary base came to a screeching halt during August 2007 to May 2008”

Like I said, the monetary base has never been a base for the expansion of new money and credit. In our Federal Reserve System, 92 percent of “MO” (domestic adjusted monetary base) was represented by the currency component prior to Oct. 6, 2008. And the currency component of MO is so prominent, and the proportion of legal reserves so negligible (and declining); that to measure the rate-of-change in currency held by the non-bank public, to the rate-of-change in M1 is, yes, to measure currency vs. currency (cum hoc ergo propter hoc); in probability theory and statistics, not a cause and effect relationship

26. August 2020 at 14:14

In our Federal Reserve System, 92 percent of “MO” (domestic adjusted monetary base) was represented by the currency component prior to Oct. 6, 2008. And the currency component of MO is so prominent, and the proportion of legal reserves so negligible (and declining); that to measure the rate-of-change in currency held by the non-bank public, to the rate-of-change in M1 is, yes, to measure currency vs. currency (cum hoc ergo propter hoc); in probability theory and statistics, not a cause and effect relationship

26. August 2020 at 23:24

@msgkings – “I’m Jewish. I’m a descendant of slaves in Egypt. ” – what? I thought you were Black. And anyway from memory, historically, the Joseph et al storyline about Jewish slaves in Egypt is a myth not really recorded in evidence outside the Old Testament (remember history is only what’s recorded, and the Greeks did well by writing stuff on permanent stone).

As for reparations, the Greeks are constantly asking the Germans for some money, for WWII, and got some money in the 1960s but not claim it was not enough or invalid. I think Blacks would likely do the same in the USA, it’s a never ending political battle.

PS–I’m Jewish too on my mother’s side, but they changed religion to GR Orthodox. Why can’t we just get along, msgkings? lol

26. August 2020 at 23:54

Ray, in 2004 I bought MSFT instead of APPL and it cost me $500k…$50k to most descendants of American slaves is a lot of money but to me it would be like finding a $20 bill on the ground. The key is getting $$$ to people living paycheck to paycheck because all of those dollars end up in the pockets of productive Americans.

27. August 2020 at 07:27

@Gene Frenkle – Good one, but I got an AAPL story to raise you. In 1997 I think it was (when Apple was at all time lows, de-friended by everybody, even Adobe dropped them as I recall) I almost bought a bunch of AAPL. I once calculated years ago something like 400:1 gains. Of course I would probably have sold a bunch before then. My sister’s old boyfriend put $20k into APPL around the same time and retired a multimillionaire to Florida. But the good news is that I managed to convince my 1% family to invest in MSFT around 2007 and they’ve done well, helping make up for their unwise C, BAC and GE purchases. And I agree with you that 50K USD these days for most upper class people is nothing, due to inflation for the stuff they like, like college education, SUVs, etc etc etc, though for me I live simply in PH and GR, and in the US I stay with my folks, yes folks, I live literally in my mother’s basement when I’m in the states.

28. August 2020 at 10:35

I thought that aggregate demand wasn’t the problem. And if not, should the Fed be doing more than keeping the financial system from imploding? Right now the virus is a severe constraint to how much anyone can do to stimulate the economy. The Fed is making some noises that indicate that once the virus is no longer an issue, they want to engage in pro-cyclical policy. They could start buying assets that would seem to manipulate market forecasts of inflation to show their seriousness, but even that would not change much about current economic conditions.

Also, won’t the economy fall off a cliff if Congress ends the extra unemployment benefits? I don’t see how the Fed could prevent an ever steeper fall in NGDP if Congress does that. So far as I know, the Fed doesn’t have the authority to do helicopter drops for ordinary households, and I really don’t see any other way to shore up the economy right now. It isn’t like banks are going to lend money to people without jobs, and I would assume it is near impossible to get a business loan right now. So it makes sense that the Fed would call for fiscal stimulus. Households with no incomes and very few assets spend very little money and create a lot of bad debt. Switching to NGDPLT right now is unlikely to change much about the trajectory of the economy until after the virus is gone.