Other things equal, lower prices cause consumers to buy less of a good

I still see confusion about the never reason from a price change concept. So let’s try again, looking to see whether “other things equal” helps.

Most people accept that fact that lower prices caused by less demand means something different from lower prices caused by more supply. But what about lower prices, “other things equal?”

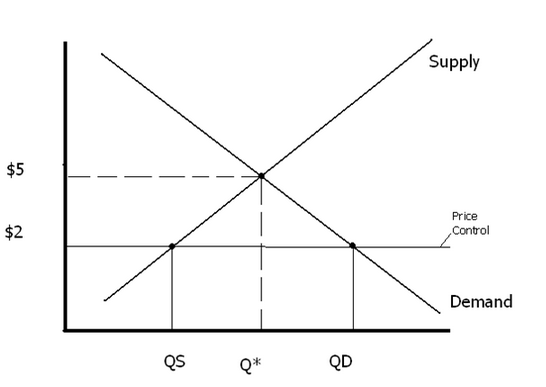

As you can see the quantity demanded exceeds the quantity supplied. In that case the actual quantity bought and sold and consumed equals the quantity supplied, unless demanders put a gun to the head of suppliers. So “other things equal” lower prices will reduce the amount that consumers purchase. If either supply or demand shifts, then other things are not equal. My “never reason from a price change” refers to equilibrium movements, you certainly can reason from a price or wage control set by the government, which moves prices away from equilibrium. But as this case shows, not necessarily in the direction that you might assume.

As you can see the quantity demanded exceeds the quantity supplied. In that case the actual quantity bought and sold and consumed equals the quantity supplied, unless demanders put a gun to the head of suppliers. So “other things equal” lower prices will reduce the amount that consumers purchase. If either supply or demand shifts, then other things are not equal. My “never reason from a price change” refers to equilibrium movements, you certainly can reason from a price or wage control set by the government, which moves prices away from equilibrium. But as this case shows, not necessarily in the direction that you might assume.

When I said price changes have no effect, I should have said “other than to subjective states of mind.” A price change, in and of itself, will change the amounts that people prefer to buy and sell. But a price change doesn’t affect any observable economic variable, unless it is an artificial price change that moves you away from equilibrium.

Ditto for interest rate changes and investment. Many people stubbornly refuse to stop thinking in terms of “interest rate change equals interest rate change caused by the Fed,” and even worse, “interest rate change equals interest rate change caused by the liquidity effect of a Fed action.” The latter claim isn’t even close to be true. It’s not even true 20% of the time. But it seems to be what many of my commenters and most economists assume is the case. Here’s a typical comment from my previous post:

If interest rate rises stifle investment . . .

Stop right there; interest rate rises do not stifle investment.

I’m not sure why so many economists are confused on this point. Perhaps they think: “The liquidity effect impacts rates in the short run. The term ‘short run’ means roughly what’s going on right now. And a long time series is just a long series of ‘right nows.'” If that’s not what they are thinking, I’d love to hear alternative theories.

PS. The term “short run” does not in any way mean “what’s going on right now.”

Tags:

12. November 2014 at 06:08

The reason most economists believe interest rate rises stifle investments is probably that they do not think beyond: higher rates make investments more expensive. They don’t consider what else might be going on.

It is not unusual for economists to fail to consider why something might happen and what other effects there might be from the underlying cause, how the effects might feed back, etc.

12. November 2014 at 06:09

So at higher interest rates the supply of capital would be increased, leading to more investment and more economic activity, and thus higher inflation!

Oddly enough, some have posited that higher interest rates in fact create capital inflows on a national level.

12. November 2014 at 06:43

While a zero bound is not an “other things equal” scenario, wouldn’t part of the Keynesian argument rest on “buying” government fiscal activity while the price of credit – i.e. the interest rate – is low?

12. November 2014 at 07:16

Foosion, Students are not supposed to be allowed to pass EC101 without understanding this point.

Becky, First you have to ask why rates are low. Maybe there are few investment opportunities.

12. November 2014 at 07:36

Good example Scott.

Interest rates are prices, but they’re way more complicated. People who talk about ‘interest rates going up or down’ seem to inhabit a world with a fixed yield curve shape that only moves up or down in a parallel fashion.

In reality, changes in the shape of the yield curve happen all the time, and there is information here too.

So, on top of everything else, equating ‘the interest rate’ to a straightforward ‘price’ (of, say, credit) is a gross, and in my opinion, unhelpful, simplification.

Also, never reason from a price change.

12. November 2014 at 08:05

Prof. Sumner,

Have you written any posts this year making the case that “Yes, the demand side matters less than it did in 2010. However, it’s still very very important as illustrated by X, Y and Z.” Have you written anything better than this (October 2013)? http://www.themoneyillusion.com/?p=24378

Kevin Erdmann and I are discussing stock valuation in this comments section: http://idiosyncraticwhisk.blogspot.com/2014/11/october-employment.html and I think gauging the importance of demand relative to supply (over the next three or four years) would be useful.

12. November 2014 at 09:38

The points you make in the last two posts are exactly why I have never really bought into the whole “the fed is causing more malinvestment” argument.

12. November 2014 at 10:15

Benjamin Cole,

“Oddly enough, some have posited that higher interest rates in fact create capital inflows on a national level.”

I never thought that this was considered controversial. If you have a trade deficit, you probably have a higher interest rate than you otherwise would have such that the current account / capital accounts will be in balance.

Or, if your currency is depreciating, the central bank will raise the interest rate. This brings in investment dollars and stems the depreciation.

12. November 2014 at 11:37

Travis, I’m afraid that you have a much better understanding of what I have written than I do. But I will say that each month a smaller and smaller share of our problems are demand-side and an increasingly large share are supply-side.

I can’t give an exact figure, because I don’t know what sort of long run target the Fed has. The big poblem now is not the current stance of policy, but rather the fact there we lack a coherent REGIME, and hence may keep repeating the same errors, the same cycles.

12. November 2014 at 12:23

Prof. Sumner,

Thanks. Two quick points:

(1) Yes, the demand side matters less than it did in 2010. But it’s still really really really important. Look what happened to the S&P 500 beginning in late September as 5-year inflation breakevens fell rapidly from 2.00% to 1.37%. And then look what’s happened the past 3.5. This is not a coincidence. The demand side is still really really really important.

(2) If inflation / inflation expectations fall to consistent rates of 0.0% to 0.5% per year that cannot be good for stocks. That would be a huge decrease from where NGDP expectations currently are. Hopefully you at least agree with me about that.

12. November 2014 at 14:07

I use a version of this in interviews:

If interest rates are rising, what happens to asset prices?

Can you think of a reason why interest rates might rise along with asset prices?

I’m just looking for some recognition that opportunity costs or risk preferences play a role. I have yet to have someone answer anywhere near correctly without walking them through it.

People here interest rates and they forget everything they know about the rest of economics.

12. November 2014 at 14:56

cthorm,

What is the duration of a high-yield bond?

12. November 2014 at 15:04

“Can you think of a reason why interest rates might rise along with asset prices?”

Because it’s 2013.

12. November 2014 at 15:23

It is a good sign that more counterfactual reasoning is taking place.

There is a problem with your analysis. You didn’t hold supply sold equal. Ceteris paribus does not mean you can make supply fall. Ceteris paribus means all else is fixed, including supply.

You may wonder what good of a use is ceteris paribus if all it allows us to do is imagine one variable changing while all other variables really do remain fixed. If we think of a variable X, and then imagine every other variable remaining fixed, it would seem to lead us to nowhere.

In the present case, we have lower prices. Ceteris paribus would mean all else is really equal, such as supply. So what now?

Well, the key to ceteris paribus reasoning is that when we think of a particular variable, say a price of a good, the structure of reality and of our knowledge enables us to expand our understanding of “price”. When we say “price”, we are not just thinking of a number of dollars. A price is actually a complex concept whereby there is a range of “sub-variables”.

Supply is not one of them. A price on its own does not convey sufficient information regarding supply. So the ceteris paribus condition means we must hold supply fixed.

Ceteris paribus reasoning is really a method of learning what a particular concept is to us.

So what really happens when a price falls, ceteris paribus? We know supply does not fall. But what does change? Again go back to what a price is. A price is the dollar exchange ratio of a good. So we know that prices carry with it spending. In the case of one good, the price paid is equal to the spending. For multiple goods sold, the spending is equal to the sum of prices paid. So we know spending is included in the concept of price and does not need to be kept constant, in fact cannot be held constant.

So if we imagine a fall in prices and no change in anything else, including supply, then what happened is that spending is lower.

Then the question might arise, OK, what happens when spending falls ceteris paribus? Answer is: Prices are lower!

Is there anything else we can find? Yes. Go back again to what a price is. A price is the dollar exchange ratio of a good. If we then ask “What happens when prices in the plural fall, ceteris paribus?”, again we must hold supply sold constant, and then ask what else is a price. A price that is an expenditure is also a revenue and money cost.

So when prices fall, then ceteris paribus revenues and money costs fall.

Then we ask what happens when revenues and money costs fall. Well, we first have to determine what revenues and money costs are. We know they are subsumed by prices, but is there anything else? A good point to make here is that some things cannot be held constant even in theory. TIME is one of them. Revenues and money costs (as well as prices) are concepts that have the sub-variable time.

Etc.

Keep going like this. This is how you do ceteris paribus reasoning.

We can make mistakes along the way, but that is how you do it.

12. November 2014 at 15:27

@Brian

Exactly. That is the worst part, it’s happening RIGHT NOW and you still think interest rate increases are ONLY EVER a sign of Fed tightening. The cognitive dissonance is alarming.

12. November 2014 at 15:29

The example is rational.

A rather empirical example is Greece.

The price of gasoline is around $ 8,65 per gallon, with 62% of $ 8.65 to be taxes (excise duties), excluding other costs of distribution, refining, marketing. Direct taxes in oil products increased significantly in 2012 and 2013. The demand for heating oil and gasoline fell around 70% and 10% respectively for that period but also the quantities.

(…)”A price change, in and of itself, will change the amounts that people prefer to buy and sell. “But a price change doesn’t affect any observable economic variable, unless it is an –artificial price change— that moves you away from equilibrium.” (…)

Revenues from oil products fell around 0,500 bil € in 2013 compared to 2012 .

0,500 bil € represent a 0,275% of NGDP.

Is the price affected and influence NGDP negatively, which is an economic variable?

An artificial price change has a logic.

What Steven Kopits wrote make sense, not exclusively as far as the price elasticity of demand but how probably carrying capacity is related with disruptive or artificially high price changes.

(High increases in oil taxes in an economy under severe recession in terms of NGDP, is possible to indicate a predictive trend over inflation in short term but also in a long term period ?)

12. November 2014 at 15:45

Scott to economists: you have models, use them.

Scott to non-economists: without some model, you are not going to get far, analytically speaking–economists have some useful models, going real cheap.

12. November 2014 at 18:48

I don’t know if there is anything new here, but I was thinking about monetary offset in relation to asset prices. Austrians point to the 2000s as if loose monetary policy led to an odd run up in houses but not measured inflation or NGDP. But, just as there is monetary offset for fiscal policy in an IT regime, wouldn’t there be monetary offset for nominal appreciation of real estate, to the extent that it leads to credit creation?

Lots of graphs, as usual. I hope I’m not just rehashing stuff you all already know.

http://idiosyncraticwhisk.blogspot.com/2014/11/monetary-offset-applies-to-asset-values.html

13. November 2014 at 01:22

A new criticism of MM, from the IEA: http://www.iea.org.uk/sites/default/files/publications/files/Briefing_Money%20and%20Micro_web.pdf

which I found on this new GMU monetary econblog: http://moneymarketsandmisperceptions.blogspot.com.au/2014/11/is-commodity-reserve-standard-with.html

13. November 2014 at 02:48

By “If interest rate rises stifle investment . . .”

I was meaning that If a high cost of borrowing in relation to the expected returns on investing in new production reduces spending on production ….

– Price changes

Its not a given that lower prices reduce supply, suppliers may increase supply at the lower price level to cover fixed costs.

Also in the Mass Production market enviroment lower demand increases prices as the unit cost then goes up.

13. November 2014 at 03:31

Saturos: For the first paper I would hardly say it is “new” criticism. If anything it is not coherent. Take these sentences for example:

“Let us assume that, because of excessive taxation and regulation, there is a real rate of growth of -2 per cent in a country. If, because of monetary growth of 3 per cent, there is a 5 per cent inflation rate, the growth rate of nominal GDP will be 3 per cent. If the target for nominal GDP is equal to 5 per cent, monetary authorities will increase the rate of growth of the quantity of money in order to reach the target. This will lead to inflation of 7 per cent. Once again, we cannot solve a problem without knowing its

causes. If the low rate of real growth is due to non-monetary factors, one cannot change it just by manipulating monetary instruments.”

The author criticized MM where it is at its strongest – response to supply shock. Imagine his example with inflation targeting. RGDP minus 2 per cent and inflation 2 percent. Zero nominal growth. Given what we know about downward wage rigidity an inflation targeting CB would add a demand shock to an already existing supply shock. NDGP level targeting will prevent that. Of course it will not prevent or offset supply shock – but that is not aim of monetary policy which brings me to next paragraph.

“It is impossible to reach two targets of economic policy with only one instrument (monetary policy) and the NGDP measure combines together two variables [RGDP and inflation] which tend to be affected by different types of policy (monetary policy and policies that affect the real economy).”

So in previous paragraph author criticizes that in case of supply shock NGDP level targeting does not stabilize RGDP because in case of supply shock it leads to increase in inflation. And now he criticizes that it focuses on “two variables” – because author few paragraphs earlier stated that NGDP is RGDP plus inflation.

Only one of these things can be valid. Either policy preferred by MMs cares or does not care about RGDP. He cannot have it both ways. And the correct answer is that they do not care about RGDP. They care about NGDP which is a completely different concept. That is why in the first scenario we saw high inflation (and no, MMs preffered policy does not care about inflation either)

The analysis and critique of MM and NGDP targeting as presented in that paper is incoherent.

13. November 2014 at 04:36

J.V. Dubois:

“Imagine his example with inflation targeting. RGDP minus 2 per cent and inflation 2 percent. Zero nominal growth. Given what we know about downward wage rigidity an inflation targeting CB would add a demand shock to an already existing supply shock. NDGP level targeting will prevent that. Of course it will not prevent or offset supply shock – but that is not aim of monetary policy which brings me to next paragraph.”

What is the solution you think the central bank should take if the -2% rate of RGDP is caused by NGDPLT? That what an economy needs in NGDPLT is periodic cleansing that only a decline in NGDP can accomplish because of the unique, and needed, redirection of relative spending that takes place? Remember, increases and decreases in NGDP do not entail equal increase and decrease rates of spending on every good and service. Central banks affect relative spending, and out of that complex of relative changes, there is an aggregate change.

It is false to assume that NGDPLT will have no effect on relative spending or relative production. Remember also that it is coordinated relative productions that makes real goods production in a division of labor possible. You cannot look at monetary policy as only related to RGDP in terms of aggregate increase and aggregate decrease. MM theory needs to be updated to include what makes production possible. It’s a small ask.

13. November 2014 at 05:58

Travis, I would say demand is still really important in the US in the sense that a demand mistake could still be really costly. But I do expect us to reach a fairly normal labor market next year, with 5% unemployment. I also expect the broader U-6 unemployment to continue falling fast.

Some of the lower inflation is a positive supply shock (commodity prices.) But not all. Some reflects money too tight to hit 2% inflation in the long run.

cthorm, Good point. Stocks sometimes rise with falling rates (if due to easy money), and sometimes rise with rising rates (boom).

Lorenzo, That’s right. Another way to put it is that many non-economists don’t understand that data never speaks for itself. Data only speaks through a model.

Dinero. You said:

“Its not a given that lower prices reduce supply”

Standard EC101 theory says lower prices have zero effect on supply.

13. November 2014 at 06:26

Doug M. — Well…it is complicated.

13. November 2014 at 06:29

Saturos,

1) James Caton challenges Pascal Salin.

2) Caton believes a nominal target to be desirable, but currently struggles with problems in U.S. GDP measurement.

13. November 2014 at 06:48

Prof. Sumner,

Thanks. We know that a lot of the lower inflation was due to lower demand because non-energy stocks crashed in late September / early October. If that had been due to a positive supply shock, non-energy stocks would have gone up, not down.

13. November 2014 at 06:53

Professor Sumner,

When you say demand is less and less important in the US but money is still ‘too tight’ to hit 2% inflation I think you mean that the percieved (and actual) reaction function of the fed is what is keeping inflation expectations low, not the literal amount of OMOs they are doing today. I think this fits with what you are saying about unemployment hitting the target soon but ‘demand mistakes could be costly’. Is this correct?

13. November 2014 at 07:03

Travis, Perhaps, but stocks have fully recovered and oil has not recovered at all–so something else is also involved.

Nick, Yes, I’m definitely not talking about OMOs.

13. November 2014 at 07:13

I guess I’m being a person of the concrete steps, but I worry that if that the problem in current fed policy is a belief that the fed will fail to hit their stated inflation target based on recent experience how is changing what target they will be expected to miss going to do anything?

Sure LT will publicly compound each failure to hit in terms of where they need to set the next target (that they will miss) … But is that a feature?

Aren’t you going to have to ‘break the back’ of expectations by intentionally overshooting your target at some point? Doesn’t that really mean more OMOs than anyone expects, even if its just for six months or something’s?

13. November 2014 at 08:18

Fear of high interest rates is a holdover from Keynes who believed that the interest rate did not successfully coordinate investment and savings. Keynes argued with Hawtrey at the MacMillan Committee. Hawtrey argued that monetary expansion would raise prices, including nominal rates, and thereby offset the deflationary spiral that had ailed the global economy. Keynes wasn’t so sure.

Sound familiar Scott???

13. November 2014 at 09:12

Wall Street thinks the Fed should tighten because U.S. workers are quitting their jobs like crazy:

http://www.businessinsider.com/markets-chart-of-the-day-november-13-2014-11

13. November 2014 at 11:03

Just a follow up…My link above points to a similar timing issue as the S&L crisis. For instance, the recent write up in Rolling Stone refers to securities fraud that started happening after the yield curve was already inverted. We have tended to look at fall 2008 as the point where the monetary hammer came down. But, short term rates were already pegged above 5% in early 2006, with an inverted yield curve. MBSs with optimistic ratings had been happening before then, but it’s worth keeping in mind that home prices leveled off and crashed and the banks panicked about the MBS collateral on their books after the short term rates were hiked.

Even at those early stages, monetary policy preceded housing bust events.

14. November 2014 at 05:41

Nick, The macroeconomic effects of continually missing their NGDPLT target by 1% each year are very small compared to missing their inflation target by 1% each year, especially after the first year. The growth rate of NGDP will still be equal to the long run target path, just 1% below in level. On the other hand the price level path will diverge more and more each year.

Jim, Yes, Hawtrey generally had better judgment than Keynes.

Kevin, It’s hard for me to see how monetary policy could have played a major role in the housing bust, given that the level of NGDP was satisfactory in 2006 and 2007, indeed it may have been too high in 2006. That’s not to say it played no role, but any role it played should have been minor.

14. November 2014 at 06:36

I would make you mad

http://www.docdroid.net/l6db/aa.pdf.html

lol

14. November 2014 at 07:32

Scott,

The YOY change in NGDP was 6.5% in 2006Q1, 4.3% in 2007Q1, 3.1% in 2008Q1, and -1.9% in 2009Q1.

Isn’t the change in forward NGDP growth the better indicator of monetary policy? Doesn’t the precipitous drop in GDP growth from the beginning of 2006 through the beginning of 2009 suggest that the monetary pullback started by 2006?

Do you assign any significance to an inverted yield curve?

14. November 2014 at 07:34

Professor sumner,

Thanks, I see what you are saying.

I guess if the reason they are missing their current stated target by X% causes them to also miss the new stated target by exactly X% then it will really do a lot of good. And I have no doubt simply adopting a much more aggressive target would do some good just bc it would mean to participants that someone on the FOMCs mind had likely changed at least a little (or been replaced).

Maybe it’s better to bring up a more intermediate case? If the FOMC announced 2% inflation LT but changed nothing else about their projections or guidance, how much good would it do? I imagine it would just make them look silly. It should be a credible promise that whenever the inflation comes they will tolerate it in equal measure to how long it takes to build. But why would anyone believe them? Promising to make up the inflation ‘someday’ is ridiculous … It won’t even be the same FOMC.

15. November 2014 at 06:18

Kevin, I’d focus on breaking that period up as follows:

2004:4 to 2005:4 6.5%

2005:4 to 2006:4 5.1%

2006:4 to 2007:4 4.4%

You could argue the NGDP growth is slowing, but under level targeting that might be appropriate. I don’t see a significant policy change from a 5% level target.

Then:

2007:4 to 2008:2 1.75% annual rate (mild recession.)

2008:2 to 2008:4 minus 3.5% (deep recession)

Nick, It would not take very long to catch up to a 2% inflation track, so I think it would be credible. But obviously they have to move the policy instruments to do so.

16. November 2014 at 10:13

Scott, I guess the question is how much lag there is between a monetary adjustment and an NGDP reaction. The Fed uses a 1 year lag on the yield curve indicator, which is the signal I reference in my blog post.

You make a good point that the moderate declines in 2006 could be reasonable trend reversion. But that’s a sign of monetary policy in 2004 and 2005, isn’t it? When would you place the monetary adjustments that relate to the increasingly sharp NGDP declines of late 2007 to late 2008?

16. November 2014 at 12:54

If I had to pick a date, I’d say the recession was triggered by a tight money decision by the Fed on December 11, 2007. Things deteriorated rapidly after that meeting. I don’t believe monetary policy works with long lags. We know it didn’t in the 1930s, it’s not clear why it would today.

16. November 2014 at 13:24

I wonder if the lag is related to the scale of the shock, since several different channels are in play at once. Large shocks might have immediate impact while slightly tight policies might have longer lags.

The Fed’s yield curve indicator has a 1 year lag. It was signaling recession by mid 2006. Fluctuations in short term rates are a big factor in the indicator, and currency growth was already very low and declining by mid 2006. The evidence seems to me that it says the yield curve inverted by 2006 because the Fed was being very stingy with currency. It wasn’t 2008 tight but it was recessionary.

16. November 2014 at 14:58

Kevin Erdmann,

You should read what Prof. Sumner has said about “long and variable lags”.

I don’t think significant lags exist. If they did, then the Efficient Markets Hypothesis would be useless…..

http://marketmonetarist.com/2012/03/06/long-and-variable-leads-and-lags

http://www.themoneyillusion.com/?p=6693

16. November 2014 at 15:39

Travis, thanks for the links.

You could have lags and have forward prices that incorporate them. Securities tend to be forward indicators. For instance, there are known seasonal fluctuations, but there tend not to be ways to trade them for profit. There is a lag between when Apple announces a new product and when they actually sell it. But you can’t earn a reliable profit from the lag.

16. November 2014 at 16:02

Travis,

To follow up, the distinction here should be between changes in prices and changes in activity. Long term interest rates, currency in circulation, and home prices all fell with little lag time in 2006. GDP (both inflation and real) fell more slowly. With each ratcheting down of Fed policy through 2007 & 2008, prices, rates and currency fell, until 2008 when it got so bad there was a run on currency.

Homes are a bit of a chimera, I think, because there is stickiness in housing markets, and also demand is filtered through the banks, where it is limited by incomes, which happen to lag. So, in 2004 & 2005, when intrinsic values of homes were starting to level off, demand got a boost because incomes were strong as a lagging effect of monetary policy in 2003 & 2004. But when monetary policy tightened, while intrinsic values would normally have been bolstered by falling long term rates, values were dampened by falling rent inflation and demand was dampened by damaged bank liquidity and falling incomes.

18. November 2014 at 04:36

“Standard EC101 theory says lower prices have zero effect on supply.”

I thought it was “standard EC101 Theory” – free market economics, that an increase in demand increased prices and that price increase encouraged more suppliers and so resulted in an increase in supply. Are you saying that is not the case.

18. November 2014 at 06:20

Dinero, Yes, that is not the case. Standard theory says higher prices caused by a shift in demand boosts quantity supplied, but have no impact on supply. That’s a hugely important distinction.