Never reason from an oil price change

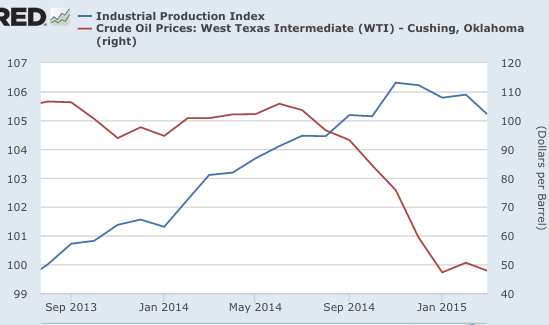

Back in late 2014, many pundits assured us that falling oil prices were bullish for the economy. I countered that one should never reason from an oil price change. The net effect is ambiguous. As the following graph shows, industrial production had been rising fast in the period leading up to November 2014, but has been falling ever since. GDP was almost flat in Q1, and the Atlanta Fed says growth will also be slow in Q2.

That does NOT mean falling oil prices hurt the economy, an equally unjustified assumption. Rather it is monetary policy (NGDP growth) that drives short run changes in output. NRFPC!

Tags:

2. May 2015 at 23:18

Sumner: “Rather it is monetary policy (NGDP growth) that drives short run changes in output.” – ??? this does not logically follow from having GDP drop in response to lower oil prices; it could simply be oversupply of oil from Saudi Arabia (as is in fact the case) coupled with less demand from China. Never reason from uncorrelated facts.

3. May 2015 at 05:25

Ray, You said:

“this does not logically follow from having GDP drop in response to lower oil prices”

Obviously I agree.

3. May 2015 at 09:50

Ray, I’m pretty sure you misunderstood the intended meaning of the word output in your quote. Otherwise your counter makes absolutely no sense.

3. May 2015 at 15:48

Italy, GDP growth outlook: Upgraded

http://www.ft.com/intl/cms/s/0/2f472b7a-dd75-11e4-bc0d-00144feab7de.html#axzz3Z7a6ooiY

Germany growth outlook: Upgraded substantially

http://www.cnbc.com/id/102591890

Spain, growth superstar:

http://www.telegraph.co.uk/finance/economics/11574536/How-Spain-became-the-Wests-superstar-economy.html

Ireland, Hungary, Portugal, lot of the rest of the Eurozone, all upgraded.

http://hereisthecity.com/en-gb/2015/04/30/eurozone-recovery-defies-the-odds-but-long-term-problems-remain/

IMF upgrades Greece:

http://greece.greekreporter.com/2015/04/15/imf-forecasts-higher-growth-for-greek-economy-in-2015/

India, 7.5% growth.

http://articles.economictimes.indiatimes.com/2015-04-28/news/61616013_1_gdp-growth-india-development-update-credit-growth

China, the stock markets have soared there with the collapse of oil. Oil demand in China is incredibly strong, but not really clear how GDP will play out.

Japan had a very respectable Q4, Q1 is still pending.

Here’s what I wrote back in October:

“As I have stated before, if oil prices remain low, then expect a really good year coming up for the US economy, an incipient recovery in northern Europe, and a surprisingly good year for the PIGS.”

http://www.prienga.com/blog/2014/12/6/oil-and-the-trade-deficit

I continue to think that low oil prices helped these economies quite a bit.

Let’s see about the US–that’s the major evidence against the oil price effect. In the US, Q1 saw some really bad weather, port strikes, and a really strong dollar (oil again, in my opinion). On the other hand, our economy remains much stronger than much of the rest of the OECD. Let see how Q2 fares.

3. May 2015 at 21:59

I’ve performed a deep oil-Real Growth study. It seems that for US oil price movements don’t affect (in the long run) real growth. Variables such as Exchange rate and inflation work like “shock absorber”. You can find more here –> http://randomwalkproject.it/?p=6963

4. May 2015 at 05:36

Random –

It matters where you put in the data breaks.

If you use binding constraint analysis, then oil matters when it’s a binding constraint. It doesn’t influence the growth rate when it’s not the binding constraint.

For an analogy, you can think about the drought in California. Water is increasingly becoming a binding constraint there and it should start affecting the economy at some point if the drought continues.

4. May 2015 at 06:13

Jason, He does that a lot.

Steven, For any claims about Chinese stocks and oil prices you’ll need regression analysis. Otherwise you have one observation. And Chinese stocks don’t correlate well with Chinese growth (for reasons I don’t understand.)

Yes, QE has modestly boosted growth in Europe, but it’s still lousy.

Modi seems to have pushed India into a slightly higher growth path.

And I very much doubt whether water will have much impact on California, except obviously it will temporarily reduce farm output.

Thanks Randomize.

4. May 2015 at 06:14

Steven, BTW, falling oil prices should cause the euro to appreciate. As you probably noticed, it plunged instead. It’s the QE.

4. May 2015 at 07:43

You were, are still, certainly correct that falling crude oil prices are eo ipso good the economy of the United States. You are equally correct that it is wrong to *assume* that falling crude oil prices are bad for the economy. The question at hand is not what is assumed, but what is observed.

When prices fall, suppliers of goods and services see that as “market signal” to reduce supply and lay-off employees. Consider the current situation in the petroleum business. Prices of crude oil began falling in June of last and now production employment are beginning to decline. As people lose their jobs, they spend less. As companies shut down production, they spend less. So for example, shale oil companies are laying off employees as prices fall. This has a ripple effect. United States Steel just shut down a mill and laid off 614 workers because of reduced demand from oil drilling firms for steel pipe[1]. GasFrac Energy Services Inc. of Calgary an oil drilling and exploration company has filed for bankruptcy [2]. The economy of Texas is suffering badly from the current decline in prices [3] which is impacting other parts of the economy :

“Citing the collapse in global oil prices, U.S. Steel Corp. will idle its plant in Lorain, Ohio, laying off 614 workers, a company spokeswoman said Tuesday. The plant makes steel pipe and tube for oil-and-gas exploration and drilling. With oil prices currently around $50 a barrel, their lowest level since 2009, energy companies have far less incentive to drill for new supply, reducing demand for the plant’s products.”[4]

Assuming the impact of oil price decline is wrong but examining the actual impacts is useful.

[1] http://bit.ly/17fPHjo

[2] http://www.mysanantonio.com/business/eagle-ford-energy/article/Canadian-drilling-services-firm-files-bankruptcy-6025822.php

[3] http://seekingalpha.com/article/2943266-oil-bust-mauls-texas-manufacturers-atlanta-fed-sees-hit-to-broader-u-s-economy

[4] http://bit.ly/17fPHjo

15. July 2016 at 06:47

[…] oft-repeated mantra of “not reasoning from a price change”. Probably its most familiar usage is related to the oil price, although there are many, many […]

31. August 2016 at 04:43

[…] been his oft-repeated mantra of “not reasoning from a price change”. Probably its most familiarusage is related to the oil price, although there are many, many […]