My critics in 2012: “See Sumner, housing prices were way too high in 2006”

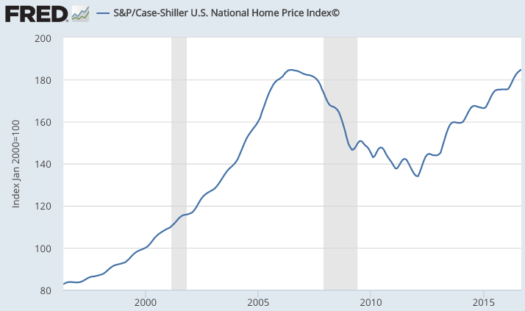

Real house prices are still well below the peak, but nominal prices hit a record high in September:

The 2006 period may have been a bubble, but as of today is seems far less irrational than it seemed in 2012. (This recovery also makes Kevin Erdmann’s arguments look even stronger.)

The world’s full of uncertainty and markets are volatile. Get used to it.

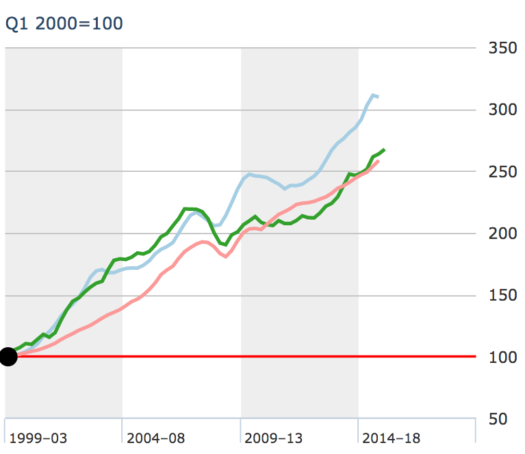

PS. UK house prices (green) took a dip after 2006, but are now well above 2006 levels (and equal to 2006 prices in real terms). Australia (blue) and Canada (pink) are much higher in both real and nominal terms.

What goes up must eventually . . . go up even more!

So the US is down in real terms, the UK is even, and Canada and Australia are up in real terms. Isn’t that sort of consistent with the EMH?

Sure, those prices will dip at some point in the future. That’s what efficient markets do, they go up and down.

Tags:

19. December 2016 at 09:31

Sigh. Here we go again. Once again, Sumner ignores that short term price fluctuations cause anxiety. To believe Sumner, a flash crash where the market drops 30% in five minutes has no bad effects since the market rebounds. Yes, in Sumner’s mind when it comes to crashes, money is indeed neutral.

OT (but on point): marginalrevolution.com/marginalrevolution/2016/12/reasons-mundell-fleming-model-simply-flat-wrong.html

Another nail in ‘money non-neutrality’ and Mundell-Fleming model; see the comments, mine, if you are clueless.

19. December 2016 at 09:36

Kooky Sumner is in good company, the below author also said, in 2008, there was no real estate bubble. Birds of a feather (Sumner, Kevin Erdmann, Burnham)…

“Markets and Lizard Brains: How to Profit from the New Science of Irrationality” – September 29, 2008 by Terry Burnham (Author) -chapter 9, ‘real estate is not in a bubble’

19. December 2016 at 09:49

Silly doctors, you said the patient had too much to drink as evidenced by that massive hangover he had that lasted so long?

Pssshh, look at him now, he is already drunk again. Obviously that last hangover was just a figment of your imagination. The problem wasn’t that he had too much to drink last time, but that he reduced his drinking unnecessarily instead of staying nice and drunk all the time.

Where’s that pseudo-Nobel prize folks? My fireplace only has a worn out copy of Keynes’ General Theory with a few sporadic amendments made here and there, and a copy of The Communist Manifesto, with plank number 5 underlined, highlighted, with what appears to be exclamation points all around it.

19. December 2016 at 11:02

To believe Sumner, a flash crash where the market drops 30% in five minutes has no bad effects since the market rebounds. Yes, in Sumner’s mind when it comes to crashes, money is indeed neutral.

So Ray, what’s your opinion? If the market drops 30% in five minutes, is money then neutral or not? Did you shoot your own foot again or what happend?

19. December 2016 at 11:04

Yes Scott, you were mostly right and you’ve always acknowledged some bad loans were made. They seem to have been a relatively minor factor.

19. December 2016 at 11:14

If I were trying hard to play devil’s advocate, I might point to interventions in the housing market since the crash, claim that those alo g with QE and maybe especially Operation Twist artificially lowered mortgage rates, juicing housing prices, but I don’t find it persuasive myself. More realistically,new banking regulations have hurt supply of new housing, as spec loans, for example, are harder to get than otherwise.

Mostly, the first graph Scott presents is consstent with the cause being a big NGDP drop, followed by a fecovery in which NGDP never returned to trend.

19. December 2016 at 11:38

I’m with your point 100%.

Also, about half of all prices will rise slower than inflation from any given point in time. So when someone says, “well, house buyers may have nominally made money since 2006, but they made less than inflation”, they may be correct (so far), but it’s basically conceding that there was no bubble. And that EMH is still the best we’ve got.

19. December 2016 at 11:43

Solid post.

19. December 2016 at 12:19

Scott, You said:

“Mostly, the first graph Scott presents is consistent with the cause being a big NGDP drop, followed by a recovery in which NGDP never returned to trend.”

Yes, I think that’s the best explanation. I wouldn’t rule out a bit of excess in what Kevin Erdmann calls the “Contagion cities”, but those are only about 5% of the country, so that can’t be the main story. Kevin’s blog is looking better and better.

19. December 2016 at 12:31

I’d love to see your thoughts on this:

http://krugman.blogs.nytimes.com/2016/12/18/will-fiscal-policy-really-be-expansionary/?module=BlogPost-Title&version=Blog%20Main&contentCollection=Opinion&action=Click&pgtype=Blogs®ion=Body

In your spare time, of course. 😉

19. December 2016 at 12:56

@bill

Keynesians like Krugman are gold. He could have written just two words: monetary offset. A simple and very elegant theory, basically invented (or better: revived) by Scott Sumner.

But no, he had to write paragraph after paragraph after paragraph about his inelegant Keynesian multiplier theory.

19. December 2016 at 15:06

Scott,

I am not trolling you (here and now). I am honestly asking: How long would it have had to take, for nominal housing prices to return to their 2006 peaks, for you to NOT have written this post?

E.g. suppose house prices bottomed in 2012, and then slowly rose until 2050, at which point they were in record territory. Would you, at that point, still write a post making fun of the people who said houses were overpriced in 2006?

If not, can you give us an idea of where the line would be? To be clear, I understand that the pattern you displayed in this post is consistent with the EMH. Yet you seem to be arguing that the people who said (U.S.) house prices were too high in 2006 now look like idiots. I don’t see why that is the case.

19. December 2016 at 15:31

Bob, You said:

“Yet you seem to be arguing that the people who said (U.S.) house prices were too high in 2006 now look like idiots.”

I’d recommending paying more attention to what I actually say, rather than focusing on what I “seem” to be saying.

Here are some examples of what I actually said:

“Real house prices are still well below the peak,”

And:

“The 2006 period may have been a bubble, but as of today is seems far less irrational than it seemed in 2012.”

I don’t see the term ‘idiot’, indeed I don’t even see an implication of idiocy. I see nuanced language. Accurate language. What do you see?

Yes, all judgments about market rationality are provisional, which is my point. The 2006 housing market looks much less crazy today than it looked as of 2012.

19. December 2016 at 16:09

Why not call 2009 a “reverse bubble”?

BTW the bubble-mongers missed a great buying opportunity. Leverage and buy real estate.

No discussion of property values is complete without mentioning zoning.

Why is it orthodox macroeconomists will forever mention the minimum wage or wrinkles in international trade, but cannot bring themselves to mention property zoning?

Kevin Erdmann also points out that the bottom half income of the US population cannot borrow to buy property, due to underwriting standards.

Remember, property zoning is not a topic but rent control is bad bad bad.

19. December 2016 at 17:06

What is strange to me is that in 2006 home prices were blamed on credit. But the recovery has happened without any mortgage growth, so it’s blamed on QE cash. How many decades does this have to go on before the default reaction is that there is a structural problem in the housing stock? And before 1995 was there any economic theory that predicted 2 decades of demand side excess would lead to high asset prices without showing up in wage or generalized price inflation? It seems like we’re living in a weird ex post version of BAHHfest.

19. December 2016 at 17:28

OK Scott, I’ll try again. You titled this post, “My critics: ‘See Sumner, Housing Prices Were Way Too High in 2006.'”

So my question is, suppose it took till the year 2050 for us to be where we are right now. Would you at that time have written this exact same post, except that the graph would be stretched longer and your years would be different?

And then, if not, at what year would you draw the line?

19. December 2016 at 17:54

Bob, If nominal prices didn’t recover until 2050, then real prices would never have recovered. My point is that even real prices have recovered a lot of ground since 2006. Not all the ground, but quite a bit of it. The nominal house price increase vastly outperforms inflation, since 2012. That’s important.

If you mean real housing prices, then yes, even a recovery in 2050 would have been enough to cast doubt on the bubble claim. But not a nominal house recovery, for obvious reasons.

19. December 2016 at 20:53

@Christian List – “So Ray, what’s your opinion? If the market drops 30% in five minutes, is money then neutral or not?” – this is not my blog but Sumners. Note he has studiously avoided answering your (and mine) question. Slime.

Question to Sumner: if there’s no such thing as a bubble, so what? Are you saying sudden shifts in prices have no effect? If not, then what is the point of your post? Quit playing games man, we’re onto your game. You blow hot and cold, like in Aesops fable with the human and Κένταυρος

19. December 2016 at 22:33

Scott, your denial that there was a housing bubble that popped in 2006 is probably my biggest reason to doubt you on anything.

I lived through it. I worked in that market as a contractor. I benefited from it till the end and then got hurt a bit when some customers couldn’t pay when their “investments” couldn’t sell. It was a crazy time where I spent half my time (when pricing jobs) trying to talk potential customers out of their plans for work for me.

What is it that makes you so adamant that there could not have been a malfunction in expectations about housing prices?

What is it that requires you to maintain that there was not a housing bubble?

20. December 2016 at 01:21

Why there was ‘a bubble’?

“And Bezemer and Hudson are completely wrong about bank credit pushing up mortgage debt. The increase in mortgage debt was entirely due to funding by private investors – mostly thru Private Mortgage Conduits (AKA private label mortgage backed securities) If you subtract out the mortgages financed by private investors the period from 1990 to the present would have been below normal for mortgage debt.”

https://fred.stlouisfed.org/graph/?g=c4Mb

“It was those mortgages that banks would have never funded that were responsible for jacking up house prices because without that funding source almost all of the excess house sales would never have happened.

And it was those mortgages funded by private investors that have almost all now failed while the mortgages funded by banks proved to be pretty sound and have mostly endured.”

https://www.blogger.com/comment.g?blogID=2098432983500045934&postID=20506938437665882

20. December 2016 at 03:51

If anyone else is counting, that’s two dodges of Murphy’s question. We’re told a recovery by 2050 will still “cast doubt” on the bubble “claim”. But when will it not?

I have a question after that…if the answer is say 2075, or whatever, why THAT approximate year? What is it in the (anti) market monetarism “claim” that leads to conclusions about the approximate number of years that needs to pass?

Please note that the actual content of the bubble theory does not depend on the number of years, so just so you know, any counter-claim that is based on timespans is not actually a counter-argument. And no, excuses of “well then it isn’t useful” are themselves your personal preferences for what is and is not useful to you. Those excuses will not be not useful to everyone else. The standard for what is right and wrong is not your personal feelings.

20. December 2016 at 05:43

Jerry, You said:

“What is it that makes you so adamant that there could not have been a malfunction in expectations about housing prices?”

I’m not at all adamant, indeed in cities like Vegas and Phoenix there might well have been a bubble.

But as far as a nationwide bubble, I want to see solid evidence before believing it, and I’m just not seeing it. Where is the evidence?

20. December 2016 at 06:08

BuB’s statistical analyses (wizardry), deployed on Gov’t economic data, is like a computer programmers’ code to the knowledge workers’ data (the system analysts’ puzzle), viz., GIGO.

The economic output resulting from BuB’s professed complex mathematical methods is as contagious (& as wrong) as McCarthyism was in the early 1950s.

20. December 2016 at 06:21

“A bubble, from a historical perspective, is a large, and long-lasting deviation of the price of an asset from its fundamental value, relative to the price of other competing alternatives.” Blinder

“Underestimating the risk of default, and income streams (the ingredient from which debt is paid), is overestimating the value of a bond.” Blinder

“The fundamental determinants of stock values are dividends, their expected growth rates, and interest rates.” Blinder

“And spending on residential construction started to decline well before house prices topped out, typically 4% of gDp. So the stunning collapse in home building was not near enough to cause a serious recession. Bernanke caused the GR all by himself.” — Alan Blinder, Princeton University

“27 million subprime and other risky loans – ½ of all mortgages in the U.S. – were already to default as soon as the massive 1997-2007 housing bubble began to deflate”

Bad Ben thinks (2002 speech) “financial regulation and supervision should be h first line of defense against asset-price bubbles”.

He’s an idiot savant. The “administered” prices would not be the “asked” prices, were they not “validated” by (M*Vt), i.e., “validated” by the world’s Central Banks. As such, if the G.6 debit and demand deposit turnover release was still being reported, the housing bubble would have stood out like a sore thumb.

The FACT is that EVERYONE is WRONG:

Alan Blinder: “After the Music Stopped”

1) Bubble bursting is like that. At some unpredictable moment, investors start “looking down”…, realizing that the sky-high prices they believed would never end are not supported by the fundamental – and start selling. It is abundantly clear that the crash must come eventually. Fundamentals win out in the end. But why it happens just when it does is always a mystery.

2) No one will ever know…why the stock market crashed in October 1987, rather than September, or November.

Alan Greenspan: “The Map and the Territory”

3) The wholly unprecedented stock price crash on 10/19/87…there was no simple probability distribution from which that event could be inferred

4) with rare exceptions it has proven impossible to identify the point at which a bubble will burst, but its emergence and development are visible in credit spreads

Ben S. Bernanke: “The Courage to Act”

5) First, identifying a bubble is difficult until it actually pops.

6) A lack of transparency caused a loss of confidence.

Janet Yellen’s speech: “A Minsky Melt Down”

7) “Minsky understood this dynamic He spoke of the paradox of deleveraging, in which precautions that may be smart for individuals and firms – and indeed essential to return the economy to normal state – nevertheless magnify the distress fot eh economy as a whole”

Joseph E. Stiglitz “Free Fall”

8) Bubbles are, however, usually more than just an economic phenomenon. They are a social phenomenon.

9) 2) Futures prices are unpredictable.

Paul Krugman “End This Depression Now”

10) What actually happened, of course, was the Fed did everything Friedman said it should have done in the 1930’s – and so the economy seems trapped in a syndrome that, where not nearly as bad as the GD 1.0, bears a clear family resemblance.

I cracked the code in July 1979. BuB should be in prison for economic treason.

20. December 2016 at 07:23

Readers: note Sumner, as MF once pointed out, only responds to softballs, and when he does respond to hardballs he’s selective in what he responds to. The open question by Christian List and myself above, on why the issue of a bubble is even important to Sumner is left unanswered by our host. But Sumner does respond to noted troll Bob Murphy. Noted.

Again, let me dumb down this debate a bit more. Sumner says that EMH implies no such thing as a crash (false, since EMH is a Gaussian distribution while crashes such as Oct 2007 and Oct 1987 are ‘black swan’ Levy distributions, but I digress). Fine. Let’s do this: let’s call any ‘crash’ that 99.999% of the population believes in, let’s call it a “SUMNER UNICORN NON-ANOMALY”, or “SUN” for short. So we don’t have crashes in markets, we have SUNS. Now, please, tell us professor, so what? There’s no crashes, we agree, just SUNs. Ok. Now take the next step. Do SUNs have any effect on real output? Yes or no? Just to dumb it down a bit more for any thick heads, if SUNs always have a real effect it proves money is not neutral. If SUNs always have no real effect, it proves money is neutral. If SUNs have both a real and non-real effect (compare 1987’s SUN to say 1933 or 2008’s SUN), it proves that SUNs per se are irrelevant, so money is largely neutral, and other factors like animal spirits are at play. What is your stance professor? (I trapped Sumner into a corner, don’t expect an answer, watch the little coward run away)

20. December 2016 at 08:06

I can, of course, answer that. There is, to a large extent, evidence that price dispersions are “washed out” or “mopped up”, as when the Fed’s “elephant tracks” are inadvertently covered up.

20. December 2016 at 08:36

“it proves that SUNs per se are irrelevant, so money is largely neutral”

———-

Wrong again, this isn’t an “advanced class”. It doesn’t require prerequisites. The draining and injection (liquidity effect) works both ways (one offsetting the other).

1987 was the litmus test for stupidity (no black swan). Even Robert Prechter’s Elliott Wave International got it exactly right.

Monetary flows (our means-of-payment money X’s the transactions rate-of-turnover), fell from 16 in AUG, to 4 in NOV (See G.6 release – debit and demand deposit turnover).

http://monetaryflows.blogspot.com/2010/07/monetary-flows-mvt-1921-1950.html

Conterminously (3 months prior to the crash), the rate-of-change in RRs (the proxy for R-gDp), was surgically sharp, decelerating faster than in any prior period since the series was first published in Jan 1918. The proxy declined from 11 in JUL to (-)4 in OCT.

Accompanying this sharp deceleration in the roc for M*Vt (proxy for all transactions in Irving Fisher’s truistic: “equation of exchange), the monetary authority mis-judged economic strength, and on Sept. 4 the Fed raised (1) the discount rate 1/2 percent to 6, & (2) the policy FFR 1/2 percent to 7.25 (up from 5.875 percent in Jan).

On Sept. 30 the effective FFR spiked at 8.38; fell to 7.30 by Oct. 7; then rose to back to 7.61 Oct 19 (Black Monday). Thus, the effective FFR spiked 36 basis points higher than the FOMC’s target (policy), rate on “Black Monday”.

The shortfall in the quantity of legal reserves (which had already dropped at a rate not exceed since the Great Depression) bottomed with the bi-weekly period ending 10/21/87. This was the trigger.

At the same time, the 30 year conventional mortgage yielded 11.26 percent, up from 8.49 percent in Jan. 87, & Moody’s 30 year AAA corporate bonds yielded 11.06 percent on 10/19/87, up from 9.37 in Jan. 87.

The preceding tight monetary policy (monetary policy blunder), i.e., the sharp reduction in legal reserves, had effectively forced all rates up along the yield curve in the short-run (when inflation and R-gDp were already markedly subsiding).

On 10/19/87 the CBs had to scramble for reserves at the end of their maintenance period (bank squaring day), to support their loans-deposits (contemporaneous reserve requirements were then in effect exacerbating the shortfall & response time). A significant number of banks, with large reserve deficiencies, tried to settle their obligations at the last moment. But the FRB-NY’s “trading desk” failed to accommodate the liquidity needs in the money market – until it was already way too late.

I.e., it was a major monetary policy blunder by Alan Greenspan.

20. December 2016 at 08:40

I.e., the 2 forces are cancelled out thus confusing RAY LOPEZ.

21. December 2016 at 04:29

“That’s what efficient markets do, they go up and down.”

Amazing. A PhD Economist reaches the same conclusion as my mother-in-law who got her GED at age 25. So one can’t help but ask, what exactly is the point of the PhD making such a fuss about “efficient markets” when a person with zero years of formal Economic training can make the same conclusion.

21. December 2016 at 09:05

@flow5 – you may be confusing cause and effect: if a rooster crows before the sun rises, it doesn’t mean the rooster must crow before the sun will rise. My point about Oct 2008 and Oct 1987 are simply that big nominal swings may not necessarily have big effects, and thus rather than money non-neutrality being the ’cause’, it’s simply animal spirits. If big price drops always had big effects, you could say money is not neutral, but that’s not always true.

Side note: EMH is almost certainly wrong, see: http://www.cs.ucl.ac.uk/fileadmin/UCL-CS/research/Research_Notes/RN_11_04.pdf (good survey article). Anecdotally, by definition, a stock market crash such as 1987’s happens once every several lifetimes of a universe if you use a Gaussian distribution; if you don’t use a Gaussian distribution, then you’re cheating, and just back fitting data to fit a curve and calling that random.

So the question (unanswered by Sumner) remains: if there’s no such thing as a ‘crash’, so what? What is your larger point? Do price drops cause real effects or not? It’s astonishing that our host will not answer such a core question. Seems he’s trolling his readers.

21. December 2016 at 09:07

@Dan W- right on brother (“what exactly is the point of the PhD making such a fuss about “efficient markets”). Read my comment, it’s exactly addressing this issue. Time for Sumner to come clean with a post explaining exactly why he thinks price drops don’t make a difference (or if they do) and why the public might think price drops (which the public calls a ‘crash’) might be a bad thing. Is the public irrational? Put up or shut up professor.

21. December 2016 at 12:49

Ray, I choose to shut up, until I get some intelligent comments.

23. December 2016 at 20:02

Never reason from an NGDP change.

The bubble bust phenomenon is structural, caused by central banking:

http://m.imgur.com/NLoT1?r