Monetary policy counterfactuals are tricky

Rajat asked one of his characteristically probing questions, in the previous post:

As you’ve often said with monetary policy, it all depends on the yardstick or counterfactual. With your examples, because you’ve put the focus on interest rates, the reader naturally assumes that the counterfactual is no change in official interest rates. For example, in (1), surely the cut in the Fed Funds rate from 5.25% to 2% was less contractionary than if the Fed did not lower the rate? The money supply may not have risen in 2007-08, but wouldn’t it have fallen if rates were kept at 5.25%, as the market devoured the short-term securities the Fed offered at that yield? I understand that the reduction in official rates was not expansionary in any meaningful sense (ie against a benchmark of ideal monetary policy under inflation or NGDP targeting).

This is probably correct, but I’d argue that it could also be misleading, resulting in too much reassurance that interest rates aren’t that bad an indicator after all. Rajat’s point is that if the Fed never even began cutting rates, then they would have had to reduce the money supply rather dramatically. So much so that NGDP would have done even worse than with cut from 5.25% to 2.0%. So does that mean the interest rate cut was expansionary after all? Not quite.

Consider the two following hypotheticals:

A. No change in the base from August 2007 to May 2008, rates fall from 5.25% to 2.0% (actual policy)

B. The base rises by 5%, while rates move from 5.25% in August 2007 to 5.25% in May 2008.

I would claim that policy B is almost certainly more expansionary. Rajat might reply that policy B was not an option. If the monetary base had risen by 5%, then interest rates would have declined even more rapidly than they actually did.

I don’t quite agree, although for any given day I’d agree with that claim. Thus on any given day, a lower fed funds target requires a larger base than otherwise (at least before IOR was instituted in October 2008). But that true fact leads many Keynesians to jump to a seemingly similar, but unjustified conclusion. Many people assume that over a 9-month period a more expansionary monetary policy implies a faster decline in interest rates.

In fact, option B probably was available to the Fed, but only if they moved much more aggressively in the early part of this period and/or if they changed their policy target. Thus there are two possible ways the Fed might have achieved policy option B:

B1. Cut rates sharply enough in August 2007 to dramatically boost NGDP growth expectations, and then gradually raise rates enough over the next few months to get them back to 5.25% by May 2008. In that case, NGDP growth would have held up well, and yet the path of interest rates over that period would have ended up higher than otherwise.

B2. Adopt a policy of 5% NGDPLT, which would have radically changed expectations, and hence boosted the Wicksellian equilibrium rate.

Rajat might view option B2 as cheating, so let me make a case for option B1. I’d argue that the Fed did almost exactly what I describe in option B1 during 1967. Just to set the scene, the economy was slowing sharply during early 1967, and some people worried that we might enter a recession. The Fed moved quite aggressively, and their move was so successful that over a period of 10 months there was no rate cut at all.

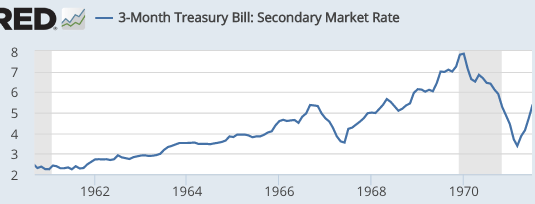

3 month T-bill yields:

January 1967: 4.72%

June 1967: 3.54%

November 1967: 4.73%

So interest rates were basically unchanged over this period, and yet I’d argue that policy was far more expansionary than during August 2007 to May 2008, when rates fell sharply. The monetary base grew by over 5% in just 10 months, and this allowed the US to avoid recession.

(BTW, in retrospect, a mild recession would have been preferable in 1967, as a way of avoiding the Great Inflation. Instead, the US left the gold standard in April 1968, Bretton Woods blew up 3 years later, and the rest is history. But since policymakers didn’t know all of this would occur, the mistake of the 1960s was sort of inevitable—just a question of when.)

In 1967, the expansionary policy early in the year boosted NGDP growth expectations enough so that they could raise rates back up later in the year, and still see robust NGDP growth. In 1968, interest rates rose still higher, but this was expansionary because the base was also rising briskly. So you have both rising base velocity (from higher rates) and a rising monetary base.

There’s a grain of truth in Rajat’s comment, but it’s best thought of as applying to a given day, where a lower interest rate implies a faster growth in the money supply, and easier money. Over a more extended period of time things become much dicier. Those who focus on interest rates are more likely to be led astray, the longer the period being examined.

Tags:

17. December 2016 at 16:12

Scott,

The relationship is orthogonal and depends as you say on expectations. I would not entertain any notion that rates are a good indicator of the stance of policy. The growth rate of NGDP is the only good indicator of the state of policy.

17. December 2016 at 16:27

The Fed can’t target N-gDp because they can’t forecast M*Vt. Their money stock definitions increasingly overstate M1. And their velocity figure is contrived.

And there’s no such phenomenon as a Wicksellian rate of interest.

Cutting rates wouldn’t have worked. The damage was already done. It’s all about LEVERAGE and Yale Professor Irving Fisher’s “price-level”:

“Peter J. Wallison, a co-director of AEI’s program on financial policy studies in his dissent to the majority report of the Financial Crisis Inquiry Commission argued that “the sine qua non of the financial crisis was U.S. gov’t housing policy which led to the creation of 27 million subprime and other risky loans, – half of all mortgages in the US which were ready to default as soon as the massive 1997-2007 housing bubble began to deflate”

Bernanke remarked: “I’d still like to know what the stuff is worth”. He should have asked AIG’s creditors (and AIG stopped writing CDS in early 2006), who were asking for stiffer haircuts and more collateral.

17. December 2016 at 17:33

I think this post is correct.

One cannot decipher monetary policy on the basis of any single variable, monetary or macroeconomic.

The recent Richmond Fed taper applied a complicated Taylor-rule yardstick to Fed policy, and concluded in general the Fed has been growing tighter ever since the late 1970s.

Given the secular decline in interest rates and inflation since the late 1970s, I am inclined to believe the Richmond Fed paper.

The interesting aspect of the Richmond paper was not that it id possibly incorrect conclusion about the 1970s, but that the Fed has consistently gotten tighter, even through the 2008 period.

17. December 2016 at 18:33

Why didn’t your hypotheticals include something that actually happens?

17. December 2016 at 18:55

As MF says, Sumner is arguing about metaphysics. Tell us professor, how many angles / angels dance on the head of a tetrahedral pin? Ambiguity is your friend so feel free to answer this one candidly. Such is the sorry state of your dismal science.

17. December 2016 at 19:53

Sumner, given individuals who operate in a market setting, i.e. respect for individual property rights, choose according to their own subjective preferences, even in the existing world with massive state intervention, why do your counterfactuals never include a free market in money? It is a legitimate counterfactual.

17. December 2016 at 20:41

Thanks Scott, I accept all of that. As you’ve said many times, the talk (or at least talk backed up by consistent action as needed) is the most important thing. My point was that in digesting those scenarios, many readers would assume that the talk wasn’t any different (ie the money demand curve was exogenous), and the sole question was whether or not the Fed cut the FF rate over that period according the timeframe it did.

18. December 2016 at 03:56

Scott, below, several illustrations of how focusing on interest rates can lead one astray!

https://thefaintofheart.wordpress.com/2014/12/01/monetary-policy-1992-2009-a-market-monetarist-perspective/

18. December 2016 at 05:46

Rajat, Yes, that’s a good way of putting it.

Marcus, Thanks for the link–good examples.

18. December 2016 at 06:10

Scott – When we say interest rates in this context, don’t we mean the short term rate on T-Bills only? So isn’t the simplest way to accomplish B just to buy different assets than T-Bills (10 year T-Bonds, Treasury Backed mortgages, etc.) like we eventually did?

B3 – Hold the FF Rate at 5.25% but implement enough QE to cause the base to rise 5%.

Note – Like your examples, I’m not suggesting it’s the best policy, just that it’s possible.

18. December 2016 at 15:38

B Cole said: “One cannot decipher monetary policy on the basis of any single variable, monetary or macroeconomic.”

Just how does one come up with such non-sense? Answer, by not studying the markets.

19. December 2016 at 02:03

flow5

Peter J. Wallison cannot be correct as there are no such things as ‘bubbles’?

And it wasn’t ‘about’ bank credit pushing up mortgage debt?

“And Bezemer and Hudson are completely wrong about bank credit pushing up mortgage debt. The increase in mortgage debt was entirely due to funding by private investors – mostly thru Private Mortgage Conduits (AKA private label mortgage backed securities) If you subtract out the mortgages financed by private investors the period from 1990 to the present would have been below normal for mortgage debt.”

https://fred.stlouisfed.org/graph/?g=c4Mb

“It was those mortgages that banks would have never funded that were responsible for jacking up house prices because without that funding source almost all of the excess house sales would never have happened.

And it was those mortgages funded by private investors that have almost all now failed while the mortgages funded by banks proved to be pretty sound and have mostly endured.”

https://www.blogger.com/comment.g?blogID=2098432983500045934&postID=20506938437665882

It was the incompetence of the ‘financial sector’?

“The problem was not that the economy could not climb down from a situation of irrationally exuberant and elevated asset prices without a major recession. The problem lay in the fact that the major money center banks were using derivatives not to lay subprime mortgage risk off onto the broad risk bearing capacity of the market [I assume that this was possible?], but rather to concentrate it in their own highly leveraged balance sheets. The fatal misjudgment on Greenspan’s part was his belief that because the high executives at money center banks had every financial incentive to understand their derivatives books that they in fact understood their derivatives books.

As Axel Weber remarked, afterwards:

I asked the typical macro question: who are the twenty biggest suppliers of securitization products, and who are the twenty biggest buyers. I got a paper, and they were both the same set of institutions…. The industry was not aware at the time that while its treasury department was reporting that it bought all these products its credit department was reporting that it had sold off all the risk because they had securitized them… “

http://equitablegrowth.org/equitablog/misdiagnosis-of-2008-and-the-fed-inflation-targeting-was-not-the-problem-an-unwillingness-to-vaporize-asset-values-was-not-the-problem/

http://www.barrons.com/articles/the-truly-scary-clowns-central-bankers-1475902258

19. December 2016 at 08:21

Negation, The impact on the term structure doesn’t depend all that strongly on which assets you buy. It’s more about the macro impact on the economy.