Kocherlakota told you so

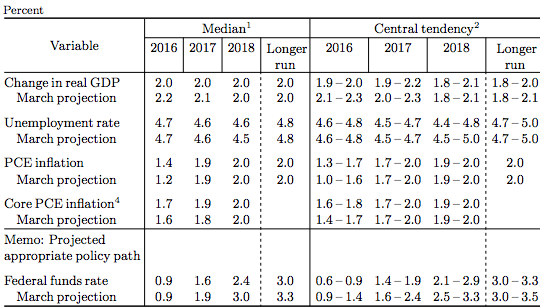

Dots down again. More to come. . . .

Long term RGDP growth forecasts also down. Fed starting to wake up to reality. But more downshifts in RGDP forecasts are coming. All this predicted by yours truly, many times.

Goldman Sachs: The Fed is just following the market. Great idea!

Actually the shorter term RGDP projections are down, but the longer term growth forecasts will also fall, it’s just a matter of time.

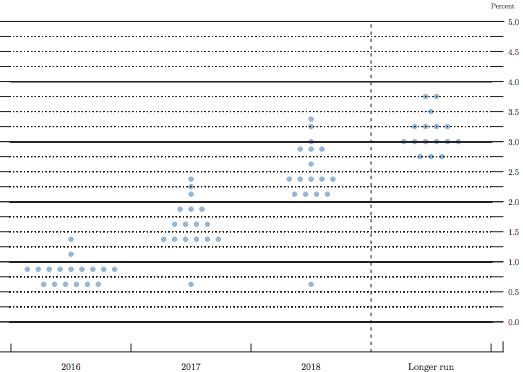

Actually the shorter term RGDP projections are down, but the longer term growth forecasts will also fall, it’s just a matter of time.  Here are the most recent dots.

Here are the most recent dots.

This post shows the dots last September, you can see the Kocherlakota dots far below the others.

Tags:

15. June 2016 at 11:28

Truth! And I don’t believe for a second the unemployment rate in March 2017 will be 4.6%, at least, if the Fed does its job right (i.e., focus on stabilizing the nominal economy, not electing Trump). It’s more likely to be 4.0%.

BTW, if the Fed did its job right in 2000, Bush wouldn’t have become President.

15. June 2016 at 11:30

But who is the low dots now? Since Kocherlakota has left.

15. June 2016 at 11:57

Britonomist, Very good question. Evans?

15. June 2016 at 12:13

I’m wondering the same. I man, what would change a member’s views of 2017 & 2018 so drastically from one FOMC meeting to the next?

15. June 2016 at 13:28

The market reaction was quite something.

15. June 2016 at 13:48

Scott

The Fed doesn’t “wake up to reality”. It creates the reality. It needs to wake up to what it has been doing.

https://thefaintofheart.wordpress.com/2016/06/13/the-data-is-fed-dependent/

15. June 2016 at 13:49

Scott, Britonomist

The low dots are being led by Brainard. See post above.

15. June 2016 at 14:18

Are those dots best estimates?

Was it Caplan that called a bet a tax on bullshit?

Get me as much action as you can on the under.

15. June 2016 at 15:02

Excellent blogging.

15. June 2016 at 18:24

James, Brianard would be an interesting choice, but I’m not convinced based on that quotation alone.

You said:

“The Fed doesn’t “wake up to reality”. It creates the reality.”

It does both. I suspect that it is more serious about its 2% inflation target than some skeptics assume.

15. June 2016 at 20:47

I don’t think you can successfully target 2% inflation. The error bars on the two key numbers, NGDP and RGDP are too large. Larger than 2%.

Bringing PCEPI down from 10% to 5%, maybe the change is bigger than the error bars. But at these little numbers you do much more damage than central banks imagine. Whether the Fed’s 2% or the insane “close to, but below, 2%” of the ECB.

15. June 2016 at 20:51

I agree Brainard not so likely as she is also a permanent-Fed member. More likely a regional. Only newbie Kashkari has the liveliness and independence of mind, and sympathy for the poor bl00dy wage-slaves that I’ve seen.

16. June 2016 at 00:12

Nobody can predict the future, only fools claim to. The economy is nonlinear and short term random, with a slight upward bias. Bernanke et al (2002) say in their FAVAR econometrics paper that Fed policy shocks only account for 3.2% to 13.2% out of 100% of any change in economic variable, including GDP. Long term, even Sumner admits, money is neutral.

Connect the dots.

16. June 2016 at 05:39

So, how are insurance companies going to make money if nominal rates also go negative, Scott?

Real monetarists follow their leader, their genius. http://www.talkmarkets.com/content/economics–politics-education/fed-tricksters-put-your-monetarism-where-your-mouths-are?post=97455&uid=4798

16. June 2016 at 06:24

@Gary Anderson – nice article of yours. I would clarify one thing: that helicopter money is not just ‘base money’ but, potentially (if this is your point) money created out of thin air without any assets behind it. Recall most Fed base money has some assets behind it (the Fed uses the money to buy say commercial paper–often junk from toxic mortgages that our host Sumner thinks are fine–but typically government bonds). But true heli money can simply be the Bureau of Engraving and Printing just printing dollar bills, backed by nothing, and mailing them to citizens. I doubt most people understand this. Even our featured guru, Kocherlakota, said in a Bloomberg article that helicopter money as I define it above (printed out of thin air) is similar to traditional base money at the zero bound and has the same effect in his opinion. But this is a ‘supposition’ or ‘hypothesis’. It may well be that Kocher* is right, but it may be he’s wrong. In any event, people should be careful in how they define heli money. Selling bonds and sending the cash to citizens won’t necessarily cause inflation, as it’s “old money”. You need to do what the US did in the Civil War and Revolutionary War: print money, send it to people, and have it backed by nothing. It did raise nominal prices the first time (disastrously: ‘not worth a Continental’) and more better the second time (“Greenbacks”, which were eventually paid off at par, though it took 40 years or so).

16. June 2016 at 06:30

@everybody–btw, I should not be lecturing here, it should be our host Sumner. But Sumner’s prose is so elliptic–on purpose so you can’t pin him down–that, like Oakland, ‘there’s no there, there’. It’s all things to everybody, and therefor nothing to nobody. The other day I overlooked a key sentence in Sumner’s prolix post and didn’t get that he’s advocating making paper money no longer legal tender. But it was buried in the paragraph. Sumner knows that if he writes Strunk and White grammar, his proposals will be transparent and seen as what they are: smoke and mirrors. Sumner is selling snake oil where the ingredients are not listed.

16. June 2016 at 08:16

I wonder how we should read these dot plots. Even a voting member on the Fed probably feels a little like an outsider making predictions in that they aren’t 100% in control. So that member could think “if I were in control, I’d lower IOR to 0% and restart QE until I hit an NGDP growth target of 7% and then I could raise the logically hit a Fed funds rate between 3% and 7% over the longer term. But, I’m not in control and with these guys itching to take away the punch bowl, no matter what FFR we use in the next 6-12 months, I see us stuck with 1.9% inflation as the target and the FFR will not rise above 2.5% in the next 10 years”. So if even the members of the Fed feel like they’re trying to predict what the Fed will do, then we’re doing that in a second derivative sort of way, no longer judging a beauty contest contestants, nor judging the judges, but judging the judges estimation of the judges. Yet back to the dots – I bet some members are thinking of it as their “full control” wish and others are judging the judges, and more than half of them are still confused by the “conundrum” that Greenspan spoke of a decade ago.

16. June 2016 at 09:05

Can they add just one more dot, for the market’s forecast? And then rank the forecasters based on accuracy? Or would that be embarrassing…

16. June 2016 at 09:15

Ray, You said:

“@Gary Anderson – nice article of yours.”

Why am I not surprised that you are impressed by Gary. Have you figured out what an AS/AD graph looks like yet?

You said:

“he’s advocating making paper money no longer legal tender.”

Very funny.

JJ, Of course the market dots are still way below the consensus.

16. June 2016 at 09:15

jj

Great idea!

16. June 2016 at 09:53

Economic prognostications are infallible. What’s comical is that the bankers pay for what they already own. And the evidence is straight forward (though hard for some to understand – Jeremy Blum thinks banks create new money as they earn profits).

The drive by the commercial bankers to expand their savings accounts (fostered by elimination of Reg. Q ceilings), which has a totally irrational motivation, since it has meant, from a system’s standpoint, competing for the opportunity to pay higher and higher interest rates on deposits that obviously ALREADY EXIST in the commercial banking system.

But it does initially profit a particular bank, Citibank, to pioneer the introduction of a new financial instrument, such as the negotiable CD in the early 1960’s – until their competitors catch up; and then all are losers.

The question is not whether net earnings on CD assets are greater than the cost of the CDs to the bank; the question is the effect on the total profitability of the banking system. This is not a zero sum game. One bank’s gain is less than the losses sustained by other banks.

Net changes in Reserve Bank Credit since the Treasury-Reserve Accord of March 1951 are determined by, and should be predicated on, monetary policy objectives. Paying interest to capture deposits (or giving away toasters), is virtually tantamount to redlining or redistricting (monopolistic price practices by the oligarchs).

Laissez faire economics obviously does not apply (e.g., Greenspan’s signature TBTF endorsement).

And if there is to be a growth in interest bearing accounts in the commercial banking System there must be an offsetting structural increase in the transactions velocity of bank deposits (now heuristically improbable since 1981).

16. June 2016 at 16:18

@Sumner – I know more than you about economics, that’s sad. By painting yourself into a corner with your NGDPLT, which works only in your mind’s eye, you have become a strawman, hence your strawman projections on the rest of the world. You, not I, need to study Econ 101. Econ, not e-con, which is what you do here.

17. June 2016 at 07:39

Bullard was responsible for the low dot per

http://www.businessinsider.com/feds-dot-plot-mystery-solved-2016-6

More Bullard comments:

http://www.businessinsider.com/r-st-louis-feds-bullard-says-us-may-only-need-single-rate-hike-for-now-2016-6

17. June 2016 at 09:43

Ray, Can you draw an AS/AD diagram for me? Hint, what variables go on each axis?

Thanks Brent, check out my new post.

20. June 2016 at 19:35

I added a few dots to the plot:

-actual rate

-FOMC average rate

-Fed funds forward implied rate

(hope the image works, otherwise can I email it to you Scott?)

21. June 2016 at 06:40

jj, Feel free to email it to me, at my bentley email.