It’s the NGDP, stupid

It seems like supply chains are stressed almost everywhere in the world. So why is Japan’s price level lower than two years ago. Why haven’t they had any inflation at all?

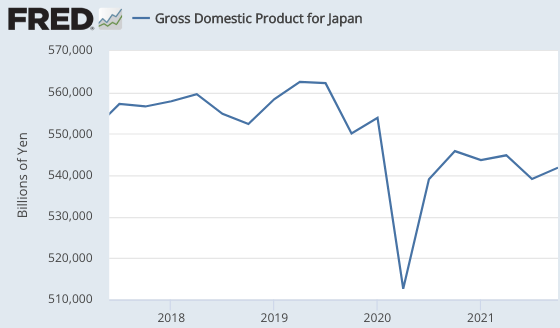

The answer is simple. In the US, NGDP has risen by more than 10% over the past two years. In Japan, NGDP has fallen by nearly 2%. Monetary policy is far more contractionary in Japan than in the US.

Of course, NGDP is not the only factor explaining inflation; RGDP matters too. But over any extended period of time, NGDP is by far the most important factor.

The Philadelphia Fed’s survey of professional forecasters predicts continued rapid growth in NGDP in 2022. They don’t specifically ask about NGDP, but the rapid expected growth in RGDP and (PCE) prices clearly indicates that forecasters expect fast growth in NGDP. In other words, monetary policy is still too expansionary.

PS. I have a new piece at Discourse.

Update: John Hall points out that they do ask about NGDP.

Tags:

18. February 2022 at 12:07

Only the owners of bank deposits can spend/invest them. The banks can’t do anything with their customer’s deposits. It’s stock vs. flow.

If the commercial banks aren’t lending/investing, new money is not flowing. From a system’s standpoint, the savings of the public are not lent by the banks. Banks pay for their earning assets with new money, not existing deposits.

Economists haven’t been able to fashion the DFIs in a system’s context. Economists aren’t conceptual thinkers. Banks aren’t intermediaries. Transactions between the banks and their customers alters the volume of money.

All bank-held savings are lost to both consumption and investment. Secular stagnation is the destruction of velocity. It is the bottling up of savings in the payment’s system.

The Japanese save a greater proportion of their income and keep a larger proportion in their payment’s system. “Japanese households have 52% of their money in currency & deposits, vs 35% for people in the Eurozone and 14% for the US.”

18. February 2022 at 12:08

Survey of Professional Forecasters don’t ask about NGDP?

https://www.philadelphiafed.org/surveys-and-data/ngdp

18. February 2022 at 12:19

Thanks John, I added an update.

18. February 2022 at 12:52

What is money? Money is a medium of exchange. If it is not being exchanged, turning over, it does not represent our means-of-payment money.

All demand drafts clear through the payment’s system. And 95 percent of all demand drafts clear through DDs. The economics profession has done a good job hiding that fact.

It’s a confusion of theory and practice. The ratio of demand deposit turnover to savings deposit turnover is > 99:1. The majority of economic payment’s, maybe unlike yours, are not from interest-bearing checking accounts.

Both Alan Greenspan and Jerome Powell correctly state that M2 has been disconnected from the economy for a long time. M2 is mud pie.

But Powell says: “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time”

Powell confuses money with savings:

“Inflation is not a problem for this time as near as I can figure. Right now, M2 [money supply] does not really have important implications. It is something we have to unlearn.”

“the correlation between different aggregates [like] M2 and inflation is just very, very low”.

Powell should be fired.

18. February 2022 at 13:37

WRONG!

There doesn’t “seem to be” (poor word choice). There is! Why? Because supply bottlenecks emerge when countries tighten restrictions and employ heavy handed police tactics on their citizens. You have a backlog of boats waiting to port. Let them in.

Contraction in Japan is the culmination of globalist policies; policies that seek to have products built for free, using uighyer and other prison camp labor, while enriching a nation that looks eerily similar to Nazi, Germany. In other words, the Japanese people are being replaced with slaves (as are americans).

And the only reason America is not contracting is because it keeps printing!

But you can’t play that game for ever.

Ease off the boobtube, and the bucks games, and read a book. You might learn something. And you might also learn how to write cogently, something you struggle with mightily.

Meanwhile, this will help illustrate Sumner’s leftwing propaganda machine:

Today, Trudeau blundgeons peaceful protesters, and then his foreign ministry sends out this message:

“Canada condemns #Cuba’s harsh sentencing following the July 2021 protests. Canada strongly advocates for freedom of expression and the right to peaceful assembly free from intimidation”…

Oh really?

It’s official. The left is now the CCP. “War is peace, freedom is slavery, ignorance is strength”!

18. February 2022 at 14:26

Scott,

Interesting thing I noticed about NGDP with respect to Japan and the US and the yen.

NGDP rose in the US 10% and in Japan it fell around 2%, so shouldn’t we see the Yen rise in value relative to the dollar? Yet, if you check the value of the USD in yen, it has risen considerably throughout this last year and hit a five year high in early February.

That is strange because Japan is 2% smaller in RGDP from the beginning of 2020, and the US is 2% bigger in RGDP, yet the dollar rose despite a relative rise of 12% in NGDP for the US.

It’s strange, because a sharp rise in relative NGDP in one country should be matched with a weakening of the currency with respect to the currency of the other country.

I’m probably missing something, but I think that is strange.

18. February 2022 at 15:30

Our convoy will be in washington by the end of this month. Will sumtard try the same strong armed thuggery he pulled in Canada?

I doubt it. Do you know why? Because little sumtard and his WEF thugs have to deal with the big and beautiful second ammendment in the United States.

So yeah, sorry boomertard. What’s your next thuggish move? Civil War? I wait with bated breath. Nothing satisfies me more than taking down scrawny commies.

Bunker? Imminent threat? Red army?

Nope. just your own people rebeling against your everyday thuggery.

Punk!

18. February 2022 at 16:26

Sumner’s, WEF children, also known as totalitarians, are getting destroyed in their primaries.

Liz “CCP” Cheney is on her way out! Others will join her.

Let’s hope the Fed, and Macroeconomists like Sumner, are on their way out too.

Freeeeeeeeeeeeeeeeeeeeeeedddddddooooooommm!

18. February 2022 at 16:48

So you continue to spend money you don’t have, and then argue that the Fed needs to slow down the economy? Your economy is already slow. You hardly produce anything anymore. Your gdp growth is under 5%. You have astronomical debt that can never be repaid. But you want a slower economy? lol. Yeah, let’s handicap ourselves even more.

How about just stop printing! Doesn’t that make more sense? Stop using your credit card.

And America, wake up please.

https://www.opindia.com/2022/02/meta-facebook-executive-caught-in-paedophile-sting-operation-fired/

More Americans raping little boys and girls. And guess what, he’s another radical tech leftist with no moral values. When you are a leftist, anything is okay. Everything is subjective. And everyone can be used as a means to an end, instead of an end in itself.

You are suffering from a disease. And it’s disgusting. You need to shake off those leftists like a bad case of fleas.

18. February 2022 at 17:04

Anon, It is strange, and its been going on for 30 years. I.e. the real exchange rate for the yen has been rapidly depreciating for 30 years. Japan has gone from being an expensive country for American tourists to a cheap country.

How much longer can this go on? I’m not sure, but I suspect the answer is not much longer.

18. February 2022 at 17:50

Little bitch boy sumtards wef youth with his boy Schwab

https://financialpost.com/opinion/terence-corcoran-in-canada-follow-the-money-the-ideas

We know all about your totalitarian plans boomertard.

Punk

18. February 2022 at 18:13

Isn’t that just an accounting tautology.

18. February 2022 at 18:16

dtoh, So you are saying I’m correct? 🙂

18. February 2022 at 18:45

I really enjoyed the Discourse article.

Your point that “…on monetary policy the Fed has no option to abstain from acting.” is my favorite, drawing a nice bright line around the role of the Fed.

19. February 2022 at 03:38

Beginning to wonder if my 5-11% NGDP growth forecast on Hypermind is too low.

19. February 2022 at 04:46

Scott,

Yes. You’re right about most things regarding monetary economics. Maybe you could elucidate further by saying the delta between NGDP and RGDP drives inflation.

19. February 2022 at 08:55

M*Vt = AD, where N-gDp is a subset. But the FED discontinued the transactions’ velocity of money publication in 1996, and now Powell has diluted the money stock figures.

See: Fed Points

https://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html

“Following the introduction of NOW accounts nationally in 1981, however, the relationship between M1 growth and measures of economic activity, such as Gross Domestic Product, broke down.”

But Powell, with no historical perspective, eliminated the 6 withdrawal restrictions on savings accounts.

As I said:

The 4th qtr. 2019 is not the problem. The 1st qtr. 2020 will be negative.

Nov 26, 2019. 07:19 PMLink

Covid-19 exacerbated the decline, but R-gDp fell by 5.1% and N-gDp fell by 3.9% in the first quarter of 2020. However, my forecast was based on the rate of change in required reserves that Powell discontinued.

Powell is now “flying by the seat of his pants”.

19. February 2022 at 09:01

Scott,

Could it be the *relative* quality of Japan’s exports are declining?

For instance, in the 80s, Japan seemed to have much better manufacturing and technological products as America, as well as much better infrastructure, and the gap seems to have diminished in infrastructure and have totally reversed in products. That would jibe with the typical Japanese sentiment that the country has either stagnated or gotten worse over the last twenty years, with exception of broad technological improvements that happened everywhere(which doesn’t really affect relative standings). I am no Japan expert, but that is my idea.

Otherwise, the implications of a depreciating yen that are somewhat decoupled from economic conditions makes it seem that Japan is losing hundreds of billions on trade on the international markets, due to underpriced exports.

19. February 2022 at 10:56

Tacticus, What do you mean by a 5-11% forecast? Do they allow a wide range?

dtoh, My point is that variation in RGDP is rather small, so big changes in NGDP mostly show up as variations in inflation. I wasn’t claiming any sort of perfect correlation, as the term “tautology” might imply.

Anon, Yeah, I think they’ve been in the wrong industries. They missed the boat on high tech (even relative to Korea and Taiwan) and China has reduced the relative price of traditional manufactured goods. Meanwhile, the boom in high tech has helped the US dollar.

19. February 2022 at 11:26

re: “My point is that variation in RGDP is rather small, so big changes in NGDP mostly show up as variations in inflation.”

The delta means that money isn’t ever neutral.

19. February 2022 at 12:01

#1 Reserve Balances at Federal Reserve Banks, a proxy for excess reserves in the commercial banking system declined by $410.0 billion in the period from September 1 to February 16.

#2 From September 1, 2021, to February 16, 2022, the funds in the Treasury Department’s General Account rose by $478.2 billion.

All Powell has to do is stop buying bonds.

20. February 2022 at 06:37

Lenin once pontificated to the effect that he would destroy capitalism, and presumably capitalists, by making their money worthless.

How can inflation, FAIT, be harmless? Inflation cannot destroy real property nor the equities in these properties, but it can and does capriciously transfer the ownership of vast amounts of these equities thus unnecessarily accelerating the process by which wealth is concentrated, i.e., income inequality is accentuated, among a smaller and smaller proportion of people.

The concentration of wealth ownership among the few is inimical both to the capitalistic system and to democratic forms of government. A financial oligarchy and a government of, by, and for the people, simply cannot exist side by side.

Based on the distributed lag effect of money flows, a 24-month roc (which the FED’s Ph.Ds. ignore), the rate-of-change in prices peaked in January. The St. Louis FRED database reflects this blatant disregard, as neither the lags, which are mathematical constants (not “long and variable”), for real output nor inflation are available in its database calculations.

20. February 2022 at 08:50

Japan’s income velocity is .55. U.S. income velocity is 1.12. Japan’s deposit insurance is unlimited for transaction accounts. American’s is $250,000 per account. Banks don’t lend deposits. Deposits are the result of lending.

20. February 2022 at 11:10

Bonds don’t take money out of the economy.

People choosing not to spend their money entirely independently of the concept of government bonds is what takes spending pressure out of the economy.

In that sense we can see financial saving as voluntary taxation. It stops money circulating.

If we stop selling bonds people will still choose not to spend their money for insurance and status purposes.

That is one of the vital concepts of MMT that makes it different from traditional Keynesianism. MMT doesn’t see interest rates on what is called the vertical money channel (public to private spending) as having any material effect on proceedings.

Instead it is driven by the private choice to save financially in the currency of issue, which is mostly for reasons other than interest rates.

If you confiscate people’s savings via taxation (the usual tax the rich argument), then they will tend to save more – because they want to hold it for insurance and status purposes. That then reduces spending pressure below that required and you get a recession.

21. February 2022 at 02:27

Before you consider Sumner’s great replacement theory, just remember that this is the same guy who quoted CNN over the least 6 years, especially during the four years of the Trump presidency.

https://www.theguardian.com/media/2022/feb/13/cnn-jeff-zucker-chris-cuomo-fox-news

You know its bad when the guardian – not a very moderate paper – calls your news “tabloid journalism”.

Sumner has not only echoed CNN sentiments throughout the BLM burnings, which is to say they were all lovely and wonderful people, but he is also the same guy who watched CNN’s fear mongering death counter and wrote 10 posts in the span of two weeks lamenting America’s individualism and lack of obediance towards government. He wrote another post titled “Trump Kills Americans to look good, no kidding!”, in which he tries to convince his readers – bizarrely – that Trump really wants to kill the American people.

This is the same guy who – without any evidence – tried to blame the pandemic on Thailand and Laos in posts titled “Did Covid originate in Laos”, and “Did Covid originate in Thailand”?

And this is the very same guy who boasts when China scores a political or economic victory over the United States, which one can read in posts:”Once Again China to the Rescue”, “Good News it looks like a big win for China”, “How are those china crash predictions working for you”, and in a post titled “Random Thoughts” in which he tells his readers that TikTok’s rise to power is a “Christmas Gift” to the world, despite many countries banning its service over privacy violations.

Whatever Sumner proposes – do the opposite!

21. February 2022 at 11:11

Charles Evans, president and chief executive officer, Federal Reserve Bank of Chicagore: “The inflation path certainly didn’t follow the hallmark characteristics of the Friedman–Phelps narrative or many other models in which monetary accommodation slowly generates inflation”

The FED doesn’t know money from mud pie. And we knew this already:

http://bit.ly/1A9bYH1

Nobel Laureate Dr. Milton Friedman famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

22. February 2022 at 06:08

thugboy sumtard and his pet Trudeau are attacking old woman now, because they donated $50. March 1st bitch boy, we suffocate Washington like a boa contrictor.

End the mandates & return people’s money.

https://www.newswars.com/canadian-mp-details-how-struggling-single-mothers-bank-account-has-been-frozen-by-trudeau-regime/

Punk!

22. February 2022 at 14:36

There aren’t different types of broad inflation. But we are definitely headed for peak oil. Broad inflation, contrary to Charles Evans, always results from monetary policy blunders, a rate-of-change in monetary flows, volume times transactions’ velocity, greater than the roc in real output.

Contrary to Powell’s transitory remarks in April 2021, the distributed lag effect of money flows has been a mathematical constant for > 100 years. Severe shortages of both goods and labor in supply chains, are the direct result of these policy errors.

Contrary to the FED’s accountants, RPs add reserves, RRPs drain reserves.

link: Daniel L. Thornton, Vice President and Economic Adviser: Research Division, Federal Reserve Bank of St. Louis, Working Paper Series

“Monetary Policy: Why Money Matters and Interest Rates Don’t”

bit.ly/1OJ9jhU

Interest Rate Swap Spreads are compressing, not decompressing. The FED has already tightened monetary policy via O/N RRPs, and inflation is about to decelerate.

23. February 2022 at 03:48

‘Tacticus, What do you mean by a 5-11% forecast? Do they allow a wide range?’

Yes, one predicts a range. It does not need to be linear, like 5-11%, either; it can be a multimodal forecast, too.

I’ve moved my forecast up to 6-12%.

23. February 2022 at 06:37

Tacticus, thanks for your recent comments–I should bump my Hypermind bet up a little bit.

Based on some of the messages I see from participants on Hypermind many people do not grasp the difference between “R” and “N”—so I think the median forecast position for ’22 is being dragged down considerably.

The wisdom of crowds kept Barnum in business.