Is China actually growing rapidly?

There continues to be a great deal of skepticism about whether China is actually growing at 6.5%/year. Here is China expert Michael Pettis, in a blog post from January of this year:

The Chinese economy is not growing at 6.5 percent. It is probably growing by less than half of that. Not everyone agrees that the rate is that low, of course, but there is nonetheless a running debate about what is really happening in the Chinese economy and whether or not the country’s reported GDP growth is accurate.

The reason for the widespread skepticism is the disconnect between the official data and perceptions on the ground. According to the National Bureau of Statistics, China’s economic growth in every quarter last year exceeded 6.5 percent. While that is much lower than the heady growth rates China has experienced for most of the past forty years, it is still, by most measures, a very brisk rate of growth.

And yet, when you speak to Chinese businesses, economists, or analysts, it is hard to find any economic sector enjoying decent growth. Almost everyone is complaining bitterly about terribly difficult conditions, rising bankruptcies, a collapsing stock market, and dashed expectations. In my eighteen years in China, I have never seen this level of financial worry and unhappiness.

Pettis is very knowledgable about the Chinese economy, having taught at Beijing University for 18 years. So it’s obviously possible that he’s correct. But I just can’t make the pieces in the slow growth story fit. I see too many data points that don’t fit the picture he describes.

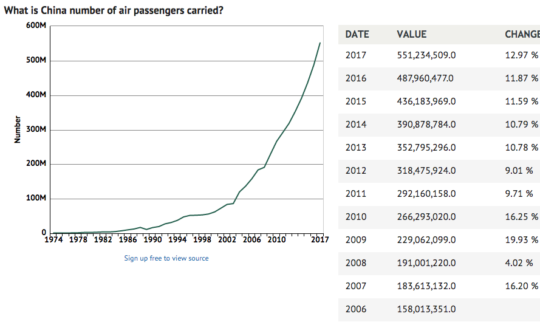

I will be traveling to Beijing later in the summer, and was just reading about the new Beijing airport, which will open in September. It will handle 100 million passengers a year, on top of the 100 million a year at Beijing’s “old” airport (which is also pretty new and is bursting at the seams.) So it occurred to me that the airline industry might be a good barometer of China’s growth. After all, it represents a cross section of tourism and business travel, a good barometer of a modern economy.

Of course I do understand that flying is a luxury good, and that air travel will grow faster than RGDP in a developing country. Nonetheless this data is pretty impressive:

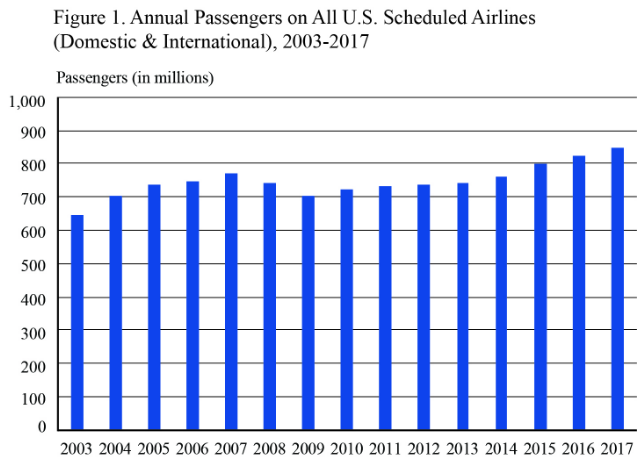

That’s way more impressive than the US, where RGDP has been growing at roughly 2%/year:

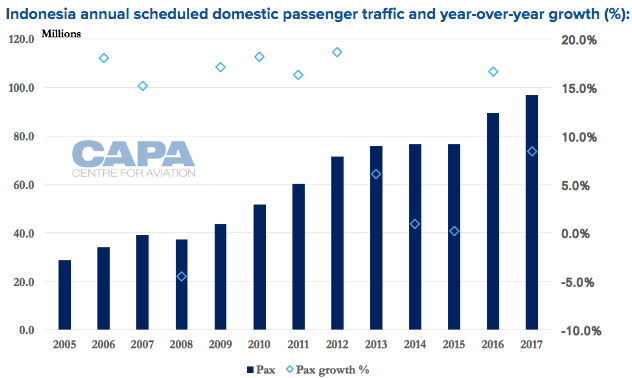

And it’s also a bit faster than Indonesia, another geographically large, populous, and fast-growing (5% to 6%) East Asian economy:

Now for some caveats:

- I would have normally expected the gap between China’s and Indonesia’s airline growth to be even larger. After all, while today China is growing only slightly faster than Indonesia, in the 2000s and early 2010s it was claiming to grow considerably faster. That surprisingly small gap supports Pettis’s argument.

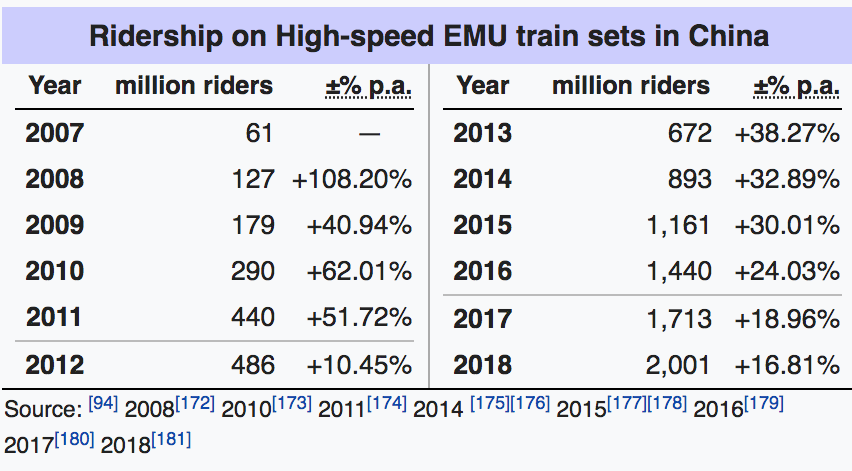

- Cutting the other way is the fact that China’s high speed rail network has exploded during this period:

Two billion riders in 2018! I recall commenters a decade ago telling me that the Chinese would not be able to afford to ride these trains. It seems plausible that at least 10% of that travel is on long routes such as Beijing-Shanghai (roughly as long as New York to Chicago.) That’s important because in both the US and Indonesia, flying is basically the only way for most people to quickly move that sort of distance. So while Indonesian air travel has increased 2.5 times from 2007-17, and Chinese air travel has increased 3-fold, the combination of Chinese air travel plus long trips on high speed rail has probably increased at least 4-fold, if not more. That is consistent with China growing quite a bit faster than Indonesia.

Admittedly, the Pettis quote (from January) referred to the recent past, presumably economic conditions in 2018. But elsewhere I discovered that 2018 was another boom year for Chinese airlines, with traffic rising another 11.4% to 610 million.

Is it possible that the airline passenger numbers are just as “fake” as people allege the GDP numbers to be? Anything is possible, but think how big the conspiracy would have to be. Are the airport passenger numbers also faked? Is Beijing airport not actually handling 100 million passengers a year? Are Boeing and Airbus faking their claims to export hundreds of jets to China? How deep would this conspiracy have to be?

To be fair, Pettis doesn’t make that argument, and indeed specifically refers to sectoral data in support for his claim that Chinese growth has slowed sharply. Perhaps there are sectors that support that view. But it seems to me that if there truly were a major slowdown then you’d expect it to show up in the airline passenger data for 2018. Airline travel is a cyclical industry.

I look forward to my first visit to China since 2012, and will report back on what I see.

To summarize, based on the above I doubt that actual Chinese growth is more than 1% below the reported figures, at least up through 2018. Of course it’s possible that things have changed in 2019; if so I expect that to show up in upcoming airline travel data for China.

PS. Pettis also has a post arguing that China’s large purchases of US debt do not represent a weapon that they can use in trade negotiations. I agree with his basic analysis, although I differ with his view that a smaller US trade deficit helps the US economy.

PPS. This Econlog post provides additional evidence that China is growing rapidly.

Tags:

2. June 2019 at 18:38

Scott, I have been meaning to ask you about Chinese interest rates. I believe you said before that interest rates tend to be related to NGDP. I was surprised to see on this website

https://www.koyfin.com/gyld

that Chinese interest rates were so low: 2.57% for 1-yr and 3.31% for 10-yr. Are those rates right and, if so, how could those interest rates be consistent with 6% RGDP and 6+(infl?) NGDP growth?

2. June 2019 at 21:32

People have been talking about a China bubble for over a decade now. Remember all those articles about ghost cities that came out years ago? Wish someone would follow up with these places and see if they are still empty.

2. June 2019 at 21:33

BC, The Chinese financial system is heavily distorted. I’d add that low global rates also tend to depress Chinese rates.

3. June 2019 at 03:03

I have read the suggestions that the Chinese growth rates are much lower than the reported figures for roughly a decade now, since the time when many observers were impressed by the lack of recession in China in 2008. If the Chinese would have faked their growth data for 10 years, adding (as many say) 3-4% to their growth ‘on paper’ we would have looked at the Chinese economy being 30-50% bigger on paper than in reality. There is no way to hide a difference that stark

3. June 2019 at 03:55

Scott,

Between 2010 and 2015, US iPhone sales increases at an annual compounded rate of 50%. Does this imply that use GDP grew at high rate?

3. June 2019 at 07:11

Scott,

Doesn’t focusing on just airlines take a relatively myopic view of Chinese growth? What about other cyclical sectors?

3. June 2019 at 08:12

If someone (or the government) buys a ticket but does not show up, do the statistics accurately exclude them?

3. June 2019 at 14:32

“PS. Pettis also has a post arguing that China’s large purchases of US debt do not represent a weapon that they can use in trade negotiations. I agree with his basic analysis…”

It’s frustrating that any serious attention gets paid to this idea. The bonds are non-callable so there’s nothing they can do except shop elsewhere and push competing money back into US bonds. It’s like trying to drain one end of the pool by removing water with a bucket and dumping it into the other end.

Enjoy the trip to China!

3. June 2019 at 16:36

Randomize

Ditto! To anyone with even a vague inkling of how financial markets work, what you and Pettis say is totally obvious.

Even if they had a put (not a call) option on the bonds, what are they are going to do with money? There is no place else where you can park 3 trillion dollars.

3. June 2019 at 19:02

Benny, Some are still empty, most are not.

dtoh, I’d suggest you reread the post, I answered that question.

Derrick, Read the Econlog post I linked to.

4. June 2019 at 03:39

Scott,

It’s not a question of luxury goods. It’s a question of marginal supply and demand intersecting at point in the curves where both curves are pretty flat. And when that happens I don’t think you can assume that there is even a positive correlation with RGDP growth.