Inflation has averaged 2.14% over the past 4 years

Yes, I know that that is CPI inflation, and the PCE inflation rate (1.74%) has undershot the Fed’s 2.0% over the past 4 years. That’s not my point.

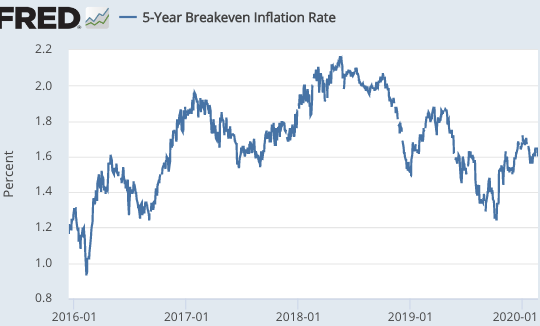

Rather, I’d like to revisit some criticism I got in the comment section over the past 4 years, when I began to argue that TIPS spreads seemed slightly biased by a liquidity premium. Because conventional Treasuries are slightly more liquid than TIPS, it seems that investors are willing to accept a slightly lower rate of return on Treasuries. Thus the TIPS spread slightly underestimates the market’s expected rate of CPI inflation.

Over the past few years, 5-year TIPS spreads have averaged about 1.7%. Because TIPS use the CPI to adjust for inflation, it is appropriate to look at the CPI when judging the accuracy of TIPS forecasts. (If you are not paying attention, this is my “I told you so” paragraph.)

On the other hand, the Fed targets PCE inflation, which tends to run below CPI inflation. Because the TIPS tend to underestimate CPI inflation, but CPI inflation runs higher than PCE inflation, these two biases partially offset.

In my view, the TIPS spread is actually a pretty good predictor of future PCE inflation, although if anything I think it probably slightly underestimates future PCE inflation. In other words, the TIPS spread may underestimate CPI inflation by a bit more than the CPI overestimates PCE inflation.

If I had to guess, I’d say PCE inflation is likely to average about 1.7% over the next 5 years, even though the TIPS spread suggests only 1.6% for CPI inflation. The consensus of private sector forecasters is for 2.0% PCE inflation during 2020-24, but they’ve pretty consistently overestimated inflation for a decade. If you assume that the TIPS spread implies roughly 1.3% PCE inflation, then my prediction is roughly half way between the market and the survey forecast.

Tags:

23. February 2020 at 16:19

Wrong. Sumner. Again.

Here’s why: inflation may have averaged 1.7% a year over the last four years but the variance is wide. Meaning: unless you live according to a very narrow set of rules, your inflation is likely much higher.

Your inflation is much higher than the government numbers if you are: In college; Have high interest student debt; Looking to buy a home; Pay for own health care insurance; Have high interest credit card debt; Live in a high-rent city

Source: https://moneymaven.io/mishtalk/economics/how-closely-do-you-match-the-purported-cpi-ONAGUtDguEWzOkyt4IzYKQ

23. February 2020 at 18:11

Ray, LOL. You don’t even know what this post is about.

23. February 2020 at 18:57

@Ray: “the variance is wide. Meaning: unless you live according to a very narrow set of rules, your inflation is likely much higher.”

No. That’s not what “the variance is wide” means. It does not mean that most people are likely to experience “much higher” inflation.

23. February 2020 at 19:47

I will correct this quote from Scott Sumner; corrections are in brackets:

“The consensus of private sector forecasters is for 2.0% PCE inflation during 2020-24, but they’ve pretty consistently overestimated inflation for [the last four] decade[s].”

The coronavirus scare may yet again undercut inflation and interest rates—a variation of any number of scenarios in the last four decades that have resulted in secular disinflation globally, and then ultimately deflation in some economies.

Some very intelligent and prominent macroeconomists of the last forty years—-Martin Feldstein and Paul Volcker come to mind—-spend the better part of lifetimes warning about pending higher inflation and interest rates. Jim Grant of “Grant’s Interest Rate Observer” has been as wrong as a pickled onion in a banana split since the 1970s.

Why? What is the basic flaw in orthodox macroeconomics that so undercuts its utility in regards to inflation and interest rates?

24. February 2020 at 01:44

@Don Geddis – good to see you’re still here, the same old foggey as before. I envision you as a Humpty Dumpty shaped senior who has the laughable tenacity to argue with experts over something that their travel guide says despite knowing nothing about the subject matter. I can envision you talking to some expert in Vatican art and saying “But it sez right here in my reader’s guide that Mike Angelo carved David from a single block of the finest marble…”. Do try and understand statistics better, and standard deviations.

@ SSumner – never forget I have an IQ of at least 120. I know more than you do about your post. Consider what would happen in your worldview if inflation is not a ‘single number’ but rather a range, depending on the class of person. For a person living at the poverty level, it might be negative. For the shrinking middle class, it might be 2.14%. For the 1%, which controls half the wealth in the USA, and which I’m a member of, it might be 10%. What does this do to your vaunted ‘money illusion’ and ‘sticky prices’ theories? Given that the 1% consume less but invest more than the average Joe, given that they control half the wealth in the country, and 10% inflation would be more important to them than deflation to the poor? Time to discard your obsolete ideas formulated by right-wing economists who were attempting to differentiate themselves from left-wing Keynesians. These obsolete battles have no place in today’s modern economy.

24. February 2020 at 05:35

I am not entirely sure what this post is about either. I think it is about how close the Fed has been to matching its target and what instruments we should look at to assess market’s forecast.

I think the Fed as an institution, as I mentioned in another post, tends to be overly cautious—-the PCE ex F&E has averaged about 1.5% -1.6% over last 10 years——with an almost cap at 2%. Reading on 1/31/2020 was 1.6%.

This is why observers believe if they cannot hit their target they “have no more ammunition” left or “they have a perpetual tightening bias”.

Before I began reading Scott, I believed the former——now I believe the latter. Not saying SS believes or does not believe that, but I do.

As a sidebar—-before one kicks Ray too hard—-I do wonder if the measurement of reality is correct—-and if not—-what are the implications of that for Fed Policy.

Without defining “correct” —-the CEPR (Dean Baker) argues that given how housing is measured——the forces driving it are different than the rest of what is in PCE. So he would exclude food, energy and housing in core inflation. Under that scenario the Fed is lagging its target by even more.

Not suggesting it is the right way to look at it——but I assume “reality” matters.

24. February 2020 at 07:42

Michael, You said:

“but I assume “reality” matters.”

Nope. The Fed is targeting measured PCE inflation, not actual inflation, whatever that is. (And the term ‘inflation’ has never even been properly defined, so there is no “actual” inflation.)

If you proved that actual inflation were 7% while PCE inflation is 2%, then the Fed would respond, “OK, then we are targeting actual inflation at 7%.”

24. February 2020 at 09:53

@Ray: “Do try and understand statistics better, and standard deviations.”

Alas, I already do. And you got it wrong. I was merely pointing out your error.

24. February 2020 at 10:11

I get that markets can reflect predictions of future outcomes, but presumably that included a market view about what the Fed will do. How can the Fed then use the markets’ second guessing it to set it’s instruments?

24. February 2020 at 12:39

Thaomas, That’s the “circularity problem.” The Fed needs to estimate the market forecast of the instrument setting that leads to on-target inflation.

Right now the markets are forecasting below target inflation and falling interest rates.

24. February 2020 at 12:40

I understand the “reality” concept, as a generality, and agree we only have an operational definition of inflation.

But Baker raises the issue of what in markets we all know as basis risk. The idea would be, if a component is a different style of measurement—-which he claims housing component is—-and which the Fed already concedes with food and energy——then it should be ignored for targeting (it is not important if Baker is right or wrong on housing——just an example of an idea the Fed already accepts with F&E).

So—-what if there is some “unknown” which exists outside the measurement system——but has a real impact on the success of Fed policy (as claimed by Baker re: Housing—-but because it is misunderstood—-even though “inside).

Even if that is too many derivatives (I.e.teeny-tiny) away from important, Baker’s housing concept seems relevant

25. February 2020 at 07:08

Michael, It’s relevant if it helps predict future measured inflation, which is what the Fed cares about.