I’m “not sure” if higher rates are inflationary

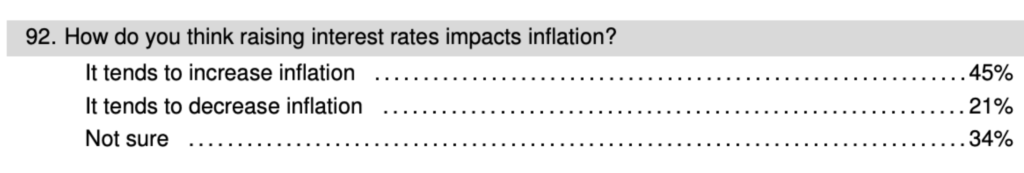

Economists are split between mainstream economists who believe that higher interest rates are disinflationary and NeoFisherians who believe that higher interest rates are inflationary. The public is also split on the issue:

I’m in the “not sure” camp, or more precisely “it depends”. If the higher interest rates are caused by a monetary policy change that causes the spot exchange rate to appreciate (as in Dornbusch overshooting), then it’s deflationary. If the higher rates are caused by a monetary policy that causes the spot exchange rate to depreciate, then it’s inflationary.

Most economists believe that higher interest rates are deflationary, at least in the US. So why does the public disagree? I see two possible explanations:

1. Maybe the public is NeoFisherian. They notice that inflation is higher when interest rates are higher (1960s, 1970s), and lower when interest rates are lower (1930s, 2010s.)

2. Maybe the public is thinking about the fact that higher interest rates make it more costly to finance the purchase of cars, homes, etc. In other words, they define “inflation” differently from the way economists define inflation.

Any other theories?

PS. Can we safely ignore public opinion on monetary policy? That’s one thing I am sure about. The answer is YES. Most of the public (not you guys) doesn’t have even a clue as to what monetary policy is.

Tags:

2. February 2022 at 11:52

US 2yr yields really began their rise on September 21st. They’ve since gone from 20bp to 116bp.

Over the same time frame, 10 year inflation expectations have gone from 2.3% to 2.4%.

The question is clearly an oversimplification.

2. February 2022 at 12:46

Note that the questions reads “raising interest rates” not “rising interest rates”. The former is more likely to be interpreted as “changes in the central bank policy rate, ceteris paribus” which would explain why economists would generally be in the 21%. Given the wording, I would put myself in there. If the question read “rising (or higher) interest rates” then I would be with you.

2. February 2022 at 12:56

“Can we safely ignore public opinion on monetary policy?”

I know that it’s not really a contradiction but I am a little amused to read that on a blog featuring a (Hypermind and Mercatus sponsored) US NGDP forecasting challenge.

(And I can unfairly caricature Fed thinking in 2007/2008 – “We can safely ignore public markets’ opinion on monetary policy.”)

2. February 2022 at 12:56

“the public” is defined as the 80% who have jobs and vote.

inflation is despised, and supremely politically powerful, bc it hits all of them. Inflation is a tax but folks can think of it as cost of securing funds (like a safety deposit box or a vault), something PRICE LOW ENOUGH THAT DOESNT FORCE THEM TO ACT IN WAYS THEY DONT WANT – 2% is “acceptable” bc thats what Fed can get away with without the 80% freaking out and it becomes a voting issue.

Note: ‘being concerned with inflation’ (everyone with money is concerned) doesn’t make it a voting issue. It becomes a voting issue after something like 2%.

ALSO NOTE: Econos can’t goose inflation to “nudge” the Economy, bc the political consequences of people having to do what they don’t want – “I don’t want to do X just bc prices are soaring” outweigh the gains.

Ultimately inflation isn’t a tool for Fed, it’s an extra tax everyone with a job will put up with at low levels, at high levels, they will throw the govt out.

2. February 2022 at 12:57

https://new-wayland.com/blog/interest-price-spiral/

2. February 2022 at 14:08

When the Fed issues forward guidance that indicates an intention to tighten policy and I see long-term interest rates rise, with stock prices falling in proportion to the interest rate increases, I think it’s a good indication policy has tightened. It is also a good indication the Fed is not expected to overdo the tightening, as the Fed sees it, because otherwise I’d expect longer rates to fall.

Of course, I see this as unfortunate news as it means there might not be as much bounce back in the real GDP growth path as I expected. Hence, I have to start asking whether I was wrong about potential real GDP being higher for many years, or is it some combination of the pandemic having damaged the economy more than expected and/or the recovery taking longer than expected.

2. February 2022 at 14:09

Scott,

Which Dollar spot exchange rates do look at? One of the Dollar indexes?

2. February 2022 at 14:23

Classical, Yes, but you can raise interest rates with either an expansionary or a contractionary monetary policy. In January 2015, the Swiss cut rates with a tight money policy, for instance.

Brent, As you know, public opinion and market opinion are two very different things.

Michael, I don’t tend to look at those markets, but when I have it’s the euro/US dollar forward market I look at most.

2. February 2022 at 15:06

Here’s Stephen Williamson’s explanation “One way to think about this…is to think how an increase in the nominal interest rate affects the opportunity cost of holding money. Obviously, the opportunity cost rises. When it does, people are compelled to economize on their money balances. Of course, collectively, people cannot get rid of their money balances and so what you get is a sort of “hot potato” effect — the price of goods that people are willing to sell for money starts to go up, that is, the purchasing power of money has to fall, because people are trying to economize on their money holdings. And, if you combine that intuition with the fact that, for an interest rate target the Fed must be accommodating money demand, then you’re done. That is, while the demand for real money balances goes down, the *growth rate* in the supply of *nominal* money balances must go up — the Fed is accommodating the nominal demand for money that comes along with a more rapidly rising price level.” What do you think of this explanation? It seems to implicitly assume that for a pegged nominal rate there will necessarily be convergence towards the rate peg minus the real rate; as to the validity of that assumption I am clueless.

2. February 2022 at 15:44

It depends on many factors IMO. how high a rate are we talking? Balances of trade, supply and demand of things etc.

As an input to the forward pricing formula, then those commodities will be more expensive in the future. Housing prices may decline, but financing is more expensive – maybe this is neutral, lower or higher depending on the interest rate structure. Financing inventories is more expensive at higher rates.

Erdogan is a NeoFisherian guy, but I think his mistake is that Turkey is a net importer of key things like food – so what is the interest rate level that keeps the currency stable – higher lower?

John Cochrane (Grumpy Economist) had a good post on this (via Nick Rowe) back in 2014:

https://johnhcochrane.blogspot.com/2014/11/the-neo-fisherian-question.html

2. February 2022 at 16:46

All of this, the last couple posts and comments is just re-hashed arguments.

The only NEW thing we have for a youngish audience to realize why Fed hates inflation so much – bc voters all hate inflation, and only a small number need jobs.

The new info is the bit that lets everyone re-jigger the rest of their analysis. Everyone who thought it was worth it, finds out it doesn’t what they think is worth it, all that matters is what it does to political fortunes.

2. February 2022 at 21:34

Oh, the arrogance. The excessive hubris is on full display again.

The public can be “ignored”.

They are those wortheless pesky truckers & farmers, no nothing fools, and plebians.

While many of them have never taken a course in “economics”, (just like you have never taken a course in truck driving or farming) they do feel the effects of YOUR bad policy.

And YOUR bad policy, and YOUR terrible ideas, doesn’t make their life better.

Stop IGNORING the public.

https://twitter.com/DTeplitzer/status/1488393319709216771?cxt=HHwWhsCotdT16qcpAAAA

2. February 2022 at 22:17

the old scrawny commie is getting nervous.

https://naturalselections.substack.com/p/the-cavalry-rolled-in?utm_source=substack&utm_medium=email&utm_content=share

We got you, you son of bitch.

Call the WEF….tell your boyfriend Schwab that we no longer take orders from him.

2. February 2022 at 22:57

Every Tryant that ever lived “ignored the public”.

What is doubly bizzarre is that Sumner is the public. He is a middle class guy, with relatively little money. He is in esssence, ignoring himself. Because nobody – other than the general public – is going to protect Sumner. When the mob comes, he’s dead. (radical left or radical right). Both will eliminate him. He’s not an “essential” elite.

The only difference between people like Sumner and the people who detest globalizing is who benefits. Sumner benefits from propagating globalist nonsense, as do most urban inner city workers.

But the rest do not. And the concentration of wealth from economies of scale creates a new kind of tyranny, one where MNC’s are more economically powerful than nation states. A new system whereby the tyranny of the consolidated market now merges with the tyranny of centralized government.

Ignore them at your peril! History has shown that stategy won’t end well.

2. February 2022 at 23:11

Indeed Ankh,

And that is precisely what happened in Russia, China and Germany. The scholars thought that if they aligned themselves with the elite and ignored the public, that it would save them from persecution.

The intelligent one’s, like Einstein, new it wouldn’t. But the one’s who stayed soon found themselves hiding, inprisoned or dead.

2. February 2022 at 23:51

Sumner thinks the “public” is stupid and should be “ignored”.

https://www.wionews.com/world/how-a-us-hacker-took-down-north-koreas-internet-in-a-revenge-cyber-attack-450032

Sumner could study for three hundred years and not be able to pull off what this guy did between snacks, football games, and probably – TRUCKING!

3. February 2022 at 00:12

Is this a serious question?

And from a guy calling himself an economics?

The public doesn’t give a shit about the Fed and their interest rates.

What they care about is purchasing power. If they have to use half their check to pay for gasoline and beef, then little stupid theories and policies aren’t working for them.

And no, the alternative is not weeds and worms, or growing it in a lab.

All the public asks for is fiscal responsibility and liberty. Stop regulating their small businesses, and flooding the market with money!

3. February 2022 at 00:57

“Ignore the public opinion”… (idiots & wortheless losers)

“Not you guys”… (is that because economists are a special group of philosopher kings?)

Hmm….That mindset is very revealing.

3. February 2022 at 03:12

thugtard Sumner refuted by Johns Hopkins.

https://www.newswars.com/new-johns-hopkins-study-lockdowns-have-had-little-to-no-public-health-effects-and-imposed-enormous-economic-and-social-costs/

America’s great truckers now headed towards Washington.

Sumtard doesn’t want to listen; he wants to ignore the hard working men and woman. But we’ll make him listen.

Bring out the gallows boys.

3. February 2022 at 05:03

Related to a prior post, David Beckworth is making the case on twitter that FAIT is asymmetric (to the upside, of course). Wouldn’t this make the future inflation rate unknowable? What effects would that have?

3. February 2022 at 06:47

The “public” in this case is not casting aspersions on all people who are not economists – it is only recognizing that people who do not have economics training might answer the given question differently.

I have an education and job that technically places me in the “economist” bucket (non-academic) – but if I were asked, lets say a medical field survey question – then I would be the “public”.

3. February 2022 at 07:08

Interest is the price of credit. The price of money is the reciprocal of the price level. Thus, the money stock can never be properly managed by any attempt to control the cost of credit.

As Scott Grannis says: “supply and demand shocks can only affect the prices of some goods and services, but not the overall price level. If all, or nearly all prices rise, that is a clear-cut sign of an excess of money relative to the demand for it. That is how inflation works.”

The investing public is concerned with real interest rates, not nominal interest rates. In contrast, the government would prefer to get a free lunch.

3. February 2022 at 08:35

Scott, I think your explanation #2 is more relevant for how the public perceives a link between interest rates and inflation–if we perceive any link at all! I remember riding the refi train down the mountain from 2010 through 2013ish. I was happy to be paying less per month with each drop, but I don’t recall making any comparisons to other price levels–probably because general inflation during that period was so muted.

Over the next 10 months, explanation #1 might start to be more relevant as borrowing cost pick up and price levels remain stubbornly high in some categories. But of course, inflation is mainly experienced, and complained about, at the gas pump and the grocery store. Price drops are never discussed or noticed, except when we boast about getting a great deal on chicken wings.

3. February 2022 at 08:48

Tristan, That’s one possibility, but there are others where policies leading to higher rates are disinflationary. Think of higher IOR. Or high rates produced by open market sales. In other words, never reason from a price change (or an interest rate change.) “Are higher interest rates inflationary?” is no more a valid question than “Are interest rates inflationary? High interest rates produced how?

Effem, Anything is possible, but I’d rather wait before jumping to conclusions.

David, I agree about explanation #2

3. February 2022 at 10:20

Scott,

I doubt the public sees this distinction, but the question asks about “raising” interests rates rather than “rising” interest rates. I think it would be a more interesting question if it said “rising” but it didn’t. I think the most reasonable way to read this question is what happens when the Fed announces that it is increasing interest rates.

3. February 2022 at 10:38

Rinat wrote: While many of them have never taken a course in “economics”, (just like you have never taken a course in truck driving or farming) they do feel the effects of YOUR bad policy.

Still, it would be nice if a basic intro to economics was required for high school students. Supply and demand would be a great start. If nothing else, they could recognize political, demagogical BS.

3. February 2022 at 10:44

ssumner asks why the public says high interest rates are inflationary.

Are you sure about that? Anyone who reads mainstream news hears over and over again how high interest rates will cause a recession.

Maybe they didn’t understand the question.

3. February 2022 at 10:52

Fortunately we have a real experiment on this issue, Ergodan and Turkey. So far, lower interest rates are inflationary. Oops.

3. February 2022 at 10:53

“Any other theories?”

It’s kind of what you wrote in your PS already. The public and like 99% of politicians don’t even understand the question in the first place. This is true for Germoney – and the US won’t be much different.

And you are not really in the “Not sure” camp. “It depends” is obviously not the same as “I’m not sure”. You are 100% sure.

And the question says “raising” and not “rising”, so I agree with bb on that one.

3. February 2022 at 13:34

These have got to be paid trolls right? How can one blog pick up 5-10 trolls all on the same bizarre message on every post? And if so, what does this say about the world? Is Russia trying to somehow disrupt U.S. monetary policy by commenting on Sumner’s blog??

3. February 2022 at 18:10

BB, Either way, I’d say the answer is that it depends how the central bank raises interest rates.

Anonymous, Maybe I pay them. 🙂

4. February 2022 at 00:22

Scott,

“Most of the public (not you guys) doesn’t have even a clue as to what monetary policy is.”

What riles me more is that a great many investment advisors and finance people don’t seem to understand it either, because I always and ever only read opinion based on the “conventional” view. Not to mention howlers such as “investors sold off stocks today” (where to? a black hole? ahhhh, other investors. Ah well.)

4. February 2022 at 06:48

Isn’t the way to think about essentially that interest rates are effectively the price of money? Thus, when the price of money goes up, demand for money goes down as in an Econ 101 supply/demand graph. Since there is less demand for money, the general price level in the economy goes down.

Or is this totally dumb?

4. February 2022 at 10:38

mbka, Also “money went into the stock market”. Is there a box on Wall Street where they keep the money? Or do they mean “transactions”? Like October 19, 1987 when there were record transactions? Did money go into the market on that day?

Derek, I prefer to think of interest rates as the rental cost of money (currency). I think of something like the inverse of the price level as the price of money.

And when the demand for money falls, velocity rises and the price level rises.

5. February 2022 at 10:22

ssumner, in reply to mbka, asks: Is there a box on Wall Street where they keep the money? Or do they mean “transactions”? Like October 19, 1987 when there were record transactions? Did money go into the market on that day?

Rhetorical questions? Investors direct money to the stock market and bid up prices. In 1987, money exited the stock market, reflected in lower prices.

6. February 2022 at 08:42

Vince, You said:

“In 1987, money exited the stock market, reflected in lower prices.”

So let me get this straight. There’s a box on Wall Street where they keep the money. And money was removed from that box on October 19, 1987. Do you realize how silly that sounds?

When you sell a stock, someone else buys. It has nothing to do with “money leaving a market”.

6. February 2022 at 23:18

How is it silly? I have $100,000 in the stock market and I believe stocks are overpriced and real estate is a better deal. My take my money out of the stock market and move it to the real estate market. If many investors agree, stock prices decline and real estate prices increase.

We must be talking about different things.

7. February 2022 at 01:46

Vince… the money you took “out of the market”, was paid for by some other investor who put it “into the market”, by buying your shares. Not to mention… the market itself doesn’t hold any money. The money only passes through the market.

7. February 2022 at 09:46

It’s very common to say money is going into or out of the stock market. How does the S&P go up if money is not flowing into it?

8. February 2022 at 04:40

Vince,

the S&P is an average of prices (ask and bid), not of total volume sold. It’s entirely feasible that prices in any market multiply by 10 of what they used to be and transactions fall to zero. It’s entirely feasible that prices fall to 1/10 of what they used to be and transaction volume multiplies by 20. But besides all that: the money of any transaction does not go into the market. The money changes hands on the floor of the market, moving from the hands of one investor into the hands of some other investor. It does not go into the market. The market is not a bank. It is an interface of exchange. Yes, it is common to say money went into the market but it is still meaningless.

8. February 2022 at 10:06

Sure, for every buyer there’s a seller. Money changes hands, but the more hands, the more money.

If you don’t like “money going into the market”, how would you describe an S&P increase due to increased demand?

Some investors refer to a money flow index, with positive money flows and negative money flows.

Somewhat related is the inelastic markets hypothesis. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3686935