Government spending in rich countries

It’s widely known that governments in rich countries spend much more than governments in poor countries, even as a share of GDP. There are a number of possible explanations of this pattern. Perhaps rich countries choose to consume more government services, such as education, health care and pensions. Or maybe it’s hard to extract a lot of tax revenue in poor countries where corruption in endemic and many people are peasant farmers or unregistered small businesses. (The fact that the least corrupt rich countries (the Nordics) are especially adept at collecting tax revenue is suggestive.)

Today I’m going to look at a different question; what is the relationship between government spending and wealth among rich countries?

First I’ll list countries in order of government spending as a share of GDP. My sample includes all countries richer that the EU average (which is $31,673 per capita GDP (PPP) in 2011:

[Update: Commenter JN sent me data that is 2 years newer–I put it in parentheses. Most numbers are higher–reflecting the recession? Big swings like Ireland and Iceland might reflect the different timing of big bailouts. Take either series with a grain of salt.]

1. Singapore 17.0% (17.0%)

2. Taiwan 18.5% (22.4%)

3. Hong Kong 18.6% (19.2%)

4. UAE 26.4% (22.3%)

5. Qatar 27.0% (25.1%)

6. Kuwait 31.8% (35.8%)

7. Switzerland 32.0% (34.7%)

8. Australia 34.3% (35.2%)

9. Japan 37.1% (42.8%)

10. Luxembourg 37.2% (42.0%)

11. USA 38.9% (41.7%)

12. Canada 39.7% (42.9%)

13. Norway 40.2% (44.6%)

14. Ireland 42.0% (48.7%)

15. Germany 43.7% (45.7%)

16. Netherlands 45.9% (50.1%)

17. Britain 47.3% (49.2%)

18. Austria 49.0% (50.5%)

19. Finland 49.5% (54.1%)

20. Belgium 50.0% (53.4%)

21. Denmark 51.8% (56.0%)

22. Sweden 52.5% (51.3%)

23. France 52.8% (56.1%)

24. Iceland 57.8% (46.1%)

And here’s a list of the countries in order of income per capita (PPP, IMF)

1. Qatar

2. Luxembourg

3. Singapore

4. Norway

5. Hong Kong

6. United States

7. UAE

8. Switzerland

9. Netherlands

10. Kuwait

11. Austria

12. Australia

13. Ireland

14. Sweden

15. Canada

16. Germany

17. Iceland

18. Belgium

19. Taiwan

20. Denmark

21. Britain

22. Finland

23. France

24. Japan

A few observations:

1. Germany is a fairly typical rich European Country. Of the 15 countries richer than Germany, only three have larger governments (Austria, Netherlands, Sweden). Of the 8 countries poorer than Germany, only two have smaller governments (Taiwan, Japan.)

2. It appears that among the very rich countries of the world, the correlation between per capita GDP and size of government reverses. I can’t be certain, but I think this is even true if you exclude the 4 petro-states (Norway, UAE, Qatar, Kuwait.)

3. Part of this reversal may be due to wealth causing less government spending. Once the basic services are provided, a gusher of oil wealth leads to more non-government consumption.

4. Part of this reversal may be due to high taxes reducing work effort. Many of the richest countries (excluding petro-states?) have both lower taxes and longer working hours.

5. What are we to make of the exceptions?

a. Some rich countries have policies that encourage female employment, despite high taxes. Sweden doesn’t have a marriage penalty discouraging wives from working, for instance, and provides lots of childcare. Others have quite market-friendly policies, despite the big government. This is especially true of the Nordics. Thgis might explain their relatively high productivity, despite high taxes.

b. One country on the list is arguably still developing. Taiwan will likely move into the richer group over time. Its relatively low level of income does not reflect a lack of work effort, but rather low productivity.

c. Japan is the real puzzle here. Like Taiwan, hours worked are pretty long, much higher than Western Europe. This suggests the Japanese workers are extraordinarily unproductive. Some might point to low female labor force participation. But that just means that Japanese females are very unproductive. You could argue that they are at home taking care of the chilren, except that they aren’t having any children.

6. This reversal of correlation at the top end often shows up in comparisons of similar neighbors. The US is richer than Canada, and has a slightly smaller government. Australia is richer than New Zealand, and has a significantly smaller government. Switzerland is richer than Austria, and has a smaller government. Norway is the richest of the Nordics, and has the smallest government. Belgium is ethnically part French and part Dutch, and both its size of government and its wealth is midway between the two. Spain is richer than Portugal and has a smaller government.

7. The East Asian rich tend to have small governments. South Korea was a bit too poor to make the list, but its government spends only 30% of GDP. It will be on the list quite soon. This pattern has huge implications for where the world’s biggest economy (no, not the US anymore) will end up on the list.

8. I predict that within a few decades the US will no longer be regarded as an outlier. It will no longer be regarded as a very rich country with a surprisingly small government.

9. Clinton said the era of big government is over. Obama seems determined to prove Clinton wrong. (Don’t ya just love it when progressives insist Obama is a centrist. Yes, he’s right in the center of progressivism.) This data has support for both sides. It shows that a country can be fairly rich, and still have a very large government. But it also suggests that if Obama pushes the size of government substantially higher, there may be a price to pay. We’ll still be rich, but not as rich. More like France than Switzerland or Norway. I’m not sure how voters would react to that outcome.

10. Sweden’s government is vastly larger than the Swiss government, and yet from an American perspective the two countries seem quite similar. Do both liberals and conservatives overrate the importance of big government? I.e. are conservatives wrong that it would wreck the economy, and are liberals wrong that lots more government spending would greatly improve quality of life? If so, why isn’t Switzerland a hellhole, and why isn’t Sweden poor?

Overall I don’t know if the sample is big enough to be statistically significant, especially without the petro-states. Taiwan would have a big impact–so maybe the results will be different in ten years. If anyone wants to do a regression and/or graph, I’ll add it to the post. If you could find data for government spending and hours worked, the correlation might even be stronger than for wealth.

PS. I could not find size of government data for San Marino and Brunei, which is probably just as well.

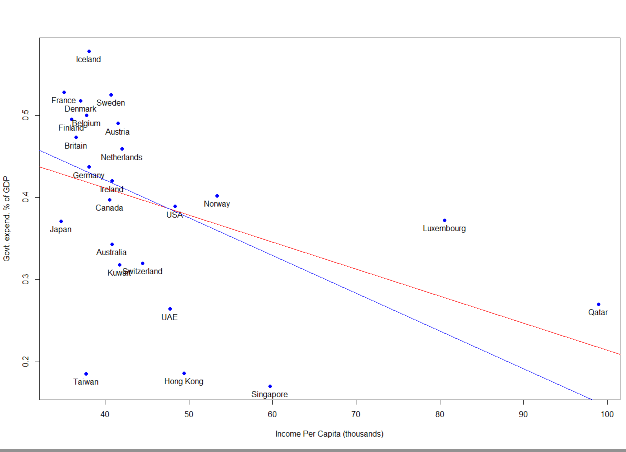

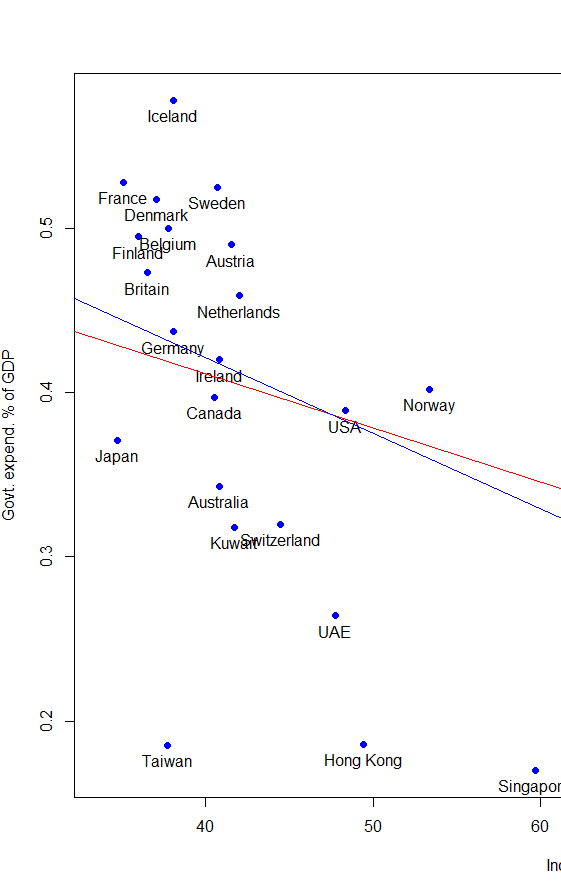

Update: Christopher Burgoyne sent me some graphs with trend lines. The blue line is without the petro-states and the red line is with them included. Even the without is distorted by Luxembourg. But if you look at the core countries and leave out the tiny outliers, it still looks slightly downward sloping to me.

Tags:

25. January 2013 at 06:26

A slightly different issue, but in same ball park: Revenues collected as % of GDP. One thing always stood out to me as someone who traded sovereign credit (and lived through many crisis) is how high the correlation is between low revenues as % of GDP and default.

Argentina & Russia had stunningly low Revenues as % GDP and if you look at Europe pre crisis the countries with lowest revenues were Greece, Spain, Ireland and Portugal.

Its not an issue of not trying to have high taxes necessarily or about the size of the government as % of GDP, but about collection and corruption.

25. January 2013 at 06:44

Scott,

The data is outdated.

According to Eurostat (http://epp.eurostat.ec.europa.eu/portal/page/portal/government_finance_statistics/data/database), France’s gov spending in 2011 was 56%, not 53, Ireland 48%, not 43%, Iceland 47%, not 58% (big difference), etc.

It changes the order and the correlation…

Apparently the Index of Economic Freedom index website was updated with the new figures (http://www.heritage.org/index/explore?view=by-variables).

25. January 2013 at 06:59

“I’ve been saying, that the former communist states are trying as hard as they can to go to where we were 50 years ago, whereas we’re trying as hard as we can to go where they were 10 years ago.”

[“Why?”]

“Because of the inertia and drive for power. It’s very hard to turn things around. The big problem with government, as Hayek points out, is that once you start doing something, you establish vested interests, and it is extremely difficult to stop and turn things around.” – Milton Friedman,

http://www.youtube.com/watch?v=uZq1_yDTpxU#t=1m20s

25. January 2013 at 07:03

Chris, Interesting data. Of course default is a very different issue from what I was examining. But it makes sense.

JN, Thanks for the data. Over the years I’ve noticed that no two sources agree on the size of government spending. I imagine that’s because in certain cases it’s tough to decide whether something is “spending.” For instance, should the TARP bailouts be included? I imagine something like that was involved in Iceland’s big number—your data seems more plausible to me for Iceland. But I’m a bit surprised about Ireland, given its low tax reputation.

I was also surprised how low Norway was–what do your figures show?

25. January 2013 at 07:13

GDP is the wrong denominator for Ireland, Scott.

25. January 2013 at 07:13

JN, I notice that almost all the countries had big jumps in government spending between 2011 and 2013. That obviously didn’t happen, so I wonder if they changed their definiton of government spending.

25. January 2013 at 07:43

This post had interesting figures regarding this subject:

http://worthwhile.typepad.com/worthwhile_canadian_initi/2012/11/one-of-these-countries-is-not-like-the-others.html

25. January 2013 at 07:45

Given that some of the countries here are city-states and some are avowedly non-militaristic, I really wonder how good of a list this is. For example, nice for Hong Kong to have 18% GDP spending, but how does that figure change if you were to adjust it for the security services provided by the mainland Chinese?

And military aside, this is a very dubious data set over which to build policy implication theses. It’s hard to understand what lessons can a country like United States, Germany or France learn from Singapore or Hong Kong. It’s equally hard to understand what an energy-resource barren Japan can learn from UAE or Norway.

There is just so much more to GDP/capita equation than the level of taxation and government spending. But maybe that’s what the hodge podge result and very weak correlation actually shows.

25. January 2013 at 07:50

I thought it was here that I read government spending as a share of GDP is a very poor measure of the “size of government”. I don’t think you can draw a lot of conclusions simply because government red tape doesn’t show up as spending in GDP. Also, high taxes to pay for a giant army will have very different effects than high taxes to pay for retirement benefits. I would likely only work less for the second one.

25. January 2013 at 08:00

Scott,

Just want to draw out something here. From the article you cited re: Obama’s agenda:

“With specifics not usually offered in inaugural addresses, Mr. Obama promised to preserve government health-care programs, expand rights for women and gay couples, and press for gun controls, overhauls of the tax code and immigration laws, as well as climate-change measures.”

All of these things definitely maintain or expand the role of government in the economy relative to the status quo. But the above metric you were using is spending, and somewhat ironically I think most of the items on that list don’t involve very much spending. You could probably institute a revenue-neutral carbon tax alongside other tax reforms most analysts would cheer and have large immigration and gun reforms that cost very little. The only major spending commitment on the list is preservation of existing health-related programs, and how much spending that represents depends largely on per-capita health expenditure growth, and there is no prima facie reason to think that greater government involvement in health care will lead to increased per-capita spending.

I suppose the point I’m trying to make is that government spending as a share of GDP is at best quite a poor metric for the size of government. By this metric, Alaska is a socialist paradise, whereas Dodd-Frank, which results in ~$80b in total cumulative spending over the next two decades, would barely register.

25. January 2013 at 08:11

I think there is an artifact in the data given rise to by the fact that the USA is being viewed as a single country rather than as collection of states, when it’s size in terms of geometry and population are incomparable to that of other nations. This is a very common distortion in country to country comparisons. When you weight the data by population, I think there will be a much less ambiguous relation between government size and wealth among wealthy countries. Also, the government spending % for the US is higher than I’ve seen it listed in other resources. See for example the much bigger gap between European and US in this data: http://en.wikipedia.org/wiki/List_of_countries_by_tax_revenue_as_percentage_of_GDP

25. January 2013 at 08:34

Trying to use any one metric to compare countries is a fools game. You have some places that are diverse economies like US and others that are oil companies pretending to be countries. Defense spending and demographics morph the data as well.

Most economist are loath to talk about culture and history but they play a huge role, as can be seen by Sweden vs Switzerland. Investors do factor in culture, and it’s the investors who often finance the debt and determine how large it can be.

25. January 2013 at 09:01

I would definitely exclude the middle eastern oil states. Each have national oil companies (government owned) that are big employers with high pay, not particularly efficient (no need to be) but, of course, make a ton of money, really because of their resource rights. Of course, they also represent a huge portion of GDP. For instance, in Kuwait 85% of the citizens (not residents) work for a government entity in some form, although some of them are profit-making entities that don’t “consume” any government spending.

25. January 2013 at 09:02

Japan’s service sector is extraordinarily unproductive. Noahpinion will certainly chime in.

It is a root canal everytime I have to deal with our Tokyo office. The culture in the services industry there has absolutely no connection to the famed productivity of Japanese auto and semiconductor manufacturing. Manual procedures are preferred over automation. Fax machines over email. It is a disaster.

25. January 2013 at 09:40

Scott

This old post dealt with changes in G/Y and growth and includes a few of the countries you consider.

http://thefaintofheart.wordpress.com/2012/04/22/it%C2%B4s-not-so-much-the-level-of-public-debt-but-the-weight-of-government-that-tends-to-slow-growth/

25. January 2013 at 09:42

Scott,

I’m not too sure about the definitions, but the Wikipedia link in your post seems to refer to the Index of Economic Freedom’s figures.

This index has been updated since then with figures closer to the Eurostat ones apparently (but not yet reflected on Wikipedia), including for Iceland.

I was surprised when I saw the figure for France in your post, as France is now always said to be closing in on 60%…

Regarding Iceland, Eurostat seems to show that it effectively was at 57.7% in 2008 (a jump of more than 15 points within one year…), before going back down to more “reasonable” levels in the following few years.

25. January 2013 at 10:25

Scott,

On Japan, I would be a bit skeptical of the IMF/World Penn table PPP measure. Since 1986, the actual JPY exchange rate has been “overvalued” by an average of 23%. Over this period, the market exchange rate has never converged with the IMF PPP rate. This is not the case for any other OECD economy. If the “true” PPP rate were closer to 95 than the 105 that the IMF is assuming, then Japan would jump past several countries on your GDP/capita list.

My basic point is that there is probably more uncertainty around Japan’s PPP rate than there is for the PPP rates for the UK, the euro zone, Canada or Australia. In these economies, there is a long-run relationship between the PPP rate and the actual exchange rate. For Japan, there doesn’t appear to be.

There are also other cyclical (AD) reasons for Japan’s poor standing. Hours worked/working age population plunged in 2008 and have barely recovery any of the drop. And productivity growth appears to have been hampered by a very low I/GDP ratio which, in turn, appears to be the result of a prolonged period of excess capacity. But of course these “real problems” can be revered, in part, by stronger NGDP growth!

25. January 2013 at 10:36

You could define “government” revenue and expense broader than just officially reported amounts. “Government” revenue and expense could mean all the money collected and spent by people who work for the government.

In that “government black market” formulation, government officials in patronage/corruption societies hoover vast amounts of money and spend it on their own glory or to sustain their influence peddling network. Think Putin, Mayawati, Teodoro Mbasogo, etc., although we’ve got that here at the margins: every U.S. cabinet secretary has his/her portrait painted at a cost of $50,000, anonymous bureaucrats command multiple bodyguards and police escorts to feel important about themselves, city council members on “trade missions” to Beijing?

25. January 2013 at 10:41

For a different perspective, try looking at per capita government spending (PPP adjusted) over the last 40 years. The USA, France, Germany, UK and Finland are very close together, forming a fairly narrow band on a graph. Sweden was inline with these other countries in 1970, before it diverged upward significantly, it has now nearly converged back to the other countries. The USA looks poised to start its own divergance having recently overtaken France, and most of the other major European countries.

25. January 2013 at 11:02

If the US. replaced government healthcare and elder welfare, with a compulsive, highly-regulated private system, we’d have a smaller government size, but about the same system. Conversely moving all healthcare to single payer would make government bigger without changing things very much. I wonder if the dichotomy is between the domination by oligopolies vs. centralized govt.

25. January 2013 at 11:27

I think the best use of numbers like these is to remind us that we know a heck of a lot less than we think we do, and should check our assumptions appropriately.

It’s funny how our government (and most other political entities) spends so much time and effort trying to make relatively small changes in the hope of getting positive results, when we can’t agree what results are desirable, how to get those results, what negative consequences there might be, whether those consequences are acceptable, etc.

For example, a quick Google search indicates that Americans spent $7.7 billion on tax preparation last year, and the tax preparer industry employs about 130,000 people. I believe those numbers don’t include personal finance software, and they certainly don’t include all the wasted hours of people like me who do their own taxes.

So the question is: Does fine tuning our tax code (Read: adding complexity) really benefit us? Could we not find something more productive to do with nearly $8 billion and 130K people?

And to return to the opening post: Is it really the “size” of the government that makes a difference? If it were possible to form a government which was completely efficient, it could represent 100% of GDP and that would be okay.

Of course history has taught us that governments are not efficient, and in fact are so given to inefficiency that we have to engage in a constant struggle to control their tendency toward self-preservation and growth at the expense of the citizenry they were created to serve.

So I would argue that the relative efficiency of a government is far more important than its size. In some cases a huge government is a symptom of inefficiency, but in others it reflects a desire to distribute national wealth derived from natural resources, or the desire of citizens for more government services at the expense of less personal income.

25. January 2013 at 12:31

I would argue to exclude those countries that are essentially one city. i.e. Singapore, Hong Kong, and Luxembourg. The economics of these countries are sufficienly unique as to not compare to countries with a little bit more land mass.

25. January 2013 at 12:36

By the way, did you see Nate Silver’s piece on the changing nature of Government spending a 60 year trend away from Defense, Infrastructure and Services and toward welfare and entitlements.

http://fivethirtyeight.blogs.nytimes.com/2013/01/16/what-is-driving-growth-in-government-spending/

25. January 2013 at 13:42

Everyone, I do know that government spending is not a good metric for total government involvement in the economy, as I indicated in the post. Many readers seemed to assume I was trying to make some sort of argument that I never made.

Bob, I think that’s right.

Alekseyev. You said;

“For example, nice for Hong Kong to have 18% GDP spending, but how does that figure change if you were to adjust it for the security services provided by the mainland Chinese?”

Much less than you’d think.

I agree that it’s tough to make comparisons between widely dissimilar countries. Still I found it interesting that the positive correlation between size of government and wealth seems to reverse slightly at the very top. Maybe others don’t find that interesting. Years ago whwen I predicted Singapore and Hong Kong would become very rich, almost no one believed me. Now that they have, the same people tell me that it’s meaningless. But is it?

Sam, Yes, that’s what I said in the post, isn’t it?

Squarely rooted, You said;

“I suppose the point I’m trying to make is that government spending as a share of GDP is at best quite a poor metric for the size of government.”

I mentioned this as well in the post. But I don’t agree that Obama doesn’t favor expanding the size of government in terms of spending as a share of GDP. He most certainly does favor doing so.

Rademaker, That’s tax revenue not spending.

Chris: You said;

“Trying to use any one metric to compare countries is a fools game.”

That’s a pretty measningless statement, isn’t it? Suppose you were comparing the land areas of each country. Would a single metric work? Yes!

JN, Thanks, I added your figures.

bababooey, Don’t those portraits get included into G/GDP?

Luke, That’s a very good point that Mankiw highlighted a few years ago. In per capita terms the US is actually a big spender, as big as the more “socialist” European countries.

Don, I’ve pointed that out in a previous post.

Doug, Yes I saw that post–it’s actually a pretty well know fact.

I’d add that there are small European countries that are highly urbanized and have populations similar to HK and Singapore, and yet spend 50% of GDP or more. So I’m not sure that’s as big a factor as you assume.

But it raises an interesting question. Would Europe be better off dividing up into even tinier countries? In my view the answer is yes.

25. January 2013 at 13:46

Marcus, Very good post. I would add that in recent years the Swedish ratio has been trending back down again, and Sweden is outperfoming in relative terms.

25. January 2013 at 14:21

I guess your argument is that because of the ACA Obama is creating a shift to larger government and that this is a bad thing? I’m wondering what you think would actually be a reasonable long term policy goal regarding health care policy in the US. A lot of desirable solutions are not currently viable politically. We can’t jump to a relatively cheap single provider system like the UK in short order, or even a relatively cheap single payer system like France. And individual health care is super-expensive, and provider costs are a big part of the reason why, so Singapore is not a viable model either. I hope you are not one of those folks who thinks if we just stopped regulating healthcare all of our costs problems would go away.

25. January 2013 at 14:53

Great post Scott.

I think it would be interesting to add another variable: Gini coefficient (or another similar inequality measure), a favourite argument of “progressives”. If wealth and wealth equality are not related to big governments, maybe we could start defeating the stupidity of idealogies and instead focus on knowledge.

25. January 2013 at 15:34

Including CPF alone would bump Singapore’s nearly ~10%.

25. January 2013 at 17:24

I agree with Alexeyev. The only thing that is even more dubious is EU regional GDP report (used for eurocunds). Suddenly completely new microstates emerge (like London region) that can easily beat asian tigers in everything

Anyways, if you are looking for something useful for predicton of how rich a nation gets, try corruptions. This one does not fit only rich countries, but all of them (ok, except oil ones). Everything else including government involvement seems like a noise.

26. January 2013 at 01:18

Given the distortions related to the GFC wouldn’t pre-crisis spending be a more appropriate measure.

Take Ireland for instance, acording to the IMF spending was 33.5% of GDP in 2006 and 46.9% in 2011.

26. January 2013 at 05:43

mpowell, You said;

“I guess your argument is that because of the ACA Obama is creating a shift to larger government and that this is a bad thing? I’m wondering what you think would actually be a reasonable long term policy goal regarding health care policy in the US.”

Singapore’s government spends less than 2% of GDP on health care, and they have universal coverage and the longest life expectancy in the world. It’s not a perfect system (I’d spend a bit more) but it’s far better than Obama’s approach. They use HSAs.

Alejandro, I suspect Ginis are related to big government. But obviously not perfectly, as the US is more unequal than other countries with similar G/GDP ratios.

JV, I have many posts discussing corruption and wealth. This post is NOT trying to explain how rich countries are.

sdfc. Maybe, that’s why I included both.

26. January 2013 at 07:44

Check out bridge waters the formula for economic success part one, it is very similar thinking to this

http://www.bwater.com/home/research–press.aspx

You have to sign a waiver to get to it

I think you’ll enjoy all the articles there, like yourself bridgewater is that currently rare species in America, a conservative who interacts with reality

26. January 2013 at 15:43

There is some interesting research in the paper: Government Size and Growth: A Survey and Interpretation of the Evidence

They find a significant negative correlation between government size and economic growth whereby a 10% increase in the size of government is associated with 0.5-1% lower annual growth.

26. January 2013 at 15:45

Per capita income should be adjusted to reflect income distribution. Some countries with very high per capita incomes have very large numbers or low income people, others have big wealthy middle classes.

26. January 2013 at 21:18

Y.Alekseyev:

I don’t know how much Hong Kong spends on security, or how the figures will look if they are adjust it for the “security services provided by the mainland Chinese”. But just to point out that the Singapore government spends nearly a third of its budget on Security/Defense. The per capital expenditure on defense is probably within the top five in the world. Unlike Hong Kong, Singapore actually is a fully sovereign state–with all the burdens following that, even if a small one with a resident population only just a bit higher than that of Norway.

* * * * *

But these sorts of spending figures are really blunt measurements. It would be nice if there is a way to figure out the %of GDP that is ‘directed by Government’. Take CPF for example, an individual based government enforced savings scheme. As David above suggests, taking it into account can add another 10% to Singapore’s numbers. The money may not be spent directly by the Government, but in a limited sense, its use is *directed* by the Government rather than private citizens. (To be more precise, the money is invested in sovereign wealth funds.)

27. January 2013 at 06:44

Mikio, You said;

Per capita income should be adjusted to reflect income distribution.”

Not if you are trying to discuss per capita income.

27. January 2013 at 06:45

Thanks for the links Anthony and Barnley.

27. January 2013 at 13:07

Well, this might be too simple to tell us much about whether lots of government spending is a good idea.

I think what we really want is something telling us the correlation between total government spending and long-term growth rates, adjusted for PPP GDP per capita levels. That would then suggest what level of spending would maximize growth for a given country (given similar levels of corruption, etc).

Below is probably the closest I’ve seen to that, I think we find economic growth peaking at total government spending of around 20-25% of GDP (about where Hong Kong is today, I believe U.S. is still around 35%).

http://mercatus.org/publication/does-government-spending-affect-economic-growth

28. January 2013 at 07:57

Talldave, You said;

“Well, this might be too simple to tell us much about whether lots of government spending is a good idea.”

Agreed, and that wasn’t my intention. BTW, the growth maximizing level is also not necessarily best.

28. January 2013 at 07:58

Scott,

I found this on Nate Silver’s site. It has some interesting break downs of U.S. spending which dovetails with this post.

http://fivethirtyeight.blogs.nytimes.com/2013/01/16/what-is-driving-growth-in-government-spending/#more-38257

7. July 2013 at 01:38

The problem with this data – is that it does not allow for the different ways in which output in the public sector is valued from output in the private sector. The valuation of public sector generally is assumed to be the sum of the inputs – ie the public sector is assumed to add no value – this clear is not the case for services which produce end goods like education, health care or similar. Thus countries which develop large productive public services will appear to have lower GDP, yet clean streets, quality health care and education are clearly goods.

15. October 2013 at 14:59

Doesn’t the Rahn Curve definitively demonstrate the relationship between size of government and economic growth?

It appears that the optimal size of all levels of government in a country should be somewhere between 15 and 20%. Spending beyond that level results in the marginal increase in government expenditures causing lower economic growth.

Empirical evidence is clear – those countries with 100% of government eventually become bankrupt – such as the USSR, and North Korea and eventually Cuba when tourism can no longer sustain their economic needs. Countries that allowed government to grow too large such as Greece, Spain and Portugal have become insolvent. Italy and Japan only survive due to a domestic population that are prolific savers and can internally fund their debt – but even here there will eventually be a limit reached. Common sense and a basic understanding of economics dictates that government operations are inefficient and crowd out the private sector which is more efficient. Transferring resources from the efficient to inefficient sector of an economy will eventually result in slower economic growth.

I don’t see a debate here anymore – the evidence appears to be conclusive that larger government equals less prosperity for a nation.

23. February 2017 at 06:33

[…] http://www.themoneyillusion.com/?p=18942 […]

23. March 2017 at 05:06

[…] http://www.themoneyillusion.com/?p=18942 […]